Global Dental Insurance Market Size, Share, Trends & Growth Forecast Report By Coverage (Dental Preferred Provider Organizations [DPPO], Dental Health Maintenance Organizations [DHMO], Dental Indemnity Plans, Others), Type (Major, Basic, Preventive), Demographic (Senior Citizens, Adults, Minors), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Dental Insurance Market Size

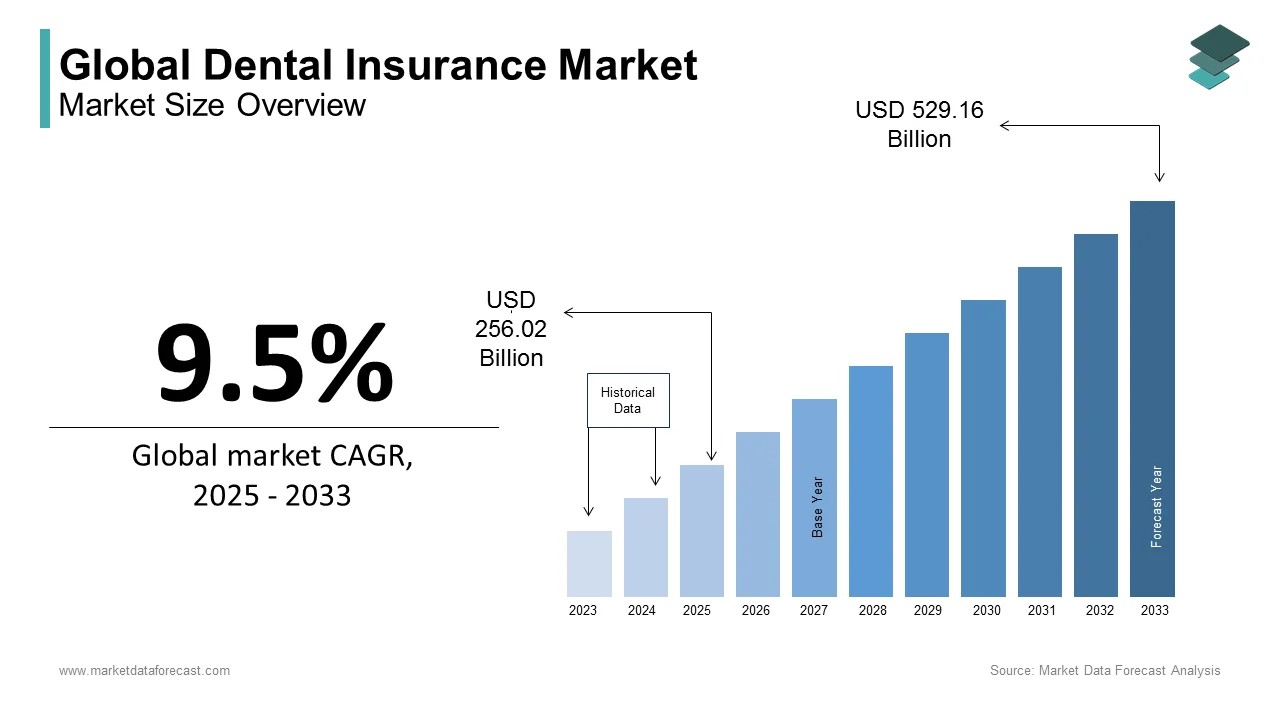

The size of the global dental insurance market was worth USD 233.81 billion in 2024. The global market is anticipated to grow at a CAGR of 9.5% from 2025 to 2033 and be worth USD 529.16 billion by 2033 from USD 256.02 billion in 2025.

Dental insurance is an insurance type that provides coverage for a range of dental services such as preventive care, routine check-ups, diagnostic services, and major dental surgeries. It helps to offset the costs of dental procedures, which are often not covered by traditional health insurance. Dental insurance plans are typically offered by private insurance companies, employers, and government programs, with varying coverage options, premiums, and cost-sharing models.

The dental insurance market has grown significantly due to factors such as rising awareness of the importance of oral health, increasing dental care costs, and an aging global population. In the U.S., approximately 77% of adults have dental coverage, with the majority of these individuals covered through employer-sponsored plans, according to National Association of Dental Plans. Preventive care, including regular check-ups and cleanings, is a key focus in many dental insurance plans, as it helps to reduce the need for costly treatments and encourages early detection of oral health issues.

In developed markets like North America and Europe, the dental insurance market is well-established, while in emerging markets, growth is fueled by rising incomes and improved access to healthcare. According to the World Health Organization, the global burden of oral diseases, which affect nearly 3.5 billion people worldwide shall drives demand for dental coverage. This expanding market is projected to continue growing, with factors such as technological advancements in dental care and increasing healthcare awareness supporting sustained demand for dental insurance products across both developed and developing regions.

MARKET DRIVERS

Rising Healthcare Costs

One of the primary drivers of the dental insurance market is the escalating cost of dental care, which has led many individuals to seek insurance coverage to mitigate out-of-pocket expenses. Dental procedures, such as fillings, crowns, and root canals, can be expensive, especially in countries where dental services are not covered under general health insurance plans. In the United States, for instance, the average cost of a routine dental visit can range from $75 to $200 without insurance, while major procedures like crowns can exceed $1,000 according to the U.S. Centers for Medicare & Medicaid Services. The growth of the dental insurance market is with more consumers are turning to dental insurance for financial protection. Furthermore, employer-sponsored dental plans are becoming a standard employee benefit that further driving the demand for dental insurance coverage.

Growing Awareness of Oral Health

Increased awareness of the importance of oral health is another major driver for the growth of the dental insurance market. Public education campaigns have highlighted the link between oral health and overall well-being by encouraging more individuals to seek preventive dental care. The World Health Organization reports that nearly 3.5 billion people worldwide suffer from oral diseases by making oral health a critical concern. They are more likely to seek insurance plans that cover preventive care such as cleanings and screenings as people become more aware of the risks associated with untreated dental issues. This growing focus on oral health has been a key factor in driving both individual and group dental insurance plan adoption.

MARKET RESTRAINTS

High Premium Costs

One of the major restraints in the dental insurance market is the high premiums associated with comprehensive dental coverage. Despite the growing demand for dental insurance, many individuals find the cost of premiums to be a barrier to entry. According to the National Association of Dental Plans, the average monthly premium for dental insurance in the U.S. can range from $20 to $50 per person for basic coverage with higher premiums for more extensive plans. These premiums are often more affordable than paying out-of-pocket for dental procedures where they can still be prohibitive for individuals, especially in low-income households. This financial burden can limit the overall penetration of dental insurance, particularly in emerging markets or regions with a significant portion of the population uninsured.

Limited Coverage for Major Procedures

Another key restraint on the dental insurance market is the limited coverage for major dental procedures which often results in high out-of-pocket costs for policyholders. Most dental insurance plans focus on preventive care and basic treatments, but coverage for more complex procedures like root canals, crowns, and orthodontics is often limited or excluded. According to the U.S. Centers for Medicare & Medicaid Services, dental insurance typically covers only 50% to 80% of the cost of major procedures is leaving patients to pay the remaining balance. This limited coverage often leads to dissatisfaction among policyholders who may seek alternative payment solutions which is hindering the growth potential of dental insurance plans that fail to meet the comprehensive needs of their customers.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

One significant opportunity in the dental insurance market is the increasing adoption of dental coverage in emerging markets. As disposable incomes rise and healthcare awareness improves in regions like Latin America, Asia-Pacific, and Africa, the demand for dental insurance is expected to surge. According to the World Bank, emerging economies have experienced robust economic growth, with many countries seeing rising middle-class populations. As a result, the dental insurance market in these regions is projected to expand significantly over the next decade. In particular, countries like India and Brazil are witnessing a growing demand for both private and employer-sponsored dental plans which is driven by increasing awareness of the importance of oral health and access to dental care.

Integration of Digital Health and Telemedicine

Another opportunity for the dental insurance market lies in the integration of digital health solutions, including telemedicine and AI-driven diagnostic tools. With the rise of telehealth services, insurers can offer virtual dental consultations and remote care management, which can enhance the convenience and affordability of dental care. The U.S. Centers for Medicare & Medicaid Services reports that the adoption of telemedicine has grown significantly, with a 154% increase in telehealth visits in 2020 alone. This trend is expected to extend to dental care by providing policyholders with more affordable access to dental consultations, especially in rural or underserved areas. The integration of telemedicine in dental insurance plans could increase market penetration and attract younger, tech-savvy customers seeking convenient dental care options.

MARKET CHALLENGES

Lack of Comprehensive Coverage

A significant challenge in the dental insurance market is the lack of comprehensive coverage, particularly for major dental procedures. Many dental insurance plans provide limited coverage for preventive care and basic treatments, but more complex procedures, such as root canals, crowns, and orthodontics, are often excluded or have a high out-of-pocket cost. According to the National Association of Dental Plans, most dental plans cover only 50% to 80% of the cost for major dental procedures, leaving a significant financial burden on patients. This lack of comprehensive coverage can deter individuals from enrolling in dental insurance plans, as many prefer not to pay high premiums for plans that do not adequately cover essential treatments, particularly in high-cost procedures.

Fragmented Market and Lack of Standardization

Another challenge facing the dental insurance market is the fragmented nature of coverage and the lack of standardization across plans. Unlike other healthcare insurance sectors, where policies are often more standardized, dental insurance plans vary greatly in terms of coverage, premiums, and reimbursement structures. The U.S. Centers for Medicare & Medicaid Services report that about 40% of U.S. adults are not covered by dental insurance, and the range of plans available can be confusing for consumers, which contributes to low enrollment rates. This lack of uniformity makes it difficult for consumers to compare policies and find plans that best meet their needs by limiting the market's potential growth, especially in emerging regions where consumer education is still evolving.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.5% |

|

Segments Covered |

By Coverage, Type, Demographic, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cigna Corporation, Aetna Inc., UnitedHealthcare, Humana Dental Insurance, MetLife Dental Insurance, Guardian Life Insurance Company of America, Blue Cross Blue Shield, Lincoln Financial Group, Anthem Inc., and Others. |

SEGMENT ANALYSIS

By Coverage Insights

The dental preferred provider organizations (DPPO) segment accounted for 55.8% of the global dental insurance market share in 2024. DPPO plans are popular due to their flexibility, as they allow individuals to choose any dentist while providing reduced costs for those who choose in-network providers. This balance between cost savings and freedom of choice makes DPPO plans highly attractive for both employers and employees. As of 2022, around 80% of employer-sponsored dental insurance plans in the U.S. offered DPPO options by making it the most widely adopted dental insurance model.

The dental health maintenance organizations (DHMO) segment is anticipated to witness a CAGR of 6.2% over the forecast period. DHMOs are gaining traction due to their lower premiums and emphasis on preventive care, which reduces long-term healthcare costs. These plans are designed to provide cost-effective dental care by requiring patients to select a primary care dentist and limiting coverage to a network of providers. The growing focus on affordability and the increasing emphasis on preventive care drive the demand for DHMO plans, particularly among price-sensitive consumers and organizations seeking cost-effective options.

By Type Insights

The preventive care segment had 50.4% of the global market share in 2024. Preventive care includes essential services such as routine check-ups, cleanings, and diagnostic screenings, which are crucial in maintaining oral health and preventing more severe dental issues. According to the U.S. Centers for Medicare & Medicaid Services, about 85% of dental insurance plans provide coverage for preventive services at little or no cost to the insured. This focus on preventive care not only helps in reducing the prevalence of dental diseases but also lowers the long-term costs associated with more extensive treatments. The wide availability and affordability of preventive care coverage contribute to its dominance in the market, as it is a fundamental aspect of most dental insurance plans.

The major care segment is projected to register a CAGR of 7.8% from 2025 to 2033. The increasing demand for major dental procedures is primarily driven by the aging population and the rising number of patients seeking cosmetic and orthodontic treatments. According to the American Association of Orthodontists, approximately 4.4 million people in the U.S. are currently undergoing orthodontic treatment, with a substantial portion covered by dental insurance plans. Major care continues to expand rapidly by highlighting its increasing importance in modern dental insurance offerings.

By Demographic Insights

The adults segment held the major share of 65.6% of the global market share in 2024. The higher share of adults is driven by the widespread availability of employer-sponsored dental insurance plans, which are the primary means of coverage for this group. In the United States, approximately 50% of the adult population is covered by employer-sponsored dental insurance, according to National Association of Dental Plans. Adults typically require more frequent dental care than other age groups due to preventive needs, such as cleanings, fillings, and routine exams. The emphasis on maintaining oral health as part of overall wellness contributes significantly to the high adoption of dental insurance in this group which further expands its market share.

The senior citizens segment is growing at the fastest CAGR of 7.5% from 2025 to 2033. This growth is largely attributed to the aging global population and the increasing dental care needs of older adults. According to the National Institute on Aging, approximately 40% of adults aged 65 and older suffer from untreated dental disease with the growing need for dental insurance as they age. Many seniors face significant dental issues such as tooth loss, dentures, and periodontal disease, which often require expensive procedures. The rising awareness of the importance of maintaining oral health in older age is driving the demand for dental insurance by making this demographic a key area for market growth in the coming years.

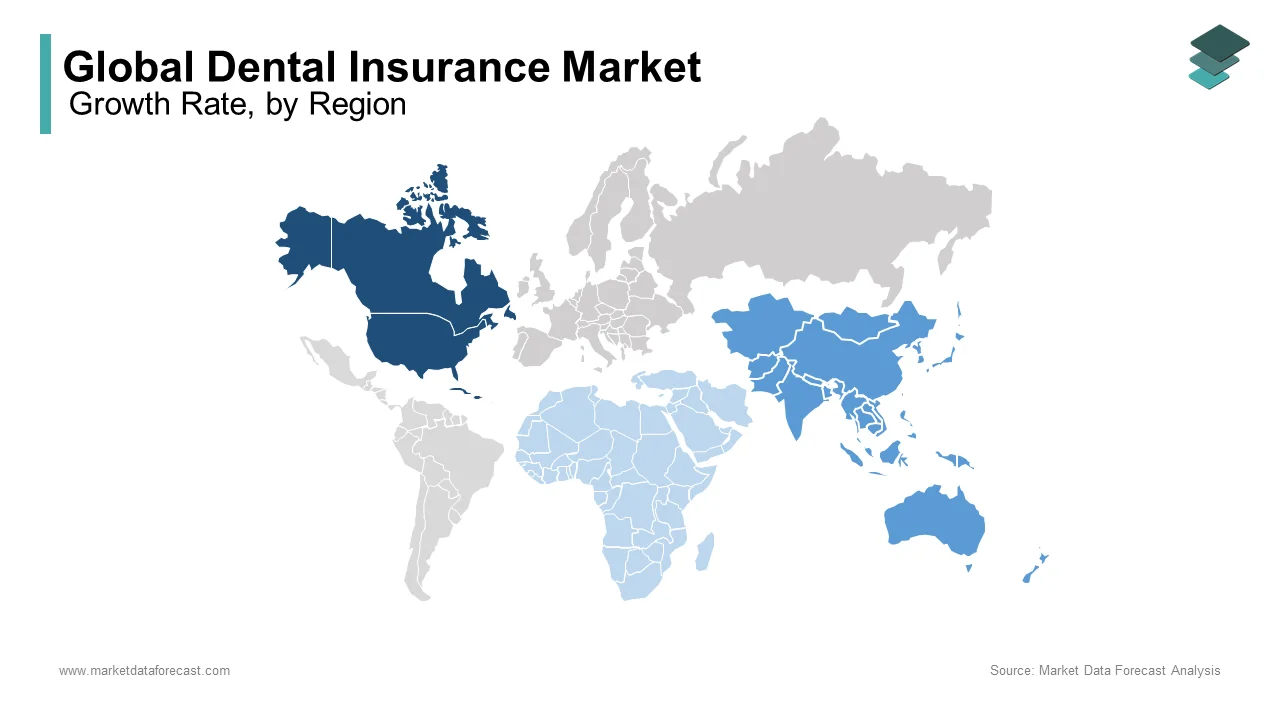

REGIONAL ANALYSIS

North America led the dental insurance market worldwide by accounting for 44.8% of the global market share in 2024. This dominance is primarily due to the widespread adoption of employer-sponsored dental insurance plans in the U.S., where over 77% of adults have some form of dental coverage, according to National Association of Dental Plans. The region’s established healthcare infrastructure, high awareness of oral health, and robust insurance frameworks are ascribed to bolster the growth rate of the market. The growing focus on preventive dental care, as well as increasing healthcare costs shall further drives demand for dental insurance in North America.

The dental insurance market in the Asia-Pacific region is gaining prominence and is expected to register a CAGR of 8.2% from 2025 to 2033. This growth is driven by rising incomes, improving healthcare access, and a growing middle class in countries like China, India, and Southeast Asia. According to the World Health Organization, approximately 3.5 billion people globally suffer from oral diseases which is leading to a rising demand for dental care and insurance in the region. Additionally, as dental awareness increases and healthcare infrastructure improves, more individuals in Asia-Pacific are seeking coverage for dental services which shall contributing to the region's rapid growth.

In Europe, the dental insurance market is expected to grow steadily, with a focus on high-quality dental care, particularly in countries like Germany and the U.K., where coverage is increasingly included in national healthcare plans.

In Latin America, growth is moderate but will accelerate due to rising incomes and improving access to dental care, especially in Brazil and Mexico. The World Bank reports a steady increase in healthcare spending in these countries, which is expected to drive dental insurance adoption.

Meanwhile, the Middle East and Africa will see slower growth, with market expansion driven by economic diversification and rising awareness of dental health, particularly in countries like the UAE and South Africa.

KEY MARKET PLAYERS

Cigna Corporation, Aetna Inc., UnitedHealthcare, Humana Dental Insurance, MetLife Dental Insurance, Guardian Life Insurance Company of America, Blue Cross Blue Shield, Lincoln Financial Group, and Anthem Inc., and Others.

TOP KEY PLAYERS IN THE MARKET

1. Delta Dental Insurance Company

Delta Dental Insurance Company is one of the largest and most recognized players in the global dental insurance market, primarily operating in the United States. It holds a significant share of the market, covering millions of individuals and offering a range of plans, including PPO, HMO, and individual and group plans. Delta Dental is known for its extensive network of dental providers, which includes over 150,000 dentists, making it one of the largest provider networks in the industry. The company is also committed to preventive care, focusing on initiatives that encourage regular dental visits, which ultimately lowers overall healthcare costs. Delta Dental's leadership is solidified by its significant market presence, particularly through employer-sponsored dental plans, and its commitment to improving oral health education.

2. Cigna Corporation

Cigna is a global health service company that provides dental insurance in various regions, with a strong presence in the U.S., Europe, and other global markets. Cigna offers a wide variety of dental plans, including PPO, dental HMO, and flexible spending accounts, serving both individual and corporate clients. Cigna stands out for its focus on enhancing access to dental care and preventive services, offering a large network of dental professionals. The company’s dental insurance plans are popular for their flexibility and comprehensive coverage, which is tailored to meet the needs of both individual customers and employer groups. Cigna’s use of digital tools to manage benefits and access to care also strengthens its position as a global leader in the dental insurance market.

3. Aetna Inc.

Aetna, a subsidiary of CVS Health, is one of the prominent players in the dental insurance market, with a strong footprint in North America. Aetna provides a wide range of dental insurance options, including PPO, HMO, and indemnity plans, to individuals and employer groups. The company is known for its broad provider network and emphasis on preventive care, which helps reduce overall healthcare costs. Aetna’s dental plans offer flexibility, ensuring that individuals can choose from a range of coverage options to suit their needs. Aetna also integrates wellness and dental care, ensuring that dental health is part of an individual’s broader health management, which strengthens its appeal to consumers seeking comprehensive healthcare solutions.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

1. Expansion of Coverage and Customization

Many dental insurance companies, including Delta Dental and Cigna, offer a range of coverage options to meet the diverse needs of different demographics. These include individual, family, and employer-sponsored plans, as well as specialized plans targeting seniors, children, and low-income groups. By providing tailored solutions, these companies cater to a broad customer base, ensuring they meet the specific needs of various markets. Additionally, many insurers are expanding their coverage to include not just preventive care but also more extensive treatments, such as orthodontics and cosmetic dentistry, which are becoming increasingly important to consumers.

2. Strategic Partnerships and Network Expansion

Building a broad network of dental providers is another key strategy for market leaders. Cigna and UnitedHealthcare have expanded their provider networks to include a diverse range of dental professionals and clinics, ensuring that policyholders have convenient access to quality care. These networks are critical for customer satisfaction, as access to trusted providers can influence consumer decisions. Furthermore, partnerships with employers and group plans have been effective in increasing dental insurance adoption rates, particularly among working adults who receive coverage through their jobs.

3. Technological Integration and Digital Tools

To enhance customer engagement and streamline claims management, many dental insurance companies are incorporating digital tools and platforms into their services. Aetna and MetLife have integrated mobile apps and online portals that allow customers to check benefits, manage appointments, and track claims status. These tools make the process more convenient for policyholders, driving customer satisfaction and reducing administrative costs for insurers. The use of artificial intelligence (AI) and data analytics to predict customer needs and personalize offerings is also helping to strengthen customer relationships.

4. Preventive Care and Wellness Programs

A major differentiator in the dental insurance market is the focus on preventive care. Companies like Delta Dental and Cigna emphasize the importance of regular checkups, cleanings, and screenings to reduce the long-term costs of dental procedures. By promoting preventive care, insurers can not only improve the health of their customers but also reduce the overall claims burden. Additionally, these companies often offer wellness programs that incentivize customers to engage in healthy oral habits, such as discounts for regular visits or educational content on dental care. This proactive approach can enhance customer loyalty and lead to healthier populations, ultimately benefiting the insurer’s bottom line.

5. Global Market Expansion

In response to the growing demand for dental insurance worldwide, major players like Cigna and Aetna are expanding their footprint in international markets. These companies have been targeting regions with emerging middle-class populations, such as Asia-Pacific and Latin America, where there is an increasing awareness of the need for dental insurance. By entering new markets and offering localized dental plans that meet specific regional needs, these insurers are tapping into large, untapped customer bases, contributing to global growth.

6. Cost Control and Value-Based Insurance Plans

To stay competitive, dental insurance companies are focusing on cost control through value-based insurance plans that offer high-quality care at more affordable rates. MetLife and Humana have focused on creating dental plans that balance premiums, deductibles, and out-of-pocket expenses while maintaining comprehensive coverage. These cost-effective plans are especially attractive to individuals and small businesses that want to provide dental benefits without incurring high expenses. By managing the balance between affordability and quality, these insurers ensure they appeal to a wide range of customers.

COMPETITIVE LANDSCAPE

The competition in the dental insurance market is intense, with a wide range of players competing to capture market share across different regions and demographics. Major global players like Delta Dental, Cigna, and Aetna lead the market, benefiting from their extensive provider networks and broad customer bases. These companies offer a variety of dental plans, including PPOs, HMOs, and indemnity plans, catering to individuals, families, and corporate groups. They differentiate themselves by offering flexible and comprehensive coverage options that appeal to both cost-conscious consumers and those seeking more extensive dental services.

Smaller, regional insurers also play a significant role, often focusing on specialized products or niche markets, such as dental coverage for seniors or low-income families. Competitive pricing is a crucial factor, with many insurers introducing cost-effective plans to attract budget-conscious consumers. Additionally, customer service and digital tools, such as mobile apps for managing claims and accessing benefits, have become key differentiators in this competitive landscape.

The rising focus on preventive care and wellness programs also intensifies competition, as insurers look for ways to provide value-added services that help customers maintain oral health and reduce overall healthcare costs. As the market continues to grow, especially in emerging regions, competition will intensify, with insurers striving to offer innovative solutions and personalized coverage to meet diverse consumer needs.

RECENT MARKET DEVELOPMENTS

- In June 2023, Delta Dental expanded its network by adding 10,000+ dental care providers, enhancing access for policyholders. This expansion is anticipated to strengthen their market position by improving accessibility and customer satisfaction.

- In March 2023, Cigna launched virtual dental consultations as part of their dental insurance plans, allowing members to access dental advice remotely. This initiative is expected to increase customer engagement and attract tech-savvy consumers.

- In February 2023, Aetna partnered with CVS Health to integrate its dental plans with CVS's retail locations, making dental care more accessible and reducing barriers to enrollment. This partnership aims to enhance Aetna's market reach.

- In April 2023, MetLife introduced more flexible PPO dental plans that allow consumers to select from a wider range of dentists and dental treatments. This move is anticipated to increase customer retention and enhance MetLife's market position.

- In January 2023, Humana expanded its dental wellness program to include preventive care incentives, offering discounts on regular checkups and cleanings. This program is expected to promote oral health and improve customer loyalty.

- In May 2023, Guardian Life launched tailored dental insurance plans for employers, providing businesses with customizable options for offering dental coverage to employees. This initiative is expected to enhance their presence in the employee benefits market.

- In July 2023, UnitedHealthcare integrated its dental plans with popular health and wellness apps, allowing customers to track dental care appointments and health goals. This integration aims to improve customer engagement and retention.

- In March 2023, Blue Cross Blue Shield introduced a dental plan specifically designed for seniors, addressing the growing need for dental coverage among older adults. This launch is anticipated to increase their market share among seniors.

- In June 2023, Lincoln Financial Group expanded its dental insurance offerings into Latin America and Asia-Pacific, tapping into new markets where dental insurance demand is rising. This expansion is expected to boost their presence in emerging regions.

- In April 2023, Anthem implemented AI-driven claims processing for dental insurance, significantly reducing the time and complexity of claims handling. This technological advancement is anticipated to improve operational efficiency and enhance customer satisfaction.

MARKET SEGMENTATION

This global dental insurance market research report has been segmented and sub-segmented based on coverage, type, demographic, and region.

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Type

- Major

- Basic

- Preventive

By Demographic

- Senior Citizens

- Adults

- Minors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the projected growth rate for the dental insurance market?

The dental insurance market is projected to grow from USD 256.02 billion in 2025 to USD 529.16 billion by 2033 at a compound annual growth rate (CAGR) of around 9.5%.

2. What is the impact of rising dental care costs on the market?

Increasing dental care costs are driving demand for insurance coverage as consumers seek financial protection from high treatment expenses.

3. What challenges does the market face?

High premiums and limited coverage for major treatments are key challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]