Global Cutting Tools Market Size, Share, Trends & Growth Forecast Report – Segmented By Type of Tools (Indexable Inserts and Solid Round Tools), Material (Exotic Materials, Cubic Boron Nitride, Stainless Steel, Ceramics, High-Speed Steel, Cemented Carbide and Polycrystalline Diamond), Application (Electronics, Automotive, Construction, Aerospace and Defense, Wood, Die & Mold, Oil & Gas and Power Generation), & Region - Industry Forecast From 2024 to 2032

Global Cutting Tools Market Size (2024 to 2032)

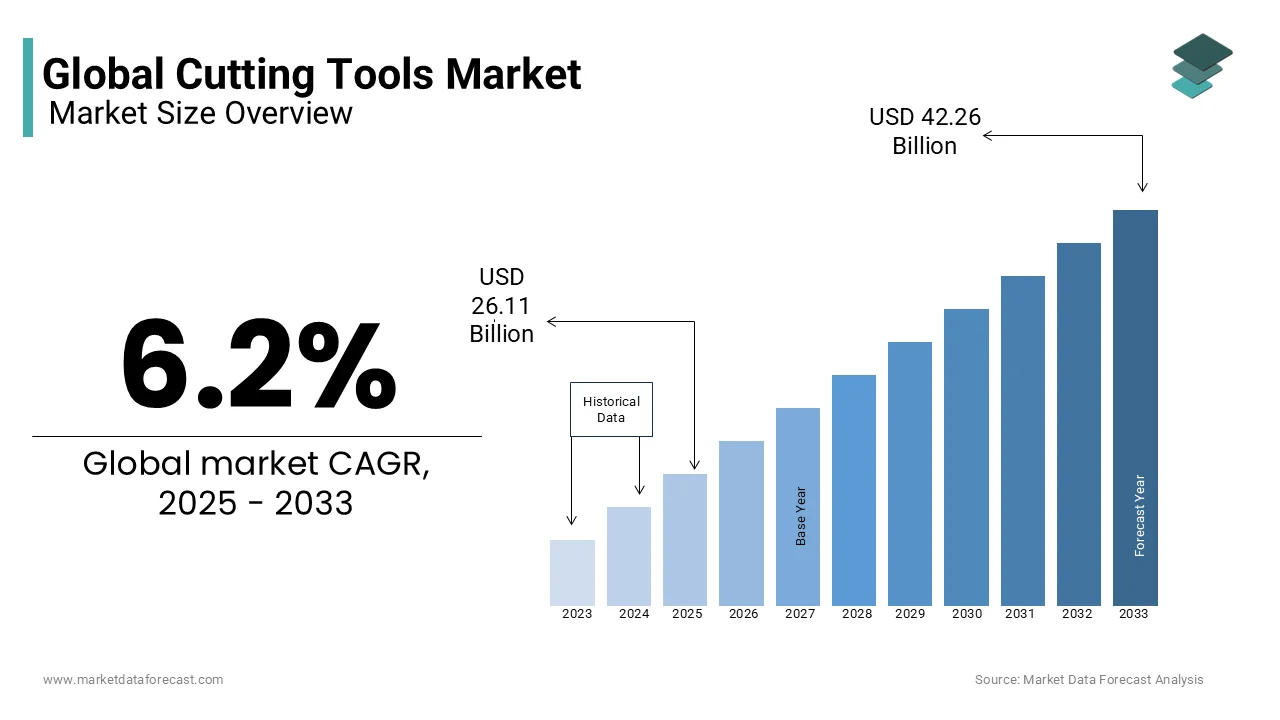

The global cutting tools market was worth USD 23.15 billion in 2023. The global market is expected to grow at 6.2% from 2024 to 2032 and the global market size is predicted to be valued at USD 24.59 billion in 2024 and increase to USD 39.79 billion by 2032.

Current Scenario of the Global Cutting Tools Market

The industry is extremely competitive and fragmented, with multiple manufacturers supplying various cutting tools such as drills, taps, end mills, inserts, and reamers.

Cutting tools shape metal, wood, plastic, and other materials. These hand-held or piston-powered instruments serve a purpose in many sectors. Saws, drills, reamers, taps, end mills, lathe tools, milling cutters, and grinding wheels are cutting tools. Material, finish, and precision determine the cutting tool. Due to a growing demand for high-quality, precise instruments that could boost productivity and efficiency, the cutting tools market is a sector of the economy expanding quickly. In addition, cutting tools have improved in sophistication, tensile strength, and efficiency with the introduction of new technologies and materials.

MARKET DRIVERS

Manufacturing automation and digitalization improve the cutting tools' efficiency, which is surging the market's growth rate.

Precision cutting tools are in great demand in aircraft, automobile, and medical device manufacture. In addition, advanced materials and technologies like composites and titanium alloys demand precise and efficient cutting tools. Businesses use cutting-edge cutting tools that may relate to robots and other automated systems to optimize output and save costs. Thus, cutting tool technologies like sensors and data analytics allow real-time monitoring and optimization of cutting processes. Sustainability and environmental responsibility also drive demand for energy-efficient and waste-reducing cutting tools. Due to stricter rules and requirements, companies actively seek cutting-edge techniques to reduce their carbon footprint and satisfy ecological objectives.

The market for cutting tools is constantly changing, with new business prospects constantly appearing. The increasing need for cutting tools in the medical and dentistry sectors is one of the most recent industry opportunities. The demand for precise equipment that can handle intricate and delicate tasks is growing as technology advances. Orthopedic surgery, neurosurgery, and dental implant placement are procedures that use cutting instruments.

The expanding need for cutting tools in the aerospace sector represents another market potential. Tools that can work with unusual materials, such as titanium, aluminum, and composite materials, are needed in the aerospace sector. The move toward lightweight materials also drives the desire for cutting tools that can make accurate and clean cuts. In addition, cutting tool manufacturers now have new business potential in the renewable energy industry. Tools that can handle the materials used in these applications are becoming increasingly vital as the demand for wind turbines, solar panels, and other renewable energy technologies rises. The parts of these technologies, such as the blades for wind turbines, are produced using cutting tools. Finally, the demand for cutting tools that can be used with cutting-edge manufacturing technologies like CNC machines and robots is being driven by the rising trend towards Industry 4.0 and automation. Cutting tools with improved geometries or specialized coatings optimized for these technologies are in great demand.

MARKET RESTRAINTS

Cutting tool makers confront substantial R&D costs to produce new and enhanced cutting tool technology.

To meet market demands for precision and effectiveness, companies must engage extensively in R&D, which may be costly. Cutting tools' competitiveness in the marketplace is another key constraint. E-commerce and globalization have given purchasers a wide selection of suppliers and options, making it harder for manufacturers to differentiate themselves and keep market dominance. Manufacturers must spend money and time on branding, marketing, and customer service to compete. 3D printing and additive manufacturing allow the fabrication of complicated parts and components that were hard to make with traditional cutting tools, impacting the traditional tools for the cutting business. Cutting tool makers must adapt to new technologies and combine their products with 3D printing and additive manufacturing. Finally, the global scarcity of competent labor restrains the cutting tools industry. There are fewer competent employees to operate and maintain modern cutting tools as demand rises. Manufacturers must train and retain skilled people, which is tough and expensive.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Material, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BIG KAISER Precision Tooling Inc., Kennametal, Nachi-Fujikoshi Corp., OSG USA, INC., Sandvik AB, Ceratizit S.A., Dewalt, Fraisa SA, Guhring, Inc., Kilowood Cutting Tools, Xiamen Golden Egret Special Alloy Co. Ltd., Zhuzhou Cemented Carbide Cutting Tool Co. Ltd., Tiangong International Co., LIMITED, Ingersoll Cutting Tool Company, Sumitomo Electric Hartmetall GmbH, Kyocera Unimerco, and ISCAR LTD and Others. |

SEGMENTAL ANALYSIS

Global Cutting Tools Market By Type of Tools

Metalworking processes frequently employ indexable inserts, including turning, milling, and drilling. They are composed of a tiny cutting edge attached to a larger substrate made of steel or another material, usually made of another hard substance like ceramic or carbide. With indexable inserts, fewer frequent tool changes are required, and efficiency is increased. The cutting edge may be shifted as it becomes worn or damaged. On the other hand, solid round tools are single piece cutting tools produced from a solid piece of material like high-speed steel or carbide. They are employed in several tasks, including drilling, boring, and reaming. Solid round tools are used in high-volume manufacturing processes because of their dependability and accuracy.

Global Cutting Tools Market By Material

Titanium and nickel alloy cutting tools are very used in aerospace and defense. They are strong and corrosion-resistant.

Cemented carbide is a popular cutting tool material due to its longevity, hardness, and strength. Turning, milling, drilling, and threading employ it. Hence, the cemented carbide segment prevails in the cutting tools market.

Drilling and milling tools often employ high-speed steel (HSS). HSS tools resist high temperatures, making them ideal for stainless steel cutting. Due to their great temperature and wear resistance, ceramics like aluminum oxide and silicon nitride are becoming desirable cutting tools. Turning, milling, and drilling require ceramics. Super abrasives like PCD and CBN are used to process hard and complex materials in cutting tools. Aerospace and automotive production benefits from their wear resistance, thermal stability, and accuracy.

Global Cutting Tools Market By Application

The automotive sector is leading with the dominant share of the market.

Engine, gearbox, and body panel output employ cutting tools. Cutting tools are also significant in aerospace and defense. Machining titanium alloys, nickel alloys, and composites need high-precision cutting tools. Due to the rising demand for aircraft and defense equipment, the aerospace and defense industries will require more cutting tools. Construction uses a lot of cutting equipment, especially drilling, sawing, and grinding. Construction, especially in emerging nations, will likely fuel the demand for cutting tools. Cutting tools also serve the wood sector. Wood uses cutting, shaping, and drilling tools. Furniture and other wood goods will likely fuel demand for cutting equipment in this market. The cutting tools market's application segment shares vary by industry and growth prospects. Due to their strong need for precision machining, the automotive, aerospace, and defense industries will continue to demand cutting tools.

REGIONAL ANALYSIS

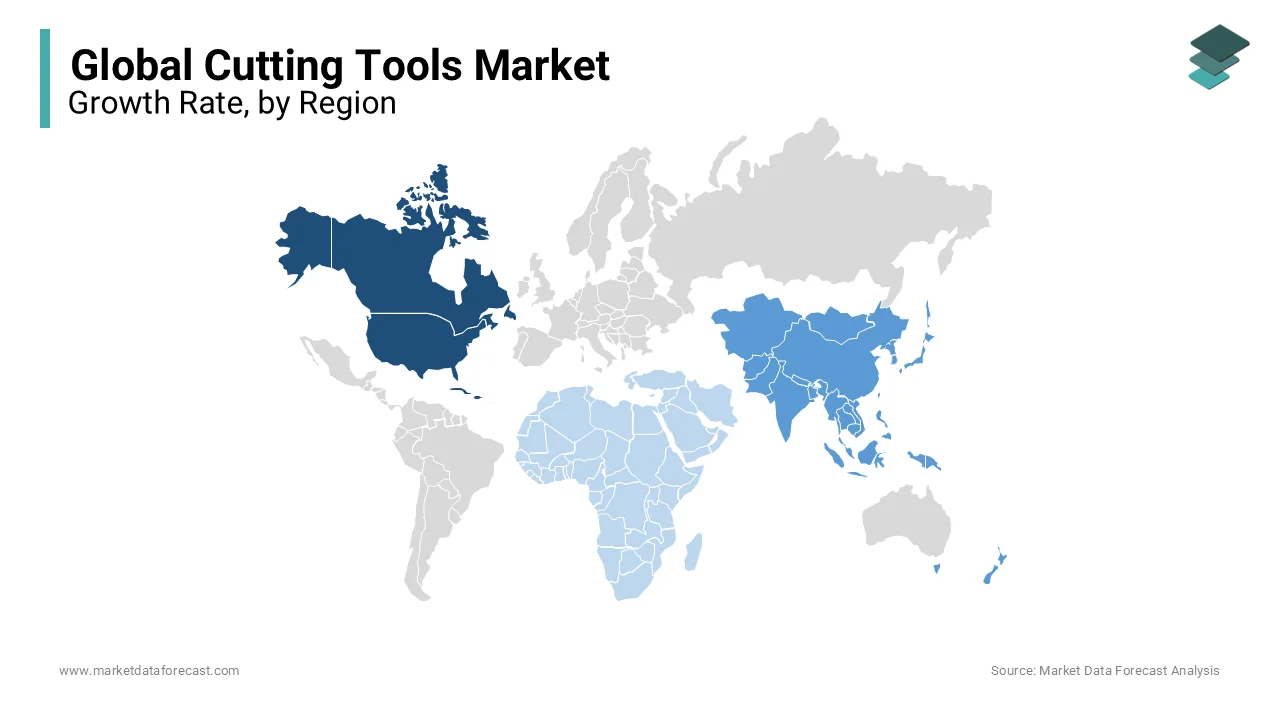

North America is ruling with the dominant share of the global market.

However, the growing prevalence of cutting tools in many industries like automotive, aircraft, and others is leveling up the market shares in North America.

Asia Pacific is next in leading the share of the worldwide market. With rising demand from China and India, cutting tools are predicted to rise quickly in Asia-Pacific.

Manufacturing, notably automotive and electronics, has grown in the region, increasing the demand for cutting tools in the market. Major manufacturers in the region are also increasing their market share. Due to manufacturing industry investments, the cutting tools market in Latin America, the Middle East, and Africa is expected to expand. In addition, construction and oil and gas development in these locations will boost cutting tool market size.

KEY MARKET PLAYERS

Sandvik AB, Kennametal Inc., Robert Bosch GmbH, Stanley Black & Decker Inc., Mitsubishi Materials Corporation, OSG Corporation, Kyocera Corporation, Guhring KG, ISCAR LTD and Seco Tools AB are some of the major companies in the global cutting tools market.

RECENT HAPPENINGS IN THE MARKET

- In March 2022, the launch of CoroDrill 860 PM was announced by Sandvik Coromant. The novel cutting tool provides ace drilling operation experience and durable and sustainable tool maintenance experience.

- In April 2022, Mitsubishi Material Corporation brought two double inserts and precision grade class type M.

- In May 2022, Sandvik AB, a crucial manufacturer of metal cutting tools, acquired Preziss, a prominent player in the composite machine and aluminum sector.

DETAILED SEGMENTATION OF THE GLOBAL CUTTING TOOLS MARKET INCLUDED IN THIS REPORT

This research report on the global cutting tools market has been segmented and sub-segmented based on type, material, application, and region.

By Type of Tools

- Indexable Inserts

- Solid Round Tools

By Material

- Exotic Materials

- Cubic Boron Nitride

- Stainless Steel

- Ceramics

- High-Speed Steel

- Cemented Carbide

- Polycrystalline Diamond

By Application

- Electronics

- Automotive

- Construction

- Aerospace and Defense

- Wood

- Die & Mold

- Oil & Gas

- Power Generation

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What are the primary drivers of growth in the cutting tools market?

Key drivers include technological advancements in manufacturing processes, increasing demand from the automotive and aerospace sectors, and the growth of the industrial and construction sectors globally.

How is the market segmented in terms of product types?

The market is segmented into milling tools, drilling tools, turning tools, grinding tools, and others. Among these, milling tools hold the largest share due to their extensive use in various applications.

How is the automotive industry influencing the cutting tools market?

The automotive industry significantly influences the market as it requires precise and efficient cutting tools for manufacturing complex components. The push towards electric vehicles (EVs) is also driving demand for specialized cutting tools.

What are the emerging trends in the cutting tools market?

Emerging trends include the adoption of advanced coatings to extend tool life, the use of AI and IoT for predictive maintenance and tool management, and a shift towards sustainable and environmentally friendly manufacturing processes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]