Global Early Production Facility Market Size, Share, Trends, & Growth Forecast Report – Segmented By Component (Two & Three Phase Separation, Gas Sweetening, Gas Dehydration, Dew Point Control Units, Oil Dehydration Desalting & Heating, Produced Water Treatment, Fuel Gas Processing, Flare System, Others), By Application (Offshore, Onshore), & Region - Industry Forecast From 2024 to 2032

Global Early Production Facility Market Size (2024 to 2032)

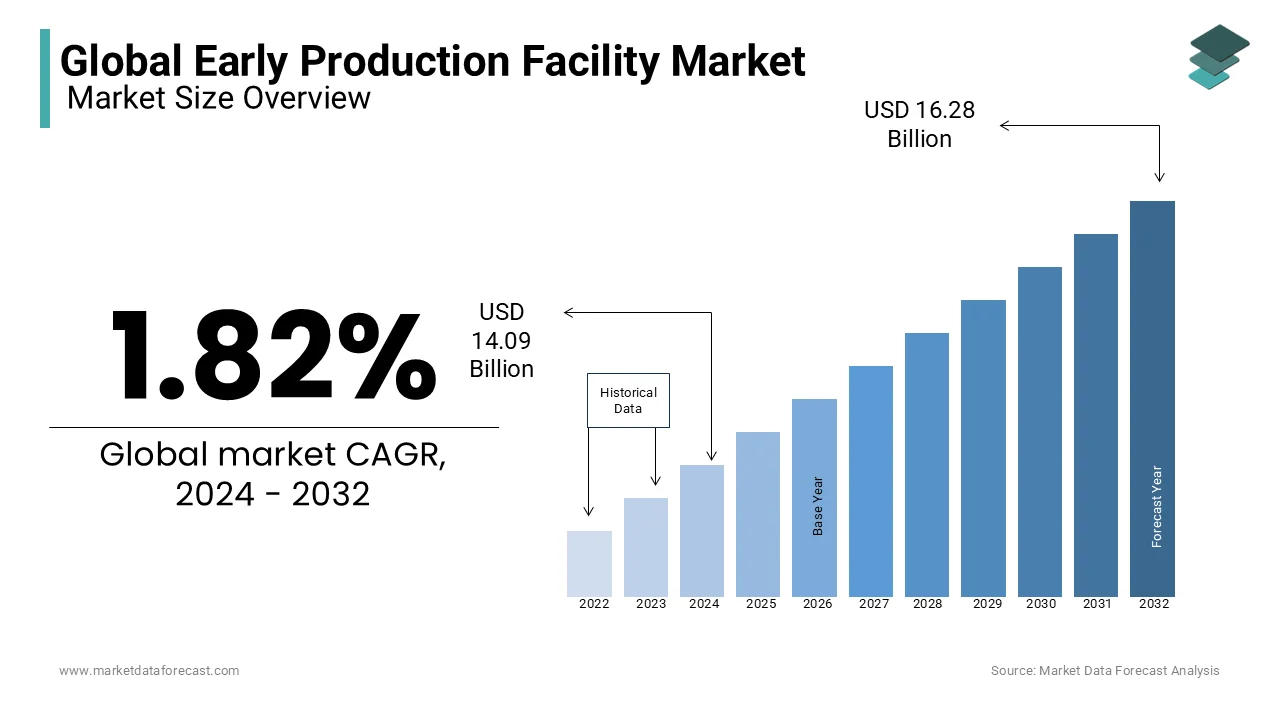

The Global Early Production Facility Market was worth USD 13.84 billion in 2023 and is projected to reach a valuation of USD 16.28 billion by 2032 from USD 14.09 billion in 2024 and is predicted to register a CAGR of 1.82% during the forecast period.

Current Scenario of the Global Early Production Facility Market

Early production facilities are also known as quick/temporary/interim units of production which are utilized to monetize assets more quickly while permanent production facilities are being constructed. The units allow operators to collect real-time production data, resulting in better operational planning and a significant increase in production performance. The capacity of the facilities ranges from 5,000 to 50,000 barrels per day, and they are designed to meet the needs of diverse fields. The operators frequently create standard designs that can be purchased or leased based on the needs of the consumer.

During the projected period, the Early Production Facility Market is expected to grow slowly at a CAGR of around 1.5%. An early production facility (EPF) allows for the collection of real-time data, which leads to better planning and execution of the production process, improving production performance and allowing for faster oil and gas production and faster disposal of produced water. As a result, EPF adoption is expanding around the world, which is fuelling total market growth at the same time. With quick advancements in oil and gas well modernization, increased improvisation in drilling technologies, and rising investments in exploration and production operations, there has been an increase in demand for early production facilities, driving the global market growth.

MARKET GROWTH

Early Production Facility (EPF) demand is being driven by the depletion of production from ageing oil and gas fields, as well as the expensive costs of maintaining large production platforms. During the projected period, the worldwide early production facility market is expected to rise at a rapid pace.

MARKET DRIVERS

Recovering oil prices, along with strong growth in energy demand, will entice big money into the business.

The deployment of new EPF units will be boosted by ongoing development efforts across multiple oil and gas fields, as well as investments in mature assets. The industry's prognosis will be bolstered by the active participation of private firms, as well as the aggressive development of unconventional hydrocarbon resources.

The early production facility market will also develop due to ongoing industry predictions about supply and demand, as well as substantial shale production across the United States.

Due to an excess in the industry, oil prices have been suppressed, promoting the deployment of EPF units. The facilities enable quick production, optimize operations, collect real-time data, and require little capital investment, making them more cost-effective than CPFs in the current climate.

Early production facility demand will be fuelled by the depletion of production from ageing oil and gas fields, as well as the high costs of sustaining huge production platforms.

MARKET RESTRAINTS

While the market has many growth drivers, a spike in crude oil prices could be a major stumbling block for the early production facility (EPF) business in the near future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

1.82% |

|

Segments Covered |

By Component, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Weatherford International, Halliburton, Frames Group, Petrocil, Process Group Pty. Ltd., Expro Group, TETRA Technologies, Inc., Pyramid E & C, Sparkletengineers.com, and Others.. |

SEGMENTAL ANALYSIS

Global Early Production Facility Market Analysis By Component

The market splits into two and three-phase separation, gas dehydration, gas sweetening, dew point control units, produced water treatment, oil dehydration desalting & heating, fuel gas processing, flare system, and others, based on components. Gas dehydration packages use glycol liquid technology such as TEG, DEG, and MEG to capture the moisture content of gas. The market is dominated by Produced Water Treatment, followed by Two & Three Phase Separation. Both of these groups are expected to rise significantly in the foreseeable term.

Global Early Production Facility Market Analysis By Application

The Early Production Facility (EPF) Market is divided into Onshore and Offshore segments in terms of application. In 2022, the Onshore category had the most significant market share, with 59 %. Increased demand for oil, gas, and other petroleum products and high global oil prices have prompted market participants to invest substantially in the search for new offshore oil and gas reserves. This is projected to fuel the market for early production facilities. New offshore projects are being driven by the expanding demand for crude oil and natural gas in developing countries, as well as the presence of mature onshore assets. These factors are projected to boost offshore exploration activities, pushing the market for early-stage production facilities forward (EPF).

REGIONAL ANALYSIS

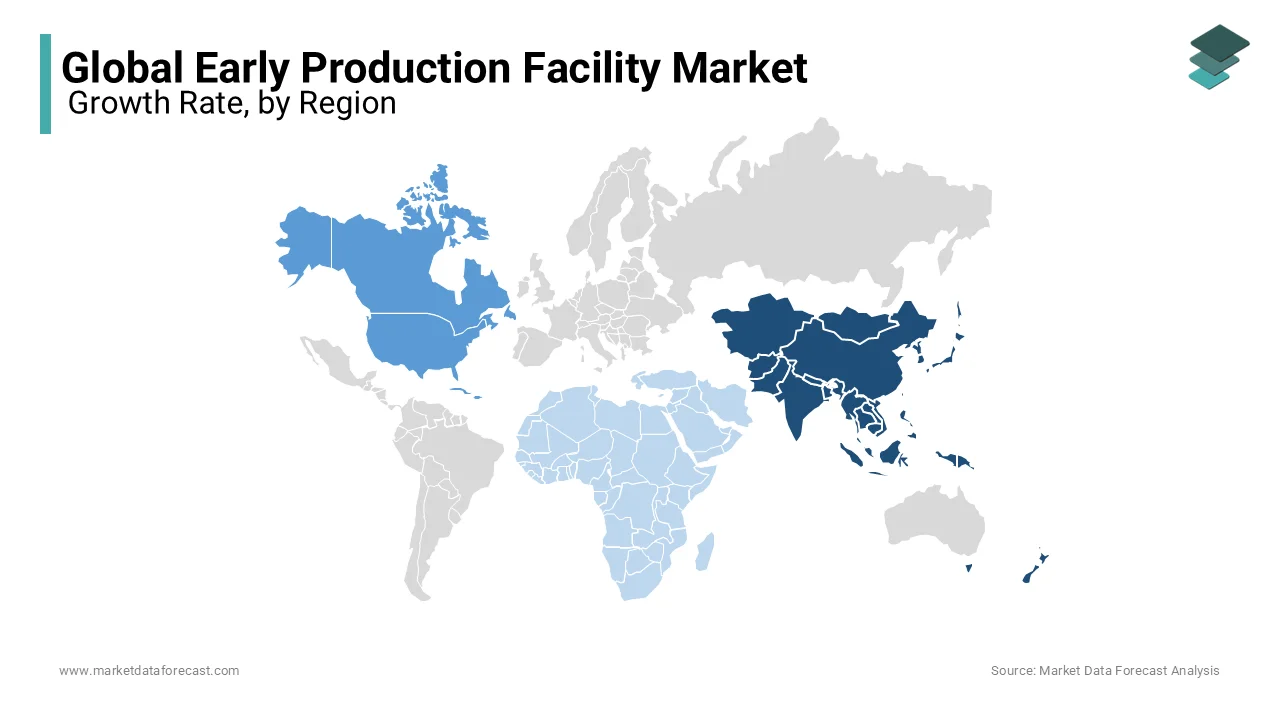

The growth of the economy in the Asia Pacific region has been fuelled by rapid industrial development resulting in an increase in urbanization and population expansion.

Furthermore, growing urbanization has resulted in governments acquiring more buses for public transportation. As a result, an increase in the sale of cars, trucks, containers, and buses is expected to boost petroleum product consumption, pushing demand for natural gas and crude oil. Investments in exploratory efforts are projected to increase as demand for natural gas rises. As a result, the early production facility market is expected to grow rapidly in the near future.

A complex mix of technological, economic, political, and logistical issues control the upstream business in the United States. Increased exploitation of unconventional reserves is projected to boost demand for good intervention in the near future. During the projected period, North America is expected to maintain its dominance in the early production facility market.

Because of the increasing acceptance of advanced technology and the continued development of new oil and gas finds, the Middle East Early Production Facility industry is likely to grow significantly in the future years. Because of their effective performance and significant cost and time savings, industry participants are increasingly embracing EPFs. Kuwait, Iraq, and Yemen are just a few of the main countries where significant deployments have occurred in the last decade.

KEY PLAYERS IN THE GLOBAL EARLY PRODUCTION FACILITY MARKET

Companies playing a prominent role in the global early production facility market include Weatherford International, Halliburton, Frames Group, Petrocil, Process Group Pty. Ltd., Expro Group, TETRA Technologies, Inc., Pyramid E & C, Sparkletengineers.com, and Others.

RECENT HAPPENINGS IN THE GLOBAL EARLY PRODUCTION FACILITY MARKET

- StrataStarTM is a deep azimuthal resistivity solution from Halliburton Company that enables multilayer imaging to increase well contact with the reservoir and improve real-time reserves appraisal.

- Halliburton's iStarTM intelligent drilling and logging platform, which blends deep subsurface insights with artificial intelligence for increased drilling performance and reliable well delivery, now includes the StrataStar service. The StrataStar service captures real-time measurement and visualization of surrounding geology and fluids up to 30 feet around the wellbore for more precise well placement. To keep within intended boundaries, it uses a complex algorithm to properly map the position, thickness, and resistivity of interbedded rock and fluid layers.

DETAILED SEGMENTATION OF THE GLOBAL EARLY PRODUCTION FACILITY MARKET INCLUDED IN THIS REPORT

This research report on the global early production facility market has been segmented and sub-segmented based on component, application, and region.

By Component

- Two & Three Phase Separator

- Gas Sweetening

- Gas Dehydration

- Dew Point Control Units

- Oil Dehydration Desalting & Heating

- Produced Water Treatment

- Fuel Gas Processing

- Flare System

- Others

By Application

- Offshore

- Onshore

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What will be the rate of expansion of the Early Production Facility Market in the near future?

In the near future, the early production facility market is predicted to increase at a 2 percent compound annual growth rate (CAGR).

What factors will drive the global market for early production facilities to grow?

Rising demand for low-cost production platforms, as well as increased investment in exploration and production, will be important drivers of global market expansion.

In the Early Production Facility Market, which region is predicted to remain dominant?

During the forecast period, North American region is expected to maintain its dominance in the Early Production Facility market.

In the Early Production Facility Market, which application type is projected to gain the most traction?

During the next five years, the onshore segment is likely to gain the most traction in the early production facility market.

What is the purpose of the Early Production Facilities?

Early production facilities, also known as quick, intermediate, or temporary production units, are utilised to monetize assets more quickly while permanent production facilities are being constructed. The units allow operators to collect real-time production data, resulting in better operational planning and a significant increase in production output.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]