Global Electronic Toll Collection Market Size, Share, Trends, and Growth Forecasts Report - Segmented By Type, Technology, End-User And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Electronic Toll Collection Market Size

The global electronic toll collection market size was valued at USD 11.73 billion in 2024 and is anticipated to reach USD 12.70 billion in 2025 from USD 23.90 billion by 2033, growing at a CAGR of 8.23% from 2025 to 2033.

Electronic toll collection involves systems that automate toll collection, replacing traditional toll booths. Technologies like RFID, DSRC, and GPS enable seamless, cashless payments as vehicles pass through toll points. In India, approximately 98% of tolls are collected through the FASTag system and is improving efficiency and reducing wait times. Globally, ETC systems have led to a 20-30% decrease in traffic congestion at toll points and a 10% reduction in fuel consumption by minimizing idling times. ETC also cuts toll collection costs by up to 50%, as it eliminates manual labor and reduces operational complexity. These benefits are central to modernizing infrastructure and enhancing transportation efficiency worldwide.

Market Drivers

Government Investments in Infrastructure Modernization

Governments worldwide are heavily investing in upgrading tolling infrastructure to improve traffic management and streamline toll collection. The Indian government, for instance, has introduced the FASTag initiative with 98% of tolls on national highways now being collected electronically which has significantly reduced congestion. According to the National Highways Authority of India (NHAI), this initiative has helped reduce average wait times at toll booths by 30% and increased revenue efficiency. Such infrastructure projects are accelerating the global adoption of ETC systems are enhancing operational efficiency and reducing operational costs.

Focus on Environmental Sustainability

ETC systems contribute significantly to reducing environmental impacts by minimizing vehicle idling time at toll booths, which lowers fuel consumption and emissions. A study by the European Commission found that electronic tolling systems can reduce fuel consumption by 10% and vehicle emissions by approximately 8%. In addition to improving traffic flow, the reduction in vehicle congestion leads to lower carbon footprints, aligning with global sustainability goals. This growing environmental awareness is driving the adoption of ETC systems as governments aim to improve air quality and reduce greenhouse gas emissions.

Market Restraints

High Initial Setup Costs

The implementation of Electronic Toll Collection (ETC) systems requires substantial investment in technology, infrastructure, and ongoing maintenance. For example, in India, the National Highways Authority of India (NHAI) allocated approximately $100 million for the rollout of the FASTag system across national highways. This covers the costs of installing RFID-enabled tags, upgrading toll plazas, and ensuring robust connectivity. Such high upfront costs present a significant barrier for governments, especially in developing economies which may delay the adoption of these advanced systems despite their long-term benefits.

Interoperability Challenges

The lack of global standardization in toll collection systems hampers the seamless integration of ETC networks across different regions. According to the International Transport Forum (ITF), over 20 tolling systems exist across Europe, each with its own set of technologies and standards making cross-border tolling cumbersome. This inconsistency prevents vehicles from using a single, unified system across borders. As of 2024, only about 30% of European tolling networks are fully interoperable, with the Interoperable European Electronic Tolling Service (EETS) still under implementation. The ITF reports that this fragmentation leads to additional administrative costs, with cross-border tolling compliance in Europe alone estimated to incur costs of over €500 million annually. Such challenges increase operational complexities, making it harder for operators to offer cost-effective, efficient tolling solutions.

Market Opportunities

Expansion of Smart Cities and Urban Infrastructure

The growth of smart cities worldwide presents a major opportunity for the Electronic Toll Collection (ETC) market. As urbanization accelerates, governments are investing in intelligent transportation systems (ITS) that integrate toll collection with traffic management and urban mobility solutions. According to the European Commission, smart city initiatives in cities like Amsterdam and Barcelona are incorporating ETC systems as part of their infrastructure modernization plans. These systems improve not only toll collection but also reduce traffic congestion, cut emissions, and enhance overall urban mobility. By 2025, smart cities are expected to account for over 40% of the global ETC market share.

Interoperability and Cross-Border Tolling Solutions

With increasing global mobility, there is a growing demand for interoperable tolling systems, especially in regions like Europe and North America. The European Commission aims to fully implement the Interoperable European Electronic Tolling Service (EETS) by 2025, allowing seamless toll payment across borders. This opportunity is compounded by the rise of international travel and cross-border freight transportation, which requires a unified tolling system. The development of cross-border tolling solutions is expected to expand the ETC market by facilitating smoother travel and reducing administrative burdens. It is projected that by 2025, interoperability could increase global ETC adoption by 25%.

Market Challenges

Security and Privacy Concerns

The widespread use of Electronic Toll Collection (ETC) systems raises concerns regarding data security and privacy, as these systems collect and store sensitive vehicle and payment information. According to the U.S. Department of Transportation, more than 75% of toll collection systems in the U.S. use RFID technology, which can potentially be vulnerable to hacking. This has led to concerns about unauthorized access to personal data. To address this, authorities are increasingly adopting advanced encryption and secure communication protocols. However, maintaining robust cybersecurity remains a significant challenge, with the potential for increased cyberattacks as the adoption of ETC systems expands globally.

Public Resistance to New Technology

While ETC systems offer several advantages, there is often resistance from the public due to unfamiliarity with the technology and concerns over added costs. According to the Indian Ministry of Road Transport and Highways (MoRTH), although the FASTag system has achieved 98% penetration in toll collections, some vehicle owners still resist adopting electronic tags due to a lack of awareness or perceived inconvenience. In several regions, such resistance has led to slower adoption rates, hindering the full realization of ETC benefits. Governments are addressing this challenge through educational campaigns and incentives to increase public acceptance and awareness of ETC benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.23% |

|

Segments Covered |

By Type, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kapsch TrafficCom, TransCore, Conduent, Thales Group, Cubic Corporation, Siemens Mobility, Toll Collect GmbH, Denso Corporation, Lumisys, VeroTrans. |

SEGMENT ANALYSIS

Global Electronic Toll Collection Market By Type

The automatic vehicle classification (AVC) segment had the largest share of 43.5% of the global market in 2024. The domination of AVC segment is majorly driven by the ability of AVC to classify vehicles automatically and efficiently for toll charges based on vehicle type. The segment is expected to rise at a CAGR of 9.5%. AVC systems are essential for toll operators to apply accurate toll rates depending on vehicle categories, such as light vehicles, heavy trucks, and buses. According to the Federal Highway Administration (FHWA), AVC helps reduce operational costs by streamlining toll collection, improving traffic flow, and enhancing revenue management. In the U.S., it’s estimated that AVC systems reduce toll processing times by up to 30%. This not only enhances the efficiency of tolling but also contributes to reducing traffic congestion.

The violation enforcement system (VES) segment is emerging at the rapid pace in the global ETC market and is projected to grow at a CAGR of 11.1% from 2025 to 2033. VES systems are increasingly being adopted as governments focus on ensuring compliance with tolling regulations. These systems detect and enforce violations such as unpaid tolls or unauthorized use of toll lanes. According to the European Commission, tolling violations in Europe lead to losses of approximately €500 million annually. The rising need for tolling compliance and enforcement is driving demand for VES, especially in regions with expanding toll road networks. As governments work to improve toll collection efficiency and reduce revenue leakage, VES solutions are becoming a priority in both developed and developing countries.

Global Electronic Toll Collection Market By Technology

The radio frequency identification (RFID) segment held the major share of 51.5% of the worldwide market in 2024. RFID technology is the most widely used due to its cost-effectiveness, reliability, and ease of implementation. It enables seamless and efficient toll payments without the need for physical contact and is reducing congestion and improving traffic flow. According to the U.S. Federal Highway Administration (FHWA), over 75% of toll roads in the U.S. use RFID-based tolling systems. RFID systems are crucial for reducing operational costs, ensuring accurate toll collection, and enhancing toll revenue management. Its widespread adoption is driven by the demand for non-invasive, automated tolling systems, especially in regions with high traffic volumes such as North America, Europe, and Asia-Pacific. RFID-based systems, like the EZ-Pass in the U.S. and Telepass in Italy, are key examples of successful implementations. As governments continue to modernize transportation infrastructure, RFID will remain the dominant technology due to its proven reliability and scalability.

The (GNSS)/GPS segment is anticipated to grow at a notable CAGR of 12.8% from 2025 to 2033. GNSS-based tolling solutions are gaining traction due to their ability to offer precise, real-time tracking of vehicles, enabling seamless tolling across vast distances without the need for physical toll booths. According to the European GNSS Agency (GSA), GNSS-based tolling is expected to account for nearly 20% of the European toll market by 2025. The segment's rapid growth is attributed to the increasing demand for more flexible and cost-effective tolling solutions, particularly for long-distance tolling and multi-lane toll collection. GNSS technology is also gaining favor due to its ability to support tolling across complex road networks, including highways and urban streets, without the need for extensive infrastructure. Additionally, the ability of GNSS to facilitate road pricing and congestion charging further drives its adoption and particularly in smart city projects and countries focused on environmental sustainability.

Global Electronic Toll Collection Market By End-user

The highway segment dominated the global electronic toll collection (ETC) market and held 68.7% of the global market share in 2024. This dominance is driven by the high volume of traffic on highways and the increasing need for efficient toll collection systems to manage long-distance travel and freight movement. The segment is expected to grow at a CAGR of 6.2% from 2025 to 2033. According to the Federal Highway Administration (FHWA), tolling on U.S. highways has increased significantly, with over 4,000 miles of toll roads in operation across the country. Highways are ideal locations for ETC systems, as they provide a large number of vehicles that can benefit from seamless, automated toll collection without the need for stopping at toll booths. The adoption of technologies such as RFID and GNSS is particularly important for highway tolling allowing for efficient and non-intrusive tolling while reducing traffic congestion. The growing trend of smart highways and the expansion of toll networks in regions like North America and Europe further contribute to the dominance of the highway segment.

The urban area segment is on the rise and is estimated to witness a CAGR of 10.7% over the forecast period. Rapid urbanization, rising vehicle ownership, and increasing traffic congestion in cities are key factors driving the adoption of ETC systems in urban areas. According to the International Transport Forum (ITF), over 50% of the world's population now lives in urban areas, and this is expected to increase, further intensifying traffic congestion. Major cities like London and Singapore have successfully implemented electronic congestion charging zones. In London, the congestion charge scheme introduced in 2003 resulted in a 30% reduction in traffic and a 20% improvement in air quality. Similarly, Singapore’s Electronic Road Pricing (ERP) system has helped reduce traffic by 15-20% in congested zones.

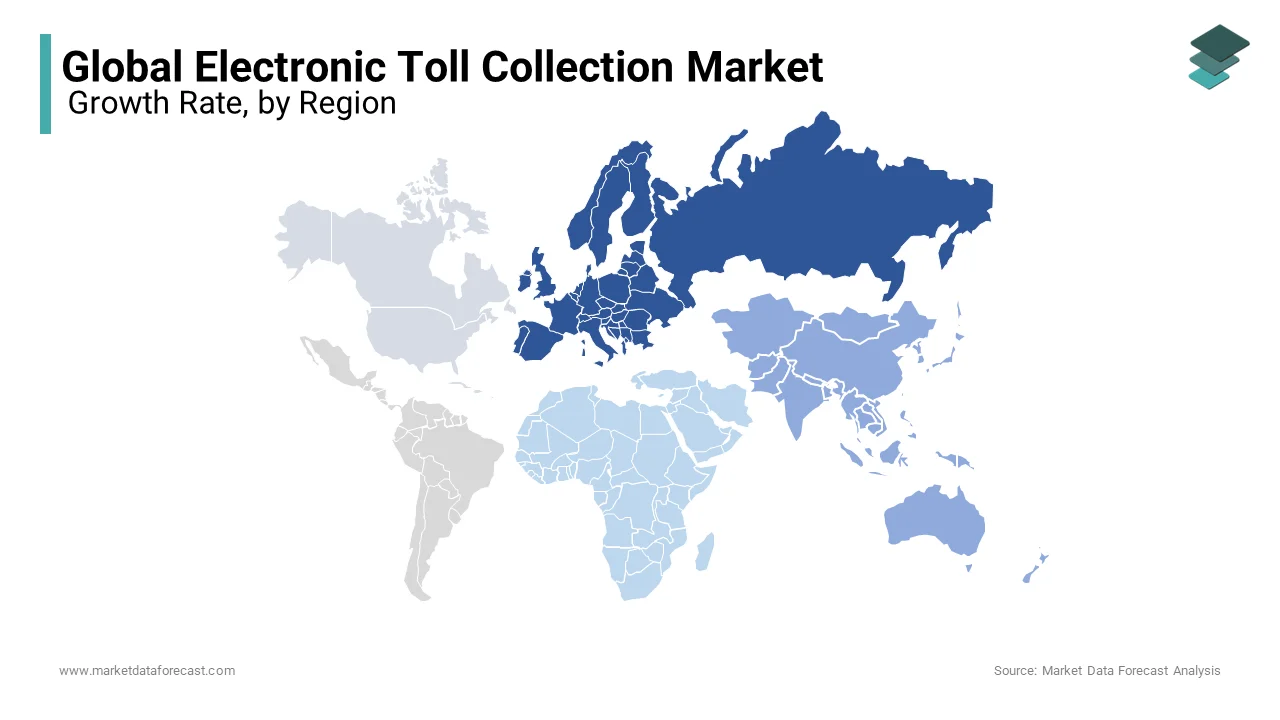

REGIONAL ANALYSIS

North America held 45.2% of the global market share in 2024. The region holds a strong market position and is driven by advanced infrastructure and the high adoption rate of tolling systems, especially in the U.S. and Canada. The U.S. is a leader with widespread use of RFID-based systems, with states like Texas and Florida having fully integrated electronic tolling systems. According to the Federal Highway Administration (FHWA), around 90% of toll roads in the U.S. now use ETC technology. The region’s future growth will be fueled by ongoing infrastructure modernization and increasing demand for seamless, cashless tolling solutions.

Europe is a notable regional segment for ETC and is predicted to witness a CAGR of 8.5% from 2025 to 2033. The region is well-established in the ETC market with countries like France, Germany, and Italy leading in the adoption of tolling systems. According to the European Commission, over 50% of European toll roads have implemented electronic toll collection systems. The region’s future performance will be influenced by the ongoing implementation of the Interoperable European Electronic Tolling Service (EETS), which aims for a more seamless, cross-border tolling system. The European market will also see growth as smart city initiatives expand.

The Asia-Pacific region is poised for fastest expansion and is predicted to record a CAGR of 12.2% over the forecast period. This growth is driven by rapid urbanization, increasing vehicle numbers, and government investments in smart infrastructure. Leading countries in this region include China and India. China’s growing network of toll roads and India’s FASTag system, which has reached a 98% adoption rate, are key drivers. According to the Ministry of Road Transport and Highways (MoRTH), India has seen a 30% reduction in congestion due to ETC implementation. The demand for seamless, cashless tolling is expected to drive market expansion across the region.

Latin America is anticipated to witness a healthy CAGR over the forecast period. Brazil and Mexico are key players in the region’s ETC market, with Brazil leading the adoption of electronic toll systems. According to the Brazilian Ministry of Transport, over 70% of toll collection in Brazil is now electronic. The region’s growth is also supported by government initiatives aimed at improving traffic management and reducing congestion. The future performance of the Latin American market will be influenced by the expansion of smart cities and increased focus on environmental sustainability.

The market in Middle East and Africa region is anticipated to hold a considerable share of the worldwide market over the forecast period. The market in this region is still in its early stages, but countries like the UAE and Saudi Arabia are leading the charge. The UAE has implemented toll systems in cities like Dubai, where the Salik system is widely used. According to the Dubai Roads and Transport Authority (RTA), Salik has successfully reduced congestion by up to 30% and improved traffic flow, with over 3 million vehicles registered in the system as of 2023. The market will grow as these nations invest in smart infrastructure and urban mobility solutions and is improving the overall adoption of ETC systems in the region.

KEY MARKET PLAYERS

Kapsch TrafficCom, TransCore, Conduent, Thales Group, Cubic Corporation, Siemens Mobility, Toll Collect GmbH, Denso Corporation, Lumisys, VeroTrans. These are the market players that are dominating the global electronic toll collection market.

COMPETITIVE LANDSCAPE

The Electronic Toll Collection (ETC) market is marked by intense competition, with numerous players striving to provide advanced solutions. Key technological innovations, such as Radio Frequency Identification (RFID), Dedicated Short-Range Communication (DSRC), and Global Navigation Satellite Systems (GNSS), are central to the competition, offering various advantages in efficiency and cost-effectiveness. Leading companies like Kapsch TrafficCom, TransCore, Conduent, and Thales continuously evolve their offerings to enhance system performance, scalability, and reliability.

Governments are heavily investing in infrastructure upgrades and smart city projects, accelerating the demand for electronic tolling systems aimed at alleviating traffic congestion and streamlining revenue collection. This has prompted strategic partnerships and acquisitions among top industry players, seeking to provide integrated solutions that cater to evolving needs. A major emphasis is placed on ensuring smooth compatibility with existing infrastructures and delivering intuitive systems to encourage widespread adoption.

In specific regions, such as Asia Pacific, the competition is particularly fierce due to rapid urbanization and increasing vehicle numbers, driving the demand for efficient tolling technologies. Furthermore, the growing need for cross-border toll interoperability has pushed companies to create solutions that can seamlessly connect different networks, presenting both challenges and opportunities in the sector.

RECENT MARKET HAPPENINGS IN THIS MARKET

- In April 2024, Kapsch TrafficCom integrated Artificial Intelligence (AI) technologies into its tolling and traffic management systems. This advancement is expected to enhance real-time data processing and video analytics, improving traffic flow and safety, thus strengthening its market position.

- In April 2024, the Indian government announced plans to introduce satellite-based toll collection on national highways by April 2025. This move is expected to revolutionize toll collection, allowing for GPS-enabled systems that calculate tolls based on distance traveled, eliminating the need for physical toll plazas.

MARKET SEGMENTATION

This research report on the global electric toll collection market is segmented and sub-segmented into the following categories.

By Type

- Automatic Vehicle Classification (AVC)

- Violation Enforcement System (VES)

- Automatic Vehicle Identification System (AVIS)

- Others (Transaction Processing/Back Office)

By Technology

- Radio Frequency Identification (RFID)

- Dedicated Short Range Communication (DSRC)

- Global Navigation Satellite System (GNSS)/GPS

- Video Analytics

- Cell Phone Tolling

- Others (Barcode-based ETC)

By End-user

- Highway

- Urban Area

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global electric toll collection market?

The global electronic toll collection market size was valued at USD 12.70 billion in 2025

What are the challenges faced in the global electric toll collection market?

The challenges are the security and privacy concerns and public resistance to new technology that are facing the global electric toll collection market.

What are the market drivers that are driving the global electric toll collection market?

The market drivers are government investments in infrastructure modernization and focus on environmental sustainability.

who are the market players that are dominating the global electric toll collection market?

Kapsch TrafficCom, TransCore, Conduent, Thales Group, Cubic Corporation, Siemens Mobility, Toll Collect GmbH, Denso Corporation, Lumisys, VeroTrans. these are the market players that are dominating the global electric toll collection market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]