Global Espresso Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Pure Espresso, Double Espresso, Ristretto, Cappuccino, Latte, Mocha, Macchiato and Americano), End Users, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2024 to 2032

Global Espresso Market Size

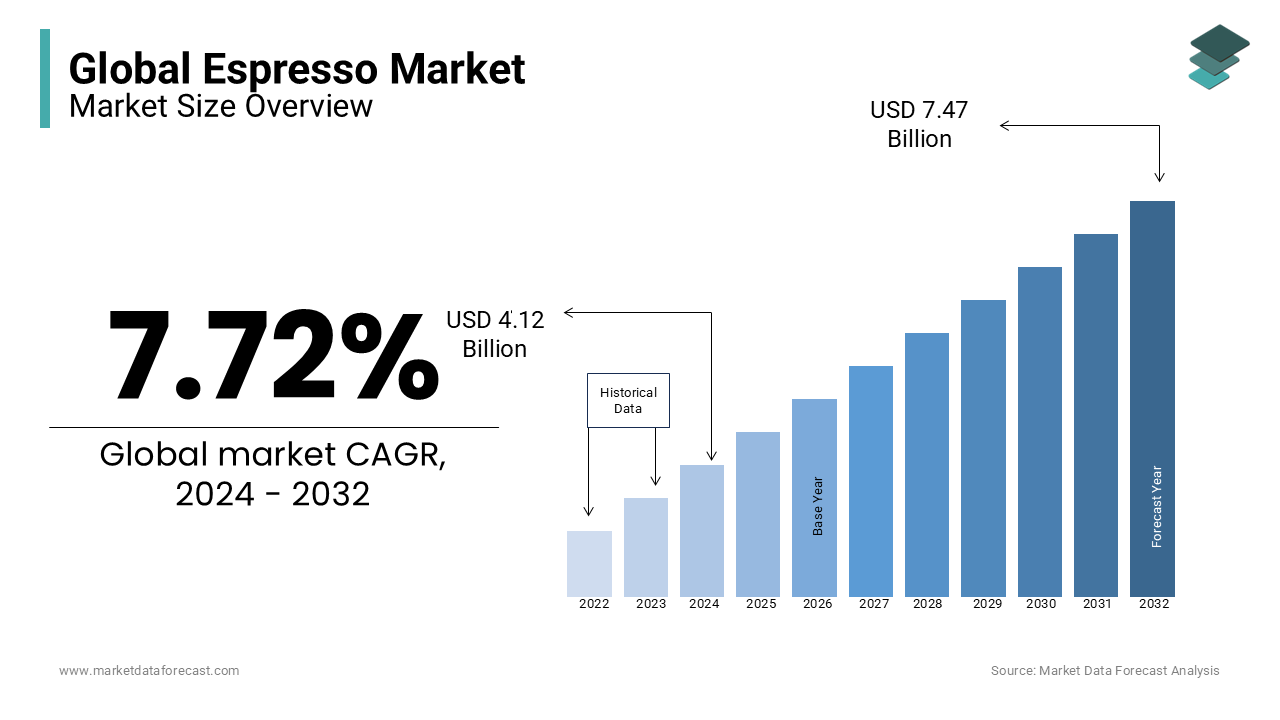

The global espresso market size was calculated to be USD 3.82 billion in 2023 and is anticipated to be worth USD 7.47 billion by 2032 from USD 4.12 billion In 2024, growing at a CAGR of 7.72% during the forecast period.

Espresso is a bold and concentrated coffee made by pushing hot water through finely-ground coffee beans and is served in small amounts with a rich taste and a creamy layer on top called crema. Espresso is also the base for many popular coffee drinks like lattes, cappuccinos, and macchiatos. According to the United States Department of Agriculture (USDA), espresso contributes substantially to world coffee consumption where it is forecasted to rise by 5.1 million bags to 168.1 million in the 2024/25 period. Moreover, in China, coffee consumption has surged by nearly 150% over the past decade, reaching an estimated 6.3 million bags in 2024/25. This growth is largely attributed to the rising popularity of espresso-based beverages among younger urban professionals, as per the USDA Foreign Agricultural Service (FAS).

MARKET DRIVERS

Rising Demand for Specialty Coffee

The growing popularity of specialty coffee is a significant driver of the espresso market. The espresso-based beverages like lattes, cappuccinos and macchiatos gaining traction as consumers increasingly prefer high-quality coffee experiences. According to the Specialty Coffee Association, specialty coffee accounted for over 48% of its U.S. consumption in 2022. This trend is influenced by younger demographics, especially millennials, who prioritize flavour and unique profiles. The global rise of this beverage culture coupled with the growth of independent cafes and premium chains that supports the demand for espresso machines and beans creating significant market opportunities.

Growth in At-Home Coffee drinking

The shift toward at-home coffee drinking continues to drive the espresso market owing to its acceleration by the COVID-19 pandemic. Sales of home espresso machines surged having shipments increase by 25% year-on-year in 2021, as stated by Euromonitor International. Customers seek convenience and cafe-quality beverages at house leading to a rise in single-serve pods and its premium-quality beans. Additionally, International Coffee Organization in their findings said that households across the globe spend over $30 billion annually on coffee-related products which reflects the growing interest in home-based brewing solutions. This pattern has encouraged innovation in compact and affordable espresso machines and further boosting the market.

MARKET RESTRAINTS

Fluctuations in Coffee Bean Prices

The espresso market is significantly impacted by the volatility in prices of beans driven by climate change, crop diseases and geopolitical factors. Brazil who is world’s largest coffee producer faced severe droughts and frosts in 2021 and 2022 causing the prices of Arabica type to rise globally by over 60% to reach $2.37 per pound that was a 10-year high, as per the FAO, USDA. These cost spikes directly affect espresso manufacturers, especially small-scale operators who lack the financial capacity to absorb higher expenditures. The unpredictability of coffee bean prices also disrupts long-term planning for businesses and impacts consumer affordability as well as potentially reducing its consumption in cost-sensitive regions.

Environmental Concerns and Sustainability Issues

The ecological footprint of espresso production is under increasing scrutiny particularly due to emissions from coffee farming and waste from single-use pods. According to the Food and Agriculture Organization (FAO), coffee cultivation contributes approximately 6% of global agricultural greenhouse gas releases owing to the deforestation in coffee-growing regions which exacerbates the issue. Furthermore, single-use espresso pods generate substantial plastic and aluminum waste having more than39,000 metric tons of annually global coffee pod waste, as reported by the European Commission. Stricter sustainability regulations such as the EU’s 2024 ban on non-recyclable single-use plastics are pressuring their manufacturers to develop eco-friendly alternatives. Therefore, these changes necessitate investments in sustainable farming and packaging and increases operational costs and complicating supply chains for the espresso market.

MARKET OPPORTUNITIES

Expansion of Specialty Coffee and Premium Espresso Offerings

The growing consumer preference for high-quality and artisanal coffee presents a significant opportunity for the espresso market. According to the National Coffee Association, specialty coffee accounted for 55% of U.S. coffee consumption in 2022 and is driving demand for premium espresso beverages. Millennials and Gen Z consumers prioritize unique flavours, single-origin beans and sustainably sourced coffee. This trend encourages cafes and brands to invest in superior-quality blends and equipment for this beverage which enhances the market growth. Additionally, the rise of micro-roasters and direct trade practices supports this niche continues to create opportunities for differentiation and customer loyalty in a competitive market.

Rising Adoption of At-Home Espresso Machines

The increase in remote work and home-based lifestyles has fueled demand for at-home espresso machines. As per the report by the International Coffee Organization, retail sales of home espresso machines grew by 30% globally between 2020 and 2022. Consumers are investing in high-end equipment to replicate cafe-style experiences at home and thereby brands are focusing on user-friendly and compact designs. Emerging markets with growing middle-class populations like India and China represent untapped potential for affordable and premium home espresso systems. This shift provides an opportunity for manufacturers to innovate and capture the home brewing segment as well as diversify their revenue streams.

MARKET CHALLENGES

Supply Chain Disruptions

The espresso market faces significant challenges from world supply chain inefficiencies impacting the availability of coffee beans and associated products. The United Nations Conference on Trade and Development (UNCTAD) stated that, global shipping delays increased by over 30% in 2021 since some routes experience lead times of up to six weeks. Moreover, ports in coffee-exporting countries such as Brazil and Vietnam faced congestion and reduced workforce availability due to the pandemic. Additionally, truck driver shortages in the U.S. i.e. a deficit of 80,000 drivers in 2022 exacerbated domestic delivery delays, according to the American Trucking Associations. These disruptions affect the espresso industry’s ability to meet consumer demand consistently.

Rising Competition from Alternative Beverages

Shifting consumer preferences toward health-focused beverages challenge the espresso market. The World Health Organization (WHO) highlights that over 39% of adults globally are overweight prompting many to reduce calorie-dense or sugar-laden coffee drinks. This has fueled interest in alternatives like herbal teas and plant-based beverages which offer perceived health benefits. For example, green tea is rich in antioxidants and has seen rising consumption, as per the FAO reporting a production increase of 75% over the past two decades. These changing preferences push espresso brands to innovate healthier and functional coffee products to stay competitive.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.72% |

|

Segments Covered |

By Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

|

Nestle (Nespresso), Starbucks Corporation, Lavazza Group, JAB Holding Company (Jacobs Douwe Egberts, Peet's Coffee), Illycaffè, Segafredo Zanetti (Massimo Zanetti Beverage Group), Luckin Coffee, Keurig Dr Pepper Inc., Breville Group, and De’Longhi Group |

SEGMENTAL ANALYSIS

By Type Insights

The cappuccino segment dominated the market and accounted for 30.4% of the global espresso market share in 2023. Its widespread popularity is due to its balanced combination of espresso steamed milk, and foam are appealing to a broad audience. Cappuccinos are a staple in coffee shops globally, particularly in Europe, where coffee culture is deeply rooted. In Italy alone, over 5 million cups of cappuccino are consumed daily (FAO). The beverage is also gaining traction in emerging markets like Asia-Pacific, where urban consumers increasingly embrace Western coffee trends. Its versatility ensures its continued dominance across regions as it is available in hot or iced versions.

The latte segment is growing rapidly and is estimated to exhibit a CAGR of 6.5% over the forecast period. This growth is fueled by its customizability and appeal to younger demographics who favour flavoured ones such as vanilla, caramel and hazelnut. In the U.S., 67% of millennial coffee drinkers prefer espresso-based beverages, with lattes leading the category, said by the National Coffee Association. The rise of plant-based milk like almond and oat has further boosted latte demand because it aligns with health and sustainability trends. Additionally, latte’s Instagram-friendly presentation makes them highly marketable in the digital age and consequently contributing to their rapid growth in urban and digital-savvy markets.

By End-Use Insights

The cafes segment by far the leading segment of the Espresso market and captured 40.7% of global market share in 2023. The dominance of this segment is attributed to their role as hubs for socialization, workspaces and premium coffee experiences. In 2022, there were over 37,000 Starbucks locations globally highlighting the global café culture’s scale (Starbucks). These are integral to espresso consumption offers a range of espresso-based beverages like cappuccinos, lattes and mochas. Europe leads in café culture and Italy among all in the region consumes over 14 billion espresso cups annually, according to FAO. The rise of independent specialty coffee shops worldwide further solidifies café’s position as the primary drivers of espresso consumption.

The home and offices segment is gaining traction and is predicted to account for a notable share of the global market over the forecast period. The COVID-19 pandemic significantly accelerated this trend due to increased demand for remote work and hybrid office models at-home espresso machines. According to the International Coffee Organization (ICO), global sales of home espresso machines grew by 30% from 2020 to 2022. Offices are also investing in premium coffee equipment to enhance employee satisfaction with 89% of employees stating that access to good coffee improves workplace morale (NCA). The rise in compact and user-friendly espresso machines along with the growing demand for cafe-quality coffee at home is driving this segment’s rapid growth.

REGIONAL ANALYSIS

North America outranked other regions and accounted for the largest share of the worldwide market in 2023 owing to the growing coffee culture and premiumization of beverages. The U.S. leads the region with approximately 62% of Americans consuming coffee daily, as per the National Coffee Association. Espresso-based drinks such as lattes and cappuccinos are among the most popular choices in urban areas. With a rise in at-home espresso machine ownership and increasing demand for specialty coffee, the region is expected to experience steady growth. Canada also contributes significantly by having a high coffee consumption per capita supported by the cafe culture in major cities like Toronto and Vancouver.

Europe is another largest market for espresso globally and is home to countries like Italy and France, where espresso is deeply embedded in the culture. Italy, the birthplace of espresso, consumes over 5.8 kg of coffee per capita annually (ICO). The region's market is supported by a high density of coffee shops and a strong tradition of coffee consumption. Northern European countries like Finland and Sweden also lead in per capita coffee consumption, creating robust demand for espresso and espresso-based beverages. Sustainability and organic coffee trends are shaping future growth, with Europe prioritizing ethical sourcing and eco-friendly products.

Asia-Pacific is the predicted to be the fastest-growing regional market for espresso worldwide over the forecast period owing to the ncreasing urbanization, rising disposable incomes and the expansion of café chains. China’s coffee consumption grew by 15% annually over the past decade (USDA), as younger generations embrace espresso as a trendy and aspirational beverage. Similarly, countries like Japan and South Korea have well-established café cultures, with espresso-based drinks gaining popularity. India’s growing middle class and expanding café chains like Starbucks and local players further boost the market. Asia-Pacific’s growth trajectory is shaped by a combination of rapid urbanization and evolving consumer preferences.

Latin America known as a leading coffee-producing region is also experiencing a growing espresso market, particularly in urban centers. Brazil, the world's leading coffee producer, accounts for 39% of global coffee production and has a strong domestic coffee culture. Espresso is becoming more popular as cafes in countries like Mexico, Colombia and Argentina cater to urban consumers seeking premium coffee experiences. The region’s future performance is supported by growing café chains and innovations in coffee brewing.

The Middle East and Africa are emerging markets for espresso with countries like the UAE, Saudi Arabia and South Africa taking the charge. The UAE’s cafe culture is expanding rapidly and is supported by a high expatriate population. South Africa’s coffee consumption grew by 3% annually in recent years driven by the rise of specialty coffee shops. While espresso is still a niche segment in many African countries, growing urbanization and rising disposable incomes are driving demand. Ethiopia, as the birthplace of coffee, presents opportunities for espresso adoption in its burgeoning cafe culture.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the Espresso Market include Nestlé (Nespresso), Starbucks Corporation, Lavazza Group, JAB Holding Company (Jacobs Douwe Egberts, Peet's Coffee), Illycaffè, Segafredo Zanetti (Massimo Zanetti Beverage Group), Luckin Coffee, Keurig Dr Pepper Inc., Breville Group, and De’Longhi Group

The Espresso market is highly competitive, fuelled by a mix of global brands, regional players and independent coffee shops. Key international companies like Starbucks, Nestle (Nespresso) and Lavazza dominate due to their strong brand equity and extensive distribution networks and innovations in premium espresso products. These companies focus on expanding product lines with options like single-origin espresso and organic blends catering to evolving consumer preferences.

Regional players contribute significantly, particularly in Europe, where brands like Illycaffè and Segafredo have a strong presence. Italy being the birthplace of espresso remains a hub of competition with traditional and artisanal brands vying for market share. In emerging markets like Asia-Pacific, local chains such as Luckin Coffee in China and Cafe Coffee Day in India compete with global players by offering affordable espresso options tailored to local tastes.

The home espresso machine market adds another layer of competition by brands like De’Longhi, Breville and Philips gaining traction as consumers increasingly brew cafe-quality espresso at home. Additionally, the rise of direct-to-consumer sales and e-commerce platforms intensifies competition enables smaller brands to reach global audiences.

To stay competitive, companies are investing in sustainability, innovation and customer loyalty programs, addressing the demand for premium and eco-conscious espresso experiences worldwide.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Starbucks at the time of new year introduced its new winter menu with Iced Hazelnut Oatmilk Shaken Espresso making its debut and the comeback of Pistachio Latte and Pistachio Cream Cold Brew.

- In November 2024, VEA Group was officially launched in Italy via the amalgamation of coffee equipment organisations Bellezza, Heylo, Elektra and Carimali. This newly united company holds all the obligations and rights of the amalgamated players.

- In April 2024¸ Nunc., a new AI-powered Espresso making system, was introduced. “Portafilter Machine” and Grinder machine by the start-up in Germany capitalise on the AI technology to simplify and modernise the extraction and grinding procedures, comprising a committed app to monitor brewing data.

MARKET SEGMENTATION

This research report on the global Espresso market has been segmented and sub-segmented based on type, end users, and region.

By Type

- Pure Espresso

- Double Espresso

- Ristretto

- Cappuccino

- Latte

- Mocha

- Macchiato

- Americano

By End-Use

- Cafes

- Restaurants

- Airports

- Hospitals

- Commercial

- Home and offices

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. How are sustainability concerns shaping the market?

Sustainability regulations, such as bans on non-recyclable single-use plastics in the EU, are pushing companies to adopt eco-friendly farming practices and develop biodegradable espresso pods.

2. What challenges does the espresso market face?

Key challenges include volatile coffee bean prices, supply chain disruptions, and environmental concerns such as waste from single-use pods and the ecological footprint of coffee farming.

3. Who are the key players in the espresso market?

Major players in the espresso market include Nestle (Nespresso), Starbucks Corporation, Lavazza Group, JAB Holding Company (Jacobs Douwe Egberts, Peet's Coffee), Illycaffè, Segafredo Zanetti, Breville Group, and De’Longhi Group.

4. Which region dominates the espresso market?

North America leads the market, with the United States being a major contributor due to its strong coffee culture and high consumption of espresso-based beverages. Europe, particularly Italy, also has a significant market share due to its rich espresso tradition.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]