Global Deep Brain Stimulation Devices Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Single Channel, Dual Channel), Application, End-User and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Deep Brain Stimulation Devices Market Size

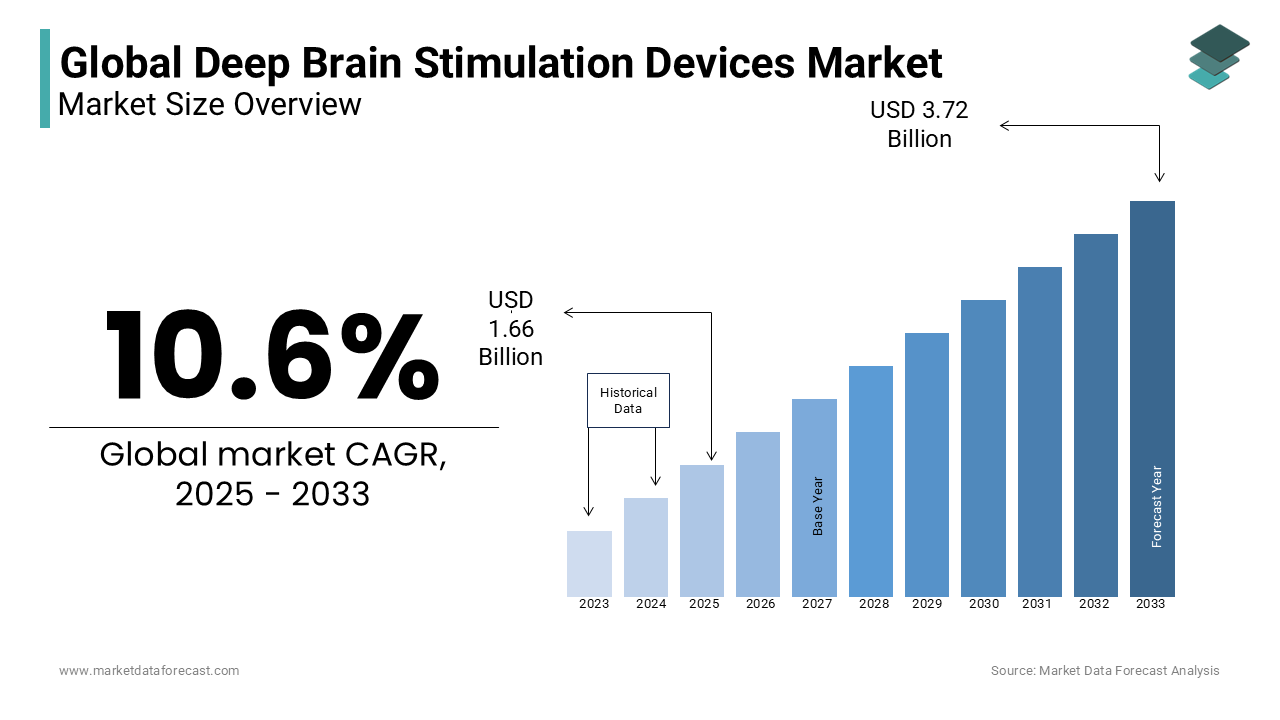

The global deep brain stimulation devices market size was estimated at USD 1.50 billion in 2024 and is projected to reach USD 3.72 billion by 2033 from USD 1.66 billion in 2025, growing at a CAGR of 10.6% from 2025 to 2033.

Deep brain stimulation (DBS) devices are designed to deliver electrical impulses to specific areas of the brain in order to alleviate symptoms associated with neurological disorders. DBS has become an established therapeutic option for conditions such as Parkinson’s disease, essential tremor, dystonia, and obsessive-compulsive disorder (OCD).

As the prevalence of neurological disorders continues to rise globally, the demand for DBS devices has seen significant growth. The World Health Organization (WHO) reports that over 7 million individuals are affected by Parkinson’s disease worldwide, with numbers expected to double by 2040. This growing patient pool, coupled with advancements in technology—such as smaller and more precise stimulators and wireless connectivity—is expected to drive the market forward. Moreover, the increasing adoption of DBS for non-motor symptoms, such as depression and anxiety, is creating new growth avenues.

MARKET DRIVERS

Growing Prevalence of Neurological Disorders

One of the primary drivers of the Deep Brain Stimulation (DBS) Devices Market is the increasing prevalence of neurological disorders, particularly Parkinson’s disease. According to the World Health Organization (WHO), Parkinson’s disease affects over 7 million people globally, with numbers expected to double by 2040. This rising burden of neurodegenerative diseases is creating a growing demand for effective therapeutic interventions like DBS. As the global population continues to age, the incidence of conditions like Parkinson’s, which predominantly affects individuals over 60, is projected to rise. The National Institutes of Health (NIH) reports that nearly 1 in 100 individuals over the age of 60 are affected by Parkinson’s, thereby directly contributing to the market's expansion.

Expansion of Applications of DBS Devices

Advancements in Deep Brain Stimulation (DBS) technology are playing a key role in expanding its clinical applications and improving patient outcomes. According to the National Institute of Neurological Disorders and Stroke (NINDS), research shows that DBS is increasingly being explored for treating psychiatric conditions, including depression and obsessive-compulsive disorder (OCD), with studies showing up to a 40% improvement in treatment-resistant depression patients. The development of smaller, more efficient devices has also reduced complication rates, with complications falling below 3% in recent studies. Additionally, minimally invasive techniques, such as the use of MRI-guided DBS, have been shown to reduce surgery time by 20%, further enhancing safety and patient recovery times. These technological improvements are contributing significantly to the expansion of DBS treatments, supporting a positive growth trajectory in the market.

MARKET RESTRAINTS

High Costs of DBS Devices

One of the key restraints in the Deep Brain Stimulation (DBS) Devices Market is the high cost of the procedure and the devices themselves. According to the National Institutes of Health (NIH), the total cost of DBS surgery, including preoperative consultations, surgery, and postoperative care, can range from $50,000 to $100,000 in the United States. The high price tag can limit accessibility, especially for patients without adequate insurance coverage or those in developing regions. As a result, the affordability of DBS devices remains a significant barrier to widespread adoption, particularly in low-to-middle-income countries where financial constraints prevent access to advanced medical treatments.

Risks Associated With the Usage of DBS Devices

The Deep Brain Stimulation (DBS) market faces challenges due to the inherent risks associated with the surgical procedure. According to the National Health Service (NHS), although DBS is generally safe, complications such as infections, bleeding, and neurological side effects can occur. The risk of infection is reported at approximately 2-3% of cases, while bleeding occurs in around 1-2% of procedures. Additionally, device malfunctions have been noted in about 0.5% of patients. Cognitive impairments and other contraindications, like age restrictions or the presence of comorbid conditions, can limit patient eligibility, with studies indicating that up to 30% of patients are excluded from undergoing DBS due to these factors. These risks influence patient selection and may hinder the broader adoption of DBS treatments.

MARKET OPPORTUNITIES

Using DBS for Psychiatric and Behavioral Disorders

A significant opportunity in the Deep Brain Stimulation (DBS) Devices Market lies in expanding the use of DBS for psychiatric and behavioral disorders. Research from the National Institute of Mental Health (NIMH) highlights the potential of DBS for treating conditions like depression and obsessive-compulsive disorder (OCD), which affect millions globally. In fact, an estimated 1 in 5 adults in the U.S. live with a mental illness, according to the National Institute of Mental Health (NIMH). As clinical trials for psychiatric applications continue to show positive results, DBS is expected to gain wider acceptance in treating mental health disorders. This represents a promising growth opportunity for the market as it broadens the scope of DBS beyond neurological conditions.

Rapid Adoption of Minimally Invasive Techniques

An emerging opportunity in the Deep Brain Stimulation (DBS) market is the growing adoption of minimally invasive techniques, which enhance both safety and efficiency. According to the National Institutes of Health (NIH), the use of MRI-guided DBS has led to a 40% reduction in complications such as bleeding and infections, compared to traditional methods. Advances in electrode design have also contributed to more precise targeting of brain regions, decreasing the risk of side effects. Furthermore, recovery times have been significantly shortened, with patients experiencing up to 30% faster recovery rates. These innovations are particularly valuable in regions with aging populations, where the demand for safer and less invasive treatments is rising rapidly, especially in countries like Japan, where over 28% of the population is over 65 years old. This progress is fueling the growth of the DBS market, particularly in regions with a higher need for effective neurological treatments.

MARKET CHALLENGES

Poor Awareness of DBS Procedures

A major challenge faced by the Deep Brain Stimulation (DBS) Devices Market is the limited awareness and acceptance of the procedure, particularly in emerging economies. According to the World Health Organization (WHO), over 70% of the global population in low-income regions lack access to advanced healthcare treatments, including DBS, with a significant gap in both awareness and infrastructure. In countries like India and sub-Saharan Africa, up to 90% of patients with neurodegenerative diseases like Parkinson’s disease may not receive timely or adequate care, including advanced treatments such as DBS. Additionally, a survey by the Parkinson’s Foundation shows that nearly 40% of healthcare providers in these regions are unfamiliar with DBS as a viable treatment option. Cultural beliefs and logistical barriers further exacerbate the problem, resulting in slower adoption and a significant delay in the treatment of diseases like Parkinson’s. These challenges hinder the potential growth of the DBS market in developing regions where neurodegenerative diseases are on the rise.

Long-Term Management of DBS

Another challenge is the complexity and long-term management of DBS therapy. The U.S. National Library of Medicine reports that while DBS offers significant symptom relief, it requires ongoing adjustments and monitoring, with patients needing follow-ups every 3-6 months. Furthermore, device batteries typically need replacement every 3-5 years, which can be costly and inconvenient for patients. According to the Parkinson's Foundation, nearly 20% of patients report experiencing complications related to device malfunction or side effects like speech difficulties or mood changes, which may require additional surgeries or therapy adjustments. These long-term management challenges create additional burdens for patients, potentially discouraging them from opting for or continuing DBS therapy, especially in regions with limited healthcare access or high treatment costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, End-Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Abbott, Medtronic, Boston Scientific, Neuropace, Synapse Biomedical, Aleva Neurotherapeutics, Nexstim, Jude Medical, NeuroSigma, Synteract. |

SEGMENTAL ANALYSIS

By Product Insights

The dual-channel segment dominated the market by capturing a global market share of 57.5% in 2024. The ability of dual chamber devices to offer enhanced flexibility and targeting precision for the treatment of movement disorders, particularly Parkinson’s disease is driving the growth of the segment in the global market. Dual Channel DBS devices allow for the stimulation of multiple brain regions simultaneously, enabling more effective symptom management. This capability is highly valued in clinical settings, as it leads to better patient outcomes, including reduced side effects and improved control over symptoms. According to data from the National Institute of Neurological Disorders and Stroke (NINDS), dual-channel systems are preferred in over 60% of Parkinson’s disease treatments due to their superior adaptability, leading to a larger market share in advanced DBS therapies. Studies show that dual-channel systems also result in a 30% reduction in symptom severity and a 25% improvement in patient satisfaction compared to single-channel devices, further solidifying their dominance in the market.

The single-channel segment is growing promisingly and is expected to register a CAGR of 11.9% over the forecast period. This growth is driven by its affordability and simplicity in treating early-stage movement disorders. As patients seek less invasive and more cost-effective treatments, Single Channel DBS systems have gained popularity in emerging markets, where budget constraints are a key factor. The increased adoption of Single Channel DBS systems, particularly in regions like Asia-Pacific and Latin America, reflects the growing demand for affordable neurostimulation options. This segment’s rapid growth is also supported by clinical findings from the World Health Organization (WHO), which reported a 25% increase in the prevalence of movement disorders, particularly Parkinson’s disease, in Asia-Pacific over the past decade. Additionally, the affordability of Single Channel systems has made them a viable solution in low-resource settings, where they are now being utilized in over 40% of new DBS cases in countries like India and Brazil. These factors contribute to the segment's expanding presence in the DBS market.

By Application Insights

The Parkinson’s disease segment accounted for 49.3%% global market share in 2024 and outperformed other segments. The growth of the Parkinson’s segment is majorly driven by the high prevalence of Parkinson's disease, a neurological disorder that affects millions globally. According to the Parkinson’s Foundation, nearly 1 million people in the U.S. alone are living with Parkinson’s disease, and DBS has been shown to be one of the most effective treatments for managing symptoms like tremors, rigidity, and bradykinesia. The high adoption of DBS in Parkinson's disease therapy is a critical driver, with numerous clinical studies validating its efficacy, making it the largest market segment.

The pain management segment is routing at the rapid pace and is anticipated to showcase a CAGR of 12.7% over the forecast period. This surge can be attributed to the expanding application of DBS technology in treating chronic pain, which affects a large portion of the global population. According to the National Institutes of Health (NIH), chronic pain affects an estimated 20% of adults in the U.S. alone. DBS is increasingly being recognized as an effective alternative for pain management, especially for patients who do not respond well to traditional pain medications. This rise in demand is driving rapid growth within the segment, particularly in regions where pain management solutions are limited.

By End-use Insights

The hospitals segment represented the biggest share of the deep brain stimulation (DBS) devices market by contributing 61.4% of the global market share in 2024. Hospitals are preferred end-users due to their advanced infrastructure, specialized neurology departments, and access to skilled neurosurgeons. According to the Centers for Disease Control and Prevention (CDC), hospitals are the primary setting for DBS procedures, performing over 70% of DBS surgeries in the U.S. Hospitals are also better equipped to provide comprehensive post-surgery care and long-term monitoring. The American Hospital Association (AHA) reports that the number of hospitals offering DBS services has increased by 15% over the past five years, further strengthening their dominance in the market. This growth is driven by the rising prevalence of neurodegenerative diseases like Parkinson’s, which are being increasingly treated with DBS in clinical settings.

The neurology clinics segment is rapidly growing and is expected to grow at a CAGR of 10.8% over the forecast period. This growth is driven by the increasing number of clinics specializing in neurological treatments and the growing demand for outpatient care. Neurology clinics offer patients quicker access to specialized treatments such as DBS, often with more affordable services compared to hospitals. According to the American Academy of Neurology (AAN), the number of neurology clinics in the U.S. has increased by 12% over the past three years, reflecting the growing demand for neurological care. Additionally, the Centers for Disease Control and Prevention (CDC) reports that the incidence of Parkinson’s disease in the U.S. is expected to increase by 60% by 2040, further driving demand for specialized care in outpatient settings. Neurology clinics, with their targeted focus on neurological diseases, are well-positioned to meet this rising demand, contributing to their rapid growth.

REGIONAL ANALYSIS

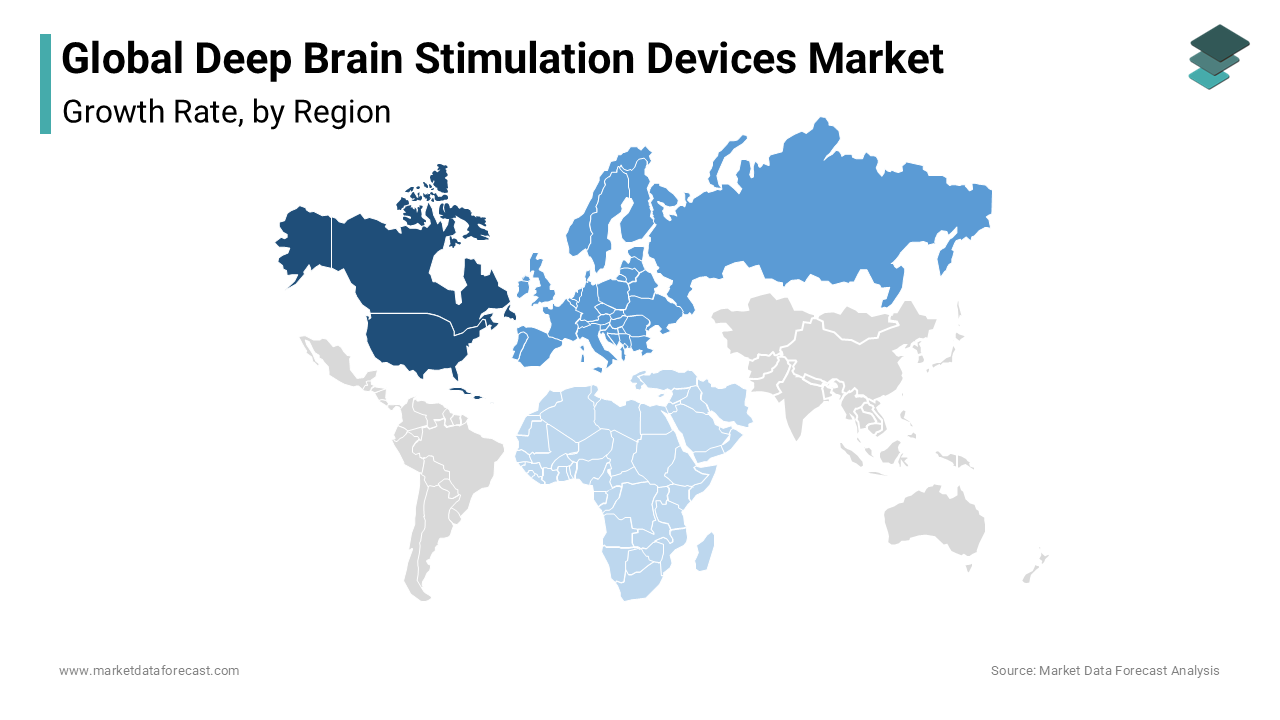

North America is the largest region in the global deep brain stimulation (DBS) devices market by holding a significant share of 38.4% of the global market in 2024. The dominance of this region is primarily due to the high prevalence of Parkinson's disease and other neurological disorders, alongside the availability of advanced healthcare infrastructure and high adoption rates of DBS technology. The Centers for Disease Control and Prevention (CDC) reports that nearly 60,000 new cases of Parkinson’s disease are diagnosed annually in the United States alone, driving demand for DBS treatments. Furthermore, the robust reimbursement systems and ongoing research into expanding DBS applications contribute to North America’s leading position.

Asia-Pacific is the fastest-growing regional segment of the global DBS Devices Market and is estimated to grow at a CAGR of 9.2% from 2025 to 2033. This growth is driven by the region’s large aging population, which increases the prevalence of neurodegenerative diseases like Parkinson’s. According to the World Health Organization (WHO), the proportion of elderly individuals in Asia is expected to double by 2050, creating a larger patient pool for DBS therapies. The number of people aged 60 and over in China alone is expected to surpass 400 million by 2040, significantly contributing to the demand for DBS treatments. Additionally, increasing healthcare investments, particularly in China and Japan, have seen a rise of 14% in public healthcare spending over the past five years, improving access to advanced treatments like DBS. These factors are contributing to the rapid market expansion in the region.

In Europe, the DBS Devices Market is expected to experience steady growth, with the region projected to hold a significant share due to an aging population and high disease prevalence. The European Parkinson’s Disease Association (EPDA) estimates that over 1.2 million people are affected by Parkinson’s in Europe, with numbers expected to increase significantly. Government health initiatives and the growing recognition of DBS for treating non-motor symptoms are anticipated to drive market expansion. However, the market in Europe faces challenges such as cost constraints in some countries and varying reimbursement policies across the region.

Latin America shows moderate growth potential for DBS devices, with rising awareness and improving healthcare access in countries like Brazil and Mexico. According to the Pan American Health Organization (PAHO), there is an increasing demand for specialized neurological treatments in these countries, with Brazil reporting a 12% rise in the number of patients seeking treatments for Parkinson's disease in the last 5 years. However, cost barriers and limited access to advanced healthcare technologies may restrict rapid adoption. Despite this, the World Bank reports that Latin American countries have increased healthcare expenditure by 7-10% annually, which will likely improve the availability of DBS devices. In the coming years, Latin America’s market for DBS devices is expected to grow, but at a slower pace compared to North America and Asia-Pacific, as healthcare infrastructure gradually improves.

In the Middle East and Africa, the market for DBS devices is still in its early stages but has significant growth potential. The region faces challenges such as limited healthcare infrastructure and high treatment costs, but governments are focusing on improving healthcare services. According to the World Bank, investments in healthcare in the Middle East have increased by 8-10% annually over the past 5 years, particularly in countries like the UAE and Saudi Arabia, which are allocating more resources to neurological care. The growing prevalence of neurological diseases, including Parkinson’s and Alzheimer’s, is expected to drive demand for DBS devices. In Saudi Arabia, the incidence of Parkinson’s disease has risen by 15% in the last decade. The region is likely to see gradual growth, particularly in countries with improved healthcare systems, where access to advanced treatments like DBS is expected to expand.

Top 3 Players in the market

Medtronic is a leader in the DBS devices market, holding a dominant market share. The company’s "Activa" line of DBS systems is among the most widely used, offering precise, customizable brain stimulation. Medtronic's contribution to the global DBS market includes continuous innovation in device miniaturization, battery longevity, and wireless technology. The company's leadership is underscored by its extensive global footprint, providing DBS solutions across North America, Europe, and Asia. Medtronic also leads in clinical research, helping to expand DBS applications beyond movement disorders to include conditions like depression and obsessive-compulsive disorder (OCD), thereby increasing the market potential. According to the company, over 125,000 patients worldwide have benefited from Activa DBS therapy.

Boston Scientific is another key player in the DBS market, offering the "Vercise" family of DBS systems. The company's devices are known for their advanced stimulation capabilities, including the use of multiple electrodes to target different brain regions for improved therapeutic outcomes. Boston Scientific’s innovation is focused on providing patients with more flexibility and better control through its Vercise Gevia system, which allows for personalized treatment adjustments. The company’s market contribution also includes its commitment to clinical trials that aim to expand DBS indications, such as for chronic pain and neurological disorders beyond Parkinson’s disease. Boston Scientific has reported growing adoption in markets like Europe and North America, contributing significantly to the expansion of the DBS market.

Abbott Laboratories is also a major player, offering the "Infinity" DBS system, which is designed to treat movement disorders with high precision. Abbott’s DBS systems are recognized for their advanced software integration, which allows healthcare providers to tailor treatment for individual patients and optimize outcomes. Abbott’s contribution to the DBS market is evident in its focus on improving patient experiences through longer-lasting batteries and more compact devices. Additionally, Abbott's strategic partnerships with academic institutions and healthcare providers contribute to the growing body of evidence supporting DBS use in new indications, including psychiatric conditions like major depressive disorder (MDD). Abbott’s DBS technology is gaining traction in both North American and European markets, further solidifying its position in the global market.

Top strategies used by the key market participants

Technological Innovation: Medtronic, Boston Scientific, and Abbott Laboratories prioritize continuous innovation in DBS technology to offer better patient outcomes. For example, Medtronic focuses on advancing the miniaturization of its DBS devices, improving battery life, and incorporating wireless technology. These innovations not only make the devices more efficient but also reduce the risks and improve the overall patient experience. Boston Scientific’s Vercise family, for instance, features a multi-directional stimulation technology that enables more precise targeting of brain regions, leading to improved therapy results. Abbott Laboratories has invested heavily in software-based technologies, offering systems that allow for real-time adjustments and personalized therapy, thus enhancing the effectiveness of DBS devices.

Strategic Partnerships and Collaborations: Strategic partnerships and collaborations with academic institutions, hospitals, and healthcare providers are key strategies used by these players to expand their product portfolios and drive clinical adoption. Medtronic, for instance, has been involved in numerous clinical studies to explore the broader use of DBS devices in treating not only Parkinson’s disease but also conditions like depression and obsessive-compulsive disorder (OCD). Boston Scientific has partnered with healthcare providers to expand its presence in emerging markets, thus increasing access to advanced DBS therapies. Abbott Laboratories collaborates with research institutions and universities to advance DBS technologies for a wider array of neurological and psychiatric conditions.

Expanding Clinical Indications: A significant strategy is the expansion of DBS indications to include new therapeutic areas. Initially, DBS was used primarily for movement disorders, but now companies like Medtronic and Abbott are researching its potential for treating psychiatric conditions. Medtronic’s continued research in the field of DBS for depression and OCD has led to positive clinical results, opening up new growth opportunities. Abbott’s Infinity DBS system is exploring applications in other neurological disorders, such as chronic pain and major depressive disorder (MDD), which is an important step in diversifying their product offerings and increasing the total addressable market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Abbott, Medtronic, Boston Scientific, Neuropace, Synapse Biomedical, Aleva Neurotherapeutics, Nexstim, Jude Medical, NeuroSigma, and Synteract are some of the key market players.

The competition in the Deep Brain Stimulation (DBS) Devices Market is intense, driven by the presence of several prominent players, technological advancements, and the increasing demand for advanced treatments for neurological disorders. Medtronic, Boston Scientific, and Abbott Laboratories dominate the market, each offering innovative DBS systems with unique features. Medtronic's Activa DBS system remains a market leader due to its long-established reputation and continuous product improvements, such as miniaturization and wireless technology. Boston Scientific's Vercise system stands out with its multi-directional stimulation technology, offering more precise control over treatment, while Abbott Laboratories has made significant strides in expanding its product line with its Infinity DBS system, focusing on improving software integration and real-time adjustments.

The competition is further intensified by ongoing clinical trials, as these companies are exploring new applications of DBS for a wider range of conditions, such as depression and chronic pain. Additionally, companies are actively involved in expanding their geographical footprint, particularly in emerging markets like Asia-Pacific and Latin America, where the prevalence of neurological diseases is on the rise.

To differentiate themselves, companies are also focusing on improving patient access through better reimbursement policies, educational initiatives, and patient support programs. As technological advancements continue, the competition in this market is expected to evolve, with companies continually striving for innovative breakthroughs to gain a competitive edge.

RECENT MARKET DEVELOPMENTS

- In December 2024, Medtronic announced the launch of its Percept RC neurostimulator in India. This device, designed for deep brain stimulation (DBS), is the smallest and thinnest dual-channel neurostimulator available.

- In January 2024, Abbott received FDA approval for its Liberta RC, a rechargeable deep brain stimulation system. Abbott claims this device is the world's smallest and has the longest charge duration among DBS technologies.

MARKET SEGMENTATION

This research report on the deep brain stimulation devices market is segmented and sub-segmented into the following categories.

By Product

- Single Channel

- Dual Channel

By Application

- Pain Management

- Epilepsy

- Essential Tremor

- Obsessive-compulsive Disorders (OCD)

- Depression

- Dystonia

- Parkinson's Disease

- Others

By End-use

- Hospitals

- Neurology Clinics

- Ambulatory Surgical Centers

- Research Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the future outlook for the Deep Brain Stimulation Devices Market?

The market is expected to grow due to rising neurological disorder cases, new therapeutic applications, and technological improvements in neuromodulation.

What factors are driving the growth of the Deep Brain Stimulation Devices Market?

The market is growing due to rising neurological disorders, increasing geriatric population, technological advancements, and improved reimbursement policies.

What conditions are treated using Deep Brain Stimulation Devices?

Deep Brain Stimulation Devices is primarily used for Parkinson’s disease, essential tremor, dystonia, epilepsy, and sometimes psychiatric disorders like OCD.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]