Global Conveyor Systems Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Roller, Flat Belt, Wheel, Vertical, and Others (Pneumatic and others)), Location, Load, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Conveyor Systems Market Size

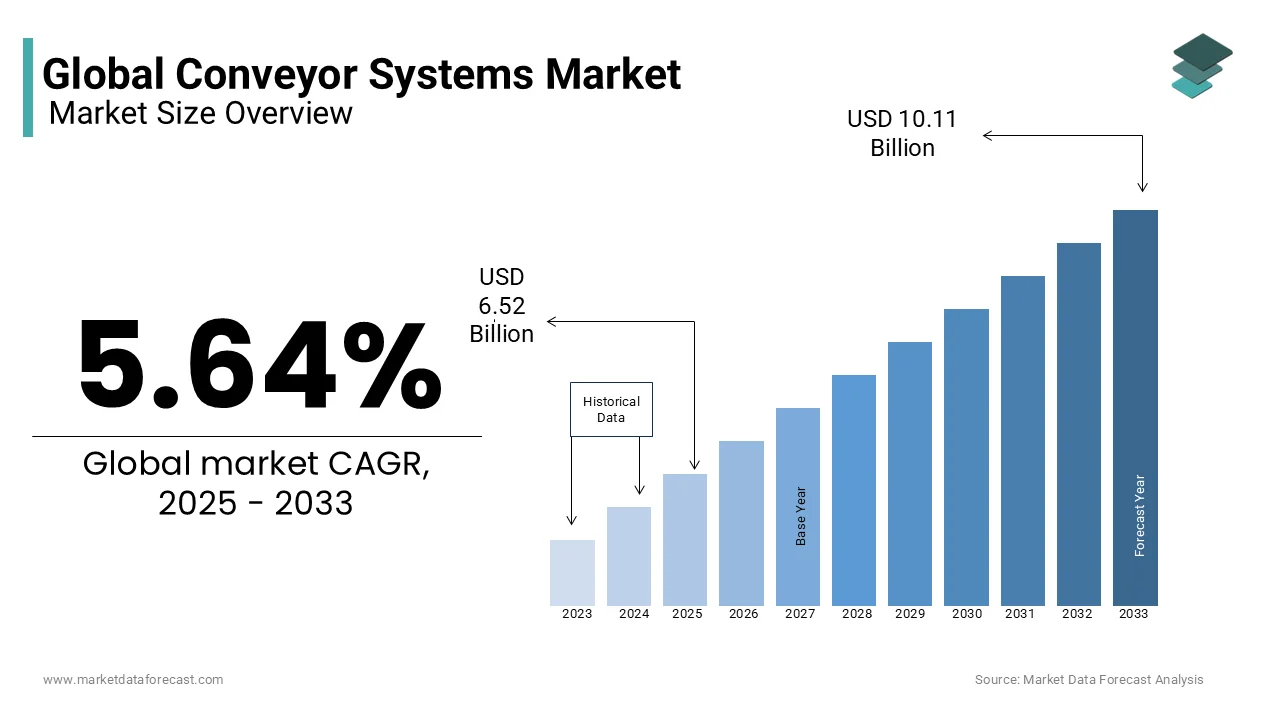

The global conveyor systems market was worth USD 6.17 billion in 2024. The global market is projected to reach USD 10.11 billion in 2033 from 6.52 billion in 2025, growing at a CAGR of 5.64% from 2025 to 2033.

A conveyor system is a mechanical handling apparatus designed to transport materials, products, or goods from one point to another within an industrial or commercial environment. These systems are widely used across multiple industries, including manufacturing, logistics, food processing, mining, and pharmaceuticals.

The demand for conveyor systems has surged due to their integration with modern industrial automation and digitalization efforts. According to the International Federation of Robotics (IFR), global industrial robot installations reached 517,385 units in 2023, highlighting the increasing reliance on automation in material handling and logistics. In warehouses and distribution centers, automation solutions, including conveyor systems, have helped improve efficiency, with reports indicating that automated logistics can increase productivity by up to 30% while reducing operational costs. Additionally, conveyor systems contribute significantly to workplace safety. The Occupational Safety and Health Administration (OSHA) states that automated material handling systems have reduced workplace injuries related to lifting and manual transport by up to 50% in industries that implement them.

As industries continue to adopt smart technologies, conveyor systems are evolving with features such as IoT-enabled predictive maintenance, AI-driven efficiency improvements, and energy-efficient motors, ensuring sustainability and long-term cost savings. With the increasing focus on automation and industrial optimization, conveyor systems remain an indispensable component of modern production and logistics infrastructure.

MARKET DRIVERS

Adoption of Automation and Artificial Intelligence

The integration of automation and artificial intelligence (AI) in material handling processes is a significant driver in the conveyor systems market. Automation technologies, such as AI-driven robotics, enhance operational efficiency by performing repetitive tasks with precision, thereby reducing human error and increasing productivity. A study by the McKinsey Global Institute indicates that automation could raise productivity growth globally by 0.8 to 1.4 percent annually. These advancements underscore the pivotal role of automation and AI in transforming industries and driving the demand for sophisticated conveyor systems.

Enhancement of Workplace Safety

Improving workplace safety is another critical factor propelling the adoption of conveyor systems. Manual material handling poses significant risks, including musculoskeletal injuries and accidents. The Health and Safety Executive (HSE) reported that, in 2023/24, there were 604,000 self-reported non-fatal workplace injuries in Great Britain. Implementing automated conveyor systems minimizes direct human involvement in hazardous tasks, thereby reducing the incidence of such injuries. Consequently, industries are increasingly investing in conveyor systems to enhance safety protocols and comply with stringent occupational health regulations.

MARKET RESTRAINTS

High Maintenance and Downtime Costs

The operational expenses associated with conveyor systems, particularly maintenance and unplanned downtimes, pose significant challenges for industries. Regular maintenance is essential to ensure optimal performance and prevent unexpected breakdowns. However, the costs can be substantial. For instance, planned maintenance services typically range between €500 to €1,000 per session, whereas emergency repairs can escalate to €2,000 to €5,000, excluding the financial impact of production losses. In severe cases, a complete system failure may incur costs exceeding €10,000, not accounting for the extended downtime and its repercussions on productivity. These figures underscore the financial burden industries face in maintaining conveyor systems and the imperative need for efficient maintenance strategies to mitigate unforeseen expenses.

Workplace Safety Concerns

Conveyor systems, while integral to automation and efficiency, present notable safety hazards if not properly managed. In the food and drink industries, conveyors are involved in approximately 30% of all machinery-related injuries, more than any other class of machinery. Alarmingly, 90% of these injuries occur on flat belt conveyors, with common incidents involving in-running nips, transmission parts, and trapping points between moving and fixed components. Furthermore, a significant portion of these injuries9 i.e. 90% happen during routine operations such as production activities, clearing blockages, and general cleaning. These statistics highlight the critical need for stringent safety protocols, regular training, and the implementation of protective measures to safeguard workers from the inherent risks associated with conveyor systems.

MARKET OPPORTUNITIES

Integration of Advanced Automation Technologies

The integration of advanced automation technologies, such as artificial intelligence (AI) and robotics, presents a significant opportunity for the conveyor systems market. These technologies enhance operational efficiency by performing repetitive tasks with precision, reducing human error, and increasing productivity. A report by the UK Parliament's Business, Energy and Industrial Strategy Committee reported that automation has been a key contributor to labour productivity growth across various sectors, including manufacturing and services. This trend underscores the potential for conveyor systems integrated with advanced automation to revolutionize material handling processes, leading to improved efficiency and competitiveness in the global market.

Reduction of Workplace Injuries Through Automation

Implementing automated conveyor systems can significantly reduce workplace injuries associated with manual material handling. According to the Health and Safety Executive (HSE) in Great Britain, an estimated 604,000 workers sustained non-fatal injuries in 2023/24, with manual handling being a leading cause. The HSE emphasizes that automation can mitigate such risks by minimizing the need for manual lifting and carrying, thereby enhancing worker safety. By adopting automated conveyor solutions, industries can not only improve operational efficiency but also foster a safer working environment, potentially reducing the economic burden associated with workplace injuries, which the HSE estimates cost £21.6 billion in 2022/23.

MARKET CHALLENGES

Integration Complexities

Implementing conveyor systems often involves integrating diverse mechanical, electronic, and software components, which can present significant challenges. These systems require seamless interfacing of various subsystems, such as belt and roller drives, programmable logic controllers (PLCs), human-machine interfaces (HMIs), and safety sensors. The complexity of ensuring compatibility and robust communication between these components necessitates extensive engineering expertise. According to industry analyses, manufacturers face difficulties in troubleshooting interconnectivity issues and achieving cohesive system integration, which can impede the efficient deployment of conveyor solutions. This complexity underscores the need for standardized protocols and skilled personnel to manage the intricate integration processes inherent in modern conveyor systems.

High Initial Investment

The adoption of advanced conveyor systems entails substantial initial capital expenditure, which can be a significant barrier, especially for small and medium-sized enterprises (SMEs). These costs encompass not only the procurement of equipment but also expenses related to installation, system integration, and necessary infrastructure modifications. While automation and smart technologies embedded in modern conveyor systems promise long-term operational savings, the upfront investment required can be prohibitive. This financial challenge may deter SMEs from implementing such systems, potentially limiting their operational efficiency and competitiveness in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.64% |

|

Segments Covered |

By Type, Location, Load, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dürr Group (Germany), ATS Automation Tooling Systems Inc. (Canada), Daifuku Co., Ltd. (Japan), Viastore SYSTEMS GmbH (Germany), TOYOTA INDUSTRIES CORPORATION (Japan), FlexLink (Sweden), KION GROUP AG (Germany), ERIKS North America, Inc (U.S.), Taikisha Ltd. (Japan), and Conveyor Systems Ltd (England). |

SEGMENTAL ANALYSIS

By Type Insights

The roller segment dominated the market by occupying a share of 35.2% in the global market in 2024. The cost-effectiveness, with installation costs being 15-20% lower than alternatives like flat belts, as noted by the Material Handling Industry (MHI). The U.S. Department of Energy reported that roller systems improve energy efficiency by 25% compared to pneumatic systems, making them ideal for high-volume industries like e-commerce and automotive. With global e-commerce sales projected to reach $6.3 trillion by 2024 (Statista), rollers play a pivotal role in streamlining logistics. Their robust design ensures durability, often lasting over 10-12 years, minimizing maintenance costs.

The vertical segment is estimated to record a CAGR of 8.2% over the forecast period. The growth of vertical segment is expected to be fuelled by urbanization trends, the United Nations projects that 68% of the global population will live in urban areas by 2050, increasing demand for space-efficient solutions. According to the International Labour Organization (ILO), vertical systems reduce material handling time by 30%, enhancing operational efficiency. Industries such as pharmaceuticals benefit significantly, as these systems optimize multi-story warehouses by reducing floor space usage by 40-50%. The rise of smart warehouses further accelerates adoption. Vertical conveyors are thus critical for modernizing logistics infrastructure.

By Location Insights

The on-floor segment led the market by accounting for 45.7% share of the global market in 2024. The growth of the on-floor segment is majorly driven by their versatility and cost-effectiveness. The U.S. Occupational Safety and Health Administration (OSHA) reported that on-floor systems reduce workplace injuries by 25%, making them ideal for industries like manufacturing and logistics. With global warehouse automation investments reaching $31 billion in 2022, these systems are critical for optimizing ground-level operations. Their robust design ensures durability, often lasting over 10-12 years, minimizing downtime and maintenance.

The overhead segment is predicted to showcase the highest CAGR of 8.7% over the forecast period owing to the increasing demand for space optimization; the United Nations projects urbanization will reach 68% globally by 2050, pushing industries to adopt vertical solutions. According to the International Labour Organization (ILO), overhead systems improve operational efficiency by reducing material handling time by 30%, enhancing productivity. Industries like automotive benefit significantly, as these systems optimize floor space by 35-40%, enabling efficient workflows.

By Load Insights

The unit load segment commanded the market by holding a 60.9% share of the global market in 2024. The adaptability of unit load in handling discrete items like packages and pallets that are critical for industries such as e-commerce and manufacturing is majorly driving the expansion of the unit load segment in the global market. The U.S. Census Bureau reports that e-commerce sales reached $975 billion in 2022 and is fuelling demand for precise material handling solutions. According to the Material Handling Industry (MHI), unit load systems reduce labour costs by 20-25%, while improving operational efficiency.

The bulk load segment is projected to progress at the highest CAGR of 7.5% over the forecast period owing to the rising demand in industries like mining, agriculture, and food processing, where bulk material handling is essential. The Food and Agriculture Organization (FAO) states that global food production must increase by 50% by 2050 to meet population demands, driving adoption of efficient bulk handling systems. According to the International Labour Organization (ILO), bulk load systems reduce material wastage by 15-20%, enhancing productivity.

By Application Insights

The supply chain and logistics segment ruled the conveyor systems market by holding of 30.3% of the global market share in 2024 due to the rapid growth of e-commerce, with global online retail sales reaching $5.7 trillion in 2022, according to the U.S. Department of Commerce. Conveyor systems reduce order processing time by 30%-40%, enhancing efficiency, as noted by the Material Handling Industry (MHI). The rise of smart warehouses, valued at $31 billion globally in 2022, further drives adoption. With urbanization increasing demand for fast delivery, these systems are critical for optimizing material flow and reducing operational costs, ensuring timely deliveries.

The food and beverages segment is anticipated to showcase the highest CAGR of 8.2% over the forecast period. The growth of food and beverages segment is majorly fueled by rising global food demand; the Food and Agriculture Organization (FAO) projects food production must increase by 50% by 2050 to meet population needs. Conveyor systems in this sector reduce contamination risks by 20-25%, ensuring compliance with stringent safety standards, as highlighted by the World Health Organization (WHO). Automation investments in food processing reached $20 billion in 2022, driving adoption. These systems streamline operations, improve hygiene, and enhance productivity, making them indispensable for modern food manufacturing.

REGIONAL ANALYSIS

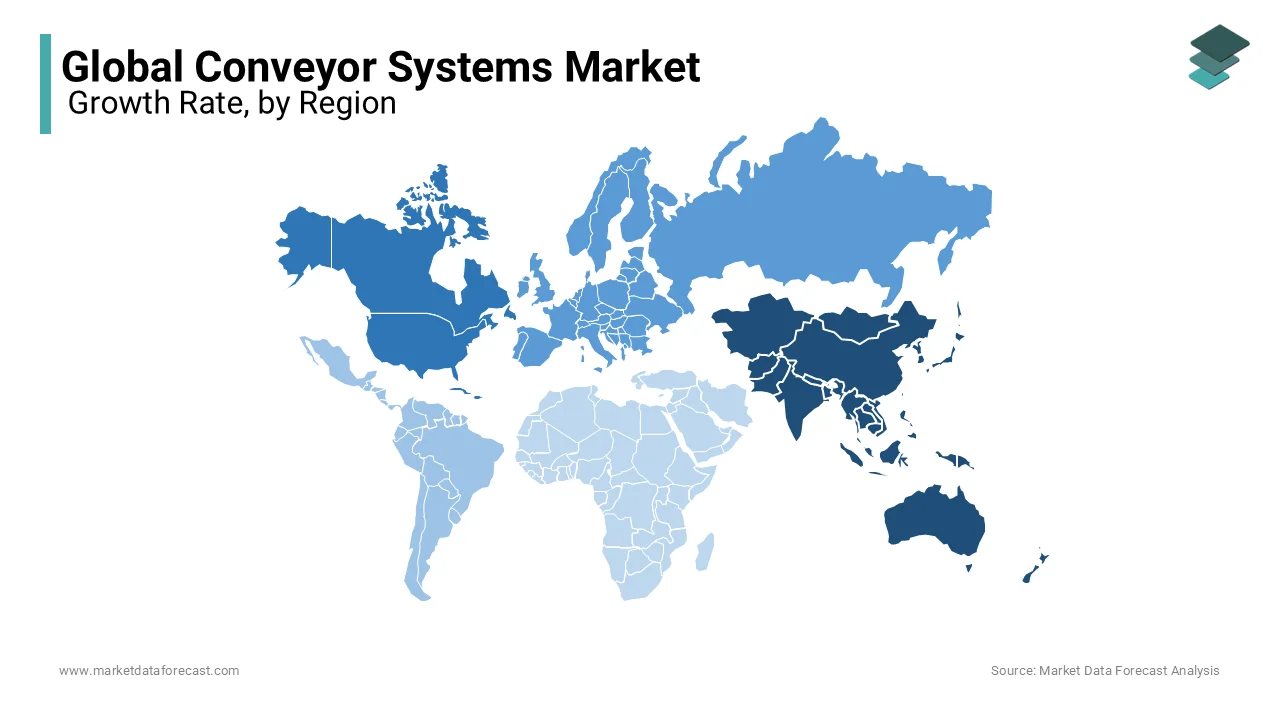

The Asia-Pacific region led the global conveyor systems market by accounting for 34.08% of the market share in 2024. The domination of Asia-Pacific in the global market is primarily due to rapid industrialization and the expansion of manufacturing sectors in countries such as China, India, and Japan. The region's burgeoning e-commerce industry has also significantly increased the demand for efficient material handling solutions. For instance, China's online retail sales reached approximately USD 2.3 trillion in 2020, highlighting the need for advanced conveyor systems in warehousing and distribution centers. Additionally, government initiatives promoting automation and smart manufacturing further bolster the adoption of conveyor technologies across various industries.

North America is projected to experience significant growth in the conveyor systems market and is predicted to progress at a CAGR of 9.57% over the forecast period. Factors such as the increasing adoption of automation and advanced technologies in manufacturing and warehousing sectors is boosting the conveyer systems market in North America. The U.S. manufacturing industry, for example, contributed approximately USD 2.3 trillion to the country's GDP in 2020, underscoring the sector's significance. Furthermore, the rise of e-commerce has necessitated the implementation of efficient material handling systems to manage high order volumes. The U.S. Census Bureau reported that e-commerce sales in the country reached USD 870 billion in 2021, reflecting a 14.2% increase from the previous year. These factors collectively enhance the demand for conveyor systems in the region.

Europe holds a significant position in the conveyor systems market which is largely due to its robust manufacturing sector. According to Eurostat, the manufacturing sector employed approximately 29.7 million individuals in 2021, contributing to 19% of the EU's business economy employment. This substantial industrial base drives the demand for efficient material handling solutions, including conveyor systems. Additionally, the automotive industry is a key contributor, with the European Commission noting that the sector provides direct and indirect jobs to 13.8 million Europeans, representing 6.1% of total EU employment. The emphasis on automation and advanced manufacturing technologies further propels the adoption of conveyor systems across various industries in the region.

In Latin America, the conveyor systems market is anticipated to experience steady growth, primarily driven by the expanding food and beverage industry. The Associação Brasileira da Indústria de Alimentos (ABIA) reported that the Brazilian food and beverage sector achieved a 0.8% increase in revenue and a 2.7% rise in physical production in the first half of 2020 compared to the same period the previous year. This growth underscores the need for advanced material handling solutions to enhance operational efficiency and meet rising consumer demand. As the region continues to industrialize and invest in infrastructure development, the adoption of conveyor technologies in sectors such as mining and manufacturing is expected to rise.

The Middle East and Africa region is poised for moderate growth in the conveyor systems market, driven by infrastructural developments and the expansion of the mining sector. The African Development Bank reported a 4.3% growth in industrial GDP in Africa in 2019, indicating positive trends in industrial activities. As countries in this region invest in infrastructure projects and industrial expansion, the demand for efficient material handling solutions, including conveyor systems, is expected to rise. Additionally, the growth of the mining industry, particularly in resource-rich countries, necessitates the use of robust conveyor systems to streamline operations and improve safety standards.

Top 3 Players in the Market

Daifuku Co., Ltd.

Daifuku Co., Ltd., founded in 1937 and headquartered in Osaka, Japan, is a global leader in material handling solutions, including conveyor systems. The company provides a wide range of conveyor technologies, such as belt conveyors, roller conveyors, and automated storage and retrieval systems. Daifuku's solutions cater to industries like automotive, electronics, e-commerce, and aviation, enhancing operational efficiency and streamlining logistics. With a strong focus on innovation, Daifuku integrates automation, artificial intelligence, and smart logistics into its conveyor systems, helping businesses improve throughput, reduce labor costs, and enhance warehouse efficiency. Their extensive global presence and commitment to sustainability make them a dominant force in the conveyor systems market.

Dematic

Dematic, an American company headquartered in Atlanta, Georgia, is a leading provider of material handling and logistics automation solutions. A subsidiary of the KION Group since 2016, Dematic specializes in high-performance conveyor systems, automated guided vehicles (AGVs), and warehouse management software. Their conveyor solutions are widely used in industries such as retail, food and beverage, and general manufacturing, where efficiency and scalability are crucial. Dematic’s advanced technology enables businesses to optimize supply chain operations, improve inventory management, and increase automation in distribution centers. With a strong presence in North America, Europe, and Asia, Dematic continues to drive innovation in the conveyor systems industry.

Interroll Holding AG

Interroll Holding AG, established in 1959 and based in Sant'Antonino, Switzerland, is a key player in the global conveyor systems market, known for its high-quality unit-load handling solutions. The company offers an extensive portfolio, including conveyor rollers, drum motors, and crossbelt sorters, which are widely used in industries such as logistics, airport baggage handling, and manufacturing. Interroll's solutions enhance material flow efficiency and automation, helping businesses improve operational productivity and reduce downtime. The company’s focus on modular and scalable conveyor solutions allows for flexible system integration, making them a preferred choice for businesses looking to optimize their supply chain and material handling processes.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Technological Innovation and Automation

Key players in the conveyor systems market, such as Daifuku, Dematic, and Interroll, focus heavily on technological innovation and automation to enhance their product offerings. They integrate advanced technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT) into their conveyor systems to improve efficiency, predictive maintenance, and real-time monitoring. Automated conveyor solutions, such as smart roller conveyors and robotic sortation systems, are increasingly being developed to meet the growing demand for faster and more reliable logistics operations. By prioritizing innovation, these companies can offer more efficient, cost-effective, and sustainable solutions that appeal to a broad range of industries, including e-commerce, automotive, and manufacturing.

Strategic Acquisitions and Partnerships

Acquiring complementary businesses and forming strategic alliances is another major strategy employed by key players to expand their market presence. Companies like Dematic, as a subsidiary of the KION Group, have leveraged mergers and acquisitions to strengthen their global footprint and technological capabilities. Daifuku has also expanded its portfolio through acquisitions, enabling it to provide more comprehensive solutions for warehouse automation and material handling. Strategic partnerships with logistics providers, retailers, and manufacturers allow these companies to enhance their supply chain capabilities, enter new markets, and cater to a more diverse customer base.

Geographical Expansion and Market Penetration

Global expansion is a crucial strategy for leading conveyor system manufacturers. Companies such as Daifuku and Interroll are continuously increasing their presence in emerging markets, including Asia-Pacific, Latin America, and the Middle East, where industrial automation is growing rapidly. Establishing regional manufacturing plants, distribution centers, and service hubs allows these players to offer localized solutions, reduce supply chain costs, and strengthen customer relationships. This approach not only enhances their global reach but also positions them to benefit from the rising demand for automated conveyor systems in warehouses, airports, and industrial facilities worldwide.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global conveyor systems market include Dürr Group (Germany), ATS Automation Tooling Systems Inc. (Canada), Daifuku Co., Ltd. (Japan), Viastore SYSTEMS GmbH (Germany), TOYOTA INDUSTRIES CORPORATION (Japan), FlexLink (Sweden), KION GROUP AG (Germany), ERIKS North America, Inc (U.S.), Taikisha Ltd. (Japan), and Conveyor Systems Ltd (England).

The global conveyor systems market is highly competitive, with several key players striving to enhance their market share through technological advancements, strategic acquisitions, and global expansion. Leading companies such as Daifuku Co., Ltd., Dematic, and Interroll Holding AG dominate the industry, offering a wide range of automated and intelligent conveyor solutions tailored to various industries, including manufacturing, e-commerce, food & beverage, and logistics.

Competition in the market is driven by factors such as increasing automation in supply chain operations, the rise of e-commerce, and the need for efficient material handling solutions. Companies focus on innovation, integrating technologies like the Internet of Things (IoT), artificial intelligence (AI), and robotics to improve conveyor efficiency, predictive maintenance, and real-time tracking. Sustainability has also become a key differentiator, with players developing energy-efficient and eco-friendly conveyor solutions.

Emerging players and regional manufacturers intensify the competition by offering cost-effective and customized solutions. Additionally, strategic partnerships and mergers are common, as companies seek to expand their market presence and technological capabilities. The market’s growth potential is significant, with increasing demand in sectors like automotive, pharmaceuticals, and airport baggage handling, making the competition more dynamic and innovation-driven.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Atlas Energy Solutions completed the construction of its $400 million Dune Express conveyor system, spanning 42 miles from Kermit, Texas, to Lea County, New Mexico. This system is designed to transport up to 13 million tons of proppant annually, reducing truck traffic and enhancing safety in the Permian Basin.

- In November 2024, Japan announced plans to develop an automated cargo transport corridor, dubbed the "conveyor belt road," to connect Tokyo and Osaka. This initiative aims to address the country's shortage of delivery drivers and streamline logistics, with test runs scheduled for 2027.

- In November 2024, UK retailer Marks & Spencer introduced self-service conveyor belt checkouts in 45 of its Food Halls. This rollout aims to improve efficiency for trolley users by allowing them to scan and pack their groceries seamlessly, though some customers have expressed concerns about reduced human interaction.

- In September 2024, Kura Sushi announced plans to open a revolving sushi restaurant at Japan's Osaka-Kansai Expo in April 2025, featuring a 135-meter (442-foot) conveyor belt—the longest in the world. The restaurant is set to provide a unique dining experience for 338 guests.

- In February 2025, new trends in conveyor belt technology emerged, focusing on the integration of IoT and AI for predictive maintenance, the use of eco-friendly materials, and the development of modular conveyor systems. These innovations are expected to enhance efficiency, sustainability, and adaptability across industries.

MARKET SEGMENTATION

This research report on the global conveyor systems market is segmented and sub-segmented into the following categories.

By Type

- Roller

- Flat Belt

- Wheel

- Vertical

- Others (Pneumatic and others)

By Location

- In-floor

- On-floor

- Overhead

By Load

- Unit Load

- Bulk Load

By Application

- Food & Beverages

- Pharmaceuticals

- Supply chain & Logistics

- Manufacturing

- Mining

- Others (Airports and others)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the conveyor systems market?

The market is growing due to increased automation demands, technological advancements, and the need for efficient material handling in various industries.

What are common issues with conveyor systems?

Common problems include misaligned belts, jams, blockages, and motor or power issues, often due to inadequate maintenance or design.

What are the benefits of using conveyor systems?

Conveyor systems enhance efficiency by automating material transport, reduce labor costs, improve safety by minimizing manual handling, and offer flexibility in handling various products.

How do I choose the right conveyor system for my needs?

Consider factors like the type and weight of materials to be transported, available space, desired production speed, and budget constraints to select an appropriate conveyor system.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]