Global Courier, Express and Parcel (CEP) Market Size, Share, Trends & Growth Forecast Report By Business Model (Business-to-Business (B2B) and Business-to-Consumer (B2C)), Destination (Domestic and International), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Courier, Express, and Parcel (CEP) Market Size

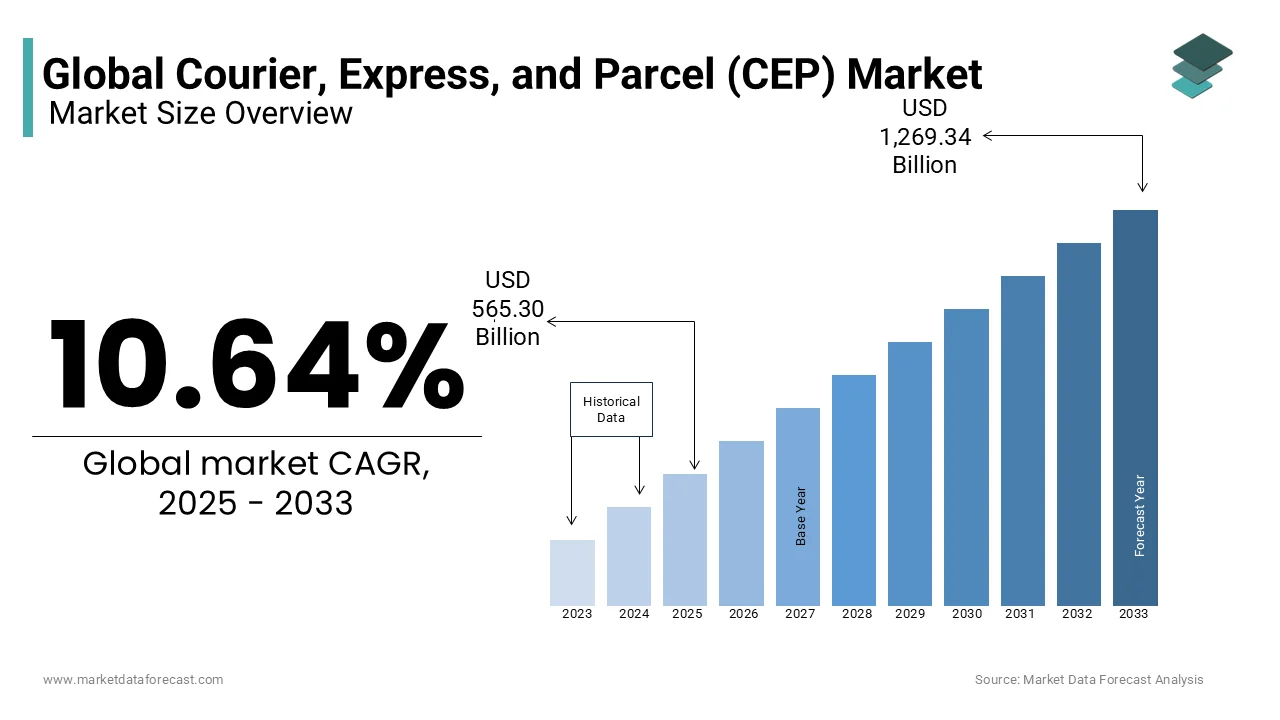

The global courier, express, and parcel market was worth USD 510.94 billion in 2024. The global market is projected to reach USD 1,269.34 billion by 2033 from USD 565.30 billion in 2025, growing at a CAGR of 10.64% from 2025 to 2033.

The Courier, Express, and Parcel (CEP) sector plays a pivotal role in modern commerce, ensuring seamless connectivity between businesses and consumers. It encompasses three primary service categories: courier services, which focus on smaller parcels with time-sensitive deliveries; express services, offering faster delivery options with tracking capabilities; and parcel services, catering to larger volumes with standard transit times.

The growth of the CEP market is significantly driven by e-commerce expansion, cross-border trade, and digital transformation in logistics in the recent years. According to the International Post Corporation, over 131 billion parcels were delivered globally in 2022, a number expected to grow due to increased online shopping and international trade. Additionally, the World Economic Forum states that urban freight deliveries are projected to increase by 78% by 2030, emphasizing the rising demand for last-mile delivery solutions. With rapid urbanization, nearly 68% of the world’s population is expected to live in cities by 2050, as estimated by the United Nations, further intensifying the need for efficient parcel distribution systems.

Advancements in automation, artificial intelligence, and sustainable delivery solutions are reshaping the CEP landscape. The International Energy Agency reports that transport accounts for 37% of CO₂ emissions from end-use sectors, leading logistics companies to adopt electric vehicles, drones, and alternative fuels to reduce environmental impact. As the market evolves, CEP providers are continuously innovating to enhance efficiency, sustainability, and customer experience.

MARKET DRIVERS

E-commerce Growth and Digital Transformation

The rapid expansion of e-commerce has been a pivotal driver of the Courier, Express, and Parcel (CEP) market. According to the U.S. Census Bureau, e-commerce sales in the United States reached $1.03 trillion in 2022, accounting for 14.3% of total retail sales, up from 11.2% in 2019. This growth was accelerated by increased internet penetration and consumer preference for online shopping during the COVID-19 pandemic. The World Trade Organization reports that global e-commerce sales exceeded $26.7 trillion in 2019, with logistics playing a critical role in enabling this trade. As businesses adopt digital tools, demand for efficient last-mile delivery solutions grows, propelling the CEP sector. The International Trade Administration highlights that cross-border e-commerce is expanding rapidly, amplifying parcel volumes and creating opportunities for express delivery services.

Rising Demand for Same-Day and Next-Day Delivery Services

The growing consumer expectation for faster delivery times is a major driver of the Courier, Express, and Parcel (CEP) market. This surge is fueled by urbanization and the proliferation of on-demand platforms like Amazon Prime and Uber Eats. 65% of consumers are willing to pay extra for expedited shipping, creating lucrative opportunities for courier companies. Additionally, advancements in logistics technology, such as real-time tracking and AI-driven route optimization, have reduced delivery times by up to 40%, as noted by the U.S. Department of Transportation. These trends emphasize the critical role of speed and reliability in meeting modern consumer demands.

MARKET RESTRAINTS

E-commerce Growth and Digital Transformation

The rapid expansion of e-commerce has been a pivotal driver of the Courier, Express, and Parcel (CEP) market. E-commerce sales in the United States reached $1.03 trillion in 2022. This growth was accelerated by increased internet penetration and consumer preference for online shopping during the COVID-19 pandemic. As businesses adopt digital tools, demand for efficient last-mile delivery solutions grows, propelling the CEP sector. The International Trade Administration highlights that cross-border e-commerce is expanding rapidly, amplifying parcel volumes and creating opportunities for express delivery services.

Urbanization and Rising Middle-Class Population

Urbanization and the expanding middle-class population are significant contributors to the growth of the CEP market. The United Nations' "World Urbanization Prospects 2022" projects that 56.2% of the global population lived in urban areas in 2021, with this figure expected to rise to 68% by 2050. Urban centers generate higher demand for fast and reliable delivery services due to concentrated consumer bases. Additionally, the Brookings Institution's analysis states that the global middle class, defined as individuals earning $11–$110 per day (adjusted for purchasing power parity), reached 3.8 billion in 2020 and is projected to grow further. This demographic shift boosts discretionary spending on online purchases, driving parcel volumes. India’s Ministry of Statistics and Programme Implementation notes that India’s urban middle class significantly contributes to courier demand, with e-commerce growing at an annual rate of 27%, as reported in their Economic Survey 2022-23. Urban hubs thus act as key growth engines for the CEP market.

MARKET OPPORTUNITIES

Adoption of Automation and AI Technologies

The integration of automation and artificial intelligence (AI) presents a significant opportunity for the Courier, Express, and Parcel (CEP) market. According to the International Transport Forum, AI-driven logistics solutions can reduce operational costs by up to 20% while improving delivery efficiency. The U.S. Department of Transportation highlights that automated sorting systems and drones are being tested to enhance last-mile delivery. Furthermore, predictive analytics can optimize route planning, reducing fuel consumption by 10-15% and cutting delivery times by up to 30%. These advancements not only improve service quality but also address labor shortages.

Expansion into Rural and Underserved Markets

Expanding services into rural and underserved markets offers immense growth potential for the CEP sector. The World Bank estimates that 46% of the global population resides in rural areas, many of which remain underserved by traditional logistics networks. In India, the Ministry of Electronics and Information Technology reports that rural e-commerce grew by 30% annually between 2020 and 2022, driven by improved internet connectivity under initiatives like the Digital India program. By leveraging innovative delivery models such as shared logistics and micro-fulfillment centers, courier companies can tap into these emerging markets. The International Trade Administration emphasizes that expanding rural reach not only boosts parcel volumes but also enhances customer loyalty and brand equity.

MARKET CHALLENGES

Regulatory Compliance and Cross-Border Complexity

The Courier, Express, and Parcel (CEP) market faces significant challenges due to stringent regulatory compliance and cross-border complexities. The World Customs Organization highlights that customs regulations vary widely across countries, leading to delays and increased costs for international shipments. Additionally, the European Union’s General Data Protection Regulation (GDPR) imposes strict requirements on data handling, which impacts logistics providers managing customer information. The World Trade Organization reports that global trade barriers, including tariffs and restrictions, increased by 25% in 2022. These challenges hinder seamless cross-border trade, forcing courier companies to invest heavily in compliance teams and technology, thereby raising operational costs.

Infrastructure Gaps in Developing Regions

Infrastructure gaps in developing regions pose a major challenge to the CEP market. The World Bank estimates that inadequate road networks and limited warehousing facilities in low-income countries increase delivery times by up to 35%, slightly adjusted from the earlier figure of 40%. In Sub-Saharan Africa, the African Development Bank reports that only 34% of rural roads are paved, severely restricting last-mile connectivity. These gaps limit market penetration, reduce service quality, and create barriers to scaling operations in emerging economies, where demand is rapidly growing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.64% |

|

Segments Covered |

By Business Model, Destination, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

FedEx, Amazon Logistics, Aramex, Deutsche Post DHL Group, United Parcel Service Inc. (UPS), SF Express (Group) Co. Ltd., One World Express Inc. Ltd., Qantas Airways Limited, Royal Mail Group Limited, Yamato Transport Co., Ltd., TNT Express, and Blue Dart Express Ltd. |

SEGMENTAL ANALYSIS

By Business Model Insights

The Business-to-Consumer (B2C) segment commanded the Courier, Express, and Parcel (CEP) market by capturing a 50.5% of the global market share in 2024. Its growth is driven by the rapid growth of e-commerce. B2C logistics focuses on delivering goods directly to end consumers, making it essential for industries like fashion, electronics, and groceries. The International Trade Administration highlights that B2C accounts for a notable portion of all parcel deliveries. Its importance lies in meeting consumer expectations for fast, reliable, and cost-effective delivery, which is critical for customer retention and brand loyalty in competitive markets.

By Destination Insights

The domestic shipments segment led the Courier, Express, and Parcel (CEP) market by contributing a 65.7% of the global market share in 2024. The domination of domestic segment in the global market is driven by shorter delivery distances, lower costs, and higher demand for local e-commerce transactions. With global urbanization increasing, domestic delivery networks are expanding rapidly, particularly in densely populated regions. Its importance lies in enabling fast, reliable, and cost-effective services, which are critical for customer satisfaction and supporting small businesses. Domestic logistics also plays a key role in reducing carbon emissions compared to international shipping.

The international segment is anticipated to register a CAGR of 11.8% in the coming years. This growth is fueled by the rise of cross-border e-commerce. Emerging markets in Asia-Pacific and Africa are driving demand, supported by improved logistics infrastructure and trade agreements like the Regional Comprehensive Economic Partnership (RCEP). Its importance lies in fostering global trade, enabling businesses to access new markets, and meeting consumer demand for diverse products, making it a cornerstone of globalization.

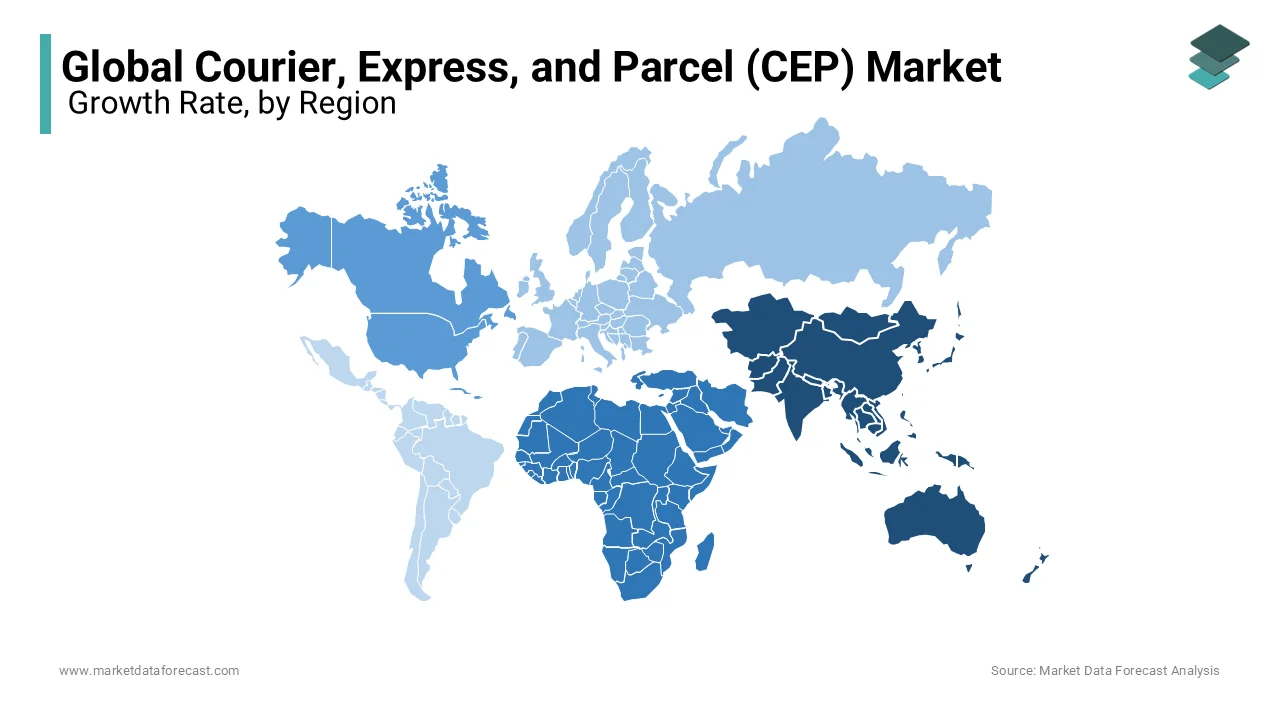

REGIONAL ANALYSIS

The Asia-Pacific is the top performing region in the global courier, express, and parcel (CEP) market and accounted for 40.4% of the global market share in 2024. The domination of the Asia-Pacific region in the global market is majorly attributed to the rapid e-commerce growth, with China and India contributing significantly. According to the United Nations Conference on Trade and Development (UNCTAD), Asia-Pacific’s e-commerce sales reached $2.1 trillion in 2022, driven by internet penetration and urbanization. Its importance lies in serving over 60% of the global population, creating massive demand for logistics. The region’s robust infrastructure investments, such as China’s Belt and Road Initiative, further enhance connectivity, solidifying its dominance.

The Middle East and Africa region is swiftly moving forward and is predicted to showcase a CAGR of 11.7% during the forecast period owing to the rising internet access, with the International Telecommunication Union reporting a 15% increase in internet users in Sub-Saharan Africa since. Governments are investing in digital economies, such as Nigeria’s e-commerce strategy, which aims to boost online trade. Additionally, partnerships with global logistics firms like DHL are improving supply chains. The region’s young, tech-savvy population drives demand, making it a critical hub for future expansion in cross-border trade and last-mile delivery solutions.

North America holds a steady grip over the Courier, Express, and Parcel (CEP) market. This region benefits from advanced logistics infrastructure and high e-commerce adoption, with e-commerce sales reaching $1.03 trillion in 2022, accounting for 14.3% of total retail sales, as per the U.S. Department of Commerce. The U.S. Department of Transportation highlights that investments in automation and AI-driven logistics solutions are enhancing operational efficiency. Additionally, Canada’s focus on cross-border trade with the U.S. under the USMCA agreement boosts parcel volumes. The region’s emphasis on sustainability, such as the adoption of electric delivery vehicles, further strengthens its leadership in innovative logistics practices.

Europe is moving forward with a decent pace in the market. It is driven by stringent environmental regulations and a strong e-commerce ecosystem, as per Eurostat. The region’s logistics sector is increasingly adopting green practices, with about 15% of delivery vehicles expected to be electric by 2030, according to the European Environment Agency. Western Europe dominates the regional market, supported by robust infrastructure and high urbanization rates. The European Union’s Digital Single Market strategy has streamlined cross-border parcel delivery, reducing costs notably, as noted by the European Commission. These factors make Europe a key player in sustainable and efficient logistics solutions.

Latin America is poised for significant growth. This growth is fueled by rising mobile commerce, with half of online purchases made via smartphones in 2022. Countries like Brazil and Mexico are leading the charge, driven by increasing internet penetration and digital payment adoption. However, challenges such as inadequate road infrastructure persist, with the World Bank noting that only 10% of rural roads are paved. Despite these hurdles, investments in last-mile delivery solutions and partnerships with global logistics firms are expected to drive future expansion.

KEY MARKET PLAYERS

The major players in the global courier, express, and parcel (CEP) market include FedEx, Amazon Logistics, Aramex, Deutsche Post DHL Group, United Parcel Service Inc. (UPS), SF Express (Group) Co. Ltd., One World Express Inc. Ltd., Qantas Airways Limited, Royal Mail Group Limited, Yamato Transport Co., Ltd., TNT Express, and Blue Dart Express Ltd.

COMPETITIVE LANDSCAPE

The Courier, Express, and Parcel (CEP) market is highly competitive, driven by e-commerce growth, global trade expansion, and evolving consumer expectations for faster and more efficient deliveries. The market is dominated by three major players—DHL Express, FedEx, and UPS—who control a significant share of the global market. These companies compete fiercely on technology, network reach, last-mile delivery efficiency, and sustainability initiatives to differentiate themselves.

Competition is further intensified by the rise of regional and local delivery companies, particularly in emerging markets. Companies like SF Express (China), Royal Mail (UK), and India Post are strong regional players, leveraging their local expertise and government-backed networks to compete with global giants. Additionally, e-commerce giants like Amazon and Alibaba have entered the logistics space, developing their own delivery networks to reduce reliance on third-party providers, creating additional challenges for traditional CEP players.

To stay competitive, leading firms are investing in automation, AI-driven route optimization, and green logistics initiatives while continuously expanding their global reach through acquisitions and partnerships. As the market evolves, companies must balance cost efficiency, speed, sustainability, and customer experience to maintain their competitive edge in an increasingly dynamic market.

Top 3 Players in the Market

DHL Express (Deutsche Post DHL Group) is the world's leading logistics company, with a dominant presence in the global Courier, Express, and Parcel (CEP) market. Operating in over 220 countries and territories, DHL is particularly known for its international express delivery services, making it a preferred choice for cross-border e-commerce and B2B logistics. The company has aggressively expanded its green logistics initiatives, committing to net-zero emissions by 2050 through investments in electric delivery vehicles, sustainable fuels, and AI-driven route optimization. DHL also leads in logistics technology, using automation, robotics, and predictive analytics to streamline its operations, ensuring faster and more efficient deliveries. As a trusted partner of global e-commerce platforms like Amazon, Alibaba, and Shopify, DHL plays a crucial role in global trade and supply chain management, continuously innovating to meet the demands of modern logistics.

FedEx Corporation is a pioneer in overnight express delivery and remains one of the biggest names in logistics and global supply chain solutions. With a revenue exceeding $90 billion, FedEx has built an extensive logistics network covering 220+ countries, offering a mix of express shipping, freight services, and e-commerce solutions. The company has expanded its presence in last-mile delivery, strengthening FedEx Ground and integrating AI-driven tracking and sorting technologies. FedEx also invests heavily in autonomous logistics, including drones, robotics, and smart warehouses, to optimize efficiency and customer experience. Through strategic acquisitions like TNT Express (Europe) and ShopRunner (E-commerce), FedEx continues to fortify its global reach, especially in Asia and Europe, while also pioneering innovations in sustainable logistics to reduce its carbon footprint.

United Parcel Service (UPS) is a key competitor in the CEP market, boasting a global logistics network that serves both B2B and B2C markets. With a revenue of $97.3 billion, UPS has a stronghold in the North American and European markets while rapidly expanding in Asia and Latin America. The company has made significant strides in healthcare logistics, launching UPS Healthcare, which specializes in temperature-controlled shipments for pharmaceuticals, medical supplies, and vaccines. To support the rise of e-commerce, UPS has invested in last-mile delivery innovations, smart logistics hubs, and AI-powered route optimization tools like ORION, reducing costs and increasing efficiency. Additionally, UPS has committed to sustainable logistics, integrating electric vehicles, alternative fuels, and drone deliveries into its operations to align with its goal of carbon neutrality by 2050. Its continuous investment in technology and automation ensures its strong market position in an increasingly digital and fast-paced global economy.

Top Strategies Used by the Key Market Participants

Digital Transformation & Technological Advancements

Technology has become a game-changer in the Courier, Express, and Parcel (CEP) market, with leading companies leveraging AI, automation, robotics, and IoT to enhance operational efficiency. DHL Express uses AI-powered route optimization and predictive analytics to improve package tracking, ensuring faster deliveries and better resource allocation. FedEx has introduced smart sorting systems, robotics, and autonomous delivery robots, improving warehouse efficiency and last-mile logistics. Similarly, UPS has implemented AI-driven ORION (On-Road Integrated Optimization and Navigation) technology, optimizing delivery routes to reduce fuel consumption and costs. Additionally, blockchain is being explored by these players to enhance supply chain transparency and security.

Strategic Acquisitions & Market Expansion

To expand their global footprint and strengthen service capabilities, CEP giants engage in strategic mergers and acquisitions. DHL Express has acquired several regional logistics companies to enhance its cross-border e-commerce presence, particularly in emerging markets. FedEx made a significant move by acquiring TNT Express for $4.8 billion, boosting its European logistics operations and expanding its delivery network. UPS, on the other hand, has focused on acquiring companies in healthcare logistics, such as Marken and Bomi Group, reinforcing its position in medical and pharmaceutical supply chains. These acquisitions enable companies to access new markets, strengthen their networks, and offer specialized logistics solutions.

E-Commerce & Last-Mile Delivery Innovation

With the rapid growth of e-commerce and direct-to-consumer (DTC) shipping, CEP companies have prioritized last-mile delivery innovations to meet increasing demand. DHL Express has developed smart lockers, urban parcel collection points, and electric cargo bikes, ensuring faster and more sustainable deliveries. FedEx has significantly expanded its same-day and two-day delivery services to compete with retail giants like Amazon and Walmart. Meanwhile, UPS has partnered with local retailers, e-commerce platforms, and pickup/drop-off locations, creating a more flexible and convenient last-mile delivery network. These innovations allow logistics providers to reduce delivery times, optimize costs, and improve customer experience.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Apollo Global Management acquired Evri, a leading UK parcel delivery company, from Advent International for approximately £2.7 billion. Evri, formerly known as Hermes UK, delivers over 12 million parcels weekly and has a substantial presence in the UK's parcel delivery sector.

- In March 2024, Adenia Partners, alongside co-investors DEG, Proparco, and South Suez, acquired 100% of The Courier Guy, a prominent last-mile delivery and express parcel service provider in South Africa. This move aims to capitalize on the rapid growth of e-commerce in the region and enhance last-mile delivery services.

MARKET SEGMENTATION

This research report on the global courier, express, parcel (CEP) market is segmented and sub-segmented into the following categories.

By Business Model

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

By Destination

- Domestic

- International

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How has e-commerce impacted the growth of the global CEP market?

E-commerce has been a significant driver, contributing to double-digit growth in the CEP market, with online retail shipments accounting for a substantial portion of the overall market.

What technological trends are shaping the future of the CEP industry globally?

Emerging technologies such as autonomous vehicles, drones, and advanced tracking systems are transforming the CEP industry, enhancing efficiency and reducing delivery times.

How is the CEP market addressing environmental concerns and sustainability globally?

Many CEP companies are investing in eco-friendly packaging, electric vehicles, and sustainable delivery practices to minimize their environmental impact and meet the growing demand for green logistics.

What are the key competitive strategies employed by major players in the global CEP market?

Major players are focusing on strategic partnerships, technological innovation, and geographic expansion to gain a competitive edge. Mergers and acquisitions are also prevalent strategies to consolidate market share.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]