Global Enterprise Asset Management Market Size, Share, Trends, & Growth Forecast Report – Segmented by Deployment (On Cloud, and On-Premises), Organization Type (SMEs, and Large Organization) Application Vertical (Government, Manufacturing, Healthcare, Transportation, Oil & Gas, and Aerospace & Defense) & Region - Industry Forecast From 2024 to 2032

Global Enterprise Asset Management Market Size (2024 to 2032)

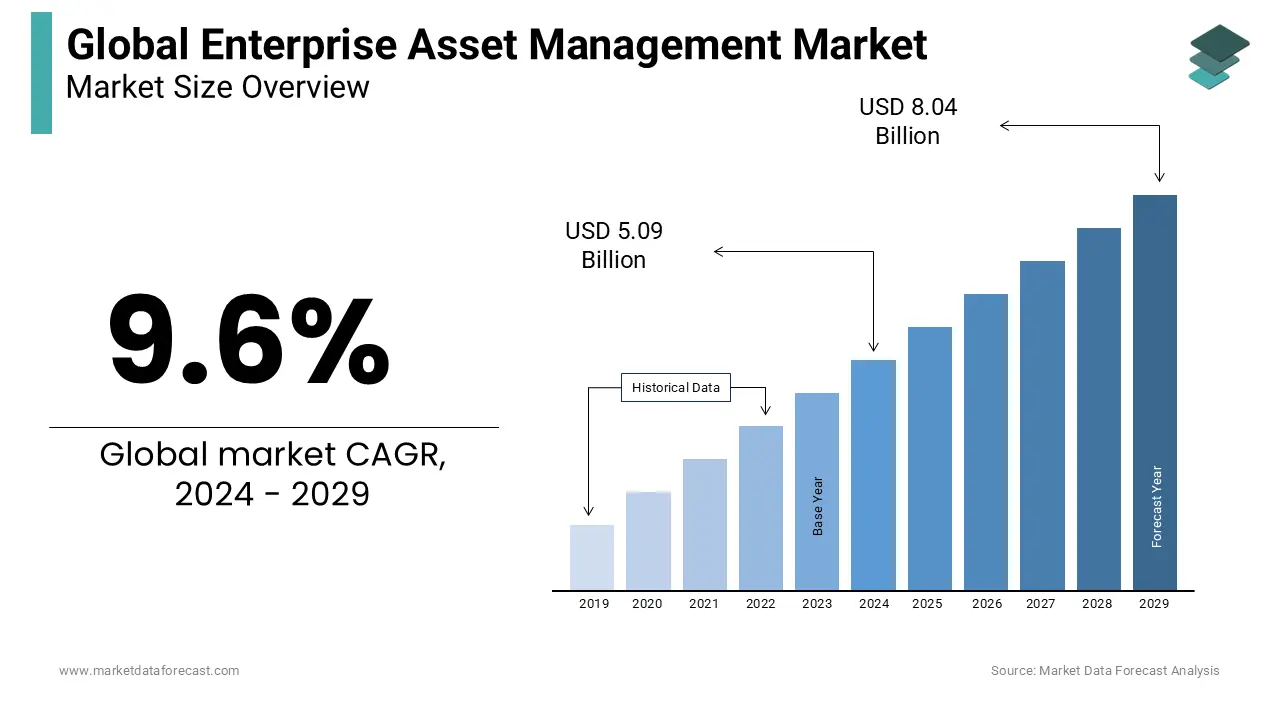

The global enterprise asset management market was worth USD 4.64 billion in 2023. The global market is predicted to reach USD 5.09 billion in 2024 and USD 10.60 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

Current Scenario of the Market

Enterprise asset management (EAM) begins the revolutionary journey in this period of swift technological developments. The current transformation of EAM is a reaction to sectors navigating over varying landscapes, targeted at achieving the needs of a dynamic and interlinked world environment. Within this circumstance, EAM has reached a central point for market players wanting to modernise their asset management functions. As sectors accept the constantly changing landscapes influenced by technological advancements, EAM acts as an important tool to attain productivity and responsiveness. Moreover, one of the most considerable patterns in the enterprise asset management market is the incorporation of the Internet of Things (IoT) which is moving forward as a vital progress in this industry. In addition, artificial intelligence is changing the EAM via its essential part in predictive maintenance.

MARKET DRIVERS

The enterprise asset management market is driven by the prevalence of mobility in EAM solutions and mobile devices. It involves phablets, tablets and smartphones pushing a “mobile-first” mindset over the companies and sectors.

This greater application of mobile gadgets is anticipated to expand the penetration of mobility in these solutions. The intelligent handheld units have risen in ability side by side EAM and field service devices with technologies like embedded cameras, RFID, GIS and GPS.

Moreover, the integration of the Internet of Things (IoT) is also propelling market growth. It is a transformational change in how assets are supervised and controlled, walking away to a proactive strategy from reactive maintenance. With IoT, companies can expect and solve possible problems before happening. Also, this pattern involves smoothly incorporating IoT into asset management customs and functions. Connected systems perform a key role by providing live information on the asset's performance. This inflow of immediate data strengthens strategies for predictive maintenance, lowering downtime and maximising operational productivity.

Additionally, sustainability and environmental, social and government (ESG) incorporation are influencing the market forward. EAM systems and networks now combine processes designed to supervise and govern assets in accordance with ecological responsibility. These consist of tools to track power consumption trends, assess carbon releases and ensure compliance with strict environmental laws. As companies progressively emphasize sustainable activities and performance, the incorporation of ESG concerns into EAM shows a tactical alignment with world measures to encourage the maintenance of the environment. This acclimatization indicates a vital transition toward accountable asset management, recognising the interrelatedness of business activities with environmental and social considerations.

MARKET RESTRAINTS

Worries regarding confidentiality and data protection is restricting the enterprise asset management market growth. As companies progressively depend on online platforms to handle their assets, the weakness of confidential data becomes a major concern. Data theft and other digital attacks have increased anxieties among companies, as EAM devices usually store important information associated with operational details, maintenance schedules and asset performance. As per a study, in 2024 the worldwide average expenditure of data breaches is 4.88 million which is a 10 per cent surge compared to 2023 and the maximum total ever. Also, the portion of breaches is 1 in 3 which are included in shadow data, displaying the spread of information is positioning it tougher to protect and track.

MARKET OPPORTUNITIES

The enterprise asset management market is expected to witness substantial growth. The junction of new trends is all set to spearhead modern asset management offerings. The effortless merger of sophisticated technologies, side by side with an unwavering dedication to sustainability, is ready to empower companies. This authorization expands beyond more productive asset management, including an essential part in advancing ecological obligations. The course ahead recommends that EAM will transform into a strong framework where technological incorporation adjusts effortlessly to environmental concerns. This cooperation not only improves functional effectiveness but also places companies as contributors to comprehensive environmental objectives. The future of this market looks dynamic, encouraging seamless incorporation of invention and sustainability for players navigating the complicated terrain of asset management.

MARKET CHALLENGES

Complications in incorporating various systems and data sources or channels is one of the major challenges for the enterprise asset management market. Several companies have varied and scattered IT landscapes, with different older systems, data banks, and information formats. Combining these devices and strengthening data from various channels into a unified platform for asset platform can be an intricate and time-consuming procedure. It needs strong data incorporation abilities, effortless compatibility and standardized data structures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.6% |

|

Segments Covered |

By Deployment, Organization Type, Application Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Brunswick Corporation, SAP SE (Germany), ABB Group (Switzerland), Mintek Mobile Data Solutions (U.S.), AssetWorks LLC (U.S.), Infor (U.S.), Oracle Corporation (U.S.), IFS AB (Sweden), Ramco Systems (India), Schneider Electric (France), and IBM (U.S.) |

SEGMENTAL ANALYSIS

Global Enterprise Asset Management Market Analysis By Deployment

The on-premise segment continued to have the biggest market share of enterprise asset management and is expected to remain on this course over the forecast period. Big companies with massive assets and confidential data favour implementing an on-premise EAM solution to fulfil legal demands and important regulations. Threats to data protection are adding to on-premise EAM software acceptance. Enterprises need this type of asset management implementation where the companies have weak internet, especially in distant locations.

Global Enterprise Asset Management Market Analysis By Organization Type

The SMEs segment emerged as the leading category and a notable portion of the enterprise asset management market share. Broad-scale deployment of EAM products amongst SMEs is the reason behind its expanding market size. Moreover, the high demand for further developments in cloud-based tools and mobile applications will accelerate the segment’s market growth. This is regularly compelling market players to innovate new EAM solutions and product characteristics.

Global Enterprise Asset Management Market Analysis By Application Vertical

Transportation is the leading segment of the enterprise asset management market. The transport &shipping sector reduces the expenses of handling and keeping their assets, like rails, tunnels, roads and bridges. In addition, the geotechnical surveillance of logistics assets provide companies to execute maintenance activities regularly and whenever needed. Best activities and functions assist in the tactical decision-making process for asset efficiency, improve service life, and keep public transit facilities for transportation and supply establishments. So, EAM products also offer "fleet management abilities, cost minimization, and enhanced return on assets (ROA).

The manufacturing segment held the second position in this market. The manufacturing sector has considerably advanced by the deployment of online solutions in business activities.

REGIONAL ANALYSIS

North America is commanding the enterprise asset management market. The regional market is propelled by greater adoption rates of modern technologies and substantial financial support in infrastructure development and upgrade and automation of the industrial sector. Further, the existence of prominent technology organisations and a strong legal framework, add to the segment’s market share.

Europe is witnessing a major upward trend in the enterprise asset management market. It is fuelled by the existence of key producing and energy industries, coupled with strict legal compliance for asset management. The countries in the region emphasize sustainability and innovation is pushing forward the implementation of sophisticated EAM solutions.

The Asia-Pacific region is experiencing swift growth in the enterprise asset management market which is influenced by the progression of transportation, energy and

manufacturing sectors, along with growing investments in digital technologies. Moreover, nations such as India, Japan and China are at the top in deploying modern EAM technologies to improve operational productivity and competitiveness.

KEY MARKET PLAYERS

- Brunswick Corporation

- SAP SE (Germany)

- ABB Group (Switzerland)

- Mintek Mobile Data Solutions (U.S.)

- AssetWorks LLC (U.S.)

- Infor (U.S.)

- Oracle Corporation (U.S.)

- IFS AB (Sweden)

- Ramco Systems (India)

- Schneider Electric (France)

- IBM (U.S.)

RECENT HAPPENINGS IN THE MARKET

- In June 2024, IFS reported the completion of the procurement of Copperleaf Technologies, an asset investment management company. With this IFS expands its applications portfolio which assists organisations handle their digital and physical assets. Moreover, Copperleaf Technologies offers software which utilises artificial intelligence to support companies in investment planning and management like utilities and manufacturers taking decisions on their assets.

- In May 2024, JFK Millennium Partners, (JMP) selected Arora to deploy Maximo Enterprise Asset Management (EAM) software by IBM and the Arora ATLAS collection of mobile solutions for T6 which is presently in the construction stage in Queens, New York (US). Moreover, previously, the Port Authority of New York and New Jersey (PANYNJ) chose the JFK Millennium Partners (JMP) to create and function the new 4.2 billion dollars JFK Terminal 6 (T6).

DETAILED SEGMENTATION OF THE GLOBAL ENTERPRISE ASSET MANAGEMENT MARKET INCLUDED IN THIS REPORT

This research report on the global enterprise asset management market has been segmented and sub-segmented based on the deployment, organization type, application vertical, and region.

By Deployment

- On Cloud,

- On-Premises

By Organization Type

- SMEs,

- Large Organization

By Application Vertical

- Government,

- Manufacturing,

- Healthcare,

- Transportation,

- Oil & Gas,

- Aerospace & Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the primary factors driving the growth of the EAM market globally?

The primary factors driving the global EAM market include the increasing need for real-time asset tracking, rising demand for predictive maintenance, and the growing adoption of IoT and AI technologies in asset management. Additionally, the increasing focus on reducing operational costs and extending the lifecycle of assets contributes to market growth.

Which industries are the leading adopters of Enterprise Asset Management solutions?

The leading adopters of EAM solutions globally are industries such as manufacturing, energy and utilities, transportation, healthcare, and oil and gas. These sectors rely heavily on physical assets and require efficient management to ensure operational efficiency and regulatory compliance.

What are the key technological trends influencing the EAM market?

Key technological trends influencing the EAM market include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, the adoption of cloud-based EAM solutions, the use of Internet of Things (IoT) for real-time asset monitoring, and the increasing importance of mobile EAM applications for on-the-go asset management.

What challenges are faced by companies in implementing EAM solutions?

Companies face challenges such as high initial investment costs, complexities in integrating EAM systems with existing IT infrastructure, resistance to change from employees, and the need for specialized training to effectively use EAM systems. Additionally, data security concerns in cloud-based EAM solutions also pose a challenge.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]