Global Electric Van Market Size, Share, Growth, Trends & Forecast Research Report By Propulsion (Battery Electric Vehicle (BEV), Hybrid Vehicle (HEV)), Range (Up to 100 miles, 100 to 200 miles, Above 200 miles), Battery (Lithium Ion, Sealed Lead Acid, Nickel Metal Hydride (NiMH)), Application (Commercial, Personal), And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From (2025 to 2033)

Global Electric Van Market Size

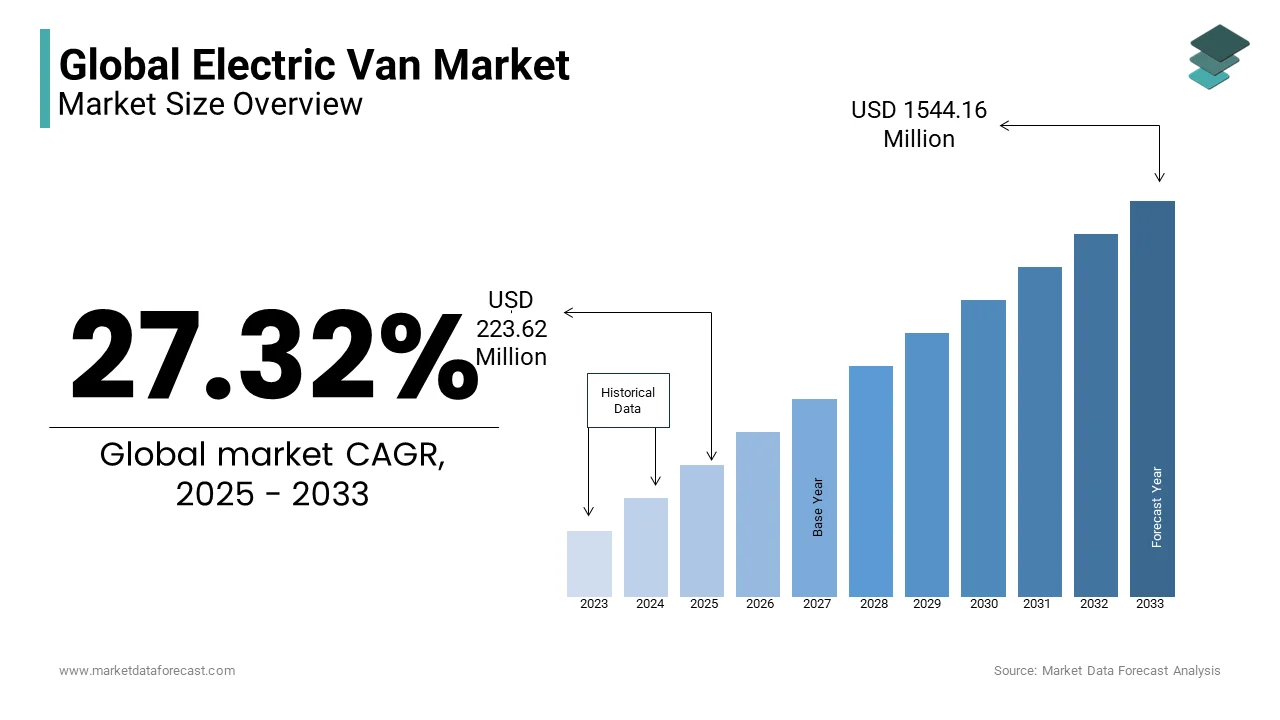

The global electric van market size was valued at USD 175.64 million in 2024 and is anticipated to reach USD 223.62 million in 2025 from USD 1544.16 million by 2033, growing at a CAGR of 27.32% during the forecast period from 2025 to 2033.

The demand for electric vans is growing significantly due to the increasing demand for sustainable and efficient transportation solutions in commercial sectors. Electric vans are battery-powered vehicles designed to carry goods and services, offering an environmentally friendly alternative to traditional internal combustion engine (ICE) vans. These vehicles are gaining popularity due to their lower operational costs, reduced carbon footprint, and advancements in battery technology, which provide longer driving ranges and faster charging times.

The global electric van market is poised for rapid expansion over the forecast period as governments worldwide intensify their efforts to combat climate change through stringent emission regulations and incentives for electric vehicle adoption. For instance, in Europe, countries like the UK and Germany have been actively promoting electric vehicle adoption through subsidies and tax rebates. According to a report by Bloomberg New Energy Finance, the global market for electric vans is expected to reach 1.5 million units by 2040, which accounts for more than 20% of all commercial vehicles on the road.

In 2023, the electric van segment witnessed substantial growth, with sales in Europe increasing by 30% compared to the previous year. Major manufacturers, such as Ford, Mercedes-Benz, and Volkswagen, are investing heavily in electric van production to meet the growing demand. Moreover, the shift towards electric vans is anticipated to continue as businesses look for ways to reduce their carbon emissions and comply with regulations and thereby further accelerating market growth in the coming years.

Market Drivers

Sustainability and Reducing Carbon Emissions

One of the key drivers of the electric van market is the growing focus on sustainability and reducing carbon emissions. Governments around the world are implementing stringent regulations and offering substantial incentives to encourage the adoption of electric vehicles. In the European Union, the Green Deal and the Fit for 55 package aim to reduce carbon emissions by 55% by 2030, significantly impacting the commercial vehicle sector. According to the European Environment Agency (EEA), emissions from the transport sector account for around 25% of total greenhouse gas emissions, with a large portion attributed to road freight. This regulatory push is prompting businesses to transition to electric vans, contributing to the market's expansion. The UK Government, for example, has committed to banning the sale of new petrol and diesel vehicles by 2030 and is further driving the demand for electric alternatives.

Cost of Ownership (TCO) For Electric Vans

Another crucial driver is the reduction in total cost of ownership (TCO) for electric vans, making them more attractive to businesses. As battery technology advances, the cost of electric vans has steadily decreased. The U.S. Department of Energy reports that the price of lithium-ion batteries has dropped by nearly 89% since 2010, leading to lower upfront costs for electric vans. Additionally, electric vans have lower operating expenses due to fewer moving parts, reduced maintenance costs, and savings on fuel. According to the International Council on Clean Transportation (ICCT), electric vans can save fleet operators up to $10,000 annually on fuel costs alone. This cost-effectiveness is driving increased adoption across logistics and delivery companies.

Market Restraints

limited Charging Infrastructure And Widespread Adoption of Electric Vans

A major restraint for the electric van market is the limited charging infrastructure, which hampers the widespread adoption of electric vans, particularly in rural and less-developed regions. While urban areas are seeing an increase in public and private charging stations, the availability of charging points remains insufficient in many countries. According to the International Energy Agency (IEA), as of 2023, there were approximately 1.5 million public charging points globally, yet the number of charging stations is still far behind the number needed to support the growing electric vehicle market. This shortage can cause significant range anxiety for fleet operators, limiting the feasibility of electric vans for long-haul or high-mileage operations, particularly in regions with less robust charging infrastructure.

High Initial Purchase Cost Compared to Conventional Internal Combustion Engine Vehicles

Another significant barrier to the growth of the electric van market is the high initial purchase cost compared to conventional internal combustion engine vehicles. Despite the decrease in battery prices over the past decade, electric vans remain more expensive upfront. According to the U.S. Department of Energy, electric vans can cost between $10,000 to $20,000 more than their diesel counterparts. This price difference is a significant deterrent for small and medium-sized enterprises (SMEs) that often operate on tight budgets. While the total cost of ownership is lower over time, the higher initial cost of electric vans is a primary challenge and especially for businesses with limited access to financial incentives or subsidies.

Market Opportunities

Growing Trend of E-commerce and Last-mile Delivery Services

One key opportunity for the electric van market is the growing trend of e-commerce and last-mile delivery services, which increasingly rely on sustainable transportation solutions. The surge in online shopping has led to a significant rise in demand for efficient and eco-friendly delivery options. According to the International Transport Forum (ITF), the global e-commerce market is projected to exceed $6.5 trillion by 2023, creating a growing need for last-mile delivery fleets. Electric vans are particularly well-suited for these operations due to their reduced emissions and lower operating costs. As more logistics companies and e-commerce giants such as Amazon transition to electric fleets and consequently the market for electric vans is expected to expand significantly in the coming years.

Government Incentives And Subsidies

Another opportunity lies in the substantial government incentives and subsidies available to encourage the adoption of electric vehicles, including electric vans. In the United States, the Inflation Reduction Act offers up to $7,500 in federal tax credits for electric vehicle purchases, including vans. Similarly, the European Union offers substantial rebates and incentives to businesses purchasing electric commercial vehicles. These financial incentives significantly reduce the initial cost burden for fleet operators, making electric vans a more viable and attractive option. According to the European Commission, such incentives have led to a 30% increase in electric vehicle sales within the EU, suggesting that continued support could further accelerate market adoption.

Market Challenges

Limited Driving Range Compared to Traditional Diesel Vans

A significant challenge for the electric van market is the limited driving range compared to traditional diesel vans, which can deter potential buyers. While advancements in battery technology have improved range, many electric vans still fall short of meeting the long-distance demands of certain industries. According to the U.S. Department of Energy, the typical electric van can travel between 100 to 250 miles on a single charge, while a diesel van can cover upwards of 400 miles. This discrepancy presents a challenge for businesses that require long-haul transportation or those operating in remote areas. Even though developments in charging technology are underway, range limitations remain a critical factor for market growth.

Slow Pace of Technological Development In Charging Speed And Battery Capacity

Another challenge facing the electric van market is the slow pace of technological development in charging speed and battery capacity. Despite significant advancements, the time required to charge electric vans remains a barrier, especially for fleet operators who need quick turnaround times. According to the European Commission, while rapid chargers can charge a vehicle in 30 minutes, most charging stations still take several hours to fully charge an electric van. This delay can disrupt operations, especially for businesses relying on round-the-clock deliveries. Additionally, as battery capacity increases to extend driving range, the charging times could also increase, presenting a continuous challenge for both manufacturers and end-users in optimizing efficiency.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

27.32% |

|

Segments Covered |

By propulsion, Range, Battery, Application and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mercedes-Benz USA, LLC, Ford Motor Company, Rivian, Nissan, Volkswagen, Stellantis, Europe S.p.A., Renault, BYD Singapore, MAN, Volvo Car Corporation. |

SEGMENT ANALYSIS

Global Electric Van Market Analysis By Propulsion

The battery electric vehicle (BEV) segment continued its domination in the electric van market in 2024 by capturing 71.2% market share due to its distinct advantage in reducing carbon emissions. According to the International Energy Agency (IEA), BEVs have contributed to a 70% reduction in tailpipe emissions compared to conventional internal combustion engine vehicles. This makes BEVs crucial in addressing global climate change, especially since the transport sector accounts for about 24% of global CO2 emissions. The widespread adoption of BEVs is further driven by environmental policies across major economies, such as the European Union’s goal to cut carbon emissions by 55% by 2030 and is positioning BEVs as a vital tool in achieving these climate goals.

The hybrid electric vehicle (HEV) segment is growing rapidly and is estimated to showcase a CAGR of 18.3% from 2025 to 2033. According to the U.S. Department of Energy, HEVs help reduce fuel consumption by an average of 20-35% compared to traditional vehicles. Their ability to combine internal combustion engines and electric power provides an immediate solution to the challenges of reducing emissions while retaining the convenience of conventional fuels. The continued development of hybrid technology enables a reduction in urban air pollution and especially in high-traffic areas. As governments focus on lowering emissions and improving fuel efficiency, HEVs are becoming increasingly important for businesses transitioning toward sustainable transportation.

Global Electric Van Market Analysis By Range

The 100 to 200 miles range led the market by accounting for 57.2% of global market share in 2024. According to the U.S. Department of Energy, electric vehicles in this range offer a significant reduction in fuel consumption, cutting emissions by up to 50% compared to traditional internal combustion engine vehicles. This range is well-suited for last-mile delivery services, which represent a substantial portion of global logistics. With urban areas facing rising pollution levels, the adoption of electric vans in this range is critical for improving air quality, reducing noise pollution, and enhancing the overall sustainability of urban transport systems.

The Above 200 miles range segment is on track for the rapid growth and is expected to grow at a CAGR of 22.1% from 2025 to 2033. According to the U.S. Environmental Protection Agency (EPA), electric vehicles with a range of over 200 miles can reduce greenhouse gas emissions by up to 75% compared to gasoline-powered vehicles, making them pivotal in achieving national and international climate goals. This range offers significant environmental benefits, especially in areas where public transportation or infrastructure for charging stations may be less frequent. The demand for long-range electric vans continues to grow rapidly as more fleet operators seek to reduce their carbon footprints and improve operational efficiency, .

Global Electric Van Market Analysis By Battery

The Lithium-Ion battery segment captured the maximum share in the electric van market by accounting for 80.4% of the global market share in 2024. According to the U.S. Department of Energy, lithium-ion batteries are able to store and release up to 200 Wh/kg and is allowing electric vehicles to travel longer distances on a single charge. Additionally, lithium-ion batteries are known to reduce greenhouse gas emissions significantly up to 50% when used in electric vehicles, compared to conventional internal combustion engine vehicles. These characteristics are critical in addressing the environmental challenges posed by the transportation sector, making lithium-ion the most widely used battery technology in electric vans and other EVs.

The nickel metal hydride (NiMH) battery segment is growing promisingly and is likely to exhibit a CAGR of 16.6% from 2025 to 2033. According to the U.S. Environmental Protection Agency (EPA), NiMH batteries are gaining traction due to their environmental benefits, such as lower toxicity and better recyclability. In fact, NiMH batteries can be recycled up to 95% of their materials, making them a more sustainable option than traditional lead-acid batteries. They also have a longer lifespan—up to 1,000 charge cycles when compared to lead-acid batteries, which typically last around 500 cycles. NiMH batteries are becoming more popular in regions with limited access to fast-charging infrastructure because they require less frequent charging and can be charged with standard outlets.

Global Electric Van Market Analysis By Application

The commercial segment dominated the market by holding 75.7% of the global market share in 2024. According to the U.S. Department of Energy, commercial electric vehicles, such as electric vans, can reduce tailpipe emissions by as much as 75% compared to their gasoline counterparts. The adoption of electric vans in commercial fleets helps reduce the environmental impact of the transportation sector, which is responsible for nearly 28% of total greenhouse gas emissions in the U.S. By transitioning to electric, companies can also save on operating costs such as fuel and maintenance and is making commercial electric vans an attractive option for businesses seeking to improve sustainability while optimizing logistics.

The personal segment is accelerating rapidly and is estimated to progress at a CAGR of 20.2% from 2025 to 2033. The U.S. Environmental Protection Agency (EPA) reports that personal electric vehicles, including vans, can reduce greenhouse gas emissions by up to 60% compared to traditional gasoline-powered vehicles, depending on the energy mix used for charging. Consumer demand for eco-friendly transportation solutions is growing, driven by rising concerns over air pollution, particularly in urban areas.

REGIONAL ANALYSIS

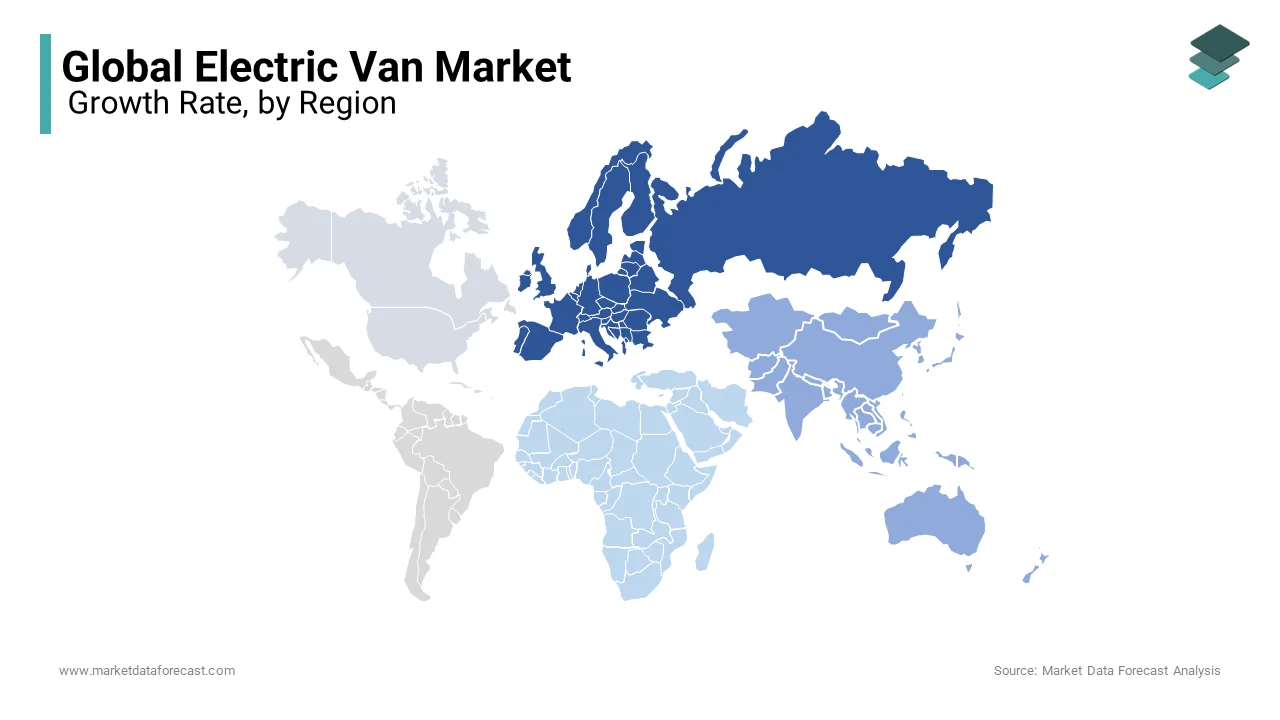

Europe dominated the electric van market in 2024 and accounted for 50.4% of the global market share. According to the European Automobile Manufacturers Association (ACEA), in 2023, electric vans accounted for approximately 12% of all commercial vehicle sales in Europe. The region's leadership is attributed to strict emission regulations, such as the EU’s Green Deal which aims to reduce CO2 emissions by 55% by 2030, and the Fit for 55 initiative. Additionally, Europe’s extensive charging infrastructure and government subsidies have significantly accelerated the adoption of electric vans and thereby making it a critical hub for the electric vehicle market.

The Asia-Pacific region is expected to be the emerging segment of the electric van market with a projected CAGR of 22.7% from 2025 to 2033. According to the International Energy Agency (IEA), the Asia-Pacific region already accounts for more than 60% of global electric vehicle sales. The rapid adoption of electric vehicles in countries like China and Japan, bolstered by government incentives and policies to reduce emissions which is driving the growth of electric vans in the region. Furthermore, significant investments in electric vehicle manufacturing, such as the Chinese government’s push to expand EV infrastructure, are contributing to this growth and is making the region a key player in the market’s expansion.

In North America, the electric van market is expected to see moderate growth in the coming years, primarily driven by the U.S. The U.S. government’s focus on sustainable transportation, including the $7,500 federal tax credit for electric vehicles, is expected to boost adoption. However, the market faces challenges such as limited charging infrastructure and higher initial costs. According to the U.S. Department of Energy, electric vehicle sales in North America grew by 60% in 2023, and this trend is expected to continue as infrastructure improves.

In Latin America, the electric van market is emerging, with countries like Brazil and Mexico leading the way. However, the market remains small, with infrastructure and financing constraints limiting growth. According to the Inter-American Development Bank (IDB), the adoption of electric vehicles in the region is still low but the market is expected to grow by 18% annually over the next decade due to increasing government incentives and environmental awareness.

In the Middle East and Africa, the electric van market is in its infancy, but growing interest in sustainable transport solutions is driving gradual market penetration. The International Renewable Energy Agency (IRENA) indicates that the region is focusing on diversifying its energy sources, and the electric vehicle market is expected to grow by 12% annually, driven by government policies in countries like the UAE and South Africa to reduce emissions and promote clean energy.

KEY MARKET PLAYERS

Mercedes-Benz USA, LLC, Ford Motor Company, Rivian, Nissan, Volkswagen, Stellantis, Europe S.p.A., Renault, BYD Singapore, MAN, Volvo Car Corporation. These are the market players that are dominating the global electric van market.

Top 3 Players in the market

Three of the top players in this market are Ford Motor Company, Mercedes-Benz, and Volkswagen Group. These companies are leading the charge in the electric van sector, with each one playing a crucial role in shaping the market’s future.

Ford Motor Company is a prominent player with its commitment to electrifying its commercial vehicle lineup. The company’s electric van, the Ford E-Transit, launched in 2022, has rapidly gained traction in the global market, particularly in North America and Europe. Ford’s contribution includes leveraging its extensive experience in commercial vehicles, and its robust production and distribution network. The E-Transit, with its combination of performance, range, and lower total cost of ownership, is an important step toward supporting businesses’ transition to sustainable transportation. According to Ford, it expects to produce more than 600,000 electric commercial vehicles globally by 2030, signaling its strong role in decarbonizing the transportation sector.

Mercedes-Benz, a leader in luxury electric vehicles, has expanded its offerings to include the Mercedes-Benz eSprinter and the eVito, two electric vans designed for businesses looking to reduce their carbon footprint. These vehicles are equipped with state-of-the-art technology, including advanced battery management systems and autonomous driving capabilities. Mercedes-Benz’s commitment to the electric van market is backed by its extensive research and development, as well as its strong manufacturing capabilities. The company’s parent, Daimler AG, has pledged to invest billions in electric vehicle technology, positioning the company to become one of the dominant forces in the electric van space.

Volkswagen Group is another major contributor, offering a range of electric vans under its Volkswagen Commercial Vehicles division. The ID. Buzz Cargo, launched in 2022, is part of the group’s electric strategy to offer an all-electric version of its iconic van. Volkswagen’s push to electrify its commercial vehicle lineup is part of its broader strategy to become a leader in clean transportation. The company plans to ramp up production of electric vehicles, with a goal to offer a fully electric range of vans and commercial vehicles by 2030. Volkswagen’s heavy investments in EV infrastructure and battery technology further enhance its contribution to the electric van market.

Top strategies used by the key market participants

Investment in Research and Development (R&D)

Leading electric van manufacturers prioritize R&D to drive technological advancements, improve vehicle performance, and enhance battery efficiency. Ford Motor Company, for example, has heavily invested in R&D to develop its electric commercial vehicle lineup, including the E-Transit. This focus on innovation helps Ford stay ahead of the curve by delivering higher-performing and more energy-efficient electric vans. Similarly, Mercedes-Benz invests significantly in R&D to integrate cutting-edge technologies like autonomous driving and advanced safety systems into their electric van offerings, such as the eSprinter and eVito.

Strategic Partnerships and Collaborations

Another major strategy is forming partnerships and collaborations to bolster the electric van market. Volkswagen Group has formed multiple partnerships with energy companies and technology providers to enhance its electric van offerings. For instance, Volkswagen has partnered with companies like QuantumScape to develop next-generation solid-state battery technologies, which promise to increase energy density and charging speed. Ford has also entered into partnerships with companies like Rivian, a leader in electric vehicle technology, to improve its electric platform for commercial vehicles.

Expanding Production and Manufacturing Capabilities

As demand for electric vans rises, expanding production capacity is a key strategy for market players to maintain leadership. Mercedes-Benz is expanding its manufacturing footprint to meet the growing demand for electric commercial vehicles, with plans to produce electric versions of its vans at several plants across Europe. Similarly, Volkswagen Group is ramping up its production of electric commercial vehicles, particularly with its ID. Buzz Cargo van. Volkswagen aims to become a major player in the electric van segment, with plans to manufacture electric vans at multiple plants across Europe and North America, scaling up production to meet future market demand.

RECENT HAPPENINGS IN THIS MARKET

In November 2024, the UK government initiated a consultation to review its ZEV mandate, which requires 10% of new van sales to be electric in 2024, with increasing targets in subsequent years. This review aims to address industry concerns about meeting these targets and potential penalties for non-compliance.

On September 2024, the Indian government notified the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme, with a total outlay of ₹10,900 crore. Effective from October 1, 2024, to March 31, 2026, the scheme aims to promote green mobility and develop the EV manufacturing ecosystem, including support for electric trucks and the installation of fast chargers for various electric vehicles.

MARKET SEGMENTATION

This research report on the global van market size is segmented and sub-segmented into the following categories.

By Propulsion

- Battery Electric Vehicle (BEV)

- Hybrid Vehicle (HEV)

By Range

- Up to 100 miles

- 100 to 200 miles

- Above 200 miles

By Battery

- Lithium Ion

- Sealed Lead Acid

- Nickel Metal Hydride (NiMH)

By Application

- Commercial

- Personal

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global electric van market?

The global electric van market size was valued at USD 223.62 million in 2025

What are the challenges faced in the global electric van market?

The challenges are limited driving range compared to traditional diesel vans, which can deter potential buyers, and the slow pace of technological development in charging speed and battery capacity.

What are the market drivers that are driving the global electric van market?

Focus on sustainability and reducing carbon emissions and total cost of ownership (TCO) for electric vans. These are the drivers of the global electric van market.

who are the market players that are dominating the global electric van market?

Mercedes-Benz USA, LLC, Ford Motor Company, Rivian, Nissan, Volkswagen, Stellantis, Europe S.p.A., Renault, BYD Singapore, MAN, Volvo Car Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]