Global Docks Market Size, Share, Trends, & Growth Forecast Report Segmented By Material (Wood, Metal, Plastics & Composites, Concrete), Product Type, End Use, Dock Accessories, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Docks Market Size

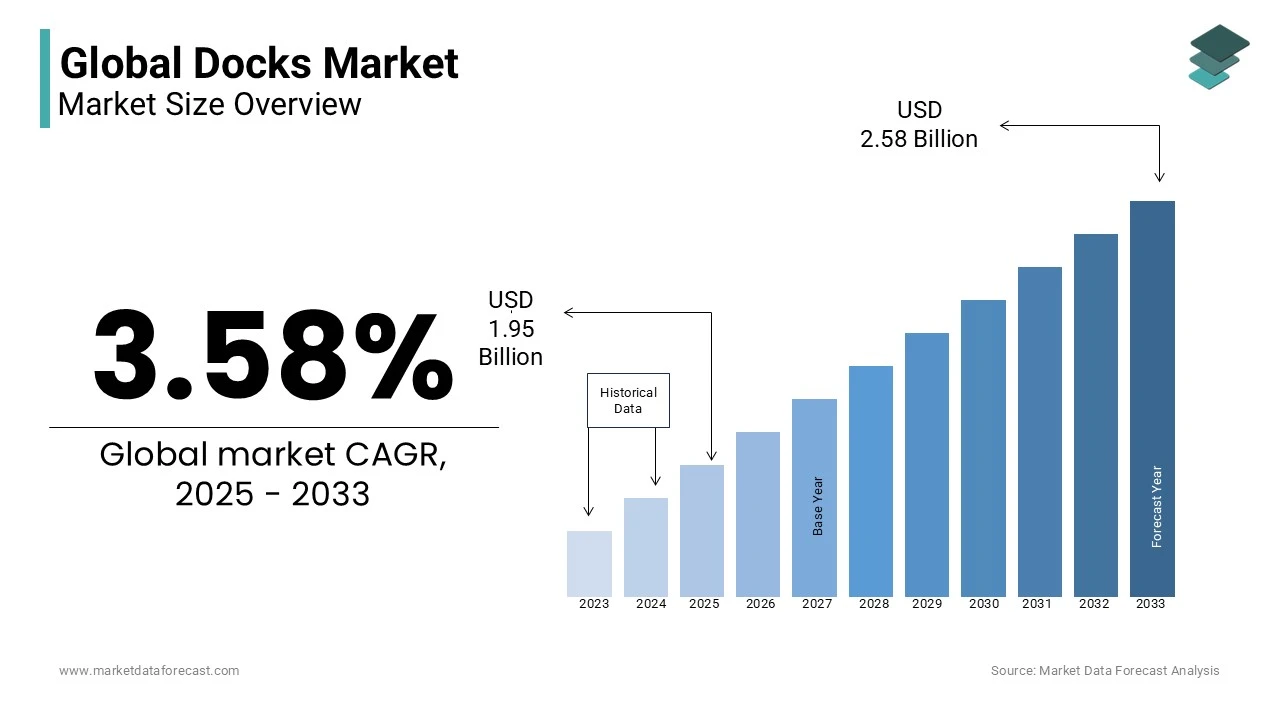

The global docks market size was valued at USD 1.88 billion in 2024 and is projected to grow from USD 1.95 billion in 2025 to USD 2.58 billion by 2033, the market is expected to grow at a CAGR of 3.58% during the forecast period.

In recent years, the docks market has experienced substantial growth in the recent years and majorly due to the increasing global trade volumes and the expansion of the shipping industry. According to the United Nations Conference on Trade and Development (UNCTAD), global seaborne trade volumes surpassed 11 billion tons in 2022, highlighting the need for efficient and modern docking infrastructure. Additionally, the rise of recreational boating and waterfront tourism has fueled demand for marinas and leisure docks in regions like North America and Europe, where waterfront development projects are on the rise.

MARKET DRIVERS

Growth in Global Trade and Shipping Activities

The exponential growth in global trade is a primary driver of the docks market. According to the International Maritime Organization, over 80% of global trade by volume is carried by sea, with maritime trade volumes reaching 11 billion tons in 2022. This surge is fueled by the increasing demand for raw materials, manufactured goods, and energy resources by necessitating the expansion and modernization of port infrastructure. For instance, major ports like Shanghai and Singapore have reported record-breaking cargo handling capacities, with Shanghai handling over 47 million TEUs (twenty-foot equivalent units) in 2022. This growth underscores the critical role of docking facilities in supporting global supply chains and trade networks.

Rising Investments in Port Infrastructure Development

Governments and private entities worldwide are investing heavily in port infrastructure to enhance capacity and efficiency. The World Bank reports that global investments in port infrastructure exceeded 50 billion in 2023 with significant projects under way in emerging economies like India and Southeast Asia. For example, India’s Sagarmala Program aims to modernize ports and reduce logistics costs, with an investment of over 120 billion by 2035. Similarly, the European Union’s Trans-European Transport Network (TEN-T) program is allocating billions to upgrade port facilities. These investments are driving the demand for advanced docking solutions, ensuring the market’s sustained growth.

MARKET RESTRAINTS

High Capital and Maintenance Costs

The construction and maintenance of docking facilities require substantial financial investments, which act as a significant restraint for the docks market. According to the U.S. Army Corps of Engineers, the average cost of constructing a medium-sized commercial dock can range from 10million to 50 million by depending on location and complexity. Additionally, maintenance costs can account for up to 20% of the initial investment annually. These high costs are particularly challenging for developing nations, where budget constraints limit the ability to modernize or expand port infrastructure. For instance, the World Bank highlights that many African ports struggle with outdated facilities due to insufficient funding by hindering their competitiveness in global trade.

Environmental Regulations and Sustainability Challenges

Stringent environmental regulations pose a major challenge to the docks market. The International Maritime Organization has implemented strict guidelines to reduce emissions and protect marine ecosystems by requiring ports to adopt eco-friendly practices. For example, the European Union’s Green Deal mandates a 55% reduction in greenhouse gas emissions by 2030 which is assumed to impact port operations. Compliance with these regulations often involves costly upgrades, such as installing emission control systems or using sustainable materials. According to the United Nations Environment Programme, ports in developed regions spend an average of $5 million annually on environmental compliance. These regulatory pressures can slow down project timelines and increase operational costs which act as a restraint on market growth.

MARKET OPPORTUNITIES

Growth in Renewable Energy Ports

The global shift toward renewable energy is creating new opportunities for the docks market, particularly in the development of ports dedicated to offshore wind energy projects. According to the Global Wind Energy Council, the offshore wind sector is expected to grow by 15% annually with installed capacity reaching 234 GW by 2030. Ports are critical for the assembly, storage, and transportation of wind turbine components. For example, the U.S. Department of Energy reports that investments in offshore wind ports along the East Coast are projected to exceed $500 million by 2025. This trend positions the docks market to play a pivotal role in supporting the renewable energy transition by offering growth opportunities for specialized port infrastructure.

Increasing Demand for Cruise and Tourism Infrastructure

The booming cruise industry is driving demand for modernized docking facilities tailored to passenger ships. According to the Cruise Lines International Association, global cruise passenger numbers are expected to reach 40 million by 2027 with up from 30 million in 2022. This growth necessitates upgrades to port infrastructure to accommodate larger vessels and enhance passenger experiences. For instance, the Port of Miami, one of the busiest cruise ports globally, invested $100 million in 2023 to expand its terminals. Similarly, the Mediterranean region is witnessing increased investments in cruise ports, as reported by the European Sea Ports Organisation. This surge in cruise tourism presents a significant opportunity for the docks market to expand into the leisure and hospitality sector.

MARKET CHALLENGES

Climate Change and Rising Sea Levels

Climate change poses a significant challenge to the docks market, as rising sea levels and extreme weather events threaten the stability and functionality of port infrastructure. According to the National Oceanic and Atmospheric Administration, global sea levels have risen by an average of 3.7 millimeters annually since 2006, with projections indicating a potential rise of up to 1 meter by 2100. This threatens coastal ports in low-lying regions. For instance, the U.S. Army Corps of Engineers estimates that over $1 billion will be needed to protect ports in the Gulf Coast from flooding and storm surges. Adapting to these changes requires costly upgrades by making climate resilience a pressing challenge for the industry.

Labor Shortages and Skilled Workforce Gaps

The docks market faces a growing labor shortage in skilled roles such as engineers, technicians, and port operators. According to the International Labour Organization, the global maritime sector is expected to face a shortage of 150,000 skilled workers by 2025. This gap is exacerbated by an aging workforce and insufficient training programs. For example, the European Sea Ports Organisation reports that 40% of port workers in Europe are over the age of 50, with fewer young professionals entering the field. Addressing this challenge requires significant investment in workforce development and training, which can strain resources and slow down port modernization efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.58% |

|

Segments Covered |

By Material, Product Type, Application, End Use, Dock Accessories, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Snap Dock, RHINO, INC., Tommy Docks, Hydrohoist, Connect-A-Dock, Carolina Docks, PMS Dock Marine Company, Cellofoam North America Inc., Sunstream, RONAUTICA QUALITY MARINAS, S.L. VERSADOCK, Bellingham Marine, Marinetek, AccuDock, MariCorp U.S., PMS Dockmarine, Martini Alfredo, Transpac Marinas Inc., Ingemar, Meeco Sullivan, Jet Dock Systems, Inc., Walcon Marine, Candock, EZ Dock, Damen , and others. |

SEGMENTAL ANALYSIS

By Material Insights

The concrete segment dominated the docks market in 2024 is holding 45.3% of the global market share. Its dominance stems from its durability, cost-effectiveness, and ability to withstand harsh marine environments. Concrete docks are widely used in commercial ports and heavy-load applications due to their high strength and low maintenance requirements. For instance, the Port of Los Angeles, one of the busiest ports globally, relies heavily on concrete infrastructure to handle over 9 million TEUs annually. The material’s versatility and long lifespan make it indispensable for large-scale port projects, ensuring its continued leadership in the market.

The plastics and composites segment is the fastest-growing in the global docks market and is projected to grow at a CAGR of 8.5% from 2025 to 2033. This growth is driven by the material’s lightweight, corrosion-resistant, and eco-friendly properties by making it ideal for recreational marinas and floating docks. For example, the U.S. National Marine Manufacturers Association highlights that over 60% of new marina constructions in North America now use composite materials. Additionally, governments are promoting sustainable materials to reduce environmental impact, with the European Union allocating €1.2 billion for green infrastructure projects by 2025. This trend underscores the segment’s importance in modern with sustainable dock construction.

By Product Type Insights

The fixed segment led the market by capturing a global market share of 65.8% in 2024. Their dominance is due to their stability, durability, and suitability for heavy-load applications, such as commercial ports and industrial facilities. For instance, the Port of Singapore, which handles over 37 million TEUs annually which relies extensively on fixed docks for cargo operations. Fixed docks are also preferred for their long lifespan and low maintenance requirements, making them a cost-effective solution for high-traffic maritime hubs. Their widespread use in global trade and logistics underscores their importance in the docks market.

The floating segment is expected to register a CAGR of 7.8% from 2025 to 2033. This growth is driven by their versatility, adaptability to water level fluctuations, and increasing use in recreational marinas and tourism. For example, the U.S. National Oceanic and Atmospheric Administration highlights that floating docks account for over 50% of new marina installations in coastal regions. Additionally, floating docks are eco-friendly and easier to install by aligning with sustainability goals. The rise in waterfront tourism and recreational boating which grew by 12% globally in 2022 that further boosts demand for floating docks by making them a key growth driver in the market.

By Application Insights

The saltwater segment held 60.9% of the global market share in 2024 due to the critical role of saltwater ports in global trade and shipping. For instance, the Port of Shanghai, a saltwater port, handled over 47 million TEUs in 2022 which make it the busiest port globally. Saltwater docks are essential for international trade, energy imports, and industrial activities in coastal regions. Their ability to withstand harsh marine conditions and support heavy cargo operations underscores their importance in the global maritime economy.

The freshwater segment is on the rise and is projected to grow at a CAGR of 6.5% from 2025 to 2033. This growth is fueled by increasing investments in inland waterway infrastructure and recreational activities. For example, the European Commission highlights that freshwater ports along the Rhine and Danube rivers are experiencing a 10% annual increase in cargo traffic. Additionally, the rise in freshwater tourism, such as lakefront developments and marinas, is boosting demand. The U.S. National Park Service reports that freshwater recreational visits grew by 15% in 2022 is esteemed to drive the need for freshwater docking solutions. This segment’s growth reflects its importance in supporting regional trade and tourism.

By End Use Insights

The industrial segment had 45.7% of the global market share in 2024 owing to the key role of industrial docks in global trade, energy imports, and manufacturing supply chains. For instance, the Port of Rotterdam, Europe’s largest industrial port, handled over 467 million tons of cargo in 2022. Industrial docks are essential for handling bulk commodities, such as oil, coal, and raw materials, making them indispensable for economic growth. Their ability to support heavy-load operations and large-scale logistics underscores their importance in the global maritime industry.

The residential segment is expected to exhibit a CAGR of 8.2% from 2025 to 2033 due to the rising demand for waterfront properties and recreational boating. For example, the U.S. National Marine Manufacturers Association states that recreational boat sales increased by 12% in 2022 is driving demand for private docks. Additionally, urbanization and the development of luxury waterfront communities are boosting the need for residential docking solutions. Governments are also promoting waterfront living, with the European Union allocating €2 billion for coastal residential projects by 2025. This trend highlights the segment’s importance in modern lifestyle and tourism.

By Dock Accessories Insights

The bumpers segment led the market and occupying a share of 27.4% of the worldwide market in 2024. Bumpers play a major role in absorbing kinetic energy during docking, thereby minimizing damage to both vessels and dock structures. Their widespread application in fendering systems at docks and harbors underscores their importance in ensuring maritime safety. The U.S. Department of Transportation highlights that proper docking equipment, including bumpers is essential for preventing vessel damage and ensuring operational efficiency.

The lighting segment is growing promisingly and is estimated to showcase a CAGR of 7.97% from 2025 to 2033. This growth is driven by the increasing emphasis on safety and security in dock operations, as well as the rising adoption of energy-efficient LED lighting solutions. Enhanced dock lighting improves visibility during nighttime operations to reduce the risk of accidents. The U.S. Occupational Safety and Health Administration (OSHA) emphasizes the importance of adequate lighting in preventing workplace injuries, further supporting the demand for advanced lighting solutions in dock environments.

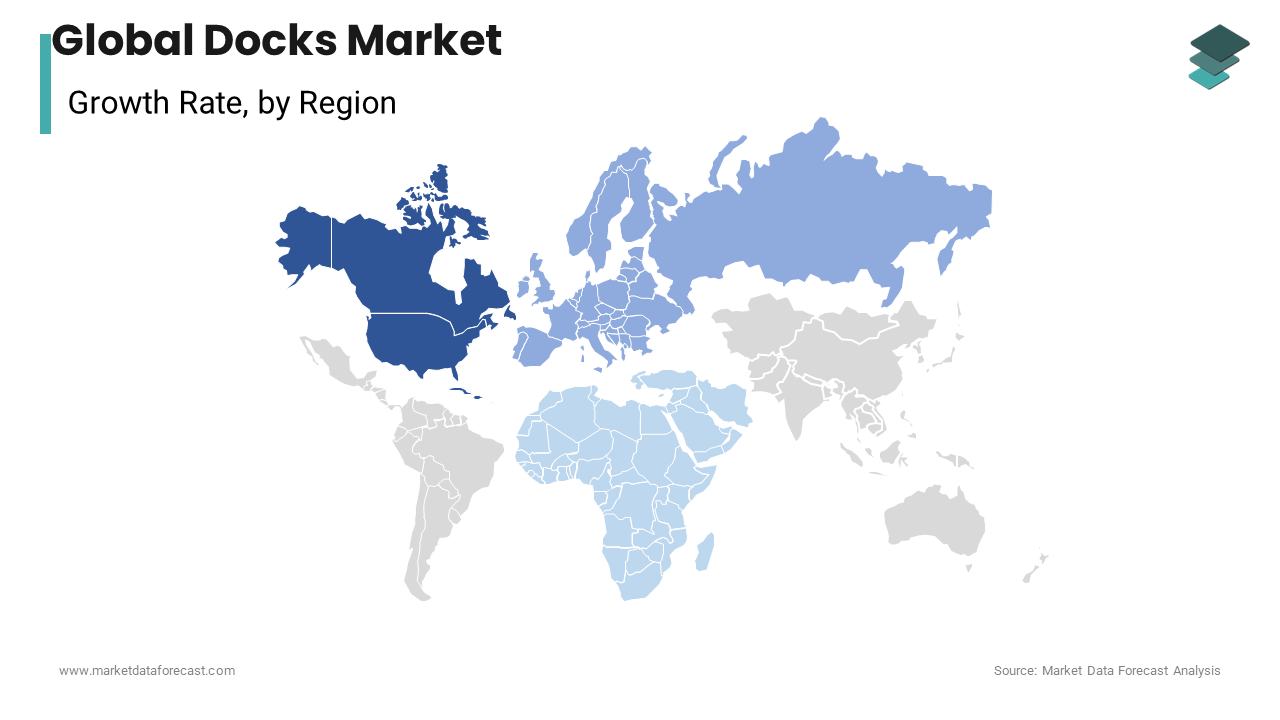

REGIONAL ANALYSIS

North America led the market by accounting for 35.3% of the global market share in 2024. The domination of North America in the global market is majorly attributed to the extensive coastline of North America, advanced maritime infrastructure, and significant investments in port modernization. The U.S. Department of Transportation reports that American ports handled over 1.5 billion metric tons of cargo in 2022 by underscoring the critical role of docks in facilitating trade and commerce.

The Asia-Pacific region is the fastest-growing segment in the global docks market and is predicted to grow at a 6.5% from 2025 to 2033. This rapid expansion is driven by increasing industrialization, urbanization, and substantial investments in port development to support burgeoning trade activities. According to the World Bank, East Asia and the Pacific have experienced robust economic growth, with a GDP increase of 6.3% in 2018 by fueling demand for enhanced dock facilities to accommodate rising cargo volumes.

Europe maintains a significant share in the docks market and the growth of the European market is supported by its extensive network of inland and coastal ports. The European Union's Eurostat agency indicates that EU ports handled approximately 3.5 billion tonnes of maritime freight in 2019. Ongoing initiatives to improve port efficiency and environmental sustainability are expected to bolster the market in the coming years.

Latin American docks market is poised for moderate growth and is driven by efforts to enhance port infrastructure and connectivity. The United Nations Economic Commission for Latin America and the Caribbean (ECLAC) reports that container throughput in the region's ports increased by 7.7% in 2021, reflecting a recovery in trade activities.

The market in Middle East and Africa is anticipated to experience steady growth in the docks market, propelled by strategic investments in port development to serve as global trade hubs. The World Bank highlights significant port projects in East and Southern Africa aimed at improving trade competitiveness and regional integration.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Snap Dock, RHINO, INC., Tommy Docks, Hydrohoist, Connect-A-Dock, Carolina Docks, PMS Dock Marine Company, Cellofoam North America Inc., Sunstream, RONAUTICA QUALITY MARINAS, S.L. VERSADOCK, Bellingham Marine, Marinetek, AccuDock, MariCorp U.S., PMS Dockmarine, Martini Alfredo, Transpac Marinas Inc., Ingemar, Meeco Sullivan, Jet Dock Systems, Inc., Walcon Marine, Candock, EZ Dock, Damen are the key players in the global docks market.

The global docks market is highly competitive, with numerous players vying for market share across different segments, including commercial docks, recreational docks, and industrial docking systems. The market features a mix of established multinational companies, specialized dock manufacturers, and emerging regional players. Key companies such as Bellingham Marine, Marinetek, and AccuDock dominate the industry through product innovation, strategic partnerships, and expansive distribution networks.

Competition in the docks market is primarily driven by factors such as product quality, durability, technological advancements, and customization capabilities. Companies are increasingly focusing on sustainability, integrating eco-friendly materials and energy-efficient solutions to appeal to environmentally conscious consumers. The adoption of smart dock technologies, such as IoT-enabled monitoring systems and automated docking solutions, has further intensified competition, with firms investing heavily in research and development to differentiate their offerings.

Additionally, regional expansion plays a crucial role in competitive positioning. North America and Europe remain key markets due to their well-established marina infrastructure, while Asia-Pacific is emerging as the fastest-growing region, fueled by increasing investments in port modernization and waterfront development. As the market continues to expand, companies are leveraging mergers, acquisitions, and strategic collaborations to strengthen their foothold and enhance their global presence.

STRATEGIES USED BY THE MARKET PLAYERS

Technological Integration and Smart Docks

The integration of IoT (Internet of Things) and smart technologies is becoming a major trend. Companies are developing docks with automated docking systems, remote monitoring, and smart lighting solutions. Smart dock innovations improve safety, efficiency, and user experience, making them a competitive advantage in the market.

Aftermarket Services and Maintenance Packages

To strengthen customer retention and build long-term relationships, leading companies offer maintenance, repair, and upgrade services. Bellingham Marine provides after-sales services such as dock inspections and refurbishments, ensuring longevity and customer loyalty.

Expansion into Emerging Markets

Companies are targeting emerging economies in Asia-Pacific, Latin America, and the Middle East due to growing investments in waterfront infrastructure. Governments in these regions are expanding ports and marinas, creating opportunities for dock manufacturers to establish a strong presence.

TOP 3 PLAYERS IN THE MARKET

Bellingham Marine

Bellingham Marine is recognized as a global leader in the design and construction of marinas and dock systems. The company specializes in floating docks, platforms, and wave attenuation systems, serving both commercial and residential markets. Their comprehensive services include design, engineering, manufacturing, and installation, ensuring high-quality and durable dock solutions. Bellingham Marine's extensive experience and innovative approach have solidified its position as a top player in the docks market.

Marinetek

Marinetek is an international company known for its high-quality floating structures, including pontoons, breakwaters, and marinas. With a strong emphasis on research and development, Marinetek offers customized solutions tailored to client needs. Their global presence and commitment to sustainability have contributed to their reputation as a leading provider in the docks industry.

AccuDock

AccuDock specializes in manufacturing floating docks and gangways, catering to various applications such as rowing, kayaking, and commercial uses. The company is known for its modular dock systems, which offer versatility and ease of installation. AccuDock's focus on quality craftsmanship and customer satisfaction has established it as a prominent player in the global docks market.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Bellingham Marine appointed Kevin Thompson as President of U.S. Operations, following the tenure of Joe Ueberroth. This leadership transition is expected to drive strategic growth initiatives and strengthen the company's market position.

- In August 2022, Bellingham Marine commenced construction at The Marina at Dana Point, initiating a comprehensive five-year redevelopment project. This endeavor aims to modernize the marina's infrastructure, enhancing its capacity and services to better serve the boating community.

- In July 2023, Marinetek Group launched an innovative floating pontoon system designed for extreme weather conditions. This product introduction addresses the increasing demand for resilient dock solutions amid changing climate patterns.

- In May 2023, AccuDock expanded its manufacturing facilities in Florida to increase production capacity. This expansion aims to meet the rising demand for modular floating docks, enhancing the company's ability to serve a growing customer base.

- n September 2022, AccuDock introduced a new line of customizable kayak launch platforms, targeting the recreational boating segment. This product launch caters to the increasing popularity of kayaking and the need for specialized docking solutions.

- In March 2023, Marinetek Group secured a contract to design and build a state-of-the-art marina in Dubai. This project expands the company's presence in the Middle Eastern market, contributing to its global growth strategy.

MARKET SEGMENTATION

This research report on the global docks market has been segmented and sub-segmented based on material, product type, application, end use, dock accessories, and region.

By Material

- Wood

- Metal

- Plastics & Composites

- Concrete

By Product Type

- Floating

- Fixed

By Application

- Freshwater

- Saltwater

By End Use

- Residential

- Commercial

- Industrial

- Institutional

By Dock Accessories

- Ladders

- Bumpers

- Cleats

- Carts

- Benches/Seats

- Fish Cleaning Station

- Kayak Rack

- Trash Cans

- Lighting

- Handrails

- Other Accessories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current market size of the global docks market?

The docks market is valued at USD 1.88 billion in 2024 and is growing at a CAGR of 3.58% (2024-2032).

2. How are technological advancements impacting the docks market?

AI, IoT, and automation are improving efficiency, reducing costs, and enhancing dock safety.

3. What are the key trends shaping the docks market in 2024?

Eco-friendly docks, smart automation, and seaport expansion are driving market growth.

4. How is the demand for floating docks changing the market landscape?

Floating docks are rising in demand due to adaptability, durability, and increased maritime transport.

5. What factors influence the future growth of the docks market?

Global trade, port modernization, renewable energy adoption, and smart docking solutions are key drivers.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]