Global District Heating Market Research Report - Segmentation By Heat Source (Coal, Natural Gas, Renewable, Oil & Petroleum Products ), By Power Plant (Boiler Plant, and CHP ), By Application (Residential, Commercial, Industrial ), By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) Industry Forecast 2024 to 2032.

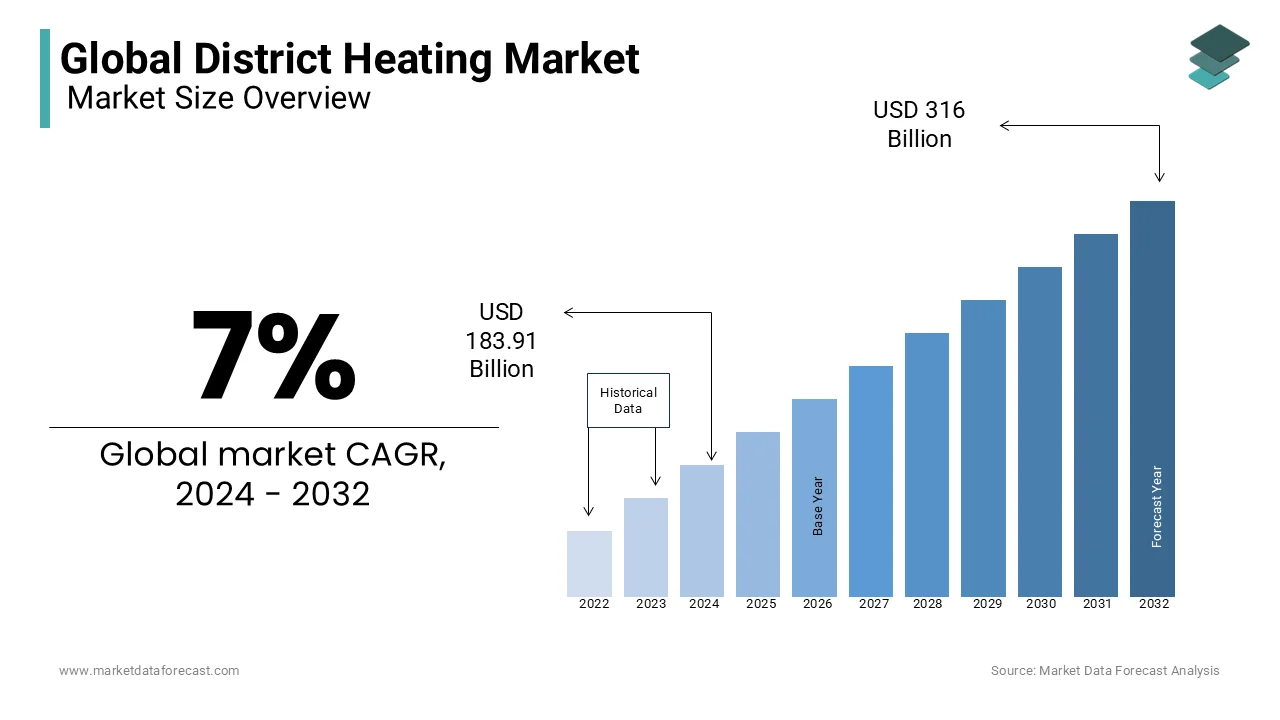

District Heating Market Size (2024-2032):

The global district heating market size was valued at USD 171.88 billion in 2023 and is expected to reach USD 316 billion by 2032 from USD 183.91 in 2024, projected to grow at a CAGR of 7% during the forecast period 2024-2032.

MARKET DRIVERS

The ongoing shift toward urban living and the growing urban population drives the district heating market.

As cities and metropolitan areas continue to expand, the demand for effective heating solutions is on the rise. In this urban landscape, district heating systems shine as a reliable and scalable option to meet heating needs. The growing necessity for efficient heating solutions in urban areas is fuelling the widespread adoption of district heating systems, ensuring warmth and comfort for city people.

The District Heating Market is being driven by a growing emphasis on energy efficiency and sustainability. These systems use a smart, centralized approach to heat generation, often making use of renewable and waste heat sources. This reduces overall energy consumption and greenhouse gas emissions. With the world's increasing concern for the environment and energy conservation, district heating systems are emerging as eco-friendly and efficient solutions for heating needs. Therefore, they are gaining prominence in the heating market and providing a greener and more efficient way to keep homes and cities warm.

MARKET RESTRAINTS

The District Heating Market faces significant restraints due to the substantial initial investment required.

Setting up district heating systems involves building heat generation facilities, laying pipelines, and establishing distribution networks, which can be very expensive. These capital costs can be quite high, which may discourage both government and private sector entities from embracing district heating solutions. The significant upfront expenses act as a barrier and limit the widespread adoption of district heating systems despite their energy efficiency and sustainability benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7% |

|

Segments Covered |

By Heat Source, Plant Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Veolia, Fortum, Vattenfall, Engie, Danfoss, Nordic Heat, Hafslund Eco, Copenhagen Infrastructure Partners, Logstor, Ramboll Group, among others. |

SEGMENTAL ANALYSIS

District Heating Market Analysis By Heat Source

Based on Heat Source Type, Renewable heat sources have taken the lead in the District Heating market due to a growing global focus on sustainability and environmental responsibility. Geothermal, solar, and biomass energy sources are gaining prominence as they offer reduced greenhouse gas emissions and align with efforts to combat climate change. The appeal of these renewable sources is further enhanced by government incentives and subsidies, making them an economically attractive choice for district heating systems. This shift reflects the industry's commitment to reducing carbon footprints and transitioning to cleaner energy options.

Natural gas is a substantial player in the District Heating market, with a second-highest CAGR of 5.5% during the forecast period due to its efficiency and cost-effectiveness. It serves as a dependable heat source and is widely accessible in numerous regions. It offers a cleaner alternative to coal and oil, supporting environmental sustainability. Its dominance stems from its capacity to provide a consistent and stable energy supply across various applications, especially in regions where renewable sources may be less prevalent, ensuring uninterrupted heat supply while minimizing environmental impact.

District Heating Market Analysis By Power Plant

Based on Power Plant Type, Combined Heat and Power (CHP) plants are the dominant force in the District Heating market, with a CAGR of 6.8% during the forecast period, driven by their exceptional energy efficiency and environmental advantages. CHP, or cogeneration, facilities generate both electricity and useful heat from a single energy source. This dual production of power and heat optimizes fuel utilization, minimizing energy wastage. CHP's efficiency leads to reduced greenhouse gas emissions, aligning with global climate change mitigation efforts. Moreover, CHP plants offer reliable, decentralized energy sources suitable for diverse residential, commercial, and industrial applications.

The boiler plants segment is expected to showcase a healthy CAGR during the forecast period due to their versatility, cost-effectiveness, and ease of implementation. These plants are widely used for district heating systems globally, favoured especially in areas with a readily available supply of fuel sources like natural gas, biomass, or coal. Known for their reliability in providing consistent and efficient heat, boiler plants remain a popular choice for district heating applications in residential and commercial settings.

District Heating Market Analysis By Application

Based on Application, Residential applications currently dominate the District Heating market with the highest CAGR of 6.8% during the forecast period due to the consistent demand for heating in cold climate regions. District heating systems offer an efficient and cost-effective solution for providing warmth and hot water to homes. The convenience of central heating, eliminating the need for individual heating systems in each household, makes district heating an attractive choice for residential communities. Furthermore, the growing emphasis on cleaner and more sustainable energy sources in residential areas has fueled the adoption of district heating, aligning with environmental goals.

Commercial applications hold the second biggest segment in the District Heating market during the forecast period. These systems are widely employed in commercial settings, including offices, retail spaces, and institutions. The scalability of district heating systems makes them well-suited to meet the diverse heating requirements of commercial buildings efficiently. Businesses and organizations appreciate the reliability, decreased maintenance demands, and cost savings associated with district heating, making it a favourable choice for maintaining comfortable and energy-efficient environments in commercial structures.

REGIONAL ANALYSIS

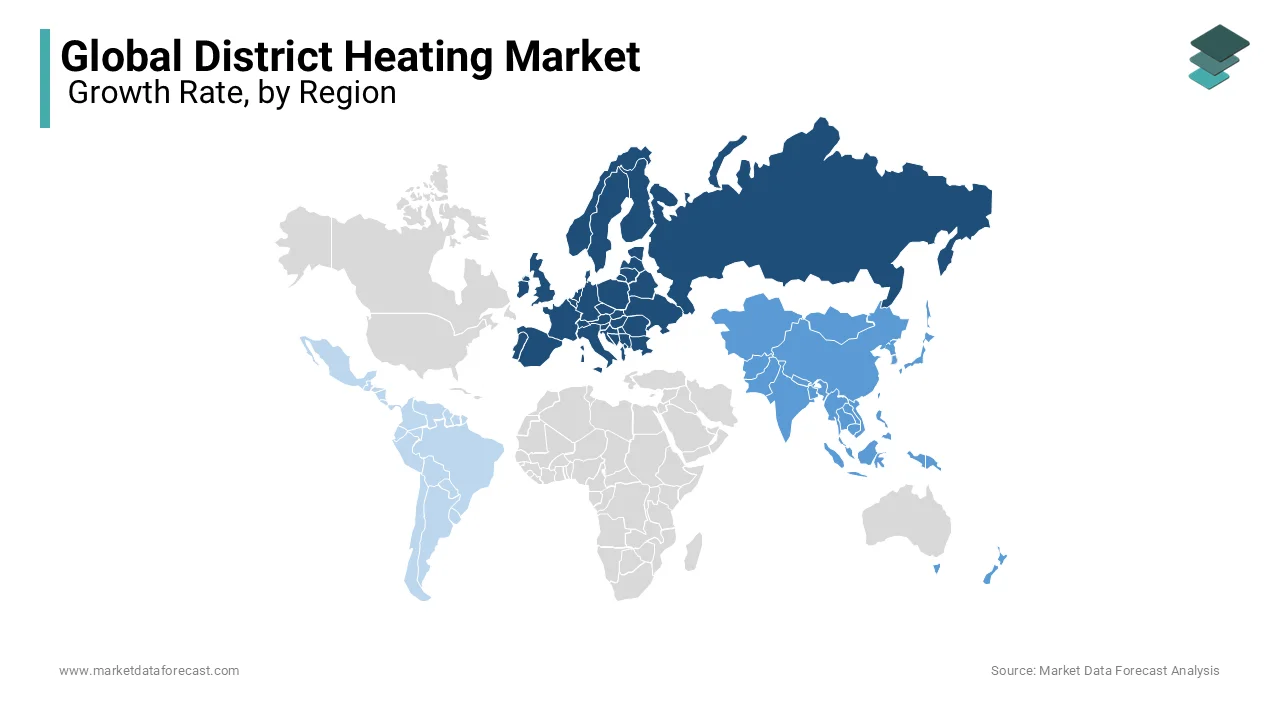

Based on Region, Europe currently leads the District Heating market and holds the largest share of 65% during 2021 due to its extensive experience with district heating systems that have been operational for decades. The European Union's active promotion and funding of sustainable energy initiatives, including district heating, to reduce greenhouse gas emissions and combat climate change have been instrumental. European cities and municipalities have made substantial investments to expand and modernize their district heating networks, improving efficiency and environmental sustainability. The widespread use of combined heat and power (CHP) systems in Europe further strengthens the region's position as a market leader.

Asia-Pacific is positioned second in leading the largest shares of the market due to rapid urbanization, population expansion, and the demand for sustainable energy solutions. This expansion reflects the region's commitment to addressing energy needs while reducing environmental impact and fostering urban development.

North America is an emerging market for district heating, driven by a strong emphasis on reducing greenhouse gas emissions and adopting cleaner energy sources. The region is increasingly exploring district heating systems to address its heating needs more efficiently and sustainably. While still in the early stages of development, North America's district heating market holds significant growth potential as it aligns with the region's environmental and energy efficiency goals, making it a promising sector for future expansion.

The Middle East and Africa are expected to grow in the district heating market due to the warmer climate and different energy priorities. However, in some regions with colder winters, district heating is gaining attention as a means to improve energy efficiency and reduce environmental impact.

Latin America is also showing potential for district heating growth, particularly in countries with colder regions or those with a strong focus on sustainability.

KEY PLAYERS IN THE GLOBAL DISTRICT HEATING MARKET

Companies playing a promising role in the global district heating market include Veolia, Fortum, Vattenfall, Engie, Danfoss, Nordic Heat, Hafslund Eco, Copenhagen Infrastructure Partners, Logstor, and Ramboll Group, among others.

RECENT HAPPENINGS IN THE GLOBAL DISTRICT HEATING MARKET

- In 2022, Danfoss continued to focus on energy-efficient district heating solutions, offering products and services to improve overall system performance and reduce energy consumption.

- In 2022, Fortum expanded its district heating network and invested in technologies for utilizing more renewable and low-carbon energy sources, reducing the environmental impact of district heating.

- In 2023, Veolia worked on increasing the share of renewable and recovered energy sources in district heating and improving the energy efficiency of its systems.

- In 2022, Vattenfall invested in upgrading and expanding district heating systems, offering cleaner and more sustainable heating options to customers.

DETAILED SEGMENTATION OF THE GLOBAL DISTRICT HEATING MARKET INCLUDED IN THIS REPORT

This research report on the global district heating market has been segmented and sub-segmented based on Heat source, power plant, application, and region.

By Heat Source

- Coal

- Natural Gas

- Renewable

- Oil & Petroleum Products

By Power Plant

- Boiler Plant

- CHP

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers for the growth of the district heating market globally?

Key drivers include increased focus on energy efficiency, rising urbanization, supportive government policies for renewable energy integration, technological advancements in heating systems, and growing concerns over climate change.

What are the primary energy sources used in district heating systems worldwide?

Globally, district heating systems use a mix of energy sources, including natural gas, coal, biomass, geothermal energy, solar thermal energy, and industrial waste heat. The transition towards renewable and low-carbon energy sources is a significant trend in the industry.

What role does technology play in the development of the district heating market?

Technology is central to the growth of the district heating market. Innovations like smart grids, energy storage systems, AI for demand forecasting, and advanced metering infrastructure enhance operational efficiency, reduce costs, and improve customer satisfaction.

How are governments supporting the district heating market globally?

Governments support the district heating market through subsidies, tax incentives, and policy frameworks promoting renewable energy and energy efficiency. For example, the EU's Renewable Energy Directive mandates increased renewable energy usage in district heating systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]