Global Crusher Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type, Power Source, Mode of Operation, Application, And Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industrial Analysis From (2025 to 2033)

Global Crusher Market Size

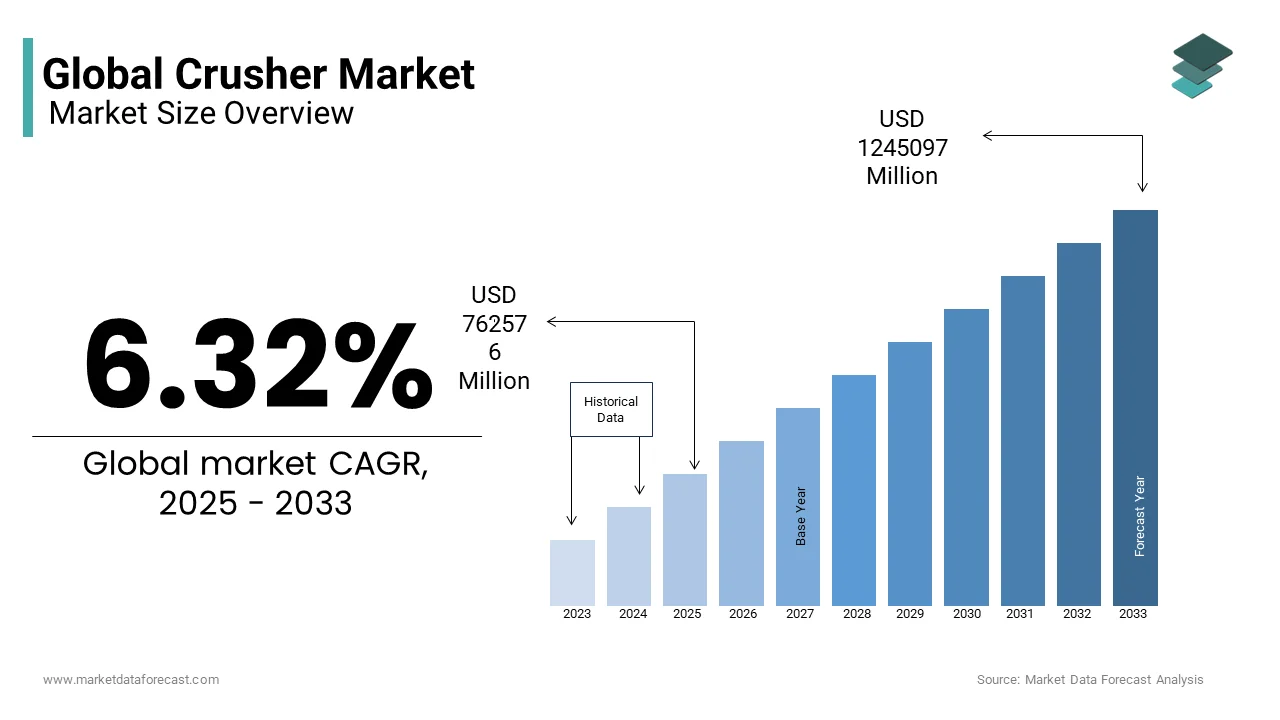

The global crusher market size was valued at USD 717246.42 million in 2024 and is anticipated to reach USD 762576 million in 2025 from USD 1245097 million by 2033, growing at a CAGR of 6.32% during the forecast period from 2025 to 2033.

Crushers are designed to break down large rocks, minerals, and construction materials into smaller, more useful sizes. These machines are widely used in industries such as mining, construction, demolition, and recycling. Each year, about 50 billion tons of sand and gravel are extracted globally. These materials are the second most used resource in the world after water. The high demand for sand and gravel is mainly due to urbanization and infrastructure development. As cities grow, more roads, buildings, and bridges are needed, which increases the need for advanced crushers to produce essential construction materials.

In waste management, construction and demolition activities generate a large amount of waste. In the European Union, this type of waste makes up about 35.7% of the total waste produced. This highlights the need for powerful crushers to process and recycle materials. Recycling construction waste helps reduce environmental harm and supports better resource management. The crusher market has grown with new technologies. Companies are now using automation, digital monitoring, and energy-saving features in their machines. These improvements make crushers more efficient and environmentally friendly, reducing pollution from material processing. Regions like Asia-Pacific, which are rapidly developing and urbanizing, have seen an increase in large construction projects. As a result, the demand for crushers has risen since these machines are necessary for producing the raw materials used in construction.

Market Drivers

Urbanization and Infrastructure Development

As more people move to cities, there is a greater need for houses, roads, and public services. This growing urbanization has increased the demand for crushers, which help in making construction materials. The United Nations Department of Economic and Social Affairs stated that in 2018, about 55% of the world's population lived in urban areas. By 2050, this number is expected to reach 68%. Most of this growth will happen in Asia and Africa, which will contribute 90% of the increase. Because of this rapid expansion, more buildings and roads are being built, leading to higher demand for crushers to process stones and other raw materials for construction.

Escalating Demand for Minerals and Metals

Crushers are essential in the mining industry because they help break down large rocks to extract valuable minerals. The growing need for minerals, especially for clean energy technologies, is driving the crusher market forward. The International Energy Agency’s Global Critical Minerals Outlook 2024 reports that the demand for minerals used in clean energy will double by 2030 under the current policies. Lithium, which is crucial for electric vehicle batteries, is expected to increase eight times by 2040 in the Net Zero Emissions scenario. As the need for minerals rises, crushers will become even more necessary for processing larger amounts of ore, ensuring that industries get the raw materials they need.

Market Restraints

Stringent Environmental Regulations

The crusher industry is facing increasing restrictions due to strict environmental rules aimed at reducing pollution. Crushing activities can release dust and emissions that harm the environment, leading governments to introduce tougher laws. The Environment Agency reported that in 2022, there were 504 serious pollution incidents in England, and 36% were linked to industries with environmental permits, including stone crushing. To meet these regulations, companies must invest in cleaner technologies, which increases costs. If they fail to follow these rules, they risk facing heavy fines or shutdowns. These strict laws are making it harder for some businesses to operate, which is slowing the growth of the crusher market.

Occupational Health and Safety Concerns

Working with crushers involves risks, such as exposure to dust, loud noise, and dangerous moving parts. The Health and Safety Executive (HSE) reported that in 2022/23, six fatalities occurred in the waste management and recycling sector, which includes crushing activities. The fatality rate was 5.02 per 100,000 workers, much higher than in most other industries. These risks require companies to invest in better safety measures, such as protective equipment and worker training. However, improving workplace safety leads to increased costs. Additionally, accidents can result in legal actions and compensation claims, which discourage some businesses from expanding their crusher operations.

Market Opportunities

Expansion of Construction and Demolition Waste Recycling

The amount of waste generated from construction and demolition is growing every year. Crushers are used to recycle this waste and turn it into useful materials. The United Nations Environment Programme’s Global Waste Management Outlook 2024 states that municipal solid waste (MSW) production is expected to increase from 2.3 billion tonnes in 2023 to 3.8 billion tonnes by 2050. Much of this waste comes from construction activities. Instead of disposing of materials in landfills, crushers help break them down for reuse, reducing waste and benefiting the environment. The use of advanced crushers for recycling is expected to grow, as more countries focus on sustainability and reducing landfill waste.

Rising Demand for Critical Minerals in Clean Energy Technologies

The transition to clean energy has increased the need for minerals like lithium, cobalt, and nickel, which are used in electric vehicles, solar panels, and wind turbines. The International Energy Agency’s Global Critical Minerals Outlook 2024 predicts that the demand for minerals in clean energy technologies will double by 2030 under current policies. Lithium demand, in particular, is expected to increase eightfold by 2040 under the Net Zero Emissions scenario. Crushers are essential in processing these minerals, making mining more efficient. Companies that develop advanced crushers capable of handling different ore types will benefit from the rising demand for clean energy technologies.

Market Challenges

Market High Energy Consumption

Crushers consume a large amount of energy, which makes operations expensive and contributes to carbon emissions. The Coalition for Eco-Efficient Comminution (CEEC) states that comminution—the process of crushing and grinding ores—accounts for about 25% of the total energy consumption at an average mining site. Reducing energy use is a major challenge for companies, as they must balance efficiency with sustainability. The need to adopt energy-efficient technologies is becoming increasingly important. Investing in crushers that use less energy can help lower costs, but these advanced machines often require a high initial investment, making it difficult for some companies to upgrade.

Supply Chain Disruptions

The crusher market relies on the availability of raw materials and machine components, which can be affected by supply chain issues. A survey by Maersk found that 76% of European businesses faced supply chain disruptions in the past year, with 22% reporting more than 20 delays in their operations. These disruptions are caused by factors such as geopolitical conflicts, transportation issues, and pandemics. When supply chains are interrupted, crusher manufacturers struggle to obtain essential parts, leading to delays in production and increased costs. To address these challenges, companies are focusing on diversifying suppliers and using technology to predict potential disruptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.32% |

|

Segments Covered |

By Type, Power Source, Mode of Operation, Application and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Astec Industries, Inc, Dragon Equipments Limited, Eagle Crusher Co., Inc, Wirtgen Group, Komatsu Ltd, Metso Corporation, Sandvik AB, Terex Corporation, Thyssenkrupp AG, Weir Group |

SEGMENT ANALYSIS

Crushers Market Analysis By Type

The jaw crushers segment held the leading share of 35.2% of the crushers market in 2024. Their widespread use in primary crushing applications across mining and construction sectors is the main reason behind the segment’s dominance. According to the U.S. Geological Survey (USGS), global crushed stone production reached 1.8 billion metric tons in 2022, with jaw crushers being the preferred choice for initial material reduction. Additionally, the International Labour Organization (ILO) highlights that jaw crushers require less frequent maintenance compared to other types, reducing operational costs by up to 20% , which reinforces their importance.

The cone crushers segment is predicted to witness the highest CAGR of 7.8% during 2025-2033 due to rising demand for high-quality aggregates in infrastructure projects. The Global Cement and Concrete Association (GCCA) states that global concrete production exceeded 4.4 billion cubic meters in 2022, driving cone crusher adoption for precision crushing. Furthermore, advancements in automation, supported by initiatives like the European Green Deal , enhance energy efficiency by up to 15% , according to the International Energy Agency (IEA) . Cone crushers' ability to produce uniform output shapes makes them critical for sustainable industrial practices, ensuring their rapid expansion in emerging markets.

Crushers Market Analysis By Power Source

The diesel-powered crushers segment captured the largest market share of 45.8% in 2024. Their portability and suitability for off-grid operations and particularly in remote mining and construction sites is fuelling the expansion of the diesel segment in the global market. The U.S. Energy Information Administration (EIA) states that diesel remains a critical energy source, powering 70% of heavy machinery globally in off-road applications. Additionally, the International Labour Organization (ILO) stated that diesel-powered equipment reduces logistical challenges in areas with limited infrastructure, improving operational efficiency by 10-15%. This reliability ensures diesel crushers remain vital in regions like Sub-Saharan Africa and Southeast Asia, where grid connectivity is sparse.

The hybrid crushers segment is quickly moving forward and is predicted to have highest CAGR of 8.5% during the forecast period owing to the rising demand for energy-efficient solutions aligned with global sustainability goals. The International Energy Agency (IEA) reports that hybrid systems reduce fuel consumption by up to 30%, supporting initiatives like the European Green Deal, which aims for a 55% reduction in carbon emissions by 2030. Furthermore, the Global Cement and Concrete Association (GCCA) emphasizes that hybrid crushers lower greenhouse gas emissions by 15-20%, making them critical for eco-friendly industrial practices. Their dual-power capability ensures uninterrupted performance, even in areas with unreliable electricity grids, driving rapid adoption worldwide.

Crushers Market Analysis By Mode of Operation

The stationary crushers segment dominated the market and held a share of 60.8% in 2024. Its high capacity and suitability for large-scale industrial applications and especially in mining and quarrying is primarily driving the progress of this segment in the global market. The U.S. Geological Survey (USGS) states that stationary crushers are responsible for processing over 80% of crushed stone in the U.S., which amounted to 1.5 billion metric tons in 2022. Additionally, the International Labour Organization (ILO) revealed that stationary units reduce energy consumption by 15-20% compared to portable alternatives in continuous operations. Their integration into permanent setups ensures long-term cost efficiency, making them indispensable for industries requiring consistent material supply.

The portable crushers segment is swiftly gaining traction and is anticipated to expand at a CAGR of 7.9% over the forecast period. The increasing demand for flexible equipment in infrastructure projects is making the segment highly popular among users. The International Energy Agency (IEA) reports that portable crushers reduce transportation costs by up to 35% , as they can be deployed directly at project sites. Furthermore, the Global Infrastructure Hub , supported by the World Bank , estimates global infrastructure investment needs will reach $94 trillion by 2040, creating significant demand for adaptable equipment. Portable crushers' ability to operate in remote or temporary locations, coupled with advancements in fuel-efficient designs, supports sustainable practices. As urbanization accelerates, their role in enhancing project efficiency becomes increasingly critical.

Crushers Market Analysis By Application

In 2024, mining was the biggest application segment and maintained a 35.5% of the market share in 2024. This dominance is driven by the growing demand for minerals and metals, with the U.S. Geological Survey (USGS) reporting global mining production reached 19.3 billion metric tons in 2022. Crushers are essential for ore processing, reducing material size for extraction. The International Council on Mining and Metals (ICMM) highlights that mining contributes 6-8% of global GDP , underscoring its economic importance. Additionally, advancements in crusher technology have improved efficiency by 20-25% , enabling higher throughput and lower operational costs, solidifying mining's leadership in the crushers market.

The environmental segment is estimated to register the fastest CAGR of 9.4% during 2025-2033 owing to the increasing focus on waste recycling and sustainable practices. The Environmental Protection Agency (EPA) states that construction and demolition waste recycling rates reached 30% globally in 2022, driving demand for crushers in waste processing. Furthermore, the World Bank reports that global waste generation is expected to increase by 70% by 2050 , creating urgent demand for recycling solutions. Governments like the European Union mandate recycling targets under the Circular Economy Action Plan , boosting crusher adoption. Crushers play a pivotal role in achieving sustainability goals, ensuring rapid expansion in this segment.

REGIONAL ANALYSIS

In 2024, the Asia-Pacific region was the top performer in the global crusher market and accounted for 47.8% share in the same year. The rapid urbanization and industrialization in countries such as China, India, and Japan are primarily driving its dominance in the market worldwide. As these countries develop, they need more roads, bridges, and buildings, which increases the demand for crushed materials. This leads to a higher need for crushers. For example, China’s Belt and Road Initiative has resulted in many new infrastructure projects, which require large amounts of construction materials. Additionally, this region is rich in natural resources, which has boosted mining activities, further increasing the demand for crushing machines.

North America is projected to emerge as the most attractive region and is expected to move forward at a CAGR of 7% through the forecast period. This growth is attributed to the robust expansion of the construction industry and increased mining activities in the region. The U.S. government has launched massive investments in infrastructure, such as the Infrastructure Investment and Jobs Act, to upgrade roads, bridges, and public utilities. As a result, the need for crushed materials has risen, boosting demand for crushers. Additionally, North America is placing more importance on environmentally friendly solutions. Many companies are now using advanced crushers that recycle waste materials to comply with strict environmental laws, making the region an attractive market for crushing equipment.

Europe holds a significant share in the global crusher market and is driven by a well-established mining and quarrying industry. The region also has a high focus on recycling and waste management, which has increased the demand for crushers that process construction and demolition waste. European countries have strict environmental policies that encourage companies to use energy-efficient crushing equipment to reduce pollution and meet sustainability targets. Furthermore, several nations in Europe, including Germany, France, and the UK, are constantly working on infrastructure renovation projects. These projects require high-quality crushed materials, which continues to drive the demand for crushers across the region.

Latin America is anticipated to witness moderate growth in the crusher market and is basically due to the expansion of the mining sector in countries such as Brazil and Chile. These nations have large reserves of minerals and metals, attracting huge investments in mining operations. This has led to an increasing need for crushers to break down ores and rocks. Additionally, the governments of several Latin American countries are investing in transportation and energy infrastructure to improve economic development. However, factors such as economic instability and political challenges in certain nations might slow down market growth in the region.

The Middle East and Africa region is expected to exhibit considerable growth in the crusher market and is propelled by infrastructural developments and mining activities. Countries like Saudi Arabia and the UAE are spending heavily on infrastructure projects as part of their plans to diversify their economies beyond oil. This has increased the demand for construction aggregates and crushers. Meanwhile, in Africa, countries like South Africa and Ghana have rich deposits of gold, diamonds, and other minerals. This has led to more mining projects that require efficient crushers. However, political instability in some areas and limited access to new crushing technologies may slow down market expansion in certain parts of the region.

Top 3 Players in the Market

Metso

Metso is a well-known industrial machinery company from Finland that provides technology and services for industries like mining, construction, recycling, and processing. It produces a wide range of crushers, such as jaw crushers, cone crushers, impact crushers, and mobile crushing plants. Metso is known for its continuous innovation, always improving its crushing technology to make machines more efficient and productive. The company's crushers are highly reliable and durable, making them a top choice in many industries. With a strong focus on performance and customer satisfaction, Metso has gained a leading position in the global crusher market.

Sandvik

Sandvik AB is a Swedish company specializing in high-tech engineering and is a global leader in mining and rock excavation, metal-cutting, and materials technology. The company manufactures different types of crushers, including jaw crushers, cone crushers, impact crushers, and roll crushers. Sandvik is known for producing high-quality, efficient, and reliable crushing equipment, widely used in mining and construction. The company also focuses on sustainability and develops environmentally friendly crushing machines. By integrating advanced technology into its crushers, Sandvik improves productivity and reduces environmental impact, making it one of the most trusted brands in the market.

Terex

Terex Corporation is a U.S.-based company that manufactures lifting and material processing equipment. It operates well-known brands such as Powerscreen and Finlay, offering a wide variety of crushers, including jaw crushers, cone crushers, impact crushers, and mobile crushing machines. Terex is known for making versatile and durable crushers that can handle different materials in mining, construction, and recycling industries. The company focuses on customer support, continuous innovation, and product reliability. By improving its product development strategies, Terex has established itself as a strong player in the crusher market worldwide.

Top Strategies Used by Key Market Participants

Product Innovation and Technological Advancement

Major crusher manufacturers like Metso, Sandvik, and Terex invest heavily in new technologies to improve their machines. These improvements focus on reducing energy use, lowering emissions, and increasing automation. For example, Metso’s crushers now come with digital monitoring systems that provide real-time data analysis to detect problems early, improving machine performance. Similarly, Sandvik has introduced hybrid and electric crushers, which help reduce pollution and energy costs. By offering advanced crushing solutions, these companies stay ahead of competitors and attract more customers looking for efficient and eco-friendly machines.

Strategic Acquisitions and Partnerships

To expand their market presence, leading companies buy smaller firms or form strategic partnerships. Metso, for example, acquired McCloskey International to improve its mobile crushing and screening equipment, strengthening its position in North America. Similarly, Sandvik purchased Schenck Process Mining to improve its crushing and screening solutions. These acquisitions help companies grow faster, integrate new technologies, and gain access to new markets. By partnering with other firms, these companies increase their product offerings and ensure they remain leaders in the industry.

Global Expansion and Market Penetration

To stay on top, major crusher manufacturers expand their presence worldwide, especially in fast-growing regions like Asia-Pacific, Latin America, and Africa. Terex has built manufacturing and distribution networks in India and China, responding to the high demand for crushing equipment in mining and infrastructure projects. Companies open new factories, establish partnerships, and strengthen their sales networks to improve their reach in different markets. This expansion strategy helps them increase revenue, meet growing industry demands, and maintain a strong position in the global market.

KEY MARKET PLAYERS

Astec Industries, Inc, Dragon Equipments Limited, Eagle Crusher Co., Inc, Wirtgen Group, Komatsu Ltd, Metso Corporation, Sandvik AB, Terex Corporation, Thyssenkrupp AG, Weir Group. These are the market players that are dominating the global crusher market.

COMPETITOR LANDSCAPE

The global crusher market is highly competitive, with companies constantly improving their technology to stay ahead. The demand for better material processing machines is rising, especially with more infrastructure projects happening worldwide. Large companies like Metso, Sandvik, and Terex lead the industry by creating advanced products, acquiring smaller companies, and expanding into new regions. These companies focus on automation, energy-saving technologies, and digital features, making their crushers more efficient and user-friendly.

In addition to these big companies, there are many smaller and regional manufacturers that serve specific needs. Some focus on making mobile crushers, while others specialize in environmentally friendly crushing machines. Competition has grown even more because of the rising need for sustainability. Many companies now invest in hybrid and electric crushers to meet environmental regulations and reduce costs.

Keeping prices competitive and offering good after-sales service is key to attracting customers. Many companies provide maintenance plans, remote monitoring, and spare parts to keep their machines running smoothly. Regions like Asia-Pacific, Latin America, and Africa offer big opportunities for new companies, which makes the competition even tougher.

To increase their market share, top companies often buy smaller firms and adopt new technologies. Since industries need strong, high-performance crushers, competition remains intense. Manufacturers must focus on innovation, sustainability, and customer satisfaction to succeed in this rapidly growing market.

RECENT HAPPENINGS IN THIS MARKET

- In December 2024, EvoQuip expanded its presence in North America by appointing new distributors, enhancing the availability and support for their compact crushing and screening equipment across the region.

- In September 2024, Metso announced the acquisition of Diamond Z and Screen Machine Industries, aiming to strengthen its position in the aggregates segment. This strategic move is expected to enhance Metso's offering in mobile equipment for the organic recycling and North American mobile crushing and screening markets.

- In June 2024, Terex MPS unveiled two new portable crushers consisting of the WG220E Portable Cone Crusher and the WV1400E Portable Vertical Shaft Impact Crusher at Hillhead 2024. These models are designed to meet the needs of the European market, focusing on efficiency and compliance with road regulations.

- In December 2024, the Ministry of Environment, Forest and Climate Change (MoEFCC) of India published the "Solid Waste Management Rules, 2024," focusing on the management of solid waste, which includes construction and demolition debris. This policy is anticipated to influence the crusher market by promoting the use of crushers in waste management and recycling processes.

MARKET SEGMENTATION

This research report on the global crusher market is segmented and sub-segmented into the following categories.

By Type

- Cone Crushers

- Impact Crushers

- Jaw Crushers

- Roll Crushers

- Other

By Power Source

- Diesel

- Electric

- Hybrid

By Mode of Operation

- Stationary

- Portable

By Application

- Aggregates

- Construction

- Demolition

- Environmental

- Industrial

- Mining

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]