Global Crypto Asset Management Market Size, Share, Trends, & Growth Forecast Report – Segmented by Solution (Custodian and Wallets), Application Type (Web-based and Mobile), End-user (Individual and Enterprise (Institutions, Retail and e-commerce)), & Region - Industry Forecast From 2024 to 2032

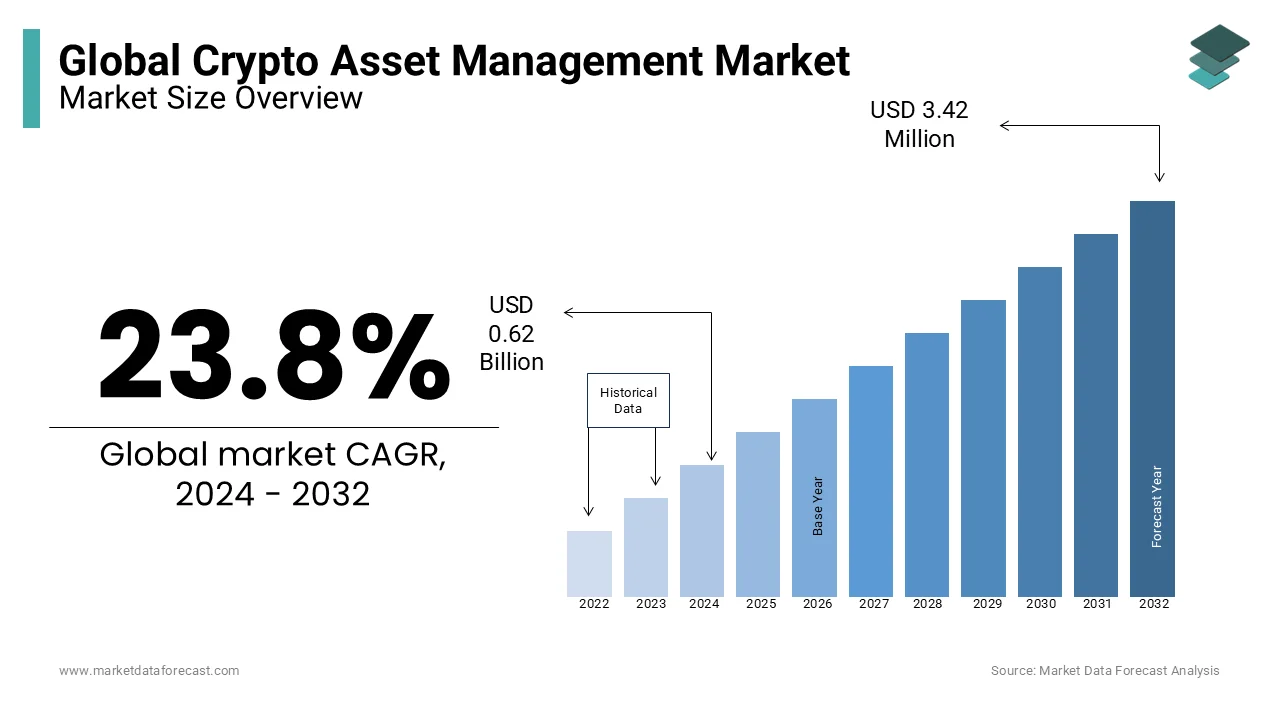

Global Crypto Asset Management Market Size (2024 to 2032)

The global crypto asset management market was worth USD 0.50 billion in 2023. The global market is foreseen to progress from USD 0.62 billion in 2024 to develop up to USD 3.42 billion by 2032 at an expansion rate (CAGR) of about 23.8% over the anticipated period.

Cryptographic assets have become one of the most important areas of discussion in government entities, financial organizations, and large businesses. The fascinating pace of digitalization around the world has forced various industries and sectors to assimilate processes and digital frameworks. In this uncontrolled rush in the digital world, cryptocurrency has become the financial counterpart of digital networks. In cryptocurrency, transactions are recorded as digital assets that are implemented with the help of strong cryptography techniques. The financial security offered by crypto assets has played a key role in the growth of the global crypto asset management market. In addition, the confidence shown by various business and administrative entities in crypto assets has also emerged as a key reason for the growth of the global market.

Current Scenario of the Global Crypto Asset Management Market

The demand for crypto asset management is expected to accelerate as several emerging economies, including China and Japan, invest their money in the development of advanced crypto networks. In addition, scams and scandals during the transaction on non-digital currencies have put digital currencies in the spotlight. Therefore, it can be safely said that the global market for crypto asset management would develop into a healthy CAGR in the years to come. The emerging blockchain technology has the potential to offer versatile business applications in various end-user industries, expanding its services through the tremendous growth of digital assets.

MARKET DRIVERS

The rising start-up culture across the globe has resulted in several crypto currencies that is mainly promoting the expansion of the global crypto asset management market.

Also, the presence of a number of companies that have given some credibility to crypto transactions has also played a central role in the growth of the global crypto asset management market. The transparent security offered by cryptocurrencies is unprecedented, and this factor has become a basis for growth in the global market for cryptocurrency asset management.

The increasing adoption of blockchain or distributed ledger technologies in the sector is expected to increase the BFSI sector's investment in cryptocurrency. For example, by establishing a decentralized payment register, banking solutions could facilitate faster payments at lower rates than traditional systems. For example, in August 2019, Uruguay-based Bantotal, a basic banking provider serving more than 60 different financial institutions in 14 different countries, collaborated with the Bitex cryptocurrency exchange to facilitate payments cross-border through the bitcoin blockchain. Additionally, Ohio is the first state in the US to accept Bitcoin tax payments, and the BitPay platform allows transactions. Such initiatives and agencies should stimulate the adoption of crypto asset management solutions in the BFSI industry. In November 2019, SEBA Bank launched a range of services to integrate crypto assets and traditional banking services. The crypto services in the banks comprise of asset management, trading, custody, and financing. Your wallet, e-banking and card application should allow customers to convert their traditional form of cryptocurrency investment. Additionally, Clipper Coin Capital (CCC), a cryptocurrency investment bank and an asset management company, recently opened in Hong Kong. Such initiatives indicate the efforts of crypto asset management companies to expand their presence globally.

MARKET RESTRAINTS

However, the large amount of energy consumed to conduct a single crypto transaction could pose a threat to the growth of the global crypto asset management market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

23.8% |

|

Segments Covered |

By Solution, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BitGo, Coinbase, Crypto Finance AG, Exodus Movement Inc., Olymp Capital, Digital Asset Custody Company, Inc., Iconomi Ltd., itbit, Ledger SAS, METACO, Vo1t, Xapo and SFOX Inc and Others. |

SEGMENTAL ANALYSIS

Global Crypto Asset Management Market Analysis By End-user

the BFSI segment in the enterprise division held the dominant portion and is likely to expand with a considerable CAGR in the coming years with the increasing call in the financial institutions.

Global Crypto Asset Management Market Analysis By Solution

REGIONAL ANALYSIS

The Asia Pacific crypto asset management market is foreseen to generate immense revenues in the following years. This is due to the introduction of new cryptocurrencies in China and the adoption of crypto assets by various commercial and financial entities in the region. The energy sector in North America and Europe has matured in recent times, which has stimulated growth in the crypto asset management market in these regions.

North America is expected to dominate the global crypto asset management market due to dominance by the United States and Canada in the adoption of Bitcoin or cryptocurrencies. The United States is a major player in bitcoin commerce and transactions.

The United States has around 27 stock exchanges, while Canada has only six. The United States ranks first in the transaction between Bitcoin exchanges according to data published by Crystal blockchain.

KEY PLAYERS IN THE GLOBAL CRYPTO ASSET MANAGEMENT MARKET

Few major competitors currently working in the global crypto asset management market are BitGo, Coinbase, Crypto Finance AG, Exodus Movement Inc., Olymp Capital, Digital Asset Custody Company, Inc., Iconomi Ltd., itbit, Ledger SAS, METACO, Vo1t, Xapo and SFOX Inc.

RECENT HAPPENINGS IN THE GLOBAL CRYPTO ASSET MANAGEMENT MARKET

-

In April 2020, Crypto Finance AG successfully raised 14 million Swiss francs in new funds, which the company should help develop despite the current challenges posed by Covid-19.

-

In January 2020, MV Index Solutions (MVIS) and Intelligence Unit (IU) collaborated with Nomura Research Institute, Ltd. (NRI) to develop the NRI/IU Crypto-Asset Index for banking and financial institutions. Using the cryptocurrency index platforms provided by MVIS and CryptoCompare, the invertible index offers an investment solution for Japanese financial institutions as well as for global investors.

DETAILED SEGMENTATION OF THE GLOBAL CRYPTO ASSET MANAGEMENT MARKET INCLUDED IN THIS REPORT

This research report on the global crypto asset management market has been segmented and sub-segmented based on the solution, application type, end-user, and region.

By Solution

- Custodian

- Wallets

By Application Type

- Web-based

- Mobile

By End-user

- Individual

- Enterprise (Institutions, Retail and e-Commerce)),

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary types of crypto asset management services available globally?

Crypto asset management services encompass a range of offerings, including portfolio management, custody solutions, trading platforms, asset valuation, and compliance services tailored to meet the diverse needs of investors.

What role do decentralized finance (DeFi) platforms play in the crypto asset management market globally?

DeFi platforms are revolutionizing the crypto asset management landscape by offering decentralized solutions for lending, borrowing, trading, and yield farming, providing investors with greater control over their assets and potentially higher returns.

How are regulatory developments impacting the global crypto asset management market?

Regulatory frameworks vary significantly across jurisdictions, with some countries introducing favorable regulations to attract investment, while others impose stringent requirements or bans on cryptocurrency-related activities, creating challenges and opportunities for market participants.

What are the future prospects for the global crypto asset management market?

The crypto asset management market is expected to continue its trajectory of growth, driven by increasing institutional adoption, advancements in technology, evolving regulatory landscape, and growing investor interest in digital assets as an alternative investment class.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]