Global Digital Therapeutics Market Size, Share, Trends & Growth Forecast Report By Product (Software, Device and Others), Sales Channel (B2C and B2B), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Digital Therapeutics Market Size

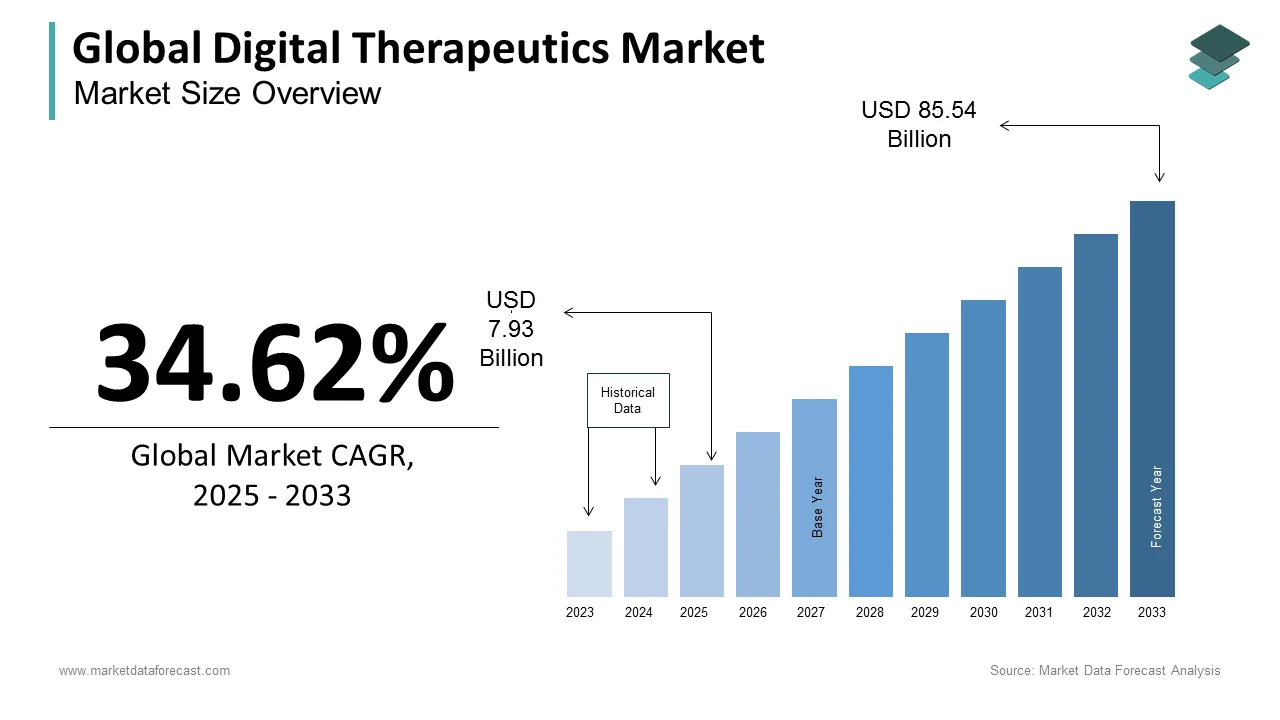

The global digital therapeutics market was worth US$ 5.89 billion in 2024 and is anticipated to reach a valuation of US$ 85.54 billion by 2033 from US$ 7.93 billion in 2025, and it is predicted to register a CAGR of 34.62% during the forecast period 2025-2033.

The digital therapeutics market continues to grow rapidly and is expected to remain on course in the coming years. It is also known as DTx and has gained significant traction in the last few years. It uses sophisticated therapeutic interventions which implement varied technologies, driven by software algorithms, to stop, manage, and treat a diverse range of disorders and diseases. Today, despite the considerable potential of DTx as a fundamental aspect of healthcare, their widespread integration is currently at a nascent stage. This low acceptance can be mostly due to the lack of extensive research that explores the breadth or extent of this field. It comprises the technological groundwork, possible application fields, and problems like limited adoption by physicians and regulatory barriers. In a recent study, this field has been dubbed as a promising substitute for pharmacological treatments and therapies across different medical conditions, underscoring their ability to transform existing treatment models. Hence, as of now, the market is experiencing an upward growth pattern.

MARKET DRIVERS

The growing prevalence of chronic diseases worldwide and the need for effective disease management solutions primarily drive the growth of the digital therapeutics market.

The number of people suffering from chronic diseases such as diabetes, cardiovascular diseases, respiratory diseases and mental health disorders is growing rapidly. Chronic diseases are the primary cause of mortalities worldwide and account for 71% of overall deaths, according to WHO. The traditional approaches to treating chronic diseases involve a combination of medications, lifestyle changes, and frequent visits to healthcare providers. Still, these practices do not guarantee optimal disease management and patient outcomes. Digital therapeutics is a technological healthcare solution that can provide evidence-based interventions, support, and monitoring directly to patients. Patients can be involved in their own care, access personalized treatment plans, receive real-time feedback, and monitor their progress remotely using digital therapeutics. Patients suffering from chronic diseases have been using digital therapeutics solutions to improve patient outcomes, enhance healthcare efficiency and transform the way chronic diseases are managed globally and this trend is likely to fuel in the coming years and drive the market growth.

The rapid adoption of smartphones, wearables and digital health platforms fuels the growth rate of the digital therapeutics market.

Smartphones and wearables have become more affordable and accessible worldwide. Technological advancements have tremendously improved the user experience and functionality and made these devices appealing to users. On the other hand, digital health platforms have become a comprehensive healthcare solution to manage health and wellness. These digital health platforms have been offering numerous services including remote patient monitoring, telehealth consultations, personalized health coaching, and access to digital therapeutics programs. The convenience, portability, and connectivity offered by smartphones, wearables, and digital health platforms have been helping people to focus on preventative healthcare and self-management and contributing to the increasing demand for digital health solutions including digital therapeutics.

The growing healthcare costs, increasing need for cost-effective treatment options, favorable government initiatives and policies promoting digital therapeutics, technological advancements including artificial intelligence and machine learning that enable personalized treatment and monitoring and expansion of digital health infrastructure and connectivity promote the digital therapeutics market growth. The growing demand for non-invasive and convenient treatment options, increasing patient awareness and acceptance of digital therapeutics, integration of digital therapeutics into healthcare systems and reimbursement policies and the growing number of collaborations and partnerships between pharmaceutical companies and digital health providers accelerate the market growth.

The growing focus on preventive healthcare and wellness, rising interest from investors and venture capital firms in digital therapeutics, increasing need for remote patient monitoring and management, especially in rural and underserved areas, improving patient engagement and adherence to treatment regimens and the expansion of telehealth and telemedicine services propel the market growth. The growing use of digital therapeutics in mental health and behavioral health conditions, expansion of regulatory frameworks and approvals for digital therapeutics and shift towards value-based care and outcome-driven healthcare models support the market growth.

MARKET RESTRAINTS

Limited awareness and understanding of digital therapeutics among healthcare providers and patients, regulatory challenges and the need for clear guidelines and frameworks for digital therapeutics hamper the market growth. Reimbursement complexities and the lack of standardized reimbursement policies for digital therapeutics interventions, data privacy and security concerns, particularly regarding the collection and storage of personal health information and resistance to change and traditional healthcare systems that may be resistant to adopting digital therapeutics further hinder the market growth. Limited interoperability and integration of digital therapeutics platforms with existing healthcare systems and electronic health records, technical challenges, such as connectivity issues, compatibility with different devices, and user interface limitations, limit the growth rate of the digital therapeutics market.

MARKET OPPORTUNITIES

The integration of advanced technologies presents potential prospects for the expansion of the digital therapeutics market.

The majority of the technological discussion around DTx concentrates on mobile apps that allow new digital cures or treatments. Even though this aspect is significant, adopting modern technologies is critical for the development of new capabilities. For example, a study published in Sage Journals established the expanding role of artificial intelligence (AI) in DTx products and the application of VR to provide digital therapeutics. These technologies present unparalleled opportunities for market expansion, however also make their adoption process complicated. Especially, AI-powered DTx products are a problem for regulatory bodies or authorities, which must identify how to control or govern algorithms that mainly depend on learning from adaptation and data. Even though their use is currently confined, tools such as generative AI systems (GenAI), medical AI models (like Med-Gemini), and general-purpose large language models (LLMs) are drawing great attention in healthcare, which ultimately benefits the market. Furthermore, concerning VR, it is an important technology to monitor or check, particularly with the beginning of Metaverse, and provides potential growth prospects for the market.

MARKET CHALLENGES

The lack of extensive research regarding all its aspects is one of the major challenges to the expansion of the digital therapeutics market.

There are 4 areas of concern which need further study or examination. Initially, the regulatory framework for this field is markedly ambiguous and inadequate, absence of a conclusive structure that maintains usability and long-term acceptance. Moreover, doubts concerning the safety of patients continue to exist, which impede the incorporation of DTx into clinical practice, as well as the market growth. In addition, the market is affected by the inadequate evidence backing digital therapeutics' clinical effect and efficacy, which further restricts the wider acceptance of these solutions. This also applies to the willingness of patients, healthcare professionals, (HCPs) and payers to adopt these healing methods. Additionally, given the high diversity of technological solutions that might facilitate DTx, there is a lack of a complete overview of the technologies that are currently utilised to enable such cures or treatments, along with the ways in which they assist therapeutic medications in various cases. Hence, all these organizational, regulatory, and clinical challenges are hindering the growth of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

34.62% |

|

Segments Covered |

By Product, Sales Channel, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

2Morrow, Inc., Pear Therapeutics, Inc., Fitbit, Inc. (Twine Health, Inc.), Proteus Digital Health, Inc., Livongo Health, Inc., Resmed, Inc. (Propeller Health), Voluntis, Inc., Omada Health, Inc. and Welldoc, Inc., and Medtronic Plc, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The software segment is expected to account for the major share of the global market during the forecast period. Ease of accessibility and widespread availability of digital therapeutics software through mobile applications and online platforms and the ability of software to deliver personalized interventions, track progress, and provide real-time feedback to users majorly drive the adoption of software and propelling the software segment in the global market. The integration with electronic health records (EHR) systems and healthcare provider workflows that enable seamless communication and collaboration further fuel the growth rate of the software segment in the global market.

On the other hand, the devices segment is expected to grow at a healthy rate during the forecast period owing to the rapid adoption of wearable devices, such as fitness trackers and smartwatches, that can collect real-time health data for monitoring and intervention purposes. Technological advancements in device sensors, connectivity, and battery life that enhance the accuracy and usability of digital therapeutics interventions and the integration of device data with software platforms drive the growth of the devices segment in the worldwide market.

By Sales Channel Insights

The B2B segment is expected to account for the largest share of the global market during the forecast period. Collaboration between digital therapeutics providers and healthcare organizations, including hospitals, clinics, and healthcare systems and the integration of digital therapeutics into existing healthcare infrastructure and electronic health records primarily drive the growth of the B2B segment in the worldwide market. The growing support from healthcare professionals who prescribe and recommend digital therapeutics interventions to their patients, the potential for cost savings and improved patient outcomes for healthcare organizations through the use of digital therapeutics and the rising emphasis on population health management and preventive care strategies where digital therapeutics can play a significant role further contribute to the growth of the B2B segment in the worldwide market.

The B2C segment is expected to grow at a prominent CAGR during the forecast period. The growing consumer awareness and interest in self-care and personal health management, rapid adoption of mobile health applications and wearable devices by individuals and convenience and accessibility of digital therapeutics directly to consumers promote the growth of the B2C segment. The growing demand for personalized and on-demand healthcare solutions and the empowerment of individuals to take control of their health and well-being further fuel the growth rate of the B2C segment.

By Application Insights

The diabetes segment is expected to register the fastest CAGR during the forecast period owing to the growing prevalence of diabetes globally and the increased demand for effective management and treatment solutions. The growing awareness about the importance of diabetes management and the role of digital therapeutics in improving outcomes, rapid adoption of digital health technologies and mobile applications for diabetes self-management and increasing emphasis on personalized and patient-centric care with digital therapeutics offering tailored interventions for diabetes management propel the diabetes segment in the worldwide market.

The obesity segment is expected to grow at a healthy CAGR during the forecast period. Factors such as the growing prevalence of obesity and overweight population, increasing need for comprehensive weight management solutions, rising awareness of the health risks associated with obesity and the importance of effective interventions majorly fuel the segmental growth. The growing interest in lifestyle modifications, including diet and exercise, for obesity management with digital therapeutics providing convenient tools for tracking and support and growing investment in digital therapeutics for obesity management, including the development of virtual coaching and personalized intervention programs contribute to the growth of the obesity segment.

REGIONAL ANALYSIS

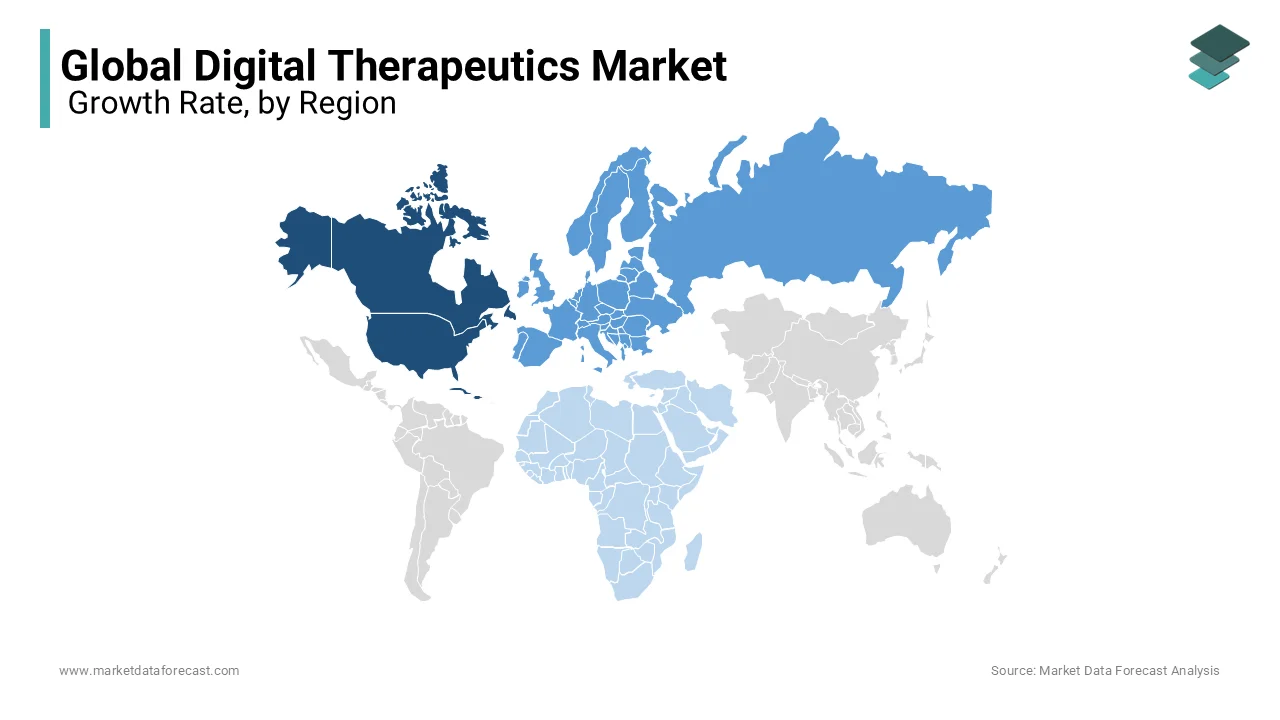

The North American region dominated the global market in 2024 and is expected to grow healthy during the forecast period owing to technological advancements and high digital literacy. The growing prevalence of chronic diseases, increasing need for remote healthcare solutions and strong healthcare infrastructure and reimbursement policies contribute to the growth of the North American market. The growing adoption of digital health technologies by healthcare providers and payers, favorable government initiatives promoting digital therapeutics and the presence of key market players and significant investment in research and development in North America fuel the regional market growth. The U.S. led the market in North America in 2024.

Europe had the second-largest market in 2024 and is estimated to grow healthily during the forecast period. The growing focus on preventive healthcare and disease management, the supportive regulatory environment for digital health innovations, the growing aging population, and the rising burden of chronic diseases primarily drive the digital therapeutics market growth in Europe. The growing number of initiatives from the governments of European countries promoting digital transformation in healthcare, strong healthcare infrastructure, rapid adoption of telemedicine and increasing number of collaborations between healthcare organizations and technology companies further boost the growth rate of the European market.

APAC is expected to witness the highest CAGR among all the regions in the worldwide market during the forecast period. The growing healthcare expenditure, increasing awareness of digital health solutions, rising population and increasing burden of chronic diseases drive the digital therapeutics market in the Asia-Pacific region. Rapidly developing healthcare infrastructure and telecommunication networks, growing adoption of smartphones and internet penetration and increasing number of initiatives from the governments of the APAC region promoting digital healthcare and telemedicine favour the digital therapeutics market growth in the Asia-Pacific region.

Latin America is anticipated to hold a substantial share of the global market in the coming years.

The market in MEA is expected to grow at a moderate CAGR worldwide during the forecast period.

KEY MARKET PLAYERS

Companies playing a leading role in the global digital therapeutics market profiled in this report are 2Morrow, Inc., Pear Therapeutics, Inc., Fitbit, Inc. (Twine Health, Inc.), Proteus Digital Health, Inc., Livongo Health, Inc., Resmed, Inc. (Propeller Health), Voluntis, Inc., Omada Health, Inc. and Welldoc, Inc., and Medtronic Plc., and Others.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, the Center for Technology and Behavioural Health (CTBH) under the Geisel School of Medicine at Dartmouth reported that it entered into a unique partnership with Boehringer Ingelheim with the objective of modernising prescription digital therapeutics that particularly aims grave mental illness. This is expected to benefit this market further technologically. Moreover, the partnership will capitalise on the strengths of each organisation in their respective healthcare industry and academic research to innovate tools to resolve the mental health crisis around the world. It is a one-year association with an option of renewal that aims to unite the ground-breaking research of CTBH with the industry expertise of Boehringer Ingelheim.

- In August 2024, Big Health, a manufacturer of digital treatments for mental health, announced that it had obtained clearance for its product from the Food and Drug Administration (FDA) for insomnia. In addition, its premier digital therapeutic, SleepioRx, aims to address chronic insomnia and insomnia disorder in adults over 18 as an adjustment to conventional care. Providers across the country can now prescribe Sleeepio as a therapeutic device.

-

In April 2024, Click Therapeutics, Inc. (Click) and Otsuka Pharmaceuticals, Co. Ltd. (Otsuka) via press release stated that the U.S. Food and Drug Administration (FDA) approved Rejoyn (developed as CT-152). It is the first-ever prescription digital therapeutic sanctioned for addressing major depressive disorder (MDD) symptoms as a complement to clinician-managed outpatient treatment for adult patients aged 22 and above who are receiving antidepressant medications. Rejoyn is aimed at lowering MDD symptoms. Moreover, it provides a unique and exciting supplementary option for treating major MDD symptoms, aligning with the current standards of patient care.

MARKET SEGMENTATION

This research report on the global digital therapeutics market has been segmented based on the product, sales channel, application, and region.

By Product

- Software

- Device

- Others

By Sales Channel

- B2C

- Patients

- Caregivers

- B2B

- Providers

- Payers

- Employers

- Pharmaceutical Companies

- Other Buyers

By Application

- Preventive Applications

- Prediabetes

- Obesity

- Nutrition

- Lifestyle Management

- Other Preventive Applications

- Treatment/Care-related Applications

- Diabetes

- CNS Disorders

- Chronic Respiratory Disorders

- Musculoskeletal Disorders

- Cardiovascular Diseases

- Smoking Cessation

- Medication Adherence

- Gastrointestinal Disorders

- Substance Use & Addiction Management

- Rehabilitation & Patient Care

- Other Treatment/Care-related Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global digital therapeutics market going to be worth by 2033?

As per our research report, the global digital therapeutics market size is predicted to grow to USD 85.54 billion in 2033.

Who are the major players operating in the digital therapeutics market?

2Morrow, Inc., Pear Therapeutics, Inc., Fitbit, Inc. (Twine Health, Inc.), Proteus Digital Health, Inc., Livongo Health, Inc., Resmed, Inc. (Propeller Health), Voluntis, Inc., Omada Health, Inc. and Welldoc, Inc., and Medtronic Plc. are some of the notable companies operating in the global digital therapeutics market.

Which region led the digital therapeutics market in 2024?

Geographically, the North American regional market led the digital therapeutics market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]