Global Energy Drinks Market Size, Share, Trends & Growth Forecast Report By Type (Isotonic, Hypotonic & Hypertonic), Ingredient Type (Water & Additives), Packaging (Bottles, Cans & Others) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Energy Drinks Market Size

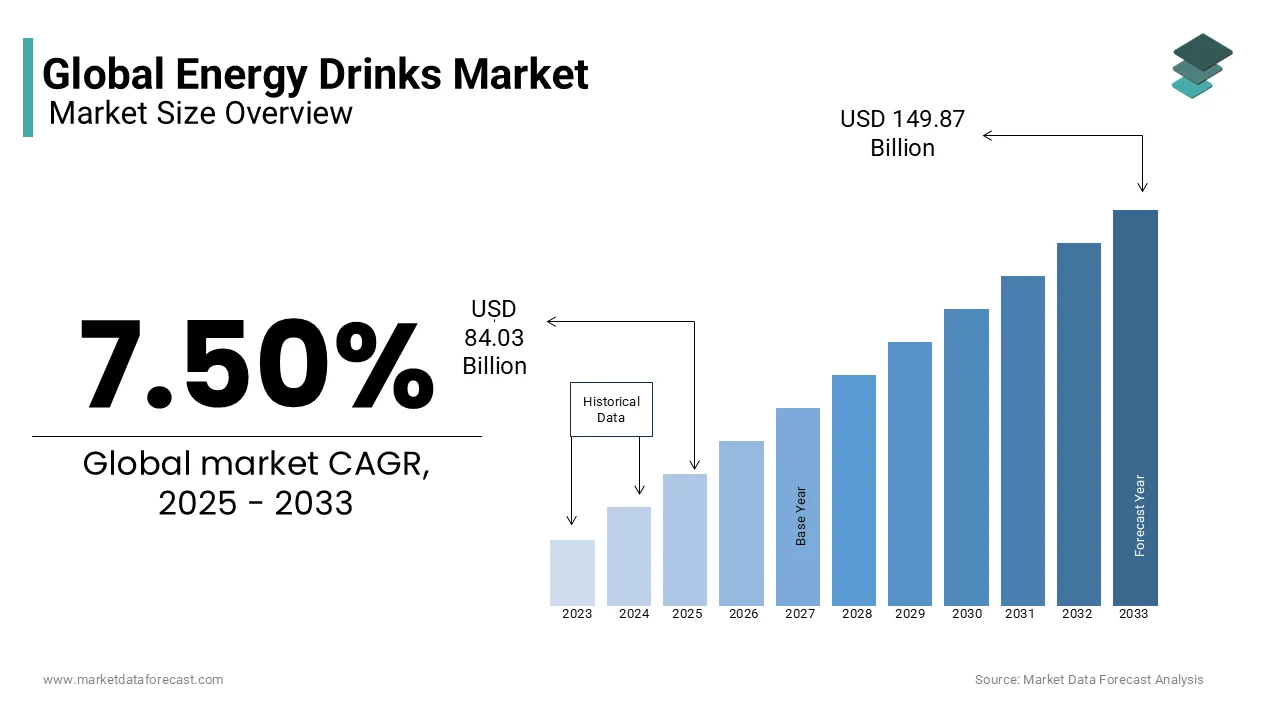

The global energy drinks market size was valued at USD 78.17 billion in 2024, and the global market size is expected to reach USD 149.87 billion by 2033 from USD 84.03 billion in 2025. The market's promising CAGR for the predicted period is 7.50%.

The energy drinks market is rapidly growing with an increased focus on sugar-free options around the world. North America is the biggest market for this kind of drink, which holds more or less a 40 per cent share and is led by the United States. Moreover, this industry is a flourishing business with various major players spearheading the pack. The market is saturated, and Rockstar, Monster, and Red Bull are among the largest companies in the world. As per industry experts, there is space in this industry for firms or corporations to distinguish themselves from the prominent players who appear exceptionally similar in their sponsorships, promotions, and advertising. However, presently, the authorities or agencies governing energy drinks worldwide have been stricter regarding the permissible additives and other ingredients, especially caffeine, than ever before. Similarly, a study recently published in the United Kingdom in 2024 suggested the ban on energy drinks for children based on evidence gathered. It sheds light on the connection to greater danger than earlier detected, like suicidal thoughts, stress and anxiety. Such development in the market is expected to affect the regional industry. Another instance was recorded in July 2023, when Canadian Authorities were also directed to recall the Prime Energy drinks because of the high concentration of caffeine levels and violations in labeling.

MARKET DRIVERS

Growing Adoption of Energy Drinks in Several Countries

The rising popularity of energy drinks that offer immediate energy along with mental and physical stimulation is propelling the global energy drinks market growth. Taurine is an important component in most energy drinks and is necessary for the growth of skeletal muscle and the cardiovascular system. This awareness among consumers is growing gradually, and energy drinks that contain taurine are experiencing promising demand in the global market. In addition, rising consumer lifestyle changes, growing health consciousness and increased awareness of health and wellness products are anticipated to drive the global energy drinks market. The demand for energy drinks increased as urbanization, disposable income, and consumer health consciousness all increased. Teenagers frequently use energy drinks because they promise to increase performance, stamina, and alertness. At the same time, consumers are being influenced to drink energy drinks by lengthy, unpredictable work hours and an increase in social events. In addition, the rising prevalence of diseases linked to a sedentary lifestyle, an increase in the population of health-conscious consumers, and consumer knowledge of active lives all encouraged people to choose drinks that are both nutritious and sugar-free. The market for energy drinks is also anticipated to expand as a result of an increase in promotional and advertising tactics.

Increasing Awareness among Consumers of Sugar-free Beverages

Due to the growing prevalence of diabetes, consumers are becoming more aware of the importance of a balanced diet and an active lifestyle. Due to growing health concerns and intensified efforts to stop the growth of lifestyle illnesses, consumers are adopting low-calorie, low-sugar, or sugar-free dietary patterns in foods and beverages. Customers prefer stevia and other natural sweeteners in their beverages. Companies like Coca-Cola and PepsiCo Inc. have made commitments to reduce sugar in their products and do away with artificial additives. Furthermore, new products launched by beverage manufacturers in response to changing consumer preferences for sugar-free or low-sugar beverages.

MARKET RESTRAINTS

The growth of the energy drinks market is decreased by the increase in the number of findings or incidences concerning the high levels of ingredients than their permissible limits. This includes caffeine, taurine, too much B3 (niacin) and B6, guarana, sugar, and ginseng. Consumers are becoming increasingly concerned about the possibility of ingredients, including prohibited colors and additives, medication residues, industrial chemicals, unreported allergies, and heavy metals. The negative health impacts brought on by consuming these residues are probably preventing the market for energy drinks from expanding. Although there were not many deaths of people aged between 18 and 34 due to consuming energy drinks, lately, the households of a 46-year-old man and a female student took legal action and registered a lawsuit against Panera over the consumption of extremely caffeinated-induced Lemonade beverage and subsequent deaths. Moreover, a much greater and whole lot of people also suffered from other adverse effects as a consequence, ranging from gastrointestinal distress to anxiety to twitchiness to sleeplessness.

Another factor impeding market growth is the rapid spread of the outcomes and findings of new studies or surveys regarding their negative effects on overall health and unique sales and marketing tactics using social media platforms, websites or other means. This quick availability of the latest updates is increasingly hurting the brand image and compelling the consumers to more suitable options.

MARKET CHALLENGES

The energy drinks market is facing tough competition from beverages. Moreover, the absence of awareness and penetration is another aspect slowing down the market growth rate. In addition, the formation or enforcement of amendments to make the regulations and potential bans stricter continues to hamper the expansion of the industry. Apart from these, the newcomers encounter difficulties with branding and distribution, further cluttering the market expansion. Beverages like sports drinks, fruit juices and carbonated soft drinks are rapidly gaining traction. Likewise, in India, carbonated soft drinks remain the most popular and consumed beverage owing to their reduced costs and extensive availability. Also, people are becoming more health-conscious, and as a result, a notable number of people are shifting to sports drinks, particularly fitness enthusiasts and athletes. This is also because they are promoted as a healthier substitute for this. Additionally, in recent years, many countries have intensified their measures against energy drinks and have also implemented a ban for children below the age of 16. Therefore, all these factors collectively severely derail the market’s growth trajectory.

MARKET OPPORTUNITIES

The developments in filling technology provide substantial opportunities for the energy drinks market. This involves improving their functional productivity and fulfilling customer needs for sustainability and quality, propelling expansion in a competitive industry. Across various industries, sustainability is in focus, so in this market as well, players are progressively going for raw materials, equipment, and packaging that support their objective. Another major factor anticipated to contribute to the market expansion is the Clean-in-Place (CIP) systems and hygienic design. The industry is experiencing the incorporation of CIP systems that optimize the cleaning procedure and lower the danger of contamination. Machines designed for hygienic filling minimize the possibility of bacterial rise, ensure item integrity, and adhere to strict food protection regulations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.50% |

|

Segments Covered |

By Type, Packaging, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Red Bull, Monster Beverage Corporation, Rockstar Inc., Coca Cola, Pepsi Co, Arizona Beverage Company, National Beverage Corp., Dr. Pepper Snapple Group, Living Essentials, Cloud 9 |

SEGMENTAL ANALYSIS

By Type Insights

The non-alcoholic segment stood as the dominating segment and held 53.9% of the worldwide energy drinks market share in 2023. This is because of the non-alcoholic energy drink segment's transformation over the previous few years from a small product category to one of the fastest-growing product categories in the overall energy drink market. During the forecast period, it is anticipated that a rise in teen popularity and a rise in health consciousness will favor the growth of the non-alcoholic energy drink segment. Apart from this, the consumption of non-alcoholic beverages and mocktails has continued to be robust over 2023 and has maintained this trend so far in 2024 as well.

By Packaging Insights

The cans segment dominated the market and occupied a share of 59.7% of the worldwide energy drinks market share in 2023. Because consumers' tastes and options have evolved, they are increasingly choosing these drinks over bottled wine and other alcoholic beverages. Cans are portable and don't break like glass; young customers prefer metal cans. As a result of the closure of bars, pubs, and restaurants due to the coronavirus pandemic, demand for the product in cans has greatly surged and is anticipated to keep growing over the forecast period. Problems over the implications of plastic bottles on the surroundings have risen in the last few years. Market players are exploring substitute packaging choices as consumers become more cognizant of their carbon effect and the demand to reduce trash.

By End-User Insights

The adult segment was the major segment in the global market in 2023 and held 60.9% of the global energy drinks market share. This is owing to the increase in energy drink consumption by working adults who want to maintain a healthy lifestyle. Moreover, producers have fixed their focus on adults above college age, particularly women, as per a recent study. They are engaging these new people by leveraging on an increasing and slightly fanciful need that the beverage we consume not only fulfills our thirst but also enhances our physical stamina, focuses our minds, and lowers stress.

REGIONAL ANALYSIS

In 2023, North America outranked all the regions and stood as the most dominating regional segment in the global market, accounting for 30.8% of the worldwide market share. The rise in disposable income, the introduction of various indigenous brands, and the rise in marketing and promotional efforts for product growth are factors contributing to the region's expanding product consumption. Due to shifting demographics, customer preferences, and drinking behaviors, North Americans consume more energy drinks than any other geographic market in the globe. The U.S. is the major market for energy drinks in North America and captured approximately 80% of the share of the North American market in 2023. The growth of the U.S. energy drinks market is majorly attributed to the rising demand for convenience beverages, especially among urban populations with hectic schedules and the strong presence of key market players. The rise in the popularity and consumption of alcoholic and non-alcoholic energy drinks among college students and young working professionals in the U.S. is further propelling the U.S. market growth.

During the forecast period, the Asia Pacific is expected to be the fastest-growing regional segment worldwide. Due to customer readiness to try new flavors and the high demand from immigrants living in the country who show interest in a variety of beverages, the market is anticipated to experience significant growth in the economies of China, India, and Japan. The demand for products in the region has been fueled by product launches there that aim to target and appeal to a wide range of consumers.

Europe is a noteworthy regional segment for energy drinks worldwide and occupied 24.2% of the worldwide market share in 2023. The growth of the European market is attributed to the increasing demand for functional beverages and the growing recognition of energy drinks as a healthy beverage among consumers across Europe. In Europe, people have been showing interest in consumer energy drinks that are natural and organic. Considering this trend, the regional market participants have been focusing on innovation to introduce products that address and cater to the preferences of various types of consumers. The UK, Germany, and France are the key markets for energy drinks in Europe and collectively hold around 65% of the sales for energy drinks in Europe.

Latin America and MEA regions accounted for a moderate share of the worldwide market in 2023. However, these regions are anticipated to grow considerably during the forecast period owing to the growing awareness about energy drinks, increasing consumption of energy drinks among the young population, and changing consumer preferences.

KEY MARKET PARTICIPANTS

Companies playing a major role in the global energy drinks market include Red Bull, Taisho Pharmaceutical Co. Ltd., PepsiCo. Inc., Monster Energy, Lucozade, The Coco-Cola Company, Amway, AriZona Beverages USA, Living Essentials LLC and Xyience Energy.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Freego, a European energy drink company, commenced its business in India in key cities and intends to expand beyond. It has already made its presence known in areas like Bihar, Punjab, Assam, Kolkata, Mumbai, and Pune.

- Anheuser-Busch Companies LLC introduced energy drinks in India in January 2022, as the category is predominantly driven by millennials and wealthy consumers in the nation's major urban centers.

MARKET SEGMENTATION

This research report on the global energy drinks market has been segmented and sub-segmented based on product, type, consumption, distribution channel and region.

By Type

- Alcoholic

- Non-alcoholic

By Packaging

- Cans

- Bottles

By End User

- Kids

- Adults

- Teenagers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What can be the total Energy Drinks Market value?

The global energy drinks market size was valued at USD 78.17 billion in 2024, and the global market size is expected to reach USD 149.87 billion by 2033 from USD 84.03 billion in 2025, with a growing CAGR of 7.50%.

Mention the region which has the largest share in the Energy Drinks Market?

North America region is expected have the largest market share of the global Energy Drinks Market

Name any three Energy Drinks Market key players?

AriZona Beverages USA, Living Essentials LLC and Xyience Energy are the global Energy Drinks Market key players

What is the major effecting factor in the global Energy Drinks Market?

The negative health impacts brought on by consuming these residues are probably preventing the market for energy drinks from expanding.

Mention the latest driver in the global Energy Drinks Market?

Increasing consumer awareness towards sugar free beverages tends to propel the global energy drinks market growth during the forecast period

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]