Global Edge Computing Technology Market Size, Share, Trends, & Growth Forecast Report Segmented By Component (Hardware, Software, and Services), Provider Type (Cloud Providers, and Enterprises), Industry (Manufacturing, Energy and Utilities, Telecommunications, Healthcare and Lifesciences, Financial Services, Transportation and Logistics, Retail, Media and Entertainment, Agriculture, and Construction) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Edge Computing Technology Market Size

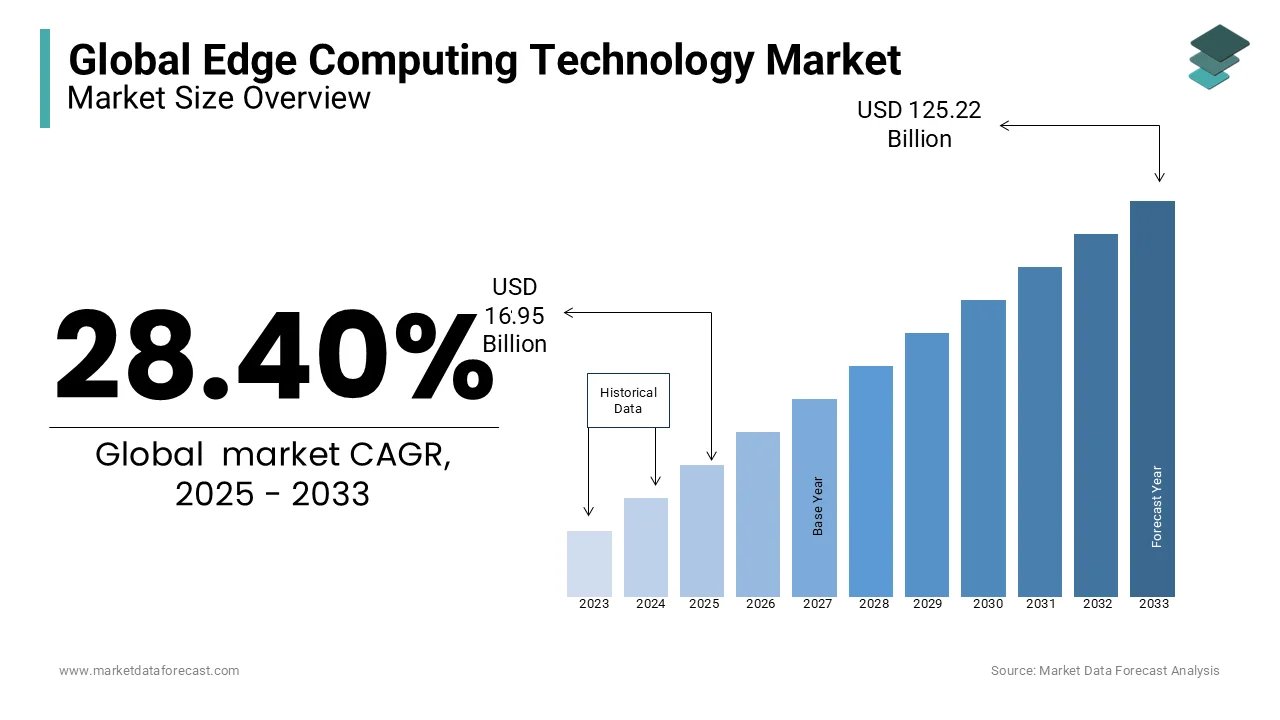

The global edge computing technology market was valued at USD 13.20 billion in 2024. The market is projected to reach USD 16.95 billion in 2025 and USD 125.22 billion by 2033, rising at a CAGR of 28.40% during the foreseen period.

Edge computing decentralizes data processing by bringing it closer to devices and end-users, reducing reliance on centralized cloud infrastructure. This approach enhances performance, minimizes latency, and improves security to make it a critical enabler for applications such as autonomous vehicles, industrial IoT, and smart cities.

A significant trend is the adoption of edge solutions in healthcare for remote monitoring and diagnostics that reduces hospital readmission rates by up to 20%, according to recent studies. Similarly, edge computing improves operational efficiency by enabling predictive maintenance, reducing equipment downtime by 30%.

Key enablers include advancements in AI, 5G connectivity, and edge-optimized hardware. These developments empower industries to harness actionable insights while optimizing costs and addressing scalability challenges.

MARKET TRENDS

Integration with Artificial Intelligence (AI)

Edge computing is increasingly paired with AI to process and analyze data locally, enabling real-time decision-making. This trend is pivotal in industries such as autonomous vehicles, where edge-based AI reduces latency for object detection and navigation. According to industry estimates, edge AI can process data up to 10 times faster compared to cloud-reliant systems. Additionally, in retail, edge AI facilitates personalized shopping experiences, with over 60% of retailers implementing edge solutions for real-time customer engagement. By enabling faster and more secure data handling, this synergy enhances operational efficiency and drives innovation across multiple sectors.

Expansion of 5G Connectivity

The proliferation of 5G networks is transforming edge computing by enhancing bandwidth and reducing latency, critical for applications like smart factories and telemedicine. For instance, 5G-enabled edge computing in industrial IoT can achieve latency as low as 1 millisecond, enabling real-time control of robotics. Similarly, in healthcare, edge solutions powered by 5G support remote surgeries and high-quality video diagnostics. Reports indicate that by 2025, over 45% of edge deployments will leverage 5G connectivity, accelerating adoption and enabling seamless data processing closer to end-users. This convergence is key to unlocking the potential of next-generation edge applications.

MARKET DRIVERS

Rising IoT Adoption

The exponential growth of IoT devices is a key driver for edge computing, enabling real-time data processing and reducing reliance on centralized cloud systems. By 2030, over 29 billion IoT devices are expected to be in operation globally that generates vast amounts of data. Edge computing processes this data locally which can reduce latency and bandwidth costs by up to 40%. This is particularly impactful in sectors like smart cities, where traffic management systems and connected infrastructure rely on instant analytics for operational efficiency and safety.

Data Privacy and Security Demands

As regulatory frameworks like GDPR and CCPA tighten data privacy requirements, businesses are adopting edge computing to ensure compliance. Processing data closer to its source minimizes transmission risks and enhances security. Edge computing can reduce data breach risks by up to 30% in sectors like healthcare and finance. Localized processing ensures sensitive data, such as patient records or financial transactions, remains protected to meet stringent compliance needs.

Demand for Low-Latency Applications

Applications requiring immediate responses, such as augmented reality (AR), gaming, and autonomous systems, are fueling edge computing adoption. For example, AR applications demand latency below 20 milliseconds for seamless user experiences, which edge solutions effectively deliver. Autonomous vehicles also rely on sub-millisecond decision-making to ensure safety and efficiency. These requirements are driving investments in edge infrastructure, enabling industries to meet the performance standards essential for these high demand use cases.

MARKET RESTRAINTS

High Initial Investment Costs

Implementing edge computing infrastructure requires significant capital for hardware, software, and skilled personnel. Edge devices, such as edge servers and gateways can cost 20–30% more than traditional cloud solutions due to their advanced capabilities. Additionally, ongoing maintenance and integration with existing systems add to expenses which makes it challenging for small and medium-sized enterprises (SMEs) to adopt. This cost barrier slows market penetration in price-sensitive regions.

Limited Standardization

The lack of uniform standards in edge computing poses interoperability challenges between devices, networks, and platforms. Disparate protocols and architectures lead to inefficiencies and hinder seamless integration. For example, over 50% of businesses report difficulties in aligning edge deployments across multi-vendor ecosystems. This fragmentation restricts scalability and increases deployment complexity which is hindering the market growth.

Cybersecurity Concerns

While edge computing enhances data privacy, it also introduces new cybersecurity risks. Distributed infrastructure creates more attack surfaces, increasing vulnerability to breaches. According to Accenture research, over 30% of businesses using edge solutions have experienced targeted cyberattacks. Sectors like finance and healthcare mostly deals with sensitive data which are particularly cautious with concerns about endpoint security slowing adoption. Overcoming these risks requires significant investment in robust security protocols which can deter potential users.

MARKET OPPORTUNITIES

Growth in Smart City Initiatives

Edge computing offers significant opportunities in smart city development by supporting real-time data processing for connected infrastructure. For instance, traffic management systems using edge solutions can reduce congestion by up to 25%, while smart grids optimize energy distribution, cutting costs by 20%. The demand for edge computing is expected to grow with over 600 smart city projects globally by enabling efficient public services and sustainable urban planning.

Emerging Applications in Healthcare

Healthcare presents immense potential for edge computing in remote monitoring and telemedicine. Edge-powered wearable devices can process patient data locally eventually to reduce hospital visits by up to 30%. Additionally, edge solutions improve imaging diagnostics by enabling AI-driven analysis at the point of care. The adoption of edge in healthcare is expected to accelerate as precision medicine and real-time monitoring gain traction.

Advancements in Edge AI Hardware

The development of specialized hardware for edge AI, such as energy-efficient processors and accelerators is driving innovation. Companies are investing in systems-on-chip (SoC) solutions optimized for edge deployments to reduce power consumption by up to 50%. These advancements open doors for applications in robotics, drones, and AR/VR, where lightweight and efficient hardware is essential. This trend is unlocking new use cases across industries which expands the market potential of edge computing.

MARKET CHALLENGES

Scalability Issues

Scaling edge computing deployments across diverse locations is complex due to fragmented infrastructure and resource constraints. Businesses often face challenges in managing decentralized systems, with 40% of organizations citing difficulties in scaling edge nodes effectively. The need for consistent power, connectivity, and maintenance across remote locations adds to the complexity in rural or underdeveloped regions.

Latency in Data Synchronization

Although edge computing reduces latency locally, synchronizing data between multiple edge nodes and centralized systems can introduce delays. This is particularly problematic for industries requiring consistent real-time data, such as logistics. Studies indicate that synchronization delays can exceed acceptable thresholds in 25% of deployments which impacts decision-making and efficiency.

Limited Expertise and Skilled Workforce

The adoption of edge computing is hindered by a shortage of professionals skilled in managing edge architecture and security. Reports show that 35% of businesses struggle to recruit talent with expertise in edge technologies that leads to deployment delays and increased training costs. This gap slows adoption and innovation in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

28.40% |

|

Segments Covered |

By Component, Provider Type, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Intel Corporation, Huawei Technologies Co., Ltd., and EdgeConneX |

SEGMENTAL ANALYSIS

By Component Insights

The Hardware segment is holding the dominant share of the market with 44.6% of the global market. This dominance is attributed to the essential role of hardware components such as edge servers, gateways, and sensors in establishing robust edge infrastructure. These components are crucial for processing and storing data locally, reducing latency, and enhancing real-time decision-making capabilities across various industries. The increasing deployment of IoT devices and the need for efficient data handling at the edge further drive the demand for hardware solutions.

The Services segment is experiencing the fastest growth, with a projected Compound Annual Growth Rate (CAGR) of 35.24% over the forecast period. This rapid expansion is fueled by the growing need for specialized services, including system integration, consulting, and managed services to effectively implement and manage edge computing solutions. Organizations seek expertise to navigate complexities such as network configuration, security, and compliance by adopting edge computing. The emphasis on optimizing edge deployments to achieve operational efficiency and scalability underscores the critical importance of the services segment in the evolving edge computing landscape.

By Provider Type Insights

Cloud Providers segment is ruling with 60% of the global edge computing technology market share. This dominance is due to their extensive infrastructure and expertise in delivering scalable, low-latency services. Companies like Amazon Web Services (AWS) and Microsoft Azure have integrated edge solutions into their offerings by enabling clients to process data closer to its source. For instance, AWS's edge services have been adopted by over 50% of Fortune 500 companies by highlighting their pivotal role in the market.

The Enterprises segment is experiencing the fastest growth with a projected Compound Annual Growth Rate (CAGR) of 25% over the next five years. This surge is driven by organizations developing proprietary edge solutions to meet specific operational needs, enhance data security, and reduce dependency on third-party providers. Industries such as manufacturing and healthcare are leading this trend by implementing edge computing to facilitate real-time analytics and improve decision-making processes. For example, a recent survey indicated that 40% of manufacturing firms plan to deploy in-house edge solutions within the next two years by underscoring the segment's growing importance.

By Industry Insights

The Manufacturing sector holds the largest share accounting for approximately 30% of the global market. This dominance is driven by the industry's adoption of Industrial Internet of Things (IIoT) technologies, which require real-time data processing for applications like predictive maintenance and quality control. Implementing edge computing enables manufacturers to reduce equipment downtime by up to 30% and improve operational efficiency. For instance, smart factories utilize edge solutions to monitor machinery performance with significant cost savings and productivity gains.

The Healthcare and Life Sciences sector is experiencing the fastest growth in edge computing adoption, with a projected Compound Annual Growth Rate (CAGR) of 38.2% during the forecast period. This rapid expansion is fueled by the increasing need for real-time patient data processing, telemedicine, and remote monitoring solutions. Edge computing facilitates immediate analysis of patient data at the point of care with diagnostic accuracy and treatment outcomes. For example, wearable health devices equipped with edge capabilities can monitor vital signs continuously by alerting healthcare providers to potential issues promptly. This advancement is crucial in managing chronic diseases and improving patient care which drive the sector's accelerated adoption of edge technologies.

REGIONAL ANALYSIS

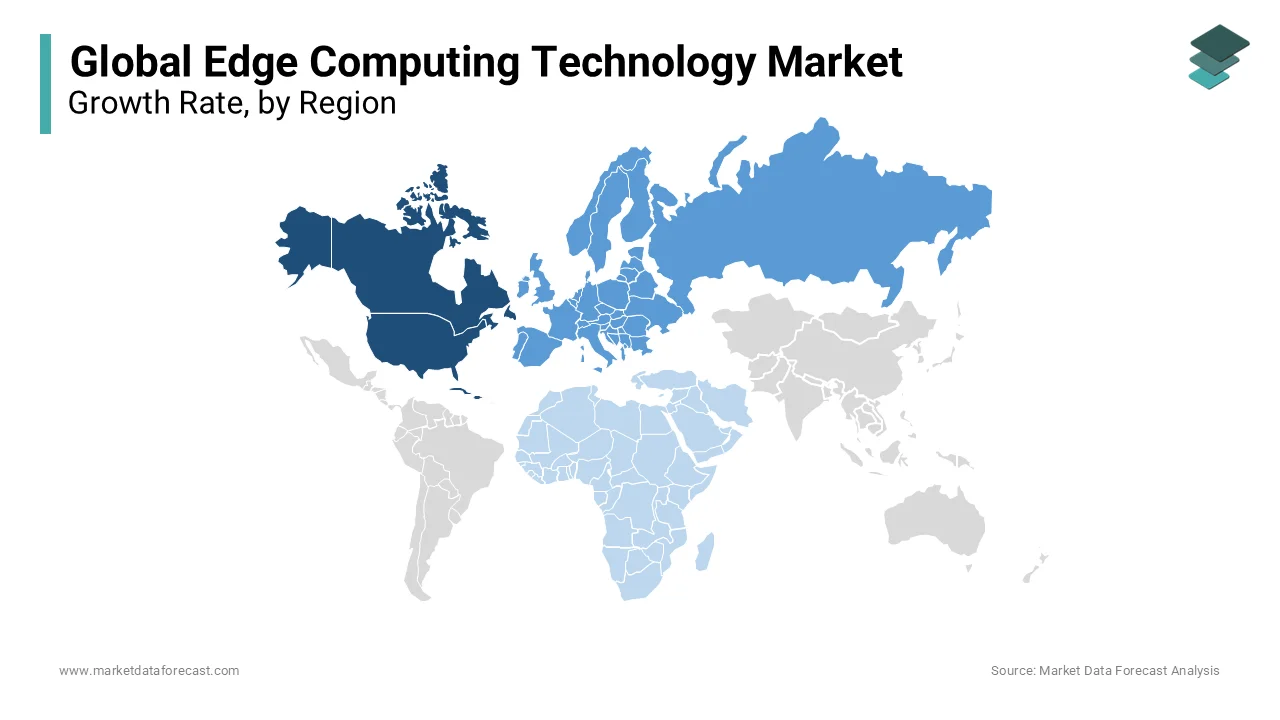

The North America region dominates the global edge computing market holding the largest market share due to its advanced digital infrastructure, widespread adoption of IoT, and early deployment of 5G technologies. The presence of technology giants such as Microsoft, Amazon Web Services (AWS), and IBM has catalyzed the development and adoption of edge computing solutions. Additionally, industries like healthcare, automotive, and retail in the U.S. and Canada are increasingly integrating edge computing for real-time data processing and enhanced operational efficiency. The region is forecasted to grow at a strong CAGR of 20% from 2024 to 2030. The U.S., with its robust R&D ecosystem and high adoption of smart technologies is showcasing huge opportunities for the market growth in next coming years. Canada is focusing on deploying AI-driven edge applications in sectors like manufacturing and transportation which is expected to lead the market share in future period.

Europe is projected to grow at a steady CAGR of 18% over the forecast period, driven by increasing digitalization across industries and the growing adoption of IoT-enabled devices. The adoption of edge computing in smart city initiatives and automotive applications, such as autonomous vehicles, has significantly boosted the region's market position. Germany and the UK are leading the market share. Focus on industrial automation and logistics applications and investments in edge computing for enhanced retail experiences and efficient supply chain management are propelling the market’s growth rate in these countries. France is also emerging as a key player, with investments in energy management and defense systems utilizing edge computing.

The Asia-Pacific region stands out as the fastest-growing market for edge computing, fueled by large-scale digital transformation initiatives and rapid urbanization. The region's edge computing market is predicted to grow at a CAGR exceeding 25% by 2034, driven by the expanding deployment of 5G networks and IoT integration in industries such as manufacturing, agriculture, and healthcare. China is at the forefront, leveraging edge computing for smart factories, telecom advancements, and urban development projects. India follows closely, focusing on deploying edge technologies in agriculture and healthcare to enhance efficiency and accessibility. Japan is another major contributor, investing in smart cities and autonomous technologies powered by edge computing in the automotive sector.

Latin America is emerging as a growing market for edge computing with a focus on reducing latency for cloud services and enabling industrial IoT applications. The region is projected to grow at a CAGR of 16–18% during the forecast period with countries like Brazil and Mexico leading the way. Brazil is leveraging edge computing for financial services and logistics, while Mexico focuses on integrating edge solutions into its manufacturing and retail sectors. These advancements are aimed at improving operational efficiency and meeting the region’s growing demand for digital services.

The Middle East and Africa currently hold the smallest market share but display significant growth potential. The region is expected to grow at a CAGR of 17–19%, driven by smart city projects and increasing investments in digital infrastructure. Countries like the UAE and Saudi Arabia are leading the adoption of edge computing with projects such as Saudi Arabia’s NEOM smart city initiative showcasing the transformative potential of this technology. South Africa is also making strides by incorporating edge computing into mining and retail operations to optimize processes and reduce costs.

KEY MARKET PLAYERS

Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), Intel Corporation, Huawei Technologies Co., Ltd., and EdgeConneX.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Legrand, a data center solutions provider, acquired ZPE Systems, Inc., a California-based critical solutions company. This acquisition is anticipated to enhance Legrand's offerings from data centers to the edge, strengthening their market presence.

- In January 2024, SonicWall, a cybersecurity service provider, acquired Banyan Security, a firm specializing in Security Service Edge (SSE) solutions. This move is expected to bolster SonicWall's Secure Access Service Edge (SASE) capabilities.

- In January 2024, LightEdge, a colocation provider, expanded into the Minneapolis market by acquiring a 76,000-square-foot, 3.6 MW data center. This acquisition is projected to enhance LightEdge's colocation and cloud solutions.

- In November 2023, Zayo Group, a communications infrastructure provider, acquired Globalways GmbH, a Stuttgart-based fiber infrastructure company. This acquisition aims to strengthen Zayo's fiber network capabilities in the European market.

- In March 2024, Zayo Group partnered with Netskope, a SASE developer, to enhance its Managed Edge services. This partnership is expected to expand Zayo's edge computing offerings and increase their competitiveness.

- In May 2022, Google acquired MobiledgeX, an edge computing company, and made its code open source. This acquisition aims to integrate MobiledgeX’s capabilities into Google Cloud, enhancing its edge computing portfolio.

- In June 2022, Limelight Networks completed the acquisition of Edgecast from Yahoo! Inc. and rebranded itself as Edgio. This acquisition strengthened its global delivery network and added enterprise-class security solutions.

- In August 2023, Fastly acquired Domainr, a domain status API provider. This acquisition bolstered Fastly's edge computing services by integrating advanced domain intelligence capabilities.

- In August 2023, StackPath sold its content delivery network (CDN) business to Akamai. This strategic move allowed StackPath to focus on its core edge computing services.

MARKET SEGMENTATION

This research report on the global edge computing technology market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Provider Type

- Cloud Providers

- Enterprises

By Industry

- Manufacturing

- Energy and Utilities

- Telecommunications

- Healthcare and Lifesciences

- Financial Services

- Transportation and Logistics

- Retail

- Media and Entertainment

- Agriculture

- Construction

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is edge computing technology, and how does it differ from cloud computing?

Edge computing is a distributed computing paradigm that processes data closer to the source of data generation (e.g., IoT devices or sensors), rather than relying on centralized data centers as in cloud computing. This reduces latency, minimizes bandwidth usage, and enhances real-time processing capabilities. While cloud computing is centralized and ideal for large-scale data storage and computation, edge computing provides localized data processing, enabling faster decision-making.

What is driving the growth of the global edge computing technology market?

The key drivers include the proliferation of IoT devices, increasing demand for low-latency applications, advancements in 5G networks, and the need for real-time data processing across industries such as healthcare, manufacturing, retail, and transportation. The rise of smart cities and autonomous systems is also contributing significantly to the market's growth.

Which industries are adopting edge computing technology most rapidly?

Edge computing is gaining traction in industries such as healthcare (remote monitoring and diagnostics), manufacturing (predictive maintenance and automation), retail (personalized shopping experiences), transportation (autonomous vehicles), and telecommunications (network optimization). These sectors benefit from the technology’s ability to deliver real-time insights and improve operational efficiency.

What role does 5G play in the adoption of edge computing?

5G networks provide high-speed, low-latency connectivity, which is crucial for the effective implementation of edge computing. By enabling faster data transfer and real-time processing, 5G enhances the performance of edge computing solutions in applications like autonomous vehicles, smart cities, and industrial automation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]