Global Ethylene Vinyl Acetate Market Size, Share, Trends, & Growth Forecast Report Segmented By Grade (Low Density, Medium Density, High Density), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Ethylene Vinyl Acetate (EVA) Market Size

The global ethylene vinyl acetate (EVA) market size was valued at USD 10.41 billion in 2024 and is expected to reach USD 16.67 billion by 2033 from USD 10.97 billion in 2025. The market is projected to grow at a CAGR of 5.37%.

Ethylene Vinyl Acetate (EVA) is a high-performance thermoplastic copolymer composed of ethylene and vinyl acetate monomers. Known for its flexibility, impact resistance, durability, and adhesive properties, EVA is widely used across multiple industries, including footwear, renewable energy, medical devices, automotive, and packaging.

EVA is a primary material for shoe soles and midsoles in the footwear industry which is providing superior cushioning and shock absorption. With the global footwear producing over 20 billion pairs annually, EVA remains a key component in athletic, casual, and industrial footwear due to its lightweight and durable nature. The renewable energy sector extensively utilizes EVA as an encapsulant in solar photovoltaic (PV) panels and is ensuring protection against moisture, UV degradation, and mechanical wear. The International Energy Agency (IEA) reported that global solar PV capacity increased by approximately 25% in 2023, reinforcing EVA’s critical role in advancing solar technology. EVA is also biocompatible and chemically resistant, making it a preferred material for medical applications such as orthopedic braces, prosthetic liners, drug delivery systems, and medical tubing. EVA-based medical-grade materials continue to gain traction because of the rising healthcare demand.

MARKET DRIVERS

Technological Advancements in Solar Energy

The Ethylene Vinyl Acetate (EVA) market is considerably propelled by innovations in solar energy technologies. EVA serves as a critical encapsulant in photovoltaic (PV) modules safeguards solar cells from environmental factors and enhancing their durability. This surge in solar installations amplifies the demand for high-quality EVA materials because manufacturers seek reliable encapsulants to ensure optimal performance and longevity of solar panels. Consequently, advancements in solar technology directly bolster the EVA market and is aligning with global efforts toward sustainable energy solutions.

Growth in the Packaging Industry

The packaging sector's expansion notably drives the EVA market owing to its desirable properties such as flexibility, clarity, and strong adhesion. It is extensively utilized in the production of films and coatings that enhance packaging durability and integrity. The U.S. Environmental Protection Agency (EPA) found that containers and packaging constitute a major portion of municipal solid waste and that reflects the vast scale of this market. Consumer demand for packaged goods is rising and is particularly in food and healthcare products so the need for efficient and reliable packaging materials like EVA correspondingly increases. This trend underscores EVA's integral role in meeting the evolving requirements of modern packaging applications.

MARKET RESTRAINTS

Environmental Concerns

The production and disposal of Ethylene Vinyl Acetate (EVA) raise important environmental issues. EVA is a copolymer of ethylene and vinyl acetate, and its degradation can lead to the release of acetic acid which may contribute to environmental pollution. The National Renewable Energy Laboratory (NREL) has reported that EVA under exposure to atmospheric water and ultraviolet radiation can decompose to produce acetic acid, potentially lowering pH levels and increasing corrosion rates in embedded devices. Additionally, the U.S. Environmental Protection Agency (EPA) classifies vinyl acetate as a hazardous air pollutant, indicating its potential environmental impact. These environmental concerns may hinder the widespread adoption of EVA in applications where ecological impact is a critical consideration.

Health and Safety Risks

Exposure to vinyl acetate which is a monomer used in EVA production poses health risks. The Occupational Safety and Health Administration (OSHA) has set permissible exposure limits for vinyl acetate due to its ability to cause respiratory tract irritation and other health effects upon inhalation. The National Institute for Occupational Safety and Health (NIOSH) also stated that vinyl acetate can cause irritation to the eyes, skin, and respiratory system. These health and safety concerns necessitate stringent handling and processing protocols, potentially increasing operational costs and limiting EVA's use in certain industries.

MARKET OPPORTUNITIES

Advancements in Medical Applications

Ethylene Vinyl Acetate (EVA) is progressively utilized in the medical field due to its biocompatibility, flexibility, and chemical resistance. The U.S. Food and Drug Administration (FDA) recognizes EVA as a safe material for medical devices which is leading to its widespread use in products such as intravenous (IV) bags, tubing, and orthopedic padding. The FDA's approval emphasizes EVA's suitability for applications requiring stringent safety standards. The demand for EVA in medical applications is expected to grow owing to continuous advancement of healthcare industry and that is presenting significant opportunities for market expansion.

Expansion in the Footwear Industry

The footwear industry extensively uses EVA for its lightweight and cushioning properties, especially in shoe soles and midsoles. The United States imported over 2.5 billion pairs of shoes in 2020 with a major portion incorporating EVA components. This substantial import volume reveals the material's importance in footwear manufacturing. The consumer demand for comfortable and durable footwear rises and particularly in the athletic and casual segments and the utilization of EVA is also poised to increase which is offering considerable growth prospects for the market.

MARKET CHALLENGES

Regulatory Compliance Challenges

The Ethylene Vinyl Acetate (EVA) market deals with significant challenges in adhering to evolving environmental regulations. Compliance with such regulations requires substantial investment in pollution control technologies and continuous monitoring which is increasing operational costs. Additionally, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits for vinyl acetate due to its potential health risks, further complicating compliance efforts. These regulatory requirements pose challenges for EVA manufacturers in maintaining profitability while ensuring adherence to safety and environmental standards.

Competition from Alternative Materials

The EVA market is experiencing increased competition from alternative materials that offer similar properties with potentially lower environmental impacts. For instance, thermoplastic polyurethanes (TPU) and bio-based polymers are gaining traction in applications traditionally dominated by EVA, such as footwear and packaging. The U.S. Department of Agriculture (USDA) has been promoting the development and use of bio-based products through its BioPreferred Program, encouraging manufacturers to explore sustainable alternatives. This shift towards eco-friendly materials is caused by consumer preferences and governmental support, presents a challenge to EVA producers to innovate and adapt to changing market dynamics.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.37% |

|

Segments Covered |

By Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

LyondellBasell Industries Holdings BV, Arlanxeo, Asia Polymer Corporation, ExxonMobil Corporation, Braskem, Celanese Corporation, Dow, Hanwha Solutions/Chemical Corporation, Innospec Inc, Repsol, Clariant AG, and others |

SEGMENTAL ANALYSIS

By Grade Insights

The medium density segment had the largest share of 40.5% in the global market in 2024. The domination of the medium density segment is majorly driven by its versatility in applications such as packaging, footwear, and solar encapsulant films. Additionally, the International Energy Agency (IEA) reports that solar photovoltaic capacity additions increased by 23% globally in 2022 which is driving demand for EVA in solar panel manufacturing. These factors solidify medium-density EVA's leading position.

The high-density segment is estimated to witness a CAGR of 6.5% over the forecast period owing to the rising demand in automotive and industrial sectors. Automotive lightweighting trends have surged with electric vehicle (EV) sales increasing by 54% from 2021 to 2022, according to the International Council on Clean Transportation. This trend favours high-density EVA for its durability, thermal stability, and ability to reduce vehicle weight. Government initiatives like the European Green Deal promote sustainable materials, enhancing its appeal. Plastics Europe stated that plastics usage in automobiles is expected to grow to 11 million tons annually by 2030 and is propelled by regulatory mandates for fuel efficiency and reduced emissions, further boosting high-density EVA's critical role in the market.

By Application Insights

The films segment dominated the EVA market by grabbing 35.6% of the global market share in 2024. The extensive use of EVA films in packaging, agriculture, and industrial applications is majorly driving the growth of the films segment in the global market. Additionally, the Food and Agriculture Organization (FAO) revealed that plastic mulch films improve crop yields while conserving water which is boosting their adoption. Their versatility, durability, and cost-effectiveness make them indispensable across industries.

The solar cell encapsulation segment is estimated to register a CAGR of 8.2% over the forecast period owing to the rapid expansion of solar energy capacity which increased by 23% globally in 2022, per the International Energy Agency (IEA). For instance, governments worldwide are promoting renewable energy and the European Union’s Green Deal aims to achieve 42.5% renewable energy usage by 2030, as stated by the European Commission. EVA films used in solar panels enhance durability and efficiency, making them critical for photovoltaic systems. According to BloombergNEF, cumulative solar power installations are expected to reach between 2-5 terawatts globally by 2030, ensuring robust demand for EVA in this segment. Its role in sustainable energy solutions underscores its importance.

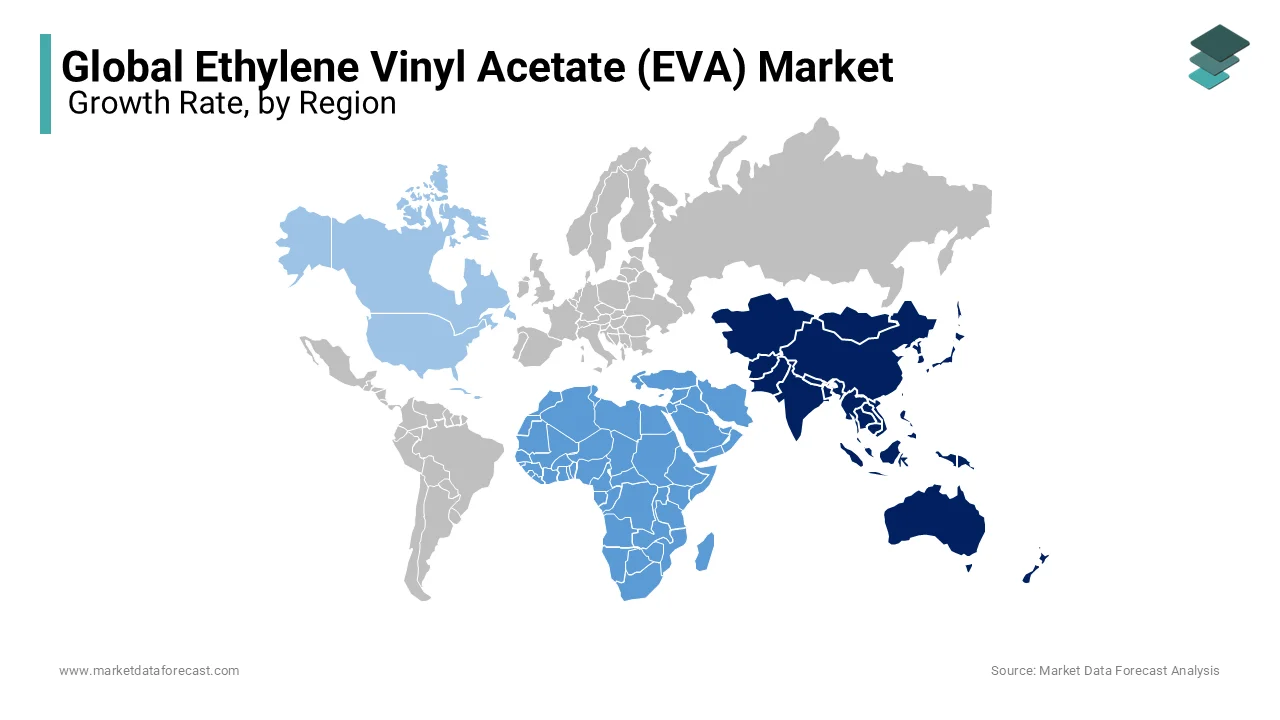

REGIONAL ANALYSIS

Asia-Pacific dominated the EVA market by holding 45.7% of the global market share in 2024. The growth of the Asia-Pacific region in the global market is majorly fuelled by rapid industrialization, rising demand for solar panels, and growth in packaging industries. China alone accounted for 45% of global solar photovoltaic capacity additions in 2022, according to the International Energy Agency (IEA). The presence of major manufacturing hubs and supportive government policies, such as India’s Production Linked Incentive (PLI) scheme for solar manufacturing, further solidifies Asia-Pacific’s dominance.

The Middle East and Africa is estimated to progress at a CAGR of 7.8% over the forecast period due to the increasing investments in renewable energy projects. For instance, the UAE aims to achieve 50% clean energy usage by 2050 , as per the UAE Ministry of Energy. Solar power capacity in the region grew substantially between 2019 and 2022, according to the International Renewable Energy Agency (IRENA). Rising urbanization and infrastructure development also drive demand for EVA in construction and packaging. With the African Development Bank investing $25 billion in climate adaptation by 2025 , this region’s EVA market will expand significantly, playing a pivotal role in sustainable development.

North America holds a significant share of the EVA market and is driven by its advanced automotive and packaging industries. Lightweight materials like EVA reduce vehicle weight by up to 10%, improving fuel efficiency, according to the U.S. Department of Energy. Additionally, the U.S. solar energy sector added 17 GW of capacity in 2022 which is boosting EVA use in solar panels. With supportive policies like tax incentives for renewable energy, North America is expected to maintain steady growth in the coming years.

Europe’s EVA market is fueled by stringent environmental regulations and sustainability goals. The European Green Deal aims to achieve 55% greenhouse gas emissions reduction by 2030, as stated by the European Commission, driving demand for EVA in solar panels and eco-friendly packaging. The region’s solar photovoltaic capacity grew remarkably in 2022 , according to the International Energy Agency (IEA). Additionally, the automotive industry’s shift toward lightweight materials supports EVA adoption, with electric vehicle sales in Europe increasing by 65% in 2022 , per the European Automobile Manufacturers’ Association (ACEA). Europe’s focus on renewable energy and circular economy initiatives ensures moderate but consistent market growth.

Latin America’s EVA market benefits from agricultural advancements and infrastructure development. Brazil, a key player, uses plastic mulch films extensively. Rising urbanization and construction activities also drive demand for EVA in adhesives and foams. The region’s renewable energy sector is expanding, with solar capacity additions reaching 4.6 GW in 2022 , according to IRENA. Government initiatives, such as Mexico’s clean energy targets of 35% by 2024 , further support EVA adoption. While Latin America currently holds a smaller market share, its focus on agriculture and renewables positions it for steady growth in the coming years.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

LyondellBasell Industries Holdings BV, Arlanxeo, Asia Polymer Corporation, ExxonMobil Corporation, Braskem, Celanese Corporation, Dow, Hanwha Solutions/Chemical Corporation, Innospec Inc, Repsol, Clariant AG are playing dominating role in the global ethylene vinyl acetate (EVA) market.

The global Ethylene Vinyl Acetate (EVA) market is highly competitive, driven by the increasing demand for EVA across diverse industries such as solar energy, packaging, footwear, adhesives, and automotive. Major players, including ExxonMobil, Dow Inc., LyondellBasell, and Sipchem, dominate the market through large-scale production, advanced R&D, and strategic investments. Competition is fueled by technological advancements, sustainability initiatives, and cost efficiency, as companies seek to improve EVA’s properties and expand applications.

A significant aspect of competition is production capacity expansion, where leading manufacturers invest heavily to meet rising global demand. For instance, Sipchem’s $187 million EVA plant expansion aims to increase supply for solar encapsulants and adhesives. Additionally, Lummus Technology’s collaboration with Sumitomo Chemical strengthens their market presence through advanced LDPE/EVA production technology.

Sustainability has become a key battleground, with companies innovating bio-based and recyclable EVA solutions. Dow-Mitsui Polychemicals' launch of biomass-based EVA and Braskem’s sugarcane-derived EVA showed the market’s push for eco-friendly alternatives.

Regional competition is also intense, with China, the U.S., and Europe being major production hubs. Chinese companies, such as CHN Energy Ningxia Coal Industry, are rapidly expanding capacity, intensifying market dynamics and price competitiveness.

STRATEGIES USED BY THE MARKET PLAYERS

Expansion of Production Capacities

To meet the increasing global demand for Ethylene Vinyl Acetate (EVA), leading companies are significantly investing in expanding their production facilities. This strategy allows them to maintain a competitive edge, secure long-term supply contracts, and cater to the growing needs of industries such as solar energy, footwear, packaging, and automotive. For example, Sahara International Petrochemical Company (Sipchem) announced a $187 million investment in July 2024 to expand its EVA plant, increasing production capacity by 70,000 tons per year, bringing the total to approximately 290,000 tons annually. Similarly, Celanese Corporation expanded its Edmonton, Alberta facility in 2023, increasing production by 35%, while CHN Energy Ningxia Coal Industry started constructing a 100,000-ton/year EVA copolymer project in May 2024. These expansions ensure a steady supply of high-quality EVA materials while reinforcing the companies’ market dominance.

Strategic Partnerships and Collaborations

Leading EVA manufacturers form strategic alliances to leverage technology, expand production capabilities, and improve supply chain efficiency. Partnerships enable companies to co-develop advanced production processes, enhance sustainability initiatives, and enter new markets. For example, in May 2024, Lummus Technology and Sumitomo Chemical collaborated to license and commercialize low-density polyethylene (LDPE) and EVA production technologies, strengthening both companies’ efforts in sustainable manufacturing. Additionally, LyondellBasell partnered with PetroChina Guangxi Petrochemical in June 2023 to implement Lupotech process technology, improving PetroChina’s EVA and LDPE manufacturing efficiency. Another key collaboration occurred in September 2024, when Mitsui Chemicals and Dow launched biomass-based EVA, advancing sustainable solutions for industries such as renewable energy and automotive. Through such partnerships, EVA producers enhance innovation, reduce costs, and establish a strong foothold in the global market.

Innovation and Development of Sustainable Products

Sustainability is becoming a critical focus for the EVA market as companies prioritize eco-friendly materials, recyclable solutions, and bio-based alternatives. Major players are investing in green chemistry and renewable resources to align with environmental regulations and consumer demand for sustainable products. For example, Dow-Mitsui Polychemicals introduced biomass-based EVA and LDPE in September 2024, reducing greenhouse gas emissions while maintaining conventional EVA properties. ExxonMobil is developing recyclable EVA materials for applications in packaging and adhesives, supporting the industry’s transition towards circular economy models. Additionally, Braskem and Sojitz are pioneering the production of bio-based EVA from sugarcane, offering an eco-friendly alternative for footwear, consumer goods, and healthcare applications. These innovations not only help companies comply with sustainability goals but also strengthen their market positions by differentiating their products from conventional petroleum-based EVA offerings.

TOP 3 PLAYERS IN THE MARKET

ExxonMobil Corporation

ExxonMobil, headquartered in Spring, Texas, is one of the world's largest publicly traded energy providers and chemical manufacturers. The company operates through multiple segments, including Upstream, Energy Products, Chemical Products, and Specialty Products. In the Chemical Products segment, ExxonMobil produces a variety of petrochemicals, including EVA, which are utilized in applications such as packaging, automotive components, and footwear. The company's commitment to developing and applying next-generation technologies underscores its significant role in the EVA market.

LyondellBasell Industries N.V.

LyondellBasell, with dual headquarters in Houston, Texas, and Rotterdam, Netherlands, is a leading plastics, chemicals, and refining company. The company offers a diverse range of products, including polyethylene, polypropylene, and advanced polyolefins. In the EVA sector, LyondellBasell's materials are essential in industries such as automotive, packaging, and consumer goods. The company's focus on innovation and sustainability, along with its global manufacturing and distribution network, solidifies its position as a key contributor to the EVA market.

Dow Inc.

Dow Inc., headquartered in Midland, Michigan, is a prominent player in the chemical industry, offering a wide array of products, including EVA copolymers. These materials are widely used in applications such as adhesives, foams, and solar cell encapsulation. Dow's emphasis on sustainability and innovation has led to the development of advanced EVA materials that meet the evolving demands of various industries. The company's strategic focus on diversification and partnerships enhances its offerings in the EVA sector.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Sahara International Petrochemical Company (Sipchem) awarded a $187 million contract to SGC E&C Co., Ltd. and SGC Arabia Company Limited for the expansion of its EVA plant. The project aims to increase production capacity by 70,000 tons, bringing the total to approximately 290,000 tons annually. This high-grade EVA is essential for industries such as solar power cell encapsulants and hot melt adhesives.

- In September 2024, Dow-Mitsui Polychemicals began marketing biomass-based Ethylene Vinyl Acetate (EVA) and low-density polyethylene (LDPE) using the mass balance method. These bio-based materials offer the same properties as conventional EVA but contribute to reducing greenhouse gas emissions, supporting sustainability efforts in the polymer industry.

MARKET SEGMENTATION

This research report on the global ethylene vinyl acetate market has been segmented and sub-segmented based on grade, application, and region.

By Grade

- Low Density

- Medium Density

- High Density

By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global Ethylene Vinyl Acetate (EVA) market?

As of 2024, the global EVA market was valued at approximately USD 10.41 billion.

2. What is the projected growth of the EVA market?

The market is expected to reach USD 16.67 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.37% from 2025 to 2033.

3. What factors are driving the growth of the EVA market?

Key drivers include technological advancements in solar energy, where EVA is used as an encapsulant in photovoltaic modules, and growth in the packaging industry due to EVA's flexibility, clarity, and strong adhesion properties.

4. Which region holds the largest share in the EVA market?

The Asia-Pacific region holds the highest share in the EVA market as of 2024

5. What challenges does the EVA market face?

Challenges include environmental concerns related to EVA production and disposal, as well as competition from alternative materials in various applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]