Global Distillers Grains Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report – Segmented By Type (Wet Distillers’ Grains, Dried Distillers’ Grains, and Dried Distillers’ Grains with Solubles), Source (Barley, Corn, Rice, Rye, Sorghum and Wheat), Livestock (Poultry, Swine, and Ruminants), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) – Industry Analysis From 2025 to 2033

Global Distiller’s Grains Market Size

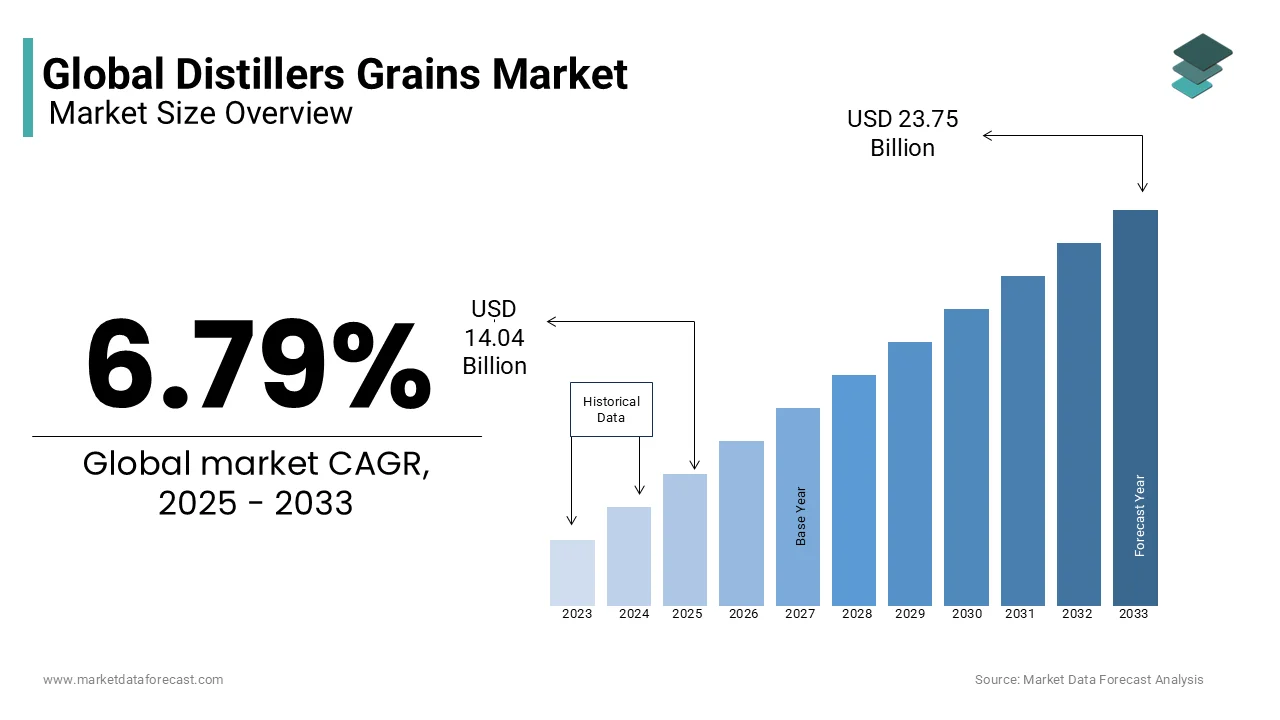

The global distillers’ grains market was valued at USD 13.15 billion in 2024 and is anticipated to reach USD 14.04 billion in 2025 from USD 23.75 billion by 2033, growing at a CAGR of 6.79% during the forecast period from 2025 to 2033.

Distillery grain refers to a by-product of grain from the distillation plant or dry grind ethanol plants in wet and dry form. These are inexpensive alternative ingredients that are produced in large quantities. Distillery grain is an essential diet for livestock and poultry that provides an adequate nutritional source of cereal protein, fat, minerals, vitamins, fiber, oil, and amino acids. The supply of insufficient feed for livestock of insufficient nutritional quality has increased the demand for distillery grains. Continued growth in end-user demand for nutritious food products has boosted the market for distillers grains by replacing expensive traditional foods around the world. Factors such as the increasing popularity of dry distillery grain as a long-lasting product with an essential nutritional supplement for livestock that can be distributed and stored are driving distillery grain sales worldwide. Also, distillery grain is preferred by end users as it is a means of enhancing the physical growth of cattle, providing excellent milking and laying performance as well as ensuring meat quality.

Market Drivers and Restraints

The main drivers of the market for distiller’s grains are the availability of low-cost alternative ingredients for livestock, high-quality nutritious feeds, a source of adequate nutritional value according to animal nutritionists, and the growing concern about feeding cattle on a quality diet among end-users, and rising ethanol distillation units and biofuel plants around the world. Also, since corn-based distillery grains are an important ingredient in ethanol production, demand is increasing rapidly and is expected to drive growth in the global distillers’ grain market during the forecast period. Besides, new product development, collaboration with agribusiness companies, and product penetration through e-commerce are supposed to create significant opportunities for the global distillers’ grain market.

However, the lack of awareness of distillery grains in emerging economies, together with fluctuations in prices, are important factors restricting the growth of the global distillers’ grain market. Additionally, issues related to overconsumption of these grains are a factor that is likely to limit demand and, in turn, hamper the growth of the global distillers’ grain market during the conjecture period.

Impact of COVID-19 on Distillers’ Grains Market

The start of the coronavirus pandemic coincided with the peak harvest season. Even between different segments, the impact varies considerably between different regions and between producers and salaried workers. This impact will reverberate throughout the economy and will last for more than a few months. For crop production, most of the sowing process will be practically unaffected by the summer. Therefore, there would be no impact as such on the availability of seeds at the moment. Due to the disruption of world trade, farmers face shortages of agricultural inputs such as fertilizers and pesticides. In a shorter period, it is to be expected that there will be a shortage. In the longer term, the delivery of fertilizers through international markets could become a problem as some production plants in China have been closed. Agricultural products are mainly perishable in nature, so farmers are forced to keep unsold products for longer. This has led to a reduction in the quality of the feed and an increase in production costs. Different agricultural sectors, such as farming and fishing, have been greatly affected by the pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.79% |

|

Segments Covered |

By Type, Source, Livestock and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Crop Energies AG, Purina Animal Nutrition, Lincolnway Energy, LLC, Greenfield Global, Inc., POET LLC, Tharaldson Ethanol, Central Indiana Ethanol, LLC, Nugen Feeds, Valero, Husky Energy Inc., Flint Hill Resources, Bunge Limited, Didion Milling Inc., United Wisconsin Grain Producers, Green Plains Inc., Pacific Ethanol, Inc., and Archer Daniels Midland Company and Others. |

SEGMENTAL ANALYSIS

Global Distiller’s Grains Market By Type

Wet Distillery grains posted high revenue in 2019 and is poised to grow over the forecast period (2020-2025). The growth is due to its good protein content, high energy and high digestible phosphorus content. Another factor that determines the market is the long shelf life of its shell, which results in minimal risk of spoilage during transport and storage. The market is supposed to grow during the forecast period 2020-2025 due to its use in traditional raw materials and the growth of the organized livestock sector.

Distiller’s Grains Market By Source

The corn segment was at the top in terms of revenue in 2020 and is set to grow during the outlook period (2022 - 2027). The growth of the segment is due to a high content of available phosphorus that provides high energy and high protein content to livestock.

Global Distiller’s Grains Market By Livestock

It was dominated by the ruminant segment in 2017. The growth in demand for quality dairy and meat products has led to the use of distillery grains in ruminant feed, due to their higher protein content than traditional foods such as corn. The poultry segment is estimated to experience the fastest growth during the conjecture period.

REGIONAL ANALYSIS

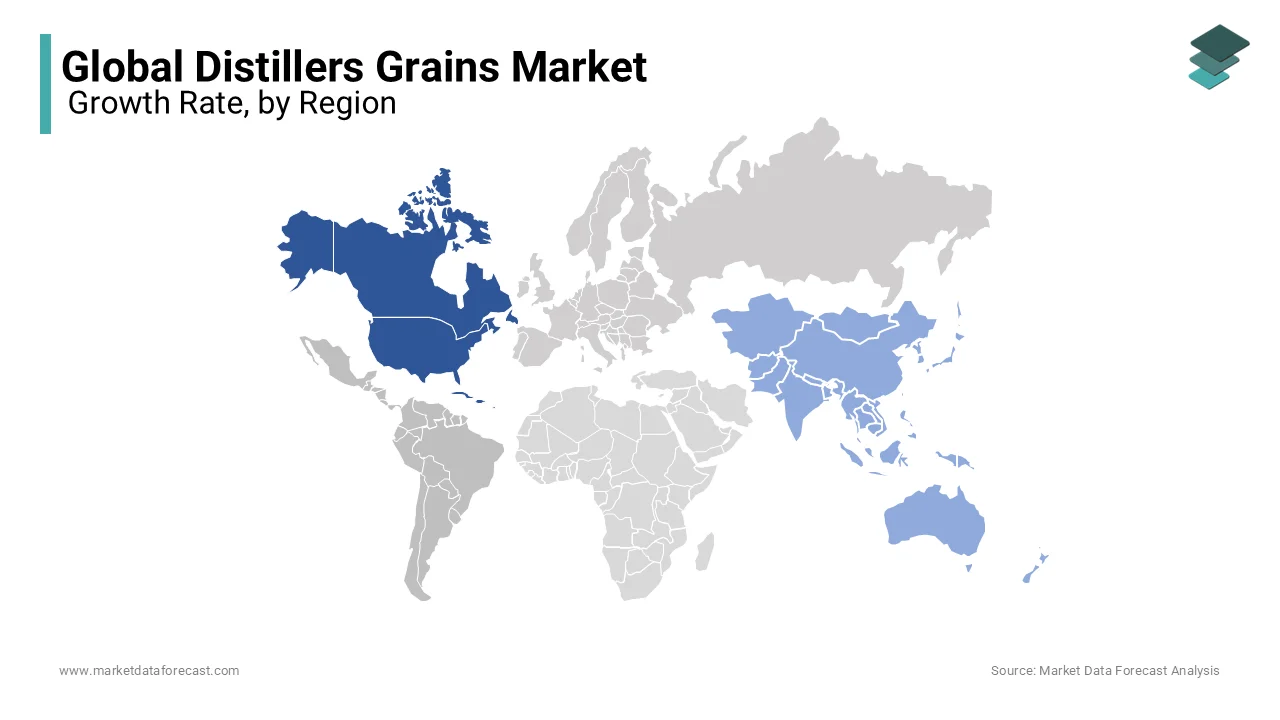

The Distillers’ Grains market has been divided by geography into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa. Currently, the North American market dominates the global market in terms of income due to the high production and consumption of distillery grain and increased government initiatives to facilitate trade in products promoted by the Council of Grains of the States.

The Asia-Pacific region market accounted for the second largest revenue share in the global distillers’ grain market, followed by the markets of Europe, Latin America, and the Middle East and Africa, respectively. The Asia Pacific market is expected to experience the fastest growth in terms of revenue due to the increasing adoption of distillery grains, higher purchasing power, and modernization of machinery equipment, raw materials, and the livestock industry in the countries of the region.

Leading Company

Purina Animal Nutrition had the largest share of the Distillers’ Grains Market in terms of sales revenue in 2019.

KEY MARKET PLAYERS

Key players in the Distillers’ Grains Market include Crop Energies AG, Purina Animal Nutrition, Lincolnway Energy, LLC, Greenfield Global, Inc., POET LLC, Tharaldson Ethanol, Central Indiana Ethanol, LLC, Nugen Feeds, Valero, Husky Energy Inc., Flint Hill Resources, Bunge Limited, Didion Milling Inc., United Wisconsin Grain Producers, Green Plains Inc., Pacific Ethanol, Inc., and Archer Daniels Midland Company.

RECENT HAPPENINGS IN THIS MARKET

- In March 2020, MGP Ingredients, Inc., a leading company in premium distilled spirits and specialty wheat proteins and starches, completed the purchase of New Columbia Distillers LLC.

- In October 2019, ST Equipment & Technology (STET), a division of Titan Group, introduced a "revolutionary" method for grain ethanol plants to generate high-content dry grain Protein (DDG) and Dry Grain and Soluble Co-product (DDGS) using their patented waterless separation technology.

MARKET SEGMENTATION

This research report on the global distillers grains market is segmented and sub-segmented into the following categories.

By Type

- Condensed Soluble Distillery Grains

- Dry Distillery Grains

- And Dry Soluble Distillery Grains

- Modified Wet Distillery Grains And Beans

By Source

- Barley

- Corn

- Rice

- Rye

- Sorghum

- Wheat

By Livestock

- Ruminants, Pigs

- Poultry

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]