Global Environmental Health and Safety Software Market Size, Share, Trends & Growth Forecast Report By Component (Solution and Services), Services (Analytics, Project Deployment, and Implementation, Business Consulting and Advisory, Audit, Assessment, Regulatory Compliance, Certification, Training, And Support), Deployment Mode (Cloud and On-Premises), Vertical (Chemicals and Material, Food and Beverages, Government and Defense, Energy and Utilities, Healthcare, Construction and Engineering, Automotive, Telecom, IT and Retail) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Environmental Health and Safety Software Market Size

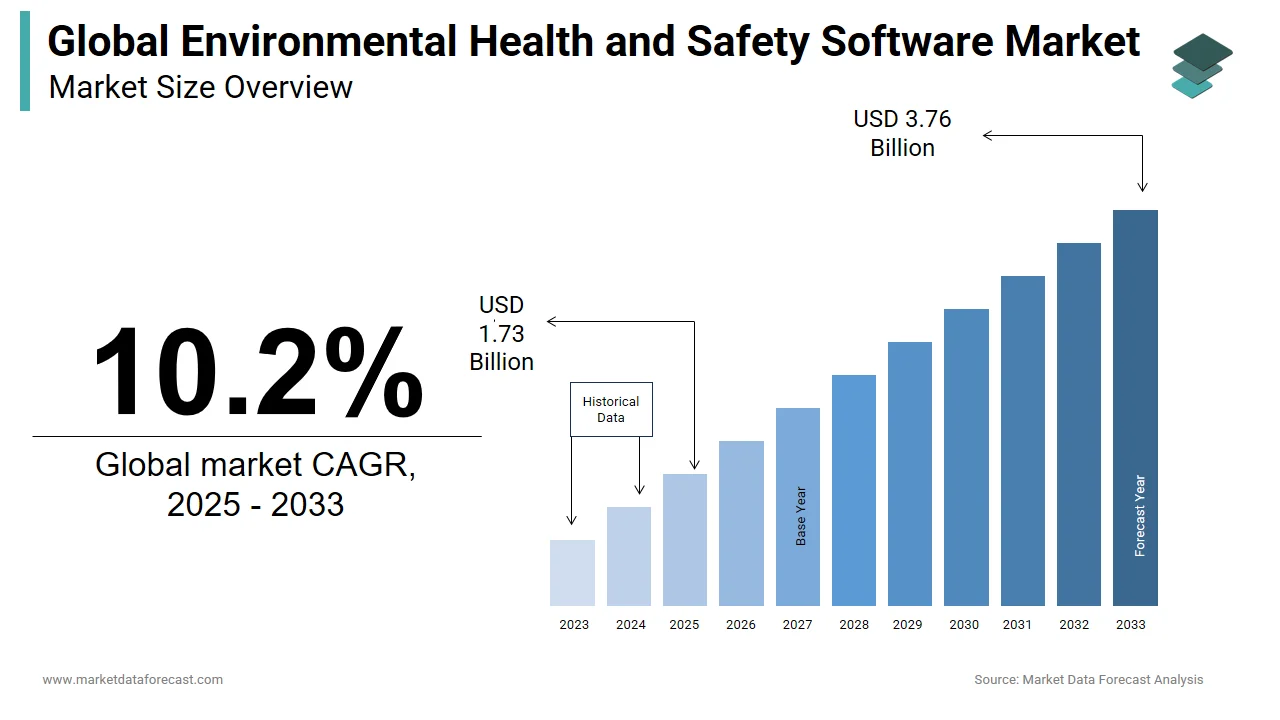

The global environmental health and safety software market was worth USD 1.57 billion in 2024. The global market is predicted to reach USD 1.73 billion in 2025 and USD 3.76 billion by 2033, growing at a CAGR of 10.2% during the forecast period.

Over the last few years, the demand for the environmental health and safety (EHS) software market has been growing gradually and is expected to accelerate further during the forecast period. An increase in the number of regulatory requirements, growing awareness of workplace safety, and the push for sustainable business practices have been propelling the global market growth, and these factors are continuing to boost the global market growth during the forecast period. The U.S. is currently playing a major role in the global market as the U.S. has stringent regulations from bodies such as OSHA and the EPA on sustainability and risk management.

- According to the U.S. Bureau of Labour Statistics, in 2022, among all 19 sectors, the transport and warehousing sector had the maximum number of illnesses and serious injury rate of an estimated 3.8 cases per 100 workers. This also involves last mile delivery and e-commerce warehouses.

On the other hand, Europe and Asia-Pacific have also been experiencing substantial growth for environmental health and safety (EHS) software. Countries such as Germany and China implemented EHS standards to ensure compliance and worker safety.

Companies such as SAP, IBM, and Enablon are playing a dominating role in the global EHS software market and currently, this market has intense competition. The growing need for continuous innovation and increasing investments by market participants in AI and cloud-based solutions to improve predictive analytics and the capabilities of real-time monitoring is expected to fuel the competition level in the global market further.

MARKET DRIVERS

The growing strict laws, regulations, guidelines, and processes related to the safety of the environment is one of the key factors propelling the growth of the environmental health and safety (EHS) software market.

The safety of workers and the environment is paramount to the governments and regulatory bodies, and considering this, they have been imposing strict environmental, health, and safety regulations. These measures are also required to fill the gap in the training of frontline workers.

- A 2024 study of more than 700 employers and 1000 workers in all frontline industries found that only 24 per cent fully agree that they possess the right set and amount of training and practice they require to thrive at work. And, 50 per cent stated the necessity to learn new things every day or weekly.

For instance, the European Union launched regulations called the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and Industrial Emissions Directive for industrial entities mandating stringent compliance measures. The United States came up with the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) and gave standards to maintain workplace safety and environmental protection. The growing need to meet the changing regulatory requirements to avoid costly fines and legal issues is likely to fuel the demand for EHS software and boost the global market growth.

An increase in the number of environmental protection initiatives is further contributing to the global EHS software market growth.

The governments of several countries and organizations worldwide have been prioritizing environmental protection to fight climate change, reduce pollution, and conserve natural resources. Initiatives such as the Paris Agreement and the European Green Deal have been working towards reducing carbon emissions and promoting sustainable practices. EHS software plays an integral part in assisting the organizations monitor and manage their impact on the environment and further helps to make sure to comply with the environmental regulations and thus achieve sustainability goals.

The rising awareness of workplace safety worldwide is boosting the growth of the environmental health and safety software market growth.

Workplace safety is a major concern for organizations, and to ensure workplace safety, organizations have been increasingly using EHS software. In the present era, maintaining a safe work environment to prevent accidents, injuries, and fatalities is the topmost priority for organizations.

- As per the statistics of the International Labour Organization (ILO), more than 2.3 million work-related deaths and hundreds of millions of non-fatal occupational injuries and illnesses record every year.

These statistics have promoted organizations to consider investing in the EHS solutions to improve safety protocols, track incidents and implement preventive measures. For instance, the initiatives of OSHA in the U.S. such as Safe + Sound campaign focuses on the importance of proactive safety and health programs.

In addition to the above, factors such as the acceptance of international standards across emerging economies, the emergence of predictive analytics and IoT, growing business demand to enhance operational efficiency and stability, and rapid increase in demand for EHS solutions and services are contributing to the expansion of the global EHS market. Furthermore, Y-o-Y growth in the need for data analytics in safety management, rising focus on sustainability practices, rapid adoption of cloud-based EHS solutions, an increasing number of corporate social responsibility (CSR) initiatives, growing need for risk management solutions and rising investments in EHS programs are favouring the growth of the global environmental health and safety software market.

MARKET RESTRAINTS

Data privacy issues, privacy concerns, and the high price associated with the software are majorly impeding the growth of the global EHS software market.

Limited awareness and understanding of the benefits of the EHS software, resistance to change from traditional methods, complexity of integration with existing systems, and lack of skilled professionals to manage EHS software are hampering the growth of the global market.

- A survey revealed that about 7 per cent of companies do not presently utilise an emergency management tool or instrument. This underscores the requirement for more strategic emergency preparation and response all over industries.

Inconsistent regulatory standards across regions, budget constraints in small and medium-sized enterprises, slow adoption of advanced technologies in some industries and the dependence on manual data entry and reporting are further affecting the growth of the global environmental health and safety software market negatively.

MARKET OPPORTUNITIES

Various technological integrations are expected to shape the future of the environmental health and safety market. EHS management is quickly evolving with innovative technologies such as fatigue-detection systems, artificial intelligence (AI), wearable, IoT, and smart sensors. IoT and smart sensors are fundamentally changing live tracking, observation, and workplace safety management. The market is set to benefit from the offerings of these technologies, including real-time insights into operational settings, and identifying situations such as machinery malfunctions, gas leaks, and temperature variations. This greatly improves the efficiency of the manufacturing sector by minimizing downtime, mitigating accidents, and anticipating equipment breakdowns. It also helps feasibility-wise and cost-wise.

AI and ML learning is another factor slated to further expand this market. This goes past predictive analytics to regulatory adherence monitoring and extensive risk management. Both ML and AI can determine and access hazards, assisting EHS managers in solving problems rapidly and detecting non-compliance patterns from incident logs and safety audits. Hence, ML solutions and cloud-based AI reduce costs for small businesses, ultimately leading to the development of the environmental health and safety software market.

MARKET CHALLENGES

The evolving compliance landscape is one of the challenges faced by professionals in the environmental health and safety software market. The constantly changing nature of workplace standards and regulations of the Occupational Safety and Health Administration (OSHA) makes it tough to keep adhere to these. This duty is further complicated by the range of industries, with each one having its own expectations and rules of procedure.

- According to a survey published in ilobby, close to half of companies, i.e. 48 per cent depend on consistent revisions and training for their EHS group to maintain compliance with the newest regulations, exhibiting the significance of current learning.

Risk detection and reduction is another major hurdle for the expansion of the market. Most of the professionals in this field struggle of timely identify and mitigate the problem.

- As per the report by the Intelex, over 50 per cent of companies encounter difficulties in gathering the necessary information for proactive and productive EHS and ESG initiatives.

Dangers are not stationary, they change as new technologies are accepted, procedures are modified or altered, and employee attrition happens. The thing which makes risk management especially hard is the twofold necessity to quickly identify new risks alongside evaluating current controls to confirm.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Component, Services, Deployment Model, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IsoMetrix (South Africa), Airsweb (England), Quentic (Germany), Sphera (US), Enviance (US), ETQ (US), UL (US), SAP (Germany), DNV GL (Norway), SAI Global (US), Verisk 3E (US), Enablon (France), VelocityEHS (US), Intelex (Canada), Gensuite (US), Cority (Canada), Dakota Software (US), ProcessMAP (US), SafetyCulture (Australia), ProntoForms (Canada), and Enhesa (US) and Others. |

SEGMENTAL ANALYSIS

By Component Insights

The solution segment held 66.3% of the global market in 2023. The solutions segment is the largest and fastest growing segment in the global market. The dominance of the solutions segment is majorly credited to the growing need for regulatory compliance, the rapid adoption of advanced technologies such as IoT and AI, and the rising emphasis on workplace safety and environmental sustainability. The rapid adoption of cloud-based EHS solutions by organizations is further boosting the growth rate of the solutions segment in the global market. For instance, the usage of cloud-based EHS solutions is currently experiencing a 30% y-o-y growth.

The services segment held a substantial share of the worldwide market in 2023 and is predicted to grow at a notable CAGR during the forecast period. The growing complexity of EHS regulations, the increasing need for customized solutions, and the escalating demand for ongoing support and maintenance to ensure optimal software performance and compliance are propelling the growth of the services segment in the global market.

By Services Insights

The analytics segment led the market by accounting for 22.9% of the global market share in 2023 and is predicted to grow at the fastest pace during the forecast period. Organizations have been increasingly depending on analytics to identify trends, manage risks, and make sure of compliance. The growing need for data-driven decision-making, predictive insights, and real-time monitoring of environmental and safety metrics is majorly propelling the growth of the analytics segment in the global market.

- According to Verdantix, more than 70% of the large enterprises use EHS analytics software to improve their operational efficiency and regulatory compliance.

The project deployment and implementation segment is also a notable segment and is expected to account for a considerable share of the global market during the forecast period. The rising complexity of EHS regulations and the need for seamless software integration are boosting the expansion of the project deployment and implementation segment in the global market.

By Deployment Model Insights

The on-premises segment currently dominating the global EHS software market and is expected to grow at a steady CAGR during the forecast period. The on-premises deployment model enables the deployment of EHS solutions within company premises, helps customers maintain compliance needs, and monitors the security of deployed applications. The data security concerns for large-sized enterprises are one of the factors driving the expansion of the on-premises segment in the global market.

The cloud segment is anticipated to witness the fastest growth in the global market during the forecast period. The cloud deployment model in the EHS software market is rapidly gaining traction. The benefits of the cloud-based deployment model, such as scalability, cost-effectiveness, and ease of access, are one of the key factors contributing to the expansion of the cloud segment in the global market. The adoption of cloud-based EHS solutions is particularly high among SMEs due to their lower upfront costs and minimal IT infrastructure requirements, and this trend is likely to continue during the forecast period and boost the segmental expansion.

- According to Deloitte, more than 70% of the SMEs prefer cloud-based EHS solutions due to the cost and operational flexibility.

By Vertical Insights

Among these, the energy and utilities segment held 21.8% of the global market share in 2023 and is predicted to continue to be the dominating segment throughout the forecast period. The growth of the energy and utilities domain is majorly driven by the rapid adoption of EHS solutions due to the evolving laws, regulations, and standards around the world.

- As per the data from Aberdeen Group, more than 85% of the companies that operate in the energy and utilities sector worldwide use EHS software to monitor emissions and ensure regulatory compliance.

The growing investments in renewable energy projects and stringent environmental regulations are further driving the adoption of EHS solutions in the energy and utilities sector and boosting the segmental expansion.

The construction and engineering segment is another major segment and is estimated to hold a substantial share of the global market during the forecast period. The rising adoption of Building Information Modeling (BIM) and IoT technologies is one of the major factors driving the growth of the construction and engineering segment in the global market.

- According to the statistics provided by the UK’s Health and Safety Executive (HSE), the construction sector, along with two other sectors (Agriculture, Forestry, Fishing, and Manufacturing) in Britain, registered two-thirds of all deaths. Of these, 51 fatalities of workers in 2023-24 happened in the construction sector, which is 4 more than the last year. This makes an average death count of 42 every year.

REGIONAL ANALYSIS

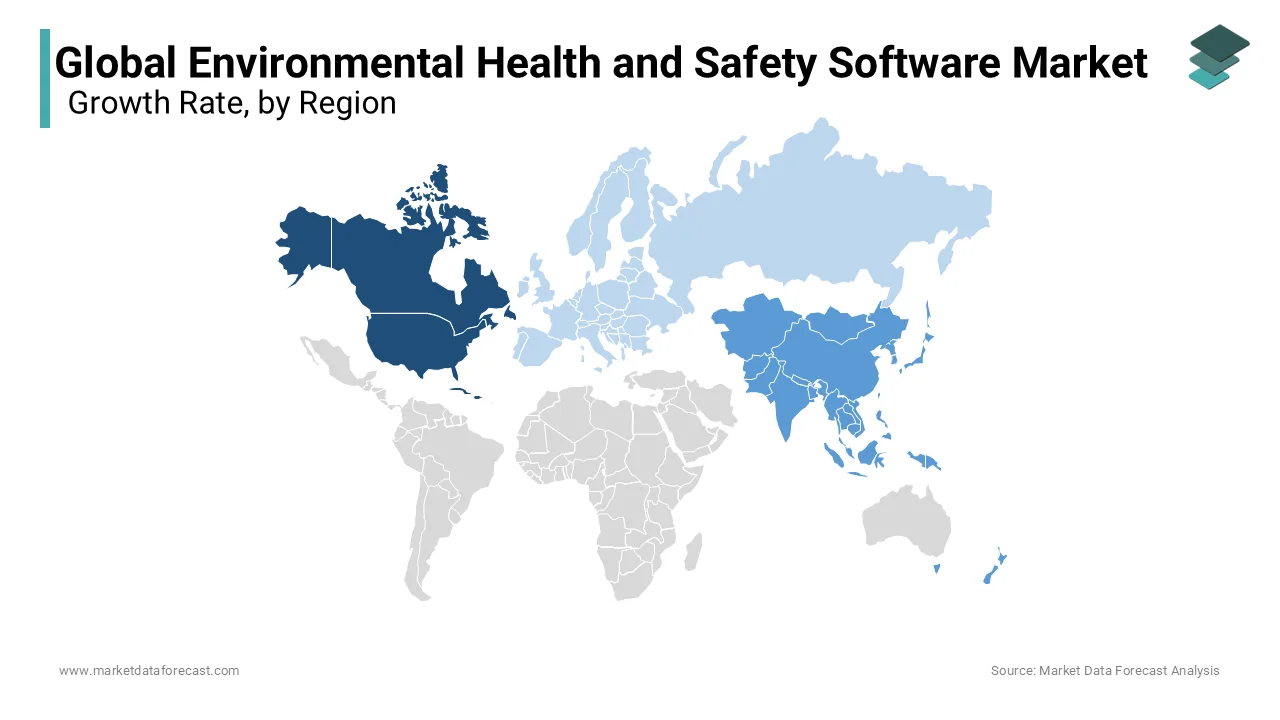

North America held 40.8% of the global market share in 2023. During the forecast period, North America is anticipated to account for a notable share of the global market and grow at a prominent CAGR owing to stringent regulatory requirements, strong emphasis on workplace safety, and rapid adoption of technological developments in various industries. The well-established infrastructure that helps generate a huge demand for EHS solutions and increasing investments by the major key players in the North American region are further boosting the growth rate of the regional market.

Asia Pacific region is predicted to grow rapidly in the global market. The market in the Asia-Pacific is and holds the second largest share of the environmental health and safety software market due to the increasing demand for businesses to enhance operational efficiency and stability, especially in nations such as India, China, Japan, Australia, and others. Factors such as the industrial expansion, increasing awareness of workplace safety, and government initiatives to enforce environmental standards are further boosting the regional market expansion.

- As per the data of Asia-Pacific Economic Cooperation, more than 50% of the organizations in the Asia-Pacific region are investing in EHS software to improve compliance and operational efficiency.

Europe is also a key regional segment in the global environmental health and safety software market. Europe is expected to record a noteworthy CAGR during the forecast period owing to the rapid increase in the need for EHS solutions and services across the European nations. The growing adoption of circular economy principles and green technologies to manage sustainability goals and operational risks are fuelling demand for EHS solutions in Europe and driving the European market growth.

- As per the data released by the United Kingdom’s Health and Safety Executive (HSE), between April 2023 and March 2024, overall 138 workers died as a consequence of work-associated accidents and injuries, compared to data for the same period last year there is an increase of 2 deaths.

KEY MARKET PARTICIPANTS

The major companies operating in the global Environmental Health and Safety Software market include IsoMetrix (South Africa), Airsweb (England), Quentic (Germany), Sphera (US), Enviance (US), ETQ (US), UL (US), SAP (Germany), DNV GL (Norway), SAI Global (US), Verisk 3E (US), Enablon (France), VelocityEHS (US), Intelex (Canada), Gensuite (US), Cority (Canada), Dakota Software (US), ProcessMAP (US), SafetyCulture (Australia), ProntoForms (Canada), and Enhesa (US).

RECENT MARKET DEVELOPMENTS

- In September 2024, Benchmark Gensuite, an EHS and sustainability platform company, reported that it won the 2024 New Product of the Year Award in the software category. This was facilitated by the Occupational Health & Safety (OH&S) magazine.

- In October 2024, PCL Construction announced that it entered into a multi-year deal with HammerTech, which is a safety intelligence software company, to assist in creating a work location safer and enhancing productivity for all operations worldwide.

MARKET SEGMENTATION

This research report on the global environmental health and safety software market has been segmented and sub-segmented by component, services, deployment mode, vertical, and region.

By Component

-

Solution

-

Services

By Services

-

Analytics

-

Project Deployment and Implementation

-

Business Consulting and Advisory

-

Audit

-

Assessment

-

Regulatory Compliance

-

Certification

-

Training And Support

By Deployment Model

-

On-Premises

-

Cloud

By Vertical

-

Chemicals and Material

-

Food and Beverages

-

Government and Defense

-

Energy and Utilities

-

Healthcare

-

Construction and Engineering

-

Automotive

-

Telecom

-

IT

-

Retail

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What are the primary factors driving the growth of the Global EHS Software Market?

The increasing focus on workplace safety, stringent regulatory requirements, the need for efficient risk management, and growing awareness regarding environmental sustainability are key factors driving the adoption of EHS software globally.

How are advancements in technology influencing the Global EHS Software Market?

Technological advancements such as artificial intelligence, Internet of Things (IoT), and cloud computing are revolutionizing EHS software by enabling real-time monitoring, predictive analytics, and remote access capabilities, thereby enhancing overall efficiency and compliance.

What are the key challenges faced by the Global EHS Software Market?

Integration complexities, data security concerns, resistance to change from traditional systems, and the high initial investment required for implementation are some of the key challenges faced by the EHS software market globally.

What are the emerging trends shaping the future of the Global EHS Software Market?

Emerging trends include the integration of EHS software with enterprise resource planning (ERP) systems, the rise of mobile applications for on-the-go monitoring and reporting, and the emphasis on sustainability and circular economy principles within EHS management practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]