Global Digital Transformation Market in Oil and Gas Industry Market Size, Share, Trends, & Growth Forecast Report by Technology (Big Data/Analytics and Cloud Computing, Internet of Things (IoT), Artificial Intelligence, Industrial Control Systems, Extended Reality and Field Devices), Sector (Upstream, Midstream, Downstream), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Digital Transformation Market in Oil and Gas Industry Market Size

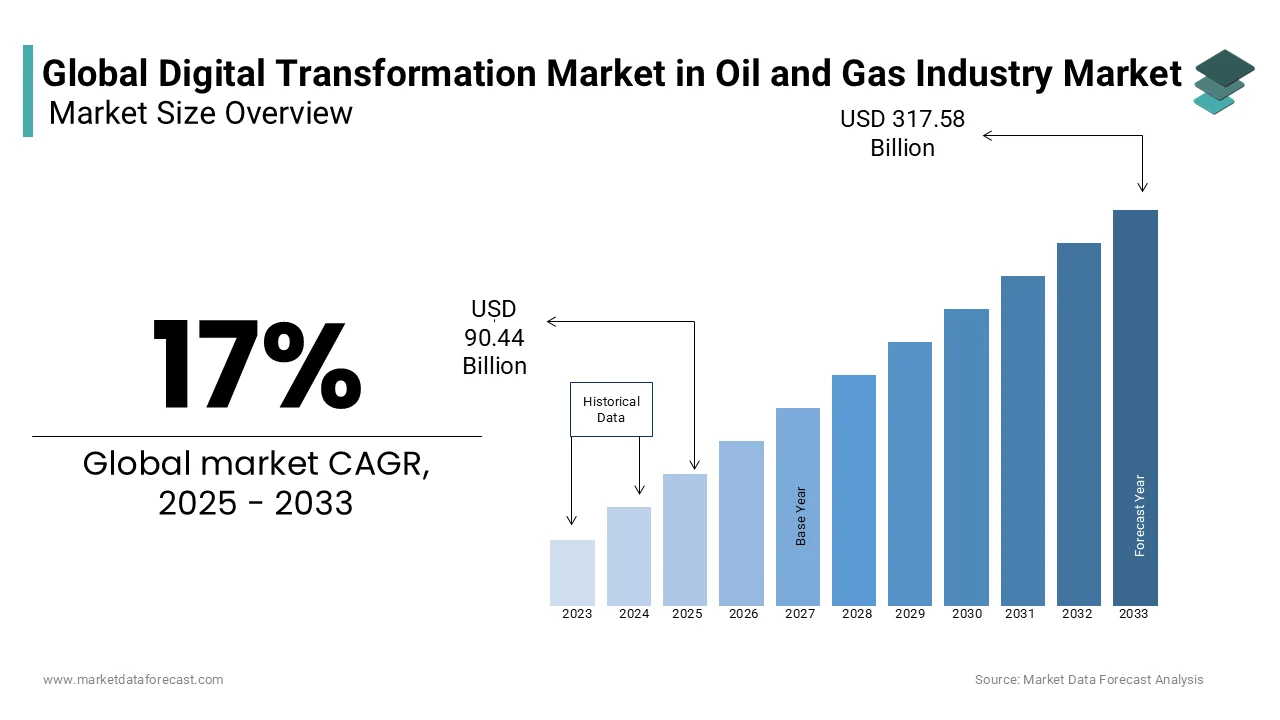

The global digital transformation in the oil and gas market was worth USD 77.30 billion in 2024. The global market is predicted to reach USD 90.44 billion in 2025 and USD 317.58 billion by 2033, growing at a CAGR of 17% during the forecast period 2025 to 2033.

Digital transformation harnesses current and emerging digital technologies for tangible, game-changing benefits across all application fields. The fourth industrial revolution technologies are reshaping the market. Oil and gas companies are employing digital solutions to fulfill global energy requirements, simultaneously reducing carbon emissions, improving energy efficiency, saving water, and building next-generation materials for making lighter and stronger consumer products.

Digital transformation has been one of the main trends in the global oil and gas industry for the past decade. This transformation enables operations to use advanced digital technologies such as AI, IoT, Big Data, etc., to stimulate business. Efficiency and, therefore, new opportunities for everything, as this could involve digital twins. It improves the efficiency of predictive maintenance of critical assets and, therefore, limits the exposure of hazardous tasks to facility workers.

- For instance, the Uthmaniyah Gas Plant of Aramco, one of the giant gas processing plants worldwide, utilizes AI solutions to enhance productivity while improving the dependability of its facilities. The application of wearable technologies and drones at the plant site to examine machinery and pipelines has helped lower the inspection period by 90%.

Moreover, the process of exploring an oilfield is complex because it requires the analysis of large volumes of data, such as environmental data, equipment data, and seismic data, to detect new oil and gas reserves. This pushes oil and gas industry providers to implement novel technologies like big data and AI. Given the ecological concerns and expenses related to exploration, they adopt real-time decisions with ML and predictive analytics. This is supposed to optimize exploration and production operations in the oil & gas sector. Hence, the increasing need for advanced technologies will lead to the expansion of the global oil and gas industry digital transformation market during the forecast period.

MARKET DRIVERS

Digital transformation is one of the main innovations that drive downstream operations in the oil and gas industry.

Companies are focused on increasing the use of assets by improving the efficiency of factory manufacturing. Oil and gas companies' downstream activities, such as petrochemical and refining, have always adopted technology to improve their operations. Several innovative approaches have been implemented to manage complex processes and interpret information to enhance performance. The pursuit of the digital switchover is expected to have even more significant potential, given the strategic will of many companies to expand their activities down the oil and gas value chain, particularly in petrochemicals.

Factors such as creating a safe working environment throughout the entire value chain will play an essential role in the IoT segment and help it maintain its position in the market. Additionally, our global oil and gas industry digital transformation market examines factors such as increased investments and partnerships, increasing pressure to improve operational efficiencies, and the growing need for advanced technologies in business exploration.

The main concern of suppliers is how to predict, prevent, or reduce maintenance costs. The automation solutions for delivery and maintenance planning tools use AI-based simulation and application performance management and can be easily added to an existing operating system. Additionally, upgrading sensor systems for better predictive and prescriptive maintenance can lead to long-term operational efficiency gains. Many oil and gas companies rely on technologies such as AI, IoT, and Big Data, among others, to improve their operations. For example, Shell's downstream business, responsible for supplying oil and gas to the end consumer, uses artificial intelligence technology to predict consumer demand for petroleum products and measure fuel shortages. Find and recommend an oil blend for a refining process.

Reserve replacement is one of the challenges encountered by the oil and gas industry, and the use of intelligent digital technologies can bridge the supply gap. This contributes to the growth of the market. Oil reserves are being used faster than they are refilled.

- As per Rystad Energy, discovered quantities have reached historic low levels, and the reserve replacement ratio (RRR) is 16 per cent. This means that only 1 barrel is replenished for nearly every 6 barrels produced.

Sufficient reserve replacement is increasingly essential because global energy and fuel demand is estimated to rise during the upcoming 10 to 20 years. To restore reserves, operators are using multiple approaches, one of them being infrastructure-led exploration (ILX) through new technologies. ILX approach uses existing infrastructure to direct exploration in regions of close-by producing fields or reserves. Hence, it is expected to fuel the market growth.

MARKET RESTRAINTS

Increasing Data Quality and Management Issues

However, the need for a trained workforce, the growing threat of cyberattacks, and increasing data quality and management issues can hamper the growth of the digital transformation in the oil and gas market in the foreseen period. The biggest hurdle in the adoption and operational effectiveness of digital technologies is cybersecurity, including ransomware attacks, industry espionage, and data breaches. The threat of these attacks against this industry has remained consistently higher because of the critical and strategic nature of activities, technological complexities, and geo-economic significance. In addition, with the rise of Large Language Models (LLMs) and artificial intelligence, this market's threat to IoT and operational technologies (OT) systems is at an all-time high.

- According to a study published in World Oil, only half, i.e., 52%, of oil and gas experts, believe their organization invests adequately in creating the cybersecurity defense of operational infrastructure and assets.

Malicious entities, with the help of vicious payloads, are attacking onshore and offshore assets, refineries, substations, and pipelines. Another factor derailing the market growth is data management. The biggest issue is the integration of legacy systems with advanced data analytics. This results in data silos, impeding the optimization of operations and effective decision-making.

MARKET OPPORTUNITIES

AI-Powered Safety Management

AI-powered safety management is expected to significantly elevate the digital transformation market in the oil and gas market. It enables the review of large amounts of data on previously occurring incidents. This will keep the workforce safe in extremely vital and hazardous activities. These insights get integrated into continuously self-improving algorithms. Also, companies in this market are progressively incorporating AI and Gen AI to maximize activities and drive productivity through live insights and data. AI tools are being incorporated over the value chain, indicating a substantial transition in the market.

- For instance, Vedanta's oil and gas division, Cairn, employs an AI-driven process for digital twins of offshore and gas facilities, resulting in around a 30% decrease in flaring and an 18% optimization in fuel gas. It uses machine learning (ML) and AI to minimize machine idle time, like hydraulic rod pumps, and maintain upward oil production levels.

Moreover, adopting blockchain supply chain management will considerably benefit market operations. This industry contains extensive networks of equipment transportation, trading, and sourcing. Monitoring these complicated transactions can be difficult. Disconnected spreadsheets, paper agreements, and obsolete databases each possess unique puzzle elements. Blockchain ledgers are revolutionizing that. Therefore, AI and blockchain are projected to accelerate the market expansion.

- Saudi Aramco announced that it will invest 5 million dollars in a blockchain company to assist it in broadening access to financial markets.

MARKET CHALLENGES

Aging legacy structures and systems impede the expansion of digital transformation in the oil and gas market.

- According to a study, about 70% of organizations starting digital transformation initiatives have yet to progress past the pilot stage.

Digital solutions and tools transform the functioning of the oil and gas sector. Foremost, companies must address the problem of aging legacy systems that still run so many assets. Updating old applications and their related procedures poses difficulties, but further prospects exist. A considerable portion of the industry was established on machinery aimed at the previous century and was dependable then. These legacy systems do not have the visibility and connectivity required to identify and adjust to modern-day progressively changing circumstances. Obsolete monitoring compromises security if risks go unnoticed. Therefore, updating old systems and structures is daunting for the market.

Apart from the technical issues of modernizing outdated systems, convincing, training, and syncing people with digital technologies is equally challenging. Companies may encounter rigid internal opposition to changes or upgrades from employees who are impacted the most and have depended on old processes to do their tasks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17% |

|

Segments Covered |

By Technology, Sector, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Emerson Electric Co., General Electric Co., IBM Corp., Intel Corp., Microsoft Corp., Oracle Corp., Rockwell Automation Inc., SAP SE, Tata Consultancy Services Ltd., Teradata Corp., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

The big data or analytics segment has gained the top position in the global market in 2024. Data has grown in prominence as it helps in decision-making in almost all industries, allowing companies to gain insights and streamline processes. The oil and gas industry, especially, is spearheading the integration of data analytics to improve exploration, production, and functional efficiency. Operators can forecast, improve resource management, and optimize drilling procedures and equipment failures using advanced data analysis methods. Moreover, the segment's growing market share can be credited to the increasing demand for operational productivity and data-oriented decision-making. As the segment encounters challenges, including ecological problems and unstable oil prices, it facilitates affordable management of resources and key information for strategic planning.

On the other hand, the artificial intelligence segment is the fastest-growing category in this market. AI's potential to analyze massive datasets, anticipate results, and automate complicated processes is especially beneficial in this oil and gas market, which deals with harsh conditions, volatile industry situations, and the demand for continual efficiency improvements. Today, AI has already become operational in prominent companies in this domain and has become an intrinsic component of processes throughout the value chain, significantly elevating the segment's market growth. Also, neural networks and advanced ML algorithms are deployed for more complex jobs. Hence, the segment's market share will surge in the coming years.

- According to a study, about 79 percent of companies will be informed of their future business strategy via opportunities accessible by employing AI technologies.

By Sector Insights

The upstream segment is the commanding segment projected to attain a higher CAGR. Today, most of the information any company maintains in personal hard drives, shared data servers, or libraries holds no economic value. Various other potentially valuable data needs include large expenditures on information transmission to consumption points, data curation, quality assurance, and employing well-paid domain specialists to translate and understand data analysis and make business decisions. This entire scenario, which is related to complexities with upstream data, makes the segment extremely important, consequently fuelling the market share.

REGIONAL ANALYSIS

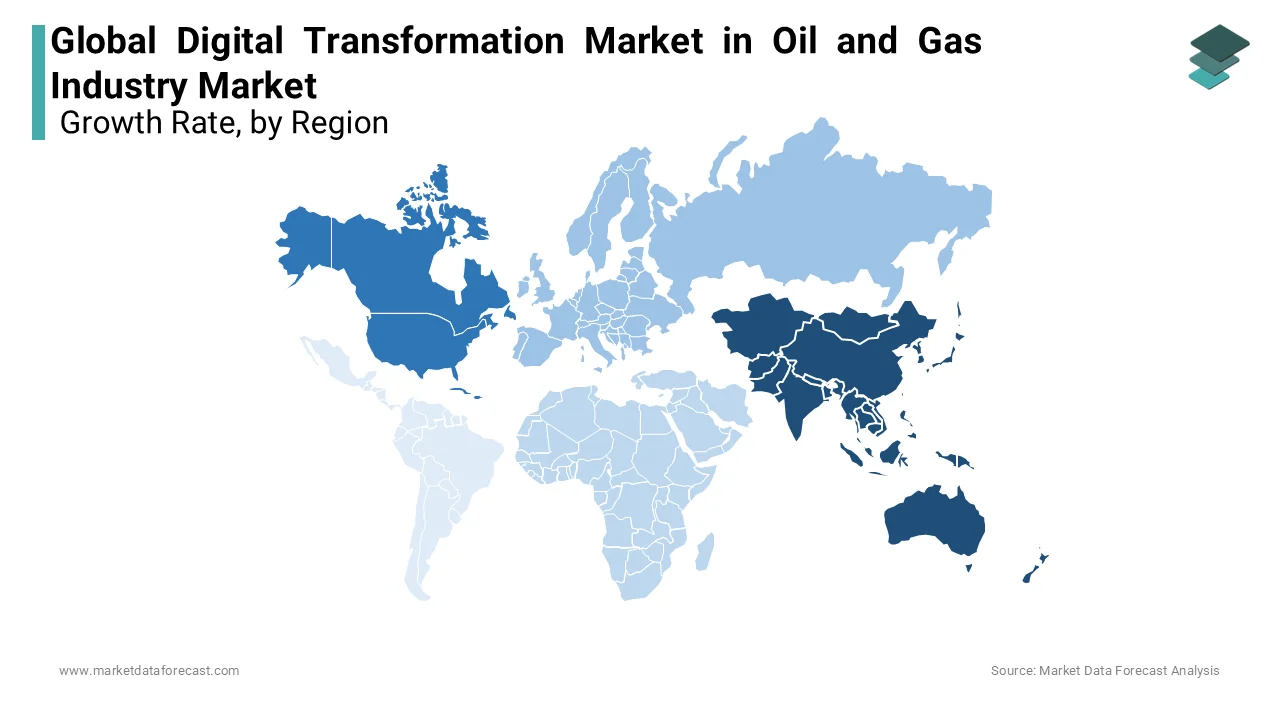

With unstable oil prices, the APAC region's refining capacity has recently experienced record growth. Given the long lead times and huge capital expenditures involved in oil and gas production, major industry players are looking to gain a competitive advantage through transformative technologies such as artificial intelligence. For example, Woodside, Australia's largest natural gas producer, has implemented IBM Watson to run AI algorithm operations and search over 25 million documents, retrieve content, compare historical performance, and suggest related information to anyone in business. Countries such as China, India, Japan, and South Korea have some of the most active downstream oil and gas sectors in the APAC area. Together, they are responsible for more than 78% of capacity, with large refineries deeply integrated with petrochemical production units in the Asia Pacific region.

The North American market stands out in the global market, witnessing significant growth. The region's energy shift towards an ecologically friendly and reduced-emission system, driven by decentralization, digitalization, and decarbonization, is a unique aspect. The market growth is particularly led by the United States, with its increasing numbers of smart meters and data centers. The region is also home to various prominent producers of digitalization in the energy framework, investing substantially in research and development projects for unique and sustainable technology. The USA and Canada are the driving forces behind the regional market expansion, with the United States being the largest market in North America.

Europe is likely to witness notable growth during the forecast period. Europe is another significant market for digital transformation in the oil and gas industry owing to the heightened frequency of cyberattacks, data breaches, ransomware attacks, etc., on the energy facilities. The crucial elements of the digitalization of oil and gas systems are open digital solutions and interoperability. European Union's aim to achieve a 55% reduction in greenhouse gas discharge and capture a portion of 45% renewables in 2030 is fuelling the segment's market share. This is why the demand is increasing to develop a more communicative and much more intelligent energy system than the existing ones.

KEY PLAYERS IN THE MARKET

A few of the companies that play a key role in the global digital transformation market in the oil and gas industry include Emerson Electric Co., General Electric Co., IBM Corp., Intel Corp., Microsoft Corp., Oracle Corp., Rockwell Automation Inc., SAP SE, Tata Consultancy Services Ltd., and Teradata Corp

RECENT HAPPENINGS IN THE MARKET

- In December 2023, the industry saw a potential game-changer as Saudi Aramco announced a collaboration with SBI Holding, a Japanese financial services group. The partnership, aimed at exploring investment opportunities in digital assets, could have a significant impact on the industry. SBI is also considering the introduction of a subsidiary to expand its footprint in the Middle East region, further underlining the potential of this collaboration.

- In November 2023, Aramco introduced the Saudi Accelerated Innovation Lab, which is committed to innovation space and digital venturing.

- In October 2019, IBM introduced a new integrated supply chain suite, integrated with Watson AI and IBM Blockchain and open to developers, to help organizations make their supply chains smarter, more efficient, and able to make decisions needed to adapt to disruptions and opportunities in a market where supplier networks are more complex and vulnerable.

- In September 2019, Schneider Electric announced its Eco Structure Power & Process launch in India to increase efficiency and profitability in the oil and gas sector. The company aims to combat the volatility associated with the oil and gas industry by reducing operating expenses and private equity by 20% to 30%. This system classifies end users to connect the assets that are the hub of projects with those that are the hub of operations. In addition, the company has also partnered with Microsoft to create professional IoT solutions.

MARKET SEGMENTATION

This research report on the global digital transformation market in oil and gas market has been segmented and sub-segmented based on the technology, sector, and region.

By Technology

- Big Data/Analytics

- Cloud Computing

- Internet of Things (IoT)

- Artificial Intelligence

- Industrial Control Systems

- Extended Reality

- Field Devices

By Sector

- Upstream

- Midstream

- Downstream

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa

Frequently Asked Questions

How is the digital transformation impacting traditional oil and gas operations on a global scale?

Digital transformation is revolutionizing traditional oil and gas operations by enabling real-time monitoring, predictive maintenance, and data-driven decision-making, leading to improved asset performance, reduced downtime, and enhanced production efficiency across global operations.

What are the major challenges hindering the adoption of digital transformation in the oil and gas sector worldwide?

Challenges include legacy infrastructure integration, cybersecurity concerns, skill gaps, regulatory compliance, and the complexity of managing big data. Overcoming these hurdles requires strategic planning, robust cybersecurity measures, and investment in talent development.

What strategies are leading oil and gas companies employing to overcome cybersecurity challenges in their digital transformation journey globally?

Leading companies are implementing robust cybersecurity frameworks, conducting regular risk assessments, adopting encryption technologies, implementing multi-factor authentication, and investing in employee training to mitigate cyber threats and safeguard critical infrastructure and data on a global scale.

How are governmental regulations and policies influencing the pace of digital transformation in the oil and gas industry on a global scale?

Governments worldwide are enacting regulations to promote environmental sustainability, safety standards, and data privacy, which are driving oil and gas companies to accelerate their digital transformation efforts. Compliance with regulations necessitates the adoption of advanced technologies and data management practices across the industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]