Global Engineered Wood Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Construction, Flooring, Furniture, Packaging, Transport, Others), End-User Industry, Type, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Engineered Wood Market Size

The global engineered wood market size was valued at USD 272.89 billion in 2024 and is expected to reach USD 438.83 billion by 2033 from USD 287.68 billion in 2025. The market is projected to grow at a CAGR of 5.42%.

Engineered wood is also known as composite or manufactured wood and is a category of wood products created by bonding wood fibers, strands, or veneers using adhesives under high pressure and heat. Engineered wood is widely used in construction, furniture, and interior applications due to their consistent strength and dimensional stability. A key advantage of engineered wood is its efficient material utilization. Additionally, plywood and OSB can be manufactured from fast-growing species such as poplar and eucalyptus, which reach harvest maturity in 10-15 years unlike traditional hardwoods that require several decades.

From an environmental perspective, engineered wood also contributes to sustainability. The U.S. Environmental Protection Agency (EPA) states that wood-based materials sequester approximately 1.8 metric tons of CO₂ per cubic meter which is reducing atmospheric carbon levels. Furthermore, engineered wood production consumes 50% less energy than concrete and 80% less than steel, according to the Forest Products Laboratory. This makes it a sustainable alternative in construction and manufacturing by promoting resource conservation and energy efficiency.

MARKET DRIVERS

Urbanization and Construction Growth

The global trend of urbanization and the expansion of construction activities are significantly driving the demand for engineered wood products. There is an increased need for residential and commercial buildings that is leading to a higher consumption of construction materials. Engineered wood offers advantages such as strength, sustainability, and cost-effectiveness is making it a preferred choice in modern construction. The U.S. Census Bureau reports that in 2020, 82.66% of the U.S. population resided in urban areas with a steady increase in urbanization. This shift contributes to the rising demand for engineered wood in building projects.

Government Initiatives and Environmental Regulations

Government policies promoting sustainable building practices and environmental regulations are propelling the adoption of engineered wood. Many governments have implemented green building standards and incentives to encourage the use of eco-friendly materials. The U.S. Environmental Protection Agency (EPA) supports the use of sustainable materials in construction to reduce environmental impact. Engineered wood products, known for their efficient use of resources and lower carbon footprint, align with these initiatives which is leading to increased utilization in public and private sector projects.

MARKET RESTRAINTS

Economic Viability of Native Forest Logging

The financial sustainability of native forest logging has come under scrutiny. In New South Wales, Australia, the Forestry Corporation's native hardwood division reported losses totaling $72 million since 2020. Factors contributing to these losses include operational challenges, extreme weather, and regulatory changes. Economist Graham Phelan suggests that the state should reconsider the economic costs and benefits of native forest logging, noting that other regions have already ended the practice. This situation clarifies the broader economic challenges within the engineered wood sector where profitability is threatened by high operational costs and competition from alternative materials.

Limited Production Facilities and Higher Costs

The production of engineered wood products, such as cross-laminated timber (CLT) is concentrated in specific regions that is leading to increased transportation costs and limited accessibility in other areas. For instance, a report by the U.S. Department of Agriculture's Forest Service notifies that the majority of wood-based panel manufacturing facilities are located in the Pacific Northwest and the South. This regional concentration results in higher costs for transporting products to other parts of the country, thereby limiting market expansion. Additionally, the initial capital investment required for establishing new production facilities is substantial which further hindering the growth of manufacturing capabilities in underserved regions.

MARKET OPPORTUNITIES

Increased Adoption in Residential Construction

The growing demand for residential construction presents a major opportunity for the engineered wood market. As housing developments expand, builders seek cost-effective and sustainable materials that provide both structural integrity and environmental benefits. Engineered wood meets these needs by offering greater stability, resistance to warping, and efficient material utilization. The U.S. Census Bureau reported that single-family housing starts in the United States increased by 8.6% in 2017 is reflecting a continued rise in new home construction. Additionally, the National Association of Home Builders states that engineered wood is increasingly used in roof trusses, flooring systems, and wall panels is replacing traditional solid wood due to its ability to reduce material waste and optimize resource efficiency. Engineered wood products are expected to play a crucial role in the future of residential construction as urbanization accelerates and housing demand grows.

Expansion into Non-Residential Applications

Beyond residential housing, engineered wood is finding expanded use in commercial buildings, public infrastructure, and high-rise construction. Engineered wood is now competing with steel and concrete in large-scale construction with innovations such as cross-laminated timber (CLT) and laminated veneer lumber (LVL). The U.S. Forest Service’s Forest Products Laboratory reports that mass timber buildings store carbon is reducing their environmental footprint compared to traditional construction materials. The American Wood Council states that CLT can support loads comparable to reinforced concrete by making it suitable for office buildings, schools, and bridges. Government initiatives promoting low-carbon construction methods further enhance the potential for engineered wood in non-residential applications is opening new market opportunities and driving adoption in the commercial sector.

MARKET CHALLENGES

Environmental Concerns and Regulatory Scrutiny

The environmental impact of engineered wood production has come under increased scrutiny. For instance, the UK government has mandated that biomass power plants, such as Drax, utilize 100% sustainable wood sources. This decision aims to ensure environmental sustainability and has led to a 50% reduction in subsidies for non-compliance by saving consumers an estimated £170 million annually between 2027 and 2031, as reported by The Guardian. The stringent regulations necessitate that engineered wood producers adopt more sustainable practices to potentially increase operational costs and affecting market competitiveness.

Market Competition and Trade Challenges

The engineered wood industry faces intense competition from alternative materials and international trade disputes. The European Union has initiated an anti-dumping investigation into low-cost plywood imports from China by following complaints from domestic producers about unfair pricing practices, as detailed by the Financial Times. Such trade disputes can lead to tariffs and trade barriers that further complicating the market landscape for engineered wood products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.42% |

|

Segments Covered |

By Application, End-User Industry, Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Weyerhaeuser Company, Lamiwood™ Designer Floor, Universal Forest Products, Inc., Louisiana-Pacific Corporation (LP), Raute Group, Norbord Inc., PFEIFER GROUP, Celulosa Arauco Y Constitucion SA, Boise Cascade Company, Huber Engineered Woods, and others |

SEGMENTAL ANALYSIS

By Application Insights

The construction segment led the market by capturing 45.7% of the global market share in 2024. Engineered wood products like laminated veneer lumber (LVL) and cross-laminated timber (CLT) are widely used in structural applications due to their superior strength, durability, and sustainability. U.S. Department of Housing and Urban Development (HUD) reports that engineered wood reduces construction time by 20% compared to traditional materials by making it ideal for urban housing projects. The construction sector is relying heavily on engineered wood to meet green building standards as it lowers carbon emissions by 30%. This segment’s dominance is driven by rapid urbanization. United Nations is projecting 2.5 billion new urban residents by 2050 which is a specific factor for the market to grow eventually in the coming years.

The furniture segment is estimated to showcase a CAGR of 7.8% from 2024 to 2033 owing to the rising urbanization and increasing disposable incomes drive demand for affordable yet stylish furniture. The global furniture market was valued at $650 billion in 2022, with engineered wood gaining popularity due to its cost-effectiveness and design flexibility. Engineered wood reduces production costs by 25% compared to solid wood while offering similar aesthetics. Younger consumers, particularly Millennials and Gen Z prioritize sustainable and lightweight materials which is boosting this segment’s growth. Innovations like veneered engineered wood enhance durability and visual appeal by making it critical for modern furniture manufacturing. The World Bank notes that furniture exports from developing countries grew by 12% annually.

By End User Industry Insights

The residential segment dominated the engineered wood market by holding 60.3% of the global market share in 2024. Engineered wood is widely used in residential construction for flooring, roofing, and structural framing due to its cost-effectiveness and sustainability. The U.S. Census Bureau reports that single-family housing starts reached 1.2 million units in 2022 which is driving demand for engineered wood products like laminated veneer lumber (LVL) and oriented strand board (OSB). Residential applications benefit from engineered wood’s ability to reduce material waste by 30% compared to traditional lumber. Its importance lies in addressing urbanization needs, with the United Nations projecting 2.5 billion new urban residents by 2050 which is fueling the steady growth.

The non-residential segment is estimated to register the fastest CAGR of 8.5% during the forecast period owing to the increasing investments in commercial infrastructure, educational institutions, and healthcare facilities. The global non-residential construction spending is expected to reach $4.5 trillion by 2025 with engineered wood gaining traction for its durability and eco-friendly properties. Cross-laminated timber (CLT) is a key engineered wood product reduces construction time by 25% and carbon emissions by 40%. Governments worldwide are promoting green building standards is further boosting adoption. For instance, the European Commission mandates sustainable materials in public projects is enhancing this segment’s importance.

By Type Insights

The plywood segment accounted for 35.8% of the global market share in 2024. The widespread adoption of plywood due to its strength, versatility, and affordability is majorly driving the growth of the plywood segment in the global market. FAO (Food and Agriculture Organization) states that global plywood production exceeded 160 million cubic meters in 2022 with demand rising due to urbanization and infrastructure projects. Plywood’s resistance to warping and cracking ensures durability while its ability to reduce material waste by 25% supports sustainability goals. The United Nations notes that plywood’s adaptability and cost-effectiveness make it indispensable in developing regions where affordable housing remains a priority.

The cross laminated timber (CLT) segment is estimated to register the fastest CAGR of 14.5% over the forecast period. The growth of the segment is majorly driven by their increasing demand for sustainable building materials in urban construction. The European Commission states that CLT reduces construction time by 30% and carbon emissions by 40% compared to traditional materials like concrete and steel. Governments are promoting green building standards which is driving CLT adoption in high-rise and commercial projects. The U.S. Department of Energy reports that CLT’s thermal efficiency lowers energy costs by 20% is making it a preferred choice for eco-friendly buildings. Its superior strength-to-weight ratio further enhances its appeal.

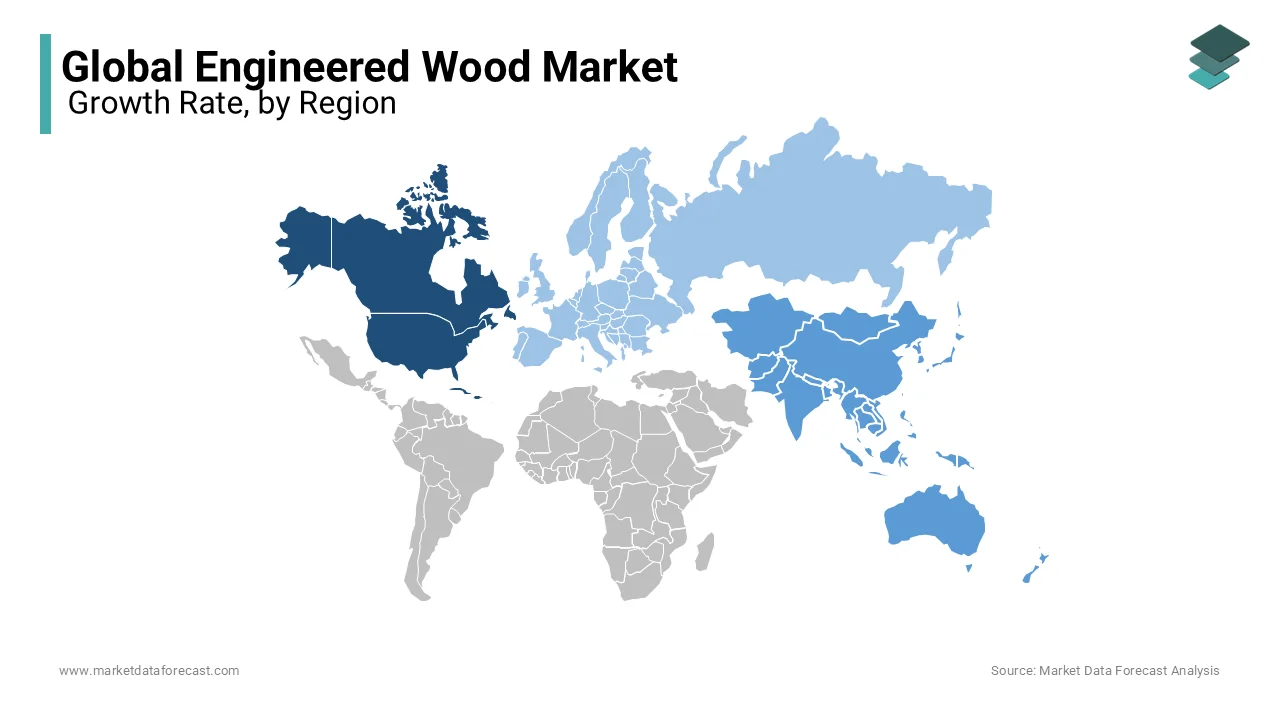

REGIONAL ANALYSIS

North America was the top performer in the global engineered wood market and held 35.3% of the global market share in 2024. The dominance of North American market is driven by a robust construction industry with over 1.6 million housing starts annually in the U.S. alone. Engineered wood is widely used in residential and non-residential projects due to its cost-effectiveness and sustainability. The U.S. Department of Commerce reports that engineered wood reduces material waste by 30% by aligning with green building standards. Urbanization and infrastructure investments further fuel demand. North America’s advanced manufacturing capabilities and strict environmental regulations ensure steady growth and leadership in the market.

Asia-Pacific is predicted to witness the highest CAGR of 9.2% from 2025 to 2033. Rapid urbanization and industrialization drive demand, with UNESCAP projecting that 50% of the global urban population will reside in Asia by 2030. Rising disposable incomes and government initiatives like India’s Smart Cities Mission boost engineered wood adoption in construction and furniture. The region’s tropical climate favors durable materials like engineered wood by reducing maintenance costs by 25%. Its importance lies in meeting the needs of densely populated areas is ensuring long-term market relevance.

Europe shows steady growth is driven by stringent environmental policies promoting sustainable materials. Latin America benefits from abundant forest resources but faces challenges like illegal logging which is limiting its market potential. The Middle East and Africa are poised for moderate growth is supported by urbanization and infrastructure projects. The African Development Bank notes that Africa’s urban population will double by 2050 by creating opportunities for engineered wood in affordable housing. However, limited awareness about sustainable sourcing and underdeveloped processing facilities hinder growth. Collectively, these regions are expected to contribute 25% to global demand by 2030.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Weyerhaeuser Company, Lamiwood™ Designer Floor, Universal Forest Products, Inc., Louisiana-Pacific Corporation (LP), Raute Group, Norbord Inc., PFEIFER GROUP, Celulosa Arauco Y Constitucion SA, Boise Cascade Company, Huber Engineered Woods LLC are playing dominating role in the global engineered wood market.

The engineered wood market is highly competitive, characterized by the presence of established global players, regional manufacturers, and niche innovators striving to capture market share. Key companies like Weyerhaeuser, Louisiana-Pacific (LP), and Norbord Inc. dominate the industry through their focus on innovation, sustainability, and strategic expansions. These leaders invest heavily in research and development to introduce advanced products such as cross-laminated timber (CLT), laminated veneer lumber (LVL), and moisture-resistant oriented strand board (OSB), addressing critical challenges in construction and furniture manufacturing. Sustainability has emerged as a major competitive differentiator, with companies adopting eco-friendly practices and aligning their products with green building standards like LEED and BREEAM.

Regional players, such as Celulosa Arauco y Constitución SA in Latin America and smaller firms in Asia-Pacific, leverage localized expertise and cost advantages to cater to regional demand. This creates a fragmented yet dynamic competitive landscape, where global giants compete with local manufacturers for market dominance. Strategic mergers, acquisitions, and partnerships are common tactics used to consolidate resources, expand production capacities, and access new markets. For instance, Norbord’s acquisition by West Fraser Timber Co. emphasize the trend toward consolidation to enhance scale and efficiency.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and R&D Investments

Leading companies like Weyerhaeuser and Louisiana-Pacific (LP) focus heavily on research and development to introduce innovative products that meet evolving market demands. For instance, LP’s SmartSide® and TechShield® product lines are designed to offer superior moisture resistance and energy efficiency, addressing key challenges in construction. Similarly, Norbord Inc. has pioneered advancements in cross-laminated timber (CLT), enhancing its structural performance and sustainability. These innovations not only differentiate their offerings but also align with global trends toward eco-friendly and high-performance materials.

Sustainability and Eco-Friendly Practices

Sustainability is a cornerstone strategy for major players. Weyerhaeuser emphasizes sustainable forestry practices, ensuring responsible sourcing of raw materials while maintaining forest health. Louisiana-Pacific incorporates recycled content into its products and focuses on reducing carbon footprints during manufacturing. This commitment to environmental responsibility resonates with governments, builders, and consumers increasingly prioritizing green building standards and certifications.

Strategic Acquisitions and Mergers

Acquisitions have been a key growth strategy for companies aiming to expand their market presence. For example, Norbord Inc.’s acquisition by West Fraser Timber Co. strengthened its position in North America and Europe, creating synergies in production and distribution. Such mergers allow companies to consolidate resources, enhance product portfolios, and access new markets, thereby elevating their competitive edge.

Expansion of Manufacturing and Distribution Networks

Key players invest in expanding their manufacturing facilities and distribution channels to meet rising global demand. Celulosa Arauco y Constitución SA, for instance, has expanded its production capacity in Latin America to cater to regional and international markets. Similarly, Boise Cascade Company has enhanced its logistics network to ensure timely delivery of engineered wood products. These expansions enable companies to reduce costs, improve supply chain efficiency, and reach underserved regions.

Focus on Green Building Standards and Certifications

Companies align their products with global green building standards, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method). Huber Engineered Woods LLC, for example, designs products that comply with these certifications, appealing to environmentally conscious architects and developers. This strategy not only enhances brand reputation but also opens doors to lucrative projects in urban development and infrastructure.

Partnerships and Collaborations

Collaborations with governments, NGOs, and industry bodies help companies promote sustainable practices and gain regulatory support. Raute Group, for instance, partners with local stakeholders to develop advanced machinery for engineered wood production, fostering innovation across the value chain. Such partnerships enable companies to stay ahead of regulatory changes and emerging trends while strengthening their market position.

Customer-Centric Solutions and Marketing

To strengthen their foothold, companies focus on providing tailored solutions and enhancing customer experience. Universal Forest Products, Inc. offers customized engineered wood products for specific applications, ensuring higher customer satisfaction. Additionally, targeted marketing campaigns highlighting the durability, cost-effectiveness, and sustainability of engineered wood help build brand loyalty and drive adoption.

TOP 3 PLAYERS IN THE MARKET

Weyerhaeuser Company

Weyerhaeuser is a global leader in the engineered wood market, known for its focus on sustainable forestry and innovative product offerings. The company specializes in oriented strand board (OSB) and laminated veneer lumber (LVL), which are widely used in construction and furniture manufacturing. Weyerhaeuser’s commitment to eco-friendly practices ensures a reliable supply of raw materials while minimizing environmental impact. Its durable and lightweight products have made it a preferred choice for builders and manufacturers seeking high-performance materials. The company’s leadership in sustainability and innovation has strengthened its position in the global market.

Louisiana-Pacific Corporation (LP)

Louisiana-Pacific (LP) is a prominent player in the engineered wood industry, recognized for its advanced building solutions. The company offers a range of products, including LP® SmartSide® siding and LP® TechShield® Radiant Barrier, designed to address key challenges like moisture resistance and energy efficiency. LP’s focus on research and development has enabled it to create cutting-edge materials that meet the demands of modern construction. Its strong distribution network and reputation for quality have made it a trusted name in both residential and non-residential projects worldwide.

Norbord Inc.

Norbord Inc., now part of West Fraser Timber Co., is a major contributor to the engineered wood market, particularly in North America and Europe. The company specializes in oriented strand board (OSB) and cross-laminated timber (CLT), which are increasingly used in sustainable construction. Norbord’s CLT products are favored for their ability to reduce construction time and enhance structural performance. The company’s emphasis on innovation and efficiency has positioned it as a leader in green building solutions, aligning with the growing demand for environmentally responsible materials in urban development

RECENT HAPPENINGS IN THE MARKET

- In April 2024, UFP Industries acquired CL Wood Products Inc. This acquisition is anticipated to expand UFP Industries' manufacturing capabilities and strengthen its position in the engineered wood market. CL Wood Products Inc., a leading producer of high-quality engineered wood components, will enable UFP Industries to enhance its product offerings and meet the growing demand for innovative building solutions. The acquisition also aligns with UFP Industries' strategy to diversify its portfolio and increase its footprint in key markets, reinforcing its commitment to delivering value-added products to customers globally.

- In October 2023, Boise Cascade announced a $140 million investment to support its engineered wood products growth strategy in Alabama and Louisiana. This investment is anticipated to enhance the company’s production capabilities by upgrading facilities and increasing operational efficiency. The move underscores Boise Cascade's commitment to meeting the rising demand for engineered wood in the U.S. housing market while maintaining its competitive edge. By expanding its manufacturing capacity, the company aims to strengthen its supply chain, improve product availability, and amplify its leadership in the engineered wood industry.

MARKET SEGMENTATION

This research report on the global engineered wood market has been segmented and sub-segmented based on application, end-user industry, type, and region.

By Application

- Construction

- Flooring

- Furniture

- Packaging

- Transport

- Others

By End User Industry

- Residential

- Non-Residential

By Type

- Plywood

- Medium Density Fiberboard (MDF)

- Cross Laminated Timber (CLT)

- Laminated Veneer Lumber (LVL)

- Oriented Strand Board (OSB)

- Glue Laminated Timber (Glulam)

- Particle Board

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the global engineered wood market?

As of 2024, the global engineered wood market was valued at USD 272.89 billion.

2. What factors are driving the growth of the engineered wood market?

Key drivers include urbanization and construction growth, government initiatives promoting sustainable building practices, and environmental regulations encouraging the use of eco-friendly materials.

3. What challenges does the engineered wood market face?

Challenges include the economic viability of native forest logging, with financial sustainability concerns due to operational challenges and regulatory changes, and limited production facilities leading to higher costs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com