Europe Advanced Wound Care Market Research Report - Segmented By Type (Dressings, Therapy Devices, Active wound care), Application, End-User, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

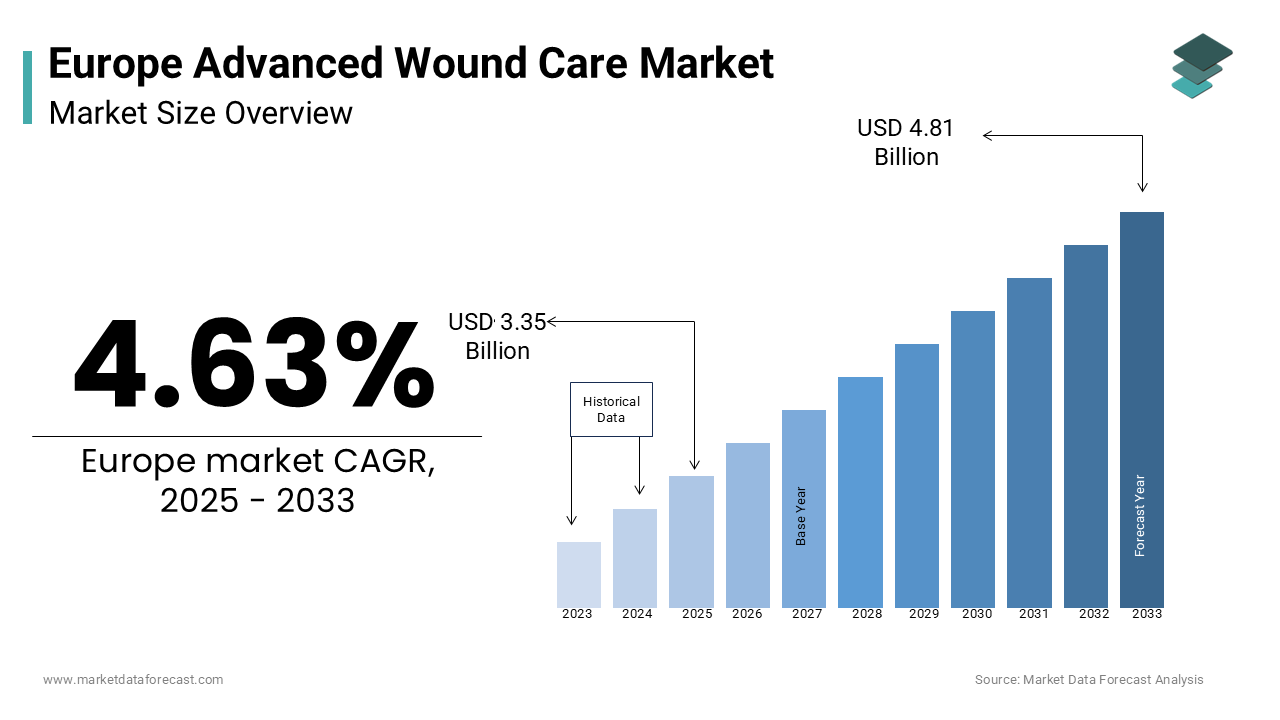

Europe Advanced Wound Care Market Size

The European advanced wound care market size was valued at USD 3.2 billion in 2024. The size of the European market is estimated to be worth USD 4.81 billion by 2033 and USD 3.35 billion in 2025, growing at a CAGR of 4.63% during the forecast period.

The Europe advanced wound care market plays a pivotal role in addressing chronic and acute wound management which is driven by an aging population and rising prevalence of chronic diseases. According to Eurostat, over 20% of Europe’s population is aged 65 or above, with age-related conditions like diabetes and vascular diseases contributing to a surge in chronic wounds such as diabetic foot ulcers and pressure ulcers. The European Wound Management Association estimates that chronic wounds affect a significant percentage of the population, costing healthcare systems billions each year. Germany, France, and the UK collectively account for a major share of the market, supported by robust healthcare infrastructure and government initiatives promoting advanced wound care solutions. Also, innovations in biomaterials and regenerative therapies have further bolstered demand, ensuring steady growth despite economic uncertainties.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders is a key driver propelling the advanced wound care market. According to the International Diabetes Federation, Europe has over 60 million people living with diabetes, with diabetic foot ulcers affecting 15% of this population. Also, a study by the European Society for Vascular Surgery highlights that chronic wounds associated with diabetes result in amputations in 25% of untreated cases, exhibiting the need for effective wound management. Advanced dressings, therapy devices, and regenerative solutions are critical in reducing healing times and improving patient outcomes. Additionally, government programs aimed at reducing healthcare costs by preventing complications have amplified demand for innovative wound care products, reinforcing their adoption across Europe.

Aging Population and Geriatric Healthcare Needs

Europe’s aging population is a significant factor driving the advanced wound care market. Like, the number of individuals aged 65 and above is projected to increase notably between 2020 and 2030 which is creating substantial demand for specialized wound care solutions. Age-related conditions such as venous leg ulcers and pressure ulcers are prevalent among geriatric patients by accounting for a major share of the elderly population. Advanced wound care products reduce hospital stays considerably, lowering overall healthcare costs. Moreover, the rise of home healthcare services has further amplified demand for user-friendly and portable wound care devices, ensuring sustained market growth.

MARKET RESTRAINTS

High Costs of Advanced Wound Care Products

The high cost of advanced wound care solutions remains a significant barrier to widespread adoption, particularly in economically weaker regions. Similarly, advanced dressings and therapy devices can cost considerably more than traditional wound care products. This price disparity limits accessibility for smaller healthcare facilities and low-income patients. A significant percentage of hospitals cite affordability as a primary concern when adopting advanced wound care technologies. Besides, reimbursement policies often fail to cover the full cost of these products, further constraining adoption and undermining market growth.

Regulatory and Compliance Challenges

Stringent regulatory frameworks governing the approval and commercialization of advanced wound care products pose a restraint for the market. According to the European Medicines Agency, manufacturers must comply with over 100 safety and efficacy standards, including ISO certifications and CE marking requirements. Meeting these regulations necessitates significant R&D investments, estimated at a significant amount annually for large firms. Smaller players struggle to keep pace, leading to consolidation and reduced competition. Furthermore, delays in product approvals hinder market responsiveness, forcing companies to navigate complex bureaucratic processes.

MARKET OPPORTUNITIES

Adoption of Regenerative Medicine and Biomaterials

The growing adoption of regenerative medicine and biomaterials presents a transformative opportunity for the advanced wound care market. These innovations offer superior healing outcomes compared to traditional methods are making them ideal for managing complex wounds. A considerable portion of healthcare providers prioritize regenerative solutions due to their ability to reduce scarring and improve functionality. Moreover, EU funding programs like Horizon Europe allocate a significant portion of their budget for biotechnology research, providing strong impetus for the development and adoption of regenerative wound care products.

Expansion into Emerging Markets within Europe

Eastern European countries present untapped potential for advanced wound care manufacturers. Like, healthcare spending in Poland, Romania, and Hungary grew between 2020 and 2022 which is creating substantial demand for affordable yet efficient solutions. A report by the World Health Organization highlights that a significant percentage of rural healthcare facilities in Eastern Europe lack access to advanced wound care products, offering a lucrative growth avenue. Government initiatives provide subsidies for adopting innovative technologies, further stimulating demand. Manufacturers targeting these markets can achieve significant market share expansion.

MARKET CHALLENGES

Limited Awareness and Training Among Healthcare Providers

Limited awareness and training among healthcare providers remain persistent challenges for the advanced wound care market. According to a survey by the European Wound Management Association, 45% of healthcare professionals in rural areas lack the skills required to use advanced wound care products effectively. Training programs and technical support are essential but often insufficient or inaccessible. Furthermore, integrating advanced solutions into existing healthcare workflows requires significant adjustments, which can disrupt operations and delay ROI. In addition, a considerable share of European hospitals cite a lack of expertise as a primary reason for hesitating to adopt advanced wound care technologies.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions have emerged as a critical challenge for the advanced wound care market. Geopolitical tensions and logistical bottlenecks have exacerbated these challenges, leading to delays in manufacturing and delivery. Many European manufacturers experienced production halts due to material shortages in 2022. These disruptions not only increase lead times but also undermine long-term contracts, forcing companies to explore localized sourcing options despite higher costs.

SEGMENTAL ANALYSIS

By Type Insights

The segment of dressings dominated the Europe advanced wound care market by holding a 45.7% share in 2024. This is driven by their widespread use in managing chronic and acute wounds, including diabetic foot ulcers and surgical wounds. Similarly, advanced dressings make substantial annual revenue, supported by innovations in biomaterials such as hydrocolloids, alginates, and foam-based solutions. Also, these products reduce healing times, making them indispensable in both in-patient and out-patient settings. Additionally, government initiatives promoting cost-effective healthcare solutions have encouraged hospitals to adopt advanced dressings, reinforcing their dominance.

Therapy devices are the fastest-growing segment, with a CAGR of 11.2%. This growth is fueled by the increasing adoption of negative pressure wound therapy (NPWT) and electrostimulation devices, particularly in managing complex wounds. Therapy devices improve healing outcomes compared to traditional methods, driving demand across Europe. Moreover, advancements in portable and user-friendly devices have expanded their application in home healthcare settings, further accelerating growth. This trend displays the transformative potential of therapy devices in revolutionizing wound care.

By Application Insights

The skin ulcers segment accounted for the largest share of the Europe advanced wound care market, representing 40.5% in 2024. This dominance of the segment is attributed to the high prevalence of chronic skin conditions such as venous leg ulcers and diabetic foot ulcers, which affect a eye-catching percentage of the population. Moreover, age-related diseases contribute significantly to this burden, with millions of Europeans living with diabetes. Additionally, government programs aimed at reducing healthcare costs have amplified demand for specialized solutions, reinforcing this segment's leadership.

The burn wounds segment is the swiftest growing application, with a CAGR of 9.8%. This growth is driven by advancements in bioengineered skin substitutes and regenerative therapies, which offer superior healing outcomes for severe burns. These innovations reduce scarring and improve functionality, making them ideal for managing burn injuries. Moreover, rising awareness about advanced wound care solutions has amplified demand, particularly in urban areas with robust healthcare infrastructure.

By End-User Insights

The in-patient service segment attained the highest prominence in the Europe advanced wound care market by accounting for 60.5% of the total share in 2024. This leading position of the segment is propelled by the critical role of hospitals and specialized clinics in managing complex wounds, including surgical and chronic ulcers. A significant portion of advanced wound care products are utilized in in-patient settings due to their ability to provide comprehensive treatment under medical supervision.

The out-patient services are the end-user segment having highest growth rate, with a CAGR of 8.5%. This progress is influenced by the rise of home healthcare and ambulatory centers, which prioritize cost-effective and patient-centric solutions. Moreover, out-patient services reduce healthcare costs, while improving accessibility for elderly patients. Also, advancements in portable therapy devices and user-friendly dressings have expanded their application in home settings. This trend underscores the segment’s potential to capitalize on the growing demand for decentralized healthcare.

REGIONAL ANALYSIS

Germany led the Europe advanced wound care market by commanding a 25.9% share in 2024. This leading position is supported by the country’s aging population and robust healthcare infrastructure. Like, over 20% of Germany’s population is aged 65 or above, with age-related conditions like diabetes and vascular diseases driving demand for advanced wound care solutions. The European Wound Management Association notes that Germany accounts for approximately €5 billion in annual revenue from advanced wound care products, supported by government initiatives promoting regenerative medicine and biomaterials. Additionally, innovations in bioengineered skin substitutes and NPWT devices have strengthened their place. Germany’s strategic investments in healthcare modernization, including €10 billion allocated annually under its National Health Plan, ensure sustained growth and accessibility to cutting-edge wound care technologies.

Poland exhibits the highest CAGR of 9.2%. This growth is fueled by increased healthcare spending and EU funding programs aimed at modernizing facilities. Poland’s healthcare sector is creating substantial demand for affordable yet efficient wound care solutions. Also, the rise of home healthcare services, coupled with government subsidies for adopting innovative technologies, has amplified adoption. Poland’s strategic geographic location also positions it as a gateway to Eastern European markets, enhancing its importance in the regional landscape.

France, Italy, and Spain are poised for steady growth, driven by aging populations and rising chronic disease prevalence. France, with its focus on regenerative therapies, is projected to grow in the coming years. Italy, renowned for its manufacturing excellence, continues to drive demand for advanced dressings. Besides, Spain benefits from its expanding home healthcare services, supported by government policies mandating cost-effective solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few of the notable companies operating in the Europe advanced wound care market are Acelity L.P., Inc., Smith and Nephew Plc., Mölnlycke Health Care, ConvaTec, Coloplast Corp., 3M Healthcare, Medtronic, Integra Lifesciences Corporation, and Organogenesis Inc.

The Europe advanced wound care market is characterized by intense competition, driven by technological advancements, regulatory pressures, and evolving consumer demands. Leading players such as Smith & Nephew, Mölnlycke Health Care, and ConvaTec Group dominate the market, leveraging their expertise in regenerative medicine and sustainable solutions to differentiate themselves. However, smaller players and regional firms are also gaining traction by offering cost-effective solutions and focusing on niche applications.

The shift toward sustainable healthcare solutions has intensified competition, with companies investing heavily in R&D to develop eco-friendly alternatives to traditional products. Moreover, the rise of regenerative therapies and advanced biomaterials has created new opportunities for differentiation, with players competing to provide innovative solutions for chronic and acute wound management.

Strategic partnerships and collaborations with healthcare providers ensure long-term contracts and enhance brand reputation. Despite economic uncertainties and supply chain disruptions, the market remains resilient, with innovation and customer-centric strategies driving sustained growth.

Top Players in the Market

Smith & Nephew

Smith & Nephew, headquartered in the UK, is the largest player in the region. The company specializes in bioactive dressings and negative pressure wound therapy (NPWT) devices, which are critical for managing chronic and acute wounds. Smith & Nephew’s focus on innovation is evident in its development of regenerative solutions, such as bioengineered skin substitutes, aligning with EU healthcare goals. Its global presence and strong distribution network enable it to serve diverse applications, reinforcing its leadership position.

Mölnlycke Health Care

Mölnlycke Health Care, based in Sweden, is recognized for its high-performance dressings and infection control solutions. The company leverages advanced technologies to offer sustainable and durable products, such as antimicrobial dressings and foam-based solutions. Its commitment to sustainability is evident in its development of eco-friendly dressings made from recyclable materials, aligning with EU policies promoting circular economies. Mölnlycke’s ability to adapt to evolving market demands ensures its continued growth in the competitive European landscape.

ConvaTec Group

ConvaTec Group, headquartered in the UK, and specializes in advanced wound therapeutics and ostomy care. The company invests heavily in R&D to develop innovative solutions, such as hydrocolloid dressings and silver-based antimicrobial products. Additionally, ConvaTec’s partnerships with major healthcare providers, including NHS hospitals, ensure a steady demand for its products. Its focus on affordability and scalability has made it a preferred supplier in both inpatient and out-patient settings, driving its growth in the European market.

Top Strategies Used by Key Players

- Product Innovation : Companies like Smith & Nephew and Mölnlycke invest heavily in R&D to develop next-generation products, such as bioengineered skin substitutes and eco-friendly dressings. These innovations not only enhance performance but also address environmental concerns, aligning with EU regulations.

- Strategic Partnerships: Collaborations with research institutions, hospitals, and technology providers are a cornerstone of market strategies. For instance, Mölnlycke partners with EU research institutes to advance infection control technologies, ensuring cutting-edge solutions for healthcare providers.

- Acquisitions and Expansions To expand their geographic footprint and product portfolios, companies pursue mergers and acquisitions. Smith & Nephew’s acquisition of a regenerative therapy firm in 2023 exemplifies this strategy, enabling it to tap into new markets and strengthen its supply chain capabilities.

- Customer-Centric Solutions: Tailoring products to meet specific customer needs is another key strategy. For example, ConvaTec offers modular wound care solutions that can be adapted for both small-scale and large-scale applications, ensuring flexibility and scalability for its clients.

RECENT MARKET DEVELOPMENTS

- April 2024 - Smith & Nephew Launches Bioactive Dressing Line: Smith & Nephew introduced a new line of bioactive dressings designed to accelerate wound healing. This innovation aligns with EU healthcare goals, reinforcing its leadership in regenerative solutions.

- June 2024 - Mölnlycke Partners with EU Research Institutes Mölnlycke announced a partnership with EU research institutes to advance infection control technologies, ensuring cutting-edge solutions for healthcare providers.

- September 2024 - ConvaTec Invests €50 Million in R&D: ConvaTec invested €50 million to develop cost-effective wound therapeutics, enhancing affordability and accessibility for patients.

- January 2025 - Smith & Nephew Acquires Regenerative Therapy Firm Smith & Nephew acquired a firm specializing in regenerative therapies, expanding its geographic footprint and bolstering its product portfolio.

- March 2025 - Mölnlycke Launches Sustainable Dressing Solutions: Mölnlycke launched eco-friendly dressings made from recyclable materials, aligning with EU sustainability objectives and enhancing its market presence.

MARKET SEGMENTATION

This research report on the European advanced wound care market has been segmented and sub-segmented into the following categories:

By Type

- Dressings

- Therapy Devices

- Active wound care

By Application

- Skin Ulcers

- Surgical Wounds

- Burn Wounds

By End-User

- In-patient services

- Out-patient services

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which segment by type held the leading share in the Europe advanced wound care market?

Based on type, the dressing segment dominated the EU advanced wound care market in 2033.

Which are potential countries for advanced wound care in the European region?

During the forecast period, European countries such as UK and Germany are expected to have promising growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]