Global Digital Utility Market Size, Share, Trends, & Growth Forecast Report – Segmented By Technology (Hardware and Integrated Solutions), Network (Transmission and Distribution, Generation and Retail), & Region - Industry Forecast From 2024 to 2032

Global Digital Utility Market Size (2024 to 2032)

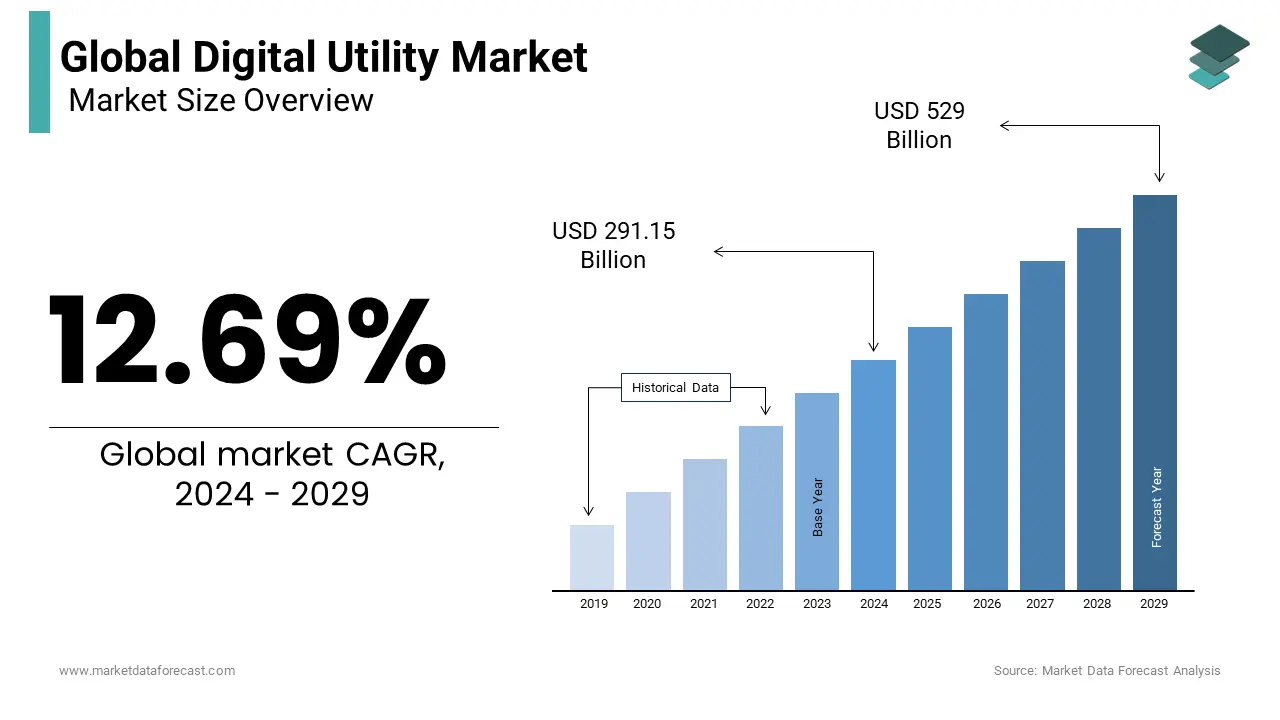

The Global Digital Utility Market was estimated at USD 258 billion in 2023 and is projected to reach a valuation of USD 757.18 billion by 2032 from USD 291.15 billion in 2024. It is predicted to register a CAGR of 12.69% during the forecast period.

MARKET SCENARIO

The use of digital ways of working in the utility industry, usually with business aims for utilities to reinvent, is known as digital utility. More simplified operations, improved client interactions, more efficiencies, and the prospect of initiating new company models are all common corporate aims. Investing in the cloud, big data, mobile, wearables, upgrading the grid with communication infrastructure, sensors, automation, IT/IoT integration, artificial intelligence, and integrated operation centres are just a few examples of today's initiatives.

In the power generation, transmission, and distribution industries, digital devices are quickly being used to improve plant productivity, reliability, and protection. Smart grids, sensors, and smart meters are digital systems that provide a more exact and real-time account of power use to businesses and consumers. These technologies help to improve the productivity, performance, safety, enforcement, and reliability of power generation and distribution systems. As a result, asset management, preparation, and execution are improved, as well as quality and customer satisfaction.

MARKET GROWTH

Technological improvements are making businesses, particularly the electricity industry, more digital. The importance of digital technology is becoming increasingly apparent in the power industry, and it is expected to boost the market throughout the forecast period. Companies have realized the advantages of digitalization and are now focusing on two major areas: customer interaction and improving operations and productivity, revolutionizing the way the power industry does business.

MARKET DRIVERS

The market for digital power utilities is being driven by the growth of the renewable energy sector and the integration of renewables.

Several countries' change from traditional power-focused policies to renewable-focused policies has resulted in a large increase in renewable energy's proportion of the digital power utility market. The rapid adoption of digital platforms is the next great revolution in the power sector, and the renewable energy sector is an early adopter of this technology. Market Growth is Boosted by Increased Transmission and Distribution (T&D) Use To improve plant productivity, dependability, and protection, digital devices are increasingly being used in the power generating, transmission, and distribution industries.

MARKET RESTRAINTS

Key industry actors are projected to face challenges due to the requirement for a huge injection of capital.

Electric utilities are expected to spend USD 3.2 trillion on new and replacement transmission and distribution infrastructure around the world. The digital transformation or upgrade of existing infrastructure would necessitate a significant investment, which would stymie the market. However, the expansion of the digital power utility industry is supported by the transformation of existing infrastructures and increases in the efficiency of electricity distribution systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

12.69% |

|

Segments Covered |

By Technology, Network, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Microsoft Corporation, Siemens AG, General Electric, IBM, Oracle Corporation, SAP SE, Schneider Electric SE, ABB LTD, Eaton Corporation, Capgemini, and Others. |

SEGMENTAL ANALYSIS

Global Digital Utility Market Analysis By Technology

The Global Digital Utility Market has been divided into Hardware and Integrated Solutions based on technology. In the digital utility market, hardware had the biggest market share. The usage of hardware in next-generation equipment, such as smart meters and transformers, is a crucial element driving up demand for the market. As demand for traditional metering systems declines and more people turn to digital technologies and smart meters, hardware demand is expected to rise. The digital utility market is expected to develop at the fastest CAGR throughout the forecast period, according to Integrated Solutions.

Global Digital Utility Market Analysis By Network

The market is divided into Transmission and distribution, Generation, and Retail based on Network. In the global Digital Utility market, Transmission and Distribution held the biggest market share. New digital devices, communications, and control systems increase asset efficiency and enable operators to monitor and manage electric transmission and distribution systems efficiently. Because of the growing necessity of monitoring and managing electric transmission and distribution networks, transmission and distribution solutions are widely used across the utility business.

REGIONAL ANALYSIS

Over the projected period, North America is expected to retain the biggest market share in the Digital Utility market. This is due to increased internet penetration and the increased use of many sorts of technology in the United States, such as smart sensors, meters, transformers, and other advanced digital technologies. One of the key causes driving utilities to reform their business, operations, and information models in North America is digital transformation. Furthermore, the North American power utility business is extremely competitive, therefore any value enhancement and improvement in existing services are quite important to customers.

Electricity is not available in some remote and rural areas of Asia-Pacific countries due to insufficient transmission and distribution (T&D) networks. The countries in the region are substantially investing in the construction of a transmission line network to supply electricity to these areas. Increased demand for power in the industrial and commercial sectors helped China become the largest market for power sector investment. In addition, China's power transmission and distribution grid has been undergoing massive improvements and modifications in order to enable it to transport more electricity and meet future demand. India has had the fastest growth in energy investment in recent years, with renewable spending continuing to outpace fossil fuel-based power generation, aided by the tendering of solar PV and wind projects. During the projected period, this is expected to drive the digital power utility market.

Germany and France are the major countries in Europe that will witness the growth of the Digital Utility Market during the forecast period.

The Middle East and Africa industry outlook will be bullish during the assessment year, owing to investments in augmented data analytics and integrated distributed energy resources (iDER). To tap profitable markets, key industry companies might invest in smart grids and artificial intelligence in the UAE, Saudi Arabia, and South Africa.

KEY PLAYERS IN THE GLOBAL DIGITAL UTILITY MARKET

Companies playing a prominent role in the global digital utility market include Microsoft Corporation, Siemens AG, General Electric, IBM, Oracle Corporation, SAP SE, Schneider Electric SE, ABB LTD, Eaton Corporation, Capgemini, and Others.

RECENT HAPPENINGS IN THE GLOBAL DIGITAL UTILITY MARKET

- Avande successfully acquired QUANTIQ, a Microsoft Business Applications provider.

- QUANTIQ will considerably enhance Avanade's Dynamics 365 capabilities and build on its existing cloud-based Microsoft Business Application services, with a focus on Dynamics 365, Power Platform, and Azure — a key goal for Avanade. Clients will benefit from enhanced solutions that will assist in speeding digital transformation across all industry sectors internationally, thanks to the combination of QUANTIQ's ERP customer experience and Avanade's offshore engineering capabilities and broad expertise across the Microsoft platform. Approximately 300 additional specialists will join Avanade's current Business Applications team as a result of the acquisition.

DETAILED SEGMENTATION OF THE GLOBAL DIGITAL UTILITY MARKET INCLUDED IN THIS REPORT

This research report on the global digital utility market has been segmented and sub-segmented based on technology, network, and region.

By Technology

- Hardware

- Integrated Solutions

By Network

- Transmission and Distribution

- Generation

- Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the definition of digital utility?

Digital Utility Solutions are built using a mix of real-world, project-tested services and leveraging software that is spatially enabled and highly flexible.

What are the main factors that are propelling the Digital Utility Market forward?

A crucial factor driving the growth of the Digital Utility market is the growing number of distributed and renewable power generation projects.

What segments does the Digital Utility Market cover?

Technology, Network, and Geographic Scope are the three segments that make up the Global Digital Utility Market.

Which region has the highest proportion of the market for digital power utilities?

The Asia-Pacific region has the largest share in the Digital Utility Market.

What will the value of the global Digital Utility Market being the future?

The market is expected to reach a valuation of USD 757.18 billion by 2032.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]