Global Electric Utility Vehicle Market Size, Share, Growth, Trends & Forecast Research Report – Segmented By Vehicle Type (Electric ATVs, Electric UTVs, Electric Utility Carts, Electric Shuttle Carts, Industrial Utility Electric Vehicle), Battery Type (Lead Acid, Lithium-Ion, Others), Application (Commercial Transport, Recreation, Industrial, Agriculture, Others), Propulsion (Pure Electric, Hybrid) And By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Electric Utility Vehicle Market Size

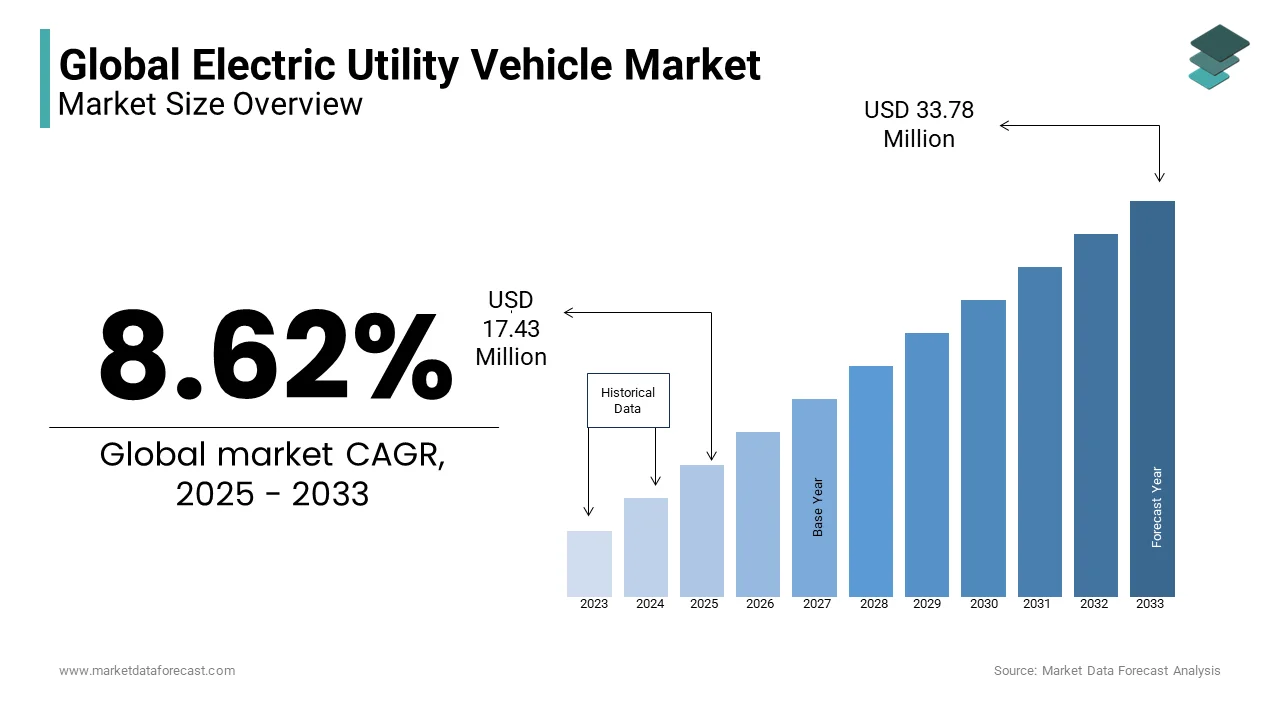

The global electric utility vehicles market size was valued at USD 16.05 billion in 2024 and is anticipated to reach USD 17.43 billion in 2025 from USD 33.78 billion by 2033, growing at a CAGR of 8.62% from 2025 to 2033.

Electric utility vehicles (EUVs) are typically used for tasks such as transporting goods, equipment, or people within specific environments like airports, golf courses, resorts, warehouses, and agricultural fields. There is a shift toward environmental sustainability and governments worldwide are implementing policies and incentives to promote the adoption of electric vehicles. The global electric vehicle market is expected to surpass 200 million vehicles by 2030, with EUVs contributing significantly to this growth due to their sustainable features. Additionally, more than 60% of electric vehicles are projected to be used for commercial purposes by 2030, underscoring the rising demand for electric utility solutions across industries.

Market Drivers

Increasing Demand for Sustainable Transportation

The demand for sustainable transportation is one of the key drivers of the Electric Utility Vehicle (EUV) market. Governments worldwide are setting ambitious goals to reduce carbon emissions and promote clean energy alternatives. For example, the European Union aims to reduce greenhouse gas emissions by 55% by 2030 under the European Green Deal. This regulatory push is driving the adoption of electric vehicles including EUVs, as they offer a zero-emission alternative to traditional fossil-fuel-powered utility vehicles. As part of this trend, the global electric vehicle fleet is expected to reach 145 million by 2030, as per the International Energy Association (IEA, 2023).

Technological Advancements in Battery Efficiency

Technological advancements in battery technology are significantly enhancing the performance and efficiency of electric utility vehicles. Electric vehicles become more practical for commercial use as battery costs decrease, energy density improves, and charging times reduce. According to the U.S. Department of Energy, battery prices have fallen by about 89% from 2010 to 2022 and is making electric vehicles more affordable. These advancements are critical for EUVs because they rely on efficient battery systems to power vehicles over long distances and ensure operational reliability in demanding environments like warehouses and industrial sites.

Market Restraints

High Initial Purchase Cost

One of the primary restraints in the Electric Utility Vehicle (EUV) market is the higher upfront cost compared to traditional gasoline-powered vehicles. Despite the decreasing cost of batteries, EUVs still remain expensive due to the cost of advanced electric drivetrains and battery technology. According to the U.S. Department of Energy, while the price of lithium-ion batteries has dropped significantly, it still represents about 30% to 40% of the cost of an electric vehicle. This higher initial cost can deter small businesses and operators from making the transition to electric utility vehicles and especially for fleets with tight budgets.

Limited Charging Infrastructure

The limited availability of charging infrastructure remains a significant barrier to the growth of the EUV market. While the adoption of electric vehicles has grown, the charging infrastructure, particularly for commercial and utility vehicles and is still underdeveloped. The U.S. Department of Energy reports that as of 2023, there are about 55,000 public EV charging stations in the U.S., but many areas, especially rural and industrial zones, still lack sufficient coverage. This scarcity of charging stations creates range anxiety and operational challenges for businesses relying on EUVs for daily use.

Market Opportunities

Government Incentives and Policies

Governments around the world are offering substantial incentives and policies to promote the adoption of electric vehicles including Electric Utility Vehicles (EUVs). For instance, the U.S. government provides tax credits of up to $7,500 for electric vehicle purchases under the Clean Energy for America Act. The European Union has set a target of having at least 30 million zero-emission vehicles on the road by 2030, along with various funding programs to support electric vehicle adoption. These favorable policies create opportunities for businesses to invest in EUVs which is benefiting from reduced operational costs and tax incentives and thereby driving market growth.

Growing Demand for Electrification in Commercial Fleets

There is a growing opportunity in the electrification of commercial fleets, particularly in sectors like logistics, agriculture, and tourism. As businesses seek to reduce carbon footprints and operational costs that electric utility vehicles present an attractive solution. The U.S. Department of Energy projects that the electrification of commercial fleets could lead to a reduction of up to 8.4 million metric tons of carbon dioxide emissions annually by 2030. The transition to electric fleets is expected to create significant demand for EUVs in the coming years owing to increased pressure on companies to meet sustainability targets and lower operating costs.

Market Challenges

Limited Charging Infrastructure

A major challenge for the Electric Utility Vehicle (EUV) market is the insufficient charging infrastructure, which limits the widespread adoption of electric vehicles. According to the U.S. Department of Energy, While the total number of public electric vehicle chargers in the U.S. has increased to approximately 55,000 by 2023 there are still significant gaps in coverage and especially in rural and industrial areas. EUVs which require reliable and accessible charging points face operational hurdles due to this limited infrastructure. Without widespread availability of fast-charging stations, businesses may hesitate to transition to electric fleets is impacting the growth of the EUV market.

Range Limitations and Battery Efficiency

Despite advancements in battery technology, range anxiety remains a significant barrier for the EUV market. Many electric utility vehicles still face limitations in their range, particularly in commercial and industrial applications that require prolonged use over long distances or extended working hours. According to the U.S. Department of Energy, the average range of electric vehicles is about 250 miles per full charge, which may not be sufficient for some industrial applications. To address this challenge, manufacturers must continue improving battery efficiency, energy density, and reducing charging times to make EUVs more viable for diverse commercial uses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.62% |

|

Segments Covered |

By vehicle type, Battery Type, Application, propulsion, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tata Motors, Polaris Industries, Textron Inc., Club Car, Yamaha Motor Co., Ltd., E-Z-GO, Linde Material Handling, Kwang Yang Motor Co. (KYMCO), Alpha Motor Corporation, Workhorse Group Inc |

SEGMENT ANALYSIS

Global Electric Utility Vehicle Market By Vehicle Type

The industrial utility electric vehicle (IUEV) segment accounted for 35.4% of the global market share in 2024. The growth of this segment is driven by the increasing adoption of electric vehicles for industrial use due to their efficiency, low operating costs, and environmental benefits. According to the U.S. Department of Energy (DOE), electric industrial vehicles can save up to 80% in maintenance and fuel costs compared to their internal combustion engine counterparts. Moreover, the global push toward sustainability and stricter emissions regulations are encouraging industries to transition to electric utility vehicles. The increasing demand for electric-powered forklifts, cargo movers, and other utility vehicles in manufacturing, warehousing, and airports further supports the growth of this segment. The adoption of IUEVs is crucial as industries seek cost-effective, eco-friendly solutions to reduce their carbon footprint and comply with environmental standards.

The electric shuttle carts segment is experiencing the most rapid growth and is estimated to grow at a CAGR of 12.4% over the forecast period owing to the increasing demand for electric shuttle carts in airports, resorts, large industrial complexes, and urban settings for short-distance transportation. Electric shuttle carts are gaining popularity due to their environmental benefits, low operating costs, and ability to reduce congestion in areas with high foot traffic. According to the International Transport Forum (ITF), electric shuttles have been instrumental in reducing emissions in crowded spaces such as airports, with many airports in Europe and North America transitioning to electric shuttle fleets to support their sustainability goals. For instance, Los Angeles International Airport (LAX) has introduced electric shuttles and is resulting in a 20% reduction in emissions from shuttle operations. Similarly, Munich Airport has expanded its fleet of electric shuttles, aiming for a 100% electric fleet by 2025.

Global Electric Utility Vehicle Market By Battery Type

The lithium-ion battery segment held the largest share of 66.7% of the global electric utility vehicles market in 2024. Lithium-ion batteries are popular for their high energy density, longer lifespan, and faster charging capabilities compared to other battery types. These batteries are crucial for electric utility vehicles, which require longer operating times and quick recharging for commercial use. According to the U.S. Department of Energy (DOE), lithium-ion batteries have about 2-3 times the energy density of lead-acid batteries and is making them more efficient for industrial and commercial electric vehicles. Furthermore, lithium-ion batteries have a longer lifespan, lasting up to 10 years or more which is essential for the high utilization of electric utility vehicles in industries. The increasing demand for sustainable and eco-friendly transportation solutions has further contributed to the dominance of lithium-ion batteries in the electric utility vehicle market.

The lead acid battery segment is growing rapidly and is anticipated to showcase a CAGR of 9.12% over the forecast period. Lead acid batteries are expected to grow rapidly due to their low cost, wide availability, and proven performance in various electric vehicle applications. According to the International Energy Agency (IEA), lead-acid batteries account for around 30% of all batteries used in electric vehicles globally, despite the increasing popularity of lithium-ion alternatives. Lead acid batteries are still widely used in electric utility vehicles in less demanding applications due to their affordability and reliability. Additionally, their established infrastructure for production and recycling contributes to their growth and especially in emerging markets where cost considerations are crucial. The low initial investment cost makes lead-acid batteries an attractive option for small businesses and industries that need electric utility vehicles but are constrained by budget. However, despite their cost advantages, their lower efficiency and shorter lifespan compared to lithium-ion batteries are limiting factors.

Global Electric Utility Vehicle Market By Application

The commercial transport segment occupied 43.1% of the global market share in 2024. The dominance of commercial transport is driven by the increasing adoption of electric utility vehicles (EUVs) in logistics, freight movement, and delivery services. The need for efficient, eco-friendly transport solutions in commercial operations is a major factor supporting the growth of this segment. According to the International Transport Forum (ITF), commercial electric vehicles, particularly electric delivery vans, are expected to constitute around 20% of the global freight fleet by 2030. Governments worldwide are offering incentives and subsidies to encourage fleet operators to transition to electric vehicles (EVs) to reduce emissions and meet sustainability targets. The commercial transport segment’s importance lies in the need for cost-effective, high-performance vehicles that help businesses lower operating costs while adhering to stricter environmental regulations. The widespread adoption of electric commercial vehicles aligns with global sustainability goals and supports the transition to low-emission freight transportation.

The agriculture sector is expected to exhibit a CAGR of 10.8% over the forecast period owing to the increasing demand for electric utility vehicles in farming operations for tasks such as crop management, material handling, and irrigation systems. The adoption of EUVs in agriculture is being accelerated by the need for sustainable farming practices and the high operational costs associated with traditional fuel-powered vehicles. According to the U.S. Department of Agriculture (USDA), electric tractors and utility vehicles are gaining traction as they offer up to 50% savings in fuel costs compared to conventional diesel-powered machinery, while also requiring 30% less maintenance. This makes them an attractive option for farmers looking to cut costs and increase profitability.

Global Electric Utility Vehicle Market By Propulsion

The pure electric propulsion segment commanded the global electric utility vehicle (EUV) market and accounted for 76.8% of the global market share in 2024. The growth of the pure electric propulsion segment is driven by the growing demand for zero-emission solutions in various sectors, including logistics, agriculture, and commercial transport. According to the International Energy Agency (IEA), global sales of electric vehicles (EVs) have surged, with pure electric vehicles making up 75% of all EV sales in 2023. This segment's growth is supported by technological advancements in battery efficiency, longer driving ranges, and lower operating costs, which make them highly attractive for long-term investments. Additionally, governments worldwide are increasing their focus on reducing emissions, offering incentives for adopting zero-emission technologies. The shift toward pure electric propulsion aligns with sustainability goals in sectors requiring heavy-duty operations, such as logistics and agriculture, while also responding to regulatory pressures for cleaner transport solutions.

The hybrid propulsion segment is anticipated to grow at the quickest CAGR of 13.7% between 2025 and 2033. This development is driven by the increasing demand for hybrid vehicles that offer the flexibility of electric motors combined with internal combustion engines, allowing for reduced emissions while maintaining extended operational range. According to the U.S. Department of Energy (DOE), hybrid vehicles now represent approximately 30% of total global EV sales and are gaining significant traction in industries requiring heavy-duty capabilities, such as construction, logistics, and agriculture.

REGIONAL ANALYSIS

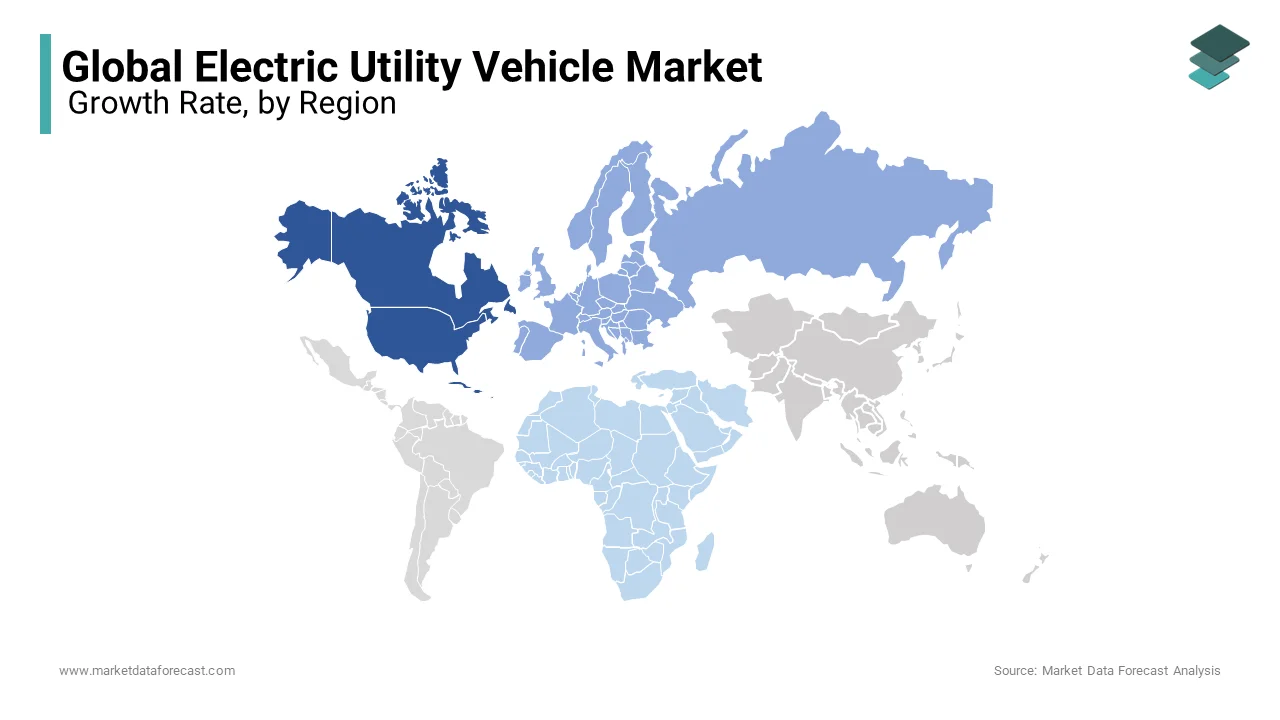

North America dominated the market in 2024 by accounting for 55.1% of the global market share. The U.S. is the leading country in the region and is supported by the government’s ambitious sustainability targets and tax incentives for electric vehicles. The U.S. Department of Energy projects a growing adoption of electric vehicles in both public and private sectors, contributing to the rise in EUV demand. The North American EUV market is expected to grow at a robust pace, driven by technological advancements in battery efficiency and infrastructure expansion. By 2030, the U.S. plans to deploy 500,000 EV chargers and is boosting EUV adoption.

Europe is a prominent player in the global EUV market and is projected to have a CAGR of 9.7% over the forecast period. The European Union’s strict emission regulations and sustainability goals, such as reaching 30 million zero-emission vehicles on the road by 2030, fuel this growth. Leading countries in the European market include Germany, the UK, and France, which are also pushing forward electric vehicle adoption with large-scale infrastructure investments. The EU market is expected to continue growing, driven by government incentives and a strong push for reducing greenhouse gas emissions, aiming for a carbon-neutral economy by 2050.

Asia-Pacific is the fastest-growing region and is anticipated to register the highest CAGR of 13.4% over the forecast period due to the rapid adoption of electric vehicles and particularly in China, Japan, and South Korea. China, as the world’s largest EV market, leads the region, with government support and subsidies playing a key role. According to the International Energy Agency (IEA), China accounted for over 50% of global electric vehicle sales in 2022. The region’s rapid urbanization and growing environmental concerns provide a strong growth trajectory for EUVs. The Asia-Pacific market is expected to outperform other regions, supported by a large-scale shift to sustainable transport.

Latin America is anticipated to experience moderate growth over the forecast period. Countries like Brazil and Mexico are showing increased interest in adopting electric vehicles, spurred by government incentives and environmental policies. However, the region still faces challenges such as limited charging infrastructure and high initial vehicle costs. According to the International Energy Agency (IEA), Latin America has only around 1,800 public charging points, with Brazil accounting for the majority. Additionally, high initial vehicle costs continue to be a barrier for widespread adoption. Latin America is slowly but steadily developing its market for EUVs with Argentina also emerging as a growing player due to favorable policies for electric transportation.

The market in Middle East and Africa (MEA) region is estimated to have steady growth during the forecast period. The UAE and South Africa are key markets in this region, focusing on energy diversification and sustainability goals. For example, the UAE is striving to reduce its carbon footprint with projects like the Dubai Clean Energy Strategy 2050, which promotes the adoption of electric vehicles. However, challenges like limited infrastructure and higher upfront costs hinder faster adoption in the MEA region. Nonetheless, the region’s increasing focus on clean energy is expected to drive gradual growth in the EUV market over the coming years.

KEY MARKET PLAYERS

Tata Motors, Polaris Industries, Textron Inc., Club Car, Yamaha Motor Co., Ltd., E-Z-GO, Linde Material Handling, Kwang Yang Motor Co. (KYMCO), Alpha Motor Corporation, Workhorse Group Inc. These are the market players that are dominating the global electric utility vehicle market.

COMPETITIVE LANDSCAPE

The Electric Utility Vehicle (EUV) market is marked by intense competition, driven by technological advancements, sustainability trends, and evolving customer preferences. Key players in the market, such as Polaris, Club Car, Textron, and Toyota Industries, compete to gain a significant market share by offering innovative, efficient, and sustainable solutions.

Major companies focus on product differentiation through features like extended battery life, advanced telematics, autonomous capabilities, and multi-functional designs. Startups and new entrants add competitive pressure by introducing cost-effective and niche products tailored to specific industries like agriculture, logistics, and urban transportation.

Geographical competition varies, with North America and Europe leading due to stringent emission regulations, government incentives, and advanced infrastructure. In contrast, Asia-Pacific is emerging as a high-growth region, fueled by urbanization and investments in smart city projects.

The market also faces competition from traditional internal combustion utility vehicles. However, the rising adoption of electric alternatives, driven by sustainability goals, is shifting demand dynamics.

Strategic partnerships, mergers, and acquisitions play a crucial role in the competitive landscape, enabling companies to expand portfolios and access new markets. The competition is also influenced by ongoing research into battery technology and cost reductions, aimed at enhancing vehicle performance and affordability.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, EQT, a private equity firm, and Singapore's sovereign wealth fund, GIC, acquired a majority stake in UK-based smart meter provider Calisen for approximately £4 billion. Calisen manages around 16 million meters across the UK and offers services related to electric vehicles, solar energy, batteries, and heat pumps. This acquisition underscores a trend of private equity investment in businesses focused on sustainable energy.

- In August 2024, VivoPower International's subsidiary, Tembo E-LV, announced plans to go public through a merger with the blank-check firm Cactus Acquisition, valuing the new entity at $904 million. Tembo focuses on battery-electric and off-road vehicles for industries such as mining, utilities, infrastructure, government, and humanitarian services. The merger is anticipated to be finalized by the end of 2024, with the new company, Tembo Group, aiming for a Nasdaq listing.

MARKET SEGMENTATION

This research report on the global electric utility vehicle market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Electric ATVs

- Electric UTVs

- Electric Utility Carts

- Electric Shuttle Carts

- Industrial Utility Electric Vehicle

By Battery Type

- Lead Acid

- Lithium-ion

- Others

By Application

- Commercial Transport

- Recreation

- Industrial

- Agriculture

- Others

By Propulsion

- Pure Electric

- Hybrid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global electric utility vehicle market?

The global electric utility vehicles market size was USD 17.43 billion in 2025

What are the market drivers that are driving the global electric utility vehicle market?

The Increasing Demand for Sustainable Transportation and Technological Advancements in Battery Efficiency are the market drivers.

What challenges are faced in the global electric utility vehicle market?

Challenges that are faced are Limited Charging Infrastructure and Range Limitations and Battery Efficiency

who are the market players that are dominating the global electric utility vehicle market?

Tata Motors, Polaris Industries, Textron Inc., Club Car, Yamaha Motor Co., Ltd., E-Z-GO, Linde Material Handling, Kwang Yang Motor Co. (KYMCO), Alpha Motor Corporation, Workhorse Group Inc.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]