Global Dark Store Market Size, Share, Trends & Growth Forecast Report Segmented By Offering (Grocery and Convenience Items, Prepared Meals and Meal Kits, Household Essentials, Specialty/Niche Products, Others), Delivery, End User, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Dark Store Market Size

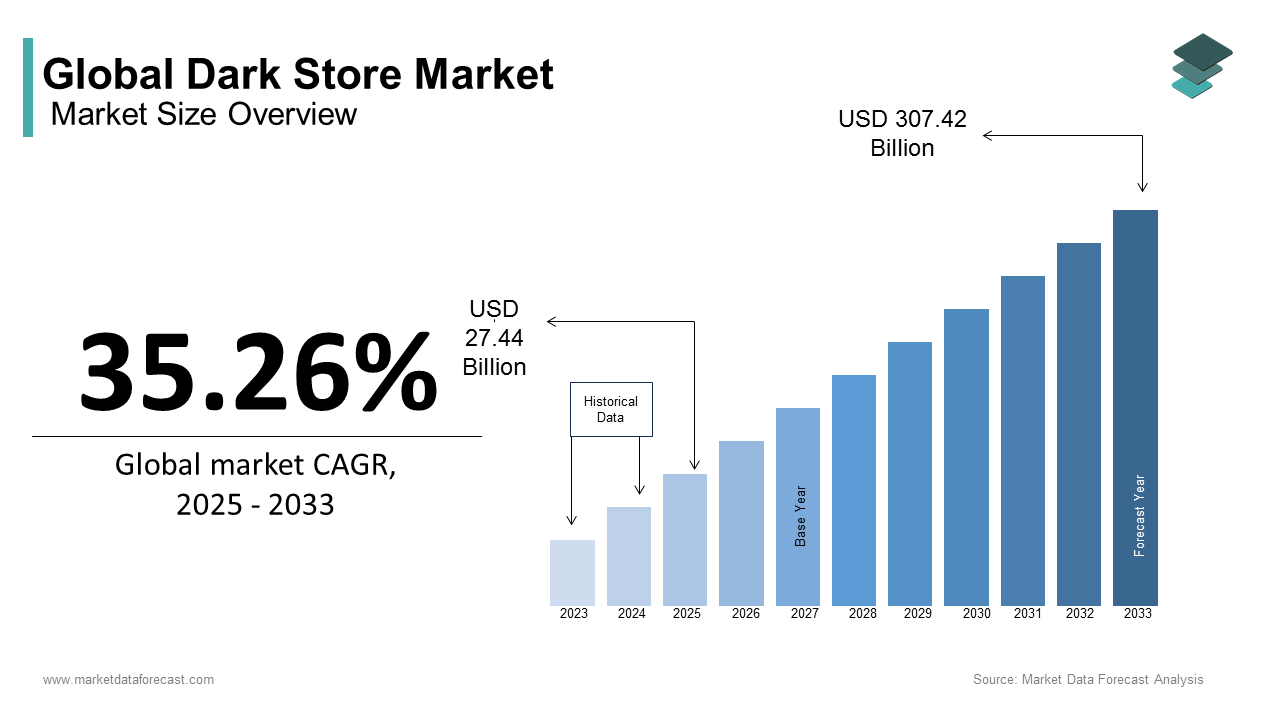

The global dark store market size was calculated to be USD 20.29 billion in 2024 and is anticipated to be worth USD 307.42 billion by 2033 from USD 27.44 billion In 2025, growing at a CAGR of 35.26% during the forecast period.

Dark stores are facilities that are strategically optimized for efficiency and operating as hubs for rapid order processing and delivery. Unlike traditional retail outlets, dark stores are engineered to streamline operations, often resembling warehouses with meticulously organized inventory systems. This innovative concept has emerged as a response to evolving consumer behaviors, particularly the growing preference for convenience and speed in receiving goods. A 2022 survey conducted by PwC found that 54% of global consumers consider fast and reliable delivery a key factor influencing their decision to shop online, underscoring the importance of agile fulfillment models like dark stores.

In terms of operational impact, dark stores have demonstrated their ability to significantly enhance order accuracy and reduce delivery times. According to a study published in the Journal of Business Logistics, businesses utilizing dark store models reported a 20% improvement in order processing efficiency compared to traditional retail setups. This is largely attributed to their dedicated focus on e-commerce logistics and proximity to urban centers, which minimizes last-mile delivery challenges. Additionally, cities such as London and New York have experienced increased adoption of dark stores, driven by the need to address logistical hurdles in densely populated areas. The World Economic Forum highlights that urban last-mile delivery accounts for over 28% of total delivery costs, a figure that dark stores aim to reduce through localized fulfillment centers. As retailers continue to adapt to the demands of a digital-first world, dark stores exemplify a critical evolution in how businesses bridge the gap between online shopping and real-world fulfillment, ensuring faster and more sustainable delivery solutions.

MARKET DRIVERS

Rising Urbanization and Population Density

The rapid growth of urbanization has been a key driver for the adoption of dark stores, as densely populated cities present unique logistical challenges. According to the United Nations Department of Economic and Social Affairs, 55% of the global population resides in urban areas, a figure projected to rise to 68% by 2050. This urban concentration increases demand for fast and efficient delivery services, making dark stores an ideal solution. The U.S. Census Bureau reports that urban households spend 20% more on e-commerce annually compared to rural households, reflecting higher engagement in online shopping. Dark stores strategically located in urban hubs reduce last-mile delivery times and costs, addressing congestion-related inefficiencies. For instance, the Federal Highway Administration highlights that traffic delays in metropolitan areas account for approximately 36% of total delivery time, significantly increasing operational expenses. By mitigating these challenges, dark stores cater to urban consumers' expectations for speed and reliability, solidifying their role in modern retail logistics.

Growing Demand for Same-Day Delivery Services

The increasing consumer expectation for same-day delivery has significantly propelled the expansion of the dark store model. A report from the U.S. Census Bureau indicates that e-commerce sales grew by 14.3% in 2022, driven in part by the rising demand for expedited delivery options. Also, 90% of consumers consider fast and reliable delivery a critical factor when choosing an online retailer, driving companies to adopt innovative fulfillment strategies like dark stores. These facilities enable retailers to fulfill orders within hours by leveraging their proximity to customers, reducing delivery windows significantly. Additionally, by meeting the dual needs of speed and environmental responsibility, dark stores have become a cornerstone of modern supply chain solutions, reshaping how businesses address evolving customer expectations.

MARKET RESTRAINTS

High Operational Costs and Infrastructure Challenges

The establishment and maintenance of dark stores present significant financial challenges, primarily due to high operational costs. According to the U.S. Bureau of Labor Statistics, labor expenses account for approximately 60% of total operational costs in warehousing and fulfillment centers, including dark stores. These facilities require skilled personnel to manage inventory, process orders, and ensure timely deliveries, which can strain budgets. Additionally, industrial real estate prices in urban areas have increased by an average of 10% annually over the past five years, making it costly to secure prime locations for dark stores. Retrofitting existing spaces or building new facilities also demands substantial upfront investment. The Federal Reserve notes that small and medium-sized retailers often face difficulties competing with larger players due to these financial barriers. As a result, the high cost of infrastructure and operations remains a key restraint, limiting the scalability of dark stores for many businesses.

Regulatory and Zoning Restrictions

Regulatory and zoning restrictions pose another major challenge to the growth of the dark store market. Local governments often impose stringent regulations on the use of commercial spaces, particularly in urban areas. A study by the Urban Land Institute highlights that zoning laws in cities like New York and San Francisco restrict the conversion of retail spaces into fulfillment centers, creating hurdles for retailers seeking to establish dark stores. Additionally, the Environmental Protection Agency mandates compliance with environmental standards, such as waste management and energy efficiency, which can increase operational complexity. These regulatory barriers not only delay implementation but also increase costs, making it difficult for businesses to expand their dark store networks efficiently while adhering to local governance frameworks.

MARKET OPPORTUNITIES

Expansion into Tier-II and Tier-III Cities

The expansion of dark stores into tier-II and tier-III cities presents a significant growth opportunity for the market. The U.S. Census Bureau reports that 80% of the U.S. population resides in urban areas, while the remaining 20% live in rural areas, with these areas witnessing steady growth in e-commerce adoption. Dark stores can capitalize on this trend by establishing localized fulfillment centers, reducing delivery times and costs in underserved regions. Tansportation expenses decrease by up to 25% when fulfillment centers are located closer to consumers. By targeting tier-II and tier-III cities, retailers can tap into untapped markets, enhance customer satisfaction, and achieve a competitive edge in the evolving retail landscape.

Integration of Automation and AI Technologies

The integration of automation and artificial intelligence (AI) technologies offers a transformative opportunity for the dark store market. According to a report by the McKinsey Global Institute, businesses adopting AI-driven logistics solutions have seen a 15% improvement in operational efficiency. Automation tools such as robotic picking systems and AI-powered inventory management enable dark stores to process orders faster and with greater accuracy. Additionally, a study by the National Institute of Standards and Technology highlights that automated systems reduce human error by up to 35%, ensuring higher order precision. Furthermore, the Environmental Protection Agency states that energy-efficient automation technologies can lower energy consumption in warehouses by 10-12%, aligning with sustainability goals. By leveraging these advancements, dark stores can significantly enhance their scalability, reduce labor dependency, and meet the growing demand for rapid and reliable deliveries, positioning themselves as leaders in the future of retail fulfillment.

MARKET CHALLENGES

Balancing Profitability with Rising Delivery Expectations

One of the major challenges for the dark store market is balancing profitability while meeting rising consumer expectations for ultra-fast delivery. According to a report, the demand for same-day delivery has grown notable over the past two years, pressuring retailers to offer faster fulfillment without compromising margins. Last-mile delivery represents a significant portion of overall expenses, making up as much as 41% of total supply chain costs and exceeding half (53%) of the total cost of shipping, making it a significant financial burden for dark stores operating on thin profit margins. Additionally, a study by the National Retail Federation states that 65% of consumers expect free delivery even for expedited orders, forcing retailers to absorb these costs. This challenge is further compounded in urban areas, where traffic congestion and limited parking increase operational inefficiencies. As a result, dark stores must innovate cost-effective solutions to meet delivery expectations while maintaining sustainable profitability.

Competition from Established E-commerce Giants

The dark store market faces intense competition from established e-commerce giants like Amazon, which dominate the logistics and fulfillment landscape. Amazon accounts for nearly 37% of all U.S. e-commerce sales, leveraging its vast network of fulfillment centers and advanced technology. Smaller retailers adopting the dark store model struggle to compete with such scale and efficiency. Furthermore, a study published in the Journal of Business Research reveals that 75% of consumers prefer platforms offering seamless integration of shopping and delivery services, an area where giants excel. This competitive pressure forces smaller dark store operators to differentiate themselves through niche markets or localized offerings to survive in an increasingly consolidated industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

35.26% |

|

Segments Covered |

By Offering, Delivery, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Albertsons, com, Inc., Auchan, DoorDash, Dunzo Daily, Flipkart, FreshDirect, Grab, Instacart, com, Kroger, Ocado, Ola Foods, and Swiggy |

SEGMENTAL ANALYSIS

By Offering Insights

The grocery and convenience items segment dominated the dark store market by accounting for 40.2% of the total market share in 2024 due to the consistent demand for everyday essentials, which surged during the pandemic. 55% of consumers now prefer online grocery shopping, with dark stores enabling faster fulfillment and fresher deliveries. Grocery’s dominance is further reinforced by its recurring purchase nature, making it a cornerstone of e-commerce logistics. As urbanization increases, localized dark stores reduce last-mile delivery costs considerably ensuring timely access to perishables and staples.

However, the prepared meals and meal kits segment is the fastest-growing segment in the dark store market and is expected to register a CAGR of 17.4% during the forecast period. This rapid growth is driven by shifting consumer lifestyles. Millennials and Gen Z are key contributors, as they seek healthier, ready-to-eat options. Additionally, meal kits can reduce food waste by up to two-thirds compared to traditional grocery shopping, appealing to eco-conscious buyers. Dark stores play a critical role by ensuring quick delivery of perishable items, maintaining quality and freshness while meeting urban consumers' demand for speed and sustainability.

By Delivery Insights

The on-demand delivery segment ruled the dark store market by capturing 50.7% of the total market share in 2024. This segment's leadership is driven by the growing consumer preference for instant gratification, with 55% of shoppers willing to pay a premium for same-day delivery. Urbanization and the rise of mobile commerce further amplify demand, particularly in metropolitan areas where convenience is paramount. Its importance lies in addressing the need for speed and reliability, making it a cornerstone of modern e-commerce logistics.

On the other hand, the curbside pickup category is the swiftly growing segment in the dark store market with a projected CAGR of 19.8. This growth is fueled by its contactless nature, which gained significant traction during the pandemic, and its ability to reduce last-mile delivery costs by up to 35. Additionally, a study published highlights that 65% of retailers view curbside pickup as a key strategy to enhance customer loyalty and streamline operations. By minimizing operational inefficiencies and meeting evolving consumer preferences, curbside pickup is reshaping the future of retail fulfillment.

By End User Insights

The Residential consumers segment represent the largest segment in the dark store market by accounting for 60.5% of the total market share in 2024. This dominance is driven by the growing adoption of e-commerce and the increasing demand for home delivery of groceries, household essentials, and prepared meals. The National Retail Federation states that 65% of online shoppers prefer direct-to-home delivery, with residential consumers benefiting from the convenience and speed offered by dark stores. Urbanization further amplifies this trend, as densely populated areas prioritize localized fulfillment. Residential consumers' consistent purchasing patterns make them a critical driver of dark store operations, ensuring steady revenue streams and operational efficiency.

The hospitality and foodservice segment is the fastest-growing segment in the dark store market and is predicted to grow at a CAGR of 20.5% over the forecast period due to the rising demand for contactless deliveries and partnerships between dark stores and restaurants, hotels, and catering services. The notes that the foodservice industry has rebounded post-pandemic, with an annual increase in online orders. Additionally, By enabling faster and fresher deliveries, dark stores empower hospitality providers to meet evolving customer expectations, making this segment pivotal for future growth.

REGIONAL ANALYSIS

North America dominated the dark store market by holding 35.3% of the global share in 2024. The U.S. accounts for over $48 billion in e-commerce grocery sales from Amazon and $25.5 billion from Walmart in 2022. High urbanization rates, advanced tech infrastructure, and increasing demand for quick deliveries drive this dominance. The region benefits from its robust logistics networks, including Amazon’s extensive fulfillment centers. North America's leadership is further reinforced by innovation hubs like Silicon Valley, fostering advancements in last-mile delivery solutions.

Asia-Pacific is anticipated to be the fastest growing regional segment for dark stores worldwide and is expected to witness a CAGR of 22.4% during the forecast period. Rapid urbanization and a growing middle-class population fuel this growth. India’s online grocery sector expanded by 65% in 2022 driven by affordability and convenience trends. Investments in digital payment systems, such as India’s Unified Payments Interface (UPI), which processed over $1.5 trillion in transactions in 2022 as per the Reserve Bank of India) , further accelerate adoption. This makes Asia-Pacific pivotal for global expansion strategies.

Europe is a notable regional market for dark stores and is expected to account for a substantial share of the global market over the forecast period. The sustainability regulations and green logistics initiatives. Germany and France leading adoption are fuelling the dark store market growth in Europe. The European e-commerce grocery market reached €26 billion in 2022 supported by high internet penetration and demand for eco-friendly delivery solutions. Over the next few years, Europe’s emphasis on carbon-neutral operations and smart city projects will enhance its contribution to the global market.

Latin America shows significant growth potential with Brazil accounting for 40% of the region's e-commerce sales in 2022. It is fueled by rising smartphone adoption and digital payment systems like Pix in Brazil. Mexico and Argentina are emerging markets due to urbanization and middle-class expansion. However, logistical challenges persist.

The Middle East and Africa remain nascent but rapidly evolving regions in the dark store market. The UAE leads with initiatives under Vision 2030, aiming for 40% smart city integration by 2030, as stated by UAE Government) . Saudi Arabia’s e-commerce market grew by 25% in 2022 driven by government-backed digital transformation programs. In Africa, Nigeria and Kenya show potential due to mobile money adoption, with M-Pesa processing over $30 billion in transactions annually, according to Central Bank of Kenya.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the Dark Store Market include Albertsons, com, Inc., Auchan, DoorDash, Dunzo Daily, Flipkart, FreshDirect, Grab, Instacart, com, Kroger, Ocado, Ola Foods, and Swiggy

The dark store market is characterized by intense competition among quick commerce players, traditional retailers, and logistics providers. As consumer expectations for rapid delivery continue to rise, companies are investing heavily in expanding their dark store networks, improving logistics efficiency, and leveraging advanced technologies to stay ahead.

Key players like GoPuff, Getir, Samokat, Blinkit, and Gorillas are engaged in a competitive race to dominate the market. These companies focus on hyperlocal expansion, ensuring they establish dark stores in densely populated urban areas to reduce delivery times and optimize supply chain efficiency. Moreover, partnerships with grocery chains and retailers have become common, allowing dark store operators to expand their product offerings and enhance service quality.

The market also sees competition from supermarkets and e-commerce giants like Walmart, Amazon, and Carrefour, which have integrated dark store models into their omnichannel strategies. Unlike standalone dark store companies, these retailers leverage existing infrastructure to compete effectively.

The competitive landscape is also shaped by cost-efficiency challenges. With high operational costs and slim profit margins, companies are investing in AI-driven inventory management, automation, and robotics to improve productivity. As the market matures, only those with strong financial backing, innovative logistics, and efficient operations will sustain long-term growth and leadership.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Expansion of Dark Store Networks

Companies are strategically increasing the number of dark stores to enhance delivery speed and coverage. For instance, in 2023, Blinkit planned to expand its dark store count by approximately 40% to improve service efficiency and customer reach.

Technological Integration

The adoption of advanced technologies such as automation, robotics, and sophisticated inventory management systems is prevalent among leading market players. These technologies optimize order accuracy and operational performance, enabling companies to meet consumer expectations for quick and reliable delivery.

Omnichannel Strategies

Retailers are integrating online and offline channels to provide a seamless shopping experience. Dark stores play a crucial role in this approach by efficiently fulfilling online orders while maintaining in-store inventory for walk-in customers. This strategy enhances customer satisfaction and loyalty.

TOP 3 PLAYERS IN THE MARKET

GoPuff

Founded in 2013, GoPuff is a prominent on-demand delivery service operating over 500 dark stores across the United States. The company offers a wide range of products, including household essentials, snacks, beverages, and groceries. By leveraging its extensive network of dark stores, GoPuff ensures rapid delivery, often within 30 minutes, effectively catering to the immediate needs of consumers.

Samokat

Established in 2017, Samokat is a leading Russian rapid delivery service specializing in food and household goods. As of 2022, the company operated approximately 1,100 dark stores across 49 cities in Russia, handling around 35% of the country's dark store deliveries. Samokat's efficient logistics and strategic placement of dark stores enable it to offer delivery times as short as 15 minutes, significantly enhancing the convenience for its customer base.

Getir

Launched in 2015, Getir is a Turkish-based rapid delivery company that has expanded its operations internationally, including in Europe and the United States. The company utilizes a network of dark stores to provide a selection of over 1,500 everyday items, delivering them to customers typically within 10 minutes. Getir's innovative approach and efficient use of dark stores have positioned it as a significant contributor to the global quick commerce landscape.

Recent Market Developments

- In September 2024, Blackstone agreed to purchase an 80% stake in a European warehouse portfolio managed by Burstone, valued at €1.1 billion. This move underscores Blackstone's continued expansion into the warehouse sector, driven by the rise of e-commerce.

- In September 29, 2024, Swiggy announced plans to invest ₹559.1 crore to establish 538 new dark stores across cities including Mumbai, Pune, Bengaluru, Chennai, Hyderabad, New Delhi, and Kolkata. This initiative aims to bolster its quick commerce capabilities and reduce delivery times.

- In October 18, 2024, home furnishing retailer JYSK revealed its strategy to open dark stores as part of its "Seamless and Closer to the Customer" initiative. The first dark store is set to open in Dublin, Ireland, in November 2024, followed by another in Casablanca, Morocco, in spring 2025. These facilities will serve as small warehouses dedicated to online shopping, aiming to shorten delivery times and enhance customer experience.

MARKET SEGMENTATION

This research report on the global dark store market has been segmented and sub-segmented based on offering, delivery, end user, and region.

By Offering

- Grocery and Convenience Items

- Prepared Meals and Meal Kits

- Household Essentials

- Specialty/Niche Products

- Others (Pharmacies, Pet Supplies, etc.)

By Delivery

- On-Demand Delivery

- Scheduled Delivery

- Curbside Pickup

By End User

- Residential Consumers

- Corporate/Office Employees

- Hospitality and Foodservice

- Others (Institutions, Events, etc.)

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who are the key players in the dark store market?

Major players in the dark store market include Gorillas, Getir, Flink, Gopuff, Zapp, and established retailers like Tesco, Carrefour, and Auchan that are integrating dark store models into their operations.

2. How do dark stores work?

Dark stores function as micro-fulfillment centers where employees pick, pack, and dispatch online grocery and retail orders. Orders are placed via apps or websites, and deliveries are typically fulfilled within minutes to hours.

3. Which factors are driving the growth of the dark store market?

Key drivers include the rise of e-commerce, increasing consumer demand for ultra-fast deliveries, urbanization, and advancements in logistics and last-mile delivery technology.

4. What are the advantages of dark stores?

Dark stores improve delivery speed, reduce operational costs compared to traditional retail stores, optimize inventory management, and enhance the overall efficiency of online grocery and retail fulfillment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]