Global Dental Syringes Market Size, Share, Trends & Growth Analysis Report – Segmented By Product (Non-disposable Syringes, Disposable Syringes, Safety Dental Syringes), By Material, Shape, Type & Region - Industry Forecast (2024 to 2029)

Global Dental Syringes Market Size (2024 to 2029)

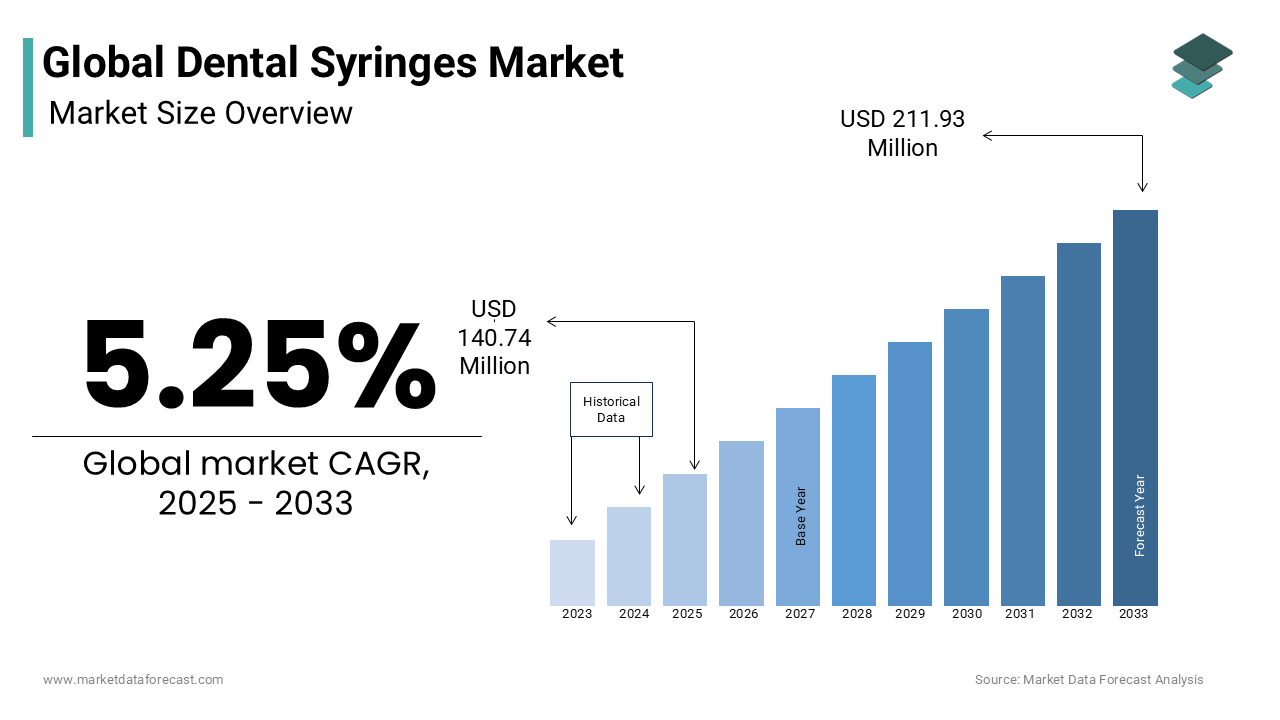

The global dental syringes market size is forecasted to grow to USD 172.71 million by 2029 from USD 133.72 million in 2024, registering a CAGR of 5.25% between 2024 to 2029.

Dental syringes are used by dentists and consist of a hermetically sealed cartridge, which stores an anesthetic solution that must be injected. It consists of a breech-loading syringe filled with a sealed anesthetic cartridge. The ancillary tool is used to supply water, compressed air, or mist to the oral cavity for irrigation. Irrigation is the process of cleaning away debris from the area the dentist is working on.

MARKET DRIVERS

The growing patient population from dental problems, the rising geriatric population worldwide, and favorable government legislation to avoid needle stick injuries propels the dental syringes market growth.

The dental syringe market is expected to grow rapidly due to rapid technological advancements in the industry. In addition, the expanding senior population, rising awareness among healthcare professionals about needlestick injuries, and continuous government measures to modernize and expand healthcare infrastructure contribute to the market's growth. Furthermore, technical developments in this category and the rising number of diabetes patients, and the prevalence of dental problems caused by poor blood glucose management are expected to increase the market in the future years.

Periodontal ligament (PDL) injection technique may now give single-tooth anesthetic with greater ease due to advancements such as customized high-pressure syringes. Advanced technology is also employed to reduce injection discomfort, pain, and other side effects. One of the primary growth drivers is the rising incidence of dental and oral diseases due to bad eating habits and a lack of vitamin D and vitamin A. Government laws restricting needle syringe use are expected to impact the industry's growth positively. When needles are used, blood-borne viruses are more likely to spread. As a result, dentists prefer to use dental syringes, which will drive the market forward. It is expected that factors such as population growth, poor dental hygiene, and bad eating habits will increase the incidence of dental illnesses.

Furthermore, the dental syringe market is likely driven by the rising popularity of cosmetic dentistry and the increasing number of dental aesthetic procedures. Implants, veneers and braces, crowns, bonding, gum surgery, and tooth whitening are some of the most common dental treatments used to improve the appearance of the teeth. As long as disposable dental instruments are used only once, there is no chance of contamination. In addition, these items are less expensive and safer for the environment when properly disposed of. Furthermore, the rising need for injectable medications will likely increase product demand in the next few years.

MARKET RESTRAINTS

The global dental syringes market is projected to be hampered by a scarcity of experienced dental surgeons. In addition, the preference for prefilled dental syringes is expected to strain the market for dental syringes. Reusable syringes should also be wholly autoclaved and sterilized after each use, mainly to avoid COVID-19 infection. With a high rate of viral transmission expected with reused syringes, the examined area is expected to be slightly constrained during the pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

Segments Covered |

By Product, Material, Shape, Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Septodont, 3M Company, Dentsply International, Integra LifeSciences Corporation, Vista Dental Products, Power Dental USA, 4tek S.r.l, A.Titan Instrument, RONVIG Dental, and Delmaks Surgico |

SEGMENTAL ANALYSIS

Global Dental Syringes Market Analysis By Product

The non-disposable dental syringes product type is expected to account for the most significant share in the global dental syringes market during the forecast period. Increasing focus on accepting new products in dental hospitals by surgeons is to fuel the market's growth. In addition, non-disposable dental syringes are affordable and reusable, which is expected to promote the segment's growth rate.

Global Dental Syringes Market Analysis By Material

The metallic dental syringe segment is predicted to lead the global dental syringes market during the forecast period. The increasing prevalence of effective treatment procedures at any cost, especially in urban areas, is expected to accelerate growth.

Global Dental Syringes Market Analysis By Shape

The linear dental syringes segment is expected to account for the leading share in the global market during the forecast period. In contrast, the gun-shaped dental syringes category has grown significantly over the past few years. Increasing disposable income in developed and developing countries is one factor that bolsters the market's demand.

Global Dental Syringes Market Analysis By Type

The aspirating dental syringes segment is expected to be the most lucrative segment. However, the government's rise in the initial steps to provide the latest treatment procedures, even in rural areas through campaigns, is outshining the market's demand.

REGIONAL ANALYSIS

Owing to the increased frequency of dental illnesses, rising healthcare expenditures, and significant players in the area, North America is likely to dominate the global dental syringes market. Easy access and high adoption of advanced dental treatment technologies (such as advanced dental syringes) among healthcare professionals, the rising prevalence of dental disorders and oropharyngeal cancers in the United States and Canada, and continuous product innovation are all driving market growth in North America. In addition, many regulatory agencies worldwide, such as Canada and the United States, have set guidelines, regulations, and standards to reduce the risk of needlestick injuries (NSIs).

Due to rising medical tourism, improved healthcare facilities, and rising consumer disposable income, Asia Pacific is predicted to be the fastest-growing industry in the future. Furthermore, increased knowledge of modern medical tools among dental surgeons will likely boost regional product demand.

KEY PLAYERS IN THE DENTAL SYRINGES MARKET

This report covers Septodont, 3M Company, Dentsply International, Integra LifeSciences Corporation, Vista Dental Products, Power Dental USA, 4tek S.r.l, A.Titan Instrument, RONVIG Dental, and Delmaks Surgico are some of the companies that are playing a promising role in the global dental syringes market.

RECENT HAPPENINGS IN THE MARKET

- In February 2021, No Borders, Inc. revealed that MediDent Supplies Needles and Syringes had been successfully launched, with millions of Needles and Syringes supplied to its customers all over the USA.

- BD introduced its new Hyflow needle in January 2021, a 27-gauge thin-wall needle that increases the performance of the company's pre-fillable syringe line.

- In October 2020, the FDA approved their Arthrotap by Accuro Technologies Inc. 510(K), intended for general aspiration/injection fluid application for healthcare professionals.

- Gemtier Medicinal (Shanghai) Inc. gained 510(k) certification in April 2020 for their Sterile Syringe with Safety Needle for Single Use, designed for aspiration and injection of fluids for medical applications.

- Credence MedSystems and SCHOTT AG announced a partnership in October 2020 to combine Credence Companion technology with SCHOTT's pre-fillable syriQ glass and SCHOTT TOPPAC polymer syringe systems. The two firms will collaborate to integrate the technologies and provide the pharmaceutical industry with a unique and new solution for injectable medicine administration using prefilled syringes.

- Directa, an innovative dental consumables business headquartered in Upplands Väsby, Sweden, is happy to announce the purchase of Swedish endodontics manufacturer Sendoline AB in December 2020.

DETAILED SEGMENTATION OF THE GLOBAL DENTAL SYRINGES MARKET INCLUDED IN THIS REPORT

This research report on the global dental syringes market has been segmented and sub-segmented based on the product, material, shape, type, and region.

By Product

- Non-Disposable Dental Syringes

- Disposable Dental Syringes

- Safety Dental Syringes

By Material

- Metallic

- Plastic

By Shape

- Linear

- Gun-shaped

By Type

- Aspirating

- Non-Aspirating

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the dental syringes market worldwide in 2021?

The global dental syringes market size was valued at USD 114.7 million in 2021.

What is the growth rate of the global dental syringes market?

The global dental syringes market is anticipated to grow at a CAGR of 5.25% from 2022 to 2027.

Which segment by product held the significant share in the dental syringes market?

Based on product, the non-disposable segment had the largest share of the market in 2021.

What are the companies playing a key role in the dental syringes market?

Septodont, 3M Company, Dentsply International, Integra LifeSciences Corporation, Vista Dental Products, Power Dental USA, 4tek S.r.l, A.Titan Instrument, RONVIG Dental, and Delmaks Surgico are a few of the notable companies in the dental syringes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]