Global Dental Implants Market Size, Share, Trends & Growth Forecast Report By Implant Type, Material, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Dental Implants Market Size

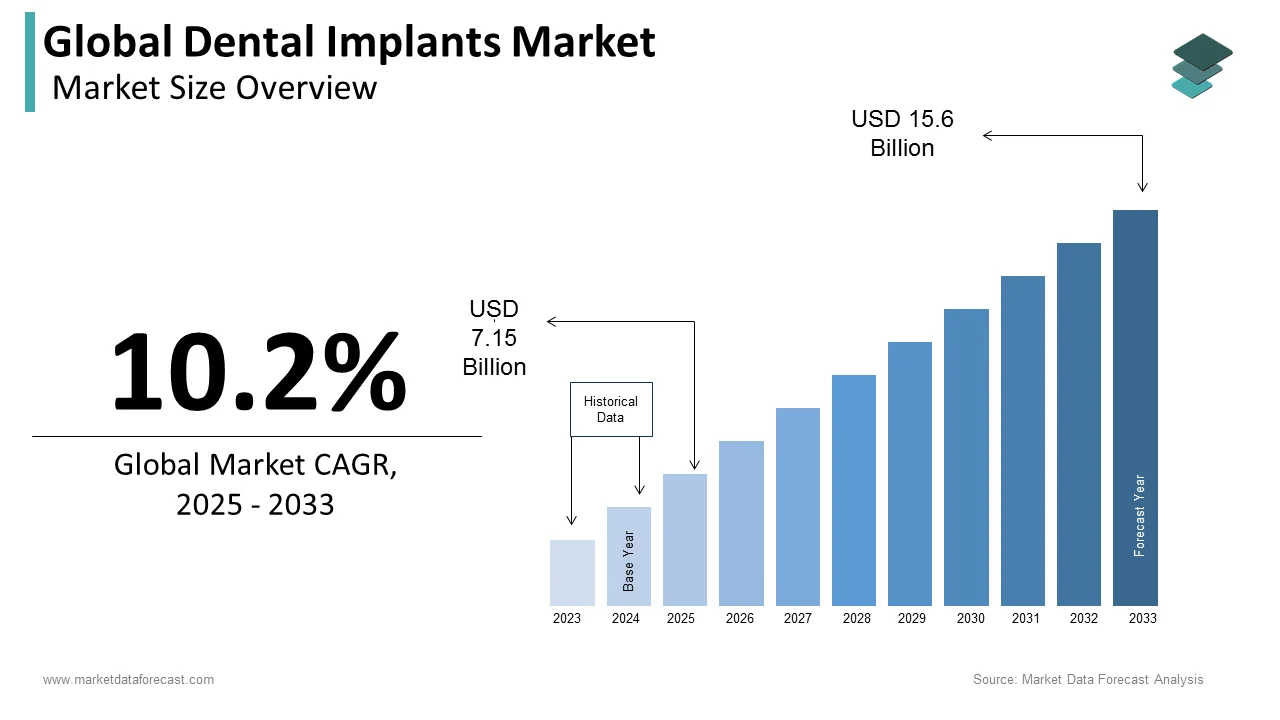

The global dental implants market was valued at USD 6.5 billion in 2024. The global market is projected to grow from USD 7.15 billion in 2025 to reach USD 15.6 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 10.2% from 2025-2033.

A dental implant is a metal post of titanium positioned into the jawbone surgically beneath the gums. After being placed into the jawbone, these implants allow the replacement teeth to be mounted over them by dentists. Dental implants act as artificial roots in the jaw to secure replacement teeth or a bridge. Dental implants are an alternative for those who have lost tooth/teeth because of periodontal diseases or injuries.

MARKET DRIVERS

The growing patient count suffering from dental disorders is propelling the dental implants market growth.

The number of people suffering from periodontal diseases, tooth decay, and oral cancer has grown significantly over the last few years. Often these conditions can result in tooth loss. Dental implants are one of the effective solutions for tooth replacement. WHO says 3.5 billion people worldwide are suffering from oral diseases and periodontal diseases are affecting a population of 1 billion worldwide. As per the data published by the Oral Cancer Foundation, an estimated 54,000 Americans had oral cancer in 2022. In addition, the population with missing tooth issues is expected to grow in the coming years owing to the growing aging population and poor oral hygiene. Dental implants are used as a solution to tooth loss and possess a high success rate. Due to this, dental implants have become the widely adopted solution for tooth loss issues.

The growing disposable income worldwide is further fuelling the growth rate of the dental implants market. Owing to the growing disposable income, the demand for cosmetic dentistry procedures, including dental implants, is increasing considerably. The growing disposable income is increasing the ability of people to invest in the treatment procedures of dental implants for their tooth replacement issues. The growing middle-class population in emerging economies is resulting in favor of the dental implants market growth. With the growing income, people are showing an increased willingness to invest in their health and appearance, including oral care.

The rising awareness among people regarding dental health is contributing to the growth of the dental implants market.

In the last few years, people’s awareness of oral care has increased tremendously. Many people have become aware of various dental procedures and treatments including dental implants. People have been taking several measures to prevent dental diseases such as cavities, gum diseases, and tooth loss. Dental implants have become one of the attractive solutions among people that are suffering from missing tooth issues. Due to the growing usage of internet and social media, people are able to find information around dental health and dental procedures. This has resulted in the growing awareness of dental implants and their benefits and success rates and resulted in market growth.

In addition, the growing aging population worldwide, rapid adoption of technological developments in the design and development of dental implants and increasing number of advancements in digital dentistry are propelling the dental implants market growth. Factors such as increasing dental tourism, increasing number of dental clinics and dentists in emerging economies and the emergence of mini dental implants are further contributing to the growth of the dental implants market.

MARKET RESTRAINTS

However, the dental implant market faced pitfalls. Limited reimbursement policies for dental treatment plans and most insurance providers are not covering dental treatments as a part of their Mediclaim policy, which are majorly projected to hinder the market growth. Dental treatment is usually excluded from the policy cover. Dental implants are considered a more reliable choice than veneers or crowns. However, the expense of treatment with dental implants is considerably high due to the high-priced implants and surgery. Most insurance providers in developed and developing companies classify dental implants as cosmetic surgery, therefore providing minimal or no dental implants. The high pervasiveness of peri-implant mucositis and peri-implantitis caused due to dental implants is further expected to restrain the market's growth.

Asia is price-sensitive and displays inhibitions to investing in dental implants, often only affordable to the elite population, offering a comparatively smaller market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.2% |

|

Segments Covered |

By Type, Material, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Osstem Implant, BiometHenry Schein Iraqi National Congress., Institut Straumann Ag, The Danaher Corporation, Biotech Dental Laboratories, Cortex Dental Implants Industries Ltd., Bicon Dental Implants, Avinent Implant System, Camlog Biotechnologies Ag, ADIN Dental Implants Systems, Glidewell Dental work, A.B. Dental Devices Ltd., Biohorizons Implant Systems, Inc., and Dentsply Sirona., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the endosteal implants segment held the major share of the global dental implants market in 2024 and the segment’s domination is expected to continue during the forecast period. The growth of the segment is majorly driven by the growing patient population suffering from dental caries and periodontal diseases. According to the data published by the World Health Organization (WHO), dental caries is very common among adults and an estimated 60% to 90% of school-going children are getting affected by dental caries. In addition, the increasing number of dental implant procedures and rising dental tourism are contributing to segmental growth. For instance, as per the statistics published by the American Academy of Implant Dentistry, an estimated 3 million people in the United States have dental implants.

By Material Insights

Based on material, the titanium segment held the largest share of the global dental implants market in 2024 and is estimated to grow at a noteworthy CAGR during the forecast period. The growing patient population suffering from dental diseases is majorly boosting segmental growth. Factors such as increasing demand for dental implant procedures and the rising adoption of computer-aided design and manufacturing (CAD/CAM) technology are further accelerating the segment’s growth rate.

However, the zirconium segment is predicted to be the fastest-growing segment in the worldwide dental implants market during the forecast period. The growing demand for metal-free dental implants is one of the key factors propelling segmental growth. In addition, the growing incidence of metal allergies, and the increasing preference for aesthetically pleasing dental restorations are driving the segmental growth.

By End User Insights

Based on end-user, the dental clinics segment held the major share of the global dental implants market in 2024 and the domination of the segment is predicted to continue throughout the forecast period. Dental clinics are primary end-users of dental implants, which is one of the major factors propelling segmental growth. The growth of the segment is majorly driven by the rising number of dental implant procedures being done in dental clinics worldwide and the increasing demand for cosmetic dentistry. The rising availability of specialized dental services is another noteworthy factor boosting the growth rate of the segment.

On the other hand, the hospitals segment accounted for a considerable share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The growing number of hospital-based dental clinics, the rising trend towards multi-specialty hospitals, and the increasing demand for comprehensive dental care are majorly driving the growth of the segment.

REGIONAL ANALYSIS

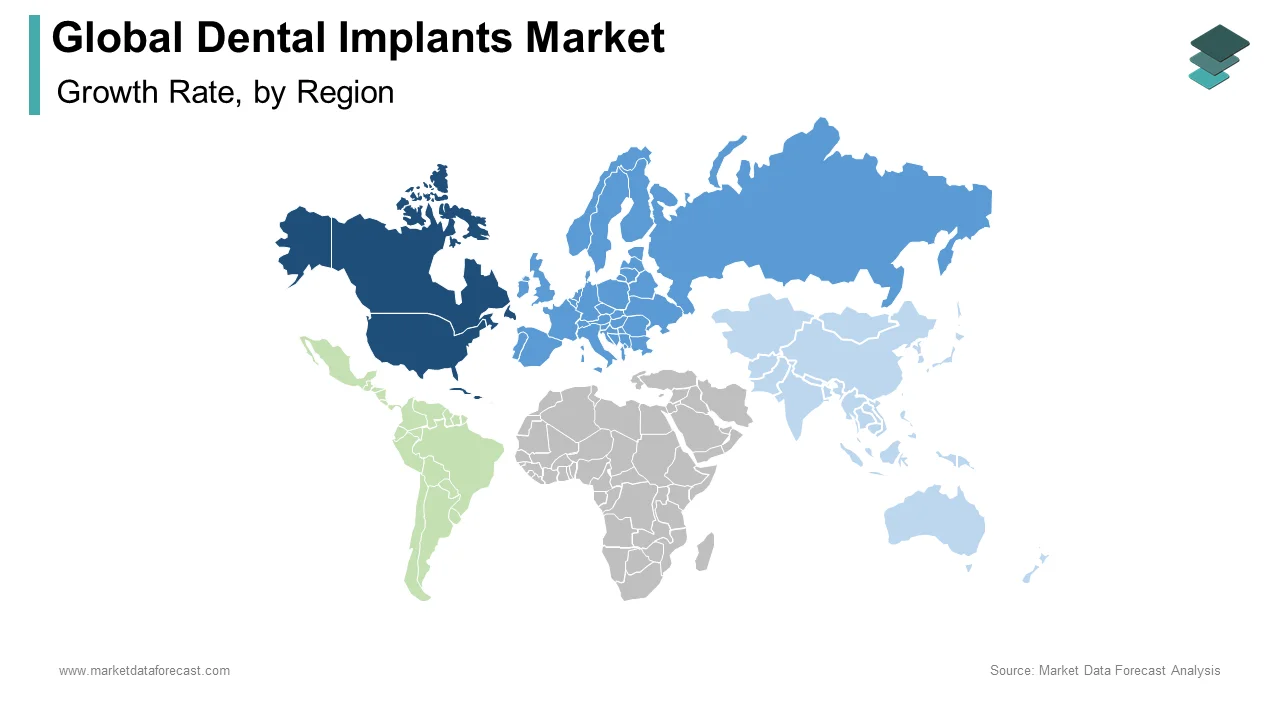

Geographically, most of the global dental implants market share was controlled by North America in 2024. During the forecast period, the North American dental implants market is forecasted to grow rapidly due to many regional dental organizations and dental procedures, mainly in the United States. The European market for dental implants is anticipated to be the second-largest during the forecast period. The growing demand for and focus on cosmetic dentistry and its increasing awareness of preventative and corrective treatment in European countries are expected to boost its growth.

The North American region dominates the worldwide dental implants market. As per a report released in 2014 by the National Institute of Dental and Craniofacial Analysis, the government initiated the National Oral Health decision to improve the standard of life of Americans. This program specialized in amending public perceptions, the amendment in policymakers' opinions, and altering health providers' opinions. Besides, factors like a well-established healthcare sector and increasing demand for dental implants boost market growth. As a result, the North American Dental Implants Market has shown commendable growth and is estimated to continue the same trend until 2033. Furthermore, the regional development can be accredited to a reasonable compensation situation within the country, including the rising geriatric public often liable to tooth loss.

Increasing incidences of dental problems and creating awareness over the availability of different treatment procedures are likely to bolster the market's growth rate in North America. More than 5 million implants are placed annually by dentists in the United States. Tooth implants are available in several countries around the world. The procedure is the most expensive in the USA, costing an average of 6000 USD. On the other hand, it is much cheaper in countries like Mexico, Thailand, Costa Rica, Poland, Hungary, and Turkey, where it costs lesser than 800 USD. Increasing dental tourism across Europe will significantly stimulate European countries' dental implant market growth.

The Europe dental implants market is also thought of as the quickest-growing marketplace for dental implant players, attributable to the large population affected by oral diseases. Moreover, increasing incidences of dental issues related to the aging population and rising government expenditure on oral health care drive market growth within the European region.

The Asia-Pacific dental implants market is predicted to be the fastest-growing market due to the rising aging population, increasing consumer awareness, accessibility, and easy availability. Further, in the Asia-Pacific, South Korea was valued at a market share of 18% in 2024. Furthermore, the Middle East & Africa market is expected to grow steadily due to rising awareness about dental care and advanced dental technologies. Countries like China in the Asia Pacific region, because of a large population littered with oral health problems. Japan may be a developed economy with a well-established healthcare system and technology.

In contrast, developing countries still specialize in new medicine and technology to treat dental implants. The Asia Pacific is anticipated to be the fastest-growing region due to increased economic stability and disposable income over the forecast period. As a result, most companies focus on strategic initiatives such as introducing novel products through customization according to consumers' needs, collaborations, partnerships, and mergers and acquisitions to expand their product portfolio in dental implantology.

On the other hand, countries with immense population growth are littered with oral health problems. Therefore, the Indian dental implants market size is expected to hike notably during the forecast period due to the increased traction. Also, India is the largest market for dental implants across the globe.

The Thailand dental implants market is another lucrative region in the Asia Pacific and is expected to register robust growth during the forecast period.

The dental implant markets in Latin America, the Middle East, and Africa have the major untapped markets. However, the dental implants market in Iran is forecasted to witness healthy growth between 2025 to 2033 due to the affordable prices of dental implants. According to Iranian Surgery, a dental implant costs USD 4500 in the United States, whereas it costs only USD 600 in Iran.

KEY MARKET PARTICIPANTS

Some of the notable dental implant manufacturers that are playing a significant role in the global dental implants market are Osstem Implant, BiometHenry Schein Iraqi National Congress., Institut Straumann Ag, The Danaher Corporation, Biotech Dental Laboratories, Cortex Dental Implants Industries Ltd., Bicon Dental Implants, Avinent Implant System, Camlog Biotechnologies Ag, ADIN Dental Implants Systems, Glidewell Dental work, A.B. Dental Devices Ltd., Biohorizons Implant Systems, Inc., and Dentsply Sirona.

RECENT HAPPENINGS IN THIS MARKET

-

In June 2019, Zfx and Zimmer Biomet launched a new restorative digital product line for Zimmer Biomet dental implant systems, GenTek. The products will strengthen the integrity of clinically proven implant connection designs.

-

In June 2019, Southern Implants, Pty introduced INVERTA Implant to enhance the patient population's aesthetic appearance.

-

In June 2018, Darby Dental Supply launched the Alfa Gate line of premium implants. Darby Dental Supply is one of the largest dental distributors in the U.S.

-

In September 2018, Azento Single tooth replacement was introduced by Dentsply Sirona in the U.S. Aim of this launch concentrated on transforming dental implant workflow by modernizing implant planning, purchase, and delivery.

MARKET SEGMENTATION

This research report on the global dental implants market has been segmented and sub-segmented based on the following categories.

By Type

-

Subperiosteal Implants

-

Intramucosal Implants

-

Endosteal implants

-

Transosteal Implants

By Material

-

Zirconium Implants

-

Titanium Implants

By End User

-

Dental Clinics

-

Hospitals

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

The Middle East and Africa

Frequently Asked Questions

What is the future of dental implants market?

The future of the dental implants market is expected to be bright and is predicted to grow at a CAGR of 10.2% from 2025 to 2033.

Does this report include the impact of COVID-19 on the dental implants market?

Yes, in this report, the COVID-19 impact on the global dental implants market is included.

Which region is predicted to lead the dental implants market in the future?

The North American regional market is estimated to occupy the most significant share of the global dental implants market from 2025 to 2033.

Who are the key players operating in the dental implants market?

Osstem Implant, BiometHenry Schein Iraqi National Congress., Institut Straumann Ag, The Danaher Corporation, Biotech Dental Laboratories, Cortex Dental Implants Industries Ltd., Bicon Dental Implants, Avinent Implant System, Camlog Biotechnologies Ag, ADIN Dental Implants Systems, Glidewell Dental work, A.B. Dental Devices Ltd., Biohorizons Implant Systems, Inc., and Dentsply Sirona are some of the major companies operating in the global dental implants market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]