Global Crosslinking Agent Market Size, Share, Trends & Growth Forecast Report By Chemistry (Polyaziridine, Polycarbodiimide, Polyisocyanate and Others), Application (Industrial Coatings And Decorative Coatings) and Region (North America, Latin America, Europe, Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Crosslinking Agent Market Size

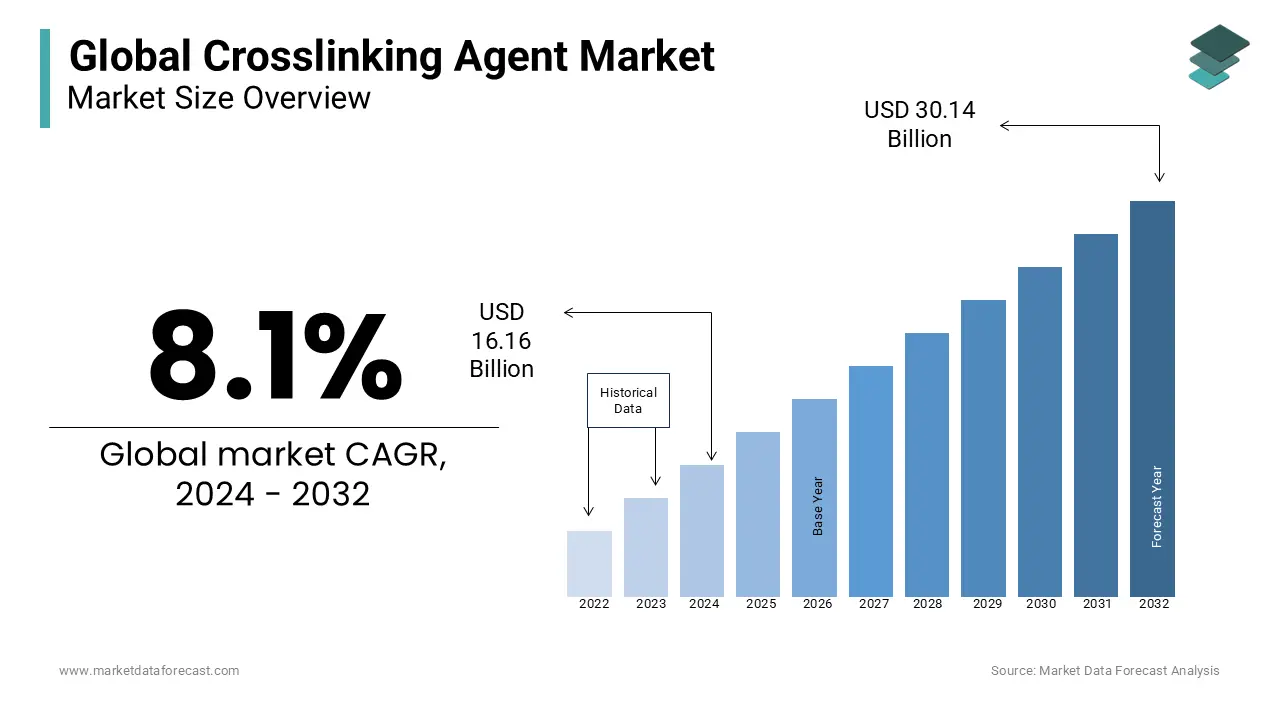

The global crosslinking agent market size was valued at USD 14.95 billion in 2023. The global market is further estimated to grow at a CAGR of 8.1% from 2024 to 2032 and be worth USD 30.14 billion by 2032 from USD 16.16 billion in 2024.

Crosslinking agents play a pivotal role in enhancing material properties across industries such as automotive, construction, textiles, and healthcare. Crosslinking agents are chemicals that form covalent bonds between polymer chains, improving properties like thermal stability, mechanical strength, and chemical resistance. These agents are crucial in manufacturing adhesives, coatings, and elastomers. The growing demand for environmentally friendly and low-VOC (volatile organic compounds) crosslinkers due to the stringent regulations and consumer awareness is one of the key trends in the global crosslinking agents market currently. Notably, polyurethane-based crosslinking agents are gaining traction due to their versatility and superior performance. In the healthcare sector, crosslinking agents like glutaraldehyde are used in biomaterials, such as tissue engineering and wound dressings, to improve durability. Additionally, advancements in photo-curable crosslinkers are supporting the growing 3D printing and electronics industries. The use of crosslinkers in adhesives improves tensile strength by up to 40%, making them indispensable in structural applications.

MARKET DRIVERS

Rising Demand for High-Performance Coatings

The demand for high-performance coatings, particularly in the automotive and construction sectors, is a major driver for the crosslinking agent market. Crosslinking agents enhance the durability, chemical resistance, and weatherability of coatings, essential for harsh environmental conditions. For instance, epoxy-based crosslinkers in industrial coatings improve abrasion resistance by 30-50% and reduce maintenance costs. Additionally, regulatory mandates for low-VOC coatings are accelerating the adoption of eco-friendly crosslinkers such as waterborne and bio-based types. The automotive industry’s push toward lightweight materials also boosts the need for crosslinking agents in specialty coatings that protect composite surfaces without adding excessive weight.

Growth in Biomedical Applications

Biomedical advancements, especially in tissue engineering and drug delivery systems, are driving demand for crosslinking agents such as glutaraldehyde and genipin. These agents provide structural integrity and enhance the stability of biomaterials used in implants, scaffolds, and hydrogels. According to research reports, crosslinked collagen scaffolds can sustain mechanical properties up to 50% longer than non-crosslinked ones under physiological conditions. Additionally, crosslinking agents are critical in developing biocompatible adhesives for surgical applications, addressing the growing global need for advanced healthcare materials amid aging populations and increased healthcare spending.

MARKET RESTRAINTS

Stringent Environmental Regulations

Strict environmental regulations on volatile organic compounds (VOCs) and toxic chemicals are significant restraints for the crosslinking agent market. Traditional agents such as formaldehyde and isocyanates are widely used for their efficacy and these pose health risks and environmental hazards. For instance, isocyanates are classified as respiratory sensitizers. Regulatory frameworks such as REACH in Europe and EPA guidelines in the U.S. are imposing restrictions and forcing manufacturers to reformulate products. Although eco-friendly alternatives are emerging, they often involve higher production costs and performance trade-offs, slowing market adoption in cost-sensitive industries.

High Production Costs of Advanced Crosslinkers

The development and production of advanced crosslinking agents, such as bio-based and waterborne types, are cost-intensive, limiting their widespread use. These alternatives require sophisticated manufacturing processes and premium raw materials, increasing production costs by up to 20% compared to conventional agents. This poses challenges for price-sensitive industries like textiles and adhesives, where cost competitiveness is crucial. Moreover, the shift to sustainable solutions often necessitates reengineering existing formulations and processes, leading to additional capital expenditure. For smaller manufacturers, these financial barriers can restrict innovation and hinder the adoption of next-generation crosslinkers, constraining market growth.

MARKET OPPORTUNITIES

Emergence of Bio-Based Crosslinking Agents

The rising focus on sustainability presents a significant opportunity for bio-based crosslinking agents. Derived from renewable sources such as plant-based oils and sugars, these agents reduce dependence on fossil fuels and align with global sustainability goals. For instance, bio-based epoxies have been shown to cut greenhouse gas emissions by up to 50% compared to traditional formulations. With increasing adoption in industries like packaging and automotive, manufacturers can capitalize on the demand for greener alternatives. Additionally, consumer preference for eco-friendly products is growing, with studies indicating that 60% of consumers are willing to pay more for sustainable materials.

Advancements in Smart and Responsive Materials

The development of smart materials that respond to external stimuli, such as temperature, pH, or light, creates opportunities for innovative crosslinking agents. These agents are critical in sectors like electronics, where they enable self-healing coatings and adaptive adhesives. For example, research into photoresponsive crosslinkers has shown potential for improving efficiency in 3D printing applications, offering up to a 40% reduction in production time. Similarly, in healthcare, crosslinkers for stimuli-responsive hydrogels are being used in drug delivery systems, enabling controlled release mechanisms. These advancements align with the growing demand for high-tech materials in diverse, cutting-edge applications.

MARKET CHALLENGES

Balancing Performance and Environmental Compliance

One of the critical challenges in the crosslinking agent market is achieving high-performance capabilities while adhering to stringent environmental standards. Traditional agents like formaldehyde and isocyanates offer exceptional performance but face restrictions due to toxicity and VOC emissions. Developing eco-friendly alternatives that match the durability, flexibility, and adhesion of conventional agents remains complex. For example, waterborne crosslinkers can face a 20-30% drop in chemical resistance compared to solvent-based options, limiting their application in demanding industries like automotive. This performance gap complicates transitions for manufacturers seeking to balance regulatory compliance with customer expectations for advanced material properties.

Raw Material Price Volatility

The crosslinking agent market is highly susceptible to fluctuations in raw material costs, particularly for petrochemical-based inputs. Price volatility of crude oil and its derivatives directly impacts the cost structure of traditional crosslinkers, squeezing profit margins. For instance, the price of methylene diphenyl diisocyanate (MDI), a key ingredient, has experienced spikes of up to 15% during periods of supply chain disruptions. Bio-based alternatives also face cost challenges, as agricultural feedstock prices can vary due to climatic or geopolitical factors. These unpredictable costs make pricing strategies challenging and limit the competitiveness of crosslinkers in cost-sensitive industries like textiles.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.1% |

|

Segments Covered |

By Application, Chemistry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lord Corporation, The Dow Chemical Company, Huntsman Corporation, Angus Chemical Company, Evonik Industries, Covestro AG, Aditya Birla Chemical Company, Stahl Holdings BV, Lord Corporation, Ineos, Shanghai Sisheng Polymer Materials Company, Allnex Group |

SEGMENTAL ANALYSIS

By Chemistry Insights

The polyisocyanate stands as the largest segment and accounted for a significant share of the global market in 2023 due to its extensive applications across various industries. Polyisocyanates are integral in producing polyurethane coatings, adhesives, and foams, valued for their exceptional durability, chemical resistance, and mechanical strength. These properties make them indispensable in sectors such as automotive, construction, and electronics, where high-performance materials are crucial. For instance, in automotive coatings, polyisocyanate-based systems enhance scratch resistance and longevity, contributing to vehicle aesthetics and protection.

The polycarbodiimide segment is expected to grow at the fastest CAGR of 8.1% over the forecast period. This rapid expansion is driven by the increasing demand for environmentally friendly and high-performance crosslinking agents. Polycarbodiimides are favored for their ability to improve hydrolytic stability and chemical resistance in waterborne coatings, aligning with the industry's shift towards sustainable solutions. Their application in protective coatings for packaging and industrial equipment is growing, as they offer enhanced performance without compromising environmental compliance.

By Application Insights

The decorative coatings segment led the market and accounted for 72.3% of the global market share in 2023. This dominance is driven by the extensive use of decorative coatings in residential, commercial, and industrial buildings to enhance aesthetics and protect surfaces. The growing construction industry, particularly in emerging economies, has amplified the demand for decorative coatings, thereby increasing the consumption of crosslinking agents. These agents improve the chemical resistance, appearance, and mechanical durability of coatings, making them essential in achieving high-performance finishes.

On the other hand, the industrial coatings segment is predicted to exhibit the highest CAGR of 6.22% during the forecast period. This rapid expansion is attributed to the rising demand for protective coatings in sectors such as automotive, aerospace, and manufacturing. Industrial coatings are crucial for protecting machinery and infrastructure from corrosion, wear, and environmental factors. The increasing focus on extending the lifespan of industrial equipment and infrastructure, coupled with stringent environmental regulations, has led to the adoption of advanced crosslinking agents that offer enhanced performance and compliance with environmental standards.

REGIONAL ANALYSIS

Asia-Pacific is the largest market for crosslinking agents and held a 36.7% share of the global market in 2023. This region is also the fastest-growing regional segment in the global crosslinking agent market. The rapid growth is fueled by industrialization, increasing urbanization, and infrastructure expansion. China is a key driver of this market, as it is the world’s largest automotive producer and has a thriving construction sector. Large infrastructure projects, including the Belt and Road Initiative, boost demand for coatings, adhesives, and sealants that use crosslinking agents. Rising income levels and a growing middle class have also increased demand for decorative coatings. India and Southeast Asia contribute significantly due to industrial growth and government investments in infrastructure. The Asia-Pacific market is expected to remain dominant due to ongoing industrial advancements and the adoption of advanced coating technologies.

North America accounts for a substantial share of the global market. The region’s growth is driven by strong demand in the automotive, aerospace, and construction industries. The United States is the leading contributor, supported by advancements in high-performance coatings that protect against corrosion and wear. The adoption of sustainable products, such as low-VOC (volatile organic compound) and waterborne coatings, is gaining momentum due to strict environmental regulations from the EPA. The rising demand for lightweight materials in the automotive and aerospace sectors will drive steady growth in this region, with Canada and Mexico also contributing through construction and manufacturing activities.

Europe is also a key regional segment for crosslinking agents worldwide. The growth of the European market is fueled by the automotive sector and increasing construction activities. Germany leads as a hub for automotive manufacturing, relying heavily on crosslinking agents for durable and aesthetically appealing coatings. Countries like France, Italy, and the UK contribute significantly, particularly through their infrastructure projects and rising demand for decorative coatings. Stringent environmental regulations in Europe drive innovation in eco-friendly and low-VOC products, helping maintain steady market growth.

Latin America holds a smaller share of the global market but is growing at a moderate CAGR. Brazil and Mexico are the leading contributors in this region, driven by expanding manufacturing and automotive sectors. Infrastructure projects, such as residential and commercial buildings, highways, and airports, are increasing the demand for coatings and adhesives that use crosslinking agents. Although Latin America lags behind other regions in market size, its growth potential is significant due to increasing industrialization and investments in infrastructure development.

The MEA region is estimated to grow steadily over the forecast period. The growth here is driven by large-scale construction projects and industrial expansion, particularly in the Gulf Cooperation Council (GCC) countries. Saudi Arabia and the UAE lead the market due to projects like NEOM and Expo 2020-related developments. The oil and gas industry also contributes significantly, as it relies on durable coatings to protect infrastructure from corrosion. In Africa, growing industrial activities and urbanization are increasing the demand for crosslinking agents, particularly in construction and automotive applications.

KEY MARKET PLAYERS

Companies playing a promising role in the global crosslinking agent market include Lord Corporation, The Dow Chemical company, Huntsman Corporation, Angus Chemical Company, Evonik Industries, Covestro AG, Aditya Birla Chemical Company, Stahl Holdings BV, Lord Corporation, Ineos, Shanghai Sisheng Polymer Materials Company and Allnex Group.

The crosslinking agent market is highly competitive, with key players striving to expand their market presence through innovation, partnerships, and mergers. Large multinational corporations like BASF SE, Dow, and Evonik Industries AG dominate the landscape, leveraging their vast R&D capabilities and extensive product portfolios. These companies focus on developing advanced solutions such as low-VOC and waterborne crosslinking agents to meet stringent environmental regulations and rising demand for sustainable products.

Regional players, particularly in Asia-Pacific, such as Wanhua Chemical Group, play a vital role in addressing local demands and maintaining cost competitiveness. The market also sees intense competition in specialty chemicals, where companies like Allnex GmbH and Hexion Inc. focus on high-performance products tailored for specific industries, including automotive, construction, and electronics.

The competitive environment is further fueled by increasing investments in emerging markets such as India, Brazil, and the Middle East, where industrialization and infrastructure development drive demand. Strategic acquisitions and collaborations are common as companies aim to enhance their geographical reach and technological capabilities. For instance, firms are partnering with application-based industries to co-develop specialized crosslinking solutions.

RECENT HAPPENINGS IN THE MARKET

- In May 2024, Novartis, a global healthcare company, announced the acquisition of Mariana Oncology for $1 billion upfront and up to $750 million in milestone payments. Purpose: This acquisition was aimed at enhancing Novartis's capabilities in radioligand therapies for cancer treatment.

- In February 2024, Novartis announced plans to acquire the German biotech firm MorphoSys AG for €2.7 billion. Purpose: This acquisition was intended to strengthen Novartis's oncology portfolio and expand its presence in the biopharmaceutical market.

- In November 2023, AbbVie, a global biopharmaceutical company, announced the acquisition of ImmunoGen, a biotechnology firm specializing in antibody-drug conjugates, for $10.1 billion. Purpose: This acquisition aimed to bolster AbbVie's oncology pipeline and enhance its capabilities in targeted cancer therapies.

MARKET SEGMENTATION

This research report on the global crosslinking agent market is segmented and sub-segmented into chemistry, application and region.

By Chemistry

- Polyaziridine

- Polycarbodiimide

- Polyisocyanate

By Application

- Industrial Coatings

- Decorative Coatings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the CAGR of Crosslinking Agent Market?

The global crosslinking agent market is estimated to grow at a CAGR of 8.1% from 2024 to 2032.

Who are the major key players involved in Crosslinking Agent Market

Lord Corporation, The Dow Chemical Company, Huntsman Corporation, Angus Chemical Company, Evonik Industries, Covestro AG, Aditya Birla Chemical Company, Stahl Holdings BV, Lord Corporation, Ineos, Shanghai Sisheng Polymer Materials Company and Allnex Group are a few of the notable companies in the global crosslinking agent market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]