Global Crowdfunding Market Size, Share, Trends & Growth Forecast Report Segmented By Product (Awards-Based Crowdfunding, Crowdfunding Auctions, and others), End-users (Cultural Industries, Technology, Product, Healthcare, Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Crowdfunding Market Size

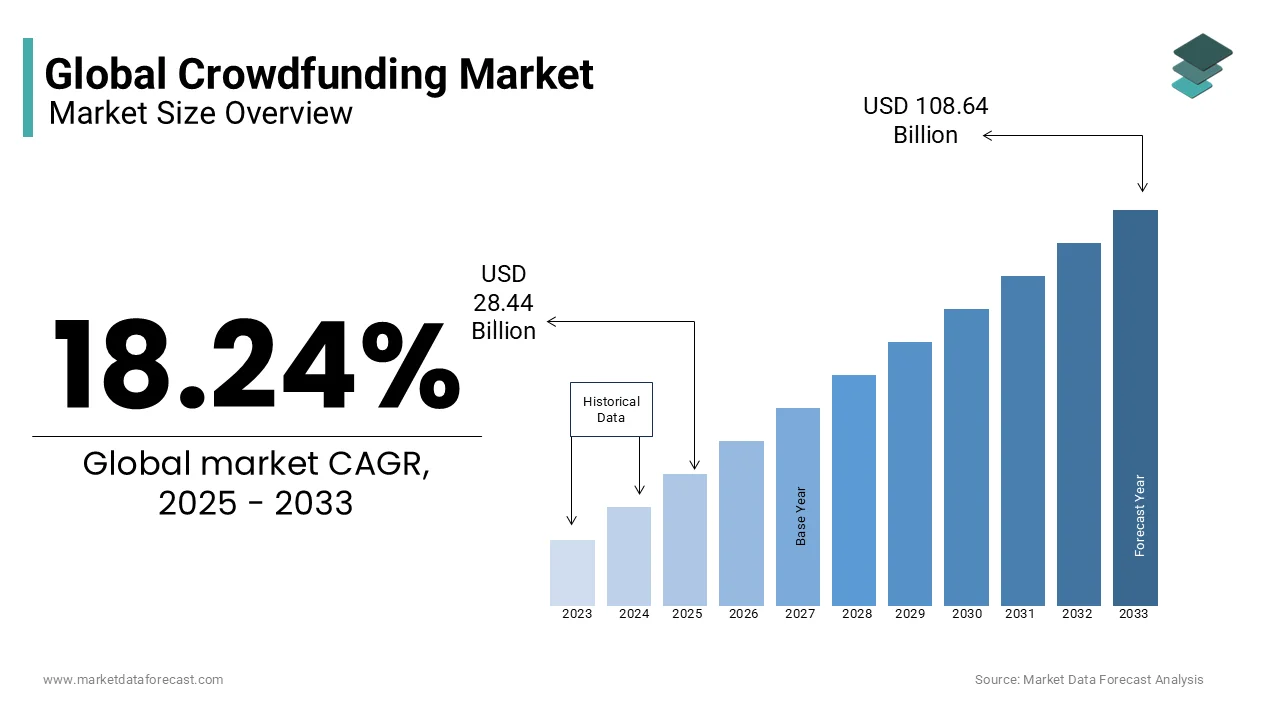

The global crowdfunding market was valued at USD 24.05 billion in 2024. The global market size is further expected to progress at a CAGR of 18.24% from 2025 to 2033 and be worth USD 108.64 billion by 2033 from USD 28.44 billion in 2025.

Crowdfunding is the use of the amount of money that a large group of people uses the Internet to finance a business. Social media and crowdfunding sites have become typical in bringing investors and entrepreneurs in one place to expand the investor pool beyond the traditional circle. The study of global crowdfunding considered the types of crowdfunding proposed for the different vertical sectors of end users on a global scale. Crowdfunding campaigns as crowdsourcing channels to stimulate market growth. There was minimal interaction with customers in the earlier product launch processes and other marketing traits. However, this scenario has been completely altered by crowdfunding campaigns, as they enable entrepreneurs to meet their customers or assess the product's success before launch.

The concept of crowdfunding has evolved as a dynamic force in finance and is providing access to capital to entrepreneurs, innovators, and creative individuals worldwide. The landscape of crowdfunding has experienced several changes and registered notable growth in recent years due to technological advancements, changing regulatory environments, and shifting consumer preferences. Funding needs and investor preferences have changed over the years, resulting in the diversification of crowdfunding models such as reward-based, equity-based, donation-based, and peer-to-peer lending platforms. The U.S., Canada, The UK, Germany, France, China, India, and Australia are hotspots for crowdfunding. These countries have a vibrant startup ecosystem and favorable regulatory frameworks that support crowdfunding. During the forecast period, the global crowdfunding market is predicted to witness promising growth due to innovation, globalization, and increasing demand for accessible funding solutions across the globe.

MARKET DRIVERS

The growing penetration of social media is promoting the growth of the global crowdfunding market.

In the crowdfunding area, over the years, the use of social networks for promotion has increased considerably. Social media platforms function as free-cost promotion resources and reach the public worldwide. This has allowed companies to pre-sell and market products with greater convenience. Therefore, active crowdfunding campaigns on social media should further stimulate the growth of the crowdfunding market in the next five years. UK-based startup BuffaloGrid, which developed a mobile phone charging hub for entrepreneurs in 2011, said it had raised around USD 683,000 through crowdfunding Crowdcube. The engagement campaign helped the company bring the next iteration to its workplace and begin mass production. BaffaloGrid then partnered with Microsoft's Affordable Access Initiative and launched live tests in India. In January 2020, the company closed a funding cycle of more than USD 4.3 million led by an early-stage venture capital company and a grant from the European Union's Horizon 2020 program.

The rising popularity of reward-based crowdfunding is propelling the growth of the global crowdfunding market.

Reward-based crowdfunding is where the business (usually a new company) raises seed capital and seed capital through an online platform and offers investors a gift or "benefit" for their financial contribution. It is considered pre-sale, in which individual projects or companies raise funds from bankers, who receive a non-monetary reward. This allows companies to join an existing network and request what can be used later. This type of crowdfunding is generally suitable for new companies or for a specific project. Okra Solar, an Australian-based start-up, tested its "intelligent plug-and-play controller" to facilitate sharing of neighbors' power. The company said it had launched an award-based crowdfunding campaign to supplement the small-scale pilot to test the technology. With this campaign, the company raised more than USD 45,000 in seed capital to build a prototype. The campaign later won numerous grants from the UK Department for International Development and the Swedish International Development Agency and obtained pre-seed funding through the Schneider Electric Energy Access Companies Fund. According to the Global Entrepreneurship Monitor, start-ups in the United States represent a significant share of 17.4% of the country's total population. This indicates the great opportunity for reward-based crowdfunding in the region. In addition, with the huge crowdfunding market in North America, this opportunity is growing.

The use of social media as a source of free promotion is one of the key factors in the growth of the global crowdfunding market. It offers the possibility of measuring public interest, pre-selling a product, and acting as a promotional tool. Therefore, an active crowdfunding campaign can go beyond simply raising the necessary funds. Social media campaigns are inexpensive, can access multiple channels quickly, and track referral traffic to websites. With social media, companies can promote an idea at no cost, which should spur growth in the crowdfunding market in the years to come.

MARKET RESTRAINTS

The complexities associated with regulatory hurdles and compliance are a major restraint to the growth of the global crowdfunding market.

Lack of investor confidence due to scams and fraud, limited access to capital for certain projects or industries, and high competition among crowdfunding platforms further inhibit global market growth. Difficulty reaching target audiences for campaigns, costs associated with platforms and transactions, limited scalability for large projects, and uncertain legal framework and jurisdictional issues also hinder global crowdfunding market growth.

MARKET OPPORTUNITIES

A data-driven approach is the future of the crowdfunding market.

Over time crowdfunding will reach a new level and be a more noticeable means of realising groundbreaking business ideas, artificial intelligence and big data analytics will have an even broader role in this market. Various applications are available for AI to raise funds from the crowd, which includes on-demand support from advanced chatbots, automated marketing campaigns, predictive analytics, and post-campaign analysis. The market players can deploy AI-powered chatbots to provide live assistance to supporters, answering frequent questions and furnishing general information about crowdfunding. This is particularly beneficial for one-person campaigns. Along with machine learning technology, it will further help in AI-driven predictive analytics by analyzing past data and identifying trends to forecast the crowdfunding campaign’s success. Moreover, AI can customize these campaigns by analyzing consumer priorities and behaviour. Platforms can customize marketing messages and suggestions to individual patrons, raising engagements and conversion rates.

Apart from this, it is projected that there will be greater integration with conventional finance. Banks and financial establishments can collaborate with crowdfunding platforms to give hybrid funding solutions, merging the advantages of both fields. In addition, equity crowdfunding is set for significant growth as more nations accept favourable laws. This will make investment opportunities greatly accessible, enabling retail investors to back unique start-ups and possibly gather financial rewards.

MARKET CHALLENGES

Running a crowdfunding campaign in today’s digital age is quite challenging. The digital marketplace is filled with campaigns which are looking for funds and attention. Attainment of desired finance in this cluttered environment requires a persuasive offer coupled with strategic engagement and visibility measures to attract potential supporters. This is one of the primary factors decreasing the growth rate of the crowdfunding market. Besides this, the regional market players also face issues on a global level, including navigating through varied legal frameworks, handling foreign currency conversion problems, and solving diverse priorities or favorites of a worldwide audience. The ongoing economic and financial crisis continues to impact crowdfunding. This has exerted considerable pressure on the general public, and with an elevated inflation rate in different countries, traditional crowdfunding has taken a major dip in recent years. The spending power of people belonging to the prominent economies declined due to heightened food costs and energy bills.

Also, companies are using social media and digital payment technologies, but are encountering challenges in building trust and confidence among the public because of poor cyber defence and privacy protection abilities. Presently, 90 percent of the potential target audience has access to the Internet and social media through which they get quick updates on all the latest cyberattacks, financial frauds, data breaches, etc. Hence, together these factors are substantially affecting the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.24% |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kickstarter, AngelList, Indiegogo, Fundable, Crowdcube, GoFundMe, Crowdfunder, GoGetFunding, CircleUp, Patreon, Campfire, Crowdo, Milaap, RocketHub, FundRazr, Crowdfunder UK, Modian, Companisto, DonorsChoose, CrowdHousababa Suning and Others. |

SEGMENTAL ANALYSIS

By Product Insights

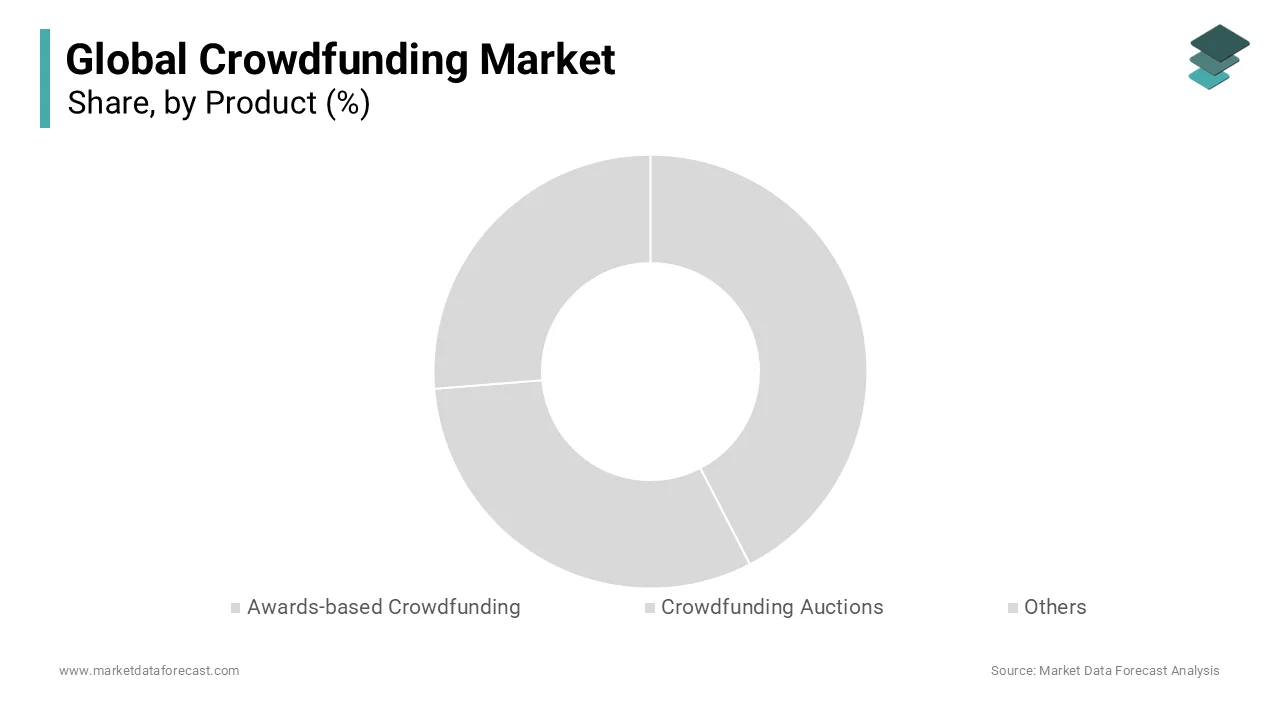

The award-based crowdfunding segment was the largest segment and captured 61.8% of the global market share in 2024. Awards-based crowdfunding is one of the most popular types of crowdfunding. The appeal of award-based crowdfunding to creators and backers is primarily propelling the segmental expansion in the global market. Platforms such as Kickstarter, Indiegogo, and GoFundMe have gained recognition worldwide and offer various projects in various categories, including technology, arts, and creative endeavors.

By End-user Insights

The technology segment led the market in 2023, accounting for 32.7% of the global market share, and is estimated to grow at a healthy CAGR during the forecast period. The domination of the technology segment in the global market is majorly attributed to the rising demand for innovative tech solutions and the democratization of startup funding. Crowdfunding has successfully gained funding for several tech startups. For instance, tech companies such as Pebble, Oculus Rift, and Exploding Kittens have gained multimillion-dollar funding through crowdfunding campaigns.

The product segment is estimated to account for a considerable global market share during the forecast period. The growing demand for unique and innovative products and the accessibility of crowdfunding platforms for product creators are propelling the segment's growth in the global market.

Another notable segment is the cultural segment, which is expected to register a healthy CAGR during the forecast period owing to the increasing support for creative endeavors from individuals and communities worldwide.

REGIONAL ANALYSIS

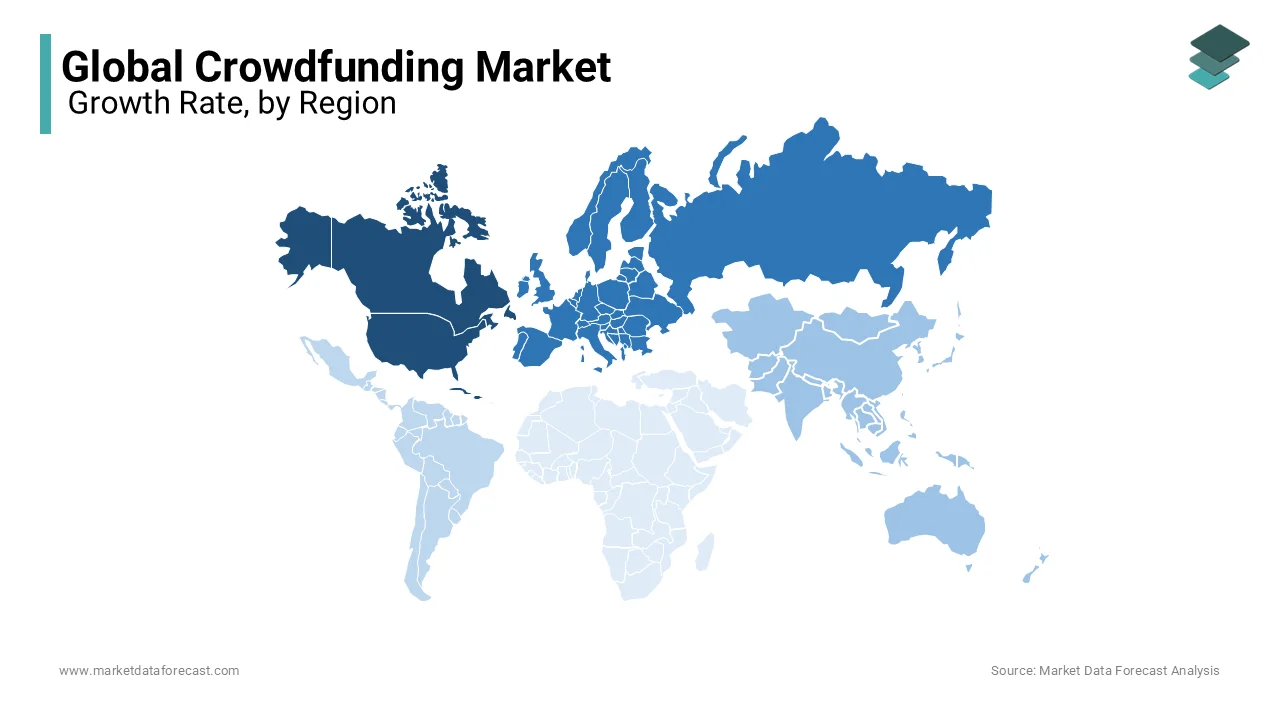

North America led the crowdfunding market in 2024, accounting for 40.8% of the global market share. The growth of the North American market is majorly credited to factors such as the rising prevalence of crowdfunding-friendly regulations, such as the JOBS Act in the United States, a strong entrepreneurial ecosystem, a supportive regulatory environment, and high internet penetration. The presence of leading crowdfunding platforms, access to venture capital, and a culture of innovation and entrepreneurship are further boosting the crowdfunding market in North America.

The European region is expected to progress rapidly during the forecast period due to increasing organizing regulations across various European countries for the crowdfunding model. According to reports, European Union countries are also planning to lay down rules to allow crowdfunding platforms in the region to operate in other EU regions. In addition, Turkey is one of the European countries experiencing significant growth in the crowdfunding market with the presence of stable employment opportunities. According to the Global Entrepreneurship Monitor 2019 report, it is one of the key factors in the country's economic growth, improving the conditions for entrepreneurship by 10%, generating more than 331 billion USD for the economy.

The Asia-Pacific region is estimated to be a lucrative regional segment for crowdfunding in the global market during the forecast period. The presence of a young and tech-savvy population, increasing initiatives from the governments of APAC countries to support entrepreneurship and innovation, and rapid adoption of mobile technology and social media platforms in countries like China, India, and Southeast Asia are propelling the crowdfunding market growth in the Asia-Pacific region.

KEY MARKET PLAYERS

Major Global Companies: Kickstarter, AngelList, Indiegogo, Fundable, Crowdcube, GoFundMe, Crowdfunder, GoGetFunding, CircleUp, Patreon, Campfire, Crowdo, Milaap, RocketHub, FundRazr, Crowdfunder UK, Modian, Companisto, DonorsChoose, CrowdHousababa Suning and others are some of the major players in the global crowdfunding market.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Jurny press released the introduction of a fresh crowdfunding drive on StartEngine. This step provides new avenues for private individuals and clients to invest next to top-rate venture capitalists in the thriving AI field and enables an initial-stage entrance point into Jurny's quickly rising venture.

MARKET SEGMENTATION

This research report on the global crowdfunding market is segmented and sub-segmneted into the following categories.

By Product

- Awards-based Crowdfunding

- Crowdfunding Auctions

- Others

By End-User

- Cultural industries

- Technology

- Product

- Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the primary types of crowdfunding models in the global market?

Globally, the crowdfunding market is categorized into four primary models: donation-based, reward-based, equity-based, and lending-based crowdfunding. Reward-based and equity-based models have seen significant growth in regions like North America and Europe, while donation-based crowdfunding has gained traction in countries with a strong philanthropic culture.

What are the key factors driving crowdfunding adoption globally?

Key drivers include increased internet penetration, social media use, entrepreneurial culture, and a rise in small- and medium-sized enterprises (SMEs) seeking alternative funding sources. Additionally, growing investor interest in supporting innovative startups and social causes has propelled crowdfunding's popularity.

What are the challenges facing the global crowdfunding market?

The global crowdfunding market faces several challenges, including regulatory uncertainties, platform fraud risks, and market saturation in some regions. Additionally, equity crowdfunding has yet to reach its full potential in certain markets due to legal and financial barriers.

What are the future trends in the global crowdfunding market?

The future of the global crowdfunding market includes increasing use of blockchain technology, the rise of niche crowdfunding platforms, and stronger regulation aimed at protecting investors. There’s also likely to be a continued expansion into developing markets, with an emphasis on sustainable and impact-driven crowdfunding campaigns.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]