Global Coupling Market Size, Share, Trends, & Growth Forecast Report By Product (Elastomeric couplings, Metallic Couplings, Mechanical Couplings and Others), Material (Aluminum Alloy, Stainless Steel, and Titanium), Application (Power Generation, Metal and Mining, Papermaking, Automotive, Oil and Gas and Others) & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2032

Global Coupling Market Size

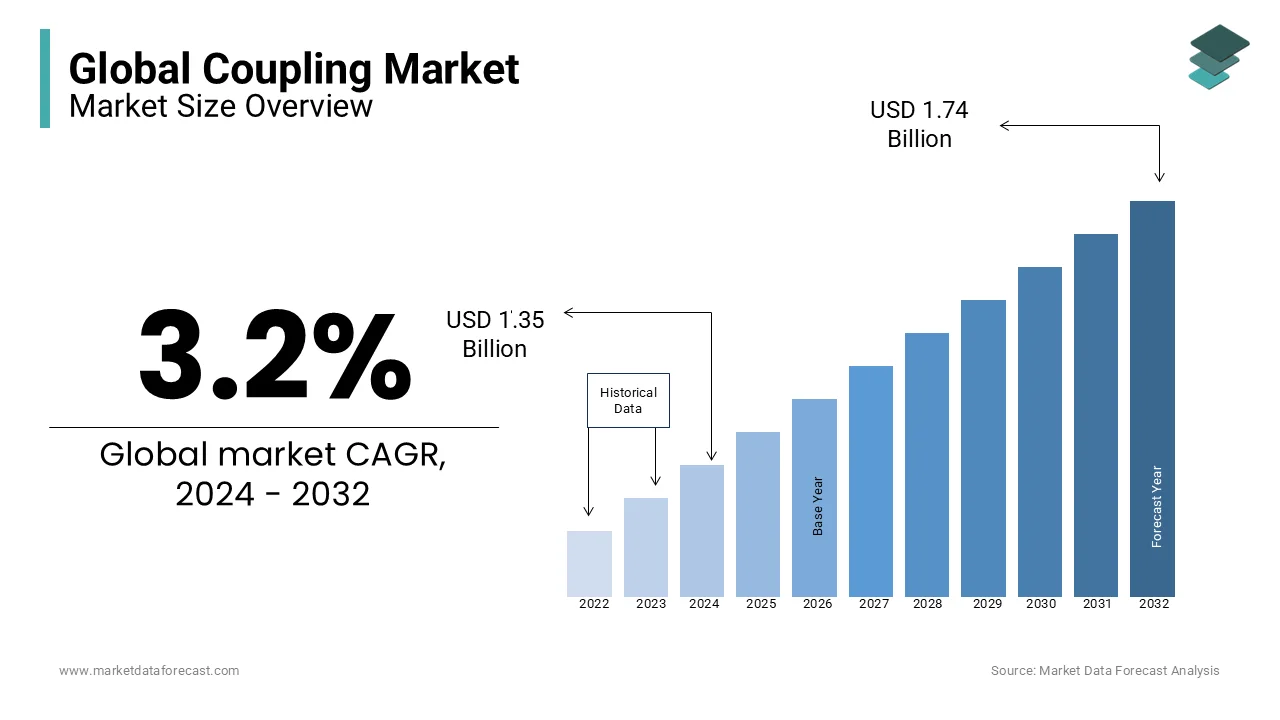

The global coupling market size was valued at USD 1.31 billion in 2023 and is expected to be worth USD 1.35 billion in 2024 and USD 1.74 billion by 2032, growing at a CAGR of 3.2% from 2024 to 2032.

Couplings play a crucial role in mechanical systems by ensuring efficient power transmission, accommodating shaft misalignment and reducing mechanical vibrations. These are widely used in sectors like automotive, manufacturing, power generation, oil and gas and renewable energy. For example, in wind turbines, flexible couplings are essential to handle torque variations and ensure smooth operation under fluctuating wind conditions. The manufacturing sector globally employs over 13% of the total workforce and a significant portion of industrial machinery relies on couplings for operational efficiency. Couplings are vital for connecting engines in the automotive industry, where over 85 million vehicles are produced annually to drive shafts and reduce mechanical stress during operation. Asia-Pacific leads in production due to rapid industrialization and at the same time Europe and North America focus on advanced coupling technologies for energy-efficient applications. Innovations like elastomeric and lightweight couplings are addressing industry demands for better energy efficiency and sustainability.

MARKET DRIVERS

Rising Demand for Industrial Automation

The growing adoption of automation in industries such as manufacturing, logistics, and process control is a key driver of the coupling market. Automated machinery requires precise and reliable power transmission systems, and couplings play a vital role in ensuring smooth operation. For instance, over 60% of global manufacturing operations are expected to integrate automation technologies by 2030, significantly increasing the demand for advanced coupling solutions. Flexible couplings usually accommodate misalignments and reduce system wear, which are particularly essential in robotics and conveyor systems where continuous and high-speed operations demand enhanced durability and efficiency.

Expansion of Renewable Energy Projects

The global shift towards renewable energy sources like wind and solar power is accelerating the demand for couplings. Wind turbines, for example, rely on couplings to transmit torque efficiently from the rotor to the generator. According to recent studies, over 700 GW of installed wind energy capacity globally highlights the critical role of couplings in this sector. Additionally, the need for high-performance and durable couplings is growing as renewable energy systems are designed to operate under extreme conditions, ensuring reliability and reducing maintenance in remote installations. This trend is driving innovation in the coupling market.

MARKET RESTRAINTS

High Maintenance and Replacement Costs

Couplings, particularly in industrial and heavy-duty applications, require regular maintenance and eventual replacement due to wear and tear from continuous operation. For example, couplings experience extreme mechanical stress in sectors like mining and oil and gas, leading to higher maintenance demands. Studies indicate that maintenance and downtime account for 15-20% of operational costs in industries reliant on heavy machinery. These costs can deter businesses, especially small and medium enterprises, from investing in high-quality couplings, impacting overall market growth. Additionally, frequent replacements in high-stress environments increase costs and shall act as a restraint for industries with tight budgets.

Challenges in Integration with Advanced Machinery

The coupling market faces challenges in adapting to advanced machinery, particularly in highly automated systems. Modern equipment often demands lightweight, compact, and high-precision components, requiring significant research and development efforts to create compatible couplings. For instance, integrating couplings in robotics or high-speed production lines requires advanced materials and designs to meet performance standards. This leads to increased production costs, limiting accessibility for cost-sensitive markets. The lack of standardized designs for diverse industrial applications further complicates integration, slowing adoption rates and innovation in certain segments of the market.

MARKET OPPORTUNITIES

Growing Demand for Smart Couplings

The rise of Industry 4.0 and IoT-enabled machinery presents a significant opportunity for smart couplings. These couplings incorporate sensors to monitor torque, misalignment, and wear in real-time, enabling predictive maintenance and reducing unplanned downtime. Studies show that predictive maintenance can cut equipment maintenance costs by 25-30% and extend machinery lifespan. Industries such as power generation and manufacturing are increasingly adopting these technologies to enhance operational efficiency. With the global IoT market projected to reach over 75 billion connected devices by 2025, the demand for smart couplings in automated systems is expected to grow substantially.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa offer substantial growth opportunities due to rapid industrialization and infrastructure development. For instance, India's "Make in India" initiative and China's focus on smart manufacturing are driving demand for industrial machinery, where couplings are integral components. Over 65% of new manufacturing facilities globally are being set up in these regions, which presents a lucrative market for coupling manufacturers. Additionally, the rising investment in renewable energy projects, particularly wind and solar farms, in emerging markets further supports growth, as couplings are vital for efficient power transmission in these installations.

MARKET CHALLENGES

Raw Material Price Volatility

The coupling market faces challenges from fluctuating prices of raw materials like steel, aluminum, and composites, which are key components in coupling manufacturing. For instance, global steel prices increased by over 50% in 2021, driven by supply chain disruptions and rising demand. Such volatility directly impacts production costs, making it difficult for manufacturers to maintain competitive pricing. Smaller companies, in particular, struggle to absorb these costs, which can limit their market participation. Additionally, the reliance on imports for specialized materials in certain regions adds to the uncertainty that further challenges market growth and profitability.

Competition from Substitute Technologies

Emerging technologies, such as advanced direct-drive systems, pose a challenge to the coupling market by offering alternatives that bypass the need for traditional couplings. Direct-drive systems, particularly in wind turbines and high-performance machinery, eliminate mechanical connections, reducing wear and increasing efficiency. For example, the adoption of direct-drive systems in the wind energy sector grew by 20% over the last five years, highlighting their rising popularity. As industries look for low-maintenance and highly efficient alternatives, coupling manufacturers must innovate to remain competitive, which adds pressure to traditional coupling market players.

Report Coverage

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.2% |

|

Segments Covered |

By Product, Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens AG, SKF Group, Voith GmbH & Co. KGaA, Rexnord Corporation, Altra Industrial Motion Corp., Regal Rexnord Corporation, ABB Ltd., John Crane (Smiths Group), Lovejoy Inc. (Timken Company), and Tsubakimoto Chain Co. |

SEGMENTAL ANALYSIS

By Product Insights

The elastomeric couplings segment holds a strong position in the market and accounted for the largest share of the global market in 2023. Elastomeric couplings offer flexibility and can absorb shocks and vibrations and are well-suited for applications needing misalignment support. They are extensively used in industries such as manufacturing and power generation. For instance, in the European Union, the manufacturing sector accounted for approximately 14.5% of the GDP in 2020, indicating a substantial demand for machinery components like elastomeric couplings. Their design reduces maintenance costs and enhances equipment lifespan, which contributes to their widespread adoption.

On the other hand, the metallic couplings segment is anticipated to witness rapid growth over the forecast period owing to their high torque capacity and durability under extreme conditions. They are essential in heavy industries such as oil and gas and mining. According to Eurostat, the mining and quarrying sector in the EU showed a production value of €142 billion in 2019, which promotes significant industrial activities. The increasing investments in infrastructure and energy projects further propel the demand for metallic couplings by highlighting their importance in supporting heavy-duty applications.

By Material Insights

The stainless steel segment held the dominating share of the global couplings market in 2023. Couplings that are made up of stainless steel are durable, corrosion-resistant, and versatile in tough conditions. These properties make them indispensable in industries like oil and gas, power generation, and marine applications. Stainless steel’s corrosion-resistant properties are crucial for offshore drilling and renewable energy systems, such as wind farms, which operate in high-moisture environments. Globally, over 70% of offshore energy installations utilize stainless steel components, highlighting their dominance. The material's ability to withstand high temperatures and pressures ensures its continued demand in heavy-duty industrial operations and critical applications.

The titanium segment is another promising segment and is anticipated to register a CAGR of 7.2% over the forecast period. This growth is fueled by their strong yet lightweight features and crucial for the aerospace and medical industries. It offers superior strength-to-weight ratios and is resistant to extreme temperatures, which makes it ideal for precision applications in turbines and advanced medical devices. According to the U.S. Geological Survey (USGS), global titanium production reached 340,000 metric tons in 2022, which reflects its increasing availability. Additionally, the rising adoption of titanium in electric vehicles for weight reduction contributes to its rapid growth. Its importance lies in enhancing efficiency and sustainability in cutting-edge industries.

By Application Insights

The oil and gas industry segment led the market in 2023 and is the top application segment in the coupling market, contributing about 35% to total usage. Couplings play a crucial role in this industry by ensuring reliable power transmission in equipment like pumps, compressors, and drilling rigs. The sector demands components that can withstand extreme temperatures, pressures, and corrosive environments. For example, in 2022, global crude oil production exceeded 88 million barrels per day, according to U.S. Energy Information Administration. With a vast network of pipelines, offshore platforms, and refining facilities, the oil and gas industry relies on durable and high-performance couplings to maintain operational efficiency and safety.

The power generation segment is expected to witness the fastest CAGR of 7.5% over the forecast period. The rapid expansion of renewable energy projects, particularly wind and solar, is driving this growth. For instance, the global installed wind energy capacity surpassed 900 GW in 2022, according to the International Renewable Energy Agency, with couplings integral to torque transmission in turbines. Additionally, thermal and nuclear power plants rely heavily on couplings for equipment like turbines and generators. According to the International Energy Agency, the sector's growth is further supported by increasing energy demand, with global electricity consumption rising by 2.3% annually. Couplings ensure efficient and reliable operations for uninterrupted power supply.

REGIONAL ANALYSIS

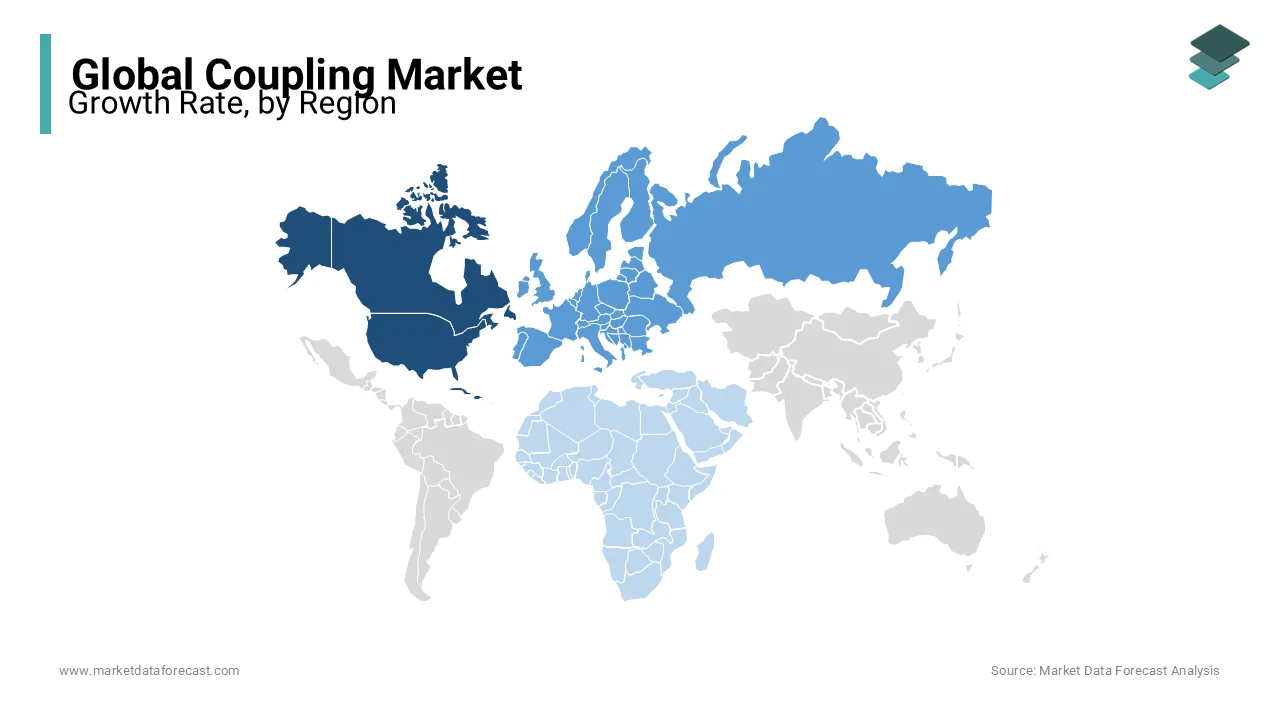

North America dominated the couplings market worldwide in 2023 and is likely to register a healthy CAGR over the forecast period. In North America, the United States and Canada have a combined population of approximately 372 million as of 2022. The region boasts a high GDP per capita, with the United States at $74,161 in 2022, indicating a strong economic environment conducive to industrial investments. The manufacturing sector is well-established, and the region is a leader in technological innovation by supporting the adoption of advanced coupling solutions. Additionally, North America's commitment to renewable energy projects, such as wind and solar power, shall drive the demand for couplings in energy applications.

Europe, with a population of approximately 920 million in 2022, exhibits a negative population growth rate of -0.3%, reflecting demographic challenges. Despite this, the region maintains a high GDP per capita of $27,537, which indicates robust economic performance. Europe's focus on sustainable development and stringent environmental regulations encourages the adoption of energy-efficient technologies with advanced coupling systems. The region's strong emphasis on research and development fosters innovation in industrial components.

The region is rapidly expanding and is expected to continue this pattern in the coupling market. The demand for electricity in APAC will surge in 2025 as it is anticipated to capture approximately 50 percent of the power consumption globally in 2025, as per Fitch Ratings. Moreover, the regional market is projected that a big portion of the incremental electricity demand in the area will be satisfied by renewables as a way to attain the shift to net zero, while the share of coal continues to be considerable. Additionally, China and India will persist in elevating power demand rise. According to the Fitch Ratings, the GDP of India and China will move forward by 6.5 percent and 4.3 percent, respectively, resulting in a similar surge in electricity consumption, which is greater than the world’s rise.

Latin America and the Caribbean, with a population of approximately 659 million in 2022, have a population growth rate of 0.7%. The region's GDP per capita is $9,559, indicating developing economic conditions. Investments in infrastructure and energy projects, particularly in Brazil and Mexico, create opportunities for the coupling market. The region's focus on modernizing industrial equipment to enhance efficiency and productivity also contributes to market demand.

The Middle East and Africa region with a population of approximately 493 million in 2022, is experiencing a population growth rate of 1.5%, the highest among the regions discussed. The region's GDP per capita stands at $8,949, reflecting diverse economic conditions. Ongoing investments in energy infrastructure, including oil, gas, and renewable energy projects, drive the demand for couplings. The region's strategic initiatives to diversify economies and develop industrial sectors further support market growth.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

Companies playing a key role in the global coupling market include Siemens AG, SKF Group, Voith GmbH & Co. KGaA, Rexnord Corporation, Altra Industrial Motion Corp., Regal Rexnord Corporation, ABB Ltd., John Crane (Smiths Group), Lovejoy Inc. (Timken Company) and Tsubakimoto Chain Co. The coupling market is highly competitive, with global, regional, and local players vying for dominance across various industries. Major manufacturers like Rexnord Corporation, Altra Industrial Motion, Siemens AG, SKF, and Voith GmbH hold significant market shares due to their extensive product portfolios, global reach, and focus on technological innovation. These companies emphasize advanced coupling designs, such as smart couplings equipped with IoT capabilities to monitor torque, misalignment, and performance in real-time.

Regional players compete by offering cost-effective solutions tailored to local industries, particularly in emerging markets like Asia-Pacific and Latin America, where industrialization is rapidly expanding. For example, Chinese manufacturers focus on affordable yet durable couplings for industries like manufacturing and energy. Competition is intensifying with the rise of niche players entering the market with specialized products, such as lightweight titanium couplings for aerospace or elastomeric couplings for vibration-sensitive applications. Additionally, the growing demand for renewable energy and automation has driven companies to invest in research and development to meet specific performance requirements. E-commerce platforms have further reshaped competition, enabling small and medium-sized enterprises (SMEs) to reach global customers. To remain competitive, companies are prioritizing innovation, sustainability, and strategic partnerships to address evolving industry needs and customer preferences.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, IM Group, at the 8th yearly UK-based Global Business Awards, was conferred with the title Emerging Integrated Engineering Solutions Company of the Year 2024.

- In March 2024, the European Union Agency for the Cooperation of Energy Regulators (ACER) permitted the revisions to the Core and Italy North Capacity Calculation Regions (CCRs). Previously, in November 203, the proposal by the ACER was submitted by the Transmission System Operators (TSOs) to revise the definition of 2 European CCR.

- In February 2024, the Central Electricity Regulatory Commission (CERC) in India released a Suo moto order instructing Grid India to deploy a shadow pilot version for the coupling of power markets. The suggested shadow pilot needs to combine the three markets on the power exchanges, involving the DAM of the three power exchanges, RTM with security-constrained economic despatch (SCED), and the RTM of the three power exchanges. This pilot is anticipated to assist in examining the regulatory, market, and functional outcomes before undertaking a full-scale implementation.

MARKET SEGMENTATION

This research report on the global coupling market is segmented and sub-segmented into the following categories.

By Product

- Elastomeric Couplings

- Metallic Couplings

- Mechanical Couplings

- Others

By Material

- Aluminum Alloy

- Stainless Steel

- Titanium

By Application

- Power generation

- Metal and mining

- Papermaking

- Automotive

- Oil and Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which industries primarily drive the demand for mechanical couplings?

The demand for mechanical couplings is largely driven by industries such as automotive, oil and gas, power generation, chemical processing, mining, and heavy machinery manufacturing. These industries require efficient power transmission solutions for diverse applications, from high-torque systems to precision operations.

What are the key drivers for the growth of the coupling market?

The growth of the coupling market is driven by industrial automation, increased demand for energy-efficient systems, rapid urbanization, and the expansion of industries like oil and gas and renewable energy. The shift toward more sustainable energy sources also plays a critical role in market growth.

What role does technology play in the coupling market?

Technology plays a pivotal role in the development of advanced couplings. Innovations in materials, manufacturing processes, and design optimization have resulted in lighter, more durable, and efficient couplings. Additionally, smart couplings with sensors are emerging to monitor performance and enhance predictive maintenance.

What is the future outlook for the global coupling market?

The global coupling market is expected to grow steadily, driven by industrial automation, advancements in coupling technologies, and the demand for energy-efficient solutions. Emerging markets in Asia, the Middle East, and Africa are likely to offer significant growth opportunities as these regions continue to industrialize.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]