Global Cosmeceuticals Market Size, Share, Trends & Growth Forecast Report By Product Type, Distribution Channel and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Cosmeceuticals Market Size

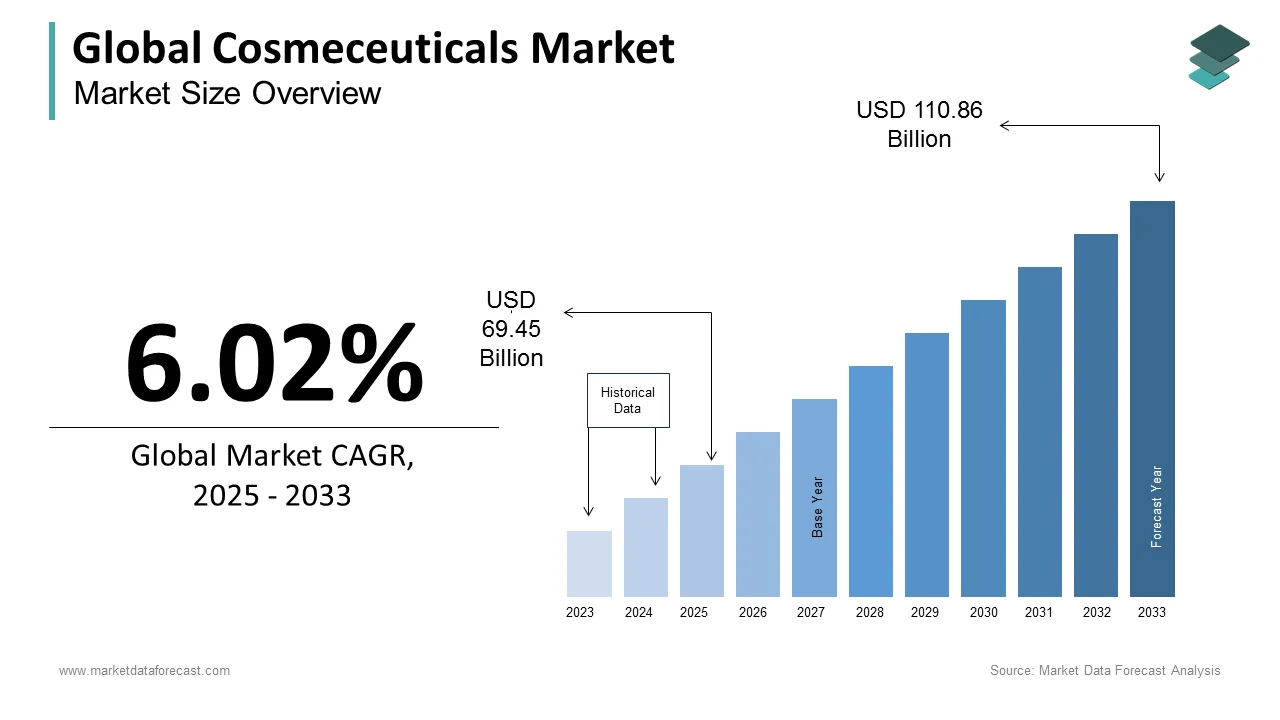

The size of the global cosmeceuticals market was worth USD 65.51 billion in 2024. The global market is anticipated to grow at a CAGR of 6.02% from 2025 to 2033 and be worth USD 110.86 billion by 2033 from USD 69.45 billion in 2025.

Cosmeceuticals market has emerged as a pivotal segment within the beauty and personal care industry and the demand for these products is driven by the growing consumer focus on health, wellness, and appearance. The increasing prevalence of skin disorders are exacerbated by factors like pollution and UV exposure has fueled demand for scientifically backed solutions. The World Health Organization (WHO) reports that 9 out of 10 people globally breathe polluted air, which is a significant contributor to skin damage and conditions like premature aging and hyperpigmentation.

Social media platforms have amplified awareness about skincare routines with influencers and dermatologists promoting cosmeceuticals as essential for maintaining healthy skin. Additionally, the rise of clean beauty trends has encouraged manufacturers to adopt sustainable practices by using natural and biodegradable ingredients. Regulatory bodies like the U.S. Food and Drug Administration (FDA) ensure product safety that is fostering consumer trust. The cosmeceuticals market is poised to remain a cornerstone of innovation in the beauty industry as urbanization and environmental concerns continue to shape lifestyle choices.

MARKET DRIVERS

Increasing Prevalence of Skin Disorders Due to Environmental Factors

One of the major drivers of the cosmeceuticals market is the rising incidence of skin disorders caused by environmental stressors. According to the World Health Organization (WHO), over 2 billion people globally are exposed to unhealthy levels of air pollution which accelerates skin aging and exacerbates conditions like acne and hyperpigmentation. The Global Burden of Disease Study highlights that skin diseases rank among the top non-fatal health burdens worldwide by prompting consumers to seek effective solutions. Urbanization further intensifies this trend as densely populated cities often experience higher pollution levels. This has fueled demand for cosmeceuticals containing active ingredients such as antioxidants and retinoids which offer therapeutic benefits. Regions like Asia-Pacific and Europe are witnessing significant growth in product adoption which are driven by heightened awareness of pollution's impact on skin health.

Rising Influence of Social Media and Digital Platforms

Another key driver is the growing influence of social media and digital platforms on consumer behavior. Influencers and dermatologists promote cosmeceuticals as essential tools for maintaining healthy skin, amplifying trends like "clean beauty" and ingredient transparency. The U.S. Food and Drug Administration (FDA) notes that this shift has encouraged brands to adopt stricter safety standards and innovative formulations. Additionally, the global reach of e-commerce has made cosmeceuticals more accessible which is anticipated to drive sales growth. This digital transformation has expanded consumer awareness and created new opportunities for brands to engage directly with their target audience by significantly contributing to market expansion.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Challenges

One of the major restraints in the cosmeceuticals market is the stringent regulatory environment governing product safety and efficacy. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and approval processes which can delay product launches by up to 24 months as highlighted by the World Health Organization (WHO). These compliance requirements disproportionately affect smaller companies with costs often exceeding 15% of total production expenses. Additionally, inconsistent regulations across regions create barriers to global expansion. For instance, the European Medicines Agency (EMA) reports that non-compliance with labeling standards has led to product recalls by impacting consumer trust. Such complexities hinder innovation and limit market entry for emerging players in developing economies where regulatory frameworks are less standardized which is restricting overall industry growth.

High Costs Limiting Accessibility for Price-Sensitive Consumers

Another significant restraint is the high cost of advanced formulations and sustainable ingredients, which restricts accessibility for budget-conscious consumers. The Environmental Protection Agency (EPA) notes that sourcing eco-friendly raw materials has increased production costs by up to 20%. Furthermore, the American Academy of Dermatology (AAD) highlights that premium cosmeceuticals often retail at prices unaffordable for low- and middle-income populations, particularly in Asia-Pacific and Africa. Counterfeit products exacerbate the issue, with the International Trademark Association estimating that 10% of skincare products globally are counterfeit.

MARKET OPPORTUNITIES

Growing Demand for Clean and Sustainable Beauty Products

A significant opportunity in the cosmeceuticals market lies in the rising consumer preference for clean and sustainable beauty products. The Environmental Protection Agency (EPA) reports that over 60% of consumers globally are willing to pay a premium for products made with natural and eco-friendly ingredients. This trend is particularly strong among millennials and Gen Z where 70% of these demographics prioritize sustainability in their purchasing decisions. Brands adopting transparent labeling and sustainable packaging are gaining a competitive edge. For instance, the U.S. Department of Agriculture (USDA) notes that certifications like "organic" and "biodegradable" have boosted sales by 15% annually in niche markets. Companies investing in green formulations and ethical sourcing can tap into this lucrative segment as environmental awareness grows is driving innovation and expanding their customer base.

Expansion into Emerging Markets with Rising Disposable Incomes

Another key opportunity is the expansion into emerging markets such as Asia-Pacific, Latin America, and Africa, driven by increasing disposable incomes and urbanization. The World Bank states that the middle class in these regions is expected to grow by 200 million people by 2030 which is creating a surge in demand for premium skincare solutions. According to the Food and Agriculture Organization (FAO), countries like India and Brazil are witnessing a 10% annual increase in spending on personal care products. Additionally, the International Trade Administration (ITA) highlights that e-commerce platforms have made cosmeceuticals more accessible in rural areas shall boost the sales. Companies can capitalize on this untapped potential and achieve significant revenue growth by tailoring affordable yet effective products to local preferences,.

MARKET CHALLENGES

Counterfeit Products Undermining Consumer Trust

A significant challenge in the cosmeceuticals market is the proliferation of counterfeit products, which undermines consumer trust and impacts legitimate brands. The International Trademark Association estimates that counterfeit skincare products account for nearly 10% of the global market by resulting in annual losses of over $5 billion for authentic manufacturers. These fake products often contain harmful ingredients by leading to adverse health effects and damaging brand reputations. According to the World Health Organization (WHO), over 40% of consumers in developing regions have unknowingly purchased counterfeit skincare items by creating skepticism about product authenticity. Additionally, the U.S. Food and Drug Administration (FDA) highlights that inadequate enforcement in some countries exacerbates the issue which is making it difficult for genuine brands to compete. This challenge calls for stricter regulatory measures and consumer awareness campaigns to combat counterfeiting effectively.

Limited Awareness and Accessibility in Rural Areas

Another major challenge is the limited awareness and accessibility of cosmeceuticals in rural and underdeveloped regions. The Food and Agriculture Organization (FAO) reports that over 3 billion people in rural areas lack access to advanced skincare solutions due to poor distribution networks and low awareness about skin health. A study by the World Health Organization (WHO) reveals that skin disorders remain untreated in these regions with only 20% of affected individuals seeking professional care. Additionally, high costs and cultural preferences for traditional remedies further restrict adoption. The International Trade Administration (ITA) notes that while urban markets are saturated, rural areas remain underserved, presenting a logistical and educational challenge for companies. Bridging this gap requires targeted marketing and affordable product offerings tailored to local needs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

L'Oréal S.A., Johnson & Johnson Services, Inc., Procter & Gamble (P&G), Unilever PLC, Beiersdorf AG, Shiseido Company, Limited, Estée Lauder Companies Inc., Avon Products, Inc., Amorepacific Corporation, Bioderma (Naos Group), and Others. |

SEGMENT ANALYSIS

By Product Type Insights

The skin care segment dominated the cosmeceuticals market in 2024 by holding 60.1% of the global market share in 2024 due to the rising prevalence of skin disorders, with over 2 billion people globally affected by pollution-related skin issues. The Global Burden of Disease Study highlights that skin conditions rank among the top non-fatal health burdens is driving demand for therapeutic skincare solutions. Consumers increasingly prioritize anti-aging, hydration, and sun protection products by making skin care the most lucrative segment. Its importance lies in addressing both aesthetic and health concerns by ensuring sustained growth and innovation in formulations tailored to diverse needs.

The hair care segment is anticipated to register a CAGR of 8.5% from 2025 to 2033 due to the increasing awareness of scalp health and the demand for solutions targeting hair thinning, dandruff, and damage caused by environmental stressors. The American Academy of Dermatology (AAD) reports that over 50% of adults experience hair or scalp issues by prompting investment in advanced formulations like serums and growth stimulants. Additionally, the clean beauty movement has encouraged the use of natural ingredients, appealing to eco-conscious consumers. Governments like the U.S. FDA are also emphasizing safer formulations, boosting consumer trust. This segment’s rapid expansion underscores its potential to address unmet needs while diversifying the cosmeceuticals market.

By Distribution Channel Insights

The online platforms segment dominated the market by capturing 30.7% of the global market share in 2024 owing to the convenience of shopping, competitive pricing, and access to a wide range of products. The U.S. Department of Commerce highlights that e-commerce sales of health and beauty products grew by 18.5% annually in 2022, with online platforms enabling direct consumer engagement through reviews, tutorials, and influencer collaborations. Additionally, a survey by McKinsey & Company found that 70% of Gen Z and millennials prefer purchasing skincare products online, making it the preferred channel for younger consumers. Its importance lies in its ability to reach global audiences with personalized recommendations and adapt quickly to trend.

The speciality stores segment is likely to have a CAGR of 9.2% over the forecast period. This growth is fueled by increasing consumer demand for expert advice and premium products. The American Academy of Dermatology (AAD) notes that 65% of consumers trust dermatologist-recommended products is driving footfall to specialty stores that offer curated selections and personalized consultations. These outlets also cater to the growing trend of "clean beauty" with 78% of consumers willing to pay more for transparent and clinically-tested formulations, as per a report by NielsenIQ. Governments like the European Medicines Agency (EMA) emphasize transparency in product claims which specialist stores excel at by curating high-quality brands.

REGIONAL ANALYSIS

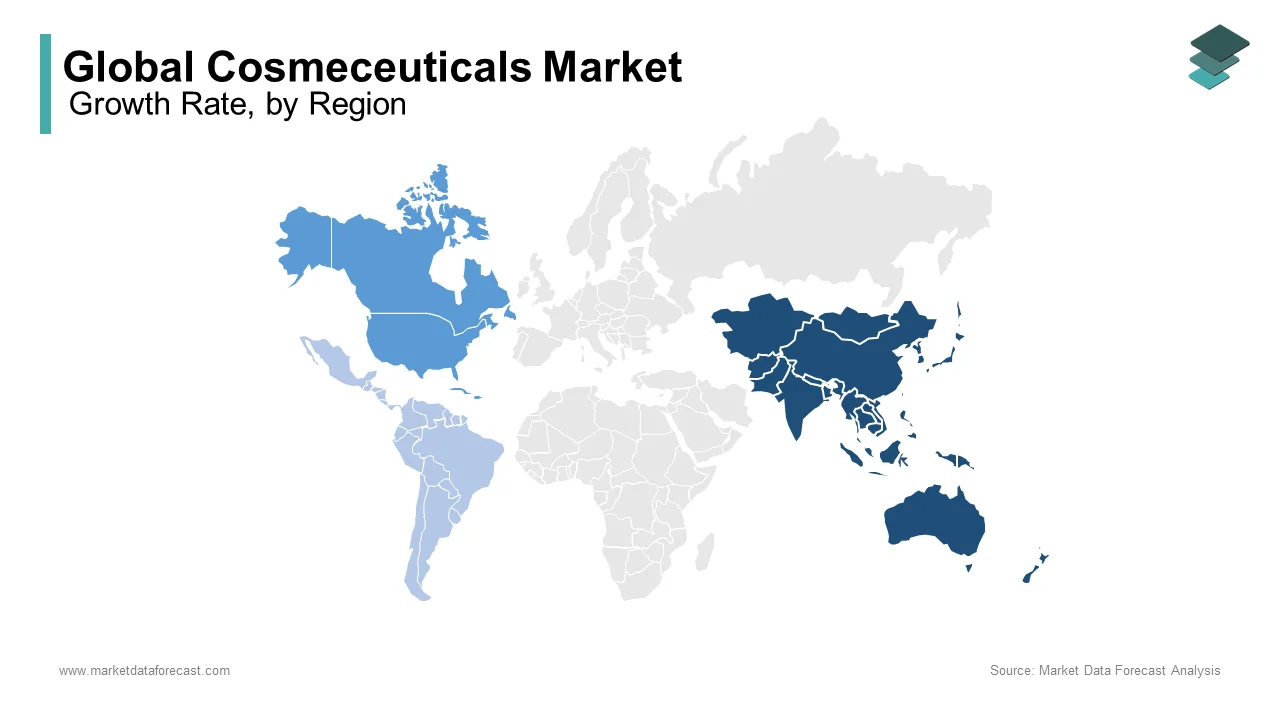

Asia-Pacific dominated the cosmeceuticals market by holding 40.7% of the global market share in 2024. The high demand for anti-aging and skin-lightening products in countries like China, Japan, and South Korea is one of the key factors propelling the cosmeceuticals market in the Asia-Pacific region. The Food and Agriculture Organization (FAO) studies shows that over 60% of Asian consumers prioritize skincare with urbanization and pollution. Additionally, rising disposable incomes and a growing middle class have increased accessibility to premium products. Asia-Pacific’s leadership underscores its role as a hub for innovation with brands focusing on clean beauty and sustainable formulations to cater to eco-conscious consumers.

North America and Europe are expected to maintain steady growth in the cosmeceuticals market which is driven by high consumer awareness of skin health and a strong preference for premium, scientifically-backed products. The U.S. Food and Drug Administration (FDA) predicts an annual growth rate of approximately 5% in these regions, supported by the rising popularity of clean beauty trends and eco-friendly formulations. European consumers, in particular, prioritize transparency and sustainability, with the European Environment Agency (EEA) reporting that over 70% of buyers prefer products with biodegradable packaging. Stringent regulatory frameworks in these regions ensure product safety which will leverage the trust among consumers.

In Latin America, the market is poised for moderate expansion is fueled by cultural preferences for natural ingredients like aloe vera and argan oil. The Food and Agriculture Organization (FAO) highlights that local sourcing of raw materials has reduced production costs by making cosmeceuticals more affordable for price-sensitive consumers. Additionally, increasing urbanization and disposable incomes in countries like Brazil and Mexico are driving demand for anti-aging and sun protection products.

The Middle East and Africa cosmeceuticals market is likely to have huge growth opportunities as governments promote local manufacturing to meet regional needs. For instance, the African Development Bank notes that investments in dermatology clinics and beauty salons are bridging gaps in accessibility, particularly in rural areas. Similarly, e-commerce platforms are playing a pivotal role in connecting underserved populations with global brands with steady growth across all regions.

KEY MARKET PLAYERS

Notable players operating in the global cosmeceuticals market profiled in this report are L'Oréal S.A., Johnson & Johnson Services, Inc., Procter & Gamble (P&G), Unilever PLC, Beiersdorf AG, Shiseido Company, Limited, Estée Lauder Companies Inc., Avon Products, Inc., Amorepacific Corporation, Bioderma (Naos Group), and Others.

LEADING PLAYERS IN THE MARKET

L'Oréal S.A.

L'Oréal is a global leader in the cosmeceuticals market, known for its diverse portfolio of brands such as La Roche-Posay, Vichy, and SkinCeuticals. These brands cater to a wide range of skin concerns, including aging, hydration, and sun protection. The company invests heavily in research and development to create scientifically-backed formulations that meet high safety standards. L'Oréal has a strong global presence, with its products available in numerous countries. The company has also embraced e-commerce platforms to connect with younger consumers and expand its reach. Additionally, L'Oréal has made significant strides in sustainability, committing to environmentally-friendly practices that resonate with modern consumers.

Johnson & Johnson Services, Inc.

Johnson & Johnson is a major player in the cosmeceuticals market, primarily through its subsidiaries like Neutrogena and Aveeno. These brands are well-regarded for their dermatologist-tested formulations targeting issues such as acne, sun damage, and sensitive skin. The company adheres to strict regulatory standards to ensure product safety and efficacy, earning consumer trust worldwide. Johnson & Johnson collaborates with healthcare professionals to promote its products, particularly in regions like North America and Europe. The company has also aligned itself with clean beauty trends, focusing on transparency and eco-friendly practices to appeal to environmentally-conscious buyers.

Procter & Gamble (P&G)

Procter & Gamble is a key contributor to the cosmeceuticals market, with popular brands like Olay and SK-II leading its portfolio. Olay is widely recognized for its anti-aging and skin-rejuvenation products, which use advanced ingredients like niacinamide and retinol. P&G leverages cutting-edge technologies, such as AI-driven skincare tools, to enhance consumer engagement and provide personalized recommendations. The company has expanded its presence in emerging markets by adopting localized strategies and offering affordable options. P&G’s commitment to sustainability, including the use of eco-friendly packaging, has strengthened its reputation among environmentally aware consumers, further solidifying its position in the industry.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Focus on Research and Development (R&D)

Leading companies like L'Oréal and Johnson & Johnson invest heavily in R&D to develop advanced formulations with clinically-proven These innovations cater to evolving consumer needs, such as anti-aging solutions, sun protection, and sensitive skin care. By prioritizing science-backed products, these players enhance credibility and differentiate themselves in a competitive market.

Expansion into Emerging Markets

Companies are aggressively targeting high-growth regions like Asia-Pacific, Latin America, and Africa. For example, Procter & Gamble has introduced affordable product lines tailored to local preferences in these markets. This strategy helps brands tap into underserved populations and capitalize on rising disposable incomes.

Adoption of Clean Beauty Trends

To align with consumer demand for sustainability, key players are incorporating natural, eco-friendly ingredients into their formulations. Brands like L'Oréal and Unilever emphasize transparency in ingredient sourcing and promote recyclable packaging, appealing to environmentally-conscious

Leveraging E-commerce and Digital Platforms

The rise of online shopping has prompted companies to strengthen their digital presence. L'Oréal and Estée Lauder have invested in e-commerce platforms and social media marketing, collaborating with influencers to engage younger audiences. AI-driven tools for personalized skincare analysis further enhance customer experience.

Strategic Acquisitions and Partnerships

Acquisitions have been a critical growth strategy. For instance, Shiseido acquired clean beauty brands to expand its portfolio, while Johnson & Johnson partnered with dermatologists to promote its medical-grade skincare products. These moves help companies diversify offerings and enter niche markets.

Emphasis on Dermatologist-Recommended Products

Brands like La Roche-Posay and CeraVe focus on gaining endorsements from dermatologists to build trust. This strategy is particularly effective in regions like Europe and North America, where consumers prioritize safety and efficacy.

Sustainability Initiatives

Companies are adopting sustainable practices to meet regulatory standards and consumer expectations. For example, Unilever has committed to reducing plastic waste, while L'Oréal aims for carbon neutrality. These efforts enhance brand reputation and foster long-term loyalty.

Localized Marketing and Product Customization

To address regional preferences, players like Amorepacific and Beiersdorf tailor their products and campaigns. For instance, Amorepacific focuses on brightening solutions popular in Asia, while Beiersdorf emphasizes affordability in emerging markets.

Focus on Anti-Aging and Preventive Skincare

With aging populations in developed regions, companies are expanding their anti-aging portfolios. Advanced formulations targeting wrinkles and fine lines are marketed as preventive solutions, appealing to younger demographics.

Regulatory Compliance and Transparency

Adhering to stringent regulations ensures consumer trust. Companies like Johnson & Johnson and Procter & Gamble comply with global standards, ensuring their products meet safety requirements while maintaining transparency in labeling and claims.

COMPETITIVE LANDSCAPE

The cosmeceuticals market is a vibrant battleground where science meets beauty, and innovation is the ultimate weapon. Giants like L'Oréal, Johnson & Johnson, and Procter & Gamble lead the charge, armed with cutting-edge formulations and dermatologist-approved solutions that cater to everything from wrinkles to sun damage. These companies aren’t just selling products—they’re selling trust, backed by rigorous testing and transparent ingredient lists. Meanwhile, smaller players are rewriting the rules, using AI-driven tools and hyper-personalized offerings to carve out their niche in this ever-evolving industry.

But it’s not just about what’s inside the bottle—it’s also about the story around it. Sustainability has become the new luxury, with eco-friendly packaging and clean ingredients taking center stage. Brands that fail to adapt risk being left behind as consumers increasingly vote with their wallets for ethical practices. The rise of e-commerce has leveled the playing field, allowing boutique brands to shine alongside industry titans.

Regionally, the competition heats up differently. Asia-Pacific is obsessed with glowing skin, while Africa and the Middle East are embracing affordable yet effective solutions. In this high-stakes arena, success belongs to those who can blend science, sustainability, and storytelling into a product that feels as good as it works.

RECENT MARKET DEVELOPMENTS

- In March 2022, L'Oréal, a global cosmetics leader, launched a new line of clean beauty products under its Vichy brand. This launch is anticipated to allow L'Oréal to cater to the growing demand for sustainable skincare solutions and strengthen its market presence among eco-conscious consumers.

- In June 2021, Johnson & Johnson, a healthcare giant, acquired a Korean skincare startup specializing in anti-aging solutions. This acquisition is anticipated to allow Johnson & Johnson to expand its portfolio in the Asian market and strengthen its position as a leader in innovative skincare technologies.

- In January 2023, Procter & Gamble, a consumer goods company, partnered with dermatologists to promote its Olay Regenerist This partnership is anticipated to allow Procter & Gamble to enhance credibility and appeal to health-conscious consumers, reinforcing its leadership in science-backed skincare.

- In September 2022, Unilever, a multinational corporation, introduced refillable packaging for its Dove DermaSeries This initiative is anticipated to allow Unilever to position itself as a sustainability leader while addressing environmental concerns and strengthening its market presence.

- In November 2021, Shiseido, a Japanese beauty brand, launched an AI-powered skincare app to offer personalized product recommendations. This innovation is anticipated to allow Shiseido to improve customer engagement and differentiate itself through technology-driven solutions.

- In April 2023, Estée Lauder, a luxury skincare company, invested $50 million in biotech research for advanced anti-aging formulations. This investment is anticipated to allow Estée Lauder to solidify its leadership in premium skincare through cutting-edge scientific advancements.

- In July 2022, Beiersdorf, a skincare company, expanded its NIVEA MEN line to include cosmeceutical-grade products. This expansion is anticipated to allow Beiersdorf to target the growing male grooming segment and diversify its offerings, capturing a broader audience.

- In February 2023, Amorepacific, a South Korean beauty brand, launched a campaign promoting traditional Korean ingredients in its Sulwhasoo This campaign is anticipated to allow Amorepacific to highlight cultural heritage and appeal to global consumers interested in K-beauty trends.

- In December 2022, Bioderma, a French skincare brand, introduced a subscription-based model for its Sensibio skincare range. This approach is anticipated to allow Bioderma to increase customer retention and create a steady revenue stream while enhancing convenience for users.

- In August 2022, Avon Products, a beauty company, collaborated with influencers to promote its Anew skincare line on social media platforms. This collaboration is anticipated to allow Avon to boost brand visibility and attract younger audiences through strategic digital marketing efforts.

MARKET SEGMENTATION

This research report on the global cosmeceuticals market has been segmented and sub-segmented based on the product type, distribution channel, and region.

By Product Type

- Skin Care

- Hair Care

- Oral Care

By Distribution Channel

- Supermarket/Hypermarkets

- Specialist Stores

- Other Distribution Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the cosmeceuticals market worldwide in 2024?

The global cosmeceuticals market size was valued at USD 65.51 billion in 2024.

Which are the significant players operating in the cosmeceuticals market ?

Unilever PLC, Shiseido Co. Ltd, Revlon Inc., Groupe Clarins SA, Beiersdorf AG, Johnson & Johnson Inc. are some of the significant players operating in the cosmeceuticals market.

At What CAGR, the global cosmeceuticals market is expected to grow from 2025 to 2033?

The global cosmeceuticals market is estimated to grow at a CAGR of 6.02% from 2025 to 2033.

Which region is growing the fastest in the global cosmeceuticals market ?

Geographically, the North American cosmeceuticals market accounted for the largest share of the global market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]