Global ERV Market Size, Share, Trends, & Growth Forecast Report Segmented By Type(Residential, Industrial, Commercial, and Others), Application (Heat pipe heat exchanger, Run-around coil, Plate heat exchanger, Rotary heat exchanger, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global ERV Market Size

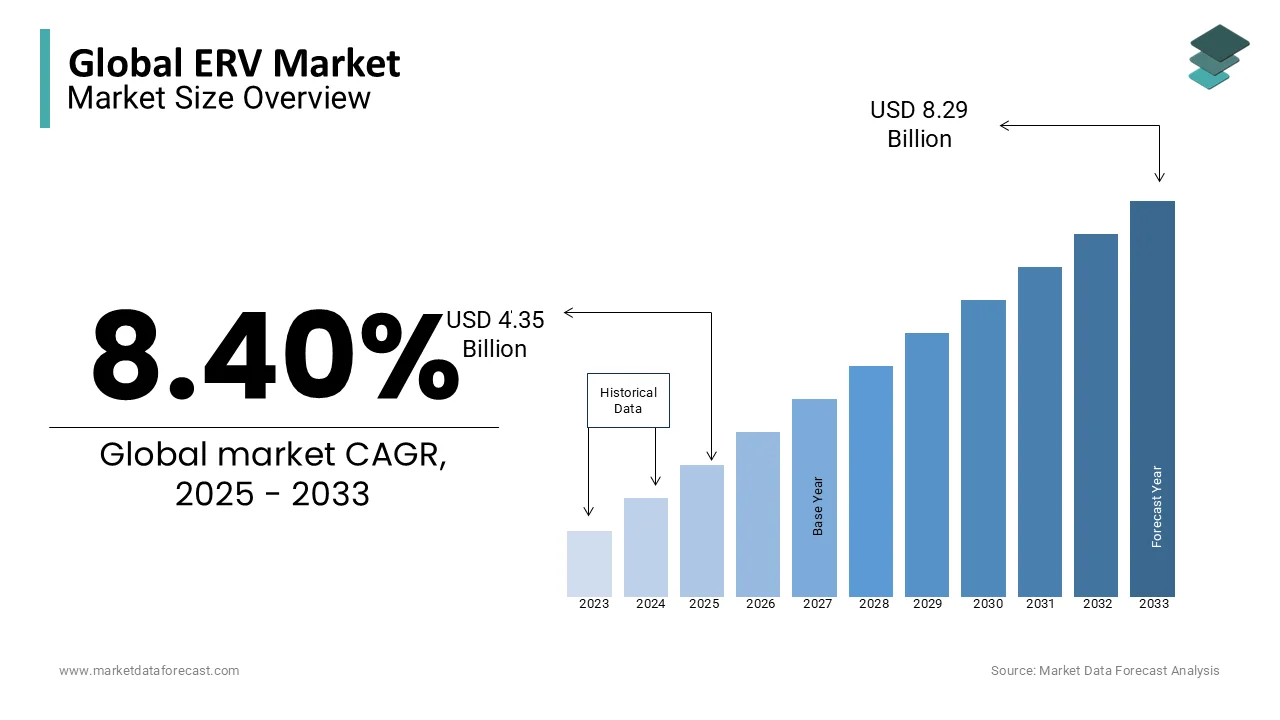

The global energy regulator ventilators (ERVs) market was worth USD 4.01 billion in 2024. The global market is predicted to reach USD 4.35 billion in 2025 and is estimated to reach USD 8.29 billion by 2033, rising at a CAGR of 8.40% from 2025 to 2033.

Energy Regulator Ventilators (ERVs) are designed to improve indoor air quality while minimizing energy loss by transferring heat and moisture between incoming and outgoing airflows. This dual function ensures optimal temperature and humidity levels by making ERVs a key component in sustainable building solutions.

Technological advancements such as the integration of smart sensors and IoT capabilities are enhancing the performance of ERV systems. For example, smart ERVs can monitor real-time air quality and automatically adjust ventilation to meet optimal conditions. The adoption of green building certifications like LEED is also driving the market with ERVs help buildings meet stringent energy-efficiency standards.

Furthermore, the rising awareness of indoor air pollution is linked to health issues like asthma and respiratory diseases with the importance of ERVs in maintaining healthier indoor environments while reducing energy consumption.

MARKET DRIVERS

Stringent Energy Efficiency Regulations

Government regulations mandating energy-efficient building systems are a significant driver of the ERV market. For instance, the European Union’s Energy Performance of Buildings Directive (EPBD) requires nearly zero-energy buildings (NZEB) by 2030 that is promoting the adoption of energy recovery systems. ERVs improve HVAC efficiency by up to 30% by enabling compliance with such regulations. Additionally, the U.S. Department of Energy has set energy conservation standards for residential ventilation systems that further promoting ERV adoption. These systems support energy savings while maintaining optimal indoor air quality which aligns with global sustainability goals and incentivizing their implementation in new and retrofitted buildings.

Increasing Focus on Indoor Air Quality (IAQ)

The rising awareness of health risks linked to poor indoor air quality, such as respiratory disorders and allergies, drives ERV adoption. The World Health Organization (WHO) reports that indoor air pollution contributes to 3.8 million deaths annually by highlighting the critical need for clean indoor environments. ERVs reduce pollutants like carbon dioxide and volatile organic compounds (VOCs) by continuously exchanging indoor and outdoor air while maintaining energy efficiency. This dual benefit of improving air quality and reducing energy consumption makes ERVs an essential component in modern ventilation systems in urban areas with high pollution levels.

MARKET RESTRAINTS

High Initial Installation Costs

The high upfront cost of ERV systems, including equipment, installation, and integration with existing HVAC systems, is a significant restraint. On average, ERV installation costs range between $2,500 to $5,000 for residential setups and much higher for commercial systems. This cost barrier discourages adoption is particularly among small businesses and budget-conscious homeowners. Additionally, retrofitting ERVs in older buildings often requires extensive modifications which further levels up the expenses. Despite long-term energy savings, the high initial investment can deter potential users that slows down the market growth in cost-sensitive regions.

Limited Awareness in Developing Regions

In developing regions, limited awareness of the benefits of Energy Recovery Ventilators (ERVs), such as energy efficiency and improved air quality will significantly hinders market penetration. A recent report by the International Energy Agency (IEA) highlights that buildings account for nearly 30% of global energy consumption but awareness of energy-efficient technologies like ERVs remains low in developing countries. For example, a 2023 study found that only 35% of building managers in emerging economies are familiar with ERV technology when compared to over 70% in developed nations. This knowledge gap is combined with a lack of incentives and supportive policies which restricts adoption in these areas. Furthermore, the World Health Organization (WHO) reports that indoor air pollution contributes to 3.2 million deaths annually with the urgent need for better air quality solutions like ERVs in developing markets. Addressing these challenges will require robust education campaigns, government subsidies, and international collaboration to promote ERV usage and unlock the potential for energy savings and health benefits in underrepresented regions.

MARKET OPPORTUNITIES

Integration of Smart Technologies

The incorporation of smart technologies, such as IoT and AI, presents significant opportunities in the ERV market. Smart ERVs equipped with real-time air quality monitoring, predictive maintenance, and automated operation enhance user convenience and system efficiency. For example, IoT-enabled ERVs can adjust airflow based on occupancy and indoor pollutant levels by reducing energy consumption by up to 20%. A 2023 report by Smart Building Solutions indicates that 45% of new ERV installations now feature smart integration is reflecting the consumer demand. This trend positions manufacturers to innovate and offer advanced products which is expanding their market share.

Growing Demand in Emerging Economies

Rapid urbanization and increasing infrastructure investments in developing countries like India, Brazil, and Indonesia provide a lucrative market for ERVs. Rising air pollution levels and greater awareness of indoor air quality are prompting governments and businesses to adopt sustainable ventilation solutions. For instance, India’s National Clean Air Programme (NCAP) aims to reduce particulate matter pollution by 20-30% by 2024 by creating opportunities for ERV implementation. Manufacturers can tap into an expanding consumer base by targeting these high-growth regions with cost-effective and tailored solutions.

MARKET CHALLENGES

Lack of Standardization Across Regions

The absence of uniform standards for ERV performance and energy recovery efficiency poses a challenge for global adoption. Different countries have varying benchmarks, creating inconsistencies in system design and certification. For example, while the U.S. focuses on ASHRAE standards, Europe prioritizes EN standards, complicating product development for manufacturers targeting multiple markets. A 2023 industry survey found that 45% of manufacturers faced delays due to regional compliance issues. This lack of standardization increases costs and slows adoption, particularly for global companies seeking to scale operations.

Complex Integration with Existing Systems

Retrofitting ERVs into older buildings often requires complex modifications to existing HVAC systems, which can deter adoption. Challenges include limited space for installation and compatibility issues with outdated infrastructure. According to a 2023 report by the Energy Efficiency Alliance, 30% of retrofit projects in North America encounter delays due to integration challenges. These complexities not only increase costs but also require specialized labor which is limiting accessibility in regions where skilled technicians are scarce. Simplifying installation processes and developing adaptable solutions is crucial to overcoming this barrier.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.40% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls International plc, Mitsubishi Electric Corporation, Panasonic Corporation, LG Electronics Inc., Trane Technologies plc, RenewAire LLC, Zehnder Group AG, and Greenheck Fan Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The commercial segment was accounted in holding for 42% of ERV market with the increasing implementation of ERV systems in office buildings, shopping centers, and educational institutions. This trend is propelled by stringent building regulations and a growing emphasis on indoor air quality to enhance occupant health and productivity. For instance, the U.S. Energy Information Administration reported that commercial buildings accounted for approximately 18% of total U.S. energy consumption in 2020 that is highlighting the potential for energy savings through efficient ventilation systems. The adoption of ERVs in commercial spaces contributes significantly to reducing HVAC energy loads and aligns with sustainability goals and operational cost reductions.

The residential segment is experiencing the fastest growth, with a projected compound annual growth rate (CAGR) of 13.10% from 2025 to 2033. This rapid expansion is attributed to increasing awareness among homeowners about indoor air quality and energy efficiency. The rise in construction of energy-efficient homes and the incorporation of ERV systems in building codes are further propelling this growth. Additionally, government incentives and rebates for energy-efficient home improvements encourage homeowners to invest in ERV systems by enhancing indoor comfort while reducing utility bills.

By Application Insights

The plate heat exchanger segment held 40% of the Energy Recovery Ventilator (ERV) market. This dominance is attributed to its high efficiency in transferring heat between air streams without mixing them by making it ideal for maintaining indoor air quality and energy conservation. Plate heat exchangers are widely adopted in both residential and commercial buildings due to their compact design, cost-effectiveness, and minimal maintenance requirements. Their ability to recover up to 80-90% of energy from exhaust air significantly reduces HVAC energy consumption by aligning with global energy efficiency standards and sustainability goals.

The rotary heat exchanger segment is experiencing the fastest growth, with a projected compound annual growth rate (CAGR) of 8.7% from 2025 to 2033. This rapid expansion is driven by its superior performance in both sensible and latent heat recovery by enhancing overall system efficiency. Rotary heat exchangers are particularly effective in climates with high humidity variations as they can manage moisture transfer alongside heat exchange. Their application in large commercial and industrial settings where maintaining precise indoor climate control is crucial which further propels their adoption. Advancements in rotor materials and designs have improved durability and efficiency by making them a preferred choice for modern ERV systems.

REGIONAL ANALYSIS

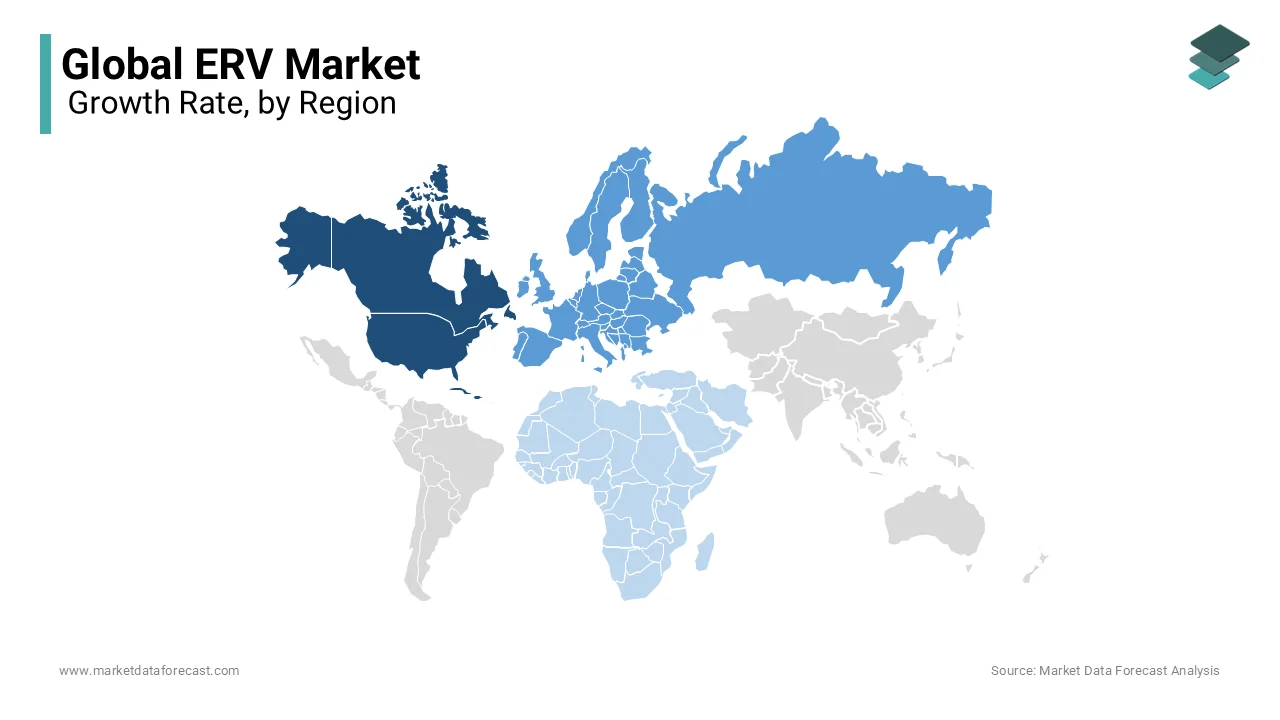

North America held a market share of USD 1.47 billion in 2024 owing to a strong emphasis on energy efficiency and indoor air quality. The mature construction industry and established HVAC infrastructure in countries like the U.S. contribute to this dominance. The market is expected to witness steady growth, supported by increasing investments in green building projects and government regulations promoting energy conservation.

Europe represents is anticipated to be second largest during the forecast period. This growth is attributed to the rising demand for energy-efficient ventilation systems and increasing awareness of indoor air quality. Leading countries in this regional market include Germany, France, and the UK which are at the forefront of adopting advanced ERV technologies.

Asia-Pacific is anticipated to witness a CAGR of 9.2% over the forecast period, driven by rapid urbanization, expanding construction activities, and increasing awareness of energy-efficient solutions. Countries like China and India are leading the adoption of ERV systems that will be supported by government initiatives promoting sustainable building practices.

Latin America: The ERV market in Latin America is expected to experience significant growth during the forecast period with increasing construction activities and a growing emphasis on energy efficiency. Countries such as Brazil and Mexico are leading the regional market with rising investments in infrastructure development contributing to the demand for ERV systems.

Middle East and Africa: This region is projected to witness steady growth rate during the forecast period in the ERV market, driven by increasing construction projects and a growing focus on indoor air quality. The adoption of ERV systems is expected to rise in countries like the UAE and South Africa where there is a significant emphasis on sustainable building practices.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

Daikin Industries, Ltd., Carrier Global Corporation, Johnson Controls International plc, Mitsubishi Electric Corporation, Panasonic Corporation, LG Electronics Inc., Trane Technologies plc, RenewAire LLC, Zehnder Group AG, and Greenheck Fan Corporation are leading players in the global ERV market. The Energy Recovery Ventilator (ERV) market is highly competitive, driven by increasing demand for energy-efficient ventilation solutions across residential, commercial, and industrial sectors. Key players such as Daikin Industries, Carrier Global Corporation, and Johnson Controls dominate the market with comprehensive portfolios and global reach. These companies leverage advanced technologies, including IoT-enabled systems, to offer innovative and efficient solutions tailored to customer needs.

Regional players like Zehnder Group and Greenheck Fan Corporation focus on specific markets, providing customized solutions and establishing a strong local presence. Competition is further intensified by new entrants emphasizing sustainability and smart ventilation features, targeting eco-conscious consumers.

Collaboration and innovation are central to market competition. For instance, established companies partner with research institutions to develop high-performance heat exchangers and enhanced control systems. Product diversification, such as ERVs integrated with advanced air filtration and humidity control, differentiates market leaders from competitors.

Government regulations promoting green building practices and energy conservation standards further drive competitive strategies. Companies are investing heavily in R&D to comply with these standards while maintaining cost-effectiveness. With the rising awareness of indoor air quality and energy efficiency, competition is expected to increase, fostering innovation and technological advancement in the ERV market.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Panasonic Corporation launched the WhisperComfort® 60 Energy Recovery Ventilator (ERV). This product introduction demonstrates Panasonic's commitment to offering whole-house ventilation solutions that are both economical and energy-efficient, enhancing their product portfolio in the ERV market.

- In August 2024, Greenheck Fan Corporation expanded its product line by adding three new high-performance residential energy recovery ventilators: SYNC-110SEA, SYNC-180TCE, and Assure-140SC. This expansion aims to meet the growing demand for energy-efficient ventilation solutions in residential applications, strengthening Greenheck's market presence.

- In 2023, Daikin Industries, Ltd. invested in research and development to enhance the efficiency of their ERV systems. This initiative focuses on integrating advanced technologies to improve energy recovery performance, aligning with global energy conservation trends and reinforcing Daikin's competitive edge.

- In 2023, Johnson Controls International plc partnered with building management firms to incorporate their ERV systems into smart building solutions. This collaboration aims to provide integrated, energy-efficient ventilation options, expanding their market reach in the commercial building sector.

- In 2023, Mitsubishi Electric Corporation introduced a new line of compact ERV units designed for residential use. These units cater to the increasing demand for space-saving and energy-efficient home ventilation systems, broadening Mitsubishi Electric's product offerings.

- In 2023, LG Electronics Inc. launched a campaign to promote awareness about indoor air quality and the benefits of ERV systems. This marketing strategy is intended to educate consumers and drive demand for their energy recovery ventilators.

- In 2023, Trane Technologies plc developed customizable ERV solutions tailored for industrial applications. This product development addresses the specific ventilation needs of industrial facilities, enhancing Trane's position in the industrial segment of the ERV market.

- In 2023, RenewAire LLC expanded its manufacturing facilities to increase production capacity. This expansion is aimed at meeting the rising demand for ERV systems, ensuring timely delivery, and maintaining market competitiveness.

- In 2023, Zehnder Group AG invested in digital technologies to offer smart control features in their ERV products. This investment enhances user experience and positions Zehnder as an innovator in the ERV market.

- In 2023, Greenheck Fan Corporation launched an educational initiative to train HVAC professionals on the installation and benefits of ERV systems. This initiative is designed to promote the adoption of energy recovery ventilators and establish Greenheck as a thought leader in the industry.

MARKET SEGMENTATION

This research report on the global energy regulator ventilators (ERV) market has been segmented and sub-segmented into the following categories.

By Type

- Residential

- Industrial

- Commercial

- Others

By Application

- Heat pipe heat exchanger

- Run-around coil

- Plate heat exchanger

- Rotary heat exchanger

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What drives the global demand for ERVs?

The increasing focus on energy-efficient HVAC solutions, stricter building codes, rising awareness about indoor air quality, and global efforts to reduce carbon footprints are key factors driving demand for ERVs worldwide.

What industries benefit the most from ERVs?

The commercial, residential, healthcare, and industrial sectors benefit greatly from ERVs. They are particularly valuable in buildings with high energy usage, such as hospitals, offices, and educational institutions.

What are the major technological advancements in the ERV market?

Recent advancements include smart ERV systems with IoT integration, improved heat exchanger materials, and enhanced moisture recovery technologies, which optimize energy efficiency and provide real-time monitoring and control.

What is the future outlook for the ERV market?

The ERV market is expected to grow steadily as energy-efficient technologies gain prominence. Factors such as smart city initiatives, technological advancements, and increasing awareness of indoor air quality will continue to drive demand globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]