Global Contraceptives Market Size, Share, Trends and Growth Forecast Report – Segmented By Drug Type (Contraceptive Pills, Topical Contraceptives, Contraceptive Injectables and Others), Medical Devices (Male Contraceptive Devices (Condoms), Female Contraceptive Devices, Contraceptive Sponges, Contraceptive Diaphragms, Subdermal Contraceptive Implants, Contraceptive Patches and Non-Surgical Permanent Contraceptive Devices), End User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Contraceptives Market Size (2024 to 2032)

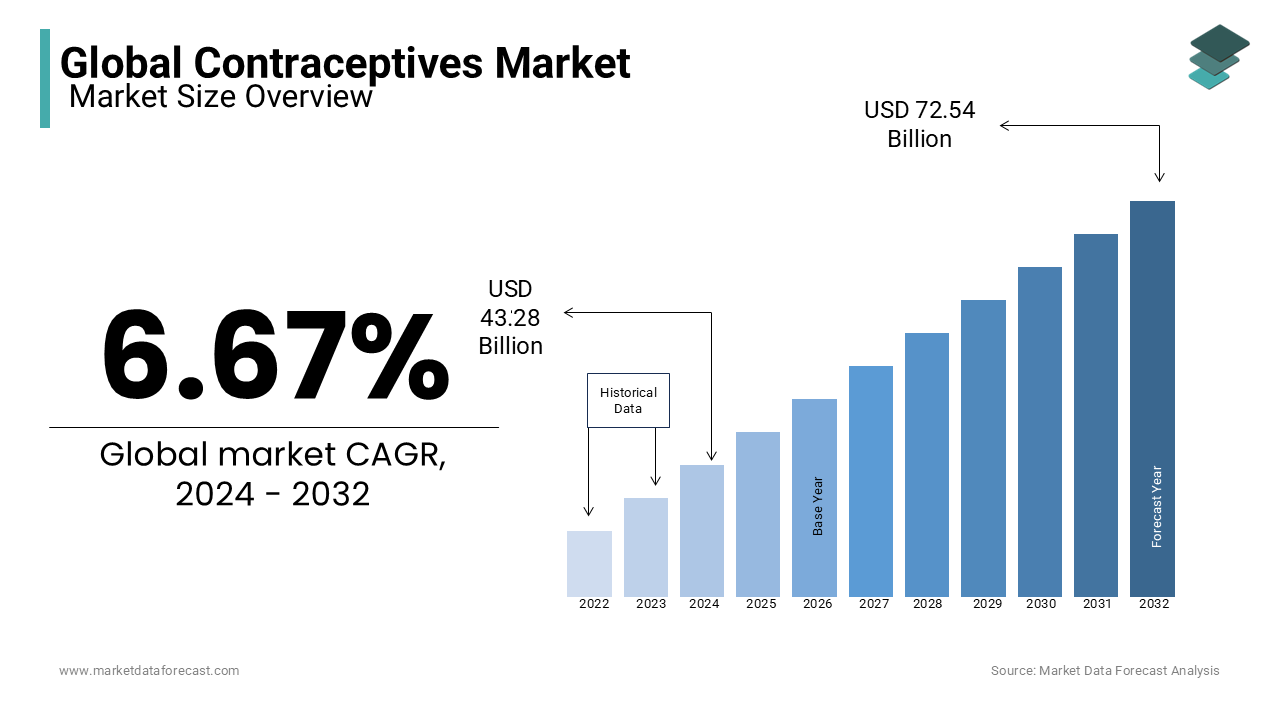

In 2023, the global contraceptives market was valued at USD 40.86 billion and it is expected to reach USD 72.54 billion by 2032 from USD 43.28 billion in 2024, growing at a CAGR of 6.67 % during the forecast period.

Current Scenario of the Global Contraceptives Market

Contraception is preventing pregnancy by interfering with the normal process of fertilization, ovulation, and implantation through drugs, barriers, medical devices, and surgical techniques. They are the drugs that will also inhibit sexually transmitted diseases. These devices are available in different forms, such as loop, coil, T-shaped, and triangle, mostly made up of plastic or metal. The trend witnessed in this market is the development of products such as vaginal rings, self-administrative contraceptive injections, sub-dermal contraceptive implants, non-surgical permanent contraception devices and others.

MARKET DRIVERS

The growing population worldwide, rising focus on women's health, increasing prevalence of sexually transmitted diseases (STDs) and increasing number of unwanted pregnancies are propelling the growth of the contraceptives market.

The population worldwide has grown consistently over the last several years, which is expected to boost the usage of contraceptives as these are used to avoid unintended pregnancies. As per the statistics published by the United Nations (UN), the worldwide population is estimated to jump from 7.9 billion in 2021 to 9.7 billion by 2050. An estimated 214 million women in developing countries do not have access to modern contraceptives. Access to modern contraceptives is 73% in developed countries and only 33% in low-income countries. In recent years, contraceptives have also been used for various other reproductive health issues such as menstrual disorders, sexually transmitted diseases (STDs), and reducing the risk of certain cancers, and the same trend is expected to fuel in the coming years owing to the growing awareness among people regarding the benefits of using contraceptives and boost the market’s growth rate. The growing awareness and focus on women's health is also accelerating the demand levels for contraceptives and promoting market growth.

An increasing number of initiatives and funding by governments for family planning programs and growing awareness about family planning among people are notable factors accelerating the growth of the contraceptives market.

Contraceptives can significantly help prevent unwanted pregnancies. The growing investments, funding and awareness programs on family planning by several governments, healthcare organizations and NGOs to limit population growth are contributing to the growing demand for contraceptives. Considering the growing awareness among people regarding contraceptives, the market participants have been investing significant amounts in the R&D of contraceptives to develop advanced, effective and innovative contraceptive methods and delivery systems. The United Nations Population Fund (UNFPA) said in one of their reports, an estimated 308 million unintended pregnancies, 119 million unsafe abortions, and 1.4 million maternal deaths were prevented by contraceptives since 1990.

The growing trend of delaying marriage and childbirth is further fuelling the growth rate of the global contraceptives market.

As per the data published by the World Health Organization (WHO), the median age at first marriage has increased to 28 years for men and 26 years for women now worldwide. In the United States, the number of women who have never married is growing significantly. The percentage of women who had never been married in the United States jumped from 15% in 1980 to 32% in 2020 aged between 25 to 30. Among the developed countries, many people have chosen to delay their marriages and decisions such as starting a family to pursue education, career goals, and personal development, and this trend is expected to continue in the coming years. The same has resulted in the growing usage of contraceptives to avoid unwanted pregnancies. As a result, the market participants have developed and marketed various range of conceptive products such as oral contraceptives, intrauterine devices (IUDs), condoms, and more to address the growing demand from people.

In addition, the growing availability of innovative and advanced contraceptive methods, rising adoption of long-acting reversible contraceptives (LARCs), increasing disposable income and urbanization, and growing usage of contraceptives for non-contraceptive purposes, such as managing menstrual disorders and reducing the risk of certain cancers are favoring the growth of contraceptives market.

Furthermore, factors such as cultural and social acceptance of family planning and contraception, growing access to healthcare facilities and services, rapid adoption of technological advancements in contraceptive methods and delivery systems by the market participants, and rising demand for male contraceptives are contributing to the growth rate of the market. The growing participation of women in the workforce, increasing availability of over-the-counter contraceptive products and the growing number of sexual partnerships and casual sex and rising demand for natural and herbal contraceptive products are further showcasing a favorable impact on the growth of the contraceptive market.

MARKET RESTRAINTS

Poor awareness levels among people regarding the importance of family planning, available types of contraceptives, and how to use them effectively is one of the major factors hampering the growth of the contraceptives market. Stigma and social taboos surrounding contraceptives in certain geographies in some countries are hindering market growth. Limited access to quality family planning services and contraceptives due to factors such as cost, availability, and distribution in developing and underdeveloped countries is diluting the growth rate of the worldwide market. In addition, factors such as religious beliefs, limited funding and the insufficient number of awareness programs by governments of some countries to promote the usage of contraceptives and the side effects associated with the usage of contraceptives are limiting the growth rate of the contraceptives market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Drug Type, Medical Devices, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer HealthCare AG, Teva Pharmaceutical Industries Limited, Medisafe Distribution Inc., Pace Pharmaceuticals Inc., Medicines360, Church & Dwight, Co., Inc., Actavis, Inc., Cooper Surgical, Inc., Merck & Co., Inc., Reckitt Benckiser plc, Mayer Laboratories, Inc. and Pfizer, Inc. |

SEGMENTAL ANALYSIS

Global Contraceptives Market Analysis By Drug Type

The contraceptive pills segment held the major share of the global market in 2023 and is expected to continue dominating the market during the forecast period. The segmental growth is majorly driven by their high efficacy rate, ease of use, and widespread availability. The growing usage of contraceptive pills for medical conditions such as polycystic ovary syndrome (PCOS) and endometriosis is further boosting the segment’s growth rate. The ability to control menstrual cycles with contraceptive pills is further fuelling their adoption and resulting in the growth of the segment.

The topical contraceptives segment is predicted to occupy a considerable share of the global market during the forecast period. The growing awareness about sexually transmitted infections (STIs) and the need for protection during sexual activity are majorly propelling segmental growth. Growing availability and cost-effectiveness are further favoring the growth of the segment.

The others segment is predicted to register a notable CAGR during the forecast period. The growth of the segment is driven by the availability of over-the-counter options and the increasing focus on family planning.

Global Contraceptives Market Analysis By Medical Devices

The condoms segment had the largest share of the global contraceptives market in 2023 and the segmental domination is estimated to continue throughout the forecast period. The segmental growth is primarily driven by the rising awareness about sexually transmitted diseases (STDs) and the need for safe sex practices. Condoms are believed to be effective in avoiding STDs and unwanted pregnancies. The growing acceptance and wide availability of condoms is other major factor contributing to the segment’s growth rate.

On the other hand, the female contraceptive devices segment accounted for a considerable share of the global market in 2022 and is expected to showcase a noteworthy CAGR during the forecast period. High efficacy rates and long-term effectiveness of female contraceptive devices are primarily boosting segmental growth. Due to the convenience and reliability of female contraceptive devices, they have become an attractive option for women to avoid unwanted complications. Under the sub-segments, the hormonal IUD segment is estimated to grow at the fastest CAGR compared to copper IUDs owing to the benefits associated such as reduced menstrual bleeding and cramps.

Global Contraceptives Market Analysis By End User

The hospital segment captured the largest share of the global contraceptives market in 2023 and is expected to grow promisingly during the forecast period. Hospitals are the go-to place for women to seek contraceptive services, which is majorly contributing to segmental growth. Hospitals offer a wide range of contraceptive services such as counseling, testing, and the provision of various types of contraceptives. Hospitals have access to advanced medical equipment and highly skilled medical professionals and provide the best quality of healthcare to the patients.

The home care segment occupied a substantial share of the worldwide contraceptives market in 2023 and is expected to showcase a notable CAGR during the forecast period. The growing adoption of self-administered contraceptives, such as oral contraceptive pills, contraceptive patches, and vaginal rings is driving the segmental growth. These products can be used at home without the intervention of medical professionals. The recent COVID-19 pandemic has boosted segmental growth. During the COVID-19 pandemic, many women preferred to use contraceptives at home instead of visiting hospitals and clinics for conceptive services. Other segments, such as clinics and ambulatory surgical centers segment, accounted for a considerable share of the global market in 2023 and are predicted to register a healthy CAGR in the coming years.

REGIONAL ANALYSIS

North America accounted for the most significant share of the global market in 2023 and is expected to witness a promising CAGR during the forecast period. The growth of the North American market is majorly attributed to the growing awareness and increasing availability of contraceptives to the public due to the Affordable Care Act and other government policies, the presence of key market participants and favorable policies from the North American governments. In addition, the rising patient count suffering from sexually transmitted diseases and the growing need to prevent unwanted pregnancies is fuelling the growth rate of the North American market. The rising awareness regarding the benefits of family planning and contraception and higher rates of education and employment among women, which can lead to a desire to delay or prevent pregnancies are further boosting the contraceptives market growth in North America. Rising acceptance of non-hormonal and long-acting contraceptive options is another notable attribute contributing to the growth of the North American contraceptives market. The U.S. market had the major share of the North American market, followed by Canada in 2023. The growing usage of contraceptives by the women population of the U.S. is primarily driving the market growth in the U.S. For instance, more than 99% of sexually active women aged 15-44 agreed that they have used one of the contraceptive methods at one point in their lives.

Europe captured a notable share of the worldwide market in 2023 and is predicted to grow at a healthy CAGR during the forecast period. The demand for contraceptive products is growing consistently across the European region, which is one of the key factors driving the regional market growth. According to the data published by Eurostat, an estimated 68% of the women who have reached the reproductive age are using a contraceptive method. Among the various types of contraceptive methods, pills and condoms were the most preferred methods by the European population. The governments of European countries have taken several initiatives to promote the usage of contraceptives, which has favored the growth of the European market in recent years and this trend is expected to continue in the coming years. The growing availability of OTC contraceptives and the rising prevalence of sexually transmitted diseases are further fuelling the growth rate of the European market. Increasing demand for emergency contraception options is another factor contributing to the growth of the European market.

Asia-Pacific is expected to showcase the fastest CAGR in the worldwide market during the forecast period. The growing awareness among the population of APAC countries regarding family planning, increasing availability of contraceptive products, and the rising need to control the population growth in the countries of APAC are majorly driving the contraceptives market in the APAC region. India and China are anticipated to hold a leading share of the APAC market during the forecast period owing to the growing population and increasing demand for family planning options. The growing availability of contraceptives in urban areas, increasing disposable income, and rising access to healthcare are further contributing to the market growth in China and India. For instance, as per the survey conducted by the National Family Health in India, the rate of contraceptive prevalence jumped from 48% to 54% in India between 2005-2006 to 2015-2016.

Latin America occupied a considerable share of the global market in 2023 and is expected to grow at a steady CAGR during the forecast period. Factors such as favorable government policies and healthcare systems that prioritize reproductive health and family planning and increasing acceptance and use of LARCs are primarily favoring the Latin American market growth. During the forecast period, Brazil is expected to hold a leading share of the Latin American market. According to the National Survey on Demography and Health conducted in Brazil, the contraceptive prevalence rate rose from 72% in 2006 to 79% in 2013.

Middle East and Africa are predicted to capture a moderate share of the global market during the forecast period. However, this region is predicted to showcase a decent CAGR in the coming years. The growing population, increasing awareness regarding the available contraception methods, and growing demand for family planning options are contributing to the growth of the contraceptives market in MEA.

KEY PLAYERS IN THE GLOBAL CONTRACEPTIVES MARKET

Companies leading the global contraceptives market profiled in the report are Bayer HealthCare AG, Teva Pharmaceutical Industries Limited, Medisafe Distribution Inc., Pace Pharmaceuticals Inc., Medicines360, Church & Dwight, Co., Inc., Actavis, Inc., Cooper Surgical, Inc., Merck & Co., Inc., Reckitt Benckiser plc, Mayer Laboratories, Inc. and Pfizer, Inc.

RECENT HAPPENINGS IN THE MARKET

- Holoxica Limited (UK) unveiled the world's first 3D digital hologram of human brain fiber pathways in May 2016. This new brain path imaging enables neurosurgeons and clinicians to identify, diagnose, and treat various neurological conditions, including Alzheimer's, MND, stroke, and cancer.

DETAILED SEGMENTATION OF THE GLOBAL CONTRACEPTIVES MARKET INCLUDED IN THIS REPORT

This market research report on the global contraceptives market has been segmented and sub-segmented based on the drug type, medical devices, end-user, and region.

By Drug Type

- Contraceptive Pills

- Topical Contraceptives

- Contraceptive Injectable

- Others (Contraceptive Gels, Jellies, and Creams)

By Medical Devices

- Male Contraceptive Devices (Condoms)

- Female Contraceptive Devices

- Female Condoms

- Intrauterine Devices

- Hormonal IUD’s

- Copper IUD’s

- Contraceptive Sponges

- Contraceptive Diaphragms

- Subdermal Contraceptive Implants

- Contraceptive Patches

- Non-Surgical Permanent Contraceptive Devices

By End User

- Hospitals

- Home Care

- Clinics

- Ambulatory Surgical Centres

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

At What CAGR, the global contraceptives market is expected to grow from 2024 to 2032?

The global contraceptive market is estimated to grow at a CAGR of 6.67% from 2024 to 2032.

Which region is growing the fastest in the global contraceptives market?

Geographically, the North American contraceptives market accounted for the largest share of the global market in 2023.

Which are the significant players operating in the contraceptives market?

Bayer HealthCare AG, Teva Pharmaceutical Industries Limited, Medisafe Distribution Inc., Pace Pharmaceuticals Inc., Medicines360, Church & Dwight, Co., Inc., and Actavis, Inc., are some of the significant players operating in the contraceptives market.

How much is the global contraceptives market going to be worth by 2032?

As per our research report, the global contraceptives market size is projected to be USD 72.4 billion by 2032.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]