Digital MRO Market Size, Share, Trends, & Growth Forecast Report – Segmented by Technology (Predictive Maintenance, AR/VR, 3D Printing, Artificial Intelligence, Internet of Things, Robotics, Others), Application (Inspection, Monitoring, Part Replacement), End-User (Aircraft OEMs, Engine OEMs, MRO Service Providers, Airlines) & Region - Industry Forecast From 2024 to 2032

Global Digital MRO Market Size (2024 to 2032)

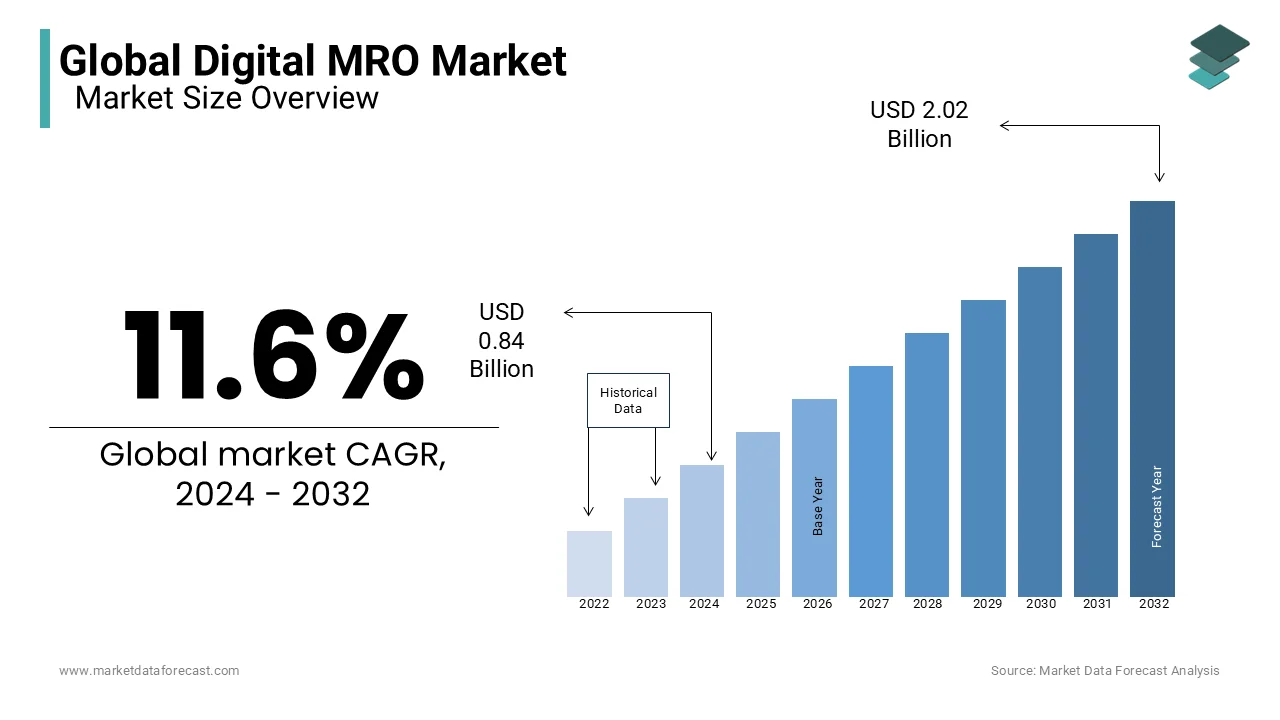

The global digital MRO market was worth USD 0.75 billion in 2023. The global market is predicted to increase from USD 0.84 billion in 2024 to arrive at USD 2.02 billion by 2032, recording a CAGR of 11.6% over the projection period.

The Digital MRO (Maintenance, Repair, and Overhaul) market is currently experiencing significant growth as the aviation industry increasingly adopts digital solutions to enhance operational efficiency and reduce costs. Driven by advancements in artificial intelligence (AI), the Internet of Things (IoT), and predictive analytics, digital MRO is transforming traditional maintenance processes by integrating real-time data and automation.

Major airlines and MRO providers are investing in technologies such as digital twins, augmented reality (AR), and cloud-based platforms to streamline workflows, predict component failures, and optimize inventory management. For instance, digital twin technology, which creates a virtual replica of aircraft components, allows engineers to monitor real-time performance and identify potential issues before they become critical, reducing downtime.

Key players, including Airbus, Boeing, and Lufthansa Technik, are expanding their digital portfolios, focusing on predictive maintenance and automated inspection. North America and Europe lead the market, while Asia-Pacific is emerging as a high-growth region due to increasing aircraft fleets and a strong focus on modernizing maintenance practices. As digital adoption continues, the Digital MRO market is set to play a pivotal role in enhancing the reliability and cost-effectiveness of the aviation industry.

GLOBAL DIGITAL MRO MARKET TRENDS

Growth of Predictive Maintenance Through AI and Big Data

Predictive maintenance is becoming a core focus in the digital MRO market, driven by advancements in artificial intelligence (AI) and big data analytics. By analyzing large datasets from sensors on aircraft components, predictive maintenance can forecast failures before they happen, reducing unplanned downtime and increasing aircraft availability. According to industry estimates, predictive maintenance can cut MRO costs by up to 30%. Major airlines, such as Delta and United, are investing in AI-powered predictive tools to streamline maintenance processes. This trend has contributed to an estimated 15% annual increase in demand for predictive analytics solutions in MRO.

Adoption of Digital Twin Technology for Enhanced Efficiency

Digital twin technology, which creates virtual replicas of aircraft systems and components, is revolutionizing MRO operations. This technology enables real-time monitoring and testing of parts without the need for physical inspections, reducing turnaround time and costs. For instance, Lufthansa Technik and Boeing have incorporated digital twin models to optimize engine maintenance and monitor wear. The adoption of digital twin technology in the aviation sector is projected to grow at a CAGR of 14%, reflecting its value in enhancing operational efficiency and predictive accuracy.

Increasing Use of Augmented Reality (AR) for Remote Assistance and Training

AR is gaining traction in the MRO industry, offering solutions for remote assistance, training, and on-site repairs. Technicians can use AR headsets to access repair instructions, connect with remote experts, or visualize component assemblies, improving accuracy and reducing repair times. Airbus has implemented AR-based training for maintenance staff, reporting a 20% increase in training efficiency. The global AR market within MRO is expected to reach $1 billion by 2027, as companies increasingly utilize AR to streamline operations and enhance technician skills.

MARKET DRIVERS

Rising Demand for Aircraft Efficiency and Cost Reduction

The aviation industry’s focus on improving operational efficiency and reducing maintenance costs is a major driver of digital MRO adoption. Traditional maintenance, repair, and overhaul procedures are time-intensive and costly, with unplanned maintenance accounting for up to 10% of operating costs. By integrating digital tools like predictive analytics and automated inspections, MRO providers can reduce turnaround times by up to 20%, minimizing downtime and enhancing fleet availability. This demand for efficiency is projected to contribute to a compound annual growth rate (CAGR) of 12% for digital MRO technologies over the forecast period.

Advancements in IoT and Big Data for Predictive Maintenance

The adoption of IoT and big data analytics is transforming the MRO landscape by enabling predictive maintenance. Aircraft are increasingly equipped with IoT-enabled sensors that monitor the real-time condition of components, collecting vast amounts of data that can be analyzed to predict potential failures. This proactive approach significantly reduces unplanned maintenance, cutting related costs by as much as 30%. For instance, Airbus and Rolls-Royce have developed IoT-based predictive maintenance platforms that are widely used in fleet management, accelerating the growth of digital MRO solutions.

Increasing Aircraft Fleets, Especially in Asia-Pacific

The expansion of global aircraft fleets, particularly in regions like Asia-Pacific, is driving demand for digital MRO. With Asia-Pacific projected to account for nearly 40% of new aircraft deliveries by 2030, the need for efficient and scalable MRO solutions is critical. Digital MRO technologies, such as cloud-based platforms and digital twins, offer scalability to meet the needs of expanding fleets. In 2022, the number of aircraft in service globally grew by 5%, further increasing the demand for streamlined digital MRO practices to manage larger, more complex maintenance operations.

MARKET RESTRAINTS

High Initial Investment and Implementation Costs

Implementing digital MRO solutions involves significant upfront costs for software, hardware, and skilled labor, which can be a barrier, especially for smaller MRO providers. Technologies such as IoT sensors, digital twins, and advanced analytics platforms require substantial investment, with implementation costs potentially ranging from $1 million to $5 million per fleet. For smaller aviation companies and MRO providers, these costs may outweigh the benefits, leading to slower adoption. This financial hurdle has contributed to a slower adoption rate, particularly in developing regions where MRO budgets are limited.

Data Privacy and Cybersecurity Concerns

The integration of digital technologies introduces cybersecurity risks, particularly due to the real-time data exchange between aircraft, MRO systems, and cloud-based platforms. In recent years, the aviation industry has seen an increase in cyber threats, with cybersecurity incidents in the aerospace sector rising by 20% between 2021 and 2022. These threats pose a significant risk to MRO operations, as compromised data could disrupt maintenance schedules and impact aircraft safety. Regulatory bodies are enforcing stricter data privacy standards, which can complicate the implementation of digital MRO solutions and increase compliance costs.

Shortage of Skilled Workforce for Digital Transition

Transitioning to digital MRO requires specialized skills in data analytics, IoT management, and digital tool operation, creating a demand for a digitally skilled workforce. However, the aviation industry faces a notable skills gap; according to a 2023 report by the International Air Transport Association (IATA), there is a 35% shortage of skilled technicians trained in digital MRO technologies. This shortage restricts the ability of MRO providers to fully utilize advanced digital tools, limiting the market’s growth potential, particularly in regions where training resources are limited.

MARKET OPPORTUNITIES

Expansion of Predictive Maintenance and Data Analytics Applications

Predictive maintenance, powered by data analytics and machine learning, is a significant opportunity in digital MRO. By leveraging real-time data from IoT sensors, predictive maintenance can identify potential issues before they lead to costly failures, reducing unplanned downtime by up to 30%. According to industry projections, the market for predictive maintenance in aviation is set to grow at a compound annual growth rate (CAGR) of 13% during the forecast period. As more airlines and MRO providers adopt predictive analytics tools, they can streamline maintenance schedules and enhance fleet readiness, presenting a strong growth avenue for digital MRO solutions.

Growing Adoption of Digital Twin Technology

Digital twin technology, which creates virtual replicas of aircraft components and systems, allows MRO providers to monitor component health, simulate performance, and predict maintenance needs more accurately. This technology is gaining traction, with the global digital twin market projected to reach $323.2 billion by 2032, a considerable portion of which will be driven by the aviation sector. Companies like Boeing and Rolls-Royce are investing in digital twin solutions to enhance predictive capabilities and improve operational efficiency, creating a lucrative market opportunity for digital MRO providers.

Rising Demand for Cloud-Based MRO Platforms

Cloud-based MRO platforms are increasingly in demand as they offer scalable, real-time access to maintenance data and collaborative tools. These platforms allow MRO providers and airlines to manage vast amounts of data efficiently, regardless of location. The demand for cloud-based aviation MRO software is growing at a promising pace due to the cost benefits, improved data security, and ease of integration. Key players, such as Lufthansa Technik and Airbus, have adopted cloud-based solutions to streamline operations, signaling strong growth potential for cloud solutions in the digital MRO space.

MARKET CHALLENGES

Integration with Legacy Systems

Integrating digital MRO solutions with existing legacy systems remains a significant challenge. Many MRO providers still rely on traditional systems and paper-based processes, which are often incompatible with advanced digital platforms. This mismatch complicates data migration and process alignment, leading to delays and increased costs. According to industry estimates, over 60% of MRO providers still rely on outdated systems, and transitioning these setups to digital platforms can be both time-intensive and costly. This challenge limits the adoption of digital MRO, especially among smaller providers with limited resources for comprehensive system upgrades.

Data Standardization and Interoperability Issues

The digital MRO market faces challenges related to data standardization, as various MRO software solutions and data formats lack uniformity across the industry. Without standardized data formats, sharing and analyzing information between different systems can be complex and error-prone, reducing the effectiveness of predictive maintenance and real-time monitoring. For instance, the International Air Transport Association (IATA) has called for greater data standardization within aviation, but implementing uniform standards remains slow. This lack of interoperability limits seamless communication across platforms and restricts the full potential of digital MRO solutions.

Limited Digital Skills and Workforce Readiness

A shortage of skilled technicians with digital expertise is another pressing challenge for the digital MRO market. The transition to digital MRO demands skills in data analytics, machine learning, and cloud computing—areas in which the aviation industry has a notable shortage. According to a 2023 report by the International Air Transport Association (IATA), the aviation industry will require over 600,000 digitally skilled technicians by 2030, yet the current training infrastructure falls short of meeting this demand. This skills gap restricts MRO providers from fully leveraging digital tools and hinders the overall adoption rate of advanced MRO technologies.

Impact of COVID-19 on the global digital MRO market

The COVID-19 pandemic had a profound impact on the digital MRO market, accelerating digital adoption as aviation companies sought ways to maintain efficiency amidst reduced operational capacity. With travel restrictions and reduced fleet usage, airlines and MRO providers faced increased pressure to cut costs and enhance maintenance efficiency. Digital MRO technologies, such as remote inspections, predictive maintenance, and cloud-based platforms, became essential in streamlining operations with limited on-site personnel. For instance, predictive maintenance saw a 25% increase in adoption during the pandemic, as companies prioritized reducing unexpected downtime and extending component life. Additionally, digital twin technology and augmented reality (AR) tools facilitated remote troubleshooting and training, enabling maintenance continuity without physical presence. Post-pandemic, this shift has established a new reliance on digital MRO solutions, with the market projected to grow at a revised promising CAGR as the market continues modernizing maintenance processes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

11.6% |

|

Segments Covered |

By Technology, Application, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM Corporation (USA), IFS (Sweden), Ramco Systems (India), Rusada (Switzerland) SAP (Germany), Swiss Aviation Software (Switzerland), Lufthansa Technik (Germany), General Electric (United States), Boeing (United States) and Honeywell International (United States). |

SEGMENTAL ANALYSIS

Global Digital MRO Market Analysis By Technology

The predictive maintenance segment captured 30.8% of the global market share in 2023. The growth of the predictive maintenance segment is driven by the widespread adoption of Internet of Things (IoT) sensors and big data analytics, enabling real-time health monitoring of aircraft components. By using predictive models, MRO providers can forecast potential failures and optimize maintenance schedules, reducing unexpected downtime by 20–30%. This technology is increasingly essential as airlines aim to enhance fleet availability and reduce operational costs. For example, Delta Air Lines and Airbus have implemented predictive analytics platforms, achieving improved maintenance planning and overall cost savings. The potential for improved fleet efficiency and reduced maintenance expenses solidifies predictive maintenance as a core MRO investment, especially in high-demand regions like North America and Europe.

The AR/VR segment is the fastest-growing segment and is anticipated to witness a CAGR of 14% over the forecast period. The growth of AR/VR segment in MRO is fueled by its applications in remote assistance, technician training, and real-time equipment visualization, all of which increase repair accuracy and reduce downtime. For instance, Lufthansa Technik uses AR for remote inspections, enabling experts to guide technicians virtually, reducing the need for on-site visits and enhancing troubleshooting speed by 20%. VR is also widely used for training, offering immersive simulation environments that help technicians acquire skills without requiring physical aircraft access. This technology is gaining traction as airlines seek ways to improve workforce productivity and ensure maintenance quality across geographically dispersed teams.

Global Digital MRO Market Analysis By Application

The inspection segment led the market and occupied for 40.4% of the global market share in 2023. The demand for digital inspection tools is primarily driven by the aviation industry’s focus on improving accuracy and reducing downtime during inspections. Digital technologies like drones, robotics, and artificial intelligence (AI) are increasingly used for automated inspections, allowing for precise and rapid evaluation of aircraft components. For example, Rolls-Royce’s robotic inspection tools can reduce inspection times by up to 80%, significantly enhancing operational efficiency. Additionally, AI-driven visual inspection systems detect wear and damage in hard-to-reach areas, reducing human error and minimizing manual labour costs. As the industry prioritizes safety and efficiency, digital inspection solutions remain essential, particularly in regions with extensive aircraft fleets, such as North America and Europe.

The monitoring segment is the fastest growing and is predicted to grow at a CAGR of 13.1% from 2024 to 2032. The growth of the monitoring segment is fuelled by the adoption of IoT and predictive analytics for real-time aircraft health monitoring. Monitoring technologies continuously track component performance, enabling MRO providers to identify potential failures before they occur. This capability is particularly valuable in high-utilization fleets, as it reduces unplanned maintenance and extends component life. For instance, Airbus’ Skywise platform integrates IoT-based monitoring, which has helped airlines cut maintenance costs by up to 15%. The increasing emphasis on predictive maintenance and the reduction of operational disruptions are key factors driving the rapid growth of the monitoring segment.

Global Digital MRO Market Analysis By End User

The MRO service providers segment accounted for 45.5% of the global market share in 2023. The dominance of MRO service providers segment is driven by the need to adopt digital solutions to enhance efficiency, reduce maintenance costs, and improve turnaround times. These providers are increasingly investing in predictive maintenance, digital inspection, and real-time monitoring tools to better serve the aviation industry’s growing demand for reliable and timely maintenance services. For instance, companies like Lufthansa Technik and Delta TechOps have adopted predictive maintenance and IoT-based solutions to optimize fleet availability and minimize unscheduled downtime. As regulatory requirements for safety and efficiency increase, MRO providers are leading digital adoption to meet industry standards and enhance service offerings.

The airlines segment is the fastest-growing segment and is projected to grow at a CAGR of 12.9% over the forecast period. Airlines are increasingly implementing digital MRO solutions to improve fleet reliability, manage costs, and reduce delays associated with maintenance. Digital technologies like predictive analytics and AI allow airlines to monitor the health of their aircraft in real-time, enabling proactive maintenance strategies that extend component life and optimize aircraft utilization. For example, major airlines like American Airlines and Emirates have invested in digital MRO tools, reporting efficiency gains and cost savings in fleet operations. With a strong focus on operational efficiency and minimizing disruptions, airlines are rapidly adopting digital solutions to enhance competitiveness and improve passenger service.

REGIONAL ANALYSIS

North America dominated the market and accounted for 35.3% of the global market share in 2023. The strong presence of major aviation companies and MRO service providers, such as Boeing and Delta TechOps, drives digital adoption in North America. The region’s focus on enhancing operational efficiency and reducing maintenance costs has accelerated the adoption of predictive maintenance and IoT technologies. The U.S., in particular, is at the forefront, with investments in digital twin and artificial intelligence (AI) technologies to streamline MRO processes. Canada also contributes to the market growth with advancements in aircraft health monitoring systems. The U.S. dominates the North American digital MRO market, supported by government incentives and the presence of leading aviation technology developers. Canada is gradually expanding its digital MRO capabilities, focusing on AI-driven diagnostics and fleet management solutions.

Europe had 28.2% of the global market share in 2023 and emerged as the second largest regional segment worldwide. The emphasis of on reducing carbon emissions and increasing operational efficiency drives the adoption of digital MRO solutions. The European Union’s regulatory policies, such as the “European Green Deal,” push for efficient maintenance practices. Key players like Airbus, Lufthansa Technik, and Rolls-Royce lead digital MRO innovation with investments in predictive analytics and AR/VR training solutions. Germany, France, and the United Kingdom are the primary contributors. Germany leads with a strong focus on digital twins and robotic inspections, while France, home to Airbus, drives technological advancements in predictive maintenance. The U.K. invests heavily in remote monitoring and IoT-based MRO solutions, aligning with its goals for sustainability and efficiency in aviation.

The Asia Pacific region is expected to grow at the highest CAGR of 12.4% over the forecast period. Rapid fleet expansion and rising air travel demand, particularly in China and India, are fueling digital MRO adoption in Asia Pacific. Countries in this region increasingly invest in IoT-based predictive maintenance to manage large fleets and improve operational efficiency. In addition, Japan and South Korea are adopting digital solutions, focusing on AR/VR for training and diagnostics. China leads the market due to its growing commercial and military fleets, with government initiatives supporting digital advancements in MRO. India follows with a high adoption rate of predictive maintenance tools as its aviation industry expands. Japan and South Korea are also seeing significant growth in AR/VR solutions for maintenance training and remote inspections.

Latin America captured about 8.4% of the global market share in 2023. The Latin American market is gradually adopting digital MRO solutions, driven by a need for cost-efficient operations and fleet reliability in countries like Brazil and Mexico. While budget constraints limit widespread adoption, digital MRO solutions are increasingly recognized for their ability to enhance efficiency in maintenance tasks. Brazil is the leading market in the region, focusing on digital inspection tools and remote monitoring to support its commercial aviation sector. Mexico is also adopting digital MRO tools, particularly in predictive analytics, to optimize maintenance in its growing aviation market.

The digital MRO market in Middle East and Africa is predicted to grow at a CAGR of 8.5% over the forecast period. High demand for digital MRO solutions in the Middle East is driven by large-scale investments in aviation by countries like the UAE and Saudi Arabia. These countries prioritize fleet modernization and are adopting digital MRO tools to improve efficiency and reduce operational costs. In Africa, digital MRO adoption is still limited but growing, with South Africa focusing on predictive maintenance for fleet optimization. The UAE leads in the Middle East with investments in advanced MRO platforms and predictive analytics. Saudi Arabia follows, focusing on digital twin and AI solutions to support its growing aviation sector. In Africa, South Africa is the primary market, utilizing digital tools for fleet health monitoring and remote diagnostics as it seeks to improve reliability and efficiency in its aviation industry.

KEY MARKET PARTICIPANTS

Some of the main players in the global digital MRO market are IBM Corporation (USA), IFS (Sweden), Ramco Systems (India), Rusada (Switzerland) SAP (Germany), Swiss Aviation Software (Switzerland), Lufthansa Technik (Germany), General Electric (United States), Boeing (United States) and Honeywell International (United States).

RECENT MARKET HAPPENINGS

- In March 2023, IBM Corporation launched a new AI-driven predictive maintenance solution for aviation, enhancing real-time monitoring and failure prediction. This solution supports airlines and MRO providers in minimizing unplanned downtime, reinforcing IBM’s presence in the digital MRO sector.

- In June 2022, IFS partnered with Airbus to develop an advanced aviation maintenance software platform, integrating IFS’ data analytics tools to optimize fleet maintenance schedules. This partnership aims to drive efficiency for Airbus clients and expand IFS’s reach in the aviation sector.

- In January 2023, Ramco Systems introduced a cloud-based MRO software module, designed for global airlines to streamline aircraft maintenance, inventory, and labor management. This release strengthened Ramco’s offering for scalable, cost-effective digital MRO solutions, particularly in emerging markets.

- In November 2022, Rusada launched the latest version of its ENVISION software, which includes predictive analytics for maintenance scheduling. This update provides MRO providers with better tools to forecast maintenance needs, enhancing Rusada’s market position among digital MRO providers.

- In February 2023, SAP collaborated with Lufthansa Technik to implement SAP’s cloud-based MRO solutions, enabling Lufthansa to streamline inventory and maintenance processes. This collaboration reinforces SAP’s role in providing digital solutions to leading aviation maintenance players.

- In September 2021, Swiss Aviation Software introduced its AMOSmobile/EXEC app, a digital tool for maintenance supervisors to manage tasks and optimize workflows remotely. This innovation supports Swiss Aviation Software’s commitment to enhancing mobile MRO solutions for aviation clients.

- In April 2022, Lufthansa Technik expanded its AVIATAR platform by adding predictive maintenance modules, offering real-time monitoring capabilities for aircraft systems. This expansion positions Lufthansa Technik as a leader in digital MRO innovation within the aviation industry.

- In October 2022, General Electric (GE) launched an AI-powered diagnostics platform for fleet management, enhancing GE’s ability to support clients with data-driven insights and predictive maintenance. This platform solidifies GE’s influence in the digital transformation of aviation maintenance.

- In December 2021, Boeing announced the expansion of its Digital Solutions and Analytics portfolio, which includes predictive maintenance and real-time monitoring tools. This update aligns Boeing with industry demand for advanced digital MRO solutions, strengthening its market position.

- In August 2022, Honeywell International introduced Forge Flight Efficiency software, which leverages IoT data to optimize fuel consumption and predictive maintenance. This innovation bolsters Honeywell’s presence in the digital MRO space by helping airlines achieve cost savings and reduce emissions.

DETAILED SEGMENTATION OF THE GLOBAL DIGITAL MRO MARKET INCLUDED IN THIS REPORT

This research report on the global digital mro market has been segmented and sub-segmented based on the technology, application, end-user, and region.

By Technology

- Predictive Maintenance

- AR/VR

- 3D Printing

- Artificial Intelligence

- Internet of Things

- Robotics

By Application

- Inspection

- Monitoring

- Part Replacement

By End-User

- Aircraft OEMs

- Engine OEMs

- MRO Service Providers

- Airlines

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key drivers of the Digital MRO Market?

Key drivers include the growing need for efficient aircraft maintenance processes, increasing adoption of advanced technologies like IoT and AI, the rising demand for predictive maintenance, the push for reducing operational costs, and the need for improved aircraft safety and reliability.

What are the main challenges faced by the Digital MRO Market?

Main challenges include high initial costs of digital solutions, the complexity of integrating new technologies with existing systems, data security concerns, the need for skilled workforce to manage and operate advanced technologies, and regulatory hurdles.

How is big data analytics transforming the Digital MRO Market?

Big data analytics enables the analysis of large volumes of data generated from aircraft operations and maintenance activities. It helps in identifying patterns, trends, and insights that can lead to improved decision-making, optimized maintenance schedules, reduced operational costs, and enhanced aircraft performance and safety.

What is the future outlook for the Digital MRO Market?

The future outlook for the Digital MRO Market is positive, with expected growth driven by continuous advancements in digital technologies, increasing adoption of IoT and AI, rising demand for predictive maintenance, and the ongoing digital transformation in the aviation industry. The market is likely to see more collaborative efforts between technology providers and MRO service providers to develop innovative solutions that address emerging challenges and opportunities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]