Global Dental Lasers Market Size, Share, Trends & Growth Forecast Report By Product (Soft Tissue, All Tissue and Dental Welding Lasers), Application (Conservative Dentistry, Endodontic Treatment and Periodontitis), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Dental Lasers Market Size

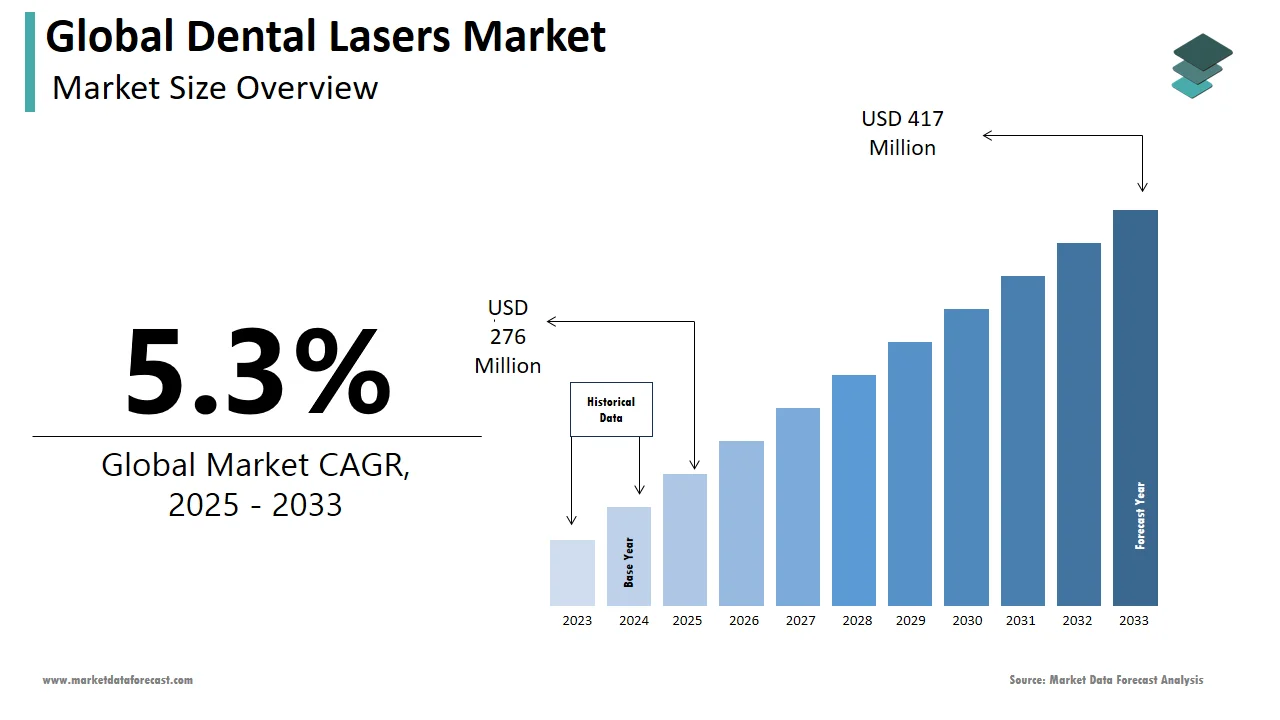

The global dental lasers market was worth US$ 262 million in 2024 and is anticipated to reach a valuation of US$ 417 million by 2033 from US$ 276 million in 2025, and it is predicted to register a CAGR of 5.30% during the forecast period 2025-2033.

Dental lasers are devices that generate a beam of light to remove or shape a tissue in the field of the dental treatment process. These dental lasers are highly productive, depending on the dentist’s capability to manage the exposure time and laser power output. These lasers are used for surgery processes; this grows in a short period. These lasers are used for cuts, destructions, periodontal treatment, and bone surgery. Unfortunately, 47% of adults who are 30 years and above are observed to be affected by at least one form of periodontal disease. 30% of people aged above 65 lack natural teeth. Nearly 300,373 people have oral cancer and lip cancer cases were recorded worldwide in 2012 and are projected to grow by 702,149 by 2017, growing at an annual rate of 18.5%.

MARKET DRIVERS

The growing patient population with dental problems and awareness among people of oral hygiene are majorly propelling the global dental lasers market growth.

Technological advancements and new product launches by key market participants in the dental industry are anticipated to boost the dental laser market. Most importantly, common dental disorders like dental caries and periodontal diseases have driven the dental laser's market growth. Furthermore, increasing demand for the cosmetic industry and rising medical tourism among developing countries promote market growth. In addition, lifestyle changes in people and the creation of awareness associated with dental care and cosmetic dentistry among developed and developing countries worldwide have surged the dental lasers market throughout the period.

The increasing adoption rate of soft tissue surgeries owing to the rising prevalence of soft tissue disorders like gingivitis and periodontal disorders is likely to offer growth opportunities. In addition, the growing demand for laser therapies using dental lasers is expected to increase growth opportunities in the market. The patients are opting for laser therapies over the traditional methods owing to the advantages associated with dental lasers, such as high comfort, less bleeding, reduced risk of contamination through instruments, effective results in less time, and reduced trauma are offering opportunities for the growth of the market during the forecast period.

The increasing adoption of technically advanced laser devices for connecting prosthetics and dental implant fabrication is further favoring the growth of the dental lasers market. In addition, increasing focus on research and adopting minimally invasive techniques to eliminate dental anesthetics and other instruments, such as dental drills, are expected to provide several opportunities for the growth of the dental lasers market.

MARKET RESTRAINTS

The restraints limiting the market's growth are the high costs of advanced dental treatments and the shortage of professionals for handling the devices. In addition, some dental procedures do not allow dental lasers, mainly when teeth have been treated with mental amalgam or other tooth components, which is expected to restrain the growth of the dental lasers market.

Impact of COVID-19 on the Global Dental Lasers Market

The eruption of the COVID-19 pandemic has created a critical disruption. Most of the researchers have faced many difficulties in meeting their timelines. The pandemic crisis has impacted every facet of modern life in the U.S. Dentists are guided to prefer laser systems used with disposable optic fiber tips whenever possible. Dental lasers are a dynamic industry with significant business development opportunities, but the present COVID-19 crisis caused shifts in short-term planning goals. During 2020, the profit pool increased widely across the dental lasers market as industries rapidly aligned their plans according to the market conditions. There was a slight decline during the lockdown period, but once the lockdown lifted, there was an increase in the economy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.30% |

|

Segments Covered |

By Product, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ZOLAR Technology & Mfg Co. Inc. and The Yoshida Dental Mfg. Co., Ltd., Biolase, KaVo Dental, and Sirona Dental Lasers, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the soft tissue segment dominated the dental lasers market in 2024 and is expected to grow at a high CAGR during the forecast period owing to the increasing number of soft tissue surgeries in which the diode lasers are major applications due to the benefits such as user-friendliness, affordability, and portability while treating the soft tissues. In addition, other factors contributing to the growth of the dental lasers market are increasing deposable income and patient preference for minimally invasive treatments.

By Application Insights

Based on the application, the periodontics segment had a significant share of the dental lasers market in 2024. It is likely to continue the trend during the forecast period due to the rise in the number of periodontics and the increasing disposable income of the people. In addition, the oral surgery segment is also rapidly growing and expected to pose lucrative growth opportunities due to increasing awareness about oral hygiene and rising demand for the gum tissue and bone reconstruction.

By End User Insights

Based on end-user, the dental clinics segment accounted for the most significant share of the dental lasers market in 2024 and is anticipated to grow at the highest CAGR during the forecast period owing to the skilled physicians. In addition, people are showing interest in regular diagnosis and dental check-ups, leading to rising in the number of dental clinics, which is increasing demand for advanced resources, especially dental lasers for surgeries, compared to hospitals resulting in the dental growth lasers market.

REGIONAL ANALYSIS

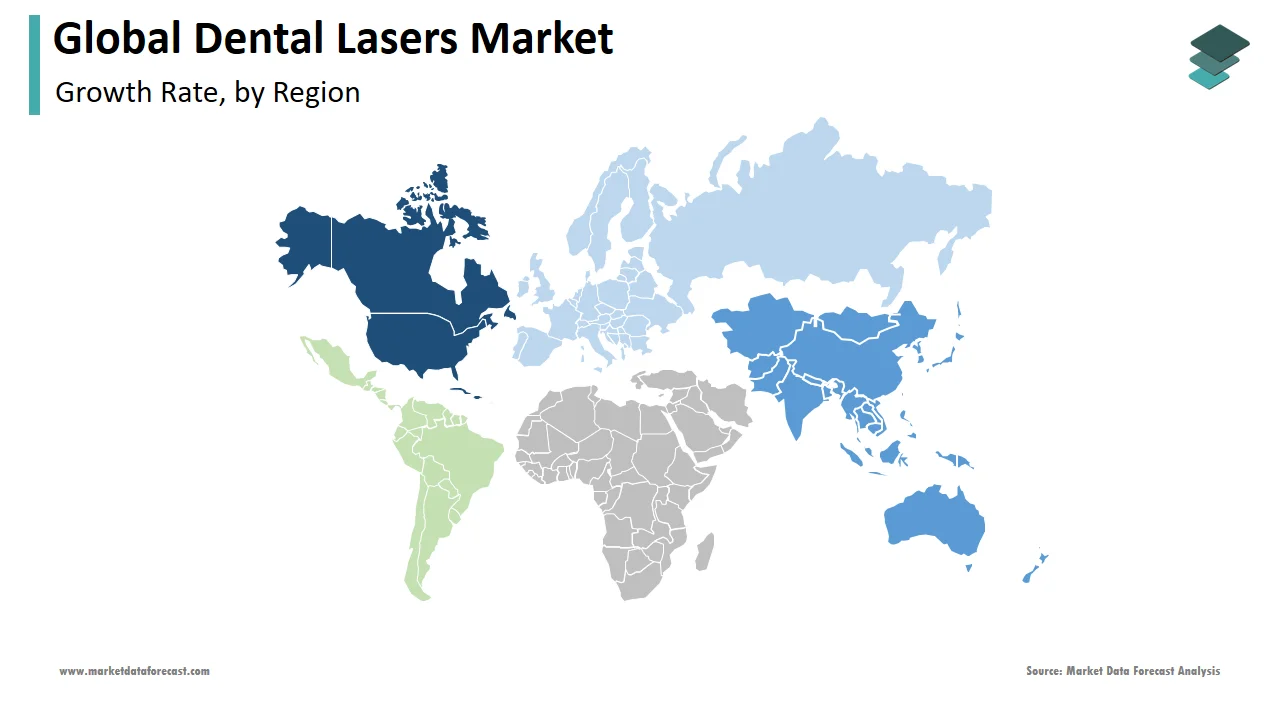

Geographically, the North American region dominates the global market and is likely to expand during the forecast period. Factors contributing to the growth of the market, such as increasing economies of the developing countries in the region, such as Brazil, resulting in the growth of the market continually improving cases of oral cancers, caries, gingivitis, and periodontics in the region is leading to the adoption of dental lasers.

The dental lasers market in the Asia Pacific region is rapidly growing. It is likely to dominate the market over the forecast period due to increasing awareness among the public regarding dental laser treatment. In addition, increasing focus on healthcare infrastructure and dental facilities in developing countries like India, which is likely to witness significant growth owing to the high population with unhealthy habits, is expected to boost the growth of this market; increasing demand for cosmetic dentistry is another factor that is fueling the growth of the market during the forecast period.

KEY MARKET PARTICIPANTS

Some of the promising companies dominating the global dental lasers market profiled in this report are ZOLAR Technology & Mfg Co. Inc. and The Yoshida Dental Mfg. Co., Ltd., Biolase, KaVo Dental, and Sirona Dental Lasers, and Others.

RECENT MARKET DEVELOPMENTS

- Biolase Company has recently launched an innovative product called Epic Pro. The device is designed with enhanced power to attain maximum efficiency and is applied to monitor and measure laser temperature.

- AMD Lasers Inc. launched a soft-tissue laser product known as Picasso Clario. It is highly efficient and can be operated at reduced costs with substantial profits in return.

- In July 2019, Light Scalpel LLC and LUxuarCare LLC were merged into a single company to enhance their operations.

- In December 2019, the Light touch Er: Yag dental laser was exhibited at an international expo in India. The device was launched by Light Instruments company in 2017; it can be applied for hard-tissue and soft-tissue treatments. The device has been accepted widely owing to its minimally invasive, faster healing, microsurgical, hand-in-operable nature.

MARKET SEGMENTATION

This research report on the global dental lasers market has been segmented and sub-segmented based on the product, application, end-user, and region.

By Product

- Soft Tissue

- All Tissue

- Dental Welding Lasers

By Application

- Conservative Dentistry

- Endodontic Treatment

- Periodontitis

By End User

- Hospitals

- Dental Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the dental lasers market worldwide in 2023?

The global dental lasers market size was valued at USD 262 million in 2024.

Which region had the major share in the global dental lasers market in 2024?

North America had the leading share of the market in 2024.

Which segment by application held the significant share in the dental lasers market?

Based on the application, the periodontics segment had the largest share of the dental lasers market in 2024.

Who are some of the notable players in the dental lasers market?

ZOLAR Technology & Mfg Co. Inc., The Yoshida Dental Mfg. Co., Ltd., Biolase, KaVo Dental, and Sirona Dental Lasers are a few of the prominent companies in the dental lasers market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]