Global Dental Market Size, Share, Trends & Growth Forecast Report By Type (Dental Consumables, Dental Equipment), End-user (Solo Practices, DSO/ Group Practices, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Dental Market Size

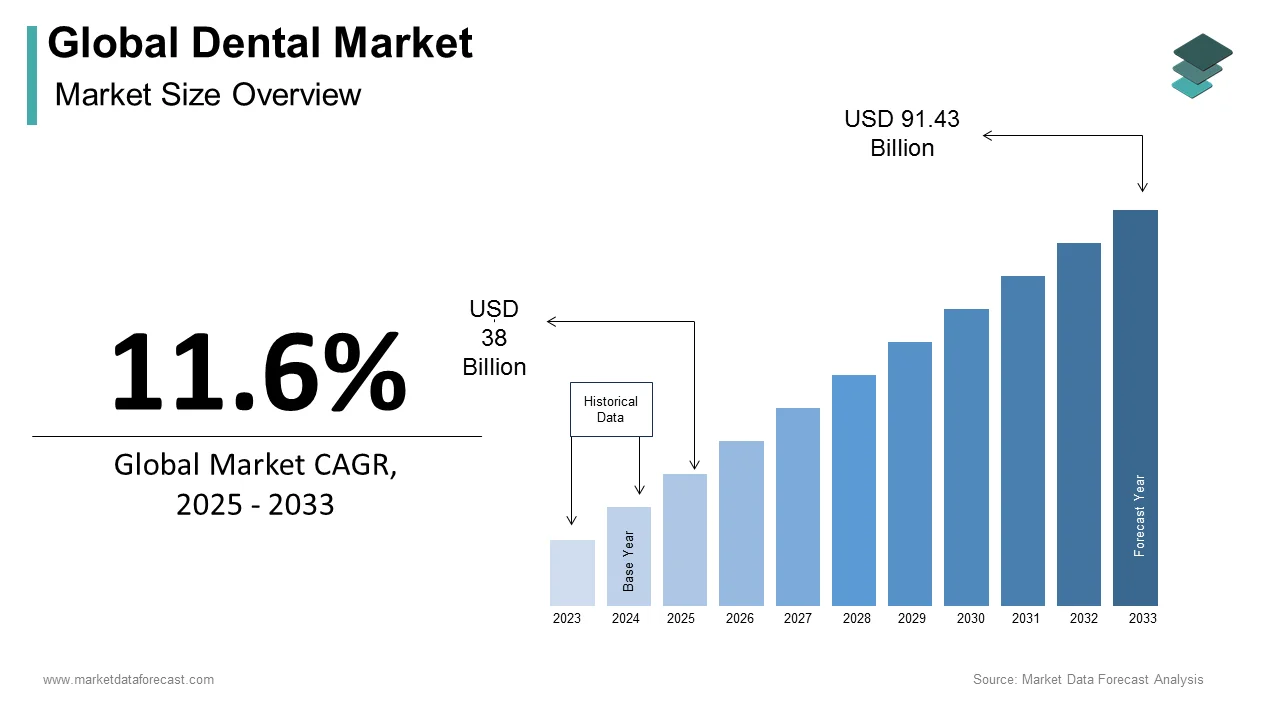

The size of the global dental market was worth USD 34.05 billion in 2024. The global market is anticipated to grow at a CAGR of 11.6% from 2025 to 2033 and be worth USD 91.43 billion by 2033 from USD 38 billion in 2025.

The dental market includes a broad spectrum of services and products dedicated to oral health maintenance, diagnosis, prevention, and treatment of dental diseases. This includes general and specialized dental care, orthodontics, prosthodontics, and the manufacturing and distribution of dental equipment and consumables. According to the American Dental Association, national dental spending in the United States increased by 2.5% from 2022 to 2023 which is indicating a growing investment in oral healthcare. The global market growth is driven by factors such as an aging population, heightened awareness of oral health's importance, and advancements in dental technologies. For instance, the increasing prevalence of dental disorders and the rising demand for cosmetic dentistry contribute significantly to market expansion. In Australia, per capita spending on dental care reached $11.1 billion in 2021-2022 and ranked the country sixth among 31 OECD nations in terms of dental expenditure, as highlighted by The Guardian. However, disparities in public funding have led to a substantial portion of costs being covered out-of-pocket by individuals which is underscoring the need for more equitable access to dental services.

MARKET DRIVERS

Technological Advancements in Dental Care

Innovations in dental technology have significantly enhanced the quality and efficiency of dental treatments. The adoption of digital imaging, laser dentistry, and computer-aided design/computer-aided manufacturing (CAD/CAM) systems has streamlined procedures, reduced patient discomfort, and improved outcomes. For instance, the integration of CAD/CAM technology allows for the precise fabrication of dental restorations, leading to increased patient satisfaction. According to the American Dental Association, national dental spending in the United States increased by 2.5% from 2022 to 2023 that is reflecting a growing investment in advanced dental technologies.

Increasing Prevalence of Oral Diseases

The rising incidence of oral health issues such as dental caries and periodontal diseases has escalated the demand for dental services globally. The World Health Organization reports that oral diseases affect nearly 3.5 billion people worldwide and is indicating a substantial need for preventive and therapeutic dental care. This growing burden of oral health problems necessitates enhanced dental services and interventions to improve overall public health outcomes.

MARKET RESTRAINTS

High Cost of Dental Services

The substantial expense associated with dental care deters many individuals from seeking necessary treatments. For instance, per capita spending in Australia on dental care reached $11.1 billion in 2021-2022 and has placed the country sixth among 31 OECD nations in terms of dental expenditure, as reported by The Guardian. Despite this high spending, a significant portion of dental care costs about 60% is covered by individuals out-of-pocket and is leading to disparities in access to care. This financial burden disproportionately affects low-income populations and is consequently resulting in untreated dental issues and exacerbating health inequalities. The high costs are often attributed to the exclusion of dental services from public health schemes like Medicare is leaving many to rely on private dental services with escalating fees. This scenario underscores the need for policy reforms to integrate dental care into public health insurance systems and thereby reducing out-of-pocket expenses and improving access to essential dental services.

Shortage of Dental Professionals

A limited number of dental practitioners contributes to inadequate access to dental services, particularly in underserved regions. In the United Kingdom, only 40% of English adults saw an NHS dentist in 2022 with some areas reporting figures as low as 30%, as highlighted by The Times. This shortage is exacerbated by a dentist-to-population ratio of 5.3 per 10,000 people when compared to over 8 per 10,000 in countries like Germany and Italy. The scarcity of dental professionals leads to prolonged waiting times and unmet dental needs and is compelling some individuals to resort to self-administered care which can result in adverse health outcomes. Addressing this issue requires strategic investments in dental education and training programs as well as incentives to attract and retain dental professionals in areas with the greatest need.

MARKET OPPORTUNITIES

Integration of Dental Services into Public Health Programs

Incorporating dental care into public health initiatives can enhance access to services and particularly for underserved populations. For instance, the Canadian government has implemented the Canadian Dental Care Plan with the aim to provide dental services to uninsured Canadians meeting specific criteria. This program covers a range of services including preventive and restorative treatments and thereby reducing financial barriers and promoting oral health equity. To qualify, individuals must have an adjusted family net income of less than $90,000, lack access to dental insurance, and be Canadian residents for tax purposes. Such integration not only improves individual health outcomes but also reduces overall healthcare costs by preventing advanced dental diseases. The success of this initiative underscores the potential benefits of similar programs in other regions.

Expansion of Dental Service Organizations (DSOs)

The growth of Dental Service Organizations offers a pathway to consolidate and streamline dental practices and is enhancing efficiency and patient care. According to data from the American Dental Association, dental offices in the United States generate approximately $478 billion in revenue annually with each dentist contributing about $2.4 million. DSOs can leverage economies of scale, provide administrative support, and implement standardized best practices and is leading to improved service delivery. The expansion of DSOs also facilitates access to advanced technologies and continuous professional development for practitioners, ultimately benefiting patients through higher quality care.

MARKET CHALLENGES

Limited Access to Dental Care in Rural Areas

Access to dental services in rural regions remains a significant challenge. For instance, in Australia, residents in remote areas often struggle to obtain timely dental care due to a shortage of practitioners and facilities. A Senate inquiry highlighted the disparity between urban and rural dental care access that is emphasizing the need for greater government investment in training and funding to address the higher costs of rural dental services. This lack of access leads to untreated dental issues, adversely affecting overall health and quality of life for rural populations. For instance, in disadvantaged areas, over 27% of residents avoid dental visits due to expense, compared to 11% in the least disadvantaged localities.

Rising Operational Costs for Dental Practices

Dental practices are grappling with increasing operational expenses, including costs for advanced equipment, compliance with regulatory standards, and staff salaries. In the United States, the American Dental Association reported that national dental spending increased by 2.5% from 2022 to 2023, reflecting higher costs within the industry. These escalating expenses can lead to higher treatment costs for patients and may deter individuals from seeking necessary dental care and thereby impacting public oral health.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Dentsply Sirona, Straumann Group, Henry Schein, Inc., Envista Holdings Corporation, Align Technology, Inc., Zimmer Biomet Dental, 3M Oral Care, BioHorizons, Osstem Implant, Nobel Biocare, and Others. |

SEGMENT ANALYSIS

By Type Insights

The dental consumables segment represented the biggest segment by capturing 33.2% of the global market share in 2024. This category includes products such as dental restoration materials, orthodontics, endodontics, and other essential supplies used in daily dental practices. The dominance of this segment is attributed to the high demand for routine dental procedures including fillings, crowns, bridges, and implants which necessitate a continuous supply of consumable materials. The increasing prevalence of dental disorders such as cavities and periodontal diseases which further drives the demand for these products. According to the World Health Organization, approximately 2 billion people worldwide suffer from dental caries in permanent teeth, underscoring the significant need for restorative dental consumables.

The cosmetic dentistry segment is growing rapidly and is estimated to showcase a CAGR of 8.2% projected from 2025 to 2033. This surge is driven by increasing consumer desire for aesthetic enhancements, such as teeth whitening, veneers, and clear aligners. Advancements in dental technology have made these procedures more accessible and less invasive, further fueling their popularity. The rise of social media and the emphasis on appearance have also contributed to the growing demand for cosmetic dental services. As more individuals seek to improve their smiles, the cosmetic dentistry segment is expected to continue its robust expansion, playing a crucial role in the overall growth of the dental market.

By End-user Insights

The solo practices segment dominated the market with 38.1% of the global market share in 2024. The domination of the segment is majorly attributed to the traditional model of individual dentists operating independent practices, which remains prevalent in many regions. For instance, in the United States, a significant proportion of dental practitioners operate solo practices, contributing substantially to the market's overall revenue. As of 2023, approximately 36% of dentists operate solo practices, while the majority are now part of group practices. This structure allows for personalized patient care and autonomy in clinical decision-making, factors that have historically supported the dominance of solo practices in the dental industry.

The dental service organizations (DSOs) and group practices segment is estimated to grow at a CAGR of 9.2% within the dental market over the forecast period. According to the American Dental Association, the percentage of dentists affiliated with DSOs increased from 7.4% in 2016 to 10.4% in 2019, indicating a notable upward trend. This growth is driven by the advantages DSOs offer, including economies of scale, centralized administrative functions, and enhanced bargaining power with suppliers. These benefits enable practitioners to focus more on patient care while improving operational efficiency. The increasing complexity of regulatory compliance and the rising costs of advanced dental technologies also make the DSO model more attractive, as it allows for shared resources and reduced individual financial burdens. Consequently, DSOs are becoming a significant force in the dental market, reshaping the landscape of dental service delivery.

REGIONAL ANALYSIS

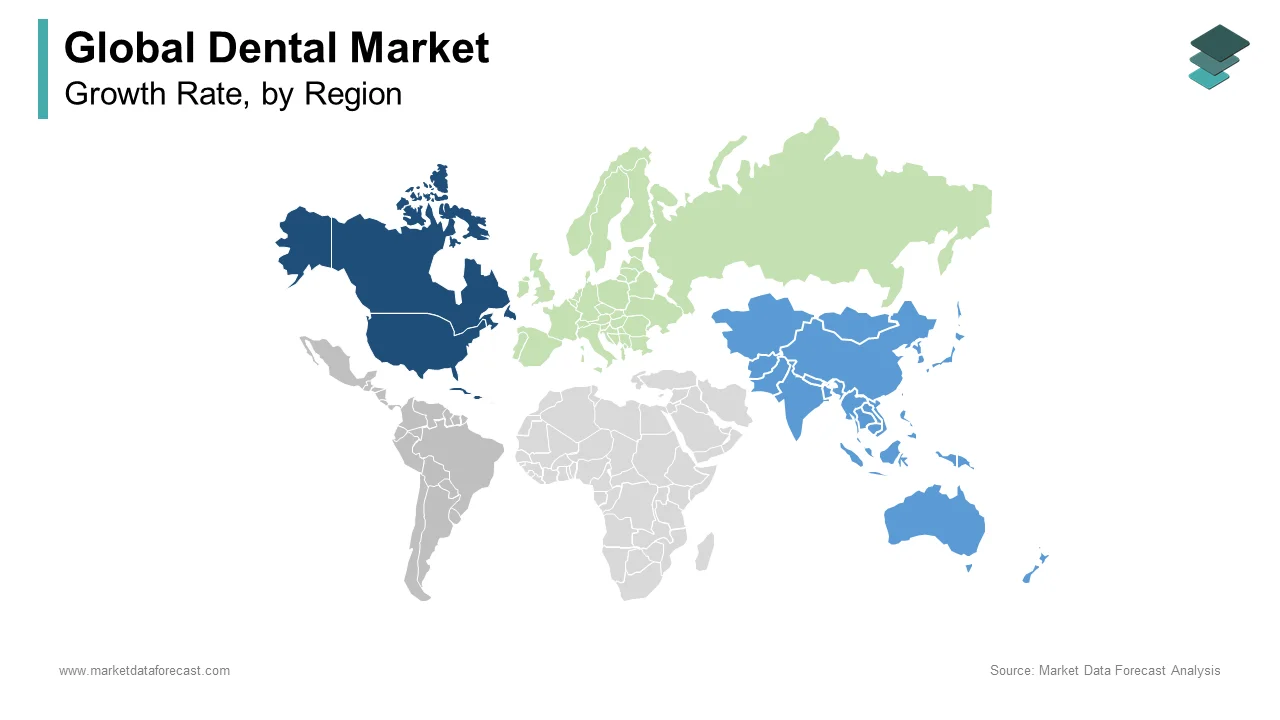

North America was the top performer in the global dental market and had 39.06% of the global market share in 2024. The lead of the North American region in the global market is attributed to factors such as advanced healthcare infrastructure, high awareness of oral health, and substantial investments in dental research and development. Approximately 50% of Americans visit the dentist annually, reflecting a strong culture of preventive care. The region's emphasis on preventive care and the availability of skilled dental professionals further bolster its leading status.

The Asia-Pacific region is experiencing the fastest growth in the dental market with a CAGR of 19.7%. This rapid expansion is driven by increasing awareness of oral health, rising disposable incomes, and the adoption of advanced dental technologies. Countries such as Thailand, India, and Malaysia have shown significant contributions to this growth, reflecting a burgeoning demand for dental services and products. Countries like Thailand and India attract over 2 million medical tourists annually and many of whom seek affordable and high-quality dental treatments.

Europe maintains a robust dental market, supported by well-established healthcare systems and a high prevalence of dental procedures. In Western Europe, approximately 70-80% of the population visits a dentist annually, reflecting high awareness of oral health. The region's focus on technological advancements and aesthetic dentistry contributes to its steady performance. However, challenges such as disparities in access to dental care and economic variations among countries may influence future growth trajectories.

In Latin America, the dental market is poised for moderate growth, driven by increasing urbanization and improving healthcare infrastructure. Efforts to enhance oral health awareness and the expansion of dental insurance coverage are expected to support market development. Brazil has the largest number of dentists in the region, with over 300,000 registered professionals , serving a population of 214 million. Nevertheless, economic constraints and unequal access to care remain challenges that could impact the pace of growth.

The Middle East and Africa region present emerging opportunities in the dental market, primarily due to a growing focus on healthcare development and rising awareness of oral hygiene. Urban populations in the region are expected to grow by 50% by 2030 , increasing access to healthcare facilities. Investments in healthcare infrastructure and initiatives to improve access to dental services are anticipated to drive market growth. However, political instability and economic disparities in certain areas may pose challenges to market expansion.

KEY MARKET PLAYERS

Some of the notable companies dominating the global dental market profiled in this report are Dentsply Sirona, Straumann Group, Henry Schein, Inc., Envista Holdings Corporation, Align Technology, Inc., Zimmer Biomet Dental, 3M Oral Care, BioHorizons, Osstem Implant, Nobel Biocare, and Others.

TOP 3 PLAYERS IN THE MARKET

Henry Schein, Inc.

Henry Schein, Inc., headquartered in Melville, New York, is a leading provider of healthcare products and services, primarily focusing on dental and medical professionals. The company offers a vast range of medical supplies, equipment, and technology solutions for healthcare practices worldwide. In January 2025, private equity firm KKR acquired a significant 12% stake in Henry Schein, aiming to enhance its operations and competitiveness in the market.

Dentsply Sirona, Inc.

Dentsply Sirona, Inc., based in Charlotte, North Carolina, is a global leader in dental solutions, offering innovative technologies and products for dental care, including dental equipment, consumables, and software. The company aims to enhance patient care and improve dental practice efficiency worldwide.

Straumann Group

Straumann Group, headquartered in Basel, Switzerland, specializes in dental implants, prosthetics, and digital dentistry solutions. In the third quarter of 2024, Straumann reported an 11.2% increase in organic revenue, reaching 585.5 million Swiss Francs. This growth was largely driven by strong demand in the Asia-Pacific region, which saw a 19.7% year-on-year increase, particularly in its implantology business.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Acquisitions and Partnerships

Companies like Henry Schein, Inc. actively pursue acquisitions to expand their market presence and service offerings. In January 2025, private equity firm KKR acquired a significant 12% stake in Henry Schein, aiming to enhance its operations and competitiveness in the market.

Technological Innovation and Digital Integration

Embracing advanced technologies is crucial for maintaining a competitive edge. Straumann Group, for instance, has invested in digital dentistry solutions, including CAD/CAM systems and 3D printing, to enhance treatment precision and efficiency. In the third quarter of 2024, Straumann reported an 11.2% increase in organic revenue, reaching 585.5 million Swiss Francs, driven by strong demand in the Asia-Pacific region and advancements in their implantology business.

Geographic Expansion

Expanding into emerging markets is a strategy employed by companies such as Sanitas Dental. In January 2025, Sanitas acquired six new dental clinics from Dental Star, located in various regions of Spain, increasing its total to 217 clinics nationwide. This move enhances their accessibility and service capacity across the country.

COMPETITIVE LANDSCAPE

The global dental market is characterized by intense competition among key players striving to expand their market share through various strategic initiatives. Companies such as Henry Schein, Inc., Dentsply Sirona, Inc., and the Straumann Group are at the forefront, leveraging acquisitions, technological advancements, and geographic expansion to strengthen their positions.

In January 2025, private equity firm KKR acquired a significant 12% stake in Henry Schein, aiming to enhance its operations and competitiveness in the market.

The market also witnesses significant consolidation activities, with companies like Sanitas Dental expanding their networks through acquisitions. In January 2025, Sanitas acquired six new dental clinics from Dental Star, increasing its total to 217 clinics across Spain.

Despite the dominance of large corporations, the market remains fragmented, with numerous small and medium-sized practices operating independently. This fragmentation presents opportunities for consolidation, as evidenced by the increasing activities of Dental Service Organizations (DSOs), which provide business management and support to dental practices, enhancing efficiency and service delivery.

Overall, the dental market's competitive landscape is shaped by strategic investments, technological innovation, and consolidation efforts aimed at enhancing service quality and expanding market reach.

RECENT MARKET DEVELOPMENTS

- In August 2024, Mitsui Chemicals, Inc. announced that its subsidiary SUN MEDICAL CO., LTD. launched sales of the i-TFC Luminous II dental material range.

- On December 15, 2023, Biodentine XP, a pulp therapeutic and restorative material, was recognized as the Product of the Year 2024 at the ADF Congress in France.

MARKET SEGMENTATION

This research report on the global dental market has been segmented and sub-segmented based on the type, end-user, and region.

By Type

- Dental Consumables

- Dental Restoration Products

- Dental Implants

- Endosteal Implants

- Superperiosteal Implants

- Transosteal Implants

- Dental Prosthetics

- Crowns

- Bridges

- Abutments

- Dentures

- Others

- Orthodontics

- Clear Aligners

- Conventional Braces

- Endodontics

- Others

- Dental Equipment

- Dental Radiology Equipment

- Dental Lasers

- Dental Surgical Navigation Systems

- CAD/CAM Equipment

- Dental Chairs

- Others

By End-user

- Solo Practices

- DSO/ Group Practices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the global dental market?

The global dental market is expected to grow from USD 38 billion in 2025 to USD 91.43 billion by 2033, at a CAGR of 11.6%.

2. What factors are driving dental market growth?

Technological advancements, an aging population, and rising demand for cosmetic dentistry.

3. What challenges does the industry face?

High treatment costs, limited access in rural areas, and a shortage of dental professionals.

4. What opportunities exist in this sector?

Public health integration and the expansion of Dental Service Organizations (DSOs).

5. How is technology shaping the dental market?

Digital imaging, laser dentistry, and CAD/CAM systems improve efficiency and patient outcomes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]