Global Container Ship Market Size, Share, Trends & Growth Forecast Report – Segmented By Container Size (Small Containers (20 feet), Large Containers (40 feet), High Cube Containers (40 feet)) Container Type (Dry Storage Containers, Flat Rack Containers, Refrigerated Containers, Special Purpose Containers and Others) And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Container Ship Market Size

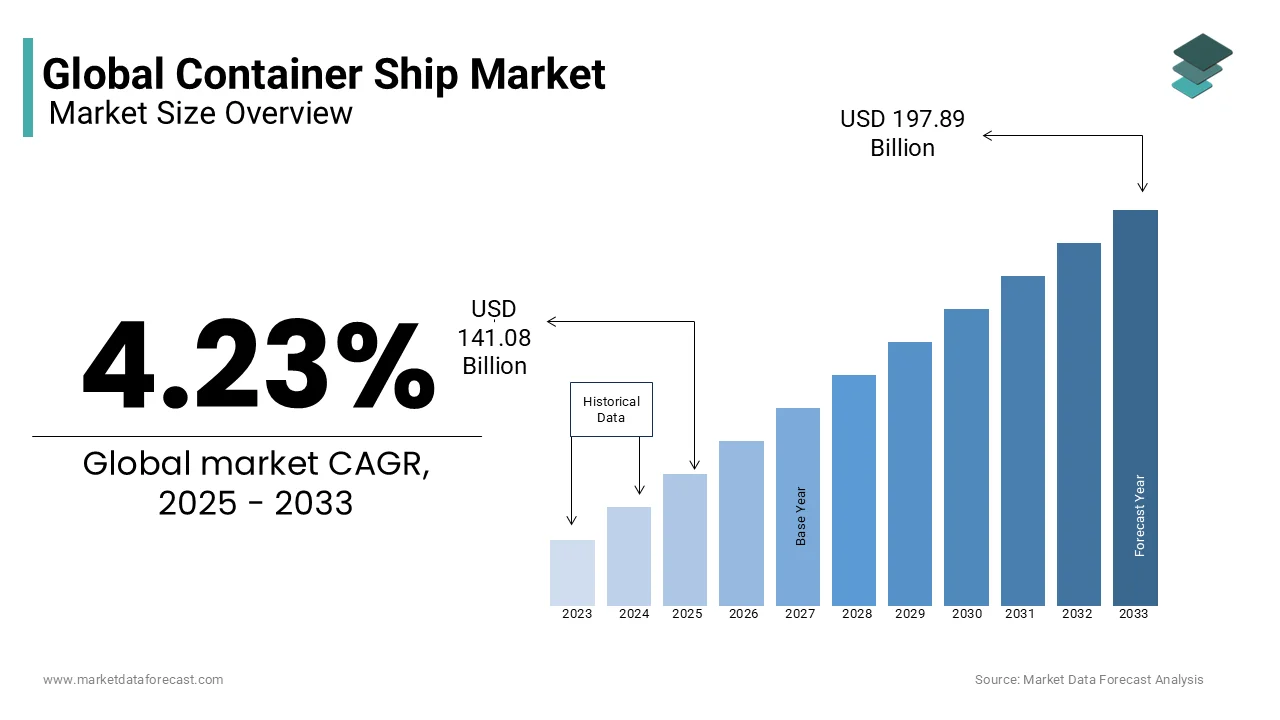

The global container ship market size was valued at USD 135.24 billion in 2024 and is anticipated to reach USD 141.08 billion in 2025 from USD 197.89 billion by 2033, growing at a CAGR of 4.23% during the forecast period from 2025 to 2033.

The container ship market represents a cornerstone of global trade, facilitating the efficient and standardized transportation of goods across international waters. Container ships, designed to carry standardized cargo containers, have revolutionized logistics by enabling seamless intermodal transport via ships, trains, and trucks. This market is integral to the backbone of globalization, ensuring that products ranging from electronics to perishable goods are delivered reliably and cost-effectively. In 2023, it is estimated that over 90% of non-bulk cargo worldwide is transported via container shipping, underscoring its dominance in maritime trade. The sheer scale of the market is further amplified by the fact that the largest container ships today can carry upwards of 24,000 twenty-foot equivalent units (TEUs), as reported by the International Maritime Organization.

Beyond trade volumes, the environmental impact of container shipping has become a focal point for regulators and industry stakeholders. According to the World Shipping Council, container ships account for approximately 2.5% of global greenhouse gas emissions, prompting calls for more sustainable practices. Additionally, the United Nations Conference on Trade and Development notes that ports globally handle around 800 million TEUs annually, with Asia dominating both supply and demand dynamics. These statistics reflect not only the logistical prowess of container shipping but also its growing challenges, including environmental concerns and geopolitical disruptions, which continue to shape its evolution in an increasingly interconnected world.

Market Drivers

Globalization and Trade Expansion

The relentless expansion of global trade remains a primary driver of the container ship market. As economies become increasingly interconnected, the demand for efficient cargo transportation has surged. The World Trade Organization reports that global merchandise trade volumes grew by 3.5% annually on average over the past decade, with containerized trade accounting for a significant share. This growth is fueled by emerging markets, particularly in Asia, where countries like China and India have seen their exports rise by over 7% annually in recent years, according to the United Nations Conference on Trade and Development. According to the International Monetary Fund, cross-border e-commerce has expanded by 25% annually.

Environmental Regulations and Technological Advancements

Stringent environmental regulations are reshaping the container ship market, pushing stakeholders to adopt cleaner technologies. The International Maritime Organization’s mandate to cut carbon emissions by at least 50% by 2050 has accelerated investments in energy-efficient vessels and alternative fuels. According to the U.S. Energy Information Administration, the maritime sector currently consumes about 4 million barrels of oil per day, but the adoption of liquefied natural gas (LNG) and other low-carbon fuels is expected to reduce this figure significantly by 2030. Furthermore, the European Maritime Safety Agency states that over 30% of new container ships are now equipped with advanced emission-reduction technologies, such as scrubbers and hybrid propulsion systems. These regulatory pressures, coupled with technological innovations, are driving the market growth.

Market Restraints

Geopolitical Tensions and Trade Disruptions

Geopolitical tensions and trade disputes have emerged as significant restraints on the container ship market, causing volatility in global supply chains. According to the United Nations Conference on Trade and Development, geopolitical conflicts, such as those involving major economies like the U.S. and China, have led to a 5% decline in containerized trade growth in affected regions over the past few years. Additionally, the World Bank reports that port disruptions caused by geopolitical sanctions or regional instability can increase shipping costs by up to 25%, straining logistics networks. For instance, the blockade of key maritime chokepoints, such as the Suez Canal, has been shown to delay nearly 12% of global trade annually, according to the U.S. Department of Transportation. These disruptions not only hinder the flow of goods but also erode confidence in the reliability of container shipping by creating long-term challenges for the market.

Rising Operational Costs and Infrastructure Gaps

The container ship market faces significant constraints due to rising operational costs and inadequate port infrastructure. The International Transport Forum notes that global bunker fuel prices surged by over 60% in the past two years, significantly increasing shipping expenses. Furthermore, the American Association of Port Authorities reports that nearly 40% of ports worldwide are operating beyond their designed capacity, leading to congestion and delays. This infrastructure gap is particularly acute in developing regions, where outdated facilities and limited automation result in inefficiencies. For example, the World Bank estimates that inefficient port operations can increase shipping times by up to 30%, driving up costs for importers and exporters. These financial and infrastructural barriers pose substantial challenges to the scalability and profitability of container shipping operations globally.

Market Opportunities

Expansion of Digitalization and Smart Shipping Solutions

The integration of digital technologies presents a transformative opportunity for the container ship market, enhancing operational efficiency and transparency. According to the International Maritime Organization, the adoption of digital tools, such as blockchain and IoT, could reduce documentation errors by up to 80% by streamlining global trade processes. As per the U.S. Department of Transportation, smart shipping solutions by including predictive maintenance and real-time tracking that have the potential to cut operational costs by 15% while improving fleet utilization rates. For instance, Maersk’s implementation of TradeLens, a blockchain-based platform, has already facilitated over 1 billion shipping events annually by demonstrating the scalability of such innovations. As digitalization continues to gain traction, it not only addresses inefficiencies but also fosters trust and collaboration among stakeholders by unlocking new growth opportunities for the market.

Emergence of Green Shipping Initiatives

The growing emphasis on sustainability offers significant opportunities for innovation in the container ship market. According to the European Maritime Safety Agency, investments in green technologies, such as wind-assisted propulsion and hydrogen fuel cells, are projected to grow by 20% annually over the next decade. As per the International Energy Agency, retrofitting existing vessels with energy-efficient technologies could reduce fuel consumption by up to 25% with global decarbonization goals. Governments are also incentivizing these efforts; for example, the U.S. Maritime Administration has allocated $230 million to support low-emission shipping projects in 2023. These initiatives promote environmental stewardship but also open doors to new markets and partnerships that is driven by increasing consumer demand for sustainable practices.

Market Challenges

Pandemic-Induced Supply Chain Vulnerabilities

The container ship market continues to grapple with the lingering effects of pandemic-induced supply chain disruptions, which have exposed systemic vulnerabilities. According to the United Nations Conference on Trade and Development, global port congestion during the pandemic caused shipping delays of up to 10 days on major trade routes, resulting in an estimated $2 trillion loss in global trade value. According to the U.S. Department of Commerce, inventory shortages and erratic demand patterns led to a 300% spike in freight rates between 2019 and 2022, straining businesses reliant on timely deliveries. These disruptions were exacerbated by labor shortages, with the International Labour Organization estimating a 15% decline in port workforce availability during peak pandemic periods. Such challenges escalate the fragility of global logistics networks and the need for more resilient systems.

Regulatory Compliance and Financial Strain

The stringent regulatory requirements pose significant financial and operational challenges for the container ship market. According to the International Maritime Organization’s sulfur cap regulation, enforced since 2020, mandates that ships reduce sulfur emissions to 0.5%, requiring costly modifications or transitions to low-sulfur fuels. According to the U.S. Energy Information Administration, compliance with these regulations has increased fuel expenses by 30% for shipping companies. As per the World Bank, smaller operators face disproportionate pressure, as retrofitting vessels or adopting new technologies can cost upwards of $5 million per ship, pushing some out of the market. These financial burdens are compounded by fluctuating fuel prices and limited access to capital by creating barriers to maintaining competitive operations while adhering to evolving environmental standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.23% |

|

Segments Covered |

By Container Size, Container Type and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc |

SEGMENTAL ANALYSIS

By Container Size

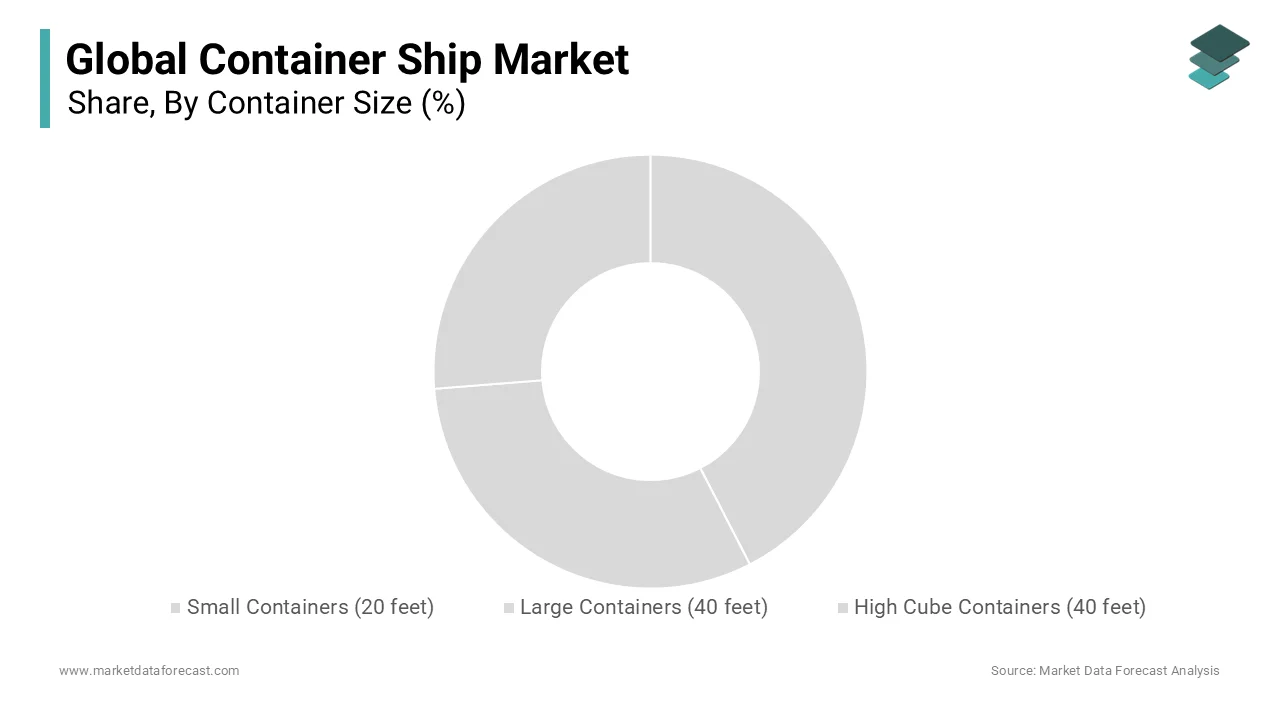

The large containers segment dominated the container ship market with a share of 51.3% in 2024 owing to their cost-efficiency and versatility that is capable of carrying twice the volume of small containers (20 feet) while maintaining standardized handling. According to the United Nations Conference on Trade and Development, 40-foot containers account for over 80% of trans-Pacific trade, underscoring their importance in high-volume routes. Their compatibility with intermodal logistics further enhances their appeal, reducing transfer times between ships, trains, and trucks.

The high cube containers segment is esteemed to witness a CAGR of 7.5% from 2025 to 2033, which is driven by increasing demand for lightweight yet bulky goods, such as electronics and automotive parts, which benefit from the extra cubic capacity. According to the World Trade Organization, e-commerce expansion has amplified the need for efficient packaging solutions, with high cube containers by enabling 15% more cargo volume per shipment compared to standard 40-foot containers. Additionally, their adaptability to specialized freight, including temperature-sensitive goods, positions them as a critical enabler of modern supply chains.

By Container Type

The dry storage containers segment was the largest and held 56.2% of the container ship market share in 2024. Their widespread use stems from their versatility and cost-effectiveness in transporting general cargo such as electronics, apparel, and machinery. According to the United Nations Conference on Trade and Development, dry containers account for over 80% of non-perishable goods shipped globally. Their standardized design ensures compatibility with intermodal transport systems by reducing logistical complexities.

The refrigerated containers segment is likely to witness a significant CAGR of 8.5% during the forecast period. This growth is driven by rising demand for perishable goods, including fresh produce, pharmaceuticals, and seafood, fueled by urbanization and changing consumer preferences. According to the World Health Organization, it is vital for vaccine distribution, with over 2 billion doses transported globally in temperature-controlled containers annually. Additionally, the International Transport Forum states that advancements in reefer technology have reduced energy consumption by 20%, enhancing efficiency. This segment’s rapid expansion reflects its importance in supporting global health and food security while addressing evolving trade dynamics.

REGIONAL ANALYSIS

The Asia-Pacific region led the container ship market with a dominant share of 49.1% in 2024. This dominance is driven by its role as a manufacturing hub, with China, Japan, and South Korea accounting for nearly 40% of global containerized exports. According to the U.S. Department of Commerce, intra-Asia trade routes are the busiest is handling approximately 28 million TEUs annually. As per the International Maritime Organization, ports like Shanghai and Singapore rank among the world’s busiest is processing over 47 million TEUs combined in 2022.

The Middle East and Africa region is the fastest-growing, with a compound annual growth rate (CAGR) of 6.8% from 2025 to 2033. This growth is fueled by infrastructure investments, such as the expansion of the Port of Djibouti and Kenya’s Lamu Port, which aim to enhance regional connectivity. According to the World Bank, containerized trade in Sub-Saharan Africa is projected to grow by 15% annually with the rising consumer demand and industrialization. As per the International Energy Agency, liquefied natural gas exports from the Middle East have increased shipping activity by 20%. This region’s rapid expansion reflects its strategic importance in bridging trade between Asia, Europe, and Africa.

North America and Europe are expected to maintain steady growth, with the U.S. Maritime Administration projecting a 3% annual increase in containerized imports due to robust consumer demand. Latin America, however, faces challenges, with the Inter-American Development Bank noting that port inefficiencies limit growth to 2.5% annually. Meanwhile, the Middle East benefits from geopolitical trade routes, while Africa’s underdeveloped infrastructure poses both risks and opportunities. The World Trade Organization forecasts that global trade diversification will drive modest gains across these regions, with North America and Europe focusing on sustainability and Latin America leveraging agricultural exports to boost maritime activity.

KEY MARKET PLAYERS

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc. are the market players that are dominating the global container ship market.

Top 3 Players in the market

China International Marine Containers Co. Ltd (CIMC)

China International Marine Containers Co. Ltd (CIMC) is a global leader in the container manufacturing and shipping industry, holding approximately 40% of the global market share for container production, as reported by the International Maritime Organization. CIMC is renowned for its innovation in producing high-quality dry storage, refrigerated, and specialized containers. The company’s contribution to the global market extends beyond manufacturing, as it plays a pivotal role in standardizing container designs that enhance intermodal logistics. CIMC’s commitment to sustainability is evident through its development of eco-friendly materials and energy-efficient container solutions. With operations spanning over 100 countries, CIMC ensures the seamless supply of containers to meet growing trade demands, particularly along Asia-Europe and trans-Pacific routes.

Triton International Limited

Triton International Limited is the largest lessor of intermodal freight containers, controlling approximately 20% of the global leasing market, according to the U.S. Department of Transportation. Triton’s fleet includes over 6 million TEUs of containers, ranging from dry storage to specialized reefer units. The company’s leasing model provides flexibility to shipping lines, enabling them to optimize capacity without heavy capital investment. Triton has been instrumental in addressing container shortages during peak trade seasons, such as the post-pandemic surge in demand. Its focus on maintaining a modern and well-maintained fleet aligns with global efforts to reduce emissions and improve operational efficiency. By bridging gaps in container availability, Triton ensures smoother global trade flows.

Evergreen Marine Corporation

Evergreen Marine Corporation, based in Taiwan, is one of the top global container shipping companies, commanding approximately 7% of the global container ship market, as per the United Nations Conference on Trade and Development. Evergreen operates a fleet of over 200 vessels with a combined capacity exceeding 1.5 million TEUs, serving major trade routes like Asia-North America and Asia-Europe. The company is known for its commitment to environmental sustainability, investing in eco-friendly vessels and adopting slow-steaming practices to reduce fuel consumption and emissions. Evergreen’s contributions extend to enhancing port infrastructure, such as its involvement in the expansion of the Port of Kaohsiung. By prioritizing reliability and efficiency, Evergreen has become a cornerstone of global maritime logistics, ensuring timely delivery of goods across continents.

Top Strategies Used By The Key Market Participants

Fleet Expansion and Modernization

Leading companies like China International Marine Containers Co. Ltd (CIMC) and Evergreen Marine Corporation have prioritized fleet expansion and modernization to meet rising global trade demands. CIMC has invested heavily in producing advanced container designs, including refrigerated and specialized containers, while Evergreen has expanded its fleet with eco-friendly mega-vessels capable of carrying over 24,000 TEUs. According to the International Maritime Organization, modernizing fleets not only enhances capacity but also reduces operational costs and emissions. This strategy strengthens their ability to serve high-demand routes efficiently.

Sustainability and Decarbonization Initiatives

Sustainability has become a cornerstone for companies aiming to align with global environmental regulations. Triton International Limited and Evergreen Marine Corporation are investing in low-carbon technologies, such as LNG-powered vessels and energy-efficient designs. According to the U.S. Department of Transportation, slow-steaming practices adopted by Evergreen have reduced fuel consumption by up to 30%. Similarly, Triton’s focus on maintaining a modern, eco-friendly leased fleet ensures compliance with International Maritime Organization (IMO) mandates, enhancing its appeal to environmentally conscious clients.

Digital Transformation and Innovation

Digitalization has emerged as a key differentiator, with companies leveraging technology to improve efficiency and transparency. CIMC has integrated IoT and AI into its manufacturing processes to optimize production and reduce waste. Meanwhile, Evergreen has adopted blockchain and real-time tracking systems to streamline logistics and enhance supply chain visibility. According to the World Shipping Council, these innovations reduce operational inefficiencies and build trust among stakeholders, reinforcing the competitive edge of these players.

Mergers, Acquisitions, and Strategic Alliances

Consolidation through mergers and acquisitions has been a critical strategy for expanding market share. For instance, Triton International Limited acquired competitors to strengthen its leasing portfolio, while Evergreen formed alliances with other shipping giants under the Ocean Alliance to optimize route planning and reduce costs. The United Nations Conference on Trade and Development notes that such collaborations enable companies to achieve economies of scale and enhance service reliability.

Geographic Expansion and Infrastructure Development

Key players are also focusing on geographic expansion and port infrastructure development. CIMC has established manufacturing facilities in emerging markets like India and Southeast Asia to cater to regional demand. Similarly, Evergreen has invested in upgrading terminals, such as the Port of Kaohsiung, to handle larger vessels and increase throughput. According to the African Development Bank, such investments in underserved regions open new trade corridors and boost economic growth.

Competitive Landscape

The container ship market is characterized by intense competition, driven by the need to meet escalating global trade demands while addressing environmental and operational challenges. Companies like China International Marine Containers Co. Ltd (CIMC) , Triton International Limited , and Evergreen Marine Corporation lead the market, leveraging their scale, technological advancements, and extensive networks to maintain dominance. CIMC’s stronghold in container manufacturing, Triton’s dominance in leasing, and Evergreen’s expansive shipping operations esclate the diverse competitive landscape.

Competition is further intensified by the rise of sustainability mandates from regulatory bodies like the International Maritime Organization (IMO), pushing companies to adopt low-carbon technologies and energy-efficient practices. Smaller players, such as Almar Container Group and Singamas Container Holdings Limited, differentiate themselves through specialized offerings, including custom-built containers and regional expertise. Meanwhile, mergers, acquisitions, and alliances, such as those within the Ocean Alliance, enable companies to achieve economies of scale and optimize route planning.

Geopolitical shifts, fluctuating freight rates, and supply chain disruptions add layers of complexity, forcing players to innovate continuously. According to the United Nations Conference on Trade and Development, digitalization has emerged as a key competitive battleground, with blockchain, IoT, and AI being deployed to enhance transparency and efficiency. This dynamic interplay of innovation, regulation, and collaboration ensures that the container ship market remains fiercely competitive, with companies striving to balance profitability, sustainability, and customer-centric solutions to secure their positions in an ever-evolving global trade ecosystem.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Triton International Limited announced its first-quarter financial results for 2023, prompting a strong performance driven by robust demand for container leasing and effective fleet management. The company reported a net income of $189.4 million, reflecting its continued focus on operational efficiency and strategic investments in eco-friendly technologies.

- In March 2023, CIMC (China International Marine Containers Co. Ltd) launched eco-friendly refrigerated containers using advanced insulation materials. This development is anticipated to enhance sustainability and compliance with IMO regulations, boosting CIMC's market appeal.

- In January 2025, Evergreen Marine Corporation announced the launch of its next-generation eco-friendly container vessels, designed to significantly reduce carbon emissions and fuel consumption. These vessels incorporate advanced technologies such as optimized hull designs and energy-efficient engines, aligning with the International Maritime Organization's (IMO) decarbonization targets.

- In April 2023, Sea Box Inc developed military-grade containers for defense logistics. This initiative is anticipated to diversify Sea Box’s offerings into niche markets, securing long-term government contracts.

- In November 2022, Ritveyraaj Cargo Shipping Containers introduced IoT-enabled tracking systems for leased containers. This innovation is anticipated to improve asset utilization and customer satisfaction through real-time monitoring.

- In February 2023, W&K Container Inc opened a new manufacturing facility in Vietnam. This expansion is anticipated to reduce production costs and tap into Southeast Asia’s growing trade demand.

- In August 2022, CARU Containers BV launched a circular economy initiative to refurbish used containers. This initiative is anticipated to promote sustainability while addressing shortages of new containers during peak seasons.

MARKET SEGMENTATION

This research report on the global container ship market is segmented and sub-segmented into the following categories.

By Container Size

- Small Containers (20 feet)

- Large Containers (40 feet)

- High Cube Containers (40 feet)

By Container Type

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

- Special Purpose Containers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global container ship market?

The current market size of the global container ship market size was valued at USD 141.08 billion in 2025.

What are the market drivers that are driving the global container ship market?

The globalization and trade expansion and environmental regulations and technological advancements are the major market drivers that are driving the global container ship market.

Who are the market players that are dominating the global container ship market?

Almar Container Group, CARU Containers BV, China International Marine Containers Co. Ltd, China Shipping Container Lines, Evergreen Marine Corporation, Ritveyraaj Cargo Shipping Containers, Sea Box Inc, Singamas Container Holdings Limited, Triton International Limited, W&K Container Inc. are the market players that are dominating the global container ship market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]