Global Ductless Heating And Cooling Systems Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Window Air Conditioner Systems, and Split Systems), Application (Commercial Buildings, Residential Buildings, and Industrial Buildings), And Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis Forecasts From (2025 to 2033)

Global Ductless Heating and Cooling Systems Market Size

The global ductless heating and cooling systems market was valued at USD 115.38 billion in 2024 and is anticipated to reach USD 124.50 billion in 2025 from USD 228.73 billion by 2033, growing at a CAGR of 7.9% during the forecast period from 2025 to 2033.

MARKET DRIVERS

The increasing prevalence of smart homes in developed and developing countries is majorly leveling the demand for the ductless heating and cooling systems market.

Ductless heating and cooling systems are used to control humidity and air temperature, which promotes fresh air intake. The demand for these is growing across the world with the increasing prominence of smart homes. For instance, in 2023, around 300 million smart homes were built across the world. Out of these, 63.43 million smart homes are actively using ductless heating and cooling systems in the US alone. This activity is mainly to fuel the growth rate of the market.

Also, these systems are highly effective in saving power, where the growing demand for the adoption of energy-efficient devices is prompting the market growth rate. The Energy Star-certified ductless mini-split systems are proven to use less energy when compared with conventional room conditioners. Roughly, these systems use 60% less energy for heating and 30% less for cooling.

In addition, increasing disposable income in developed and developing countries is elevating the growth rate of the ductless heating and cooling systems market. The trend towards adoption of advanced HVAC structures and rapidly increasing per capita income in major countries is to gear up the demand for the market.

Key players are investing huge amounts to launch innovative products with the latest technology. These products are highly efficient and consume less power. With the growing demand for less power consumption systems, the demand for the ductless heating and cooling systems market is growing eventually. Penetration of the Internet of Things in HVAC structures leverages system performance. These systems can share the data that is collected and stored in the cloud once connected to the internet. Hence, these advancements in the HVAC structures are set to promote the market value in the coming years.

MARKET RESTRAINTS

Stringent rules and regulations by the government to reduce carbon emissions are eventually pressuring the development of refrigerators and ACs to emit less carbon. These rules are quite challenging for the market key players to manufacture efficient systems at lower costs. This factor is attributed to hindering the growth rate of the market. Also, the high cost of the advanced systems due to fluctuations in the prices of the raw materials degrades the market growth rate.

MARKET OPPORTUNITIES

Global warming has become one of the major concerns for the whole world due to the rising temperatures. With the increasing temperature, the demand to buy AC around the world is rising. This is anticipated to fuel the demand for ductless heating and cooling systems at a robust rate in the coming years. According to the International Energy Agency, around 15-20 % AC sales have been increased from 2021. The increasing sales of air conditioning worldwide propel the demand for the adoption of ductless heating and cooling systems at any cost.

MARKET CHALLENGES

Easy availability of alternate innovative products at lower cost and less awareness of the benefits of ductless heating and cooling systems are key challenging factors for the market to grow during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Samsung Electronics Co. Ltd. (South Korea), Hitachi Ltd. (Japan), Blue Star (India), LG Electronics (South Korea), Voltas (India), Haier (China), Carrier (U.S.), United Technologies Corporation (U.S.), Johnson Controls (U.S.). |

SEGMENT ANALYSIS

By Type Insights

The Split System segment is leading with the dominant share of the ductless heating and cooling systems market, whereas the window air conditioning systems segment is to have a slower growth rate during the forecast period.

With the increasing prominence of adopting the latest technologies in both developed and developing countries, the demand for split systems is growing at a higher rate. Window air conditioning systems are a bit noisy and need more space, which is why the growth rate for this segment is growing at a slower rate.

By Application Insights

The commercial building segment is leading with the dominant share of the market. Increasing focus on the adoption of the centralized AC with the latest features is attributed to gearing up the demand for this segment.

The residential buildings segment is expected to grow at a higher CAGR during the forecast period with the growing expenditure on luxurious smart homes. People nowadays are gaining knowledge on reducing their carbon footprints through social media, which is surging the demand for these systems in residential buildings.

The industrial buildings segment is likely to have the fastest growth rate in the foreseen years. In order to reduce the high energy consumption in industries, rapid urbanization is prompting the demand for this segment.

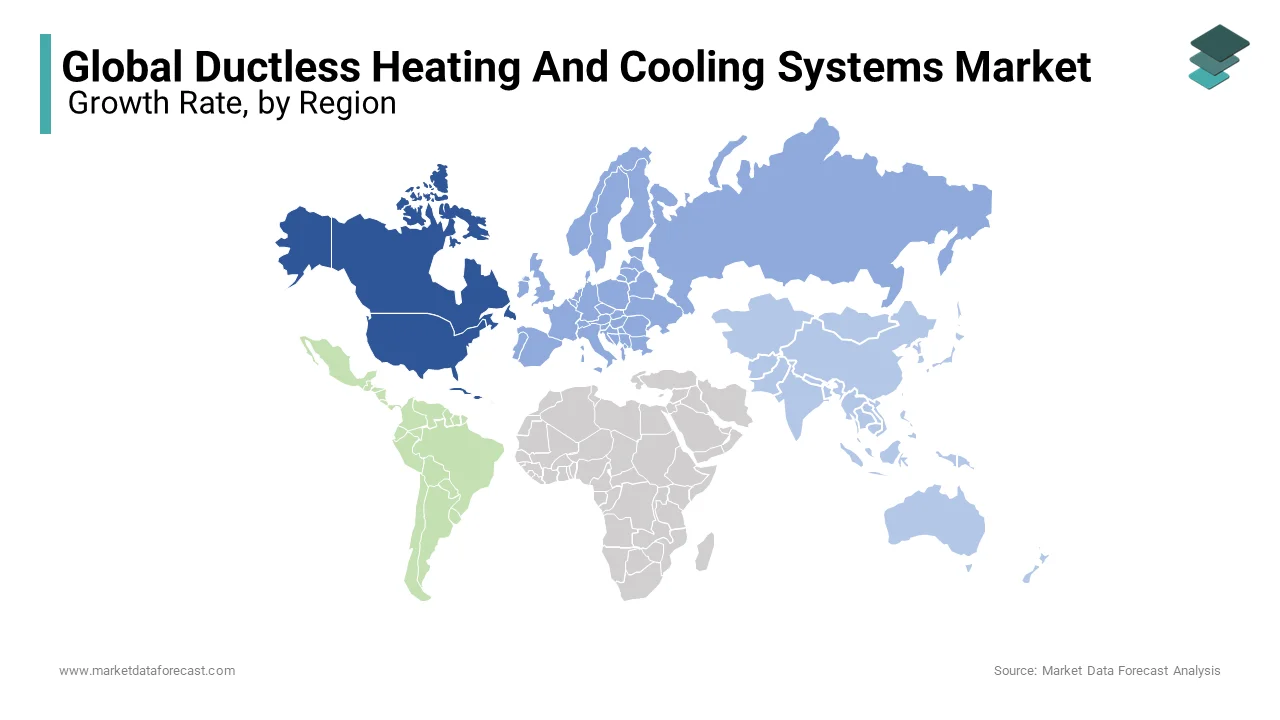

REGIONAL ANALYSIS

The North American ductless heating and cooling systems market is ruling with the largest share due to the constantly growing demand for the construction of smart homes. The US and Canada are the major countries contributing the dominant share of the market with the rapid adoption of new technologies. Continuous focus on the development of innovative products to meet industry standards using advanced technology is attributed to the prompting of market demand in the US. Changes in lifestyles and the growing prevalence of the construction of smart homes so as to inhale fresh air in closed rooms are outraging the market value in the US. In the US, space heating and cooling systems use more than half of the energy, which is influencing people to adopt these technologies in residential areas in the coming years.

Followed by North America, Europe is next in leading the highest share of the market. The rapidly growing urban population is certainly a major factor for the market to grow in the European region. Variable climatic conditions due to global warming also affect the adoption of air conditioners in many places, which potentially promotes market demand. The UK and Germany had the highest growth rate in the market during the forecast period. Increased demand for a pleasant interior environment among people is additionally to prompt the market growth rate in these countries.

Asia Pacific's ductless heating and cooling systems market is likely to hit the highest CAGR by 2028. The growing population and increasing awareness of the adoption of smart homes and their benefits are majorly contributing to the market growth rate in Asia Pacific. China is one of the countries that has had the highest market share in the past few years. In China, 78.42 million users are actively using smart home technologies, which is enhancing the demand for the market. India and Japan are next, having the fastest growth rate in the market.

Latin America and Middle East & Africa are to have significant growth opportunities in the near future. Growing support from the government authorities to leverage the industrial area is likely to fuel the demand of the market in these regions.

KEY MARKET PLAYERS

Some of the major players in the ductless heating & cooling systems market are

Samsung Electronics Co. Ltd. (South Korea), Hitachi Ltd. (Japan), Blue Star (India), LG Electronics (South Korea), Voltas (India), Haier (China), Carrier (U.S.), United Technologies Corporation (U.S.), Johnson Controls (U.S.). They are playing a dominant role in the global ductless and cooling systems market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, DAIKIN Industries, a leading company in HVAC, is committed to intensifying companies' focus on developing environmentally friendly products using ductless heating and cooling systems.

- In 2021, Carrier launched a user-friendly New Toshiba Carrier VRF touchscreen controller to connect 128 units as one control. All these units can be controlled from one location where there will be no need to monitor every single unit every time.

MARKET SEGMENTATION

This research report on the global ductless heating and cooling market is segmented and sub-segmented into the following categories.

By Type

- Window Air Conditioning Systems

- Split Systems

By Application

- Commercial Buildings

- Residential Buildings

- Industrial Buildings

By Region

- North America

- Europe

- Asia-pacific

- Middle-east and Africa

- Latin America

Frequently Asked Questions

what is the current market size of ductless heating and cooling systems Market?

The current market size of the ductless heating and cooling systems market was valued at USD 124.50 Bn in 2025

what is the CAGR of ductless heating and cooling systems market?

The ductless heating and cooling systems market will be growing at a CAGR of 7.9% during the forecast period from 2025 to 2033.

what are key players involved in ductless heating and cooling systems market?

Samsung Electronics Co. Ltd. (South Korea), Hitachi Ltd. (Japan), Blue Star (India), LG Electronics (South Korea), Voltas (India), Haier (China), Carrier (U.S.), United Technologies Corporation (U.S.), Johnson Controls (U.S.)

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]