Global Critical Illness Insurance Market Size, Share, Trends & Growth Forecast Report By Product Type (Medical Insurance, Disease Insurance, Income Protection Insurance), Application (Cancer, Heart Attack, Stroke and Others), By Type (Individual Insurance, Family Insurance) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Critical Illness Insurance Market Size

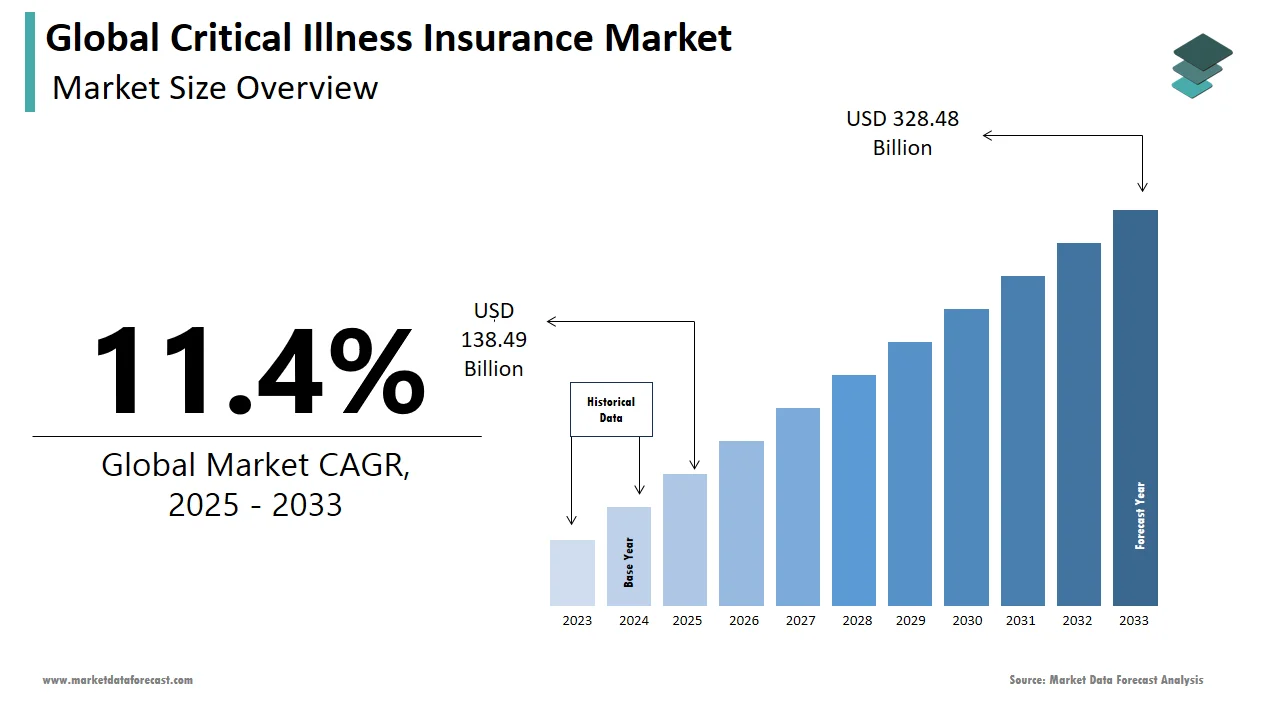

The global critical illness insurance market was worth US$ 124.32 billion in 2024 and is anticipated to reach a valuation of US$ 328.48 billion by 2033 from US$ 138.49 billion in 2025, and it is predicted to register a CAGR of 11.4% during the forecast period 2025-2033.

A critical illness is any condition that poses a prospective or immediate threat to the patient's life and necessitates extensive care and continual monitoring, frequently in an intensive care unit. An insurance plan allows the policyholder to determine if the insurer has agreed to make payments if they are diagnosed with a range of present illnesses covered by the policy. The critical illness insurance market consists of sales of necessary illness insurance by entities (organizations, sole traders, and partnerships) engaged in directly underwriting essential illness cover or a dread disease policy to cover those overruns. It is an additional coverage where traditional health insurance may fall short. Only products and services traded between entities or sold to end consumers are included. Critical illness coverage or critical illness insurance is an insurance product wherein the insurer is typically obligated to provide a lump sum cash payment if the policyholder is diagnosed with one of the specified illnesses on a predetermined list. In addition, the system may be designed to provide a regular income, and the pay-out may be contingent on the policyholder undertaking a medical procedure, such as a heart bypass operation.

MARKET DRIVERS

The growing number of critical diseases and developments in insurance policies are driving growth in the global critical illness insurance market.

The rising incidence of critical diseases is propelling the global market for critical illness insurance. Therapy for critical illnesses, such as cancer, incurs astronomical costs; therefore, critical illness insurance can reduce the financial burden of treatment. The insurance service providers give the policyholder a lump-sum payment upon diagnosing a severe illness. Other prevalent forms of critical disease include heart attack, stroke, and coronary artery bypass surgery. According to the Cancer Profile 2020 report by the World Health Organization, there will be 10 million cancer-related deaths worldwide in 2020. Consequently, the increasing occurrence of critical diseases is anticipated to drive the global market for critical illness insurance.

An expansion in the variety of critical illnesses covered by critical illness insurance policies is a significant trend influencing the critical illness insurance market. In addition to cancer, stroke, coronary bypass surgery, and heart attack, major insurance companies are working on adding coverage for many new conditions, such as Alzheimer's disease, multiple sclerosis, Parkinson's disease, and motor neuron diseases. For example, according to the Parkinson's Foundation, there are one million Parkinson's disease sufferers in the United States, which is anticipated to rise to 1.2 million by 2030. This expansion of severe illnesses is the cause of the rising popularity of insurance coverage.

The benefits of the critical illness insurance market, such as a simple documentation process, hassle-free claim settlements, the option to purchase extra riders, tax benefits, coverage of all hospitalization expenses, and many others, are also bolstering the market.

MARKET RESTRAINTS

A lack of understanding regarding critical illness insurance impedes the expansion of the global market for it. Most of the critical illness coverage is included in term plans. Most individuals are familiar with life insurance policies but are less familiar with term plans. A term plan is a life insurance plan with a fixed duration that includes critical illness coverage as a standard feature. In addition to being more cost-effective than life insurance plans' maturity benefits, the benefits payable upon the policyholder's death are more significant under term plans. For example, according to a survey published in the Economic Times in 2024, only one out of every five policyholders in metropolitan India, or 65 percent of the urban population, has term insurance. This is primarily due to people's lack of awareness regarding insurers' term plans, including critical illness coverage.

Impact of COVID-19 on the Global Critical Illness Insurance Market

The COVID-19 pandemic brought many losses and financial crises to the world. A shortage of different healthcare equipment and professionals left the public in a state of panic and high hospital bills. The pandemic raised concerns about how much the insurance would cover people. Different kinds of insurance were being depended on, like business insurance policies. The policies for critical health insurance are peculiar. They cover things that they state in their policy list. The critical insurance policy before covid covered items you would likely get as an effect of covid like heart attack, organ transplant, organ failures, etc. but not precisely the virus disease. After the pandemic, many companies have started understanding that including virus diseases in their plan may attract more consumers who may need it when faced with covid or any virus-related conditions. So, the pandemic has essentially imbibed a new policy idea for the critical illness insurance market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.4% |

|

Segments Covered |

By Product Type, Application, Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AXA, Prudential, Liberty Mutual, Star Union Dai-ichi Life Insurance, Sun Life Insurance, Aegon, United Healthcare Services, Hua Xia Life Insurance Co., MetLife Services, and Solutions, LLC, Aflac Incorporated., and Others. |

SEGMENTAL ANALYSIS

By Product Type

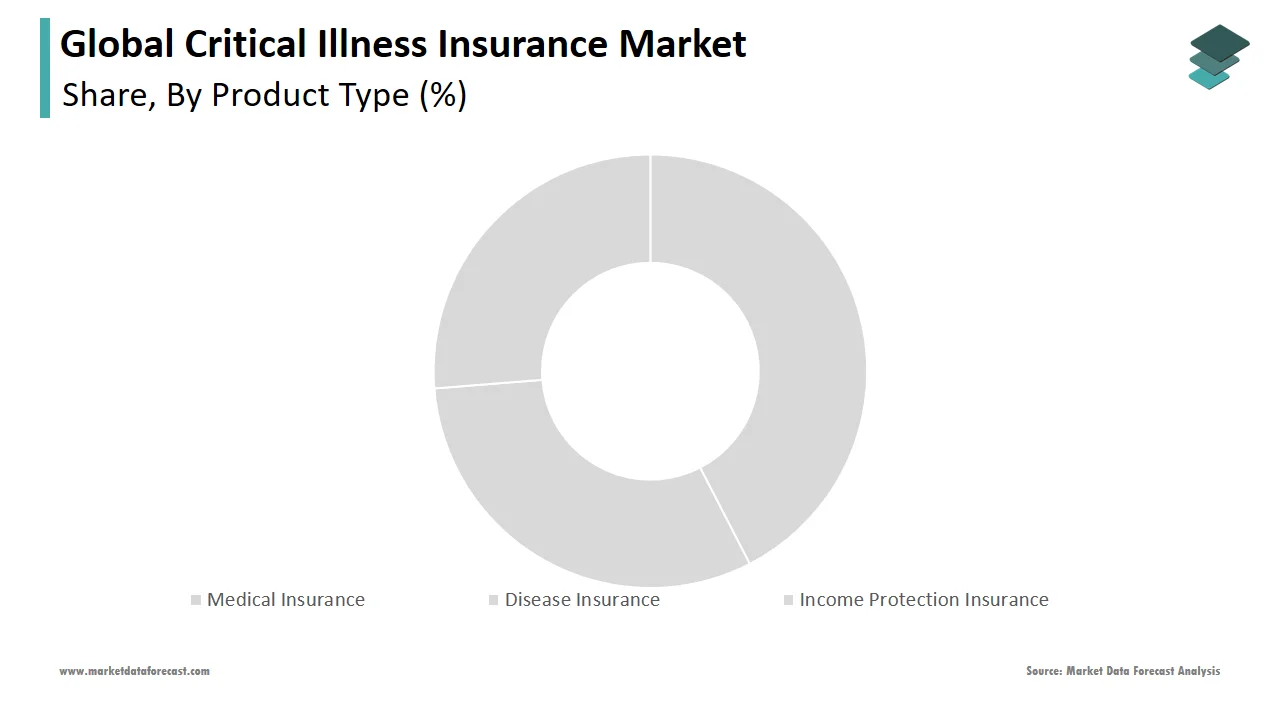

Based on the product type, the medical insurance segment is anticipated to dominate the global critical illness insurance market during the forecast period. As a result, the segment dominated the market with a 41.21% share in 2022 and is expected to keep doing so during the forecast period.

By Application

Due to the increasing medical expenses of cancer patients, it has been anticipated to have the largest share during the forecast period. As a result, the cancer market had a share of 40.23% in 2020 and is expected to keep growing.

By Type

The individual insurance market is expected to dominate the global market for critical illness insurance over the forecast period. The individual insurance segment held the largest share of 56.10% in 2020 and is expected to continue rising during the forecast period.

REGIONAL ANALYSIS

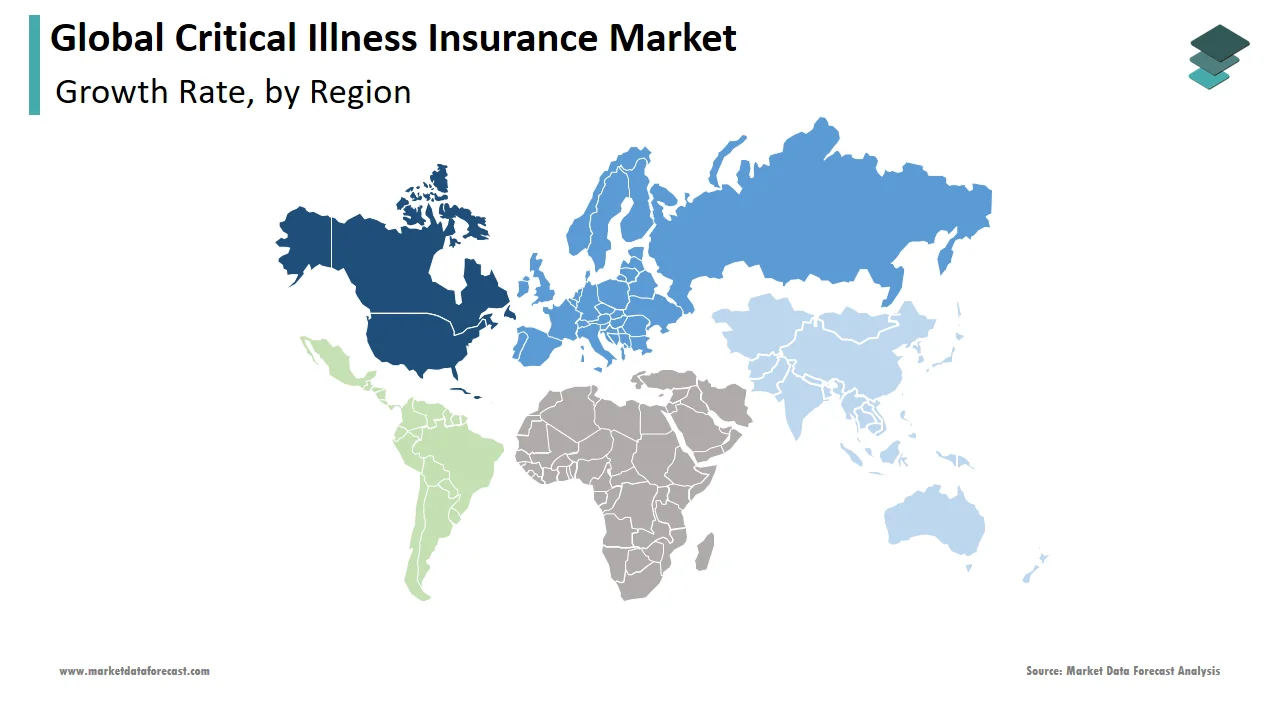

The North American region maintained the most significant market share of 30.17% in 2022 in the global critical illness insurance market and is likely to continue its growth during the forecast period. This development is attributable to the growing medical costs and incidence of chronic illnesses such as heart attack, cancer, and stroke. Additionally, the increasing rate of death and the upsurge in cancer diagnosis is also boosting the regional market expansion. Furthermore, countries like U.S. and Canada are showing increasing concerns about health insurance policies leading to a rise in the critical illness insurance market.

Similarly, Due to the escalating disease concerns in the European region's population, such as heart disease and cancer, Europe is anticipated to experience a significant increase. Due to the expanding elderly population in countries like the U.K., Germany, Italy, France, etc. The U.K. is most likely to witness a significant share in the market owing to the growing adoption of insurance products and high healthcare expenditure.

The Asia-Pacific market is likely to have considerable expansion in the following years. The growing population, presence of key market players, and supportive government policies propel market growth. Moreover, the massive population in countries such as China and India are other elements that accelerate the market expansion. The Indian market has been one of the most promising countries in the Asia Pacific over the years. In addition, the growing awareness about insurance products and initiatives by the government and private organizations through medical tourism encourage market growth.

Furthermore, the Middle East and Africa are anticipated to experience the lowest growth due to a lack of industry-wide awareness of the benefits of critical illness insurance.

KEY MARKET PLAYERS

Some of the notable companies operating in the global critical Illness insurance market are AXA, Prudential, Liberty Mutual, Star Union Dai-ichi Life Insurance, Sun Life Insurance, Aegon, United Healthcare Services, Hua Xia Life Insurance Co., MetLife Services, and Solutions, LLC, Aflac Incorporated.

RECENT MARKET DEVELOPMENTS

- The IRDAI (India's insurance regulatory and development authority) has released guidelines for standardizing crucial illness health insurance policies. They have proposed modified definitions for cancers with specified severity and multiple sclerosis with persisting symptoms and loss of speech.

- Huize, the Chinese health insurance company, has partnered with Rui Hua Health Assurance to launch "Guardian Critical Care No. 5," a customized multiple-benefit insurance product. The product will provide extensive coverage for 120 severe illnesses; it includes up to 6 claims for mild to severe diseases; it also offers optional benefits equal and many other advantages.

MARKET SEGMENTATION

This research report on the global critical illness insurance market is segmented and sub-segmented into the following categories.

By Product Type

- Medical Insurance

- Disease Insurance

- Income Protection Insurance

By Application

- Cancer

- Heart Attack

- Stroke

- Others

By Type

- individual Insurance

- Family Insurance

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the critical illness insurance market?

The global critical illness insurance market is expected to be worth USD 124.32 billion in 2024.

Which region had the largest share of the critical illness insurance market in 2024?

North America captured the biggest share of the worldwide critical illness insurance market in 2024.

Who are the key players in the critical illness insurance market?

AXA, Prudential, Liberty Mutual, Star Union Dai-ichi Life Insurance, Sun Life Insurance, Aegon, United Healthcare Services, Hua Xia Life Insurance Co., MetLife Services, and Solutions, LLC, Aflac Incorporated are some of the notable companies in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]