Global Electric Wheelchair Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Front-Wheel Drive, Center Wheel Drive, Rear-wheel Drive and Standing Electric Wheelchair), End User (Personal, Hospital and Sports Conditioning), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

Global Electric Wheelchair Market Size (2024 to 2032)

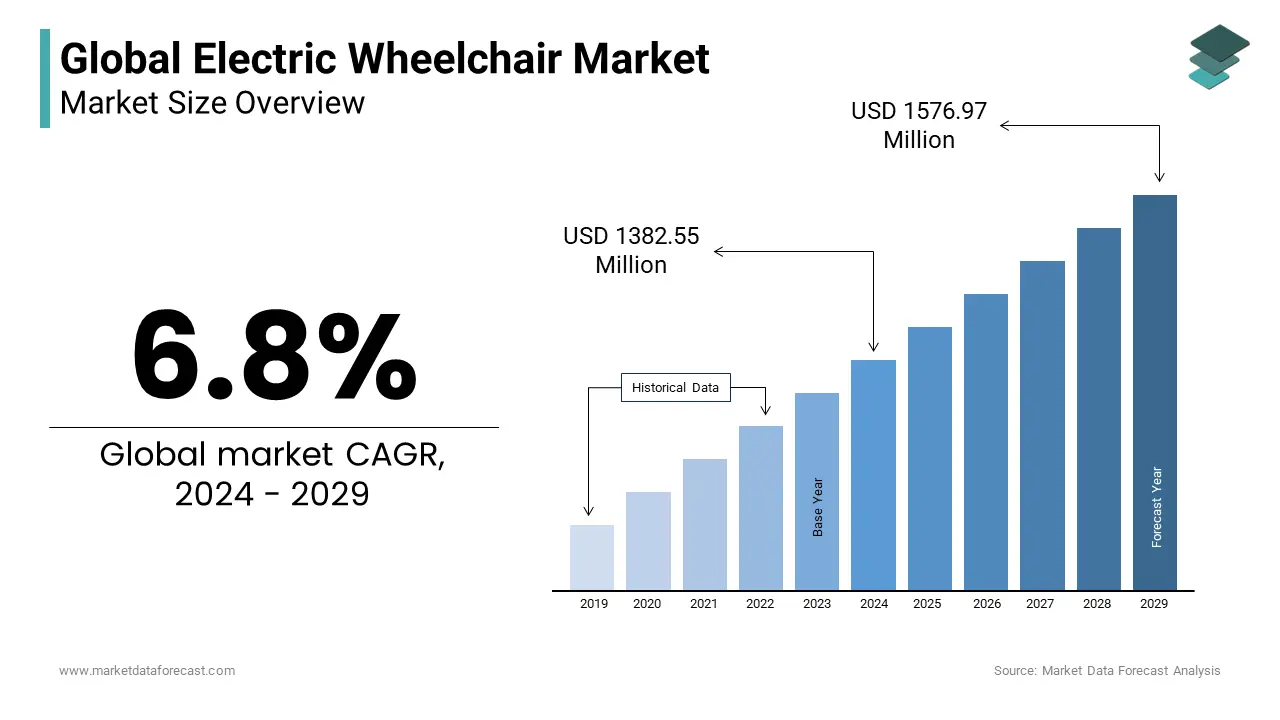

The global electric wheelchair market size is expected to reach USD 2.34 billion by 2032 from USD 1.38 billion in 2024 growing at a compound annual growth rate (CAGR) of 6.8% during the forecast period.

Current Scenario of the Global Electric Wheelchair Market

According to WHO’s estimation, 1% of the global population, which counts around 75 million people globally, needs an appropriate wheelchair.

Electric wheelchairs are motor-driven wheelchairs, also called power-driven wheelchairs. These chairs run on electric batteries and do not require any human help for movement. Electric wheelchairs are lightweight and compact after folding, so they are easy to carry. However, out of these needy people, only 5% to 15% of people have access, which shows more than 85% of people need a wheelchair. There is a space for new entrants to create demand for an electric wheelchair. There are several types of wheelchairs available in the marketplace to purchase. The front-wheeled-electric wheelchair is one of a kind. As its name suggests, the driving wheel is on the front side. This development is done over a rear-wheel wheelchair as it is found better for rough surface and weight distribution, and it also provides more space for feet position as its batteries are placed at the rear end.

Self-driving wheelchairs are being developed, but due to the high cost and maintenance cost of such wheelchairs, fewer people prefer such types of electric wheelchairs. On the other hand, standing wheelchairs are more advanced, and this gives the user a standing capability, but such types of wheelchairs are users for now. In lightweight wheelchairs by use of carbon alloy, the weight is reduced, but it costs high over aluminum and other metals. Smart wheelchairs are gaining traction. In the past few years, using technology, there have been many developments and reinventions in the electric wheelchair design to enhance safety and mobility, which led to the invention of a smart wheelchair. In this digital world, by using the Internet of Things, self-driven smart wheelchairs are being made with digital twin maps and additional safety sensors.

MARKET DRIVERS

The global population aged 60 years and above is expected to reach 2 billion by 2050 from 900 million in 2015.

Increasing orthopedic patients, post-surgery mobility requirements, and the increasing global aging population are driving the global market growth. According to a report by WHO, people above 60 years of age are susceptible to declining physical wellness; this factor can support the increasingly global market for electric wheelchairs. The simplicity and ease of an electric wheelchair over a traditional manually driven wheelchair is another factor to consider for driving the market.

MARKET RESTRAINTS

The restraints include the high cost of the electric wheelchair, lack of awareness, and low government support. Various NGOs and charities make wheelchairs available locally with public donations and donate locally to needy people, which hinders the market's growth. There is a lack of WHO guidelines in line service providing wheelchairs in the market and well-developed infrastructure.

The creation of demand for an electric wheelchair is a major challenge, as globally there are less than 15% of people are using a wheelchair for needy people. So, there is a need to increase awareness among the end-users and service providers and at the policy level. Governments are preferring for local manufacturers at low cost. Due to high costs, people are still using traditional self-driven wheelchairs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.8% |

|

Segments Covered |

By Type, End-user, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DeVilbiss Healthcare, Invacare (USA), Pride Mobility Products, Roma Medical, Sunrise Medical (Germany/USA), OttoBock Healthcare GmbH (Germany) and Permobil (Sweden) |

SEGMENTAL ANALYSIS

Global Electric Wheelchair Market By Type

The front wheel-driven wheelchair is the second most consumer-preferred type of wheelchair while the center wheel-driven wheelchair segment has the highest demand and around 50% market share, so it is considered the major segment in the future.

Global Electric Wheelchair Market By End-User

Due to increasing emergency conditions, the hospital use of wheelchairs is the fastest CAGR segment in the next 4 to 5 years.

REGIONAL ANALYSIS

North America is the largest market for electric wheelchairs, with more than 60% revenue share in 2021.

Out of the total revenue share of North America, 84% of revenue share is accounted by the adult age category, and the drivers are low cost and low weight of the product, which led to high demand in the market.

The European electric wheelchair market is known for its high cost compared to other geographies because carbon alloy is used to make lightweight wheelchairs.

High-cost products lead to high income and in terms of revenue generation, Europe follows North America. Major European players focus on providing customized products to generate high revenue.

The Asia Pacific is the fastest-growing market for electric wheelchairs and will dominate the market in the next five years with the increasing population of India and China. Due to the increase in China's aging population, China holds more than 240 million people aged more than 60 years, and this will drive the electric wheelchair market in upcoming years. On the other hand, India, 2nd largest country by population, recorded more than 4,40,000 accidents in the year 2019, more than 4,50,000 injuries, and more than 1,50,000 deaths, creating the need for a wheelchair in the market and counting in the Asia Pacific. China manufactures low-cost electric wheelchairs using aluminum.

In South America, the major key players like Drive DeVilbiss Healthcare are located, bringing innovation in technology to provide user-friendly and low-cost products, thus creating demand in South America.

Middle East and African countries are bringing new innovations like solar charging for batteries. The market is mainly in Argentina, UAE, Brazil, and Saudi Arabia.

KEY MARKET PLAYERS

Companies playing a promising role in the global electric wheelchair market include Drive DeVilbiss Healthcare, Invacare (USA), Pride Mobility Products, Roma Medical, Sunrise Medical (Germany/USA), OttoBock Healthcare GmbH (Germany) and Permobil (Sweden).

There is direct competition between the old and new brands in the market based on technological innovation. Due to government support for local manufacturers, local manufacturers are entering the market and making a presence locally, and that reduces the place in the market for big brands. Due to the unavailability of low-cost electric wheelchairs in the market, many NGOs are entering the market to provide demand-based, quality products at a low cost.

DETAILED SEGMENTATION OF THE GLOBAL ELECTRIC WHEELCHAIR MARKET INCLUDED IN THIS REPORT

This research report on the global electric wheelchair market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Front-Wheel Drive

- Center Wheel Drive

- Rear-Wheel Drive

- Standing Electric Wheelchair

By End-User

- Personal

- Hospital

- Sports Conditioning

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Frequently Asked Questions

What was the size of the electric wheelchair market in 2024?

The global electric wheelchair market was valued at USD 1382.55 million in 2024.

What factors are driving the growth of the electric wheelchair market?

The growing aging population, increasing disability rates and technological advancements are key drivers of market growth.

What are the challenges faced by the electric wheelchair market?

High costs, limited insurance coverage, and competition from other mobility aids are some of the major challenges in the global market.

What impact has the COVID-19 pandemic had on the electric wheelchair market?

The COVID-19 pandemic has led to increased awareness of mobility solutions and remote healthcare consultations, driving market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]