Global Control Valves Market Size, Share, Trends, & Growth Forecast Report – Segmented by Type (Butterfly Valve, Ball Valve, Globe Valve, Diagraph Valve and Others), Operation (Electrical Control Valve, Pneumatic Control Valve, Manual Control Valve and Hydraulic Control Valve), Application (Electrical Power, Oil & Gas, Pharmaceuticals, Water & Wastewater, Automotive, Food & Beverages, Mining, Chemicals and Others) & Region - Industry Forecast From 2024 to 2032

Global Control Valves Market Size (2024 to 2032)

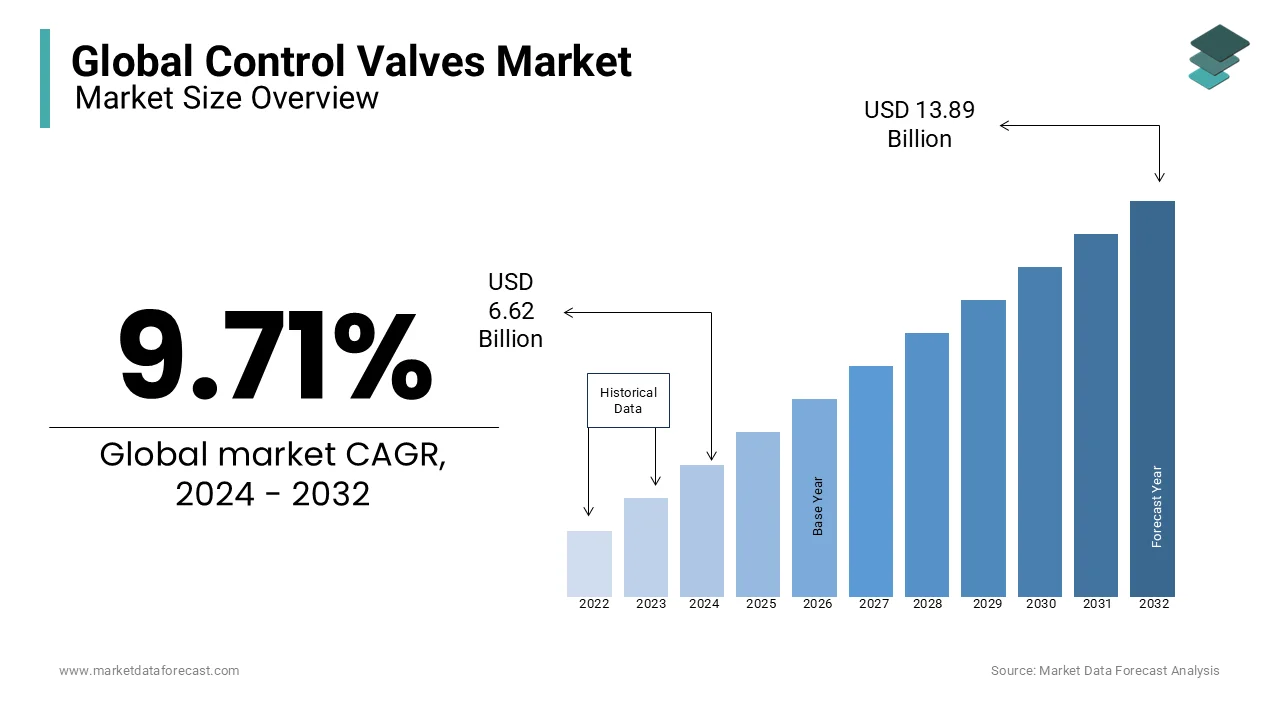

The size of the global control valves market size was worth USD 6.03 billion in 2023. The global market is predicted to register a CAGR of 9.71% from 2024 to 2032 and be worth USD 13.89 billion by 2032 from USD 6.62 billion in 2024.

Typical process plants have a slew of loops that mechanically control process variables, including temperature, pressure, and flow. Control valves are used to govern liquid flow, guaranteeing operational efficiency and reducing downtime in industrial facilities. In industries such as oil and gas, water management, chemicals, power generation, automotive, mining, pharmaceuticals, and food and beverages, control valves are used to adjust process factors like flow, temperature, pressure, and fluid level. Control valves are critical for increasing efficiency, safety, and profitability in these process industries. Furthermore, control valve manufacturers are always conducting research and development to ensure that their products meet evolving industry standards.

MARKET DRIVERS

Rapidly growing industrial automation, increasing emphasis on process efficiency, rise in smart manufacturing, technological advancements, stringent environmental regulations and growing investments in the development of the infrastructure in several countries are primarily propelling the global control valves market.

The growing usage of control valves in several industries is fuelling the growth rate of the global market. Applications in the pharmaceutical, mining, chemicals, and other sectors will continue to increase because of recent technical advancements that work in tandem with control valves. The healthcare and pharmaceutical industries are at the forefront of the pandemic's battle because to COVID-19's rapid spread. The production of critical medical devices required to treat COVID-19 patients is rising. Control valves are used in the production of a variety of medical equipment, and several major industrial firms have jumped at the chance to help in the battle against the pandemic.

Companies are progressively investing in research and development for autonomous components that are provided to the pharmaceutical sector, such as solenoid valves. Pharmaceutical businesses are also striving to build advanced fluid handling systems, such as automated sanitizer dispensers and liquid soap dispensers, which necessitate the use of valves. As a result, the control valves market is expected to rise in response to rising healthcare device manufacturing and increased R&D spending in the pharmaceutical industry.

MARKET RESTRAINTS

High initial costs of control valve systems are majorly hampering the global market growth. Long replacement cycles for existing valves, lack of skilled workforce for valve maintenance and challenges in standardization of valve specifications are further impeding the global market growth. Certain criteria and requirements must be followed by the manufacturers of valves. In terms of valve certifications and rules, various areas have distinct policies and certifications. Because valves may be used in a variety of sectors, including oil & gas, food & beverage, pharmaceuticals, energy & power, water & wastewater treatment, building & construction, chemicals, and pulp & paper, this factor produces demand diversity. However, such variation is impeding the valve market's growth since industry participants must adapt the same product to regional legislation, making it difficult for valve makers to obtain an optimal cost of installation. To address this problem, they will need to invest resources in establishing production sites throughout the world, which would necessitate extra money.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.71% |

|

Segments Covered |

By Type, Operation, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Crane Co, Alfa Laval Corporate AB, Emerson Electric Co, Flowserve Corporation, Schlumberger Ltd, Metso Corporation, KSB SE & Co. KGaA, KITZ Corporation, Samson Aktiengesellschaft, Velan Inc and Others. |

SEGMENTAL ANALYSIS

Global Control Valves Market Analysis By Type

Based on type, the ball valve segment led the market in 2023 and accounted for 31.4% of the global market share. The ball valve segment is a promising segment and is expected to account for a substantial share of the global market during the forecast period. The demand for ball valves is growing exponentially due to their tight shutoff capabilities, versatility, and applications in various industries, which is one of the major factors propelling the growth of the ball valve segment in the global market. The growing number of water treatment projects is further favoring segmental growth.

The butterfly valve segment is expected to account for a considerable share of the worldwide market during the forecast period. The compact design, low maintenance, and suitability for large-diameter applications of butterfly valves are fuelling their adoption in their industries and are primarily boosting the growth of the butterfly valve segment in the global market.

Global Control Valves Market Analysis By Operation

Based on operation, the pneumatic segment was the largest segment in the global market and held 41.8% of the global market share in 2023. The pneumatic segment is also estimated to witness healthy growth during the forecast period. Pneumatic control valves are known for their fast response, simplicity, and reliability in fluid control systems. The growing demand for precise process control and rising industrial automation are further contributing to the growth of the segment in the worldwide market.

On the other hand, the hydraulic segment is another prominent segment and is predicted to capture a substantial share of the global market during the forecast period. The usage of hydraulic control valves in several applications has increased significantly in recent years due to the high force, durability, and precise control that hydraulic control valves offer in heavy-duty industries, which is one of the major factors propelling the growth of the hydraulic control valve segment in the global market.

Global Control Valves Market Analysis By Application

Based on application, the oil and gas segment dominated the control valves market in 2023, accounting for 24.1% of the global market share and is expected to register notable growth during the forecast period. Control valves are essential for upstream, midstream, and downstream operations in the oil and gas industry, which is majorly driving the growth of the oil and gas segment in the global market.

The electric power segment is expected to hold a considerable share of the worldwide market during the forecast period owing to the rapid expansion of power generation capacity, rising emphasis on energy efficiency and the integration of renewable energy sources.

REGIONAL ANALYSIS

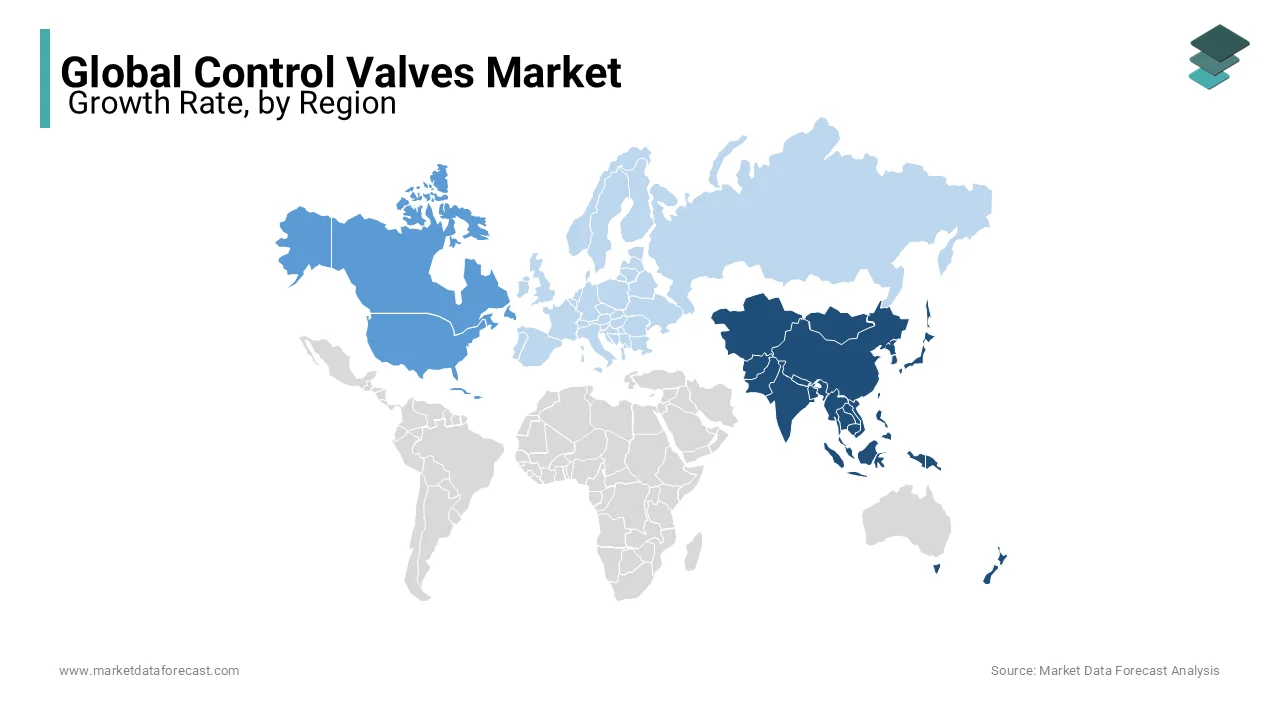

The Asia-Pacific region was the largest regional segment in the global market and accounted for 31.4% of the worldwide market in 2023. The control valves market is dominated by Asia Pacific which will be cemented by demand from India, China, Japan, South Korea, and other countries. The Asia Pacific will see significant demand for control valves during the forecast period, fueled by strong power sector demand in India and China. Over the next 10 years, the Indian government has set up USD 42 billion in the Union Budget 2021-22 for a redesigned and reform-based new electricity distribution sector program. The India Brand Equity Foundation shared this information (IBEF) and this indicates that control valve manufacturers in India have a lot of room for expansion.

The North American region had a substantial share of the global market in 2023 and is expected to register promising growth during the forecast period owing to the increased investment in the installation of electric control valves. While sales of hydraulic and pneumatic control valves are projected to continue healthy, sales of electrical control valves are expected to increase. To some extent, the energy situation in North America will give prospects for robust market growth. The growing emphasis on renewable energy will create very appealing sales prospects in the region.

Europe is estimated to witness prominent growth in the global market during the forecast period. Germany, the United Kingdom, and France are likely to lead the European control valves market in terms of growth. Mining growth will offer very profitable expansion opportunities in the region.

KEY MARKET PLAYERS

Companies playing a major role in the global control valves market include Crane Co, Alfa Laval Corporate AB, Emerson Electric Co, Flowserve Corporation, Schlumberger Ltd, Metso Corporation, KSB SE & Co. KGaA, KITZ Corporation, Samson Aktiengesellschaft and Velan Inc.

RECENT HAPPENINGS IN THE MARKET

- Emerson launched the ASC Series 158 Gas Valve and Series 159 Motorized Actuator in February 2020. The new devices, which are specifically developed for burner-boiler applications, provide OEMs, distributors, contractors, and end-users a novel combustion safety shutdown valve option that enhances both flow and control while also boosting safety and dependability.

- Curtiss-Wright Corporation has agreed to purchase Dyna-Flo Control Valve Services (Dyna-Flo) shares for CAD 81 million (USD 62 million) in cash in February 2020. For the chemicals, petrochemicals, and oil and gas industries, Dyna-Flo designs and manufactures linear and rotary control valves, isolation valves, actuators, and level and pressure control systems.

DETAILED SEGMENTATION OF THE GLOBAL CONTROL VALVES MARKET INCLUDED IN THIS REPORT

This research report on the global control valves market has been segmented and sub-segmented based on type, operation, application and region.

By Type

- Ball Valve

- Butterfly Valve

- Diagraph Valve

- Globe Valve

- Others

By Operation

- Pneumatic Control Valve

- Hydraulic Control Valve

- Electrical Control Valve

- Manual Control Valve

By Application

- Electrical Power

- Oil & Gas

- Water & Wastewater

- Automotive

- Pharmaceuticals

- Mining

- Chemicals

- Food & Beverages

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key industries that utilize control valves?

Control valves are widely used in industries such as oil & gas, water & wastewater, power generation, chemicals, pharmaceuticals, food & beverages, and automotive. The oil & gas industry is the largest consumer, accounting for a significant share of the market.

How is the shift towards automation affecting the control valves market?

The increasing adoption of automation in various industries is significantly boosting the demand for smart control valves. These valves are integrated with advanced features like remote monitoring and predictive maintenance, enhancing efficiency and reducing downtime.

What role does technological innovation play in the control valves market?

Technological innovation plays a crucial role in driving market growth. Advancements such as the development of smart valves, integration of IoT, and enhanced material durability are key trends shaping the future of the control valves market.

What are the latest trends influencing the global control valves market?

Key trends include the growing demand for smart and automated control valves, increased focus on energy efficiency, and the rise in investments in renewable energy projects. Additionally, there is a trend toward miniaturization and the development of valves for specialized applications in pharmaceuticals and biotechnology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]