Global Continuous Glucose Monitoring Market Size, Share, Trends & Growth Forecast Report By Components Type (Transmitters & Receivers, Sensors & Insulin Pumps), End Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033

Global Continuous Glucose Monitoring Market Size

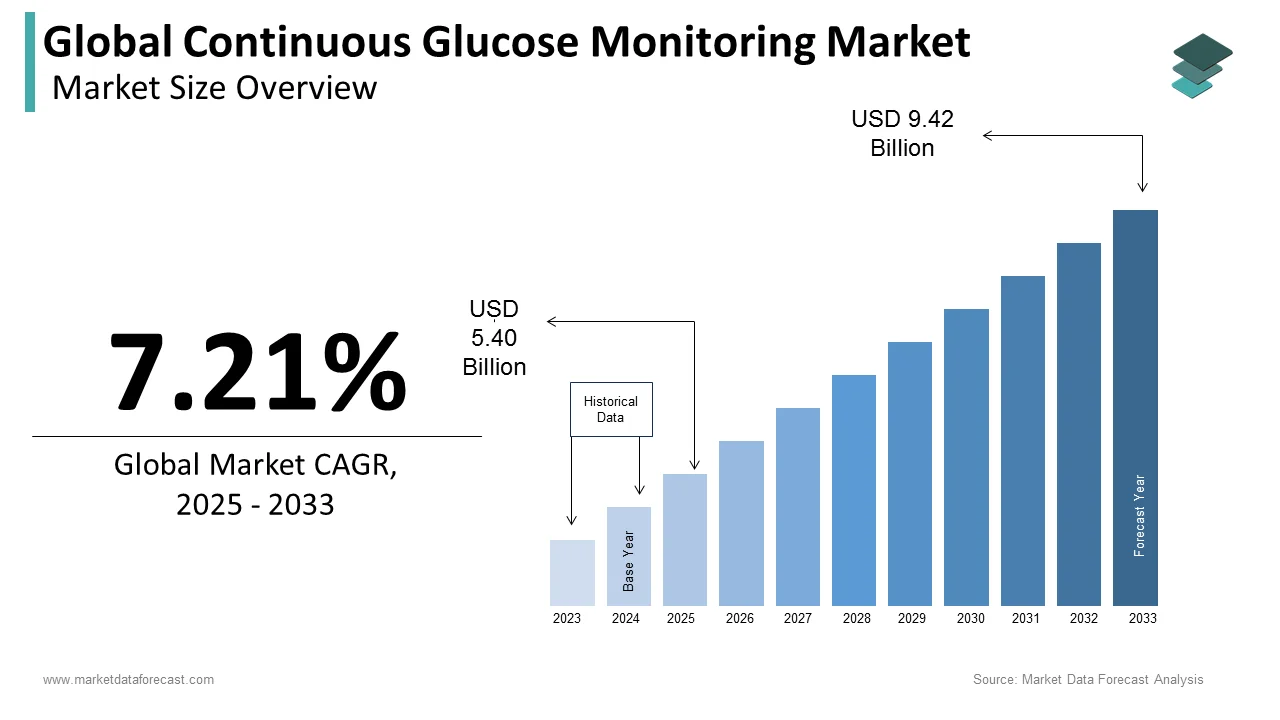

The size of the global continuous glucose monitoring market was worth USD 5.04 billion in 2024. The global market is anticipated to grow at a CAGR of 7.21% from 2025 to 2033 and be worth USD 9.42 billion by 2033 from USD 5.40 billion in 2025.

MARKET DRIVERS

Growing Diabetic Population Worldwide and Technological Advancements

The diabetic population is growing rapidly worldwide. As per the data published by the International Diabetes Federation (IDF), approximately 537 million diabetic patients were identified in 2021. WHO says diabetes caused 1.5 million direct deaths in 2019. The number of diabetic population is expected to increase in the coming years and fuel the demand for effective glucose monitoring solutions, particularly those that provide continuous and non-invasive monitoring. CGM, or continuous glucose monitoring, provides effective monitoring of glucose levels and is one of the promising solutions for diabetic patients to use for disease management.

On the other hand, technological advancements have made the CGM more accurate, user-friendly and affordable. Due to these, the adoption of CGM has tremendously increased in recent years. Using technological developments such as data analytics and AI algorithms, healthcare professionals are now able to analyze and interpret the data gathered by CGM devices, which further results in improved patient outcomes and reduces the possibility of dealing with severe health risks.

Rising Healthcare Expenditure

The costs associated with diabetes management are growing continuously, and diabetic patients are constantly looking for cost-effective solutions for disease management. CGM technology is one of the effective solutions for diabetic patients to reduce the healthcare costs of diabetes in the long run. Diabetes could lead to severe health complications such as CVDs, kidney disease, and nerve damage when managed poorly. The costs associated with hospitalization in such situations would be significantly high. By using CGM technology, diabetic patients can track continuous and real-time glucose monitoring and help avoid the health risks of diabetes. In addition, the CGM technology also helps with more accurate and reliable glucose monitoring and thereby reduces the cost of diabetes-related complications, such as diabetic retinopathy and neuropathy.

In addition, the growing awareness among people and healthcare professionals regarding the potential benefits of continuous glucose monitoring (CGM), the increasing number of initiatives by several governments in favor of CGM, and the rising number of R&D activities to develop innovative and effective CGM devices fuel the market growth during the forecast period. The growing adoption of CGM technology for better diabetes management by healthcare professionals, rising demand for a non-invasive method of monitoring glucose levels, integration possibilities of CGM devices with smartphones, wearables, such as smartwatches and fitness trackers and rising demand for personalized CGM devices accelerate the market’s growth rate. The growing obese patient population worldwide and rising emphasis on preventative healthcare further favor the market growth.

MARKET RESTRAINTS

The high cost of CGM devices is one of the key factors hampering the market growth. Due to these high costs, the adoption of CGM is limited in developing and underdeveloped countries. Limited reimbursement policies for continuous glucose monitoring in some countries hinder the overall growth rate of the market. Inaccuracies and poor awareness regarding the benefits of CGM in some countries further inhibit the market’s growth rate. Privacy concerns and technical channels are some other significant obstacles to the growth of the CGM market.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Component, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Challenges, Restraints, Opportunities; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

SEGMENTAL ANALYSIS

By Component Type Insights

The sensors segment is predicted to hold the major share of the global CGM market during the forecast period. The growing demand for accurate and reliable glucose monitoring devices, as well as technological advancements in sensor technology majorly drive the segmental growth. In addition, factors such as rising prevalence of diabetes worldwide, growing awareness about the benefits of continuous glucose monitoring, and the growing trend of self-monitoring among diabetic patients are further fuelling the growth rate of the segment. Furthermore, the growing usage of sensor-based glucose monitoring devices is another key attribute contributing to the segment’s growth rate.

The insulin pump segment had the second-largest share of the global CGM market in 2024 and is expected to account for a notable share of the worldwide market throughout the forecast period. The segmental growth is majorly driven by the growing diabetic population worldwide, increasing usage of insulin pumps by patients and healthcare professionals and rapid adoption of technological developments to innovate and manufacture advanced insulin pumps.

By End User Insights

The homecare diagnostics segment held a considerable share of the worldwide market in 2024 and is expected to grow at a promising CAGR during the forecast period. The growing demand for portable and user-friendly glucose monitoring devices, the rising trend of self-monitoring among diabetic patients, increasing healthcare costs, and the need for remote monitoring of glucose levels are majorly boosting the growth of the segment.

The hospital segment held a substantial share of the worldwide market in 2024 and is estimated to showcase a notable CAGR during the forecast period due to the growing usage of CGM by hospitals and the increasing need to eliminate the involvement of healthcare staff to check the blood sugar levels of patients. In addition,the growing demand for advanced monitoring systems in hospital settings and increasing awareness about the benefits of continuous glucose monitoring among healthcare professionals boost the growth rate of the segment.

REGIONAL ANALYSIS

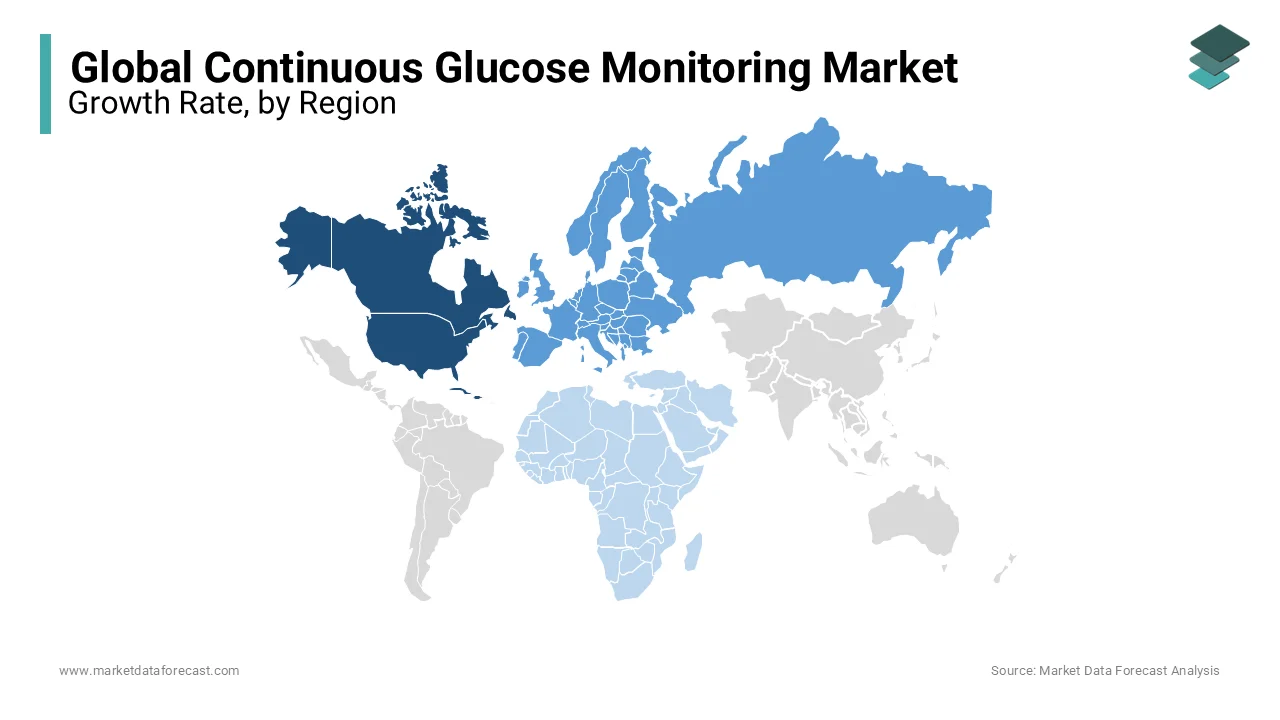

The North American region held the largest share of the worldwide market in 2024 and the domination of North America is likely to continue throughout the forecast period. The growing diabetic population across North America and an increasing number of product approvals used in CGM by the USFDA majorly propel the North American market growth. For instance, the USFDA approved FreeStyle® Libre by Abbott, which is a CGM system that doesn't need a blood sample for glucose level tests. In 2024, the majority of North America was occupied by the United States, followed by Canada. During the forecast period, the U.S. market is estimated to showcase a significant CAGR. The rising prevalence of diabetes in the U.S., the presence of notable market participants and the presence of sophisticated healthcare infrastructure majorly fuel the growth rate of the U.S. CGM market. Canada is another promising regional market for CGM in North America and is expected to grow at a notable CAGR during the forecast period.

Europe is another promising regional market for CGM worldwide and is anticipated to account for a notable share of the global market during the forecast period. The growth of the European market is primarily driven by the increasing prevalence of diabetes, particularly in countries such as Germany, France, and the UK, technological advancements in glucose monitoring devices, and favorable reimbursement policies and government initiatives for diabetes management. The rapid adoption of advanced technologies, such as cloud computing and big data analytics, for diabetes management is further propelling the European CGM market growth. The growing awareness among patients and healthcare professionals about the benefits of CGM devices, the presence of a well-established healthcare infrastructure, and the availability of skilled healthcare professionals favor the growth rate of the European CGM market. Germany held the largest share of the European market in 2024.

APAC is expected to register the highest CAGR among all the regions in the worldwide market during the forecast period. The growth of the APAC market is majorly driven by the growing diabetic population in countries such as India, China, and Japan, increasing healthcare spending, and rising investments to develop the healthcare infrastructure. The rising adoption of new technologies, such as connected devices and telemedicine, for diabetes management, growing disposable income, and changing lifestyles, leading to an increased demand for advanced healthcare technologies are further promoting the regional market growth. Japan accounted for the biggest share of the APAC market in 2024.

Latin America is a noteworthy region for CGM globally and is expected to grow at a healthy CAGR during the forecast period. The growing patient population of diabetes in Latin America, particularly in countries such as Mexico and Brazil, favorable government initiatives, and collaborations with healthcare organizations for diabetes management are propelling the Latin American CGM market growth. Brazil occupied the leading share of the Latin American market in 2024.

MEA is anticipated to register a steady CAGR during the forecast period and account for a moderate share of the worldwide market during the forecast period. Factors such as the rapidly increasing prevalence of diabetes, particularly in countries such as Saudi Arabia, Egypt, and South Africa and the presence of a large underserved population and the increasing demand for affordable healthcare technologies are majorly driving the CGM market in MEA. Saudi Arabia had the major share of the MEA market in 2024.

NOTABLE PLAYERS IN THIS MARKET

Key market participants leading the global continuous glucose monitoring market profiled in this report are Dexcom Inc., Roche Diagnostics, Medtronic plc., Novo Nordisk, Abbott Laboratories, Animas Corporation, Ypsomed AG., Bayer AG, Insulet Corporation, and Sensonic Corporation.

KEY MARKET HAPPENINGS

- On February 21, 2020, Dexcom has announced that it has gained a C.E. mark for its G6 continuous glucose monitoring, where it can be used safely over pregnant women. Dexcom is behind the pregnancy patients as it looks after the patients with Type 1 and Type 2. The company is expanding its patient pregnancy population for its signature device.

- A smart cap device that connects to insulin pens was approved by the U.S. Food and Drug Administration by Bigfoot Unity Diabetes Management System in 2021. This device translates continuous glucose data into dosing recommendations for people above 12 years.

- In 2022, a non-invasive continuous glucose monitor (CGM) called the GlucoRx BioXensor has been developed by GlucoRx and Cardiff University. this is done by extracting blood or pricking a finger.

- In 2022, the U.K. government made the Dexcom ONE real-time Continuous Glucose Monitoring (rt-CGM) System to improve access to rt-CGM for people with diabetes.

MARKET SEGMENTATION

This research report on the global continuous glucose monitoring market is segmented and sub-segmented into component type, end-user and region.

By Component Type

- Transmitters & Receivers

- Sensors

- Insulin Pumps

By End User

- Hospitals

- Homecare Diagnostics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What will be the size of the continuous glucose monitoring market by 2033?

The size of the continuous glucose monitoring market is predicted to reach USD 9.42 by 2033.

Which segment by end user is predicted to hold the highest share of the market?

Based on the End user, the homecare diagnostics holds the highest share of the market.

Which segment by component type is expected to account for the substantial market share?

By component type, the sensors segment is accounted for the highest substantial market share during the forecast period.

Who are the key market players in the continuous glucose monitoring market?

Dexcom Inc., Roche Diagnostics, Medtronic plc., Novo Nordisk, Abbott Laboratories, Animas Corporation, Ypsomed AG., Bayer AG, Insulet Corporation, and Sensonic Corporation are the key market players leading the global continuous glucose monitoring market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]