Global Cooking Oils And Fats Market Size, Share, Trends, & Growth Forecast Report - Segmented By Form (Liquid, Solid), Source, and Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Cooking Oils and Fats Market Size

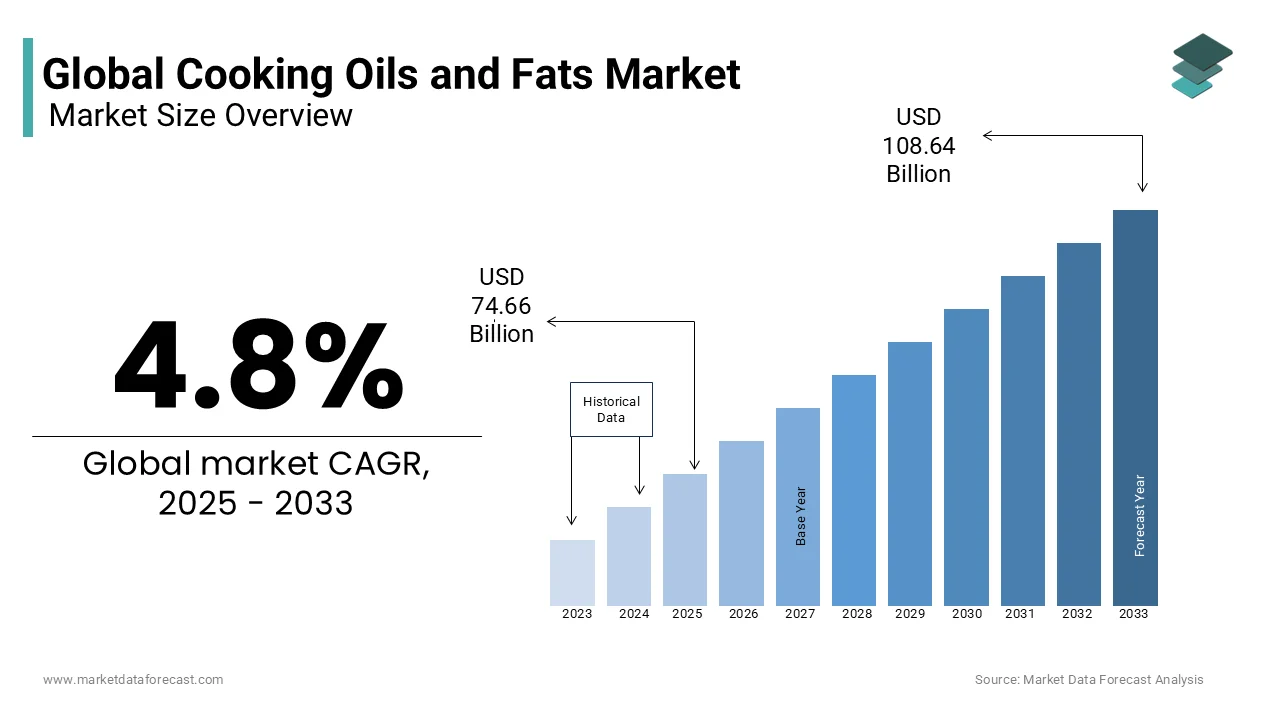

The Global Cooking oils and fats market size was valued at USD 71.24 billion in 2024, and the global market size is expected to reach USD 108.64 billion by 2033 from USD 74.66 billion in 2025. The market's promising CAGR for the predicted period is 4.8%.

MARKET OVERVIEW

Significant shifts in the competitive position of major vegetable oils have significant cost implications and may pose a danger to specific food products. In this setting, several legislations are putting pressure on the global vegetable oil market, particularly in the United States. Due to the use of misleading terminology like vegetable fats or vegetable oils,' there is a high degree of anonymity in the specific amount of the food ingredients. As a result, the ingredient's specific content and role in the entire formulation are unknown. New regulations requiring the labeling of trans-fatty acid levels in foods are putting pressure on manufacturers to use different formulations to make hydrogenated oils, which is driving up demand for oils as a trans-fat substitute. Only canola, safflower, sunflower, corn, soybean, or peanut oil may be used in a product labeled as "vegetable oil margarine" in the United States. There are no such restrictions on products that are not labeled as "vegetable oil margarine." Consumers will be more aware of the risks associated with foods containing Trans fats as a result of new regulations, forcing them to seek out suitable alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, Application, Source, Form, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Associated British Foods PLC (UK), Archer Daniels Midland Company (ADM) (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co., Inc. (Japan), Mewah International Inc. (Singapore), ConAgra Brands, Inc, Cargill Inc., |

SEGMENTAL ANALYSIS

By Type Insights

The market for fats and oils has been driven by considerations such as health benefits, ease of availability, and cost-effectiveness. Palm oil has dominated the vegetable oil market because it is readily available and offers substantially higher stability than other oils.

By Application Insights

In the global market, the domestic type sub-segment is expected to hold a dominant market share. During the projection period, the sub-segment is expected to generate $1,16,859.5 billion in sales. The demand for cooking oil in domestic use is predicted to rise as branded cooking oil becomes more popular for cooking and baking. Furthermore, market actors use methods to stay competitive. For example, in May 2021, the Adani Group, an Indian global conglomerate, announced the launch of a mobile application that will allow clients to order cooking oils under the Fortune brand online from the comfort of their own homes. These variables could help the sub-segment grow faster during the forecast period.

The fastest-growing category of the global cooking oil market is expected to be the food outlets subcategory. By2027, it is expected to have grown to $69,182.5 billion, up from $47,152.6 billion in 2021. The rise in the number of fast-food establishments and restaurants can be ascribed to the market's growth. Additionally, rising disposable incomes and living standards may hasten the trend of eating outside. All of these factors may raise demand for food services and accelerate industry expansion.

By Source Insights

Sunflower, rapeseed, soybean, palm, cottonseed, and coconut vegetable oils are widely used in food applications, which has pushed the market for oils sourced from vegetables. Products which have low fat, cholesterol, and calorie features associated with vegetable oils are gaining popularity in the market. The market for vegetable oils has also been driven by the multitude of uses of vegetable oils in food as well as other industries such as pleo-chemicals, animal feed, and energy and biomass.

By Form Insights

Fats and oils in liquid form are expected to dominate the market. However, the physical characteristics of fats and oils are influenced by a variety of factors such as degree of unsaturation, parent carbon chain length, isomeric forms of fatty acids, molecular configuration, and processing variables, but liquid oils are thought to be more unsaturated and thus preferred by consumers.

REGIONAL ANALYSIS

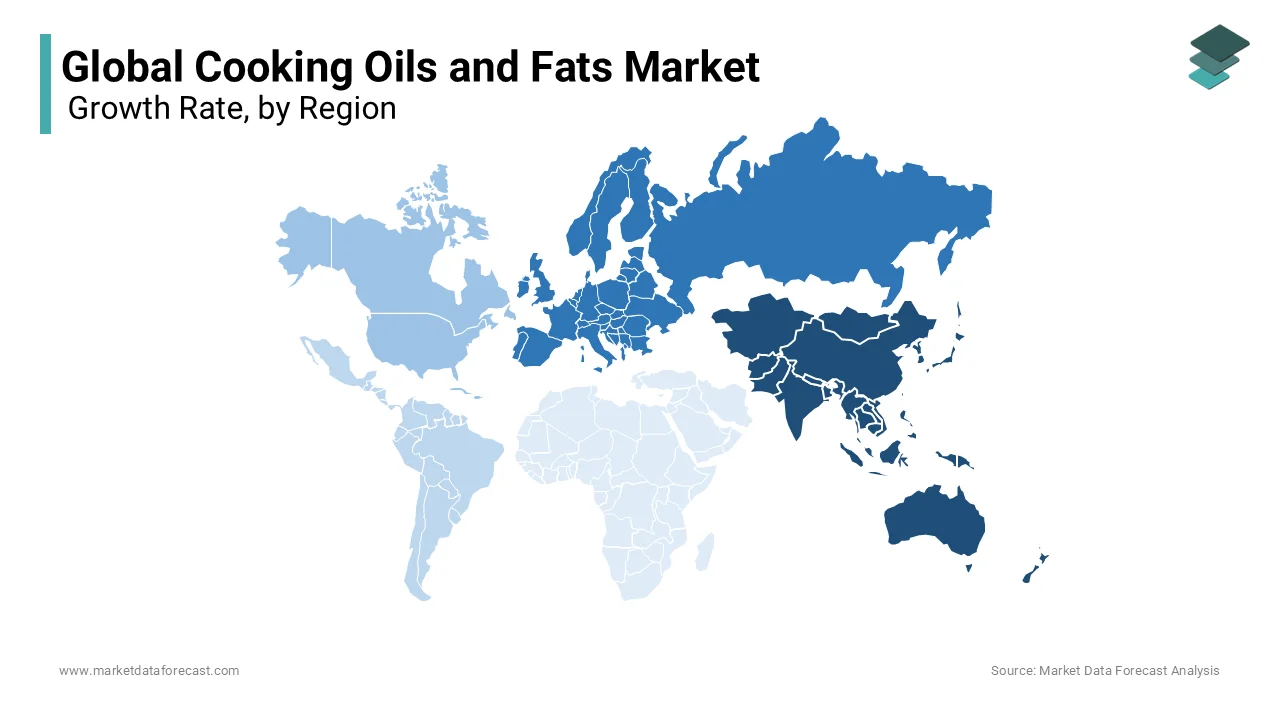

Over the period 2025 to 2033, Cooking fats and oils are expected to expand at the quickest rate in the Asia Pacific area. Two important palm and palm kernel oil-producing countries, Malaysia and Indonesia are located in the region, as are two large fats and oils-consuming countries,

China and India. Becoming one of the major reasons why the Asia-Pacific region has the biggest and most aggressive-growing fats and oils industry in the world. By 2033, the Canadian market is predicted to grow by more than 4%. Over the projection period, rising investment in the construction industry will increase technology demand.

Europe is the second-largest market, and it has experienced tremendous growth in recent years as a result of consumers' growing health consciousness and desire for organic and label-claimed cooking oils.

The United Kingdom, France, and Germany, among others, import premium sunflower, rapeseed, olive, and other oils that have an adequate quantity of unsaturated fats to enable producers sell these oils based on these features, resulting in a stronger brand positioning and sales growth. Peanut oil's commercial possibility in Europe is transitioning from a mainstream to a niche market. Because of their health benefits and textural qualities, cold-pressed oils, virgin oils, and baking oils have a lot of potential in France. The presence of rules governing the sale of edible oil across the European Union, which ensures that customers have access to high-quality products, has aided in the growth of the industry in the region.

Due to increased demand for various processed and ready-to-serve foods and rising per capita consumption of edible oils, North America is expected to have considerable growth possibilities in the cooking oil market.

High per capita income and highly advanced techniques utilized by top players in production boost the industry. For example, thanks to an investment in new technology for vegetable oil containers to upgrade old equipment and optimize the processes of its crushing and refining plants, Cargill Inc. has decreased the use of 930,000 pounds of plastic in packaging annually. Low-calorie, cholesterol-free oils have been promoted by public health officials because of their naturally low saturated fatty acids, which aid to reduce cardiovascular disease, and enhance digestion, and metabolism. Customers that are well-educated prefer healthy, organic, and nutritious products, which is predicted to drive the market.

South America is predicted to develop significantly as a result of rising health awareness as a result of rising health-related issues such as high blood hypertension, obesity, and diabetes, which has fueled the demand for antioxidant-rich, mineral-rich, and vitamin-rich oils. Furthermore, the market is expected to be driven by the region's rising palm oil farming and its use in a variety of end-user industries.

KEY MARKET PLAYERS

key players in cooking oils & fats market are Associated British Foods PLC (UK), Archer Daniels Midland Company (ADM) (US), Bunge Limited (US), Wilmar International Limited (Singapore), United Plantations Berhad (Malaysia), Unilever PLC (UK), Ajinomoto Co., Inc. (Japan), Mewah International Inc. (Singapore), ConAgra Brands, Inc, Cargill Inc.,

RECENT HAPPENINGS IN THE MARKET

-

Cargill announced plans to establish a new $200 million palm oil refinery in Indonesia in order to speed up its efforts to develop a sustainable palm supply chain and provide consumers with verified deforestation-free goods.

-

ADM planned to construct the world's first specialized soybean crusher and refinery in the United States to address rising demand from food, feed, industrial, and biofuel customers, including renewable diesel makers.

-

Richardson International has bought Conagra Food Inc.'s Wesson Oil brand, which is a well-known edible oil brand in the United States. Vegetable oils, canola oils, corn oils, and mixed oils are among the products available, which might help Richardson gain a solid presence in the North American market.

MARKET SEGMENTATION

This research report on the global Cooking Oils and Fats Market has been segmented and sub-segmented based on type, application, source, form & region.

By Type

-

Vegetable Oils

-

Palm Oil

-

Soybean Oil

-

Rapeseed Oil

-

Sunflower Oil

-

Olive Oil

-

Fats

By Application

-

Food (Domestic)

-

Industry

By Source

-

Vegetables

-

Animals

By Form

-

Liquid

-

Solid

By Region

-

North America

-

Latin America

-

Europe

-

Asia Pacific

-

Middle East and Africa

Frequently Asked Questions

1.How should cooking oils be stored to maintain their freshness?

Consider factors such as smoke point (the temperature at which the oil starts to smoke), flavor, nutritional profile (e.g., saturated vs. unsaturated fats), and intended use (e.g., frying, baking, salad dressing).

2.What factors should I consider when choosing a cooking oil or fat?

Some oils, such as coconut oil and olive oil, have moisturizing properties and are used in skincare products. However, it's essential to choose oils suitable for the intended purpose and skin type, as some may cause irritation or clog pores.

3.Can cooking oils be used for skincare or other non-culinary purposes?

Yes, there is increasing demand for sustainably sourced cooking oils, with certifications such as RSPO (Roundtable on Sustainable Palm Oil) for palm oil and Fair Trade for various oils. Consumers can look for labels indicating sustainable sourcing practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]