Global Distributed Energy Generation Systems Market Size, Share, Trends, & Growth Forecast Report – Segmented By Technology (Solar PV, Combined Heat and Power, Wind Turbines, Piston Engines, Micro Turbines, and Fuel Cells), End-User (Residential, Commercial and Industrial), Application (Off-Grid and On-Grid), & Region - Industry Forecast From 2024 to 2032

Global Distributed Energy Generation Systems Market Size (2024 to 2032)

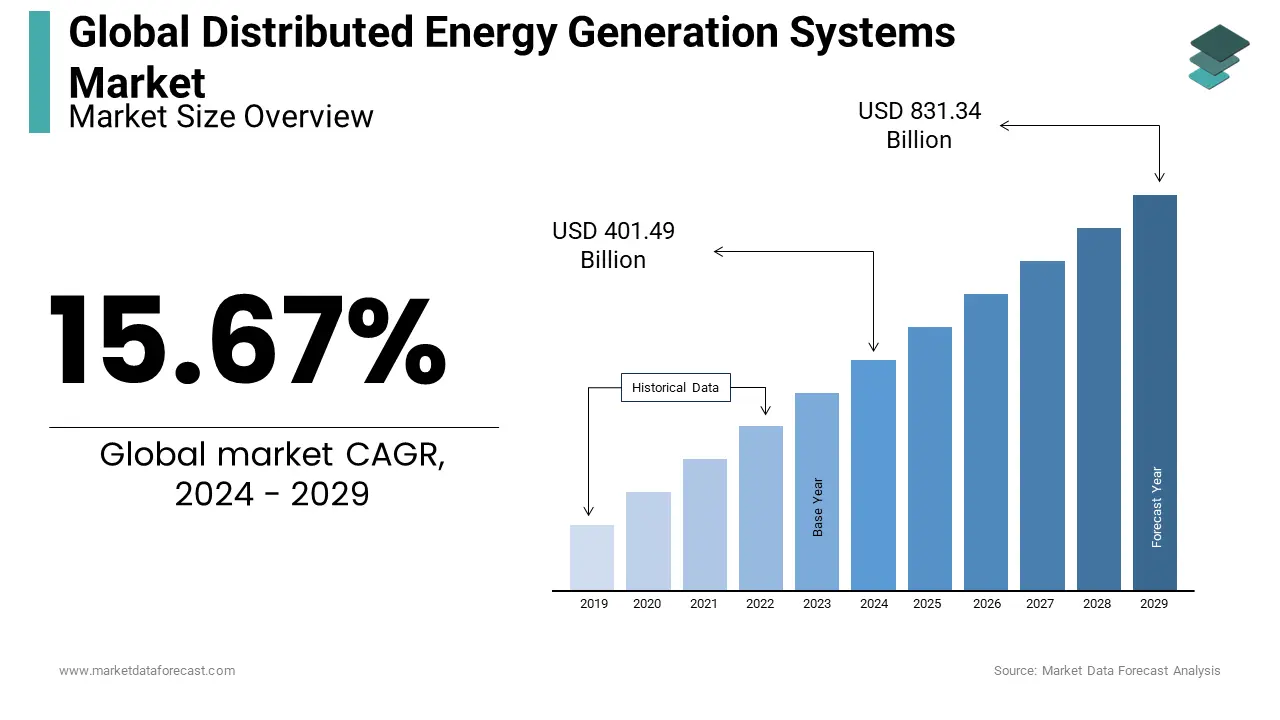

The Global Distributed Energy Generation Systems Market was valued at USD 347.10 billion in 2023 and is estimated to reach USD 1,286.59 billion by 2032 from USD 401.49 billion in 2024 and registering a CAGR of 15.67% during the forecast period.

MARKET SCENARIO

Distributed energy is a term that encompasses a wide range of energy production, storage, monitoring, and control solutions. This includes the combined production of electricity, heat, and power, energy storage (including electric vehicles), and distributed energy management systems. These systems can be tailored to meet specific requirements, including cost reduction, energy efficiency, and security of supply, and reduction of carbon emissions. The dominant trend identified in the globally distributed power generation systems market is to increase investment in microgrids due to the lack of adequate connectivity to microgrids in several countries. Increased awareness of clean energy sources is expected to improve demand for DEG systems. In addition, DEG systems are less expensive than conventional power generation methods. Therefore, it is estimated that the demand for a clean energy source, as well as the economic cost of the product, will have a positive influence on the market growth during the projection period. The current development of regulatory policies in North America has led to the advancement of the entire market. Factors such as improved provincial renewable energy policy in Canada and successful implementation of energy auctions in Mexico are resulting in a higher rate of implementation of DTS technologies in the region. The increasing use of rooftop photovoltaic solar panels for commercial and residential applications is seen as one of the key growth trends in the distributed energy generation systems market.

MARKET DRIVERS

The demand for Distributed energy generation systems is gradually increasing due to factors such as the volatility of crude oil and natural gas prices, growing concerns about energy consumption and greenhouse gas emissions, and network connectivity. Likewise, natural gas prices also fluctuate seasonally, increasing in winter and decreasing in summer.

These fluctuating prices subsequently increased attention toward the adoption of renewable energy sources such as solar, biomass, wind, and hydropower. A shift towards green technologies such as solar, wind, hydropower, and biomass is also expected to drive the growth of the distributed energy generation systems market, as these systems have relatively less impact on the environment. Due to their decentralized operation, these systems reduce carbon emissions to the environment and energy losses in transmission lines.

MARKET RESTRAINTS

The major factors limiting the market for distributed energy generation systems are the reluctance to spend on the respective technologies, as their installation and commissioning require a lot of capital and resources, and a transition to decentralized business models is a time-consuming process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

15.67% |

|

Segments Covered |

By Technology, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens AG, General Electric Company, Schneider Electric, Mitsubishi Motors Corporation, Capstone Turbine Corporation, ABB, MCV Energy, Johnson Controls, NEC Energy Solutions, and Others. |

SEGMENTAL ANALYSIS

Global Distributed Energy Generation Systems Market Analysis By Technology

Wind turbine technology occupies an important part of the market. Photovoltaic solar power is the second largest category in the market and its demand is expected to experience strong growth during the forecast period, owing to falling costs for solar installations, government subsidies, solar power charges, and restrictions on greenhouse gas emissions by various government agencies.

Global Distributed Energy Generation Systems Market Analysis By End-User

Commercial and industrial sectors together have significant participation in both value and volume due to the reuse of accessible resources such as industrial waste and thermal energy. In addition, government initiatives for green solutions, growing demand for reliable energy, and easy availability of energy resources are expected to drive market growth during the outlook period.

Global Distributed Energy Generation Systems Market Analysis By Application

The off-grid segment has experienced a significant growth rate due to increasing energy demand in areas with poorly developed grid connections.

REGIONAL ANALYSIS

Asia-Pacific distributed energy generation systems market led the global business in 2020, accounting for the largest share of over 48%. The region will maintain its dominant position by developing at the fastest CAGR from 2020 to 2025. Growing demand for energy due to population growth coupled with rapid urbanization in countries like India, China, Indonesia, and Malaysia, is likely to be the key market growth factor. The demand for products in China, in particular, is largely met by the country's urban cities. The rise in disposable income in the country is also expected to boost the Chinese market.

North American distributed energy generation systems market is expected to experience significant growth during the foreseen period. The wind turbine has the largest market share in this regional market. However, solar PV is the fastest-growing segment due to falling costs, more widely distributed products under solar rental, and third-party ownership models.

The demand for products in Europe's distributed energy generation systems market is largely served by Germany and Italy. Demand for photovoltaic solar panels and wind turbines is expected to grow rapidly in the regional market due to increasing renewable energy targets and the number of supporting policies established by governments. The European Commission has set a target to reduce GHG emissions by 43% by 2040. Fuel cells are another important technology used in Europe with cogeneration. It offers advantages over a single-fuel generator, and its cost-effective installation increases the demand for cogeneration systems in a variety of applications, including residential buildings, oil and gas production facilities, and other commercial applications.

Middle East America is expected to grow at a significant rate due to the increased adoption of DEG for industrial applications. The solar photovoltaic system market has seen substantial growth, especially in South Africa, due to the growing need for clean energy, which in turn is expected to fuel the MEA distributed energy generation systems market. The availability of solar and wind power in MEA countries, particularly Saudi Arabia and Egypt, is one of the main factors driving various end-use industries to switch to renewable energy sources.

KEY PLAYERS IN THE GLOBAL DISTRIBUTED ENERGY GENERATION SYSTEMS MARKET

Companies prominent in the global distributed energy generation systems market include Siemens AG, General Electric Company, Schneider Electric, Mitsubishi Motors Corporation, Capstone Turbine Corporation, ABB, MCV Energy, Johnson Controls, NEC Energy Solutions, and Others.

RECENT HAPPENINGS IN THE GLOBAL DISTRIBUTED ENERGY GENERATION SYSTEMS MARKET

-

In October 2020, Siemens, Macquarie's GIG Launched Distributed Energy Joint Venture Calibrant Energy to present complete onsite energy-as-a-service solutions at no advance cost.

-

On October 14, 2020, Japan introduced its latest three-year energy policy review, with the rising need to curb the emission of greenhouse gases even as the public remains wary of nuclear power following the Fukushima disaster.

DETAILED SEGMENTATION OF THE GLOBAL DISTRIBUTED ENERGY GENERATION SYSTEMS MARKET INCLUDED IN THIS REPORT

This research report on the global distributed energy generation systems market has been segmented and sub-segmented based on technology, end-user, and region.

By Technology

- Solar PV

- Combined Heat and Power

- Wind Turbines

- Piston Engines

- Micro Turbines

- Fuel Cells

By End-User

- Residential

- Commercial

- Industrial

By Application

- Off-Grid

- On-Grid Network

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Distributed Energy Generation Systems Market growth rate during the projection period?

The Global Distributed Energy Generation Systems Market is expected to grow with a CAGR of 15.67% between 2024-2032.

What can be the total Distributed Energy Generation Systems Market value?

The Global Distributed Energy Generation Systems Market size is expected to reach a revised size of USD 1,286.59 bn by 2032.

Name any three Distributed Energy Generation Systems Market key players?

General Electric Company, Schneider Electric, and Mitsubishi Motors Corporation are the three Distributed Energy Generation Systems Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]