Global Cryptocurrency Market Size, Share, Trends & Growth Forecast Report Segmented By Component (Hardware and Software), Process, Type, and End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Cryptocurrency Market Size

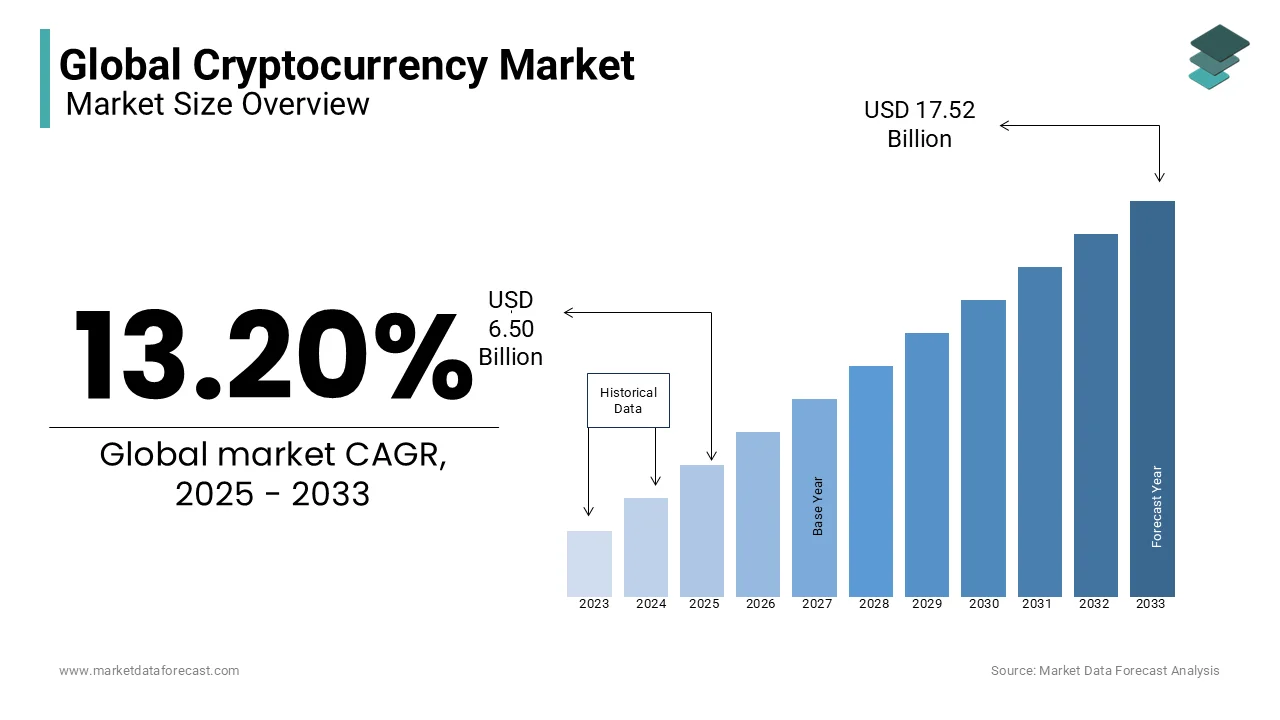

The global cryptocurrency market was worth USD 5.74 billion in 2024. The global market is projected to reach USD 17.52 billion by 2033 from USD 6.50 billion in 2025, growing at a CAGR of 13.20% from 2025 to 2033.

The cryptocurrency market is a rapidly changing sector worldwide and is majorly fuelled by blockchain technology that supports over 90% of digital currencies worldwide. According to the projections, more than 420 million people owned cryptocurrencies globally with emerging markets playing a key role in adoption due to their demand for accessible financial solutions. Major blockchain networks like Ethereum now handle over 1.5 million transactions daily with increased activity in decentralized finance (DeFi) and digital asset trading.

MARKET DRIVERS

Institutional Adoption

Institutional involvement plays a pivotal role in the cryptocurrency market with key financial organizations such as BlackRock and Fidelity incorporating digital currencies into their investment strategies. A recent U.S. Securities and Exchange Commission (SEC) report highlighted the approval of multiple Bitcoin ETFs in 2024 which broadened institutional access to digital assets. The International Monetary Fund (IMF) notes that institutional participation has contributed to market stability with Bitcoin now recognized as a hedge against inflation. Furthermore, U.S. Department of Commerce statistics indicate that blockchain investments in the U.S. grew by 23% annually which is reflecting the increasing integration of blockchain across financial sectors.

Decentralized Finance (DeFi) Expansion

DeFi is transforming conventional finance by enabling decentralized lending, borrowing, and trading without the need for intermediaries. According to a World Bank report, over 1.7 billion people worldwide remain unbanked and DeFi platforms offer a viable alternative, advancing financial inclusion. Ethereum being the dominant blockchain for DeFi handles transaction values exceeding $1 trillion annually, according to the Blockchain Transparency Institute. The rapid expansion of DeFi when coupled with the functionality of smart contracts addresses inefficiencies in traditional finance systems and also attracts millions of global users. DeFi is set to become a fundamental component of the global financial landscape because nations like Singapore and Switzerland have implemented blockchain-friendly regulations.

MARKET RESTRAINTS

Regulatory Uncertainty

The absence of definitive regulatory guidelines significantly limits the cryptocurrency market. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and the European Central Bank (ECB) have voiced concerns about the potential for money laundering and tax evasion tied to digital currencies. The Financial Action Task Force (FATF) reports that only 37% of countries fully adhere to its standards for regulating virtual assets. Furthermore, the U.S. Government Accountability Office (GAO) found that unclear policies hinder institutional investment and restrict innovation. This regulatory ambiguity forces businesses and investors to adopt a cautious approach and comnsequently slowing growth and impeding broader adoption across various regions.

Market Volatility

Cryptocurrency prices exhibit extreme volatility and makes them unreliable for both transactions and investments. For example, Bitcoin's price saw a fluctuation of over 60% within a year (2023-2024), according to the U.S. Federal Reserve. The Federal Reserve Board emphasizes that such instability erodes confidence, particularly among institutional stakeholders and more conservative investors. Additionally, the World Bank highlights that market fluctuations have a disproportionate impact on developing nations, where cryptocurrencies are often used as a hedge against economic instability. This unpredictability relegates cryptocurrencies to speculative investments rather than stable financial assets and thereby limiting widespread adoption.

MARKET OPPORTUNITIES

Central Bank Digital Currencies (CBDCs)

The emergence of Central Bank Digital Currencies (CBDCs) presents a significant growth opportunity for the cryptocurrency sector. As of 2024, the Bank for International Settlements (BIS) reports that over 80% of central banks worldwide are exploring or testing CBDCs. These digital currencies could streamline payment systems, reduce transaction fees and foster greater financial inclusion. The U.S. Federal Reserve underscores that a well-regulated CBDC could coexist alongside cryptocurrencies which is enhancing their legitimacy. For instance, China's Digital Yuan pilot has processed $250 billion in transactions, illustrating the potential for collaboration between government-backed digital assets and decentralized currencies and therefore, helping to modernize economies and broaden the market.

Blockchain Integration Across Industries

Blockchain technology’s application in sectors beyond finance offers substantial potential for the cryptocurrency market. According to a World Bank report, blockchain adoption in supply chain management could reduce fraud by 35%, improve transparency, and enhance operational efficiency. Governments are also leveraging blockchain for public service delivery; Estonia’s blockchain-based e-governance system efficiently manages 99% of its public services online. Additionally, the United Nations estimates that blockchain could reduce operational costs in energy trading by 20 to 30% and is further boosting demand for cryptocurrencies as native currencies in such applications by accelerating innovation and widespread adoption.

MARKET CHALLENGES

Cybersecurity Threats

Cybersecurity remains a major concern for the cryptocurrency sector. The Federal Bureau of Investigation (FBI) revealed that cryptocurrency-related cybercrimes totalled over $3.5 billion in 2023, underscoring vulnerabilities in exchanges and wallets. High-profile hacks such as the 2024 breach of a major decentralized exchange highlight the urgent need for more robust security measures. The U.S. Cybersecurity and Infrastructure Security Agency (CISA) emphasizes that weak defenses against phishing and ransomware attacks damage user trust and hinder institutional participation. Strengthening security protocols is crucial for ensuring safe transactions and promoting adoption across global markets.

Environmental Concerns

Cryptocurrency mining especially for proof-of-work (PoW) assets like Bitcoin, presents significant environmental challenges. The International Energy Agency (IEA) reports that Bitcoin mining consumes more energy annually than entire nations such as Argentina is leading to substantial carbon emissions. The United Nations Environment Programme (UNEP) warns that emissions from mining operations could impede progress toward global sustainability objectives unless cleaner energy sources are utilized. Although there is a growing shift toward renewable energy, but inconsistent sustainability practices continue to deter eco-conscious investors and attract increased regulatory scrutiny by putting the long-term sustainability of energy-intensive cryptocurrencies at risk. For instance, Bitcoin's annual energy consumption is estimated to be around 169.70 terawatt-hours (TWh) which is more than the entire country of Poland as per the Financial News.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.20% |

|

Segments Covered |

By Component, Process, Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The major players in the global cryptocurrency market include Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Tether (USDT), Cardano (ADA), Ripple (XRP), Solana (SOL), USD Coin (USDC), Polkadot (DOT), and Dogecoin (DOGE). |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment holds the largest share accounting for 58.3% of the market. This dominance is primarily due to the critical role of specialized hardware in cryptocurrency mining operations. Application-Specific Integrated Circuits (ASICs) are particularly significant, as they are designed to perform specific tasks more efficiently than general-purpose hardware. ASICs offer higher processing power and energy efficiency, making them essential for mining popular cryptocurrencies like Bitcoin. The substantial investment in mining hardware underscores its importance in maintaining the security and functionality of blockchain networks.

The software segment is undergoing the fastest growth in the cryptocurrency market with a projected CAGR of 15.2% from 2025 to 2030, according to Grand View Research. This rapid expansion is driven by the increasing demand for user-friendly platforms that facilitate various cryptocurrency-related activities. Wallet applications, for instance, have seen widespread adoption, enabling users to securely store and manage their digital assets. As of 2022, there were over 84 million crypto wallets worldwide, reflecting the growing user base. Exchange software platforms have also gained prominence, providing users with the ability to trade a wide range of cryptocurrencies efficiently. Additionally, the rise of decentralized finance (DeFi) has spurred the development of innovative applications that offer financial services without traditional intermediaries. The continuous advancement in software solutions enhances the accessibility and usability of cryptocurrencies, contributing to the segment's accelerated growth.

By Process insights

The transaction segment holds the largest share, accounting for approximately 67.6% of the market. This dominance is attributed to the primary function of cryptocurrencies as mediums of exchange, facilitating peer-to-peer transfers, online purchases, remittances, and trading activities on cryptocurrency exchanges. The increasing adoption of cryptocurrencies for everyday transactions underscores their growing acceptance and integration into the global financial system. In 2024, the Bitcoin network settled over $19 trillion in transactions, more than doubling the $8.7 trillion settled in 2023.

The mining segment is experiencing significant growth with a projected CAGR) of 12.9% from 2025 to 2033. This growth is driven by the rising demand for cryptocurrencies, which incentivizes the mining process responsible for validating transactions and securing blockchain networks. In 2024, the cryptocurrency mining industry saw the introduction of 30 new ASIC hardware models, delivering unprecedented hashrate outputs and energy efficiency. Advancements in mining hardware, such as the development of more efficient Application-Specific Integrated Circuits (ASICs), have enhanced mining capabilities, making the process more accessible and profitable. Additionally, the emergence of mining pools allows individual miners to combine resources, increasing the likelihood of earning rewards and contributing to the segment's rapid expansion.

By Type Insights

Bitcoin remains the dominant asset which is accounting for approximately 57% of the total market capitalization. This leading position is attributed to Bitcoin's widespread recognition as a decentralized digital currency and its status as a store of value, often referred to as "digital gold." Its limited supply of 21 million coins enhances its appeal as a hedge against inflation. The increasing acceptance of Bitcoin by institutional investors and the introduction of Bitcoin Exchange-Traded Funds (ETFs) have further solidified its market dominance.

Ethereum is experiencing the rapid growth among cryptocurrencies with a CAGR of 13.1% projected from 2025 to 2033. This rapid expansion is driven by Ethereum's smart contract functionality, which enables decentralized applications (dApps) across various sectors, including finance, gaming, and supply chain management. As of 2022, the Ethereum blockchain processed approximately 105.58 million transactions in the first quarter alone, highlighting its extensive use in decentralized finance (DeFi) platforms and non-fungible tokens (NFTs). Additionally, Ethereum's transition to a proof-of-stake consensus mechanism aims to improve scalability and energy efficiency, further attracting developers and investors to the platform.

By End Use Insights

The trading segment holds the largest share accounting for 42.3% of the market. This dominance is attributed to the high liquidity and accessibility of cryptocurrencies, enabling investors to engage in frequent buying and selling activities. The proliferation of cryptocurrency exchanges and trading platforms has facilitated this trend, allowing for seamless transactions across various digital assets. As of 2024, there are approximately 1,492 active crypto exchanges worldwide, both centralized and decentralized, according to Blockspot data cited by Coinweb. Additionally, the volatility of cryptocurrency prices attracts traders seeking short-term gains, further solidifying the trading segment's leading position in the market.

The retail and e-commerce segment is experiencing the fastest growth in the cryptocurrency market with a projected CAGR) of 19.2% from 2025 to 2033. This rapid expansion is driven by the increasing acceptance of cryptocurrencies as a payment method by online retailers and consumers' growing preference for digital transactions. As of December 2024, approximately 15,174 businesses worldwide accept cryptocurrencies as payment, with Bitcoin being the most popular, accepted by 58% of crypto-friendly businesses, as reported by Capital One Shopping. Major companies, such as Overstock and Shopify, have integrated cryptocurrency payment options, enhancing the legitimacy and convenience of using digital currencies in everyday purchases. Furthermore, the lower transaction fees and faster processing times associated with cryptocurrencies make them an attractive alternative to traditional payment methods, contributing to the accelerated growth of this segment.

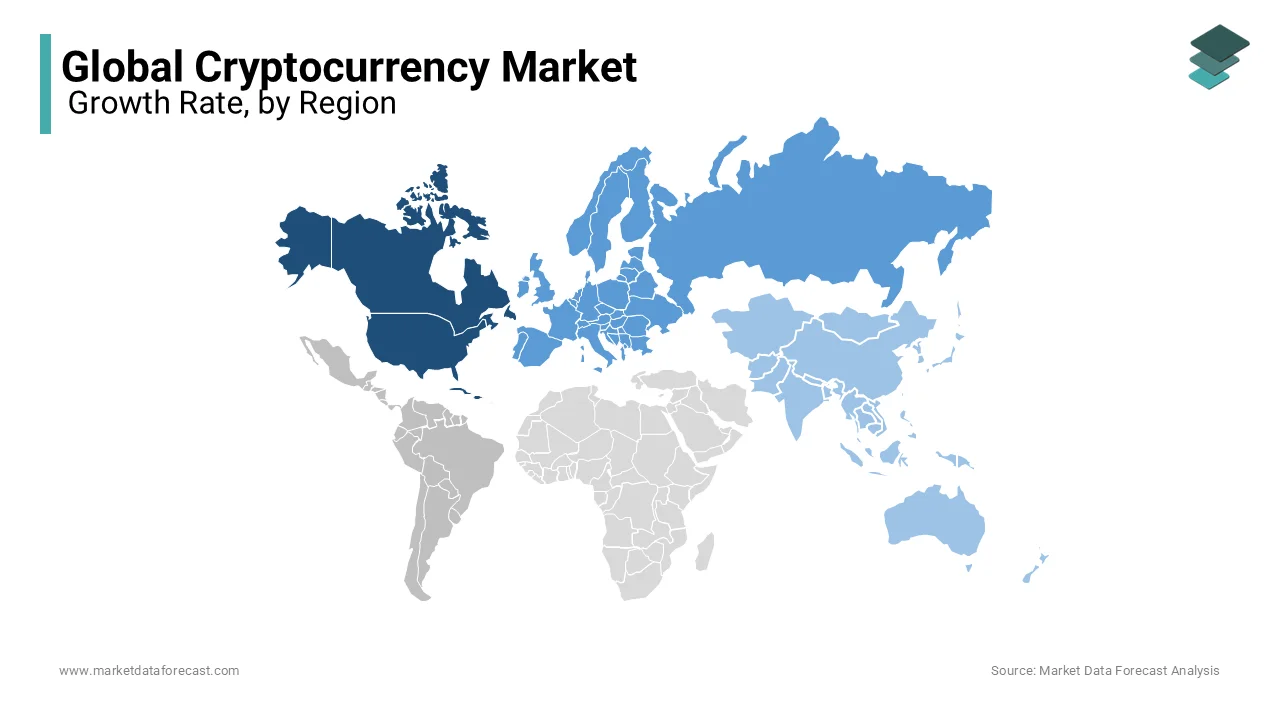

REGIONAL ANALYSIS

North America accounted for 40.6% of the global market share in 2024 and is expected to play a promising role in the North American market over the forecast period owing to the continuous rise in the institutional adoption, technological advancements, and favorable regulatory developments. In the U.S., the Securities and Exchange Commission (SEC) has intensified its scrutiny of crypto assets by initiating several enforcement actions. For instance, in 2024, the SEC charged Cumberland DRW LLC for engaging in unregistered dealings of over $2 billion worth of crypto assets. Despite regulatory uncertainties, institutional investments continue to grow. The International Monetary Fund (IMF) reports that U.S. firms, including public companies and investment funds, hold a significant share of the global Bitcoin supply, with U.S.-based Exchange Traded Funds (ETFs) owning approximately 3.41% of the total Bitcoin supply as of Q3 2023. Additionally, the Federal Reserve has examined stablecoins' role within the financial system, noting their increasing importance in decentralized finance (DeFi) and their function as digital U.S. dollar representations on blockchain networks.

Europe is a prominent market for cryptocurrencies worldwide and is predicted to grow at a CAGR of 13.8% during the forecast period. It is propelled by regulatory advancements and growing institutional investments. The implementation of the Markets in Crypto-Assets Regulation (MiCA) has provided a unified framework which is boosting investor confidence and encouraging innovation. The European Securities and Markets Authority (ESMA) expects MiCA to improve transparency and facilitate cross-border transactions by positioning the region as a global leader. Cryptocurrency transaction volumes are on the rise, with Spain recording €73.356 billion in crypto transactions between July 2023 and June 2024. The European crypto Exchange-Traded Products (ETPs) market is also expanding with £108 million in net inflows in November 2024 alone.

In the Asia-Pacific region, the cryptocurrency market is projected to grow at a CAGR of 16.2% throughout the estimation period. It is influenced by high adoption rates and technological innovation. India, despite stringent regulations leads global cryptocurrency adoption and Central Bank Digital Currencies (CBDCs) are emerging as key drivers. As of 2024, China's Digital Yuan pilot has reached 260 million wallet users and processed 5.4 billion transactions, demonstrating the significant role of CBDCs in market growth.

In Latin America, the cryptocurrency market is set to grow at a brisk pace, driven by its use as a hedge against inflation and proactive regulatory measures. Brazil saw a 60.7% increase in crypto asset imports with total of $12.9 billion in the first nine months of 2024, with stablecoins accounting for 70% of these transactions. El Salvador, a pioneer in Bitcoin adoption, recorded profits exceeding $300 million from Bitcoin investments as the cryptocurrency's value surpassed $100,000. Similarly, Venezuela's market reached $20 billion in transactions in 2024 and is driven by economic instability. Argentina saw $85.4 billion in cryptocurrency transactions, highlighting the growing role of digital assets in providing financial stability.

The Middle East and Africa (MEA) cryptocurrency market is projected to grow at a significant pace, with financial inclusion efforts and regulatory progress. The UAE and Saudi Arabia are leading the way in blockchain integration. A World Bank report estimates that full digitalization including cryptocurrency adoption could add $1.6 trillion to the MENA economy over the next 30 years. Sub-Saharan Africa particularly Nigeria, Kenya, and South Africa which remains one of the fastest-growing crypto markets globally. The IMF reports that regulatory measures are being introduced to foster trust and address risks with cryptocurrencies and CBDCs serving as tools to bridge the financial inclusion gap because only 53% of adults in the region have access to formal financial services.

COMPETITIVE LANDSCAPE

The cryptocurrency market remains highly competitive, fueled by continuous innovation, swift adoption, and shifting regulatory frameworks. Leading players like Bitcoin and Ethereum maintain dominance, with Bitcoin standing as the original and most widely recognized digital currency, while Ethereum excels in smart contract capabilities and decentralized applications (dApps). However, the competition is growing as altcoins such as Solana, Cardano, and Binance Coin gain traction by offering faster transaction speeds and lower fees, targeting specific market segments.

Stablecoins, including Tether (USDT) and USD Coin (USDC), add another layer of competition by providing price stability in a volatile market, attracting both retail investors and institutional players. Centralized exchanges, such as Binance, Coinbase, and Kraken, differentiate themselves through superior user experience, robust security features, and diverse trading options.

Meanwhile, decentralized exchanges (DEXs) like Uniswap and PancakeSwap are challenging the conventional model by enabling peer-to-peer transactions without intermediaries. The rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has further intensified competition, with numerous projects striving for dominance in these rapidly expanding sectors. Companies are setting themselves apart with blockchain scalability, sustainable mining techniques, and strategic partnerships, while regulatory changes continue to influence market dynamics, offering both opportunities and limitations depending on compliance. This ever-evolving landscape encourages ongoing innovation and intensifies rivalries.

KEY MARKET PLAYERS

The major players in the global cryptocurrency market include Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Tether (USDT), Cardano (ADA), Ripple (XRP), Solana (SOL), USD Coin (USDC), Polkadot (DOT), and Dogecoin (DOGE).

RECENT HAPPENINGS IN THE MARKET

- In January 2024, eToro confidentially filed for a U.S. initial public offering (IPO) seeking a valuation exceeding $5 billion, aiming to expand its presence in the cryptocurrency trading market.

- In May 2024, Tether acquired a $100 million stake in Bitdeer, a U.S.-listed Bitcoin mining company, with options to acquire an additional $50 million, strengthening its involvement in the cryptocurrency mining sector.

MARKET SEGMENTATION

This research report on the global cryptocurrency market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Central Processing Unit

- Graphics Processing Unit

- Application-Specific Integrated Circuit

- Field Programmable Gate Array

- Software

- Mining Software

- Exchange Software

- Wallet

- Payment

- Others

By Process

- Mining

- Transaction

By Type

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Others

By End Use

- Banking

- Gaming

- Government

- Healthcare

- Retail & E-commerce

- Trading

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors influence cryptocurrency prices?

Prices are affected by supply and demand, market sentiment, regulatory news, technological advancements, macroeconomic trends, and investor speculation.

What are stablecoins, and why are they important?

Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies or commodities. They reduce volatility and are widely used for trading, payments, and decentralized finance (DeFi) applications.

How are cryptocurrencies taxed globally?

Tax treatment depends on jurisdiction. Some countries consider them property, subjecting them to capital gains tax, while others treat them as currency or commodities with different tax implications.

What role do institutional investors play in the crypto market?

Institutional investors, such as hedge funds, banks, and corporations, bring liquidity, legitimacy, and stability to the market. Their involvement influences price movements and regulatory developments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]