Global Display Market Size, Share, Trends & Growth Forecast Report By Display Technology (LCD, OLED ) Panel Size ( Micro displays , Small & medium size panels ) Application ( Smartphone ,Television Sets ) Industry (Healthcare, Consumer Electronics ) and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Display Market Size

The global display market size was valued at USD 158.11 billion in 2024. The lamps market Size is expected to have 8.14 % CAGR from 2025 to 2033 and be worth USD 319.77 billion by 2033 from USD 170.98 billion in 2025.

The display is an ecosystem driven by innovation in visual technology by ranging from traditional liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels to emerging innovations like micro-LEDs and transparent displays. These technologies are integral to devices such as smartphones, televisions, monitors, wearables, automotive dashboards, and even digital signage in public spaces. The display market has evolved beyond mere functionality, with modern consumers demanding high-resolution imagery, energy efficiency, flexible designs, and immersive experiences.

A striking facet of this industry lies in its intersection with human behavior and societal trends. For instance, according to the International Data Corporation, global smartphone shipments exceeded 1.2 billion units in 2022 with the ubiquity of display-centric devices in daily life.. According to the World Health Organization, children aged 5-17 spend an average of three hours per day on screens by reflecting not only technological dependence but also potential health implications tied to prolonged exposure.

As sustainability becomes a growing concern, manufacturers are increasingly focusing on eco-friendly materials and energy-efficient production methods. This shift aligns with broader environmental goals while catering to conscientious consumers who prioritize greener alternatives.

MARKET DRIVERS

Technological Advancements in Display Innovation

The rapid evolution of display technologies serves as a major driver for the display market, fueled by breakthroughs in resolution, flexibility, and energy efficiency. The adoption of 8K resolution displays is gaining momentum, with the Consumer Technology Association noting that 8K TV shipments are projected to reach 1.5 million units globally by 2024. This factor amplifies the growing consumer appetite for superior visual experiences. Additionally, foldable and rollable displays are transforming user interfaces, particularly in smartphones and wearables. According to the International Energy Agency, energy-efficient OLED and micro-LED technologies have reduced power consumption by up to 30% compared to traditional LCDs, appealing to both manufacturers and environmentally conscious buyers. These advancements are further supported by government initiatives promoting research in sustainable electronics, ensuring continuous innovation and market expansion.

Rising Demand for Digital Transformation Across Industries

The increasing integration of digital solutions across sectors such as healthcare, education, and retail significantly propel the display market forward. The market growth is driven by businesses adopting interactive displays for customer engagement. Furthermore, the World Bank reports that e-learning platforms, which rely heavily on high-quality displays, have seen a 20% increase in usage since the pandemic, as educational institutions adopt hybrid learning models. In healthcare, the National Institutes of Health emphasizes that advanced medical monitors and imaging systems have improved diagnostic accuracy by 15% with the displays in enhancing service delivery. This widespread digitalization is the indispensability of display technologies in modern infrastructure.

MARKET RESTRAINTS

Supply Chain Disruptions and Material Scarcity

The display market faces significant challenges due to supply chain vulnerabilities and the scarcity of critical raw materials. According to the U.S. Geological Survey, rare earth elements, essential for manufacturing advanced displays, are concentrated in a few regions, with China controlling over 60% of global production. This geographic concentration increases risks of disruptions, as evidenced by the International Monetary Fund’s report stating that global semiconductor shortages caused a 10% decline in display-related production outputs in 2022. Additionally, geopolitical tensions and export restrictions have further exacerbated material availability. According to the United Nations Conference on Trade and Development, fluctuations in the supply of indium, a key component in touchscreens, have led to price volatility, increasing production costs by up to 25%. These factors collectively hinder the seamless scaling of display technologies by impacting both manufacturers and end-users.

Environmental and Health Concerns

Environmental and health concerns pose another major restraint for the display market regarding electronic waste and hazardous materials. According to the Environmental Protection Agency, e-waste reached 53.6 million metric tons globally in 2019, with only 17.4% being recycled, raising alarms about the sustainability of display production and disposal practices. Furthermore, the World Health Organization warns that prolonged exposure to blue light emitted by screens can disrupt sleep patterns and cause eye strain, affecting over 50% of frequent screen users. Regulatory bodies like the European Union’s REACH initiative have imposed stricter guidelines on the use of hazardous substances such as cadmium and lead in displays, increasing compliance costs for manufacturers. These environmental and health challenges necessitate costly adaptations and innovations by slowing market growth while addressing long-term ecological and societal impacts.

MARKET OPPORTUNITIES

Expansion of Immersive Technologies in Emerging Markets

The growing adoption of immersive technologies, such as augmented reality (AR) and virtual reality (VR), presents a significant opportunity for the display market in emerging economies. According to the International Telecommunication Union, internet penetration in developing countries reached 57% in 2022 by creating a fertile ground for AR and VR applications that rely on advanced displays. According to the United Nations Industrial Development Organization, investments in digital infrastructure in regions like Southeast Asia and Africa have surged by 15% annually by enabling broader access to high-resolution display devices. These technologies are increasingly being utilized in sectors such as education and healthcare, with the World Health Organization noting a 30% rise in the use of VR-based medical training tools globally.

Integration of Displays in Smart City Initiatives

The global trned toward smart city development offers another promising avenue for the display market is ascribed to drive the need for intelligent urban solutions. The United Nations Human Settlements Programme estimates that by 2030, nearly 60% of the world’s population will reside in urban areas, necessitating advanced display systems for traffic management, public safety, and energy monitoring. Furthermore, the U.S. Department of Energy states that smart lighting and digital signage systems, which incorporate energy-efficient displays, can reduce urban energy consumption by up to 20%. Governments worldwide are investing heavily in these initiatives; for instance, the European Commission has allocated over €1 billion to smart city projects in 2023 alone. This trend not only boosts demand for innovative display technologies but also aligns with sustainability goals, fostering long-term market expansion.

MARKET CHALLENGES

Escalating Regulatory Pressures on Energy Efficiency

The display market faces mounting challenges due to stringent regulatory requirements aimed at enhancing energy efficiency and reducing carbon footprints. The International Energy Agency emphasizes that displays account for approximately 10% of global household electricity consumption, prompting governments to enforce stricter energy performance standards. For instance, the European Union’s Ecodesign Directive mandates that all new displays meet specific energy efficiency thresholds by 2025, which has increased compliance costs for manufacturers by an estimated 12%. As per the U.S. Department of Energy, failure to meet these regulations could result in penalties exceeding $20 million annually for non-compliant companies. These evolving standards necessitate significant investments in research and development by creating financial and operational burdens for smaller players in the industry striving to remain competitive.

Health Impacts of Prolonged Screen Exposure

The growing awareness of health risks associated with prolonged screen exposure poses a critical challenge to the display market. According to the World Health Organization, over 60% of adults experience digital eye strain, characterized by symptoms such as headaches and blurred vision, due to excessive screen time. According to the Centers for Disease Control and Prevention, children exposed to screens for more than two hours daily are at a 30% higher risk of developing behavioral issues and sleep disturbances. These concerns have led to increased scrutiny from health authorities, with some governments considering mandatory health warnings on devices. Such measures could impact consumer perception and demand, compelling manufacturers to invest in safer technologies like blue-light-reducing displays, which often come with higher production costs and technical complexities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.14 % |

|

Segments Covered |

By Display Technology, Panel Size, Application, Industry and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Signify (Philips Lighting),OSRAM GmbH.,Herman Miller Inc.,Inter IKEA B.V. |

SEGMENTAL ANALYSIS

By Display Technology Insights

The liquid Crystal Display (LCD) segment dominated the display market with an estimated share of 55.2% in 2024 due to its cost-effectiveness, widespread adoption in televisions, monitors, and smartphones, and mature manufacturing processes. According to the U.S. Department of Commerce, LCD production costs have decreased by 15% over the past five years by making it accessible for mass-market applications. This segment's importance lies in its versatility, supporting resolutions up to 8K while maintaining affordability. LCDs remain critical for industries like education and healthcare, where budget-friendly yet reliable displays are essential.

The micro-LED segment is anticipated to witness a fastest CAGR from 2023 to 2030. This rapid growth is driven by its superior features, including higher brightness, longer lifespan, and energy efficiency compared to traditional technologies. According to the International Energy Agency, Micro-LEDs consume 40% less energy than OLEDs, appealing to eco-conscious consumers. Their application in next-generation wearables, automotive displays, and augmented reality devices further accelerates demand. Additionally, advancements in production scalability, supported by government-funded R&D initiatives, reduce costs by enabling broader adoption. As industries prioritize immersive and sustainable solutions, Micro-LEDs are poised to redefine high-end display standards globally.

By Panel Size Insights

The small and medium-size panels dominated the display market and held 60.4% of share in 2024. This segment includes displays for smartphones, tablets, and automotive dashboards, with global smartphone penetration exceeding 85% in developed regions, as reported by the United Nations Conference on Trade and Development. The ubiquity of mobile devices drives demand, making this segment critical for consumer electronics. Its importance lies in its versatility and high production volumes by enabling economies of scale. Additionally, advancements like foldable screens further solidify its dominance.

The microdisplays segment is likely to experience a CAGR of 25% from 2025 to 2033. This growth is fueled by rising adoption in AR/VR headsets and wearable devices, where compact, high-resolution displays are essential. According to the World Health Organization, over 150 million people use wearable health monitors by driving demand for microdisplays. According to the International Telecommunication Union, global investments in AR/VR technologies reached $18 billion in 2022 with expanding role in gaming, training, and remote work. Microdisplays' ability to deliver immersive experiences ensures their rapid expansion and significance in shaping futuristic applications.

By Application Insights

The smartphones dominated the display market with 45.6% of the total share in 2024 owing to the global proliferation of mobile devices, with smartphone subscriptions exceeding 8.3 billion in 2023. The importance of this segment lies in its role as a primary interface for digital consumption, driving demand for high-resolution, energy-efficient displays. According to the United Nations Conference on Trade and Development, mobile internet usage accounts for 55% of global web traffic with smartphones' centrality in modern connectivity.

The augmented reality (AR) and virtual reality (VR) segment is anticipated to witness a CAGR of 37.5% in the foreseen years. This rapid expansion is fueled by increasing adoption across industries such as gaming, healthcare, and education. According to the World Health Organization, VR-based medical training has grown by 40% annually by enhancing precision in surgeries and reducing errors. Additionally, the International Data Corporation projects that AR/VR headset shipments will surpass 50 million units by 2025, that is driven by advancements in display technologies like micro-LEDs. These immersive technologies are transforming user experiences by making AR/VR a critical area of innovation and investment in the display market.

By Industry Insights

The consumer electronics segment dominated the display market with 45.6% of share in 2024. This dominance is driven by the ubiquity of smartphones, tablets, and televisions, with global smartphone penetration exceeding 85% in developed regions, according to the United Nations Conference on Trade and Development. The segment's importance lies in its role as a primary interface for digital content consumption, supported by innovations like OLED and 8K displays. With over 1.2 billion smartphones shipped annually, as per the World Intellectual Property Organization, consumer electronics remain pivotal in shaping display technologies and driving mass adoption.

The automotive segment is projected to witness a CAGR of 14.3% from 2025 to 2033. This growth is fueled by the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely heavily on high-resolution dashboards and infotainment systems. The U.S. Department of Transportation states that EV sales surged by over 60% in 2022 by increasing demand for innovative in-vehicle displays. Additionally, the World Health Organization emphasizes the role of heads-up displays (HUDs) in enhancing road safety by reducing accidents by up to 15%. The automotive displays are becoming integral to modern vehicles by ensuring rapid expansion and technological advancements in this segment.

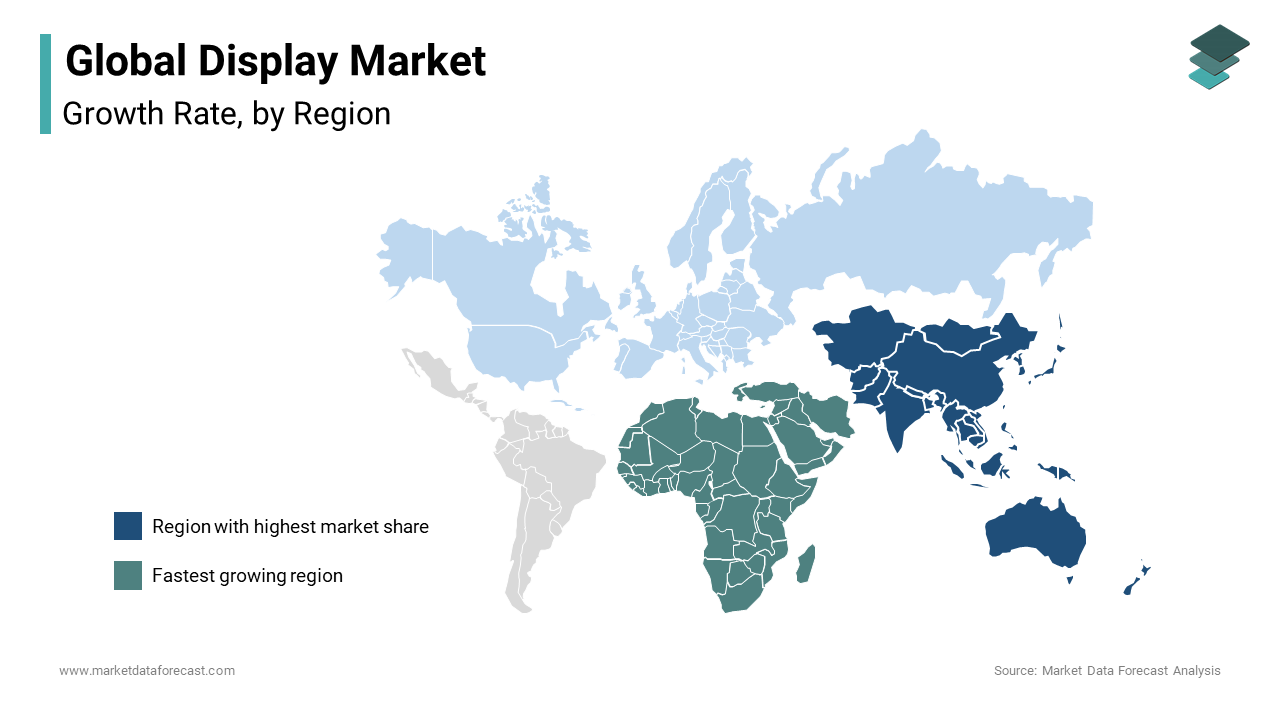

REGIONAL ANALYSIS

Asia-Pacific was the top performer in the global display market with 45.6% of global revenue in 2024 with the robust manufacturing hubs in countries like China, South Korea, and Japan, which collectively produce over 70% of the world’s display panels. According to the United Nations Industrial Development Organization, Asia-Pacific’s consumer electronics demand is unparalleled, with smartphone penetration exceeding 90% in urban areas. Additionally, government initiatives promoting smart cities and digital infrastructure have further bolstered growth.

The Middle East and Africa region is likely to exhibit a CAGR of 12.8% from 2025 to 2033. This growth is fueled by rapid urbanization, with the United Nations projecting a 40% increase in urban populations by 2035 with the demand for digital signage and consumer electronics. Investments in smart city projects, such as Saudi Arabia’s NEOM initiative, are expected to exceed $500 billion by 2030, as reported by the World Economic Forum. Furthermore, rising internet penetration, currently at 43% in Africa, as per the International Telecommunication Union, is accelerating adoption of display-centric devices.

North America and Europe are expected to maintain steady growth with the technological innovation and sustainability initiatives. The U.S. Department of Energy predicts a 10% annual increase in energy-efficient displays by 2025. Latin America shows moderate growth, with smartphone adoption projected to reach 75% by 2026, according to the Inter-American Development Bank. Meanwhile, the Middle East benefits from diversification strategies like Vision 2030, while Africa’s expanding middle class will fuel demand.

Top 3 Players in the market

BOE Technology Group Co., Ltd.

BOE Technology Group, headquartered in China, is the largest player in the global display market, commanding approximately 25% of the market share as per reports from the International Trade Administration. The company specializes in TFT-LCD and AMOLED technologies, supplying panels for smartphones, televisions, and automotive displays. BOE’s dominance is due to its aggressive investments in next-generation technologies, including flexible and foldable displays, which account for over 30% of its annual R&D expenditure. The U.S. Department of Commerce escalates that BOE produces over 150 million display panels annually, making it a critical supplier to brands like Apple and Huawei. Its dominance underscores its pivotal role in shaping the industry's technological trajectory.

Samsung Electronics Co., Ltd.

Samsung Electronics, based in South Korea, holds an estimated 20% share of the global display market, according to the Korean Intellectual Property Office. Renowned for its OLED and QLED innovations, Samsung leads in premium display segments, particularly for high-end smartphones and TVs. The company controls over 80% of the global OLED market, as noted by the World Intellectual Property Organization. Samsung’s commitment to sustainability is evident in its development of eco-friendly panels, reducing energy consumption by 15%. Additionally, its partnerships with global tech giants ensure consistent demand, reinforcing its position as a key innovator and supplier in the display ecosystem.

Innolux Corporation

Innolux Corporation, a Taiwan-based leader, accounts for approximately 12% of the global display market, as reported by the Taiwan External Trade Development Council. The company excels in manufacturing LCD panels for consumer electronics, including monitors, laptops, and TVs. Innolux’s strategic focus on industrial and automotive displays has positioned it as a major supplier to brands like Dell and BMW. According to the United Nations Industrial Development Organization, Innolux’s production capacity exceeds 40 million units annually, supported by advanced manufacturing facilities. Its emphasis on cost efficiency and technological upgrades ensures steady contributions to the global display market, maintaining its status as a key player.

Top strategies used by the key market participants

Investment in Research and Development (R&D)

Key players in the display market heavily invest in research and development to maintain their competitive edge and drive innovation. Companies like Samsung Electronics and BOE Technology Group allocate significant resources to develop next-generation technologies, including micro-LED, foldable OLEDs, and energy-efficient panels. According to the Korean Intellectual Property Office, Samsung alone files over 5,000 patents annually, ensuring its dominance in premium display segments. LG Display focuses on pioneering advancements such as transparent and rollable displays, which cater to futuristic applications like smart homes and augmented reality devices. These R&D efforts not only enhance product performance but also enable companies to meet evolving consumer demands for higher resolution, flexibility, and sustainability.

Vertical Integration

Vertical integration is another critical strategy adopted by major players to streamline operations and reduce dependency on external suppliers. Firms like LG Display and AUO Corporation have established partnerships with suppliers of raw materials such as glass, semiconductors, and rare earth elements, ensuring a steady and cost-effective supply chain. By controlling the entire production process, from sourcing materials to manufacturing finished products, these companies can significantly lower production costs and improve efficiency. This strategy also enables them to respond more swiftly to market demands and technological shifts, giving them a competitive advantage in an industry where cost management and scalability are crucial.

Strategic Partnerships and Joint Ventures

To expand their market reach and tap into new opportunities, key players often engage in strategic partnerships and joint ventures. For instance, Japan Display Inc. collaborates with automotive manufacturers to develop custom display solutions for vehicles, capitalizing on the growing demand for advanced in-car infotainment systems. Similarly, BOE Technology Group has partnered with global tech giants like Apple and Huawei to supply high-quality display panels. These collaborations allow companies to leverage each other’s expertise, access new markets, and diversify their product portfolios, ensuring sustained growth and relevance in an increasingly competitive landscape.

Adoption of Eco-Friendly Manufacturing Practices

As environmental concerns gain prominence, leading display manufacturers are adopting sustainable practices to align with global regulations and consumer expectations. Panasonic Corporation, for example, has introduced recycling programs for rare earth materials, reducing environmental impact while enhancing brand reputation. According to the International Energy Agency, energy-efficient OLED and micro-LED technologies developed by companies like LG Display have reduced power consumption by up to 30% compared to traditional LCDs. By prioritizing eco-friendly innovations, these companies not only address sustainability challenges but also position themselves as responsible industry leaders, appealing to environmentally conscious consumers and governments.

Focus on Price Competitiveness

Price competitiveness remains a key strategy, particularly for Chinese firms like BOE Technology Group, which leverage economies of scale to offer cost-effective solutions. By producing high volumes at lower costs, these companies can capture emerging markets and compete aggressively with established players. This strategy is especially effective in regions like Asia-Pacific and Latin America, where affordability is a significant factor for consumers. Additionally, offering competitively priced products allows these firms to secure long-term contracts with global brands, further strengthening their foothold in the global display market.

Diversification into Niche Applications

To differentiate themselves and address specialized demands, companies are increasingly diversifying their product portfolios by targeting niche applications. For example, medical-grade displays for diagnostic imaging and augmented reality headsets for industrial training are becoming key focus areas. These high-value segments offer lucrative growth opportunities due to their specific requirements and limited competition. By catering to industries like healthcare, aerospace, and education, companies can unlock new revenue streams while showcasing their technological capabilities, ensuring resilience in a rapidly evolving market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global display market are BOE Technology Group Co., Ltd. (U.S.),Samsung Electronics Co., Ltd. (Germany),Innolux Corporation (Taiwan),Panasonic Corporation (Japan),Japan Display Inc. (U.S.),Sony Corporation (Japan),AUO Corporation (U.S.),Sharp Corporation (U.S.),NEC Corporation (U.S.),Neyard Optoelectronic Co., Ltd. (U.S.)

The display market is characterized by intense competition, driven by rapid technological advancements and the presence of both established giants and emerging players. The industry is highly consolidated, with key players like BOE Technology Group, Samsung Electronics, and LG Display dominating the landscape. These companies leverage their extensive R&D capabilities and economies of scale to maintain its dominance in high-end segments such as OLED and micro-LED technologies. According to the International Trade Administration, the top five companies account for nearly 70% of global production, underscoring the market's oligopolistic nature.

However, regional players from Taiwan, Japan, and China, such as Innolux Corporation and Japan Display Inc., also contribute significantly by focusing on niche markets like automotive displays and industrial applications. The competitive dynamics are further intensified by government support in regions like Asia-Pacific, where subsidies and incentives promote local manufacturing. According to the Korean Intellectual Property Office, South Korea and China invest heavily in patents, with over 50,000 display-related patents filed annually. This innovation race ensures continuous evolution but also increases pressure on smaller firms to differentiate themselves. Additionally, sustainability and energy efficiency have emerged as critical competitive factors, with companies striving to meet stringent environmental regulations. The World Economic Forum notes that eco-friendly displays are becoming a key differentiator, driving investments in green technologies. Overall, the display market’s competitive environment is shaped by technological prowess, strategic partnerships, and adaptability to shifting consumer demands, ensuring a dynamic yet challenging landscape for all participants.

RECENT HAPPENINGS IN THE MARKET

In February 2022, BOE Technology Group Co., Ltd. announced the development of a 27-inch monitor with a 500Hz refresh rate, the world's fastest at the time. This innovation targeted the gaming display market, reinforcing BOE’s dominance in high-performance display solutions.

MARKET SEGMENTATION

This research report on the Display Market has been segmented and sub-segmented into the following categories.

By Display Technology

- LCD

- OLED

- Micro-LED

- Direct-view LED

- Near-Eye Display

- Others

By Panel Size

- Microdisplays

- Small & medium size panels

- Large Panels

By Application

- Smartphones

- Television Sets

- Monitors & Laptops

- Smart Wearables

- Augmented Reality & virtual Reality

- Others

By Industry

- Healthcare

- Consumer Electronics

- BFSI

- Retail

- Automotive

- Military & Defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which regions dominate the Display Market?

Asia-Pacific, led by China, South Korea, and Japan, dominates due to strong manufacturing and innovation.

What is the future trend in display technology?

Advancements in foldable, transparent, and MicroLED displays are shaping the future.

What is the impact of OLED on the market?

OLED is revolutionizing the market with better contrast, flexibility, and energy efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]