Global E-bike Market Research Report Size, Share, Trends and Growth Forecasts Report - Segmented By Product Type (Scooter, Motorcycle, Pedelecs, etc.), Battery Type (Lithium-ion, Nickel-metal Hydride, Lead Acid), Mechanism (Hub Motors, Mid-Drive, others), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Industry Analysis (2024 to 2032)

Global E-bike Market Size

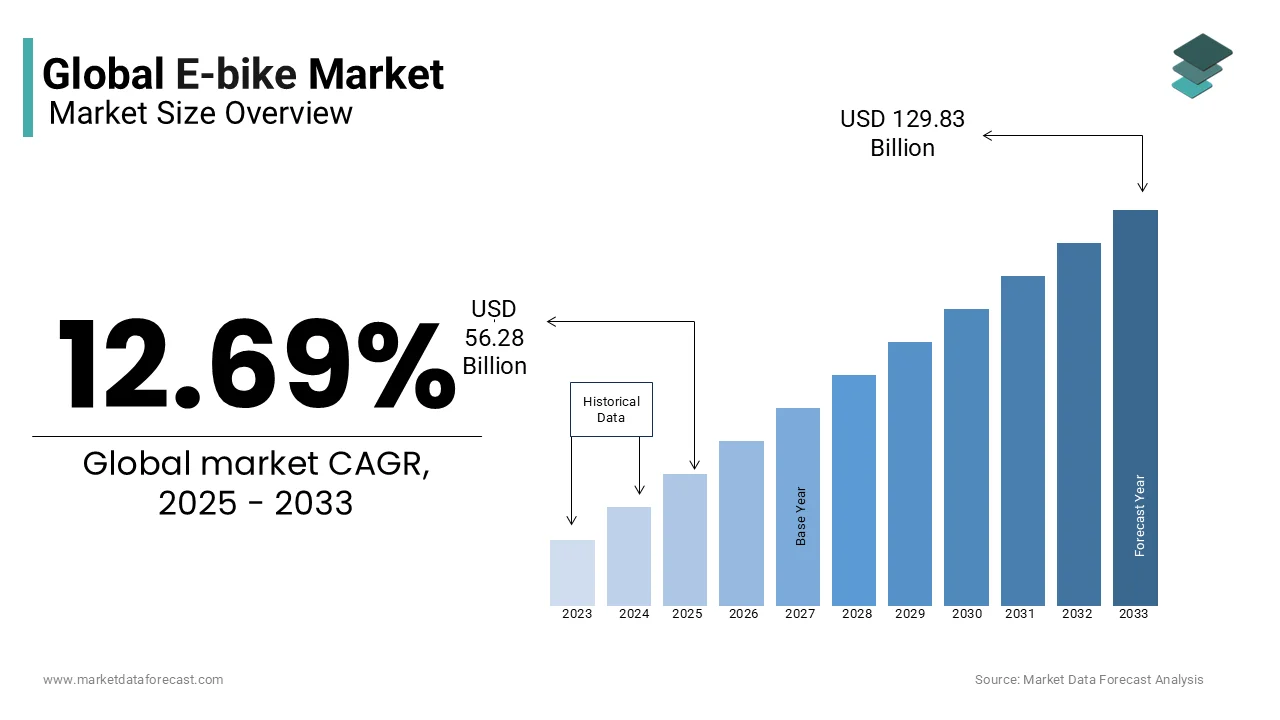

The global e-bike market size was valued at USD 49.94 billion in 2024 and is anticipated to reach USD 56.28 billion in 2025 from USD 129.83 billion by 2033, growing at a CAGR of 12.69% during the forecast from 2025 to 2033.

An electric bicycle, also known as an e-bike, is a two-wheeled vehicle equipped with an electric motor that assists the pedaling effort of the rider is offering a more efficient and eco-friendlier alternative to traditional bicycles and motorized vehicles. Depending on the level of assistance, these e-bikes can be categorized into pedal-assist (pedelec) and throttle-controlled models, with variations in speed, power output, and battery capacity.

The global electric bicycle market has witnessed exponential growth due to the rising adoption of micro-mobility solutions in densely populated urban regions. According to research conducted by BloombergNEF, global e-bike sales surpassed 40 million units in 2023 which is outpacing electric vehicle (EV) sales. Europe and China remain dominant markets, with China accounting for over 60% of global e-bike production, as per the China Bicycle Association. Meanwhile, Europe recorded a 12% year-on-year increase in e-bike sales, according to the Confederation of the European Bicycle Industry (CONEBI).

Government initiatives promoting sustainable transportation are further accelerating market growth. In the United States, the Inflation Reduction Act of 2022 introduced incentives for electric bicycle purchases, similar to tax credits offered for EVs, as reported by the U.S. Department of Energy. Additionally, the European Union’s Green Deal aims to reduce carbon emissions with a conducive environment for e-bike adoption. Technological innovations such as lightweight battery designs, improved motor efficiency, and smart connectivity features are solely responsible for the electric bicycle market expansion in the coming years.

Market Drivers

Rising Government Incentives and Policies

Governments worldwide are actively promoting electric bicycles as part of their sustainability and urban mobility initiatives. Numerous countries have introduced financial incentives, tax rebates, and subsidies to encourage e-bike adoption. The U.S. Department of Energy states that electric bicycles qualify for federal and state-level tax incentives, with some states offering rebates of up to $1,500 per e-bike purchase. Similarly, the European Commission’s Sustainable and Smart Mobility Strategy has allocated funding to increase bicycle infrastructure and reduce reliance on fossil-fuel-powered transportation. Germany, under its national climate protection program, provides e-bike subsidies for businesses and individuals, leading to a 23% increase in electric bicycle sales, according to the German Federal Ministry for Digital and Transport. With rising governmental support, e-bikes are becoming a preferred mode of transport.

Advancements in Battery and Motor Technology

Breakthroughs in battery efficiency and motor technology are significantly enhancing the performance and affordability of electric bicycles. The U.S. Department of Energy reports that lithium-ion battery prices have declined by over 89% in the past decade, making e-bikes more cost-effective for consumers. Additionally, the National Renewable Energy Laboratory (NREL) highlights that next-generation battery chemistries, such as solid-state lithium and graphene-enhanced batteries, are increasing energy density and reducing charging times. The European Commission states that investments in e-bike battery innovation under its Horizon Europe program are accelerating the market shift towards high-efficiency powertrains. These advancements have enabled longer travel ranges, with premium e-bikes now offering over 100 miles per charge, solidifying their role as a viable transportation alternative.

Market Restraints

High Initial Costs and Affordability Concerns

The upfront cost of electric bicycles remains a significant barrier to widespread adoption, particularly in developing economies. According to the U.S. Department of Transportation, the average price of an e-bike in the U.S. ranges between $1,500 and $4,000, depending on battery capacity and motor power. This is considerably higher than traditional bicycles, which typically cost between $300 and $800. Additionally, the European Environment Agency reports that premium models with advanced battery technology and smart features can exceed $6,000, making affordability a concern for many consumers. Although subsidies and incentives help reduce costs, the high initial investment required for purchasing an e-bike limits adoption, particularly among middle-income populations in emerging markets.

Lack of Standardized Infrastructure and Charging Facilities

Despite increasing e-bike adoption, the lack of dedicated infrastructure and charging facilities poses a major challenge. The European Commission’s Sustainable Transport Report highlights that less than 25% of European cities have designated lanes for e-bikes, leading to safety concerns for riders. In the United States, the National Highway Traffic Safety Administration (NHTSA) notes that the absence of standardized e-bike regulations across states results in inconsistent infrastructure development. Additionally, the U.S. Department of Energy states that public e-bike charging stations are significantly limited compared to EV chargers, with fewer than 500 publicly accessible e-bike charging points nationwide. This lack of infrastructure discourages long-distance commuting and hinders the broader acceptance of electric bicycles as a primary mode of transport.

Market Opportunities

Growth in Urban Micro-Mobility and Shared E-Bike Services

The expansion of urban micro-mobility solutions presents a significant opportunity for the electric bicycle market. As per the U.S. Department of Transportation, over 200 cities in the United States have implemented shared micro-mobility programs, with electric bicycles playing a crucial role in first- and last-mile connectivity. The European Commission’s Mobility and Transport report states that shared e-bike fleets in Europe have grown by 60% in the past five years, reducing reliance on cars for short-distance travel. Furthermore, cities such as Paris and Berlin have introduced large-scale public e-bike sharing schemes, contributing to a decline in urban congestion.

Expansion of Lightweight and Foldable E-Bike Segments

The rising demand for lightweight and foldable e-bikes is opening new market opportunities, particularly among commuters and urban professionals. According to the National Renewable Energy Laboratory (NREL), advancements in lightweight materials such as carbon fiber and aluminum alloys have reduced e-bike weight by 30%, improving portability. Additionally, the U.S. Department of Energy highlights that foldable e-bikes now constitute over 15% of the total e-bike market in North America, catering to apartment dwellers and travelers seeking compact, space-saving transport options. The European Environment Agency further reports that cities with high public transport dependency, such as Amsterdam and Copenhagen, are witnessing increased adoption of foldable e-bikes due to their seamless integration with trains and buses. This trend is expected to accelerate as urbanization continues to rise.

Market Challenges

Battery Recycling and Environmental Concerns

The increasing adoption of electric bicycles raises significant challenges related to battery disposal and recycling. The U.S. Environmental Protection Agency (EPA) states that lithium-ion batteries used in e-bikes have a recycling rate of less than 5% is leading to potential environmental hazards if improperly discarded. Additionally, the European Environment Agency reports that battery waste from electric mobility is projected to grow by over 700% by 2040 by necessitating urgent recycling solutions. The extraction of lithium, cobalt, and nickel for e-bike batteries also raises sustainability concerns with the International Energy Agency (IEA) noting that lithium demand for transportation batteries is expected to increase tenfold by 2030.

Safety Regulations and Risk of Accidents

The lack of standardized safety regulations poses a major challenge to the widespread adoption of electric bicycles. The National Highway Traffic Safety Administration (NHTSA) reports that e-bike-related accidents in the U.S. increased by 70% between 2017 and 2022 with rider injuries often linked to speed inconsistencies and a lack of helmet compliance. Similarly, the European Transport Safety Council highlights that the absence of uniform classification and safety guidelines across EU member states has contributed to increased road incidents involving e-bikes. Furthermore, the U.S. Consumer Product Safety Commission has recalled multiple e-bike models due to faulty brakes and battery malfunctions, emphasizing the need for stringent safety standards. Ensuring regulatory consistency and rider protection remains a pressing challenge for industry stakeholders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.69% |

|

Segments Covered |

By Product Type, Battery Type, Mechanism, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Giant Manufacturing Co. Ltd., Merida Industry Co. Ltd., Leader 96, BH Bikes, Pedego Electric Bikes, Yamaha Motor Co., Accell Group N.V, Energica Motor Co., Mahindra & Mahindra Ltd., Robert Bosch GmbH, and Others. |

SEGMENTAL ANALYSIS

Global E-bike Market By Product Type

The pedelecs market is highly dominating, with the adoption rate increasing rapidly. This is because of the speed difference & power. The global pedelecs market is growing at a CAGR of 7.74% during 2018-2022, owing to the high demand for eco-friendly transportation of e-bikes. E-scooters are adopted by the young population, and the sale of e-scooters has increased in middle-class communities in developing countries. The scooter is affordable for transportation. There is an increase in urbanization and moving from one to another, which will increase the opportunity for e-bikes.

Global E-Bike Market By Battery Type

The Lithium-ion segment dominated the market by accounting for 54.6% of the global market share in 2024. The growth of the lithium-ion segment in the global e-bike market is majorly driven by the high energy density, lightweight design, and longer lifespan is enhancing e-bike performance and range. Additionally, the European Commission anticipates a nearly 70% decrease in lithium-ion battery prices by 2030 is ascribed to bolster the growth rate of the market.

Global E-Bike Market By Motor Type

The hub motors segment led the e-bike market with 65% of the share in 2024. The affordability, ease of maintenance, and compatibility with various bike designs of hub motors are primarily fuelling the growth of the segment in the global market. Hub motors are directly integrated into the wheel, making them simpler to install and reducing manufacturing costs. The European Cyclists’ Federation highlights that hub motor e-bikes account for over 70% of sales in urban commuting segments, where cost-effectiveness and reliability are prioritized. Their widespread adoption underscores their importance in driving the accessibility and mass-market appeal of electric bicycles in regions like Asia-Pacific and Europe.

However, the mid-drive electric motors segment is anticipated to achieve CAGR of 12.8% over the forecast period owing to their superior performance, efficiency, and balance, making them ideal for off-road and mountain biking enthusiasts. The U.S. Department of Energy notes that mid-drive systems provide better weight distribution and torque, enhancing rider experience on challenging terrains. Additionally, rising demand for premium e-bikes in North America and Europe has accelerated adoption. Governments like the German Federal Ministry of Transport promote mid-drive e-bikes through subsidies for sustainable transportation. This segment’s rapid expansion highlights its role in catering to high-performance needs while driving innovation in the e-bike industry.

REGIONAL ANALYSIS

Asia-Pacific dominated the e-bike market worldwide with 55.4% of global market share in 2024. The growth of the Asia-Pacific in the global market is primarily driven by China and India where rapid urbanization, rising pollution levels, and government initiatives have significantly boosted demand for eco-friendly commuting solutions. The Asian Development Bank highlights that China alone accounts for over 300 million e-bikes in use, making it the largest consumer and producer globally. Government subsidies combined with strict emission regulations have encouraged widespread adoption in urban areas. Additionally, affordable pricing has made e-bikes accessible to rural populations, further driving demand. The region’s robust manufacturing infrastructure and export capabilities reinforce its dominance with sustained innovation and growth in the global e-bike industry. Asia-Pacific’s leadership underscores its critical role as both a production hub and a key consumer market.

Europe's e-bike market is forecasted to have a CAGR of 14.2% from 2025 to 2033. This impressive growth is fueled by stringent environmental policies, increasing investments in green transportation, and a cultural shift toward sustainable mobility. The European Cyclists’ Federation reports that countries like Germany and the Netherlands are at the forefront is accounting for over 40% of e-bike sales in Europe. These nations benefit from well-developed cycling infrastructure, government subsidies, and tax incentives that encourage adoption. Rising awareness of health and environmental benefits has also led to increased usage among urban commuters and recreational cyclists. Furthermore, premium e-bikes equipped with advanced features, such as mid-drive motors, are gaining popularity among affluent consumers. Europe’s rapid expansion highlights its importance as a leader in sustainable mobility is driving technological advancements and influencing global trends in the e-bike market.

North America is experiencing steady growth in the electric bicycle market, which is driven by increasing interest in fitness, outdoor activities, and eco-friendly commuting options. The U.S. Department of Transportation predicts a 10% annual rise in e-bike adoption, which is supported by expanding bike lanes and state-level incentives. In Latin America, the market is emerging as a promising segment, particularly in countries like Brazil and Mexico. According to the Inter-American Development Bank, e-bike sales in these regions grew by 25% in 2024 which is fueled by urbanization and the availability of affordable models tailored to local needs. However, limited infrastructure and high import costs remain barriers to faster adoption. In the Middle East and Africa, e-bikes are gradually gaining traction for tourism, urban transport, and last-mile connectivity. Governments are beginning to recognize the potential of e-bikes as a sustainable solution while growth is slower due to economic constraints and underdeveloped cycling infrastructure. Collectively, these regions will play a vital role in diversifying the e-bike market while addressing challenges such as affordability, regulatory frameworks, and infrastructure development.

KEY MARKET PLAYERS

Giant Manufacturing Co. Ltd, Derby Cycle, Easy Motion, Accell Group N.V., Yamaha Motor Corporation, Merida Industry Co. Ltd., Moustache Bikes Bike, NYCeWheels. These are the market players that are dominating the global E-bike market.

COMPETITIVE LANDSCAPE

The electric bicycles market is highly competitive, characterized by the presence of established global players, regional manufacturers, and emerging startups striving to capture market share through innovation and strategic positioning. Leading companies like Yamaha, Bosch, and Giant Manufacturing dominate the industry, leveraging their expertise in motor technology, battery efficiency, and lightweight frame design. These firms focus on premium offerings, such as mid-drive e-bikes with advanced features, targeting affluent consumers in Europe and North America. Meanwhile, Asian giants like Jiangsu Xinri E-Vehicle Co. Ltd. and Hero Electric cater to mass-market segments in Asia-Pacific, emphasizing affordability and scalability.

Competition intensifies as companies adopt diverse strategies to differentiate themselves. For instance, some brands emphasize sustainability by using recyclable materials and energy-efficient manufacturing processes, aligning with global environmental goals. Others invest heavily in R&D to enhance performance, battery life, and connectivity features, such as smartphone integration. The rise of e-commerce has further leveled the playing field, enabling smaller brands to reach global audiences directly.

Regionally, Europe leads in high-performance e-bikes, while Asia-Pacific dominates mass production and consumption. According to the International Energy Agency (IEA) , government subsidies and emission regulations have fueled competition, particularly in urban mobility solutions. Additionally, partnerships with cycling infrastructure developers and participation in green initiatives have become key competitive strategies.

Top 3 Players in the market

Bosch eBike Systems

Bosch is a global leader in the electric bicycle market, particularly renowned for its advanced mid-drive motor systems. The company’s Performance Line and Cargo Line motors are widely used by premium e-bike manufacturers across Europe and North America. According to the European Cyclists’ Federation , Bosch-powered e-bikes models are launched by focusing on performance and reliability. Bosch’s contribution lies in its cutting-edge technology, including smart connectivity features like smartphone integration and real-time diagnostics. By focusing on durability, efficiency, and seamless integration with bike designs, Bosch has set industry standards for mid-drive systems which is driving innovation and consumer trust globally.

Yamaha Motor Co., Ltd.

Yamaha is another key player, leveraging its decades of expertise in motor technology to produce high-performance e-bike systems. The company’s PWseries motors are known for their lightweight design and smooth power delivery, making them ideal for both urban commuting and off-road adventures. Yamaha has a strong presence in North America and Japan, supported by strategic partnerships with local manufacturers. According to the U.S. Department of Transportation, Yamaha’s focus on affordability and versatility has helped expand e-bike adoption in suburban areas. By offering reliable and customizable solutions, Yamaha contributes significantly to the global market’s growth while addressing diverse consumer needs.

Giant Manufacturing Co., Ltd.

Giant Manufacturing is one of the largest e-bike manufacturers globally, combining innovative designs with mass-market appeal. Based in Taiwan, Giant produces popular models like the Liv Amita E+ and Giant Roam E+, catering to urban commuters and adventure enthusiasts alike.. Giant’s vertical integration, from manufacturing to retail, ensures cost efficiency and quality control. By investing in sustainable materials and expanding its distribution networks, Giant has played a pivotal role in making e-bikes accessible worldwide, particularly in emerging markets.

Top strategies used by the key market participants

Focus on Technological Innovation

Leading companies like Bosch and Yamaha invest heavily in R&D to develop advanced motor systems, battery technologies, and connectivity features. For instance, Bosch’s integration of smartphone apps for real-time diagnostics and performance tracking enhances user experience, setting its products apart in the premium segment.

Expansion into Emerging Markets

Companies such as Giant Manufacturing and Hero Electric are targeting high-growth regions like Asia-Pacific, Latin America, and Africa. By offering affordable models tailored to local needs, these players are capturing untapped markets and increasing their global footprint.

Sustainability Initiatives

To align with environmental goals, brands like Trek and Specialized emphasize eco-friendly materials and energy-efficient manufacturing processes. This resonates with environmentally conscious consumers and strengthens brand loyalty.

Strategic Partnerships and Collaborations

Key players collaborate with governments, cycling infrastructure developers, and tech firms to promote e-bike adoption. For example, partnerships with European cities have expanded bike lanes, boosting demand for urban e-bikes.

Product Diversification

Companies are diversifying their portfolios to cater to specific segments, such as foldable e-bikes for urban commuters or rugged models for off-road enthusiasts. This ensures broader market appeal and reduces reliance on a single consumer group.

E-commerce and Digital Marketing

Brands like VanMoof and Rad Power Bikes leverage online platforms to reach global audiences directly. Social media campaigns and influencer marketing further enhance visibility and engagement among younger, tech-savvy consumers.

Government Subsidies and Incentives

Players actively align with government programs promoting green transportation. For instance, subsidies in Europe and China have significantly boosted sales, particularly for mid-drive and premium models.

Affordability and Financing Options

To attract price-sensitive consumers, companies like Hero Electric offer affordable models and flexible financing plans, making e-bikes accessible to a wider audience.

Vertical Integration

Manufacturers like Giant integrate production, distribution, and retail operations to reduce costs and maintain quality control. This strategy enhances competitiveness and profitability.

Focus on After-Sales Services

Providing robust customer support, warranties, and maintenance services builds trust and encourages repeat purchases. Bosch, for example, offers extensive service networks for its motor systems.

RECENT HAPPENINGS IN THIS MARKET

In March 2022, Bosch, a leader in e-bike motor systems, launched a new line of lightweight mid-drive motors for urban e-bikes. This launch is anticipated to allow Bosch to address the growing demand for efficient and compact solutions, strengthening its position in the urban commuting segment.

In June 2021, Yamaha, a motor technology giant, partnered with a U.S.-based bike manufacturer to expand its presence in North America. This partnership is anticipated to allow Yamaha to tap into the booming U.S. market and increase brand visibility among urban and recreational cyclists.

In January 2023, Giant Manufacturing, a global e-bike manufacturer, introduced a foldable e-bike model targeting urban commuters. This innovation is anticipated to allow Giant to cater to the rising demand for portable and space-saving designs, enhancing its appeal in densely populated cities.

In September 2021, VanMoof, a smart e-bike company, secured $128 million in funding to enhance its smart e-bike technology. This investment is anticipated to allow VanMoof to improve connectivity features and expand its global distribution network, solidifying its leadership in tech-driven e-bikes.

In November 2021, Hero Electric, an Indian e-bike manufacturer, launched an affordable e-bike model targeting rural consumers. This initiative is anticipated to allow Hero Electric to strengthen its market presence in price-sensitive regions and increase accessibility for first-time buyers.

In April 2022, Trek Bicycles, a leading bike brand, collaborated with European cities to promote cycling infrastructure. This collaboration is anticipated to allow Trek to align with government sustainability goals and boost e-bike adoption by improving urban cycling conditions.

In July 2022, Specialized, a premium bike manufacturer, introduced a recycling program for old e-bike batteries in Europe. This initiative is anticipated to allow Specialized to enhance its reputation as an eco-friendly brand while addressing environmental concerns related to battery disposal.

In February 2023, Rad Power Bikes, a popular e-bike brand, expanded its product line with a budget-friendly e-cargo bike. This move is anticipated to allow Rad Power Bikes to target families and small businesses, diversifying its customer base and strengthening its utility segment presence.

In December 2022, Aventon, an innovative e-bike company, launched a subscription-based service for e-bike rentals in urban areas. This approach is anticipated to allow Aventon to increase accessibility and attract younger, tech-savvy consumers who prefer flexible ownership models.

In August 2022, Merida, a global bike manufacturer, collaborated with a German tech firm to develop AI-powered navigation systems for e-bikes. This innovation is anticipated to allow Merida to position itself as a leader in high-tech biking solutions, appealing to premium buyers seeking advanced features.

MARKET SEGMENTATION

This research report on the global E-bicycle market is segmented and sub-segmented into the following categories.

By Battery Type

- Lithium-ion

- Nickel-metal Hydride

- Lead Acid

By Motor Type

- Hub Motor

- Mid Drive Electric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]