Global ESG Reporting Software Market Size, Share, Trends & Growth Forecast Report – Segmented - By Component (Solution, Services), Organization Size (Large Enterprises, SMEs), Deployment Type (On-premises, Cloud), Vertical (BFSI, Government, Public sector, and non-profit, Retail), & Region - Industry Forecast From 2024 to 2032

Global ESG Reporting Software Market Size (2024 to 2032)

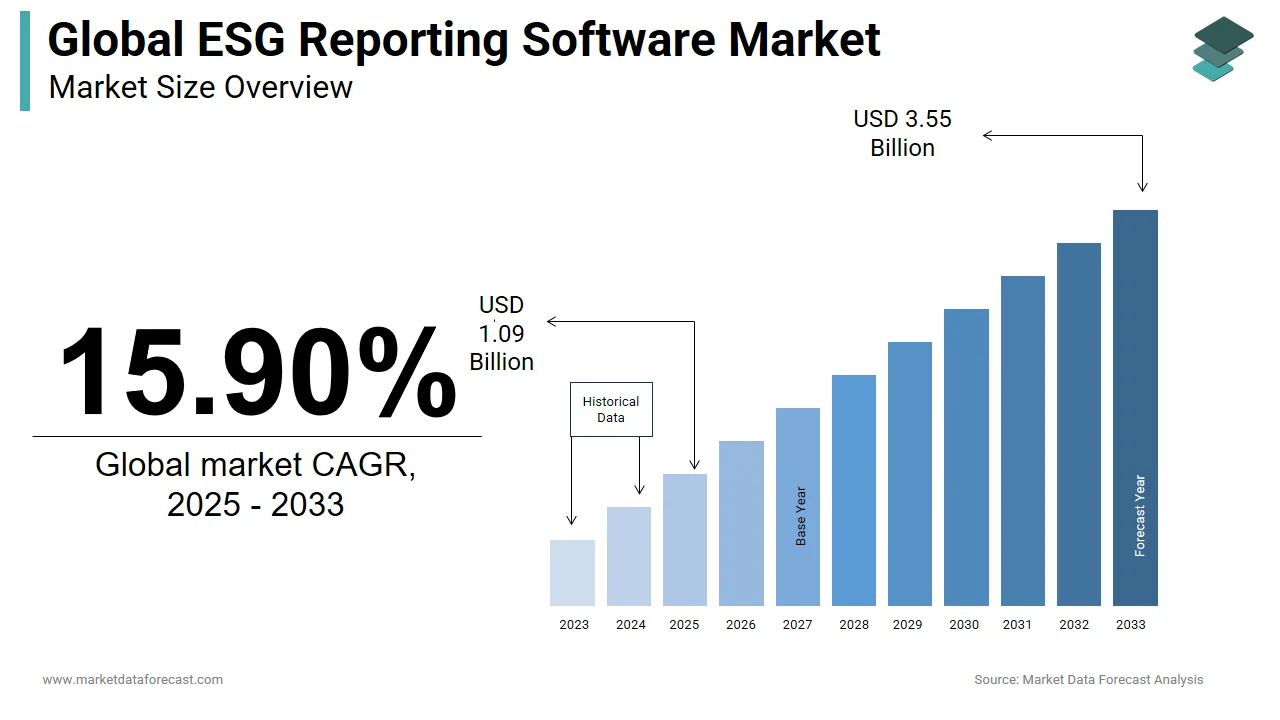

The global ESG reporting software market was worth USD 0.81 billion in 2023. The global market is predicted to reach USD 0.94 billion in 2024 and USD 3.06 billion by 2032, growing at a CAGR of 15.90% during the forecast period.

ESG Reporting software automates the collection and arrangement of ESG data to help firms comply with various disclosure requirements and evaluate key performance metrics. ESG reporting disseminates information regarding an organization's operations in three specific areas: environmental, social, and corporate governance. Investors rapidly incorporate ESG elements into their company analysis to uncover growth possibilities and significant dangers.

Current Scenario of the Global ESG Reporting Software Market

ESG software is currently used for financial, sustainable, and investment advice. Investors are focused mainly on ESG-related investments and transparency. Strong ESG performance is associated with increased investment returns, reduced risk, and enhanced crisis resilience. Due to the increasing need for organizations, institutions, and a wide range of stakeholders to address significant challenges such as prejudice, environmental degradation, change in climate, and social inequality, ESG investing has exploded in recent years. Due to the anticipated growth in the adoption and implementation of ESG investing solutions, the market for ESG reporting software is predicted to grow.

MARKET DRIVERS

Consistent growth in corporate data volume- Digitalization has provided numerous benefits, necessitating efficient resource management. Numerous organizations must store digitalized data securely to increase efficiency at a cheaper cost.

A cost-effective and efficient cloud-based information management infrastructure is viable in such conditions. It offers benefits such as minimum IT infrastructure support and rapid organization-wide utilization of cloud-based data. A company's enhanced financial success due to ESG becomes a more substantial element in its long-term viability.

Climate stress testing to gain traction among financial services organizations- Principal financial institutions and regulators have begun to see the resulting long-term threat to financial stability. In addition, they have also started to realize how vital financing will be in making the low-carbon transition easier and ensuring that the economy is resilient to climate change. Based on the research of the NGFS, central banks have started to test banks and insurers for climate risk as part of their stress tests. The European Central Bank's economy-wide climate stress tests in 2021 showed that banks need to improve how they measure their exposure to climate transition and physical risks to manage and deal with them proactively. In the US, for example, the Federal Reserve is figuring out how climate-related risks will affect financial institutions and the whole financial system.

On the other hand, China has been looking at ways to include climate change risk in its stress tests of financial institutions. Most of the work on climate stress tests is done by global central banks working together. Insurance regulators are taking similar steps to include sustainability and climate risks in their wise frameworks.

MARKET RESTRAINTS

Huge initial capital expenditure- Replacing the existing infrastructure with EHS Infrastructure will cost more money. Because of this, infrastructure investments in EHS solutions will always need a lot of money, limiting the growth of the global investor ESG reporting software market. Another significant problem in the market is that it is hard for companies to connect ESG software to their ERP systems. ESG standards are used in most of an organization's operations, no matter what kind of business it is or where it is located. However, EHS standards can be used to their full advantage by combining them with an ERP system. Still, this integration is complex because a company's IT infrastructure might not work with the investor's ESG software.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

15.90% |

|

Segments Covered |

By Component, Organization Size, Deployment Type, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Wolters Kluwer, Nasdaq, PwC, Workiva, Refinitiv, Diligent, Sphera, Cority, Intelex, Greenstone, Novisto, Emex, Enhelix, Anthesis, Diginex, Bain & Co., Keraminda, Isometrix, and others. |

SEGMENTAL ANALYSIS

Global ESG Reporting Software Market Analysis By Component

The ESG reporting software market is segmented by components into solutions and services. In 2021, the services sector increased its revenue share in the market. By providing reporting as a managed service, the services boost the consumer's accessibility to transparency and convenience. In addition, reporting services provide a set of templates for specific use cases, such as TCFD reporting, climate change reporting, and evaluating the customization capabilities for giving client brand reports.

Global ESG Reporting Software Market Analysis By Organization Size

Large enterprises and small and medium enterprises. In terms of revenue, the major share of the ESG reporting software market in 2021 was made up of large enterprises. Business practices that are open and good for society are in high demand on the market. Customers, non-governmental organizations, investors, and employees are just some of the groups that big businesses often have to think about. This stakeholder wants to know more about how the company affects the world.

Global ESG Reporting Software Market Analysis By Deployment Type

Based on deployment mode, the market for ESG reporting software is classified into on-premise and cloud categories. In 2021, the on-premises segment commanded the largest revenue share of the market. Investors and stakeholders seek to comprehend how a company's ESG practices may impact its financial performance. Hence, ESG reporting is becoming increasingly essential. In addition, ESG reporting is a useful tool that real estate firms may utilize to better their social responsibility and sustainability objectives.

Global ESG Reporting Software Market Analysis By Vertical

The government segment is leading with the most significant shares of the market. With the help of their policies and regulations, the government may make a big difference in how ESG risks are managed and changed, as well as how they turn out. However, the best way to catch them is to measure and analyze each sector's ESG risk early.

REGIONAL ANALYSIS

The ESG reporting software market is broken down by geography into North America, Europe, Asia Pacific, Latin America, and MEA. In 2021, North America held the greatest revenue share in the worldwide ESG reporting software market. The increasing acceptance of ESG by the regional institutional financial sector will likely generate considerable growth opportunities for the North American ESG software market. The benefits of shareholder ESG software contribute to the sector's expansion. Investors are interested in the challenges and potential of the ESG businesses.

KEY PARTICIPANTS IN THE GLOBAL ESG REPORTING SOFTWARE MARKET

The major companies operating in the global ESG reporting software market include Wolters Kluwer, Nasdaq, PwC, Workiva, Refinitiv, Diligent, Sphera, Cority, Intelex, Greenstone, Novisto, Emex, Enhelix, Anthesis, Diginex, Bain & Co., Keraminda, and Isometrix.

RECENT HAPPENINGS IN THE GLOBAL ESG REPORTING SOFTWARE MARKET

-

In July 2021, Sphera announced the establishment of the SpheraCloud platform through new interconnected characteristics and an enhanced user interface. These enhancements aim to offer customers vital ESG and risk management information intuitively, integrated, and streamlined.

-

In August 2021, Diligent announced the launch of Diligent ESG on its governance, risk, and compliance platform. The solution acts as a center for ESG data from various sources to assist risk monitoring, goal setting, and stakeholder reporting.

DETAILED SEGMENTATION OF THE GLOBAL ESG REPORTING SOFTWARE MARKET INCLUDED IN THIS REPORT

This research report on the global ESG reporting software market has been segmented and sub-segmented based on the component, organization size, deployment type, vertical, and region.

By Component

-

Solution

-

Services

By Organization Size

-

Large Enterprises

-

SMEs

By Deployment Type

-

On-premises

-

Cloud

By Vertical

-

BFSI

-

Government

-

Public sector & non-profit

-

Retail

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Frequently Asked Questions

How do large enterprises and SMEs differ in their adoption of ESG Reporting Software worldwide?

Large enterprises tend to be early adopters of ESG Reporting Software, driven by regulatory compliance and corporate responsibility goals. SMEs are gradually catching up, with a growing awareness of the benefits associated with sustainable business practices.

How are government initiatives impacting the ESG Reporting Software Market across different continents?

Governments globally are introducing and strengthening regulations related to ESG reporting, fostering a positive environment for the ESG Reporting Software Market. This includes initiatives in North America, Europe, Asia-Pacific, and other regions.

Are there specific industries that are more inclined towards adopting ESG Reporting Software solutions globally?

Industries such as finance, energy, and technology are at the forefront of adopting ESG Reporting Software due to their significant environmental and social impacts. However, adoption is expanding across various sectors driven by increased awareness.

How do cultural and regional differences impact the implementation of ESG Reporting Software globally?

Cultural and regional differences affect the interpretation and prioritization of ESG factors. Therefore, companies need to customize their approaches based on local contexts, making it crucial to understand and navigate diverse cultural landscapes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]