Global Entertainment Insurance Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product Type (Personal Insurance & Property Insurance), Application (Personal Insurance and Commercial Insurance) and Regional - (2024 to 2032)

Global Entertainment Insurance Market Size (2024 to 2032)

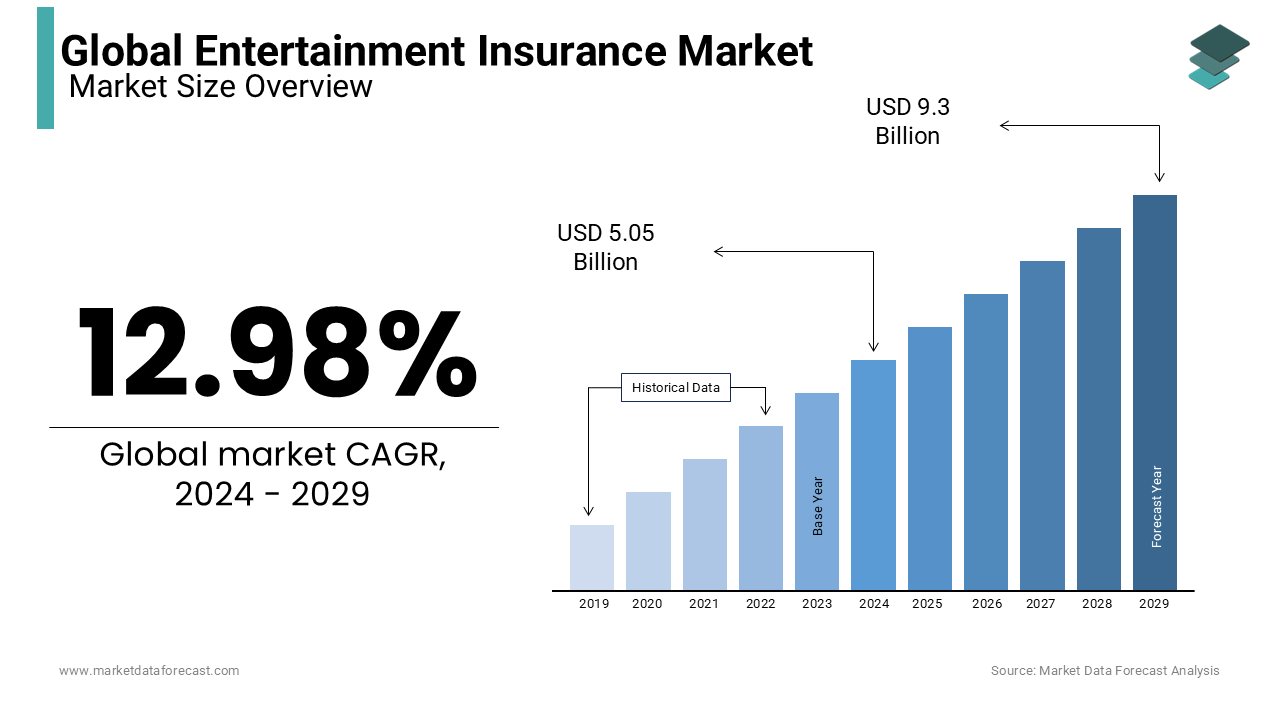

The size of the global entertainment insurance market was worth USD 4.47 billion in 2023. The global market is estimated to be worth USD 13.41 billion by 2032 from USD 5.05 billion in 2024, growing at a CAGR of 12.98% from 2024 to 2032.

The entertainment insurance industry has been developing at a modest rate with considerable growth rates over the last three years, and it is predicted to rise significantly during the forecast period. The potential risk connected with each business in the entertainment industry is exceptionally high due to the vast diversity of enterprises engaged. The need for entertainment insurance has grown because of efforts to reduce such risks. The study on the global entertainment insurance market provides a comprehensive analysis of the industry. The word "entertainment insurance" does not refer to a specific policy type. Instead, it refers to a group of policies that cover many sectors of the industry. In addition, touring insurance, production insurance, and special event insurance are among the several insurance packages available. Because there is no single type of entertainment insurance, policyholders should only pay for the coverage they require.

Entertainment insurance covers films and other forms of media such as television series, online series, infomercials, advertisements, broadcasts, documentaries, music videos, etc. The insurance is provided in an unforeseen event that could cause the project to be delayed or result in financial loss. Depending on the terms and circumstances of the insurance, it can cover production liability, filmmaking equipment, film festivals, distribution liability, defamation, invasion of privacy, and many other things. Musicians, clowns, singers, jugglers, dancers, film, television, and video producers, entertainment services providers, photographers, videographers, and event planners are all part of the entertainment sector. Because so many variables are involved, there are significant dangers associated with live events, sets, and equipment, among other things, necessitating the purchase of insurance.

MARKET DRIVERS

The enormous growth of the insurance industry worldwide and increased demand from end-users present an excellent potential for this sector.

As a result, insurance companies are experimenting with more appealing insurance packages. The high level of risk connected with each or any of the enterprises associated with the entertainment industry pushes up demand for entertainment insurance. The loss or danger can be tangible, such as losing equipment, clothing, or a crew member. The loss can also be monetary, such as the cost of re-financing the equipment, and so on. In addition, increased advertising operations by insurance companies have resulted in increased demand.

Moreover, the escalating growth of the insurance industry worldwide and the increased demand from end-users present a massive potential for this sector. Therefore, most insurance companies are experimenting with more appealing insurance packages. One of the fastest-expanding worldwide sectors is entertainment.

Entertainment insurance is a group of policies that cover all aspects of the industry and art forms. In the entertainment industry, events frequently necessitate a large amount of pricey electronic equipment and a whole management crew. As a result, entertainment firms must have adequate insurance to cover their equipment, staff, and primarily from any liability claims that may have the chance to filed against them. In addition, entertainment insurance ensures that creators and employees are protected from all hazards. Entertainment insurance is advantageous since it protects against a variety of risks. Because of the high expenditures of putting on a show, event, or festival, any company involved must have proper insurance coverage. If the right insurance policy is not secured, a tour bus crash, stolen equipment, or a flooded event venue might cost tens of thousands of dollars. The most significant advantage of entertainment insurance is its adaptability. Entertainment companies must pay for the coverage they use.

Moreover, Liability coverage is included in all entertainment insurance policies. The policy covers any settlements, medical expenses, and attorney fees in the event of an accident. These proponents of general liability insurance do more than safeguard your employees. Accidents involving independent contractors and staff from other businesses are also covered. Therefore, these are the necessary factors that drive the global entertainment insurance market during the forecast period.

MARKET RESTRAINTS

It's challenging to succeed in the insurance industry because of the strict terms and restrictions that come with it. The longer time it takes for the claim to be reimbursed causes the client to hunt for alternate financial resources to get the project started. This could have a detrimental impact on the demand for entertainment insurance. Moreover, in the entertainment sector, cyber danger takes many forms. Netflix, Hulu, and Spotify, for example, are depending on continuous service. A cyber-attack that makes those sites inaccessible might irritate marketers looking for a particular level of exposure and viewers paying a monthly subscription price for on-demand programming, which further slows down the global entertainment insurance market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.98% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hiscox, Chubb, Allen Financial Insurance Group, AXA, Hub International, Truman Van Dyke, American Entertainment Insurance, and others. |

SEGMENTAL ANALYSIS

Global Entertainment Insurance Market Analysis By Product Type

Personal Insurance and Property Insurance are the two types of insurance available. Personal insurance is expected to have a significant global entertainment insurance market share during the forecast period. Financial management is an excellent way to protect yourself from life's uncertainties. In addition, insurance can provide financial security for your family's personal needs if someone can no longer produce an income to meet those needs.

Global Entertainment Insurance Market Analysis By Application

Personal Insurance and Commercial Insurance are the two types of insurance available. Commercial Insurance is anticipated to dominate the global entertainment insurance market in the next six years. Commercial property insurance helps safeguard a firm by covering all or part of the costs when an insured loss occurs. In addition, property insurance can help keep businesses running if failures occur, regardless of whether the business structure is owned, rented, or leased.

REGIONAL ANALYSIS

With 44% of films produced in 2015, Asia dominates the film industry, accounting for nearly half of global film production. The Ramoji Film City in Hyderabad, India, is the world's largest film studio, spanning 1,666 acres and holding the Guinness World Record for being the world's largest film studio. In addition, global brands such as US dance festivals Ultra Music Festival and Electric Daisy Carnival and UK festival Creamfields have expanded and debuted in Asia in recent years, indicating that the live music segment is also thriving.

Increased Chinese investment in Hollywood, as well as an increase in co-productions and local productions, will increase demand for Entertainment insurance in the world's second-largest movie market after the United States, accounting for 8% of all films made. China's film production increased significantly between 2005 and 2015, from 260 to 686 movies. In 2017, China invested more than $5 billion in Hollywood on a global basis.

KEY PLAYERS IN THE GLOBAL ENTERTAINMENT INSURANCE MARKET

Companies playing a leading role in the global entertainment insurance market include Hiscox, Chubb, Allen Financial Insurance Group, AXA, Hub International, Truman Van Dyke and American Entertainment Insurance. After expanding its business in India, China, and Singapore, Allianz has become the global market leader of entertainment insurance.

RECENT HAPPENINGS IN THE GLOBAL ENTERTAINMENT INSURANCE MARKET

-

Hiscox OneTM, a new entertainment insurance offering from specialized insurer Hiscox USA, was launched in August 2011. The new service is a "one-stop-shop" that offers a comprehensive range of insurance packages for production, theatrical, and commercial risks, all presented in plain English to match modern technology and filmmaking processes.

DETAILED SEGMENTATION OF THE GLOBAL ENTERTAINMENT INSURANCE MARKET INCLUDED IN THIS REPORT

This research report on the global entertainment insurance market has been segmented and sub-segmented based on product type, application and region.

By Product Type

- Personal Insurance

- Property Insurance

By Application

- Personal Insurance

- Commercial Insurance

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global entertainment insurance market?

The global entertainment insurance market size was valued at USD 4.47 bn in 2023.

What factors are driving the growth of the entertainment insurance market?

Factors driving the growth of the entertainment insurance market include the increasing number of productions, rising budgets for film and TV projects, and the need for risk mitigation in live events and sports.

Which regions dominate the global entertainment insurance market share?

North America and Europe are the leading regions in the global entertainment insurance market, owing to their robust entertainment industries and high demand for insurance coverage.

How has the COVID-19 pandemic impacted the entertainment insurance market?

The COVID-19 pandemic has led to increased demand for insurance coverage against production delays, event cancellations, and losses related to pandemic-related restrictions, prompting insurers to reassess their offerings.

Who are the key players in the global entertainment insurance market?

Hiscox, Chubb, Allen Financial Insurance Group, AXA, Hub International, Truman Van Dyke and American Entertainment Insurance are some of the major companies in the global entertainement insurance market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]